Odilon Redon Fallen angel 1872

Roth

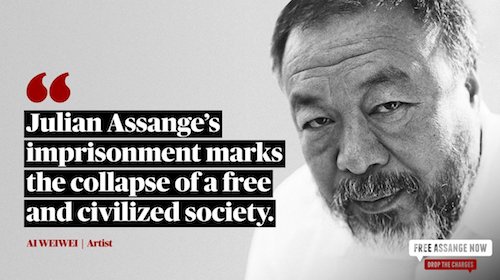

Did Mike Pompeo personally direct the CIA to spy on Julian Assange? pic.twitter.com/yCZtO552Ud

— Richard Medhurst (@richimedhurst) August 17, 2022

Roth/Ratner

Human Rights attorney, Margaret Ratner on #lawsuit against #MikePompeo#latestnews on #JulianAssange pic.twitter.com/e5nki5Cis7

— Don't Extradite Assange (@DEAcampaign) August 16, 2022

France

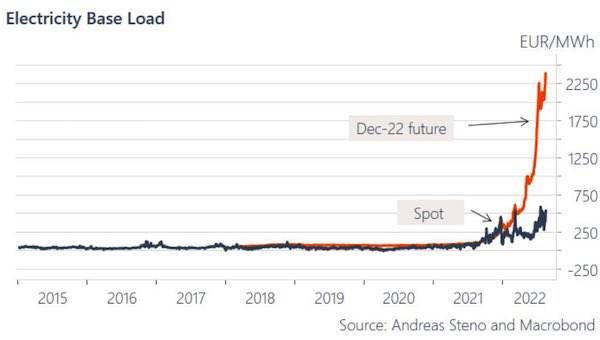

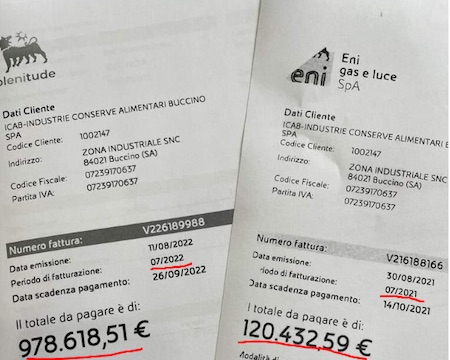

Gas & electricity bill for a business owner in the South of Italy. – July 2021: EUR 120k – July 2022: EUR 979k In his own words: ”A holiday in July would have been more profitable than running my business with these input costs”

Lawyer sundance: “.. the think-tanks and high-minded climate change ideologues do not have the ability to manage a transition and still meet the needs of people..”

• Something is Looming Geopolitically, We Better Start Taking It Seriously (CTH)

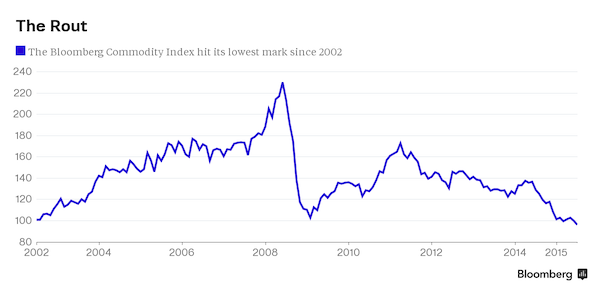

As a result of western governments’ taking collective action under the auspices of a ‘climate change’ agenda, we are on the cusp of something happening with ramifications that no one has ever seen before. Western governments’, specifically western Europe, North America (U.S-Canada) and Australia/New Zealand, are intentionally trying to lower economic activity to meet the intentional drop in energy production. This is the core consequence of the Build Back Better agenda as promoted by the World Economic Forum. Anyone who says there is a reference point to determine both the short-term and long-term consequences is lying. There is no precedent for nations’ collectively and intentionally trying to reduce economic activity.

Hiding behind the false justification that current inflation is driven by too much demand, central banks in Europe, the Bank of England, Bank of Canada and U.S. federal reserve are raising interest rates. The outcome we are currently feeling is an intentional economic contraction and global recession. The Build Back Better monetary policy is successfully shrinking western economic activity; however, the impacted nations that produce goods for markets in North America and Europe, specifically southeast Asia, Japan and China, are not raising interest rates in an effort to try and offset the drop in demand. China has announced they are dropping their central bank rates in a desperate effort to lower costs and keep their export dependent economy working.

