Pablo Picasso Guitar 1925

As I said yesterday, after 27 years without a recession, the no. 1 instrument to battle complacency, excesses and zombies, Australia is a fire hazard. At the same time, of course, after 27 years so many people have never seen a recession that nobody expects one anymore.

• Australia’s $7 Trillion Question: How Low Will House Prices Go (SMH)

Industry experts say property prices in Sydney and Melbourne, which have led a slump in Australia’s $7 trillion residential property market, are likely headed lower before they hit rock bottom. The Australian Bureau of Statistics released figures this week showing new lending to owner occupiers fell 6.4% during December last year, outpacing the fall in lending to property investors, which dropped by 4.6%. The total value of new lending to households has now dropped 19.8% in the past year — the biggest annual fall in home loans since the height of the global financial crisis. “The lending numbers are atrocious; it tells us that property markets in Sydney and Melbourne are in a tailspin,” says Louis Christopher, managing director of property researcher SQM Research.

The issue is mostly access to credit and, for at least for past six months, banks have been scrutinising the spending of borrowers more closely when assessing their loans, Christopher says. Doron Peleg, chief executive of RiskWise Property Research, says the weak lending figures also show how those who would normally be entering the property market are now shying away in anticipation of lower prices. The Westpac-Melbourne Institute Index out this week showed consumers in Sydney and Melbourne have poor property price expectations. “Buyer sentiment has been hit as residential property, particularly in Sydney and Melbourne, is seen as a depreciating asset,” Peleg says.

[..] Many property experts are expecting a peak-to-trough drop in property prices of between 15% and 20%. “Without an interest-rate cut or regulatory changes there will be tough times ahead for the property market,” RiskWise’s Peleg says. [..] Tim Lawless, the head of research at property researcher CoreLogic, is expecting a peak-to-trough fall of up to 20% for both Sydney and Melbourne before prices start to level out in 2020. However, Lawless says the price declines should be kept in perspective. Sydney house and apartment prices have risen by more than 70% in the past decade, while Melbourne prices have gained even more, he says. This is despite recent price falls of more than 12% from their peak in Sydney in mid-2017 and 8% in Melbourne from a top in late 2017, he says.

The Omen.

• US Mortgage Applications Drop Despite Lower Rates: Industry is Baffled (WS)

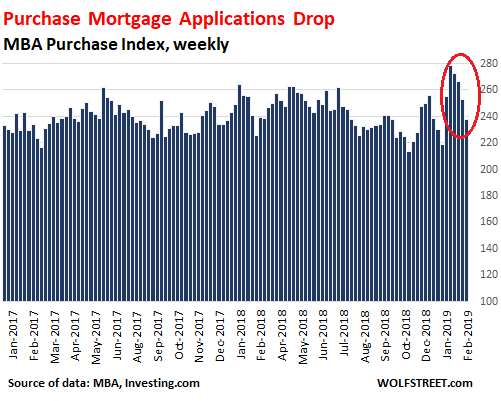

A month ago, mortgages reappeared in the housing-hype circus, when it was widely reported that mortgage applications “soared” and “jumped.” Both types of mortgage applications did so: those used to purchase a home (purchase mortgages) and those used to refinance an existing mortgage (refinance mortgages). The jump in mortgage applications was ascribed to “plunging” mortgage interest rates. It was seen as a big sign that the weakening housing market was about to turn around. But that hope has gotten unwound.

Today, the Mortgage Bankers Association (MBA) reported that its purchase mortgage index – which tracks applications (not approvals) for conventional and government mortgages to purchase a single-family house – fell 6% from the prior week and was down 5% from the same week last year – despite falling mortgage rates, which should have cranked up home buying and mortgage activity. It was the fourth week in a row of drops:

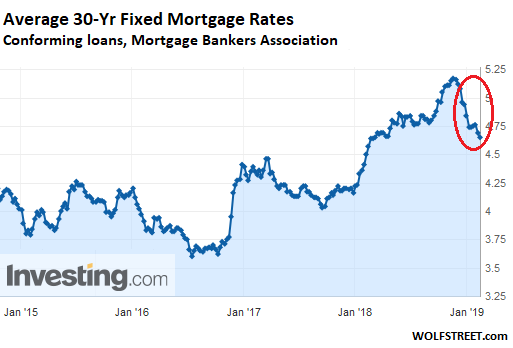

The Purchase Mortgage Index is considered a reliable indicator of impending home sales, and so this decline, given the lower mortgage rates, mystifies the industry.“Application activity fell last week – even with rates decreasing – as renewed uncertainty about the domestic and global economy likely held potential homebuyers off the market,” said MBA Associate VP of Industry Surveys and Forecasts, Joel Kan, in the report. “The 30-year fixed-rate mortgage dropped to its lowest level since last March, and was 52 basis points lower than its recent high last November,” he said.

