G.G. Bain ‘Casino Theater playing musical ‘The Little Whopper’, NY 1920

Beppe is not just an entertainer.

• 7 Unfounded Fears About An Exit From The Euro (Beppe Grillo)

1) Mortgages – Mortgages will be converted into the new currency the day we exit the Euro. For anyone with a variable interest rate, this will still remain linked to the Euribor and thus it will remain stable. In relation to mortgages, Italians will benefit.

2) Inflation – Just think that the goods (home, car, telephone) that we want to buy will come down in price. If we don’t spend, the economy stagnates. This is what is happening today with deflation. A low level of inflation is thus necessary to keep the economy going. On the other hand, it mustn’t be too high to avoid devaluing our ability to spend. This won’t happen because Italian products will become more competitive than foreign products and the products that we are obliged to import from abroad (for example: crude oil) have a limited impact on the final price (for example: in the last year the value of the Euro has fallen by about 25% in relation to the dollar, but the high level of customs duties on petrol, has meant that the effect has not been apparent).

3) Current account – Your current account in Euro will be converted into the new currency. But, just even today, you can have a different currency in your bank account. You will still be able to do that after the exit from the Euro. So you could have dollars, Euro, pounds sterling, francs or a new currency.

4) Government bonds – 95% of Italian State bonds will be converted into the new currency (given that 95% are issued in accordance with Italian legislation and so they would inherit the national currency). The State will pay out on them and will issue them in the new currency. Given the low yields and the high risk that we already see right now, Italian State bonds are not a good buy for an Italian citizen.

5) Transition from the Euro to the lira – There’ll probably be a 1 to 1 conversion with the new currency and it will then probably devalue a bit. The effect on prices will probably be that they stay the same as today but they will be given in the new currency.

6) Increase in the price of petrol – The price of petrol is a false problem as most of the price (64%) is paid in taxes. International prices of crude oil and the exchange rate only relate to 26% of the price. If we also consider that the price of crude oil is at a record low right now, an exit from the Euro will surely be no problem from this point of view.

7) Imports: increase in the prices of imported products – This problem, that is particularly important for technology products, can only be resolved by investing in innovation after the destruction of companies like Olivetti and the downsizing of Telecom Italia. Innovation is the only way to develop the country. Staying in the Euro is not going to help. Throughout history, we have exported and traded with the countries nearest to us, but not because they have the Euro, simply because they are the closest and the geographic location has made it easier to trade with them ever since the time of the Roman Empire.

However, the value of exports going into the countries using the Euro, has being going down ever since we joined the Euro. Just in 2007, those accounted for 60%, and today that’s now down to less than 50%. The only areas where the value of our exports is growing is outside the Euro zone as can be seen from research into Italian exports: “emerging markets currently represent the biggest proportion of our exports, while the importance of the Euro area has seen a significant fall“.

While Cameron is boasting this huge recovery.

• Teachers Warn Of ‘Victorian’ Poverty Among Pupils (BBC)

Teachers say they are seeing “Victorian conditions” with pupils arriving at school hungry and not wearing the right clothes needed for the weather. The NASUWT teachers’ union says schools and teachers are increasingly having to deal with the consequences of poor housing and poverty. Teachers reported bringing in their own food to school to give to children. The Conservatives said the number of children in poverty had fallen by 300,000 under the coalition government. The Liberal Democrats said they had helped families by introducing free school meals for all infant children. Tristram Hunt, Labour’s shadow education secretary, warned of the “quiet indignity of poverty that can wreak havoc with a child’s confidence”. He said poverty was one of the “biggest barriers” to pupils achieving in school.

Claims about poverty in the school-age population will be heard at the NASUWT teachers’ union annual conference in Cardiff. The union asked members for their experiences and received almost 2,500 responses. It was not a representative sample of teachers, but among those replying more than two in three reported seeing pupils come to school hungry. “Children in 2015 should not be hungry and coming to school with no socks on and no coats – some children are living in Victorian conditions – in the inner cities,” said one unnamed teacher. Almost one in four of the teachers who responded said they had brought in food for pupils who were hungry, and an even higher proportion had seen the school feeding pupils.

More than three in four had seen pupils arriving at school with “inappropriate clothing” such as no socks or coats in bad weather. Similar numbers claimed that a bad diet meant that pupils were unable to concentrate on their work. More children were being sent home with letters about unpaid school meals and pupils who were sick were still being sent to school because parents could not afford to take time off work, claimed teachers. The comments from the survey suggest teachers felt that they were having to cope with the wider problems linked to family hardship, such as children living in temporary accommodation or relying on food banks.

All about emerging markets. They’re going to be steamrollered.

• Once Over $12 Trillion, the World’s Reserves Are Now Shrinking (Bloomberg)

The decade-long surge in foreign-currency reserves held by the world’s central banks is coming to an end. Global reserves declined to $11.6 trillion in March from a record $12.03 trillion in August 2014, halting a five-fold increase that began in 2004, according to data compiled by Bloomberg. While the drop may be overstated because the strengthening dollar reduced the value of other reserve currencies such as the euro, it still underlines a shift after central banks – with most of them located in developing nations like China and Russia – added an average $824 billion to reserves each year over past the decade. Beyond being emblematic of the dollar’s return to its role as the world’s undisputed dominant currency, the drop in reserves has several potential implications for global markets.