Underneath all of this, is a drop in energy production in the same nations trying to lower economic activity. The political policymakers are attempting to manage this process without informing the citizens of the unspoken goal. Shortages of oil, coal and natural gas are self-inflicted problems, all part of the BBB agenda. Beyond the massive increases in energy costs, which is the true source of inflation and a direct/intentional outcome of the BBB effort, Europe is now facing a looming winter without the energy resources to heat homes and sustain people. Things are going to be very uncomfortable in Europe this winter as roaming brownouts are now predicted.

As the collective west attempts to, using their words, “manage the transition,” they do not have mechanisms to control an outcome of this magnitude. It is simply too big a situation to manage. Where the rubber meets the road, the think-tanks and high-minded climate change ideologues do not have the ability to manage a transition and still meet the needs of people. Beyond the esoteric thinking, there are real consequences from these actions.

What would we know about modern Asian politics without Pepe Escobar?

• A Eurasian Jigsaw: BRI and INSTC (Escobar)

There’s no question that the proxy war in Ukraine between the US and Russia has been creating serious problems for BRI expansion. After all, the US war on Russia is also a war against BRI. The top three BRI corridors from Xinjiang to Europe are the New Eurasian Land Bridge, the China-Central Asia-West Asia Economic Corridor, and the China-Russia-Mongolia Economic Corridor. The New Eurasian Land Bridge uses the Trans-Siberian and a second link through Xinjiang-Kazakhstan (via the dry land port of Khorgos) and then Russia. The corridor via Mongolia is in fact two corridors: one from Beijing-Tianjin-Hebei to Inner Mongolia and then Russia; and the other from Dalian and Shenyang and then to Chita in Russia, near the Chinese border.

As it stands, the Chinese are not using Land Bridge and the Mongolian corridor as much as before, mainly because of western sanctions on Russia. The current BRI emphasis is via Central Asia and West Asia, with one branch then bisecting toward the Persian Gulf and on the Mediterranean. And this is where we see another – highly complex – level of intersection quickly developing: how the increasing importance for China of Central Asia and West Asia mixes with the increasing importance of the INSTC for both Russia and Iran in their trade with India. Call it the friendly vector of the War of Transportation Corridors.

The hardcore vector – real war – is already being deployed by the usual suspects. They are predictably bent on destabilizing and/or smashing any node of BRI/INSTC/EAEU/SCO Eurasia integration, by any means necessary: be it in Ukraine, Afghanistan, Balochistan, the Central Asian “stans” or Xinjiang. As far as the major Eurasian actors are concerned, that’s bound to be an Anglo-American train to nowhere.

Someone will find excuses not to go. They first need to hide evidence.

• Russia Urges International Inspection Of Shelled Nuclear Site (RT)

Russia is calling on the International Atomic Energy Agency (IAEA) to visit the Zaporozhye nuclear power plant as soon as possible to fulfill its mandate as the UN’s nuclear watchdog, a senior Russian diplomat said. “We would like such an IAEA mission to take place soon. Russia will do its best to facilitate it,” Igor Vishnevetsky, the deputy foreign minister for arms control, said during a Nuclear Nonproliferation Treaty conference on Wednesday. The inspection was supposed to happen sometime ago, he added, but was derailed “not due to a fault of ours.” The diplomat pointed the finger at Ukraine, saying that its regular attacks on the nuclear site was why it was not safe for IAEA monitors to visit it. “People should not attack nuclear sites, should not use artillery or other weapons against nuclear power plants,” Vishnevetsky stressed.

“The Ukrainian side knows it very well, and nevertheless does it, effectively committing acts of nuclear terrorism.” The Ukrainian power plant, the largest of its kind in Europe, comes under regular artillery shelling. One projectile this week reportedly struck ten meters from a container holding spent nuclear fuel. Kiev denies carrying out the strikes and claims that Russian troops are shelling the plant to discredit Ukraine. It also accused Russia of stationing its military forces at the Zaporozhye plant. The UN would neither confirm nor deny allegations by either side and called for a demilitarized zone around the nuclear facility. The US said that Russia had to cede control of the plant and the city of Energodar, where it’s located, to Ukraine, to prevent the risk of a nuclear disaster.

