MC Escher Convex and concave 1955

Note: no Debt Rattle tomorrow due to travel

“Emerging market and high-yield markets are the most alarming.”

• The Great Credit Party Is Almost Over, Societe Generale Says (BBG)

The great credit party that’s taken yield premiums in major markets down around lowest in a decade is probably months away from an end, as central banks normalize monetary policy and the economic outlook softens, Societe Generale predicts. “We expect next year to be a transition year, when the ultra-low yield environment finally starts to lose its grip,” Societe Generale credit strategists Juan Esteban Valencia and Guy Stear wrote in a note. “The U.S. and the eurozone are heading for an economic slowdown in 2019, and given the rising levels of corporate leverage, this should have an impact on credit.” U.S. investment-grade bond premiums will widen by mid-2018, with European counterparts following suit, as credit markets price in the economic slowdown, they wrote.

“The sword falls in 2H,” they predicted in a report that recognized last year’s annual outlook proved too bearish. Societe Generale had anticipated political risk to hurt credit in 2017, but changed tack by March as that didn’t pan out. Now, with global premiums having fallen further, “credit looks very pricey indeed,” they wrote. “Emerging market and high-yield markets are the most alarming.”

Schiff is right, except he keeps being focused on the dollar alone. It’s an American thing.

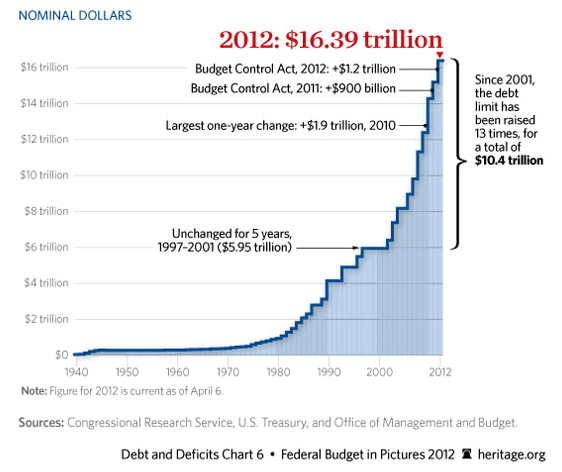

• Mother of All Bubbles Too Big to Pop – Peter Schiff (USAW)

Money manager Peter Schiff correctly predicted the financial meltdown in 2008. Now, 10 years later, what does Schiff see today? Schiff says, “I predicted a lot more than just the stock market going down back then. I predicted the financial crisis, but more importantly, I predicted what the government would do as a result of the financial crisis and what the consequences of that would be because that’s where we’re headed. The real crash I wrote about in my most recent book is still coming. . . . This is the third gigantic bubble that the Fed has inflated, and when this one pops, it’s not going to be ‘the third time is a charm.’ It’s going to be ‘three strikes and you’re out.’ I think this bubble is too big to pop. I think it’s the mother of all bubbles, and when it bursts, there is not a bigger one that the Fed is going to be able to inflate to mask these problems, meaning we can’t kick the can down the road anymore.”

This time, the crisis is going to hit everyone in the wallet. Schiff goes on to say, “I think the problem we are going to be confronted with is going to be much worse than a financial crisis. It is going to be a dollar crisis, and it is going to be a sovereign debt crisis where the bonds people are worried about are not some sub-prime mortgages. . . . It’s going to be the U.S. government that people are worried about and the solvency of the U.S. government and the Treasury bonds. If it’s a dollar crisis and people are worried about the dollar, the only thing worse than owning a dollar today is owning the promise of being paid in dollars in the future. I don’t think we have the courage to default and admit to our creditors that we don’t have the money and we can’t repay. I think we will create all the money that we need so we can pretend to repay, but what we end up doing is wiping out the debt with inflation.”