It could make it harder for emerging-market countries to boost their money supply and shore up faltering economic growth; it could add to declines in the euro; and it could damp demand for U.S. Treasury bonds. “It’s a big challenge for emerging markets,” Stephen Jen, a former IMF economist, said. They “now need more stimulus. The seed has been sowed for future volatility,” he said. Stripping out the effect from foreign-exchange fluctuations, Credit Suisse estimates that developing countries, which hold about two-thirds of global reserves, spent a net $54 billion of this stash in the fourth quarter, the most since the global financial crisis in 2008. China, the world’s largest reserve holder, together with commodity producers contributed to most of the declines, as central banks sold dollars to offset capital outflows and shore up their currencies.

A Bloomberg gauge of emerging-market currencies has lost 15% against the dollar over the past year. China cut its stockpile to $3.8 trillion in December from a peak of $4 trillion in June, central bank data show. Russia’s supply tumbled 25% over the past year to $361 billion in March, while Saudi Arabia, the third-largest holder after China and Japan, has burned through $10 billion in reserves since August to $721 billion. The trend is likely to continue as oil prices stay low and growth in emerging markets remains weak, reducing the dollar inflows that central banks used to build reserves, according to Deutsche Bank.

Such a development is detrimental to the euro, which had benefited from purchases in recent years by central banks seeking to diversify their reserves, according to George Saravelos at Deutsche Bank. The euro’s share of global reserves dropped to 22% in 2014, the lowest since 2002, while the dollar’s rose to a five-year high of 63%, the International Monetary Fund reported March 31. “The Middle East and China stand out as two regions that are likely to face ongoing pressures to run down reserves over the next few years,” Saravelos wrote in a note. The central banks there “need to sell euros,” he said.

By a gut named Clive Crook, no less.

• How Criminals Built Capitalism (Bloomberg)

Whenever buyers and sellers get together, opportunities to fleece the other guy arise. The history of markets is, in part, the history of lying, cheating and stealing — and of the effort down the years to fight commercial crime. In fact, the evolution of the modern economy owes more than you might think to these outlaws. That’s the theme of “Forging Capitalism: Rogues, Swindlers, Frauds, and the Rise of Modern Finance” by Ian Klaus. It’s a history of financial crimes in the 19th and early 20th centuries that traces a recurring sequence: new markets, new ways to cheat, new ways to transact and secure trust. As Klaus says, criminals helped build modern capitalism. And what a cast of characters.

Thomas Cochrane is my own favorite. (He was the model for Jack Aubrey in Patrick O’Brian’s “Master and Commander” novels.) Cochrane was an aristocrat and naval hero. At the height of his fame in 1814 he was put on trial for fraud. An associate had spread false rumors of Napoleon’s death, driving up the price of British government debt, and allowing Cochrane to avoid heavy losses on his investments. Cochrane complained (with good reason, in fact) that the trial was rigged, but he was found guilty and sent to prison. The story is fascinating in its own right, and the book points to its larger meaning. Cochrane, in a way, was convicted of conduct unbecoming a man of his position. Playing the markets, let alone cheating, was something a man of his status wasn’t supposed to do.

Trust resided in social standing. As the turbulent century went on, capitalism moved its frontier outward in every sense: It found new opportunities overseas; financial innovation accelerated; and buyers and sellers were ever more likely to be strangers, operating at a distance through intermediaries. These new kinds of transaction required new ways of securing trust. Social status diminished as a guarantee of good faith. In its place came, first, reputation (based on an established record of honest dealing) then verification (based on public and private records that vouched for the parties’ honesty). Successive scams and scandals pushed this evolution of trust along.

Gregor MacGregor and the mythical South American colony of Poyais (“the quintessential fraud of Britain’s first modern investment bubble,” Klaus calls it); Beaumont Smith and an exchequer bill forging operation of remarkable scope and duration; Walter Watts, insurance clerk, theatrical entrepreneur and fraudster; Harry Marks, journalist, newspaper proprietor and puffer of worthless stocks. On and on, these notorious figures altered the way the public thought about commercial trust, and spurred the changes that enabled the public to keep on trusting nonetheless.

They’ll only do snap if the polls allow for it. Doesn’t look anywhere near.

• Greek Political Unrest And Deepening Crisis Fuel Talk Of Snap Election (Guar.)

The worsening Greek debt crisis has reanimated talk within the ruling Syriza party of a snap general election if discussions with creditors fail, as the country faces a Thursday deadline to repay a €450m loan to the IMF. The Greek finance minister, Yanis Varoufakis, was scheduled to hold informal talks with the IMF’s managing director, Christine Lagarde, in Washington DC on Sunday, while warnings of early elections underscored the political unrest in Athens. The slow pace of negotiations with creditors and worsening state of the Greek economy brought a warning from the far-left Syriza of snap polls being held before the summer – just months after winning power. “If we are not satisfied [with the outcome] we will go to the people,” Kostas Chrysogonos, a prominent Syriza MEP told local media at the weekend.