You can practically hear between the lines, so to speak, the bafflement in his voice about this decline in purchase mortgage applications in light of the decline in mortgage rates. The MBA also reported today that the average interest rate for 30-year fixed-rate mortgages with conforming loan balances inched down to 4.65%, back where it had been last April (chart via Investing.com):

AKA the Thelma and Louise economy.

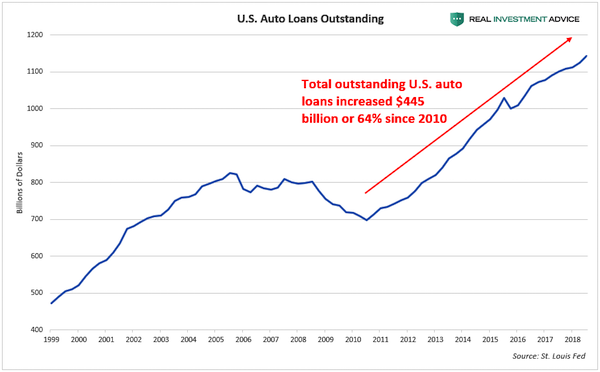

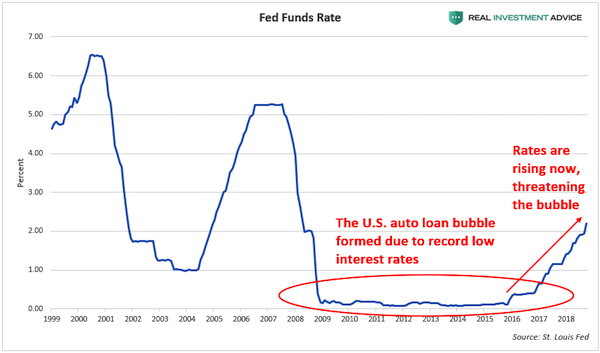

• Surge In Delinquencies Threatens US Auto Loan Bubble (Colombo)

My concerns about the U.S. automobile bubble are being confirmed. As Bloomberg reports: “More Americans than ever are at least three months behind on their auto loans, a sign that the U.S. economy may have little growth left in the tank. The number of loans at least 90 days late exceeded 7 million at the end of last year, the highest total in the two decades the Federal Reserve Bank of New York has kept track. Expressed as a percentage of total debt, the delinquency rate is the highest since 2012, as overall borrowing has also increased.

The data show not all Americans are benefiting from the strong labor market, New York Fed economists say. Consumers with the weakest credit have driven deteriorating performance of auto debt: The share of subprime borrowers who fell well behind on car payments the last three months of the year was the highest since the second quarter of 2010.

As I’ve been warning for the past couple years, the U.S. automobile sales boom is a byproduct of a bubble in auto loans:

The auto sales and auto loan bubble is a byproduct of ultra-cheap credit conditions in the past decade since the Great Recession. Interest rates are now rising, which threatens the auto bubble: It’s only a matter of time before the U.S. auto sales and loan bubble experiences a serious bust. Rising delinquencies are just the start, I’m afraid. Booms fueled by cheap credit always end the same way – in a terrible bust. Ignore the voices that say “this time will be different!”

And the people who lost their retail jobs don’t pay income taxes either anymore.

