Giovanni Bellini St. Francis in ecstasy 1480

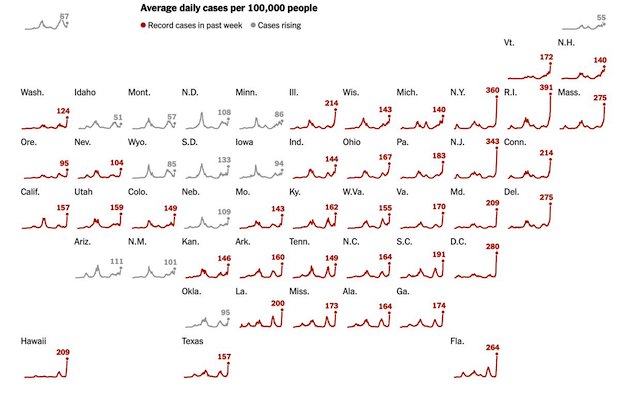

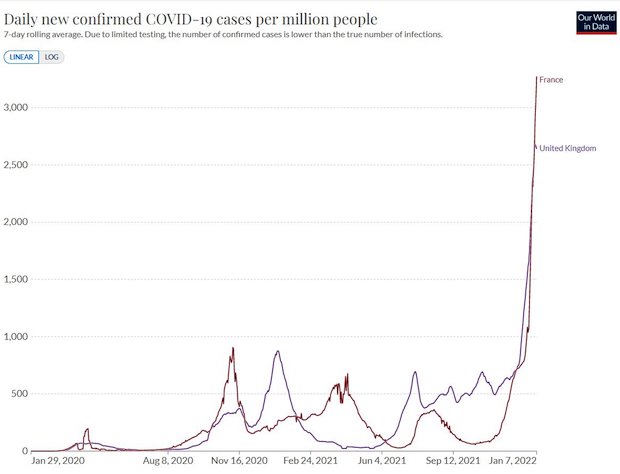

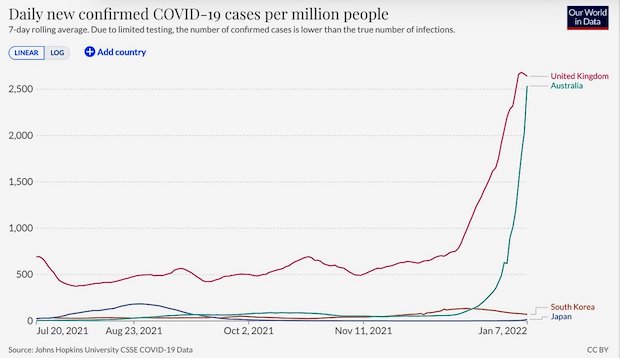

The success story of mass vaccination:

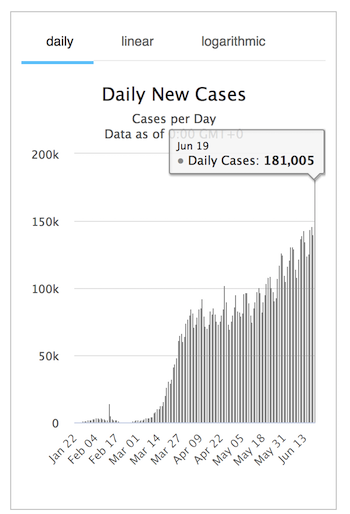

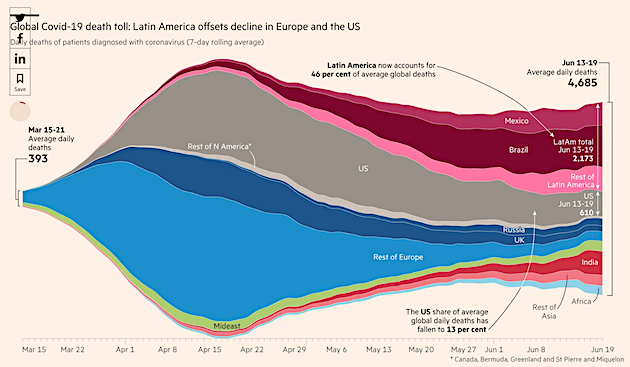

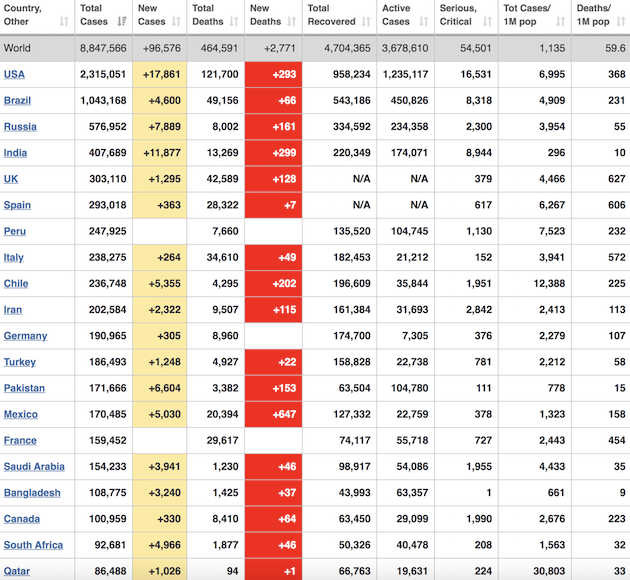

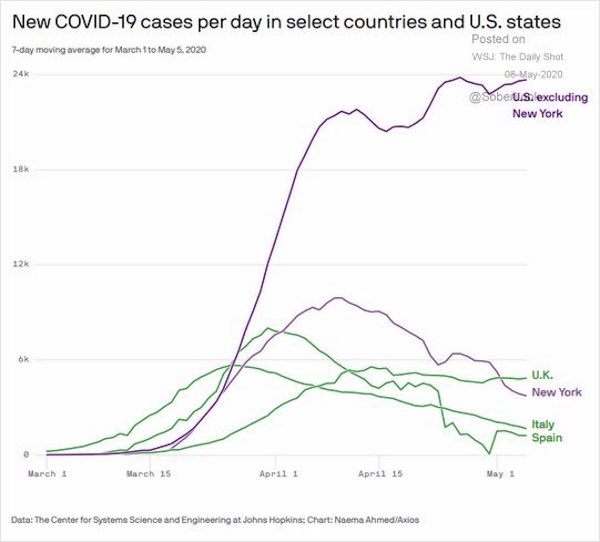

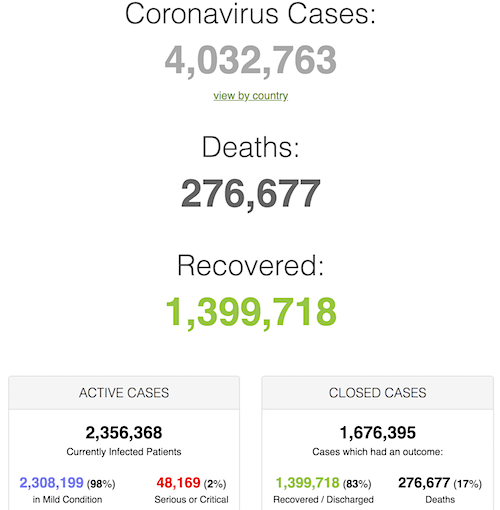

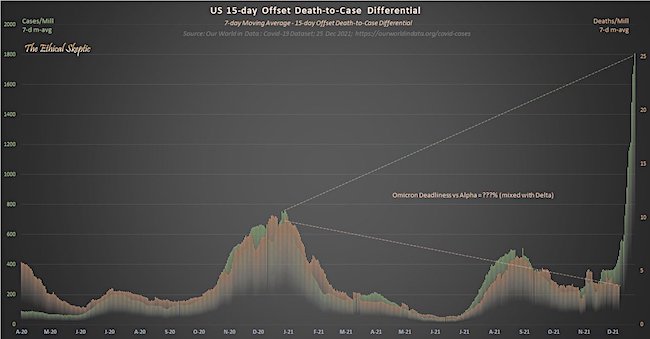

The pic is not very clear, but the message is: so-called “cases” are spiking, but deaths are falling.

McCullough Needle

Dr. McCullough @P_McCulloughMD says our Freedom has been tethered to the end of a hyperdemic needle. He says what job is worth keeping being held hostage at the end of a needle. He gives advice on dealing with employers and mandates. pic.twitter.com/g9XTDRqNPj

— McCullough's 4 Pillars of Pandemic Response (@Petersparrot) January 8, 2022

Dr Rochelle Walensky @CDCDirector: “the overwhelming number of deaths over 75% occurred in people who had at least 4 comorbidities, so really these are people who were unwell to begin with”

Greek Deputy Health Minister Mina (aka Lady) Gaga drops this bombshell (echoing Denmark’s chief epidemiologist) on the same day the government says another 40,000 kid vaccines are ready, and vaccines are to become mandatory for everyone over 50.

Don’t think they coordinated the messages. Why would anyone want a vaccine if the pandemic is basically over?

Yes, hospitals will be busy for a while, but that’s what you get when you ramp up rapid testing and those who test positive seek an opinion (I feel fine, doctor, but I guess I’m sick). For a “disease” that is 100x less deadly than Alpha or Delta, during which 99.97% already survived. Or even less deadly than the flu…

But yeah, keep your mask on says Lady Gaga!

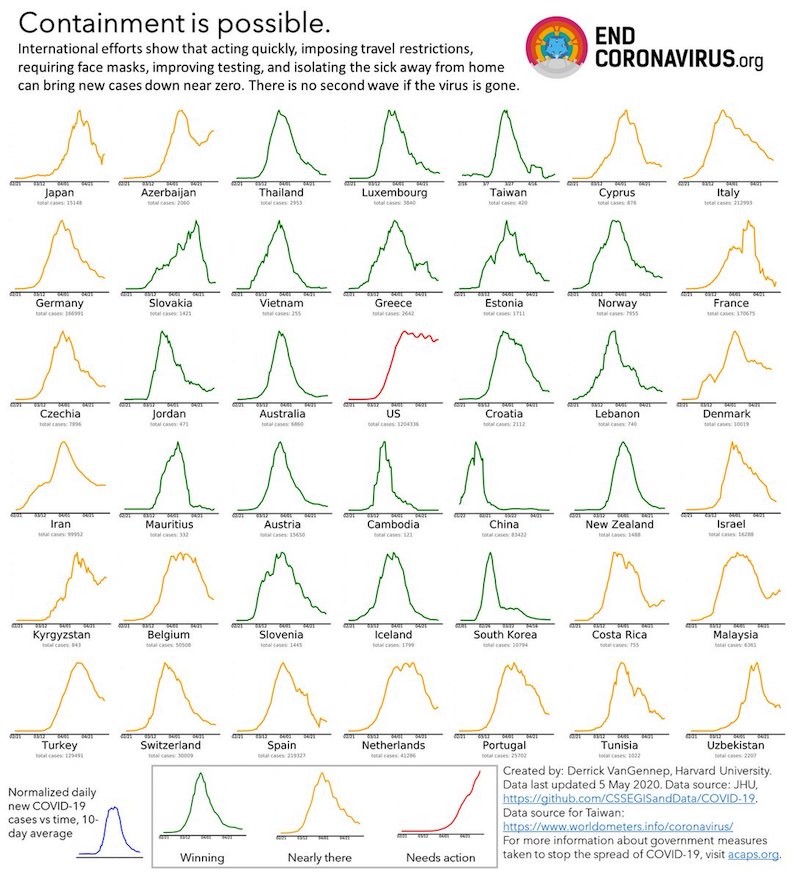

• Pandemic Soon Over, De-Escalation In 2-3 Weeks (KTG)

Deputy Health Minister Mina Gaga told media on Saturday that the Covid-19 pandemic will soon be over and that people will have to live with it like with a common flu. In an interview with news website iefirmerida.gr, Gaga estimated that things will be better in two to three weeks. however, people should comply with the measures. She predicted a quick de-escalation saying that soon the whole issue will be over. The deputy health minister, who is a medical doctor by profession said that the Omicron variant seems to be now the dominant strain of the virus in Greece, as it concerns up to 90% of new Covid-19 cases. “Internationally – and in our country – with the predominance of Omicron, there is a tendency of stabilization in the so-called hard markers (admissions to ICUs and deaths), which supports the view that this mutation causes a milder disease, especially in the fully vaccinated population,” Gaga told iefimerida.gr.

She stressed that the great contamination caused by Omicron should not be underestimated and that this can affect the proper operation of the health system. With these data, it is still early to predict the end of the pandemic and it is very important to adhere to the measures, namely masks, avoiding crowding and the booster vaccination shot that provides a strong protection, the minister said. “However, I am one of those who believe that we are heading towards the end. We have concluded two years, I think we are close to seeing Covid-19 evolve from now on like the flu. Of course, the virus will still exist, it will not disappear, it will be part of our lives. But we will return to normalcy,” Gaga said adding the whole story will be soon over, it’s a matter of weeks, as long as we have in mind to balance. We are in times of intense transmission, we have to wear mask, keep the measures, be careful.”

[..] Meanwhile, in Cyprus a new variant has been identified, the Deltacron, a mutation with both the strains of Delta and Omicron. According to professor Leontios Kostrikis at the Biological Science Department of the University of Cyprus, the Deltacron mutation has been identified in 25 cases and it seems that the strains have a genetic background of the Delta mutation. The new mutation was detected in 11 hospitalized patients and in 14 people of the general population and its frequency was higher among Covid-patients in hospitalization.

“Mass population-based vaccination in the UK should now end.”