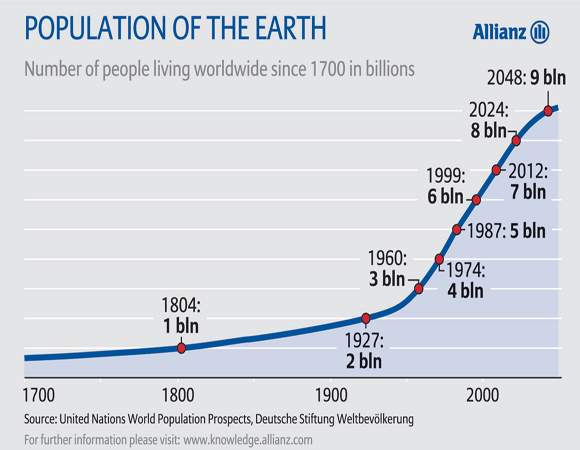

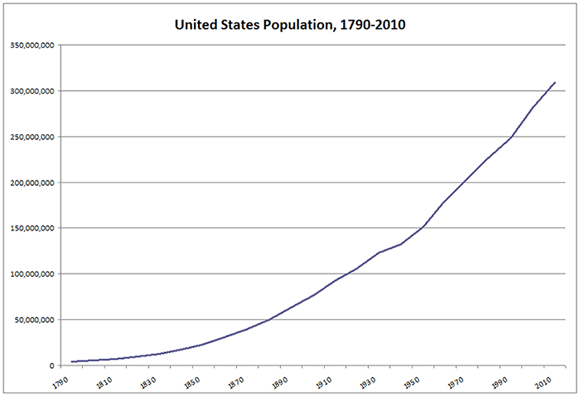

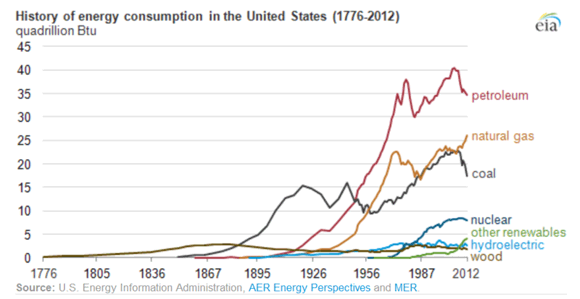

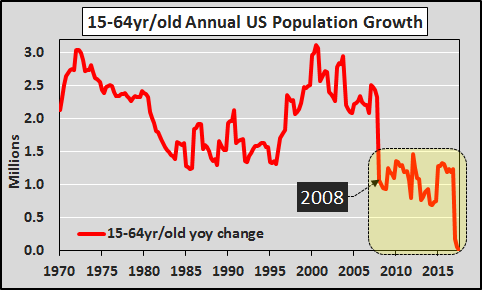

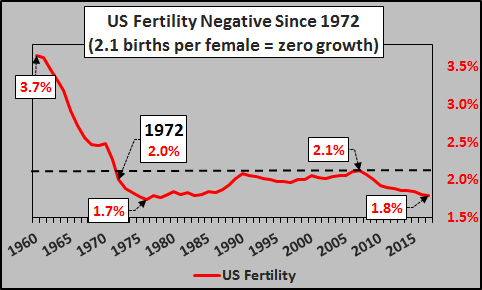

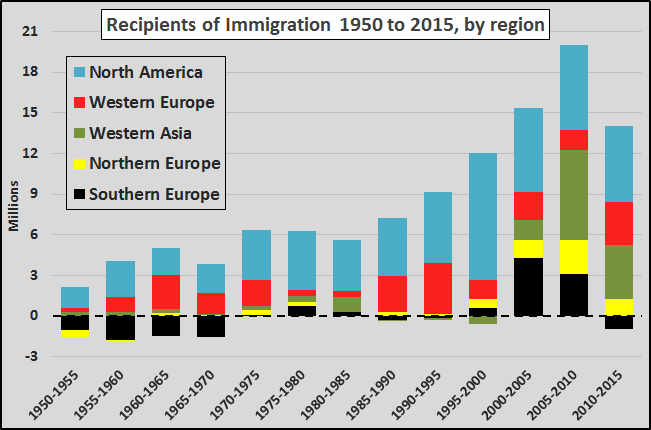

Many more graphs in this from Chris Hamilton. US population growth? It was all immigration: “.. the US fertility rate has been negative for 45 years..”