“..European military aid commitments for Ukraine have been on a downward trend since the end of April…”

• Europe’s Powers Gave Ukraine No New Military Pledges In July (Pol.eu)

Throughout all of July, Europe’s six largest countries offered Ukraine no new bilateral military commitments, according to new data — the first month that had happened since Russia invaded in February. The revelation is a sign that despite historic shifts in European defense policy — which have seen once reluctant countries like France and Germany ship arms to Ukraine — military aid to Ukraine may be waning just as Kyiv launches a crucial counteroffensive. The fresh data, covering the U.K., France, Germany, Spain, Italy and Poland and set for release on Thursday, comes from the Kiel Institute for the World Economy, which has been maintaining a Ukraine Support Tracker throughout the war.

It illustrates a point Ukrainian military officials and politicians have been repeatedly making: That major European powers are not keeping up with the military aid coming from the U.S., and that having led the charge, big-hitting Britain and Poland may be running out of steam. Military specialists and some members of European Parliament have increasingly echoed the point recently. Christoph Trebesch, head of the team compiling the Ukraine Support Tracker, said the organization’s data showed European military aid commitments for Ukraine have been on a downward trend since the end of April. “Despite the war entering a critical phase, new aid initiatives have dried up,” he said.

Western allies did meet last week in Cophenhagen to gather pledges for boosting Ukraine’s military, amassing €1.5 billion in commitments. But Trebesch, who said his team is still analyzing the numbers, cautioned the figure “is meager compared to what was raised in earlier conferences.” Trebesch argued that European countries should be considering the Ukraine war as more akin to the eurozone crisis or the coronavirus pandemic, two events that promoted the Continent to funnel hundreds of billions into emergency funding measures. “When you compare the speed at which the checkbook came out and the size of the money that was delivered, compared to what is on offer for Ukraine, it is tiny in comparison,” he said.

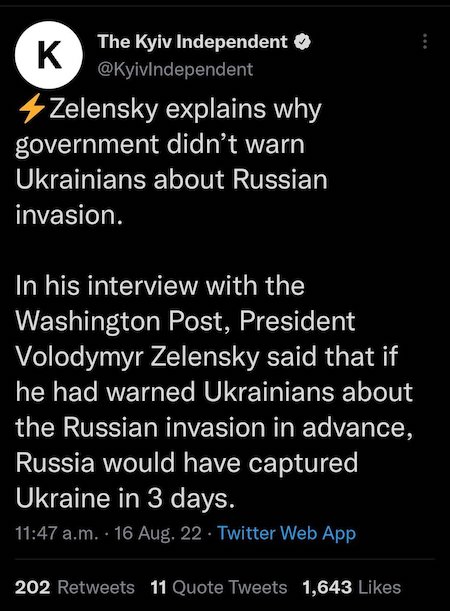

You won’t see it in the rhetoric, but “we” are withdrawing.

• Ukraine Could Be Put On ‘Ammo Diet’ – US Military Expert (RT)

Ukraine’s European backers may be about to put the country on an “ammunition diet”, an American military analyst has claimed in an interview with Germany’s Der Spiegel. Michael Kofman said these nations may already have reached their limit in terms of weapons supplies to Kiev. In an article published on Tuesday, Kofman was quoted as saying it is not in the Ukrainian military’s best interests to bide its time, as the weather will soon begin to worsen, making any counteroffensive more difficult to pull off. On top of that, according to the US expert, Russian troops could use a hiatus to regroup and “solve some of their personnel problems.” He noted that time would be on Kiev’s side if Western support was unlimited. However, that is likely not the case, and the Ukrainian leadership is well aware of this, Kofman suggested.

He added that the “Ukrainians are apparently quite concerned about for how long they can expect further support, especially from the Europeans.” The analyst went on to suggest that Kiev’s European backers may already have “given Ukraine most of the weapons they are ready to give.” “The Ukrainians will likely go on a kind of ammunition diet,” Kofman predicted. The analyst told journalists that, with this in mind, the leadership in Kiev may be concerned that Ukraine “could come under pressure to accept the stalemate” in the absence of any major success by the start of next year. Such a scenario “would be a defeat for Ukraine,” he noted. Kofman concluded that Kiev’s ability to reclaim territories seized by Russia ultimately hinges on the extent of its Western support.