• End Mass Jabs And Live With Covid, Says Ex-head Of Vaccine Taskforce (G.)

Covid should now be treated as an endemic virus similar to flu, and ministers should end mass-vaccination after the booster campaign, the former chairman of the UK’s vaccine taskforce has said. With health chiefs and senior Tories also lobbying for a post-pandemic plan for a straining NHS, Dr Clive Dix called for a major rethink of the UK’s Covid strategy, in effect reversing the approach of the last two years and returning to a “new normality”. “We need to analyse whether we use the current booster campaign to ensure the vulnerable are protected, if this is seen to be necessary,” he said. “Mass population-based vaccination in the UK should now end.”

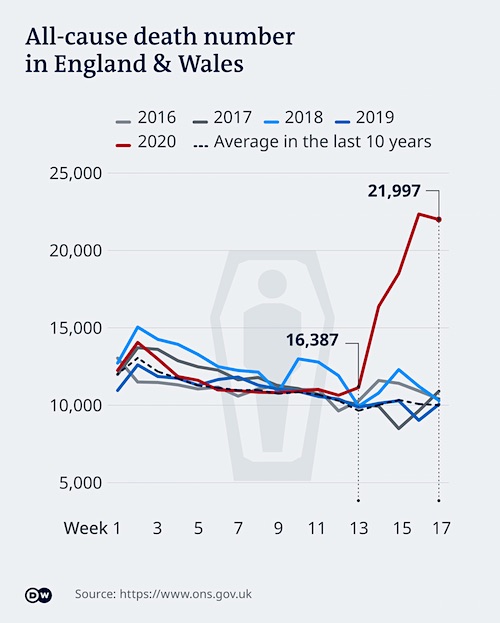

He said that ministers should urgently back research into Covid immunity beyond antibodies to include B-cells and T-cells (white blood cells), which could be used to create vaccines for vulnerable people specific to Covid variants: “We now need to manage disease, not virus spread. So stopping progression to severe disease in vulnerable groups is the future objective.” His intervention comes as it was revealed more than 150,000 people across the UK have now died from Covid. Official figures published yesterday recorded a further 313 deaths, the highest daily number since February last year when the last peak was receding. It takes the total recorded deaths within 28 days of a positive Covid test to 150,057.

Meanwhile, NHS officials are warning that patient safety has been compromised this winter because of a crippling health and social care staff shortage that requires a million additional workers by the next decade. Writing in the Observer, Chris Hopson, chief executive of NHS Providers, said that the pandemic had exposed “its weakest links”. “There is a clear, regrettable, impact on quality of care and, in the most pressured parts of the system, a worrying increase in patient safety risk,” he writes. “It is now very clear that the NHS and our social care system do not have sufficient capacity. That asking staff to work harder and harder to address that gap is simply not sustainable. That we need a long-term, fully funded, workforce plan to attract and retain the extra one million health and care staff the Health Foundation estimates will be needed by 2031.”

“..researchers at Washington University modelling the next stage of the pandemic expect Omicron to kill up to 99 per cent fewer people than Delta, in another hint it could be less deadly than flu..”

• Omicron May Be 100 Times Less Deadly Than Delta (DM)

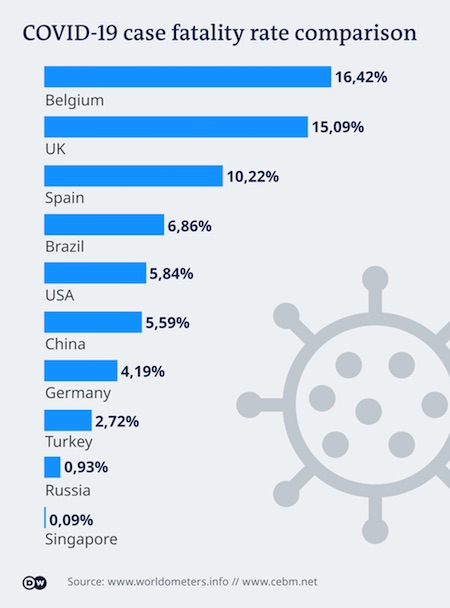

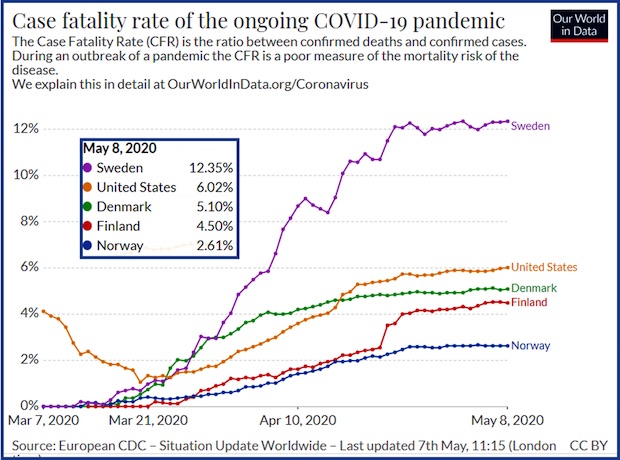

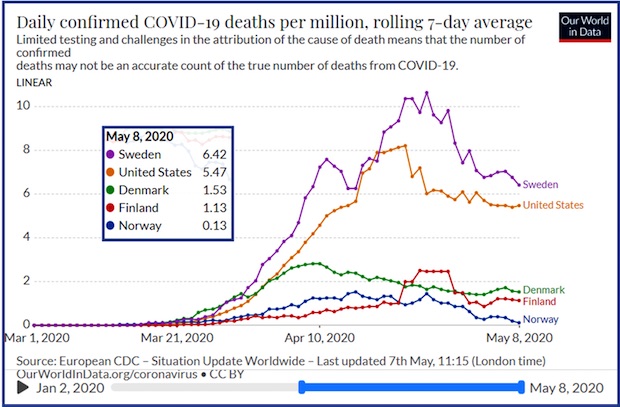

Omicron could be even less deadly than flu, scientists believe in a boost to hopes that the worst of the pandemic is over. Some experts have always maintained that the coronavirus would eventually morph into a seasonal cold-like virus as the world develops immunity through vaccines and natural infection. But the emergence of the highly-mutated Omicron variant appears to have sped the process up. MailOnline analysis shows Covid killed one in 33 people who tested positive at the peak of the devastating second wave last January, compared to just one in 670 now. But experts believe the figure could be even lower because of Omicron. The case fatality rate — the proportion of confirmed infections that end in death — for seasonal influenza is 0.1, the equivalent of one in 1,000.

One former Government adviser today said if the trend continues to drop then ‘we should be asking whether we are justified in having any measures we would not bring for a bad flu season’. But other experts say coronavirus is much more transmissible than flu, meaning it will inevitably cause more deaths. Meanwhile, researchers at Washington University modelling the next stage of the pandemic expect Omicron to kill up to 99 per cent fewer people than Delta, in another hint it could be less deadly than flu. No accurate infection-fatality rate (IFR), which is always just a fraction of the CFR because it reflects deaths among everyone who catches the virus, has yet been published for Delta.