“We have a popular mandate to bring about a better result,” he said of the talks aimed at concluding a reform-for-cash programme to keep the crisis-hit country afloat. “If, ultimately, creditors insist on following an inflexible line … then the electoral body will have to assume its responsibilities.” Varoufakis’ unexpected meeting with the IMF chief has been arranged as senior government officials repeated assurances that Greece was not about to to default on its debt repayments. The deputy finance minister, Dimitris Mardas, said the IMF payment would be made and civil service wages would be paid. “There is money for the payment of salaries, pensions and whatever else is needed in the next week.”

The prospect of renewed political strife in Greece coincided with mounting dissent within Syriza over the extent to which it should roll back on pre-electoral reforms. The anti-austerity government led by Alexis Tsipras has found itself increasingly cornered with creditors – the so-called troika – refusing to endorse proposed reforms under an extension of its €240bn bailout. Militants led by energy minister Panagiotis Lafazanis have ratcheted up the pressure by rejecting any notion of making necessary concessions starting with privatisations.

On Sunday, Lafazanis denounced Greece’s international creditors for treating the country with “unbelievable prejudice and as a colony”. Raising the prospect of a deal with Russia, he said, “A Greek-Russian agreement would help our country greatly in negotiations with lenders.” Despite assertions over the weekend that Sunday’s talks were part of the negotiation process, Athens is believed to harbour hopes that the IMF – which has proved to be a more conciliatory partner than either the EU or ECB in negotiations – will agree to cut the government some slack when Varoufakis discusses the reform programme with Lagarde. On Friday, Syriza’s parliamentary spokesman, Nikos Filis, also piled on the pressure saying Tsipras’ leftist-led coalition would prefer to pay salaries and pensions than bondholders if forced to make a choice.

“The combination of a better-than-expected tax collection in March, the postponement of some budget expenditures and internal borrowing from some state entities and other sources made it possible for the government to pay both creditors and pensioners and civil servants last month.”

• Greek Economy Staring At Recession Again (Kathimerini)

The Greek state may be able to service its debt and pay pensions and salaries to civil servants in April. However, the limited progress in negotiations between the government and the official creditors on the conclusion of the economic policy program increases uncertainty, reduces credit availability and adversely affects domestic demand despite less austerity. The economic damage has increased the risk of recession. The combination of a better-than-expected tax collection in March, the postponement of some budget expenditures and internal borrowing from some state entities and other sources made it possible for the government to pay both creditors and pensioners and civil servants last month. Greece paid an estimated €2.5 billion to the IMF and other creditors in March without including T-bills.

Assuming tax revenues remain on track and more general government entities lend part of their cash reserves to the state, we would expect Greece to be able to meet its obligations to creditors in April but it will face a tougher hurdle in May. It is reminded the state owes about 458 million euros to the IMF on April 9 and has to find an additional €700 million or so for T-bills maturing on April 14 which are held by international investors and most likely will not be rolled over. It will also have to pay €194 million to private bondholders on April 17 and €80 million to the ECB on April 20, according to Bank of America Merrill Lynch (BofA). Deputy Finance Minister Dimitris Mardas, who is in charge of the General Accounting Office, assured recently that the state will make the payment to the IMF on time and pay wages to some civil servants in the middle of the month.

This contrasts with leaks in the press, citing other government officials’ warnings that Greece would run out of money on April 9. Although no one disputes that the central government is in a tough financial position, some abroad suspect these warnings are also part of a Greek strategy to get some funding from the EU via the EFSF or indirectly from the ECB. Even if Greece is able to overcome this hurdle in April, it will have to pass another test in early May, assuming it has not reached an agreement with its creditors by then. It will have to pay €200 million to the IMF on May 1 and an additional €763 million on May 12, according to a recent report by BofA.

Of course, the country has shown that it intends to honor its obligations so far and could be able to continue doing so in the rest of April and even May to the extent that it is able to mobilize the cash reserves of state entities, collect more revenues than targeted in the adjustment program and postpone expenditures to suppliers and others for the future, building arrears.

This will take until at least June. “According to IMF protocol, Greece would be afforded a 30-day grace period..” They’ll pay on April 9. The next payments are May 1 and 12. Add 30 days to that. That’s when payments to other creditors are due.

• What Happens If Greece Defaults On Its IMF Loans? (Telegraph)

The Greek government faces another crucial deadline in its interminable bail-out drama this week, as fears mount that the country could become the first developed nation to ever default on its international obligations. After a harrowing March, cash-strapped Athens now faces a €448m payment to the IMF on Thursday. But with public sector wages and pensions to pay out, a cacophony of voices on Syriza’s Left have vowed to prioritise domestic obligations unless creditors finally unlock the remainder of its €240bn bail-out programme. “We are a Left-wing government. If we have to choose between a default to the IMF or a default to our own people, it is a no-brainer,” a senior Greek official told The Telegraph last week.