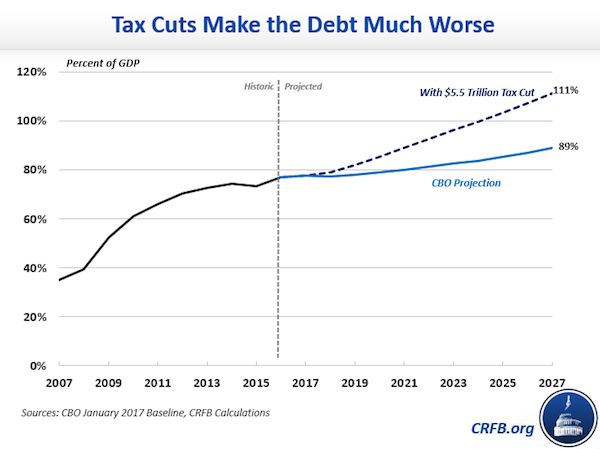

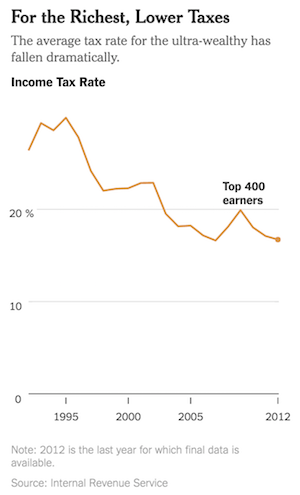

• $1 Trillion Amazon Pays $0 In Income Taxes, Gets $129 Million Rebate (RT)

Trillion-dollar-company Amazon skated through 2018’s tax filings without paying a cent for the second year in a row. The e-commerce behemoth, which made $11 billion last year, will pay no taxes at all, thanks to 2017’s tax reform. Rather than pay the standard 21% corporate income tax rate, Amazon is actually claiming a tax rebate of $129 million, which works out to a logic-defying rate of -1%. Aside from the nebulous “tax credits,” which the company does not have to spell out in its public filings, Amazon is also claiming a tax break for executive stock options, according to the Institute for Taxation and Economic Policy – a longstanding loophole that permits profitable corporations to dodge federal and state income taxes on almost half their profits.

While President Donald Trump’s 2017 tax reform legislation lowered corporate tax rates from 35% to 21%, it was sold as an incentive for companies to keep their money in the US, instead of stashing it overseas where the IRS couldn’t touch it. Now that Amazon and Netflix have both made headlines for using the new regulations to avoid paying anything at all, it remains to be seen whether the legislation’s failure to close corporate loopholes will leave the US holding the bag for fiscal year 2018 as the country’s national debt inches past $22 trillion – a record high.

Amazon’s tax windfall doesn’t even take into account the billions in tax breaks the state governments of Virginia and New York offered the company to open a second (and third) headquarters in their states, though there are rumors that New York is getting cold feet about the unprecedented corporate giveaway. Amazon didn’t pay any taxes in 2017 either, though it raked in a comparatively paltry $5.6 billion in profits and extracted a slightly larger $137 million refund.

“Verhofstadt asked Lidington four times what the British proposal was and “four times didn’t get an answer”, according to the EU official, who described the encounter as “very surreal”.”

• EU Officials: UK Only ‘Pretending To Negotiate’ Over Brexit (G.)

The British government is “pretending to negotiate” with the European Union and has not presented any new proposals to break the Brexit deadlock, according to EU officials. Theresa May’s de-facto deputy, David Lidington, and the Brexit secretary, Stephen Barclay, met senior EU officials and MEPs in Brussels and Strasbourg this week, but the talks yielded no obvious results. The British side thinks a crucial process has begun and hopes progress will have been made by 27 February when MPs are expected to have another crunch Brexit vote. However, on Wednesday night European council president Donald Tusk said the EU27 was still waiting for proposals. “No news is not always good news,” he tweeted, after meeting with the EU’s chief negotiator Michel Barnier.

“EU27 still waiting for concrete, realistic proposals from London on how to break Brexit impasse,” Tusk said. Barnier, has said current talks with the UK do not even qualify as negotiations. In a call on Tuesday morning with Guy Verhofstadt, chief Brexit representative for the European parliament, Barnier said there were “no negotiations” with the British. “These are courtesy calls at best and we have nothing new to say,” Barnier was reported to have said, by a source familiar with the conversation. Verhofstadt had asked the EU negotiator for an update, following Barnier’s meeting with Barclay over dinner at the British ambassador’s residence in Brussels, where they dined on North Sea sole, roast duck and British cheese, washed down with sancerre and saint-émilion wines.

“They are pretending to negotiate while they still don’t know what they want and how they want it,” the source said, who described this week’s meetings as “kicking up dust” and a series of “photo opportunities and pictures”. “We are willing to negotiate, but there is nothing on the table from the British side.” Verhofstadt asked Lidington four times what the British proposal was and “four times didn’t get an answer”, according to the EU official, who described the encounter as “very surreal”.