But UK Government advisers estimated the overall figure stood at around 0.25 per cent before Omicron burst onto the scene, down from highs of around 1.5 per cent before the advent of life-saving vaccines. If Omicron is 99 per cent less lethal than Delta, it suggests the current IFR could be as low as 0.0025 per cent, the equivalent of one in 40,000, although experts say this is unlikely. Instead, the Washington modelling estimates the figure actually sits in the region of 0.07 per cent, meaning approximately one in 1,430 people who get infected will succumb to the illness. Leading researchers estimate flu’s IFR to sit between 0.01 and 0.05 per cent but argue comparing rates for the two illnesses is complicated.

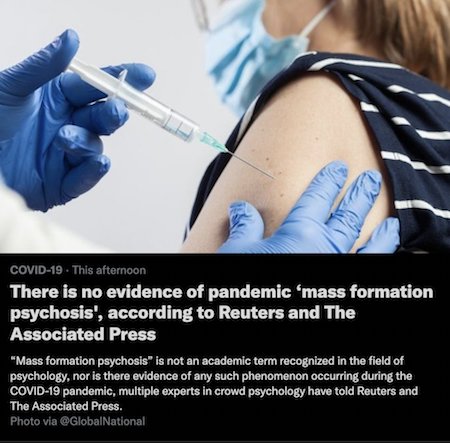

“There is no such thing as mass formation psychosis and the masses who believe otherwise have fallen prey to some type of… you know… mass formation psychosis.”

• Propaganda Institutions Collaborate to Refute “Mass Formation Psychosis” (CTH)

Well, butter my buns and call me a biscuit… if this ain’t the biggest revealing tell in years. Apparently Big Tech and big propaganda media, Reuters and the Associated Press, have joined together to refute the concept of “Mass Formation Psychosis”, and pushed their collective narrative into the narrative engineering system: The Associated Press and Reuters, quickly rush to the “fact check” typeset to stop people from recognizing what is most likely the cause of their own psychosis. In a world where things are no longer shocking, this is, well, a little shocking, in a weird and seemingly Orwellian kind of way. Yes Alice, the same “experts” and media who are credibly accused of creating/enabling the mass formation psychosis would like to assure us that no such reality exists. This is almost too funny.

(AP) – […] “The concept has no academic credibility,” Stephen Reicher, a social psychology professor at the University of St Andrews in the U.K., wrote in an email to The Associated Press. The term also does not appear in the American Psychological Association’s Dictionary of Psychology. “Psychosis” is a term that refers to conditions that involve some disconnect from reality. According to a National Institutes of Health estimate, about 3% of people experience some form of psychosis at some time in their lives. […] The description of “mass formation psychosis” offered by Malone resembles discredited concepts, such as “mob mentality” and “group mind,” according to John Drury, a social psychologist at the University of Sussex in the U.K. who studies collective behavior.

The ideas suggest that “when people form part of a psychological crowd they lose their identities and their self-control; they become suggestible, and primitive instinctive impulses predominate,” he said in an email. That notion has been discredited by decades of research on crowd behavior, Drury said. “No respectable psychologist agrees with these ideas now,” he said. Multiple experts told the AP that while there is evidence that groups can shape or influence one’s behaviors — and that people can and do believe falsehoods that are put forward by the leader of a group — those concepts do not involve the masses experiencing “psychosis” or “hypnosis.”

Reuters offers this simultaneous rebuttal: (Reuters) – “Mass formation psychosis” is not an academic term recognized in the field of psychology, nor is there evidence of any such phenomenon occurring during the COVID-19 pandemic, multiple experts in crowd psychology have told Reuters. […] There is no evidence to suggest a “mass formation psychosis” has occurred during the pandemic, experts told Reuters. The term itself is not recognised among academics, and modern research into crowd psychology has shown that crowds do not behave in mindless or non-individualistic ways. Once a collective group creates an alternate reality of itself, in this case a totalitarian reality based on government needing to create an irrational illusion of fear that becomes part of the accepted national identity, how can anyone call attention to the outcomes without finding themselves in front of the board of inquisition who organizes the collective?

Put another way… if the pod under your bed malfunctioned, but the pods under all the other beds in the city worked, what happens when you awaken and realize you are not one of them, but you must engage in the world of them while looking for others -like yourself- whose pods hopefully malfunctioned? That is the current challenge for anyone trying to communicate on contrary evidence and yet avoid the ire from the collective board of COVID compliance who have successfully brainwashed the audience. As a rather prescient Lewis Carroll shared so brilliantly in his novel of Alice, Through The Looking Glass:

“If I had a world of my own, everything would be nonsense. Nothing would be what it is, because everything would be what it isn’t. And contrary wise, what is, it wouldn’t be. And what it wouldn’t be, it would. You see?”

McCullough MFP

Dr. @P_McCulloughMD talks about the mass Psychosis that we have been put into. #MassFormationPsychosis pic.twitter.com/IksupN13g4

— My Doc is McCullough (@Petersparrot) January 9, 2022

“This is the first time since the Floyd riots in America, that major political leaders and public health authorities have said that preventing Corona can no longer be the highest goal of western society.”

“Where’s the vaccine mandate they promised us?” whines Daniel Brössler, reporter for the Süddeutsche Zeitung, disappointed because yesterday’s Corona summit of German minister presidents returned nothing but some adjustments to quarantine and sharpened testing rules. The double vaccinated will now have to submit negative tests if they want to eat at restaurants. Markus Söder, lockdown- and vaccine mandate-loving minister president of Bavaria, criticised even these milquetoast restrictions, with some bluster about how he’d already taken a hard line against bars and discos. This is after leading German Corona astrologer, Christian Drosten, used his state media podcast to suggest that Germany should start tolerating some of degree of SARS-2 transmission, and that breakthrough infections among the vaccinated should be considered normal. Such statements, which almost surely reflect sentiments within the coalition government, destroy most of the rationale for ongoing restrictions and vaccine mandates.

Meanwhile, in Austria, the thrice-vaccinated chancellor Karl Nehammer has tested positive for Corona. The news comes as Austria announces they will delay implementing their vaccine mandate by two months. It will now take effect in April, if at all. Gerald Gartlehner, an epidemiologist and sometime governmental adviser, suggested that mandates (or at least their enforcement) might have to be re-evaluated in light of Omicron and the widespread immunity the new variant will elicit across the Austrian population. There is every reason to think that Austria will be past the peak of the Omicron wave in April, and that a majority of Austrians with have SARS-2 antibodies by then.

In the United States, former Biden advisers have published a series of editorials in the Journal of the American Medical Association, arguing that it is time to normalise containment and begin managing SARS-2 as one of various seasonal respiratory infections. It is obvious that we are at a turning point, even if everyone has yet to realise it – even if France is sharpening vaccine requirements, even if Italy has imposed vaccine mandates for everyone over 50, and even if Canada is for the moment determined to remain a prison state. This is the first time since the Floyd riots in America, that major political leaders and public health authorities have said that preventing Corona can no longer be the highest goal of western society.