• One Day Soon, The Sun Will Not Rise (Econimica)

When the Q4 US resident population data is released, something that has not happened in the post WWII era will take place. The population of adults aged 15-64 years old will decline. This was not supposed to happen and will put an end to seven plus decades of continuous population growth which has meant a growing workforce, a growing consumer base, and growing tax base. A growing core US population, something considered as sacrosanct as the sun rising, will not happen. On a year over year basis, where there once were up to 3 million more homebuyers than the previous year, 3 million more car buyers than the year before, 3 million more potential customers…there will be likely be thousands fewer.

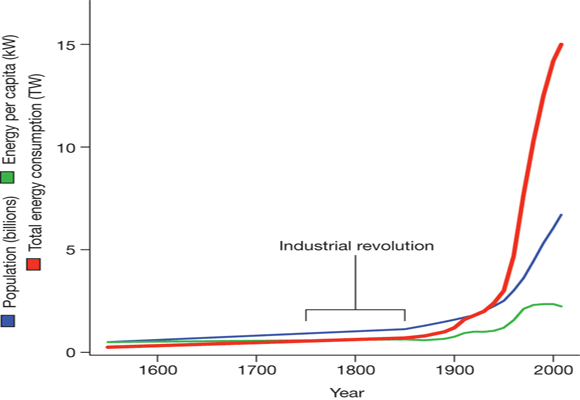

Many will assume this is a demographic issue of boomers exiting the working age population… but actually demographics is simply the early onset of a disease that will only progressively worsen. This is truly a population growth issue, not simply a demographic distribution problem. The economic system the US and world have adopted are dependent on perpetual growth on a quarter over quarter and year over year basis. Two negative quarters (or even zero growth) and a recession is called and all the Federal Reserve’s and federal governments tools are employed. Given the importance of growth, the most important factor in growing the economy is the rising demand represented by a growing population. But the US fertility rate has been negative for 45 years (chart below) meaning the native population (plus immigrants) have continually failed to replace themselves.

This means US population growth has simply been a story of immigration. And until 2000, N. America was the primary destination for the majority of the world’s immigrants. However, since ’00 and particularly since ’05, the migration patterns have significantly changed.

The soft approach.

• China’s Financial System Has Three Important ‘Tensions’ – IMF (CNBC)

An almost two-year long study of the Chinese financial system by the International Monetary Fund found three major tensions that could derail the world’s second-largest economy. Those tensions emerged as China moves away from its role as the world’s factory to a more modern, consumer-driven economy, the IMF said. The financial sector is critical in facilitating that transition, but in the process it evolved into a more complicated and debt-laden system. “The system’s increasing complexity has sown financial stability risks,” the fund said in the 2017 China Financial Sector Stability Assessment report released on Thursday morning Asia hours. The report was a culmination of the fund’s several visits to China between October 2015 and September 2017.

The assessment is intended to identify key sources of systemic risk in the financial sector so that policies can be implemented to enhance resilience to shocks and problems that could spread across the globe. The first tension in China’s financial system, according to the IMF, is the rapid build-up in risky credit that was partly due to the strong political pressures banks face to keep non-viable companies open, rather than letting them fail. Such struggling firms have, in recent years, taken on more debt to achieve growth targets set by the authorities. The overall debt-to-GDP ratio in the Asian economic giant grew from around 180% in 2011 to 255.9% by the second quarter of 2017, data by the Bank for International Settlements showed. The rise coincided with a slowdown in productivity growth and pressures on asset quality in the banking system – increasing the risks faced by the Chinese economy.

The second tension identified by the IMF is that risky lending has moved away from banks to the less-regulated parts of the financial system, commonly known as the “shadow banking” sector. That adds to the complexity of the financial sector and makes it more difficult for authorities to supervise activities in the system, the IMF said. And the third issue identified by the international organization is that there’s been a rash of “moral hazard and excessive risk-taking” because of the mindset that the government will bail out troubled state-owned enterprises and local government financing vehicles. An example is the “implicit guarantees” that financial institutions offer when selling products to retail investors. That is a situation where the financial product sold are not guaranteed, but banks almost always compensate investors for principal losses by dipping into their own capital.