He also acknowledged “some small Russian successes in the southern part of Donbass, like in Peski,” adding, however, that the offensive is largely being carried out by the militaries of the Donetsk People’s Republic (DPR) and the Lugansk People’s Republic (LPR), as well as by “Wagner mercenaries.” When asked about the possibility of a Ukrainian counteroffensive to reclaim the southern city of Kherson, which is currently held by Russian forces, Kofman pointed out that while Kiev has a lot of personnel on paper, only a limited number of units are “really trained and equipped for that.”

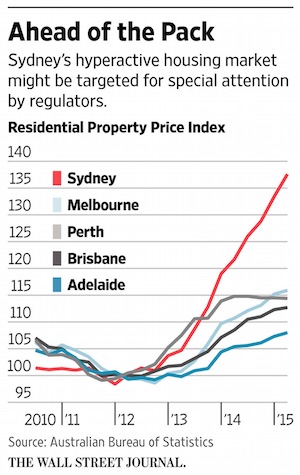

Translated from Le Courrier du Soir. “The European Union on the brink of a new unprecedented political crisis.”

• Germany Declares War On Europe And Refuses To Ban Russians (CdS)

The European Union on the brink of a new unprecedented political crisis. Less than a year after the violent crisis over Russian gas which had deeply divided the Union, it is now the thorny issue of the visa granted to Russian citizens which risks provoking a real internal war. Indeed, it all started a few days ago when the Ukrainian President, Zelensky, asked that European countries prohibit access to their soil to all Russian nationals. His wishes seem granted because for three days, EU countries have been working hard to stop granting visas to Russians. But the project risks leading to a total fiasco because Germany, Europe’s leading economic power, is firmly opposed to it. This is at least the information that Lecourrier-du-soir.com obtained on August 16 from several reliable sources including the Euronews media.

Indeed, according to information provided by this press organ, German Chancellor Olaf Scholz expressed his disagreement (on this subject) during a trip to Oslo. In front of the press, his remarks were blunt. “This is not the Russian people’s war. It’s Putin’s war and we have to be clear about it,” he said. The German Chancellor also made a point of pointing out that several Russian citizens are fleeing Russia because they are not in phase with the policy of the regime in place. Meanwhile, the subject is already on the table but could trigger a new political crisis within the EU where some believe that banning Russians from entering Europe is a good move. This is at least the opinion of Kaja Kallas, Prime Minister of Estonia who, in a tweet posted on August 09, did not mince words.

“Stop granting visas to Russians. Visiting Europe is a privilege, not a human right. Airspace must be closed. This means that while Schengen countries continue to issue visas, Russia’s neighbors bear the burden. It is time to end tourism from Russia immediately”, she reacted. And Estonia is not the only European country to refuse to grant visas to Russians. Because, on August 14, in a tweet posted on his official account, Andriy Yermak, close to the Polish president, also made it known that his country will prohibit access to its territory to all Russian nationals.

“..close the local swimming pool amid the record summer heat, citing a choice between the cost of feeding school kids increasingly pricy organic food in the cafeteria… or keeping the facility open.”

• Putin First, Populists Next – Who To Blame For The Energy Crisis? (RT)

At the outset of the Ukraine conflict, Western officials proclaimed their unity against Moscow and vowed to accelerate their transition away from Russian fossil fuels and towards greener energy. The idea was to deprive the Kremlin of revenues which, in their minds, would result in defunding the military operation in Ukraine. So they went full scorched-earth on their own cheap energy supply – that is, gas from Europe’s largest country – and sanctioned it. It wasn’t long before it became obvious that was something much easier said than done. Soon, officials started making public requests of their citizens to “do their part” by sacrificing their everyday comforts and quality of life, like taking shorter showers – as though that would remedy the fact that industrial representatives were already sounding the alarm about rationing and manufacturing shortages.

Next, Western officials started backpedalling on their pledges to eradicate those forms of energy they had previously considered non-green. It was barely a few months earlier that Germany was chastising France for persisting with nuclear energy. Now, Berlin may potentially be joining Paris in turning back to it as a source, all while it also fires the old coal plants back up. Western Europeans had initially figured that they could at least maybe rely on hydroelectric energy from Norway, but the dry summer heat now threatens that, too, as Oslo considers cuts to its exports. And even liquified natural gas from Britain may not be exportable to the EU, since toxic and even radioactive contaminantshave recently been found in the supply originally sourced from countries like the US and Qatar.