“In an open letter to the Government’s vaccination advisory committee – the JCVI – the MPs including Miriam Cates, Esther McVey and Sir Desmond Swayne and scientists including Professor Allyson Pollock, Dr Roland Salmon and Professor Brent Taylor write that “the risk to benefit ratio for child Covid vaccination has worsened since September”.

• Re: Review of Child Vaccination Programme (DS)

January 2021 – To Members of the Joint Committee on Vaccines and Immunisation, – On September 3rd 2021 the JCVI advised against recommending the mass vaccination of healthy 12-15-year-olds against COVID-19. The principal reason given for this was that, while the known benefits and harms from vaccination to this age group were both very small, the Committee was concerned about the unknown potential harms of the new vaccine, particularly the long-term and possibly serious risks of myocarditis. The JCVI estimated that for every one million 12-15-year-olds vaccinated with two doses, 2.54 ICU admissions would be avoided and up to 51 cases of myocarditis caused. Subsequently, the risk of myocarditis and other adverse events has been shown to be greater than believed by the JCVI at the time.

The Government referred the matter to the CMO, asking him to consider the ‘wider benefits’ to children of vaccination. On September 13th 2021 Professor Chris Whitty recommended that one dose of the vaccine be given to healthy 12-15-year-olds on the basis that it would possibly provide ‘marginal benefits’, specifically in reducing the time spent out of school as a result of Covid infection. This was calculated as a saving of, on average, 15 mins of education per child. (This estimate did not take into account disruption even from short term vaccine side effects and is also based on assumptions about the level of protection one dose of the vaccine gives against infection which have proved to be over-optimistic.)

The risk and benefit calculations made by the JCVI and the CMO were based on less complete data on both the harms and benefits of vaccinating children compared to the evidence now available. Four months later, we are in a very different position, with the virulent Delta variant almost completely replaced by the milder Omicron variant. Additionally, society now has a higher level of robust immunity from natural infection than it had when teenage vaccination was approved. We have seen in recent weeks that Omicron is significantly more infectious than Delta (based on secondary attack rates, it was originally twice as transmissible as Delta, but this has declined to 1.3 times as transmissible as naturally acquired variant-specific immunity to it has risen). Vaccines are also far less effective at stemming the transmission of Omicron, compared to Delta (protection appears to fall to zero, three months after vaccination).

More data have emerged about the frequency of harmful side effects of Covid vaccination. One study found that for males under 40, risk of myocarditis was up to 14 times higher after vaccination than after infection (101 cases after the Moderna second dose, compared to seven cases after infection). It is particularly important to note that the risks of myocarditis in young men and boys seems to increase significantly after a second dose of the vaccine – which is why Chief Medical Officer Professor Chris Whitty initially recommended just one dose be given to 12-15 year olds – and yet we are now offering second doses to children, despite the evidence of risk growing.

A symptom found only in one place?

• New Symptom Of Omicron In Young Children Revealed (RT)

American scientists have identified a new symptom of the Omicron variant in children under five; a “barking” cough that may sound frightening when parents hear it. According to Dr. Buddy Creech, a pediatric infectious diseases expert at the Vanderbilt University Medical Center in Nashville, some Covid patients in the youngest age group develop “croup-like” coughs which can be identified by a “barking” sound. That happens, Creech told NBC news, because “little kids’ airways are so narrow that it takes far less inflammation to clog them.” The best way to protect the youngest children, who are not yet eligible for the vaccines, is to “cocoon” them around vaccinated people, he said.

Croup, which is an infection of the vocal cords, windpipe, and bronchial tubes, is a well-known and usually easily treatable disease, so doctors are telling parents not to panic. While the croup cough may be “scary to hear,” it does not necessarily mean there are any problems with the lungs, said Dr. Amy Edwards, a pediatric infectious diseases expert at the University Hospitals Rainbow Babies and Children’s Hospital in Cleveland.

No, it’s upside down. Diabetic kids are more vulnerable to Covid. Actually, quite a sinister suggestion.

• Does Covid19 Cause Diabetes In Kids? (Prasad)

The CDC is back with a new piece of propagan—- I mean, a new publication. It claims that kids (<18) with COVID are more likely to be diagnosed with diabetes in the next 30 days than kids without COVID or kids with other pre-pandemic respiratory viruses. It asserts this is a causal effect. COVID causes diabetes in kids. To make this claim, the CDC examines 2 databases: IQVIA and HealthVerity. From IQVIA, they pull out kids <18 with COVID19 diagnosis, and age and sex matched kids without the diagnosis, as well as those with a prior non-covid respiratory infection. From HealthVerity, they pull out kids <18 with COVID19 diagnosis and kids <18 who got tested for COVID19 and were negative*. (we shall return to this).

In all cases, administrative/billing codes for COVID19 and diabetes were used to see who had COVID19 and who developed diabetes within 30 days of the index encounter. Of course, many, many more kids had COVID who are not in the database. Some may not have even had symptoms, and others may not have sought testing. In IQVIA, among kids with COVID19, a whopping 68 out of 80,000+ or 0.08% ended with diabetes; among kids without COVID19, it was 132 out of 400,000+ or 0.03% ended up with diabetes, and among kids with prior respiratory infection it was ~0.06% The absolute risk of diabetes due to COVID (if you believed this is causal) appears to be an increase on par with a swiftly eaten bag of skittles.

Now in the HealthVerity database, the risk of diabetes post COVID19 was 0.25% (a quarter of 1 percent), if you were tested for COVID19 but negative, it was 0.19% (one fifth of 1 percent). Here, COVID appears as risky as a McDonalds supersized soda. The CDC trumpets this finding as “children and teens 18 years & younger who have had #COVID19 are up to 2.5 times more likely to have a #diabetes diagnosis after infection” Is that a fair take away or a fear-mongering distortion? First, the whole analysis hinges on the idea that age-sex matched kids without covid should be comparable to the kids who got covid in terms of risk of diabetes. The only difference between the kids should be that some, unfortunately, had covid. But COVID may be more likely to affect kids of lower socioeconomic status, of certain races, and kids who were already overweight or suffering from medical problems.

Does the CDC attempt to correct for any of these confounders? Not at all. They surely have height and weight, and could adjust for BMI, but do not. I am truly puzzled as to why. Second, they don’t have the true denominator. This is only kids who present and have a COVID19 diagnosis. Seroprevalence is needed to find the real denominator of kids with COVID19. This will lower the absolute risks. COVID19 may be downgraded from a whole bag of skittles to a single, red skittle. Does the CDC adjust for this? Nope. Third, kids who seek medical care for COVID19 may get more blood tests than those without COVID19, and perhaps more than those with other respiratory viruses in yesteryear. This too may capture more diabetes. Does the CDC correct for ascertainment? Not at all.