The rhetoric is a far cry from February, when Greece’s finance minister pledged his government would “squeeze blood out of a stone” to meet its obligations to the Fund. Yanis Varoufakis will now spend Easter Sunday with IMF director Christine Lagarde in a bid to gain some leeway on the country’s reforms-for-cash programme. Greece owes €9.7bn to the IMF this year. Missing its latest installment in order to pay out its social security bill on April 14, would see the country fall into an arrears process, unprecedented for a developed world debtor. Although no nation has ever officially defaulted on its obligations in the post-Bretton Woods era, Greece would join an ignominious list of war-torn nations and international pariahs who have failed to pay back the Fund on time.

What happens after April 9? Missing Thursday’s payment would not immediately trigger a default however. According to IMF protocol, Greece would be afforded a 30-day grace period, during which it would be urged to pay back the money as soon as possible, and before Ms Lagarde notifies her executive board of the late payment. Following this hiatus, a technical default could be declared a month later, when “a complaint regarding the member’s overdue obligations is issued by the Managing Director to the Executive Board”. In the interim, Greece may well stump up the cash having spooked creditors and the markets of the possibility of a fatal breach of the sanctity of monetary union. Should no money be forthcoming however, the arrears process may well extend indefinitely. Greece’s IMF burden would also start piling up, with the government due to pay another €963m by May 12.

Very predictable.

• Greece and IMF Hold Talks on Crucial Debt Payment (NY Times)

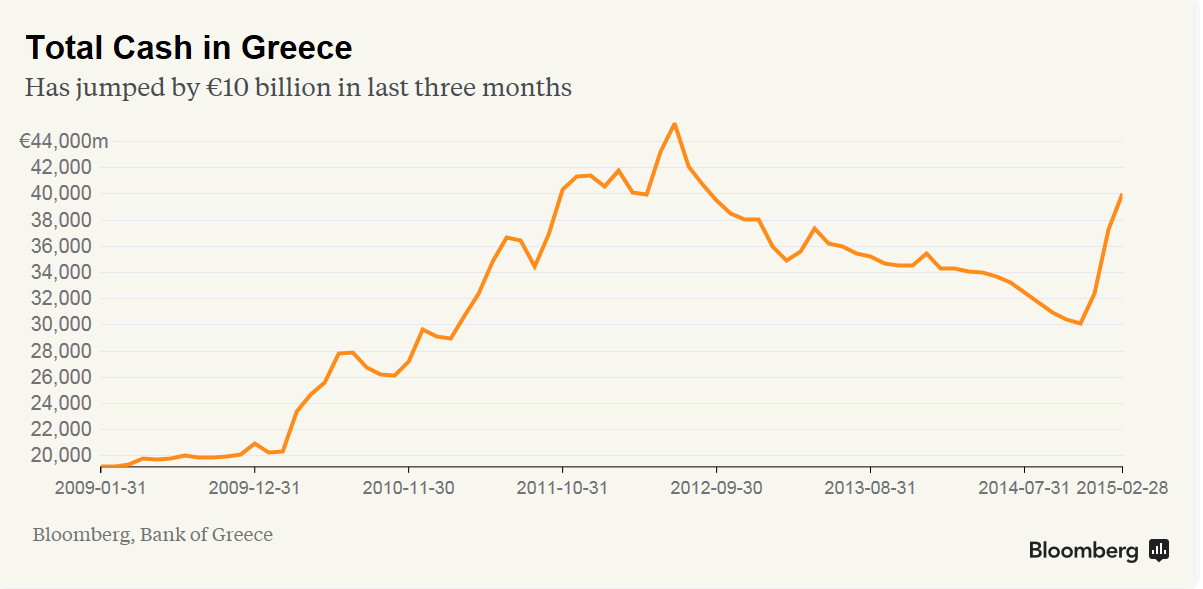

Mr. Varoufakis, from the moment he became finance minister this year, has gone out of his way to cultivate ties with Ms. Lagarde and has said that paying the fund was a priority for Greece. Over the last month, however, the economic situation in Greece has worsened greatly. Deposits worth about €25 billion have been withdrawn from Greek banks, some of which are now on life support with the European Central Bank. The government’s tax collections are also suffering as companies and consumers fret over the prospect that Greece might be forced to abandon the euro. Now, with Europe refusing to permit Greece access to temporary lines of liquidity — such as letting its banks issue more short-term treasury notes — Greece is running out of cash.

Which means that if it were to pay the fund €458 million this Thursday, there might not be enough left in the coffers to pay pensions and public sector wages the next week, some Greek officials say. Mr. Varoufakis, who came to power on a platform of ending the policy of putting the needs of Greece’s creditors above its suffering citizens, was to make the case to Ms. Lagarde that his government could not meet all of its commitments. “This government has made strong statements that they will meet their commitments,” said a person who was involved in the negotiations but was not authorized to speak publicly. The problem is, this person said, Greek officials have made commitments to their own people as well. “They are being pushed to the wall.”

There is some wiggle room. Even if Greece does not pay up on Thursday, it will not be in technical default as there is a 30-day grace period that could allow the government to pay its pension and wage obligations and strike a broader deal so that its creditors could disburse the needed funds. Mr. Varoufakis is also planning to meet with officials in the United States Treasury on Monday in the hope that the United States, as the dominant voice at the I.M.F., might pressure fund officials, and Europe as well, to cut Greece some slack. The United States has been quietly critical of Europe’s harsh stance toward Greece, warning of the consequences that a Greek default and exit from the euro would have on financial markets.