The People’s Bank of China, in response to the IMF assessment, said in a statement on its website that it disagrees with some points in the report but the fund’s recommendations are “highly relevant in the context of deepening financial reforms” in the country. One of the points the Chinese central bank said it disagrees with is the conclusion that many banks lack the ability to withstand shocks. The IMF’s stress tests found that 27 out of 33 banks studied were under-capitalized. But the PBOC said the Chinese financial system is resilient.

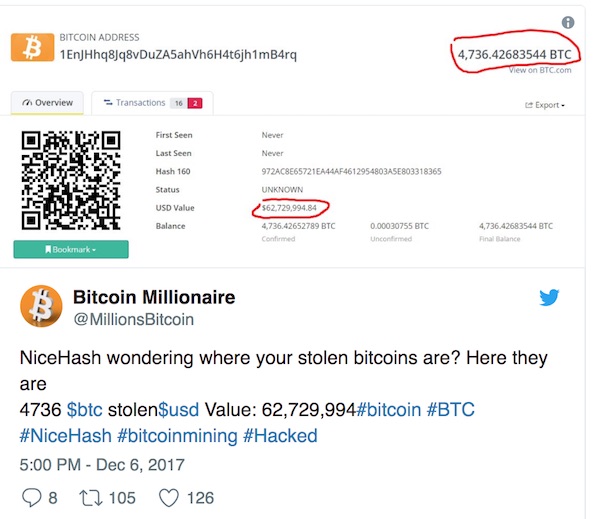

NiceHash is the largest bitcoin-mining exchange. Well, its coins have been found. But what now?

“a highly professional attack with sophisticated social engineering”

• Bitcoin Mining Service NiceHash Says Hackers Emptied Its Wallet (BBG)

NiceHash, the marketplace for cloud-based mining of cryptocurrencies, said hackers breached its systems and stole an unknown amount of bitcoin from its virtual wallet. “We are working to verify the precise number of BTC taken,” the company said Wednesday in a statement on its Facebook page. It’s halting operations for 24 hours, it said. The venture’s main webpage showed a “maintenance” error message, linking to its social media accounts. NiceHash helps match people who can spare computing capacity with miners looking to solve complex math problems to obtain a variety of new coins. It later facilitates periodic payments to the service providers with bitcoin. A wallet address circulated by NiceHash users shows that more than $60 million of bitcoins might be affected, according to CoinDesk, the cryptocurrency research and news website.

Seems a bit early, but echo chambers are deafening.

• Trump: Government Shutdown ‘Could Happen’ Saturday (CNBC)

President Donald Trump on Wednesday said that a government shutdown “could happen” as soon as Saturday. “It could happen,” Trump said during a Cabinet meeting at the White House, in response to a reporter’s question about the Friday deadline for a spending bill to fund the government. “The Democrats are really looking at something that could be very dangerous for our country,” Trump said. “They are looking at shutting down. They want to have illegal immigrants, in many cases people that we don’t want in our country, they want to have illegal immigrants pouring into our country, bringing with them crime, tremendous amounts of crime.” Congress has until midnight on Friday to approve a short-term spending package to keep the government open. Despite majorities in both chambers, Republicans will need Democratic votes to pass the bill.

House Minority Leader Nancy Pelosi, D-Calif., responded on Twitter to Trump’s comments saying: “President Trump is the only person talking about a government shutdown. Democrats are hopeful the President will be open to an agreement to address the urgent needs of the American people and keep government open.” What congressional Democrats want in exchange for supporting the spending bill are permanent protections for the nearly 800,000 young, undocumented immigrants currently living in the United States who were brought here as children, the so-called Dreamers. Earlier this year, Trump canceled an Obama-era protection policy for Dreamers, the Deferred Action for Childhood Arrivals program, or DACA. The president’s order gave Congress until March 2018 to pass a bill with DACA-like protections.

To balance out the Jerusalem decision? Jerusalem should be a religious city, not a political one.