Joe Rogan AF Neil

https://twitter.com/i/status/1479887329925996547

Turley on Twitter: “Would quoting Justice Breyer or Sotomayor from the vaccine mandate oral argument get one suspension by Twitter for covid disinformation?”

• Federal Vaccine Mandate Enters ‘Major Question’ Land (Turley)

“Major-question-land,” the term coined by Louisiana solicitor general Elizabeth Murrill during Friday’s oral arguments over the Biden vaccine mandates, has an almost Disneyesque sound to it. However, unlike Yesterland or Tomorrowland, major-question-land clearly holds no attraction for the Biden administration or the court’s liberal justices. The defenders of the mandates worked mightily to avoid the fact that it’s the first-ever national vaccine mandate and was decided without the approval of Congress. Chief Justice John Roberts, a vital vote needed by the administration, noted that this administration was relying on language passed roughly 50 years ago — closer to the Spanish Flu than the novel coronavirus — and stated ominously, “This is something the federal government has never done before.”

That sounds not just like a question but a major one. The major-questions doctrine maintains that courts should not defer to agency statutory interpretations when the underlying questions concern “vast economic or political significance.” The controversy over the mandates shows the wisdom of the doctrine demanding that Congress not only take action but responsibility, too, for such major decisions. With increasing confusion over changing CDC guidelines and the risk profile associated with the Omicron variant, congressional action could bring both greater legitimacy and clarity to questions swirling around mandates.

Instead, the Supreme Court is grappling with an executive move that was openly discussed not only as an avoidance of Congress but a circumvention of constitutional limitations. It was not a good sign for the administration that the most referenced individual during oral argument was Biden’s chief of staff, Ron Klain, who tweeted that the mandates were “workarounds” of the Constitution. Chief Justice Roberts, Justice Neil Gorsuch, and others referred to Klain’s admission as the administration’s lawyers tried to argue that the executive had the constitutional authority to implement a national mandate.

The liberal justices took the “time is of the essence” argument to an almost apocalyptic degree: Justice Stephen Breyer kept mentioning that every second they wait, more people are getting COVID, and he incorrectly stated there were “750 million new cases yesterday.” Justice Sonia Sotomayor stated as a fact that “Omicron is as deadly as Delta and causes as much serious disease in the unvaccinated as Delta did.” That is not true. Omicron appears to be far more virulent, but less lethal than Delta. Sotomayor also claimed that “we have over 100,000 children, which we’ve never had before, in serious condition, and many on ventilators.” That is also untrue. For patients, up to 17 years old, the seven-day average for hospitalizations was 797.

Tucker Sotomayor

Biden vax mandate goes to the supreme court pic.twitter.com/wNE3DSzcwm

— Nietzsche fan (@nietzsche_1984) January 8, 2022

Agricultural pilot “was told that his inner ears were ruptured, and fluid inside was leaking inward toward the inside of his skull.”

• People Injured by COVID-19 Vaccine Are Left in the Dark (ET)

People injured by the COVID-19 vaccine have no meaningful way to get compensated and have been ignored by the federal government, according to an agricultural pilot who has been seriously injured by taking the COVID-19 vaccine. “At this point, the government has totally abandoned us,” Cody Flint, a vaccine-injured pilot, told NTD’s “The Nation Speaks” program in an interview broadcast on Jan. 1. [..] On Feb. 1, 2021, Flint volunteered to get the vaccine. “Just an exciting day—thought we were gonna put this behind us,” Flint recalled.

But within 30 minutes, he developed an odd headache after receiving the vaccine. Two days later, he took his first flight that year. Immediately after takeoff, he had tunnel vision. Flint tried to push forward to keep his commitment to his client. But he felt like a bomb went off inside his head in the end. He couldn’t remember how he landed the plane back on the runway. “Really by the grace of God that there was not an accident. I went to my family doctor immediately,” Flint said. Later, he was told that his inner ears were ruptured, and fluid inside was leaking inward toward the inside of his skull. Doctors explained that only highly elevated intracranial pressure from things like a car wreck, major head trauma, or things of that nature could make that happen to both of his ears at the same time on the same day.

“Obviously, I had none of those. The only thing that changed in my life was I got the vaccine and developed a severe headache immediately that got worse leading up to that point,” Flint said. Flint went through two surgeries and dozens of doctor visits afterward. His condition improved, but he still has trouble driving. “I don’t know what my next stepping stone in life is going to be. I don’t know,” Flint said, noting that his pilot license was taken away. “I don’t know what to do at this point. I spent every dime I’ve saved my entire life on the surgeries and just trying to survive and feed my family since the incident happened.”

Having been an agricultural pilot for 15 years, Flint said he’s not an anti-vaxxer. “I signed up and got it the first day I could possibly get it. I believed in vaccines,” Flint told The Epoch Times last month. Now Flint is critical of the vaccine mandate. “That’s the Achilles heel of the mandate. This does not fit everyone. It’s not a one-size-fits-all solution,” Flint told NTD. “There are thousands and thousands of people around the country. I’ve been in touch with a lot of them that have had absolutely life-altering, career-ending injuries from these vaccines. A lot of them are pilots. It is scary that how many pilots are being injured by this.”

Dave seems to think we already finished part 1.

• 2021 Year in Review: The Rise of Centralized Healthcare (Collum)

1/The US and the World appeared to need a vaccine developed and produced. We forked up serious Federal support and threw caution to the wind via Operation Warp Speed. The vaccine policies were coming from the healthcare authorities. In our haste, all safeguards were removed, which led via shoddy methodology to produce a product of questionable efficacy pushed on the public with oppressive tactics. The medium and long-term risks are unknown.

2/ Ivermectin. Early treatment of the disease was completely neglected by policy. Frontline doctors trying to McGyver their way into solutions using Ivermectin and other drugs were shut down completely. Careers were destroyed. The public was duped by a massive media campaign and overt censorship. All this was to ensure that the vaccines and patent-protected antiviral drugs could be developed and sold. There are, however, darker and more sinister interpretations.

3/The lockdowns and social distancing policies came almost exclusively from the medical authorities paying no attention whatsoever to the socioeconomic and other health consequences.

In short, we gave healthcare “authorities” autocratic control over every facet of our society. Rochelle Walensky, the Director of the CDC, went so far as to set policy on apartment evictions. How fucked up is that? We socialized the healthcare costs and privatized the profits. Where have I heard that one before? The Overton Window is now stuck wide open. The FDA and CDC won’t go quiescent, and many of us won’t trust them now. The next crisis will be sooner than you can imagine and be accompanied by calls for further largesse and lockdowns. It will seem so natural to comply. The new normal is in society’s DNA.