The first flickers of real trouble are already evident – well ahead of the winter heating boom. The British consulting firm, Cornwall Insights, is warning of possible planned blackouts and empty shelves in Britain. Average household energy costs in the UK have reached £4,000 ($4,860) per year and are estimated to go even higher. The Bank of England is warning of a recession amid inflation which, in Germany, has just hit the highest level since reunification in 1990. Countries like Spain and Italy are imposing limits on heating and air conditioning in both public and commercial buildings. The EU’s imposition of a 15% energy cut across all member states has just come into effect, providing yet another pretext to reduce services to taxpayers. The mayor of the French town of Cabriès used it as an excuse to close the local swimming pool amid the record summer heat, citing a choice between the cost of feeding school kids increasingly pricy organic food in the cafeteria… or keeping the facility open.

And whose fault is all this? It should seem obvious, no? Western officials cut themselves off from their own energy source in order to play geopolitics by pulling Ukraine into their orbit – but the blame is squarely on Russia. That’s what they said and that’s what they’re doubling down on. Britain’s Daily Mail refers in a graphic to Putin cutting the gas supply. “Putin’s new gas squeeze condemns Europe to recession and a hard winter of rationing,” according to a CNBC headline. US President Joe Biden has framed it as “Putin’s tax on both food and gas.”Yet these officials did it to themselves – and to their citizens – “for Ukraine.”

“US attempts to divide the energy markets into ‘good’ and ‘bad’ leads to destabilization, rising fuel prices and inflation..”

• Russia Names Main Victim Of US Energy ‘Victory’ (RT)

Europe’s current woes with natural gas supplies are due to US pressure to block the Nord Stream 2 pipeline from coming online, Russian ambassador in Washington Anatoly Antonov said in a TV interview on Wednesday. With this, he said, the US won a victory not so much over Russia, but over European industry, which now has to rely on far more expensive American “molecules of freedom.” “No matter how much Washington tries to present Russia as an unreliable supplier, this is not true,” Antonov told Russia-24 in an interview that aired Wednesday evening. “The problems of our buyers began solely as a result of sanctions and restrictions imposed or inspired by the US,” the ambassador added. “We are ready to sell to everyone who needs inexpensive and high-quality resources.”

He cited the example of Nord Stream 2, the pipeline under the Baltic Sea that was supposed to deliver natural gas from Russia to Germany. It was completed last year but Berlin halted its certification in February – prior to the escalation of hostilities in Ukraine – and refused to make it operational despite appeals from German industry and local officials to do so. “The pipeline was ready to launch and could solve almost all the supply problems that arose with [Nord Stream 1] due to the sanctions confusion,” Antonov said. “The only thing missing is political will, the EU states just need to press the button and the pipeline will start working. But in the EU capitals they gave in to persistent pressure from the White House. As a result, a bet was made on expensive LNG.”

Liquefied natural gas is exported by the US in quantities nowhere near sufficient for the European market. Antonov made a pointed reference to the US Department of Energy calling it “molecules of freedom” back in 2019. Nord Stream 2 was a victory for Washington, which “struck a massive blow not so much against Russia, but against European competitiveness,” Antonov said. Addressing the reports that the US and its allies are trying to impose a price cap on Russian oil and gas exports, Antonov pointed out that such attempts would backfire, as there would be a realignment of commodity markets “not in favor of Western countries.” “US attempts to divide the energy markets into ‘good’ and ‘bad’ leads to destabilization, rising fuel prices and inflation,” Antonov said.

Google translate from Dutch. Don’t think this guy buys his own groceries.

• Government Must Quickly Start Repairing Purchasing Power – Professor (AD)

The passive attitude of the cabinet to protect the purchasing power of citizens is incomprehensible, says Tilburg economics professor Harald Benink. “A lot was possible quickly during the corona pandemic, now it is going very slowly.” High inflation, especially the high prices for energy and food, will become a huge problem, Benink predicts. “It is unprecedented what is happening with purchasing power. Energy bills that go from 2000 euros to 6000 euros per year. New families are confronted with this every day. And then the groceries are also 10 to 20 percent more expensive,” says Benink. High inflation threatens to put millions of households in financial trouble. And that will lead to more problems, Benink fears. “There will be a great demand for debt relief. But the municipalities do not have the capacity to help all those people at all.”