Hollow phrases exercise.

• Varoufakis Meets Lagarde: ‘Greece Will Pay All Creditors Including IMF’ (GR)

Greek Finance Minister Yanis Varoufakis said Greece will pay all its creditors, including the upcoming International Monetary Fund installment, as he was exiting a meeting with IMF managing director Cristine Lagarde in Washington, DC on Sunday April 5. Greece faces a deadline to repay a €450m loan to the International Monetary Fund on April 9th, and many sources had speculated that the crisis-hit country won’t be able to pay the installment. “Greece was a founding member of Bretton Woods institutions,” the Greek Finance Chief noted to reporters outside the IMF. Christine Lagarde made the following statement after the meeting: “Minister Varoufakis and I exchanged views on current developments and we both agreed that effective cooperation is in everyone’s interest. We noted that continuing uncertainty is not in Greece’s interest and I welcomed confirmation by the Minister that payment owing to the Fund would be forthcoming on April 9th.”

“I expressed my appreciation for the Minister’s commitment to improve the technical teams’ ability to work with the authorities to conduct the necessary due diligence in Athens, and to enhance the policy discussions with the teams in Brussels, both of which will resume promptly on Monday. I reiterated that the Fund remains committed to work together with the authorities to help Greece return to a sustainable path of growth and employment.” The Greek finance minister traveled to Washington, DC to hold an informal discussion on the Greek government’s reform program with the IMF’s managing director, Christine Lagarde. The Varoufakis-Lagarde meeting started at 6.15 pm on Sunday and lasted for two hours. The Greek Finance minister is also scheduled to meet with President Obama’s top economic and national security adviser Caroline Atkinson on Monday.

Lowballing.

• How Much Of Brazil’s Economy Got Lost In Petrobras Scandal? (Forbes)

A study out this week in Brazil estimates just how much the country lost to this ugly Petrobras oil scandal. The price tag: R$87 billion ($27.1 billion) that is expected to have been lost in GDP this year because of Petrobras’ corrupt, little ways. All told, that comes out to a little more than 1% of Brazil’s GDP burned up in scandal. Brazil’s GDP is about $2.2 trillion. The study was done by the Getulio Vargas Foundation. It based its estimates on Petrobras planned reduction in investments this year, which will hit oil and gas service firms, construction, engineering and consumer spending. Layoffs in construction will likely take at least R$13.6 billion from federal coffers this year. Two construction companies that colluded with Petrobras in the scandal, OAS and Galvao, have both filed for bankruptcy.

Construction companies are expected to reduce GDP by another R$10 billion, with the Foundation estimating a massive blood-letting in the job market, well into the thousands. Petrobras has yet to release earnings due to its third party auditors fearing repercussions if it signs off on phony accounts. So far, the market has April 30 as the date to discover just what Petrobras earned last year. But that can be delayed because shareholder lawsuits in New York have forced the Securities and Exchange Commission to review the earnings data before it is released to the market. The SEC will have their final say. At least three law firms have filed class action suits against the Brazilian oil giant. New York law firm Pomerantz is lead counsel on the case. Earnings will not include losses accrued from the scandal, the local Estado de Sao Paulo newspaper reported this week.

The newspaper also said that changes to the way auditors and regulators are reviewing Petrobras’ books might work in the oil firm’s favor. Last year, Deloitte said that Petrobras inflated its assets to the tune of R$88.6 billion. That number is expected to decline by at least half. Petrobras’ ex-CEO Maria Gracas Foster and her auditing firm PricewaterhouseCoopers are part of the shareholder lawsuit along with Brazilian bank Itau Unibanco. Estimates are for Brazil’s economy to contract by around 0.5% this year. “Brazil’s problems are all domestic and you can trace it to Petrobras,” says economist Alex Wolf at Standard Life Investments. “Consumer sentiment is down, unemployment is up slightly and investment is still down. We think Brazil is one of the most vulnerable emerging markets around.”

“It’s a stark reversal from five years ago when a wave of European and US oil-services companies eagerly flocked to Brazil to build plants and set up offices.”

• Petrobras Woes Reach Europe, US (Bloomberg)

When Italian oil services company Saipem spent $300 million at the start of the decade in Brazil, it joined a long list of foreign companies jockeying for business with Petrobras. Now it’s struggling to get paid. Saipem is one of at least five European companies that spoke about late payments, delivery delays or other difficulties in Brazil during fourth-quarter earnings calls. While day-to-day operations are functioning, Petrobras partners are also facing decision-making obstacles that are inhibiting planning, said officials at partners Galp Energia, BG Group and Repsol who asked not to be named. It’s a stark reversal from five years ago when a wave of European and US oil-services companies eagerly flocked to Brazil to build plants and set up offices.