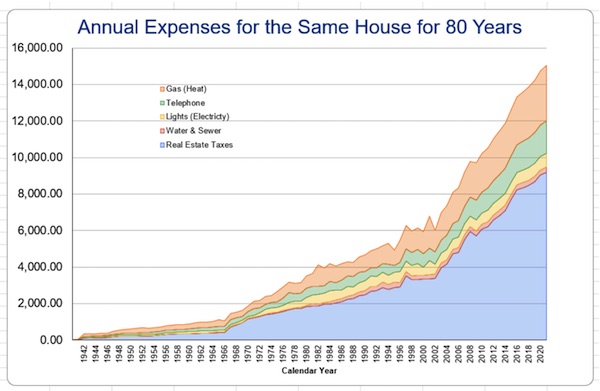

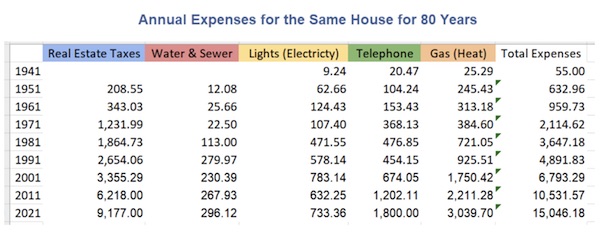

Great data. Since two thirds of the rise is taxation, I would be very careful about calling this inflation.

“My Grandfather was in the same job and same house his entire life. He maintained the same standard of living in all the years I knew him.”

• Household Expense Data, the Same House for 80 Years (Mish)

Reader Holly Writes: Dear Mish, Recently I came into possession of the financial records of my grandfather. I plugged a bunch of the numbers into a spreadsheet just for kicks. What is most interesting about these numbers is they start in 1941 when he purchased the home. It was left to my mother, and then to me in 2020 (80 years of finances for the same home!) My Grandfather was in the same job and same house his entire life. He maintained the same standard of living in all the years I knew him. The numbers show that the cost of maintaining a stable standard of living reflects a much higher inflation rate than any of the indexes I have compared it too. After my grandfather passed in 2003 until I acquired the home in 2020 I had to approximate some expenses. I took the records I had from 2020 and 2021 and filled in the missing gaps.