Benink foresees major economic damage if nothing is done to repair purchasing power. Sooner or later people will have to cut their spending. An economic contraction of more than 4 percent is then possible. And it’s not just about low-income people, middle-income people are also affected by the declining purchasing power.” Added to this is the consequential damage of problematic debts. People get stressed by money problems and that leads to illness, failure and reduced productivity. According to Benink, the government is probably so passive because they underestimated the increase in energy prices. “It was immediately clear during the corona pandemic that it was a major problem. A package of tens of billions of aid was quickly rigged. Now it is less than 10 billion euros.”

While it is the government’s turn, the professor believes. “It is a classic government function to protect people against uninsurable risks. And that’s inflation. You cannot get vaccinated against that. It’s a tsunami that’s hitting the people.” Benink thinks the cabinet will have to come up with a mix of measures to repair purchasing power. Targeted support for lower and middle incomes. I am thinking of the proposal from the Eneco director who wants an income-related energy discount. But it will also be possible to take generic measures, such as a further reduction in VAT or lower income tax.” Money is not the problem. “For example, if we spend 8 billion extra, the government debt will increase by one percentage point. We can have that easily. Doing nothing costs a lot more.”

Ha! Also Google translate from Dutch. The Central bank plays with fire. Not a matter for a central bank. The government should talk to Russia.

• Central Bank Warns Gov’t: Be Cautious With Purchasing Power Repairs (NOS)

The government is under great pressure to do something about sky-high inflation and high energy bills and is considering measures to compensate for rising prices and save purchasing power. However, the Dutch Central Bank (DNB) warns the cabinet against excessively generous financial support measures, because this could be counterproductive and actually fuel inflation. In NRC, DNB director Olaf Sleijpen argues for restraint in compensating companies and households for the increased prices. It is true that companies and households were kept afloat during the corona crisis in 2020 and 2021 with aid measures costing billions of euros, but the current price crisis works differently. “Large-scale support is now unwise and even counterproductive”, says Sleijpen. “During the corona crisis, we benefited from broad financial support – and therefore a decisive role for the government. Now we are not. As difficult as that message is, we can’t get around it.”

The cause of the high inflation is not in demand but in supply, because there is a scarcity and shortage of products and energy. Financial support does not remedy scarcity, but it does stimulate demand and thus fuel prices. “The ECB is trying to slow down demand with its interest rate policy. If the government presses the accelerator at the same time, it does not help to reach the destination (lower inflation),” Sleijpen told the newspaper. On the other hand, DNB shares the concerns about the major economic and social consequences of the rising prices of energy and groceries. Payment problems are looming for low-income households. “It goes without saying that the government will at least address the worst needs, and really focus on the hardest hit households.”

However, generic measures, such as lower energy taxes and fuel taxes, mainly benefit the higher incomes who do not need them. Additional income support measures should also not lead to a larger budget deficit. “Financing income compensation with a higher government debt means that the bill is passed on to the next generations,” says Sleijpen. The idea of asking employers to raise employees’ wages to keep up with rising inflation has raised eyebrows at DNB. It must be “an appropriate wage increase”. “We do not benefit from the full effect of inflation on wages”. There is as yet no sign of the feared wage-price spiral, DNB notes. and so there is room for stronger wage growth for the time being.

Saw a pic of this on Twitter. Went looking on the Guardian frontpage, nothing. Their UK page: nada. Went through Google search in the end. So they finally publish something useful, and then try to hide it. But it’s not about the Green Party, or even the UK: we will see this discussion in many European countries.

• UK Green Party Calls For Nationalisation Of Big Five Energy Firms (G.)

The Greens have called for the permanent nationalisation of the main energy supply companies and for domestic fuel bills to be reduced to the level of last autumn, describing this as a solution to the failed experiment with a market-based energy system. In a proposal that goes well beyond Labour’s idea for a freeze on energy bills for at least six months, the Greens said nationalising the main five energy firms was a necessary part of a plan sufficiently ambitious “to avoid a catastrophe this winter”. The scheme would be based on one proposed by the TUC last month. This was based on a cost of about £2.85bn to nationalise the big five supply firms – British Gas, E.ON, EDF, Scottish Power and Ovo. As a comparison, the government spent £2.2bn bailing out another firm, Bulb.