Back then, Petrobras was ramping up investments to more than $100 million a day after making the Western Hemisphere’s biggest crude finds in decades. Today, Petrobras is slashing spending as oil prices plunge and it’s all but locked out of credit markets because of a sweeping corruption scandal. “Brazil’s a big market,” Terje Soerensen, CEO of Norwegian Siem Offshore, said in a telephone interview. “When that stops, it affects the entire industry.” Siem doesn’t know if the four to six vessels it had marked for Brazilian contracts will be needed now, Soerensen said. Saipem executives said in a February 16 earnings call that some payments from Petrobras were late. Norway’s Aker CEO Luis Araujo said in a March 17 interview that the company was asked to delay equipment deliveries.

Vallourec, a French oil-pipeline maker, and Alfa Laval, a Swedish oil industry engineering firm, also cited a difficult business environment in February conference calls. US oilfield-service providers Halliburton and Schlumberger echoed similar concerns. Halliburton sees activity continuing to decline in Brazil, President Jeff Miller said in a conference call earlier this year. The spending cuts Petrobras has announced will create “challenges” this year, Schlumberger CEO Paal Kibsgaard said.

“But Japan’s bankers are laughing all the way to the…”

• Japan’s Wary Manufacturers Resist Abe’s Urge To Splurge (Reuters)

Hirotoshi Ogura, a self-described “factory geek”, is Daikin Industries’ master of doing more with less – and part of the reason Japan’s recovery remains stuck in the slow lane. As Japan heads into the season of peak demand for room air-conditioners, Ogura and other Daikin managers have been tasked with figuring out how to boost output by some 20% at a plant in western Japan that six years ago the company had almost given up on as unprofitable. The wrinkle: they have no budget for new capital investment at the 45-year-old Kusatsu plant.

The still-evolving workaround shown to a recent visitor involves home-made robots for ferrying parts, experimental systems using gravity rather than electricity to power parts of the line, more temporary workers on seasonal contracts and dozens of steps to chip away at the 1.63 hours it takes to make a typical new air conditioner. “We can do a lot without spending anything,” says Ogura, a 33-year Daikin veteran who joined the company just after high school. “Anything we need, we first try to build ourselves.” Like Daikin, a number of Japanese manufacturers are shifting production back to Japan from China and elsewhere to take advantage of a weaker yen.

Rival Panasonic has pulled back some production of room air-conditioners, Sharp has brought back production of some refrigerators, and Canon has repatriated some output of high-end copiers, according to a list compiled by Nomura. But even as output recovers, Japanese companies remain cautious about new capital investment in factories and equipment. The trend is especially pronounced for smaller firms down the supply chain. After increasing capital spending by 6% in the just-completed fiscal year, small manufacturers plan a 14% decrease in the current year, according to the Bank of Japan’s quarterly survey released this week. Big manufacturers like Daikin plan a 5% increase, but overall investment remains 10% below pre-crisis 2007 levels.

Economics and inbreeding.

• The Inbred Bernanke-Summers Debate On Secular Stagnation (Steve Keen)

Ben Bernanke has recently started blogging (and tweeting), and his opening topics were why interest rates are so low around the world, and a critique of Larry Summers’ “secular stagnation” explanation for this phenomenon, and for persistent low growth since the financial crisis. Summers then replied to Bernanke’s argument, and a debate was on. So who is right: Bernanke who argues that the cause is a “global savings glut”, or Summers who argues that the cause is a slowdown in population growth, combined with a dearth of profitable investment opportunities, not only now but for the foreseeable future? I’d argue both of them, and neither simultaneously—both, because they can both point to empirical data that support their case; neither, because they are only putting forward explanations that are consistent with their largely shared view of how the economy works.

And the extent to which they are the product of a single way of thinking about the world simply cannot be exaggerated. It goes well beyond merely belonging to the same school of thought within economics (the “Neoclassical School” as opposed to the “Austrian”, “Post Keynesian”, “Marxist” etc.), or even the same sect within this school (“New Keynesian” as opposed to “New Classical”). Far beyond. They did their graduate training in the same economics department at the Massachusetts Institute of Technology (MIT). They attended the same macroeconomics class: Stanley Fisher’s course in monetary economics at MIT for graduate students (was it the same year—does anybody know?) Some of their fellow Fisher alumni included Ken Rogoff and Olivier Blanchard.

And that’s not all—far from it. Paul Samuelson (MIT) was overwhelming the intellectual architect of what most people these days think is Keynesian economics. Paul Samuelson is Larry Summers’ uncle. Samuelson’s “Foundations of Economic Analysis” was the core of the MIT approach to economics, and it became the model for economics textbooks around the world. Gregory Mankiw’s (PhD, MIT) market-dominating text today is a pale echo of Samuelson’s original. This group has been notably dismissive of other approaches to doing economics. Krugman (PhD MIT) leads the pack here, deriding views that are outside this mindset.

If I were describing a group of thoroughbred horses, alarm bells would already be ringing about a dangerous level of in-breeding. Sensible advice would be proffered about the need to inject new blood into this dangerously limited breeding pool. But the issue would only be of importance to the horseracing community. Instead I am talking about a set of individuals whose ideas have had enormous influence upon both the development of economic thought and the formation of economic policy around the globe for the last four decades. The fact that so much of the dominant approach to thinking about the economy emanates, not merely from such a limited perspective, but from such a limited and interconnected pool of people, should be serious cause for alarm – especially given how the world has fared under the influence of this thoroughbred group.