Regards, Holly

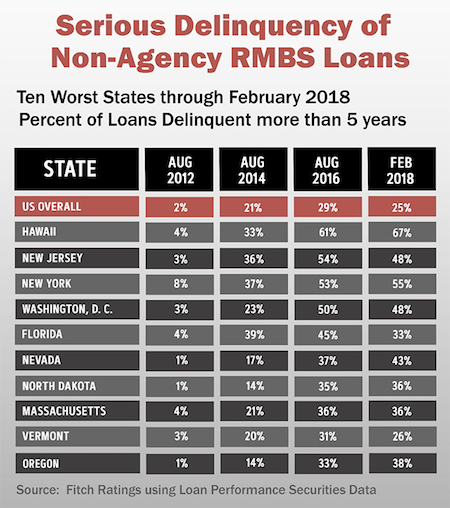

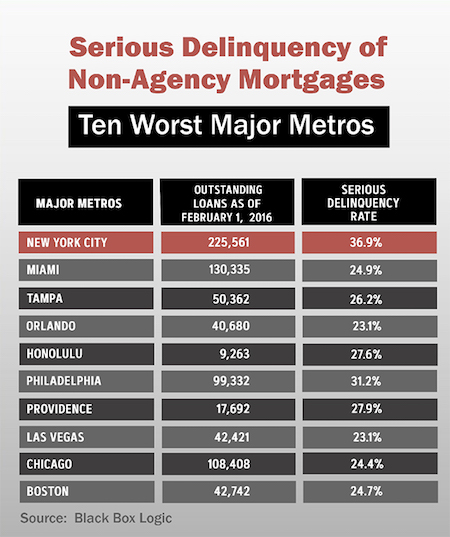

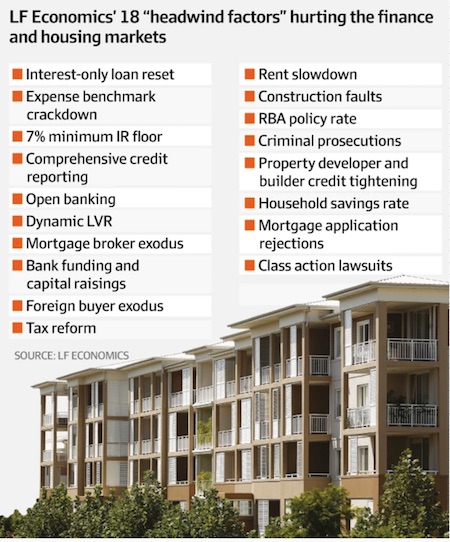

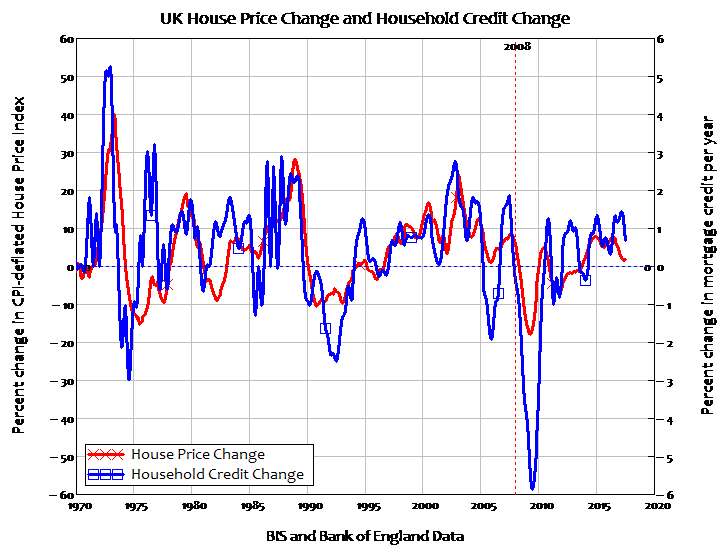

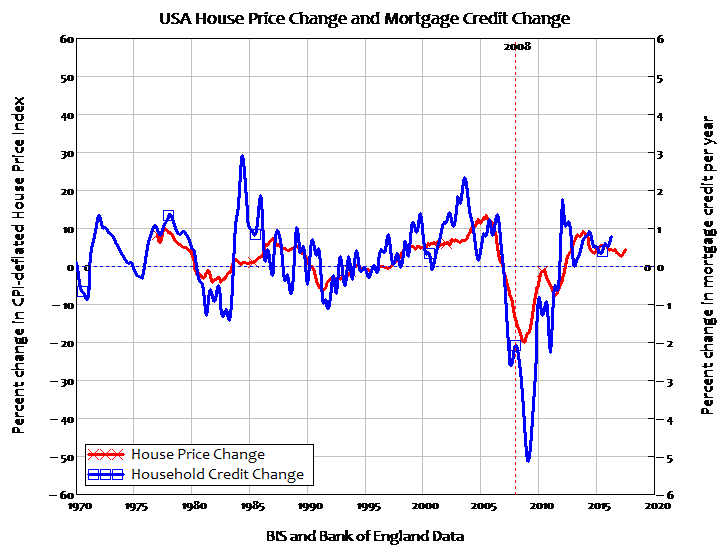

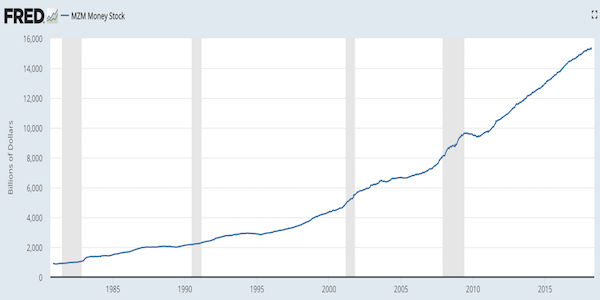

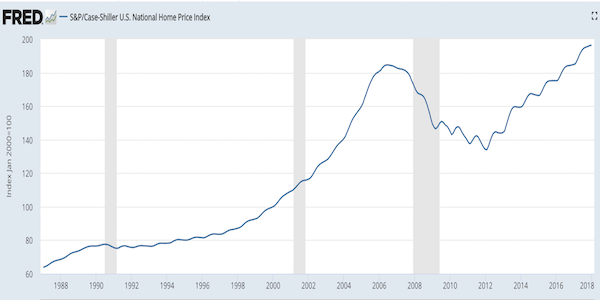

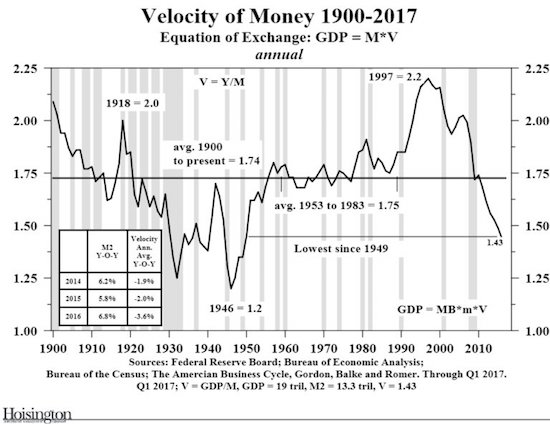

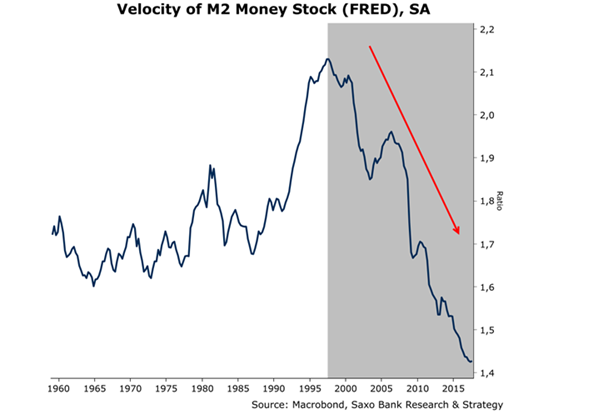

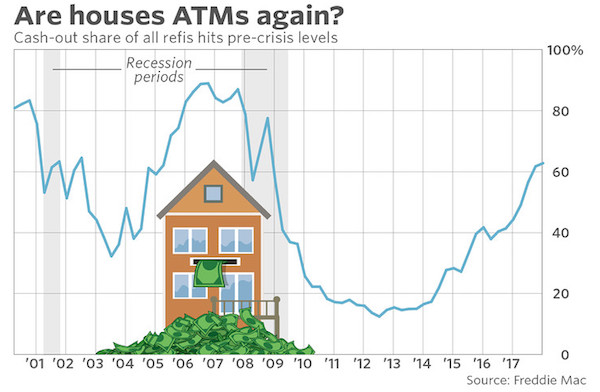

“..24% of all outstanding residential mortgages in this whole big country reside in the central bank..”

There’s neither a housing market nor a mortgage market. Both are cornered.

• The Federal Reserve Keeps Buying Mortgages (Pollock)

Runaway house price inflation continues to characterize the U.S. market. House prices across the country rose 15.8% on average in October 2021 from the year before. U.S. house prices are far over their 2006 Bubble peak, and remain over the Bubble peak even after adjustment for consumer price inflation. They will keep on rising at the annual rate of 14–16% for the rest of 2021, according to the AEI Housing Center. Unbelievably, in this situation the Federal Reserve keeps on buying mortgages. It buys a lot of them and continues to be the price-setting marginal buyer or Big Bid in the mortgage market, expanding its mortgage portfolio with one hand, and printing money with the other. It should have stopped before now, but the purchases, financed by newly created fiat money, or monetization, go on.

They proceed at the rate of tens of billions of dollars a month, stoking the house price inflation, making it harder and harder for new families to afford a house. A recent Wall Street Journal opinion piece was entitled “How the Fed Rigs the Bond Market”—it rigs the mortgage market, too. The balance sheet of the Federal Reserve has grown to a size that would have amazed previous generations of Federal Reserve governors and economists. Although we have become somewhat accustomed to it, so fast do perceptions adjust, it would also have surprised readers of Housing Finance International of five years ago, and readers of 15 years ago would probably have judged the current reality simply impossible. Over time, we keep discovering how feeble are our judgments of what is possible or impossible.

The total assets of the Federal Reserve reached $8.7 trillion in November 2021. This is just about double the $4.5 trillion of November 2016, five years before—and we thought it was really big then. Today’s Federal Reserve assets are ten times what they were in November 2006, 15 years ago, when they were $861 billion, and none were mortgages. The Federal Reserve now owns on its balance sheet $2.6 trillion in mortgages. That means about 24% of all outstanding residential mortgages in this whole big country reside in the central bank, which has thereby earned the remarkable status of becoming by far the largest savings and loan institution in the world. Like the historical U.S. savings and loans associations, the Federal Reserve owns very long-term mortgages, with their interest rates fixed for 15 to 30 years, and neither marks its investments to market in its financial statements nor hedges its substantial interest rate risk.

Size comparison between Hubble and JWST (Webb telescope) primary mirror

Tucker Viagra

Dr. Marc Siegel reacts to a U.K. nurse waking up, having been in a coma for a month, after receiving a dose of Viagra on 'Tucker Carlson Tonight.' pic.twitter.com/IfxsDYdvfC

— Nietzsche fan (@nietzsche_1984) January 8, 2022

Leave me alone!

https://twitter.com/i/status/1479765306675539970

God save the queen

That Tory MP who wants the BBC to play the National Anthem every night 1st raised the idea 5 years ago – Newsnight reaction was brilliant… pic.twitter.com/V0LAPRoQj0

— Josef O'Shea (@josefoshea) January 6, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.