The Green plan would also involve the energy price cap – the maximum households can pay – being put back to the level of last autumn, before this April’s increase of nearly £700 a year for the average household. Putting this in place throughout the autumn and winter would cost about £37bn, the party said, compared with the £29bn estimated cost of Labour’s proposal to keep the cap at its current level. The cost would be paid for in part by tightening up the government’s windfall tax on oil and gas firms’ extra profits from higher global prices, and the party also proposes higher taxes for very wealthy people. Carla Denyer, a co-leader of the Greens alongside Adrian Ramsay, said the party would also aim to create more energy efficiency by introducing differential tariffs under which households that use a lot of power face proportionally rising prices, with exceptions for people with disabilities or chronic health conditions.

The party is already committed to a mass programme of home insulation to improve energy efficiency. “This experiment with an energy supply market has failed,” Denyer said. “Only the government can intervene at the scale required to avoid a catastrophe this winter.” She said there was “nationwide anxiety about the prospect of unpayable energy bills”, adding: “Other parties have only offered to fix energy prices at current levels, but we know these are already unaffordable. We would return energy prices to an affordable level.” s

I sense a link with Melania’s underwear.

• Audio Tapes In Bill Clinton’s Sock Drawer And Mar-a-Lago Search Dispute (JTN)

When it comes to the National Archives, history has a funny way of repeating itself. And legal experts say a decade-old case over audio tapes that Bill Clinton once kept in his sock drawer may have significant impact over the FBI search of Melania Trump’s closet and Donald Trump’s personal office.= The case in question is titled Judicial Watch v. National Archives and Records Administration and it involved an effort by the conservative watchdog to compel the Archives to forcibly seize hours of audio recordings that Clinton made during his presidency with historian Taylor Branch. For pop culture, the case is most memorable for the revelation that the 42nd president for a time stored the audio tapes in his sock drawer at the White House. The tapes became the focal point of a 2009 book that Branch wrote.

U.S. District Judge Amy Berman Jackson in Washington D.C. ultimately rejected Judicial Watch’s suit by concluding there was no provision in the Presidential Records Act to force the National Archives to seize records from a former president. But Jackson’s ruling — along with the Justice Department’s arguments that preceded it — made some other sweeping declarations that have more direct relevance to the FBI’s decision to seize handwritten notes and files Trump took with him to Mar-a-Lago. The most relevant is that a president’s discretion on what are personal vs. official records is far-reaching and solely his, as is his ability to declassify or destroy records at will.

“Under the statutory scheme established by the PRA, the decision to segregate personal materials from Presidential records is made by the President, during the President’s term and in his sole discretion,” Jackson wrote in her March 2012 decision, which was never appealed. “Since the President is completely entrusted with the management and even the disposal of Presidential records during his time in office, it would be difficult for this Court to conclude that Congress intended that he would have less authority to do what he pleases with what he considers to be his personal records,” she added.

FBI cover-up.

• FBI Sought Documents Trump Hoarded for Years, Including about Russiagate (NW)

The FBI raid on Mar-a-Lago last Monday was specifically intended to recover Donald Trump’s personal “stash” of hidden documents, two high-level U.S. intelligence officials tell Newsweek. To justify the unprecedented raid on a former president’s residence and protect the source who revealed the existence of Trump’s private hoard, agents went into Trump’s residence on the pretext that they were seeking all government documents, says one official who has been involved in the investigation. But the true target was this private stash, which Justice Department officials feared Donald Trump might weaponize. “They collected everything that rightfully belonged to the U.S. government but the true target was these documents that Trump had been collecting since early in his administration,” says the source, who was granted anonymity to discuss sensitive issues.

The sought-after documents deal with a variety of intelligence matters of interest to the former president, the officials suggest—including material that Trump apparently thought would exonerate him of any claims of Russian collusion in 2016 or any other election-related charges. When Trump left the White House in January 2021, many of the normal processes of transition were not followed, especially because the president would not admit that he had lost the election or that he would be leaving office. As a result, we now know, some 42 boxes of documents were shipped to Mar-a-Lago by mistake: officials papers under U.S. law, which the National Archives is supposed to take custody of and catalog.

Over the past 18 months, the Trump camp and the Archives were engaged in a back-and-forth which resulted in the return of 15 boxes (and some additional documents). As late as June 3, when officials from the FBI and Justice visited Mar-a-Lago to serve a Grand Jury subpoena for specific documents, these negotiations were largely cordial. But in the course of its investigation, the FBI and Justice became aware of Trump’s private collection. As Newsweek previously reported, a confidential human source revealed that the former president wasn’t planning to divulge that he had possession of some of his own documents and that he did not intend to return them.