Time to stop our support right here and now.

• Leader Of Ukraine Neo Nazi Right Sector Appointed As Army Advisor (Zero Hedge)

With Greece on the verge of either getting kicked out of Europe or suffer through yet another government overhaul, one which many suggest may usher the “last” option for Greece, the ultra nationalist, neo-Nazi Golden Dawn party into governance, some wonder if it is not Europe’s ulterior intention to force a populist shift toward right wing, nationalist parties (perhaps best observed in France where Marine le Pen’s dramatic rise to power has left many dazed and confused) one which will lead to social instability and shortly thereafter, war (because in a world in which every Keynesian voodoo trick to revive the economy has failed, war is the last remaining outcome).

So while we await to see if Europe’s turn to ultra right wing movements accelerates in the coming months, we just learned of a very disturbing development in just as insolvent Ukraine, where moments ago the website of the local Ministry of Defense reported that Dmytro Yarosh, leader of Ukraine’s “Right Sector” political party, whose political ideology has been described as nationalist, ultranationalist, neofascist, right-wing, or far right, was just appointed as Advisor to Chief of General Staff. From the Ukraine ministry of defense:

Dmytro Yarosh appointed as Advisor to Chief of General Staff – Dmytro Yarosh, leader of ‘Pravyi Sector’ (Right Sector) political party, appointed as Advisor to Chief of General Staff. Yesterday, Colonel General Viktor Muzhenko, Chief of General Staff, and Dmytro Yarosh agreed the format of cooperation between ‘Pravyi Sector’ and the Ukrainian Armed Forces. Colonel General Viktor Muzhenko stressed the Ukrainian army had become one of the strongest armies of Europe; the Ukrainian soldiers proved they knew how to fight and appreciated the contribution of volunteer battalions to defense of Ukraine and said: “We understand the needs of changes and increase of efficiency at all the army levels. We also consider various models of formation of the army reserve.

We are developing the reforms and will implement them. We gathered all the patriots and defenders of Ukraine under single leadership. The enemy understands our unity and that its attempts end in failure. We have one goal and the united Ukraine. The Army becomes stronger each week”. Dmytro Yarosh underlined the unity was the key precondition for further successful fighting and demonstrated the readiness to establish the cooperation and integration of volunteer battalions to the Ukrainian Armed Forces. ‘Pravyi Sector’ is ready to be subordinated to military leaders in issues related to defense of state from the external enemy.

In other words, the leader of Ukraine’s Neo-Nazis will, as a local “patriot and defender of Ukraine” be advising, i.e., fighting for, what little remains of Ukraine’s army. Sadly the parallels with Europe of the 1920s and 1930s, not to mention the decade just following, grow more visible with every passing day.

“..the UN warned in December that Kyiv’s embargo might be a violation of its obligations to citizens in the rebel-held territory.”

• Eastern Ukraine Leaders Appeal To Merkel, Hollande To End Embargo (DW)

Alexander Zakharchenko and Igor Plotnitsky, the elected leaders of Donetsk and Luhansk, called for an end to Kyiv’s embargo on government services in eastern Ukraine on Saturday. In an open letter to Chancellor Angela Merkel and President Francois Hollande, they asked the leaders who helped negotiate the ceasefire in Ukraine to use their “influence to encourage Ukrainian offices to begin paying out welfare services to Donbass residents once again.” The government in Kyiv placed an embargo on social services to the country’s eastern residents in November following what it deemed illegal elections that gave power to Zakharchenko and Plotnitsky.

Although the EU, the US and the UN also condemned the polls, the UN warned in December that Kyiv’s embargo might be a violation of its obligations to citizens in the rebel-held territory. “The fate for many [in those areas] may well be life-threatening,” the Office of the UN High Commissioner for Human Rights said.” Kyiv had not only ceased paying out pensions, but had also relocated hospitals, schools and prisons, leaving a what the UNHCHR described as a “severe protection gap.”

The open letter to Merkel and Hollande also pointed to numerous violations of a ceasefire, which was implemented in February. Both Kyiv and Donbass have blamed each other for not upholding the truce. Over the weekend, three soldiers were killed by a landmine near Donetsk. Those were the first deaths reported since Monday, when one soldier was killed. Fighting in the region has claimed roughly 6,000 lives since last spring.

The whole world should speak up against this warfare. Where’s the US?

• Saudi Arabia Rejects Russian UN All-Inclusive Arms Embargo on Yemen (RT)

Saudi Arabia has rejected Russia’s amendments to a Security Council draft resolution which would see an all-inclusive arms embargo on all parties in the Yemeni conflict, as it continues to spiral out of control with civilian death toll climbing up. “There is little point in putting an embargo on the whole country. It doesn’t make sense to punish everybody else for the behavior of one party that has been the aggressor in this situation,”Saudi Arabia’s representative to the UN Abdallah Al-Mouallimi said after a closed emergency UN Security Council meeting on Saturday. Al-Mouallimi added that he “hopes” Russia won’t resort to its veto power in case the all-inclusive embargo clause is not added into the draft submitted by the Gulf Cooperation Council that urges an arms embargo only on the Houthis.