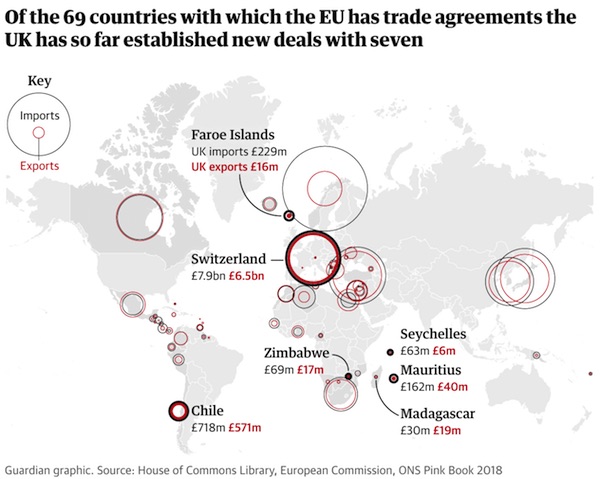

Don’t be so negative: they got a hard-fought deal with the Seychelles!

• UK Has Rolled Over Just £16bn Out Of £117bn Trade Deals (G.)

The government’s push to roll over EU trade deals from which the UK currently benefits has yielded agreements covering only £16bn of the near-£117bn of British trade with the countries involved. Despite frenetic efforts by ministers to ensure the continuity of international trade after the UK leaves the EU on 29 March, the international trade secretary, Liam Fox, has so far only managed to secure deals with seven of the 69 countries that the UK currently trades with under preferential EU free trade agreements, which will end after Brexit.

Fox’s department has yet to sign agreements with several major UK trading partners – including Canada, Japan, South Korea and Turkey – while sources have said that sufficient progress is unlikely to be made before the Brexit deadline in less than 50 days’ time. Canada, Japan, South Korea and Turkey alone accounted for goods exports worth £25bn in 2017 and imports of merchandise worth £28.6bn, with the UK currently able to access these markets on preferential terms as part of membership of the EU. Fox sought to downplay the significance of the deals in parliament on Wednesday, saying all of the countries involved only accounted for about 11% of total UK trade in 2018, with the smallest 20 nations worth less than 0.8%.

I’ve been wondering why any politician in Britain is still in their jobs.

• Labour MPs Warn Corbyn: Back A Second Referendum Or We Quit (G.)

Jeremy Corbyn faces up to 10 resignations from the Labour frontbench if he fails to throw his party’s weight behind a fresh attempt to force Theresa May to submit her Brexit deal to a referendum in a fortnight’s time, frustrated MPs are warning. With tension mounting among anti-Brexit Labour MPs and grassroots members, several junior shadow ministers have told the Guardian they are prepared to resign their posts if Corbyn doesn’t whip his MPs to vote for a pro-referendum amendment at the end of the month. Corbyn has been struggling to balance the conflicting forces in his party over Brexit, as the clock ticks down towards exit day on 29 March..

Many party members and MPs would like him to take a lead in seeking to block Brexit before time runs out – but some frontbenchers are equally adamant they could never support a referendum. Len McCluskey, the general secretary of the Unite union and a close ally of Corbyn, risked stoking the conflict in the party on Wednesday when he argued that stopping Brexit was “not the best option for our nation”. “My view is that, having had a 2016 referendum where the people have voted to come out of the EU, to try and deflect away from that threatens the whole democratic fabric on which we operate,” he told Peston on ITV. “I’m saying that in reality it is not the best option for our nation.”

43 days. Both extremities, hard brexit and 2nd referendum, think they have a chance of winning it all.

• Hardline Brexiters Threaten To Vote Down Theresa May’s Motion (G.)

Hardline Brexit supporters are threatening to inflict yet another Commons defeat on Theresa May because they fear the government is effectively ruling out leaving the EU with no deal. Members of the Tory European Research Group are unhappy with the wording of a No 10 motion because it endorses parliament’s vote against any Brexit without a withdrawal agreement. The motion for debate on Thursday simply affirms “the approach to leaving the EU” backed by the Commons on 29 January, when an amendment was passed in favour of an attempt to replace the Northern Ireland backstop with “alternative arrangements”.

The motion was thought to be fairly uncontroversial until pro-Brexit supporters realised it also encompassed a second amendment passed on that day, which ruled out a no-deal Brexit. The amendment, tabled by Dame Caroline Spelman, “rejects the United Kingdom leaving the European Union without a withdrawal agreement and a framework for the future relationship”. The ERG group, led by arch-Brexiter Jacob Rees-Mogg, is planning either to vote against or abstain on Thursday’s government motion, potentially causing another embarrassing parliamentary loss for the prime minister. However, talks with government whips will continue on Thursday in an attempt to find a compromise.