Disband. First fire Walensky.

• CDC Admits To Botched Covid-19 Responses (RT)

The CDC has acknowledged flaws in its response to the Covid-19 pandemic and announced plans to restructure the agency to rehabilitate its public image and better respond to future public health crises. “For 75 years, CDC and public health have been preparing for COVID-19, and in our big moment, our performance did not reliably meet expectations,” CDC director Dr. Rochelle Walensky said on Wednesday. “As a long-time admirer of this agency and a champion for public health, I want us all to do better.” The overhaul announcement follows an internal review that found the CDC’s “rigid, compartmentalized bureaucracy” undermined its response to Covid-19 and slowed its data analysis and releases of public advisories. When pandemic guidance was offered, it was often “confusing and overwhelming,” the review found.

The US leads the world in Covid-19 cases and deaths, by far, and the CDC has been criticized for confusing messaging and slow response times. The agency also held back much of the data it collected, in some cases because it feared the information could be “misinterpreted.” For instance, it withheld dataon Covid-19 infections among fully vaccinated Americans and the efficacy of vaccine booster shots for 18- to 49-year-olds. “Our public health infrastructure in the country was not up to the task of handling this pandemic,” Walensky told CBS News on Wednesday. She added, “We learned some hard lessons over the last three years, and as part of that, it’s my responsibility, it’s the agency’s responsibility, to learn from those lessons and do better.”

The CDC also has drawn criticism for its handling of the monkeypox outbreak. The reorganization plan, which will require approval from higher-ups in President Joe Biden’s administration, aims to get information to the public more quickly and speak about health issues in plain English, rather than scientific jargon. Walensky also plans to make the CDC more streamlined, with fewer reporting layers, and to develop a nimbler workforce that is prepared to respond to crises. “We need to have special forces, if you will, to deploy during pandemic times,” she said. Plans also call for creating a new office to promote “equity in health care,” though Walensky didn’t clarify how that would improve pandemic response.

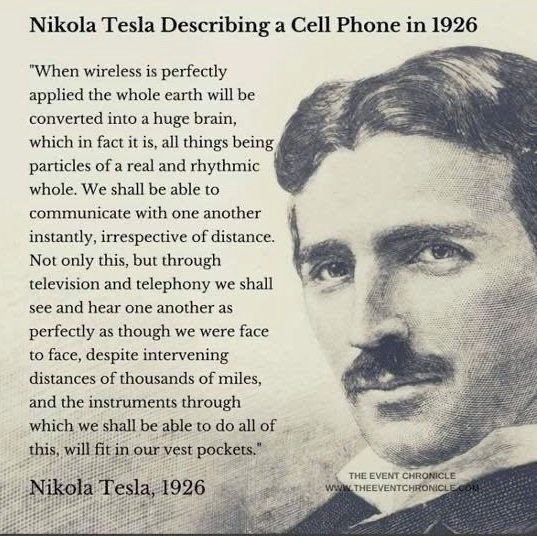

Brilliant Sagan

Poetry in motion pic.twitter.com/nb9zbBYdec

— petrichor (@1e9petrichor) August 17, 2022

Britain’s railways

https://twitter.com/i/status/1559944313055989761

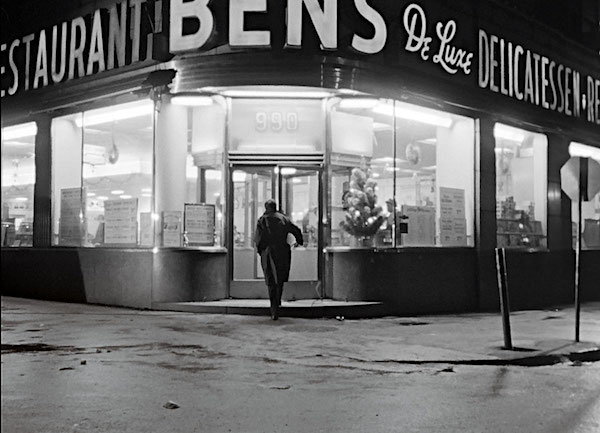

Mark Morris: My family owned an iconic restaurant, Bens Deli, in Montreal for 100 years. This is Leonard Cohen entering its doors in 1965. What a beautiful picture and legacy.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.