At the same time, Riyadh agreed with Moscow’s calls for need of “humanitarian pauses” in the Saudi-led coalition’s air campaign in Yemen – though saying that Saudi Arabia already cooperates fully in this regard. “We always provided the necessary facilities for humanitarian assistance to be delivered,” Al-Mouallimi told reporter heading out of the meeting. “We have cooperated fully with all requests for evacuation.” Moscow convened an emergency meeting on a draft resolution demanding “regular and obligatory” breaks in air assaults against Houthi rebels, in which many civilians keep dying in increasing numbers. The Russian-proposed draft circulated on Saturday demanded “rapid, safe and unhindered humanitarian access to ensure that humanitarian assistance reaches people in need.”

The current council president and Jordan’s Ambassador Dina Kawar said that the council members “need time” to consider the Russian draft resolution, adding that the talks would continue. “We hope that by Monday we can come up with something,” Kawar said. The 15-member council is considering the possibly of merging the Russian and Gulf Cooperation Council proposed drafts into one. The Security Council meeting coincided with the call from the International Committee of the Red Cross for a “humanitarian pause.” The NGO urged to break hostilities for at least 24 hours. “We urgently need an immediate halt to the fighting, to allow families in the worst affected areas, such as Aden, to venture out to get food and water, or to seek medical care,” said Robert Mardini, head of the ICRC’s operations in the Near and Middle East.

As per these geniuses, Americans are going to drive like crazy. Storage problem? Just make gasoline! It’s the Forrest Gump approach.

• Record Gasoline Output to Curb Biggest US Oil Glut in 85 Years (Bloomberg)

Refiners are poised to make gasoline at a record pace this year, keeping the biggest U.S. crude glut in more than 80 years from overflowing storage. They’re enjoying the best margins in two years as they finish seasonal maintenance of their plants before the summer driving season. They’ll increase output to meet consumer demand and they’ve added more than 100,000 barrels a day of capacity since last summer, when they processed the most oil on record. Booming crude production expanded inventories this year by 86 million barrels to 471 million, the highest level since 1930. Analysts from BofA to Goldman Sachs have said storage space may run out. What looks like an oversupply to banks is turning into an all-you-can-eat buffet for those making gasoline and diesel fuel.

“A lot of the excess crude we’ve been sitting on is going to get chewed up quickly,” Sam Davis at Wood Mackenzie, said in Houston April 2. “We’re going to move from a stock build to a stock draw.” Goldman Sachs and Bank of America have said storage builds are increasing the risk of breaching storage capacity, sending prices tumbling. West Texas Intermediate, the U.S. benchmark, already has lost more than half its value since June as growing U.S. shale production led to a global oversupply. Inventories surged as U.S. output rose 71% over the past five years as drillers used techniques like horizontal drilling and hydraulic fracturing to tap previously inaccessible oil in shale rock layers.

In Cushing, Oklahoma, the delivery point for WTI futures, supplies have more than tripled since early October to a record 58.9 million barrels. Last July, refiners processed 16.5 million barrels of crude a day, the highest level in monthly Energy Department data going back to 1961. Refining margins in March have averaged $28.09 a barrel, the most since March 2013. Refiners typically schedule maintenance shutdowns in the spring and fall, reducing oil demand during that time. U.S. refiners increased crude runs by an average 1.1 million barrels a day in April through July over the past five years. During that period, U.S. crude inventories have fallen an average of 24.7 million barrels from the end of May through September.

Just lovely.

• UK Law Changed To Force Nuclear Waste Dumps On Local Communities (Guardian)

Nuclear waste dumps can be imposed on local communities without their support under a new law rushed through in the final hours of parliament. Under the latest rules, the long search for a place to store Britain’s stockpile of 50 years’ worth of the most radioactive waste from power stations, weapons and medical use can be ended by bypassing local planning. Since last week, the sites are now officially considered “nationally significant infrastructure projects” and so will be chosen by the secretary of state for energy. He or she would get advice from the planning inspectorate, but would not be bound by the recommendation. Local councils and communities can object to details of the development but cannot stop it altogether.

The move went barely noticed as it was passed late on the day before parliament was prorogued for the general election, but has alarmed local objectors and anti-nuclear campaigners. Friends of the Earth’s planning advisor, Naomi Luhde-Thompson, said: “Communities will be rightly concerned about any attempts to foist a radioactive waste dump on them. We urgently need a long-term management plan for the radioactive waste we’ve already created, but decisions mustn’t be taken away from local people who have to live with the impacts.” Objectors worry that ministers are desperate to find a solution to the current radioactive waste problem to win public support to build a new generation of nuclear power stations.

Zac Goldsmith, one of the few government MPs who broke ranks to vote against the move, criticised the lack of public debate about such a “big” change. “Effectively it strips local authorities of the ability to stop waste being dumped in their communities,” he said. “If there had been a debate, there could have been a different outcome: most of the MPs who voted probably didn’t know what they were voting for.”