An ERG MP said many of its members were “not minded to support such a clumsily worded motion” that effectively ruled out a no-deal Brexit. Another said the group would not trust verbal assurances from No 10 that no deal was still on the table as such promises from the dispatch box had not been honoured many times in the past.

How far away is a false flag?

• Maduro Claims Foes ‘Totally Failed’ To Topple Him As Efforts Falter (G.)

Venezuela’s embattled leader, Nicolás Maduro, has claimed he has seen off a dramatic opposition challenge to his rule, as those efforts appeared to falter and the United States conceded it was “impossible to predict” how long he might remain in power. In an interview with Euronews, Maduro boasted that his political foes had “failed totally” in their quest to topple him. Opponents “could march every single day of their lives” and achieve nothing, Maduro said. Venezuela’s newly emboldened opposition continues to insist Maduro’s days are numbered, with about 50 governments now recognizing its leader, Juan Guaidó, as the country’s legitimate president.

Tens of thousands of supporters poured back on to the streets of Caracas and other major cities on Tuesday to demand the resignation of a politician they accuse of leading their oil-rich country into economic ruin. But three weeks after Guaidó electrified the previously rudderless opposition movement by declaring himself interim leader, there are signs his campaign risks losing steam. An anticipated mass defection of military chiefs – which opposition leaders admit is a prerequisite to Maduro’s departure – has not materialized, and Maduro’s inner-circle has begun claiming it has weathered the political storm. “In the end, nothing will come of [this challenge]. We will prevail,” Maduro’s second-in-command, Diosdado Cabello, tweeted on Wednesday.

[..] Opposition leaders have spent recent days trying to dampen expectations that Maduro’s exit is imminent. Juan Andrés Mejía, an opposition leader and Guaidó ally, admitted that goal “could take some time”. “We want it to end very soon because we know that every day that passes by people are suffering. But Maduro still has control of the military and basically that is the reason we haven’t been able to move things forward,” he told the Guardian.

Shaking up US politics since 2016. And c’mon, Abrams is a war criminal, he should be facing a court, not Congress.

• Venezuela Envoy Elliott Abrams Loses His Cool In Congress (ZH)

Rep. Ilhan Omar clashed with newly minted Venezuela Envoy Elliott Abrams during a Wednesday hearing in front of the House Foreign Relations Committee discussing the role of the US military in Central America. “Mr. Abrams, in 1991 you pleaded guilty to two counts of withholding information from Congress regarding your involvement in the Iran-Contra affair, for which you were later pardoned by president George H.W. Bush,” began Omar. “I fail to understand why members of this committee or the American people should find any testimony that you give today to be truthful.” “If I could respond to that…” interjected Abrams. “It was not a question,” shot back Omar.

After a brief exchange in which Abrams protested “It was not right!” Omar cut Abrams off, saying “Thank you for your participation.” Omar: “On February 8, 1982, you testified before the Senate foreign relations committee about US policy in El Salvador. In that hearing you dismissed as communist propaganda, a report about the massacre of El Mozote in which more than 800 civilians – including children as young as two-years old – were brutally murdered by US-trained troops. During that massacre, some of those troops bragged about raping 12-year-old girls before they killed them. You later said that the US policy in El Salvador was a “fabulous achievement.” “Yes or no – do you still think so?” asked Omar.

Abrams replied: “From, the day that Duarte was elected in a free election, to this day, El Salvador has been a democracy. That’s a fabulous achievement.” Omar shot back: “Yes or no, do you think that massacre was a fabulous achievement that happened under our watch?” Abrams protested: “That is a ridiculous question- to which Omar shot back, “Yes or no,” cutting him off. “Yes or no, would you support an armed faction within Venezuela that engages in war crimes, crimes against humanity or genocide, if you believe they were serving US interests as you did in Guatemala, El Salvador and Nicaragua?” “I am not going to respond to that question, I’m sorry. I don’t think this entire line of questioning is meant to be real questions, and so I will not reply.” said Abrams.

US accuses Russia of energy blackmail, tries to blackmail Germany. Germans will never accept not being independent when it comes to energy. Moreover, their economy is teetering.

• Germany Pulls Rank on Macron and Washington over Nordstream 2 (SCF)

It was billed politely as a Franco-German “compromise” when the EU balked at adopting a Gas Directive which would have undermined the Nord Stream 2 project with Russia. Nevertheless, diplomatic rhetoric aside, Berlin’s blocking last week of a bid by French President Emmanuel Macron to impose tougher regulations on the Nord Stream 2 gas project was without doubt a firm rebuff to Paris. Macron wanted to give the EU administration in Brussels greater control over the new pipeline running from Russia to Germany. But in the end the so-called “compromise” was a rejection of Macron’s proposal, reaffirming Germany in the lead role of implementing the Nord Stream 2 route, along with Russia. The $11-billion, 1,200 kilometer pipeline is due to become operational at the end of this year.

Stretching from Russian mainland under the Baltic Sea, it will double the natural gas supply from Russia to Germany. The Berlin government and German industry view the project as a vital boost to the country’s ever-robust economy. Gas supplies will also be distributed from Germany to other European states. Consumers stand to gain from lower prices for heating homes and businesses. Thus Macron’s belated bizarre meddling was rebuffed by Berlin. A rebuff was given too to the stepped-up pressure from Washington for the Nord Stream 2 project to be cancelled. Last week, US ambassador to Germany Richard Grenell and two other American envoys wrote an op-ed for Deutsche Welle in which they accused Russia of trying to use “energy blackmail” over Europe’s geopolitics.

Why on earth is that government pushing driverless cars?

• Bikes Put Spanner In Works Of Dutch Driverless Car Schemes (G.)

The Dutch government is working with Germany and Belgium on establishing “truck platooning” – where one human-driven vehicle leads a convoy of autonomous ones — on major roads. Under the plans, about 100 driverless trucks would drive the “Tulip corridors” at night – from Amsterdam to Antwerp, and from Rotterdam to the Ruhr valley – fully maximising the routes through which the Netherlands distributes its goods using 5G technology and 1,200 smart traffic lights. The Dutch infrastructure minister, Cora van Nieuwenhuizen, has announced a “driving licence” for self-driving cars, through which it would certify new autonomous models, and a framework of legislation – known as the Experimenteerwet zelfrijdende auto’s – is being prepared.

But a report by the professional service company KPMG highlights a major problem for Dutch ministers in introducing the technology to urban centres, where the bicycle is increasingly king. Driverless cars detect other road users using a variety of cameras or laser-sensing systems to ensure that they stop if an object is detected in their path. But the varying sizes and agility of cyclists, with their sudden changes in speed and loose adherence to the rules of the road, present a major challenge to the existing technology. That challenge is particularly stark in the Netherlands, where 17 million people own 22.5m bicycles. More than a quarter of all trips made by Dutch residents are by bike. Of all trips of a distance of up to five miles, a third are made by bicycle, with the rate only dropping to 15% for trips up to 10 miles in length.

Is it that hard to understand that pesticides and herbicides are the worst idea ever? Poison kills, cut it out.

• Exposure To Glyphosate Increases Risk Of Cancer By 41% – Study (G.)

A broad new scientific analysis of the cancer-causing potential of glyphosate herbicides, the most widely used weed killing products in the world, has found that people with high exposures to the popular pesticides have a 41% increased risk of developing a type of cancer called non-Hodgkin lymphoma. The evidence “supports a compelling link” between exposures to glyphosate-based herbicides and increased risk for non-Hodgkin lymphoma (NHL), the authors concluded, though they said the specific numerical risk estimates should be interpreted with caution. The findings by five US scientists contradict the US Environmental Protection Agency’s (EPA) assurances of safety over the weed killer and come as regulators in several countries consider limiting the use of glyphosate-based products in farming.

Monsanto and its German owner Bayer face more than 9,000 lawsuits in the US brought by people suffering from NHL who blame Monsanto’s glyphosate-based herbicides for their diseases. The first plaintiff to go to trial won a unanimous jury verdict against Monsanto in August, a verdict the company is appealing. The next trial, involving a separate plaintiff, is set to begin on 25 February , and several more trials are set for this year and into 2020. Monsanto maintains there is no legitimate scientific research showing a definitive association between glyphosate and NHL or any type of cancer. Company officials say the EPA’s finding that glyphosate is “not likely” to cause cancer is backed by hundreds of studies finding no such connection.