• Trump Calls On Saudi Arabia To End Yemen Blockade Immediately (Ind.)

US President Donald Trump has called on Saudi Arabia to end its Yemen blockade immediately, citing humanitarian concerns. Mr Trump said in a statement that he has directed US officials to call Saudi Arabian leaders and request they “completely allow food, fuel, water and medicine to reach the Yemeni people.” He said Yemenis “desperately need it.” A Saudi-led coalition has been fighting to defeat the Iran-backed Houthis and Yemeni President Ali Abdullah Saleh’s forces in Yemen since March 2015 with the aim of reinstating the internationally recognized government of Mr Saleh’s successor, Abed Rabbo Mansour Hadi. The US has been supporting the coalition through weapons sales, some intelligence sharing, and refuelling capabilities for air operations.

Since the conflict began, at least 10,000 people have died as a result and 40,000 have been wounded, Al Jazeera reported. Mr Saleh was killed earlier this week after moving to switch allegiances in the bloody conflict, making the situation in the country unpredictable according to experts. [..] The Saudi-led coalition had imposed a blockade on the country last month after Houthi rebels fired a missile on the Saudi capital of Riyadh. It responded by sending a slew of missiles into Yemen’s capital Sanaa. The blockade was partially lifted at the Hudaya port of the international airport in Sanaa and the first aid shipments were allowed to enter the country just last week. In the meantime, aid groups were forced to buy their own fuel in order to assist with relief work.

Stockma’s not the lonly one pointing out that the NSA already knows everything. They don’t have to interview Flynn for that.

• Why the Deep State Is at War With Trump (Stockman)

If you were a Martian visitor just disembarked from of one of Elon Musk’s rocket ships and were therefore uninfected by earth-based fake news, the culprits in Washington’s witch-hunt de jure would be damn obvious. They include John Brennan, Jim Comey, Sally Yates, Peter Strzok and a passel of deep state operatives – all of whom baldly abused their offices. After Brennan had concocted the whole Russian election meddling meme to sully the Donald’s shocking election win, the latter three holdovers – functioning as a political fifth column in the new Administration – set a perjury trap designed to snare Mike Flynn as a first step in relitigating and reversing the voters’ verdict. The smoking gun on their guilt is so flamingly obvious that the ability of the Trump-hating media to ignore it is itself a wonder to behold.

After all, anyone fresh off Elon’s rocket ship would learn upon even cursory investigation of the matter that the National Security Agency (NSA) intercepts electronically every single communication of the Russian Ambassador with any person on US soil – whether by email, text or phone call. So the clear-minded visitor’s simple question would be: What do the transcripts say? In fact, a Martian visitor would also quickly understand that the entire world – friend, rival, foe and enemy, alike – already knows of NSA’s giant digital spying operation owing to Snowden’s leaks, and that therefore there are no “sources and methods” on the SIGINT (signals intelligence) front to protect. Accordingly, the disinterested Martian would undoubtedly insist: Declassify the NSA intercepts and publish them on Facebook (and, for old timers, on the front page of the New York Times) so that the truth would be known to all.

Of course, that would punch a deep hole in the entire RussiaGate witchhunt because NSA, in fact, did record Flynn’s late December conversations with Russian Ambassador Kislyak. And there was not a single word in them that related to alleged campaign collusion or otherwise inappropriate communications by the in-coming national security adviser to a newly-elected President who was three-weeks from inauguration. Indeed, as explained below, Mueller has effectively told us that Flynn’s communications with Kislyak were clean as a whistle.

Corporatism. Another name for Mussolini’s version of fascism.

• How Corporate Power Killed Democracy (CP)

The rise of Corporate Power was the fall of democracy. Over the long haul, US politics has revolved around a deep tension between democracy and an unrelenting drive for plunder, power and empire. Granted that our democracy has been seriously flawed and only rarely revolutionary, yet the democratic movements are the source of every good thing America has ever stood for. Since the mid-1970s, when the corporations fused with the state, a new imperial order emerged that killed what remained of representative democracy. Not only would corporations exercise public authority as only government once had, but government would coordinate and serve corporate activity. Power and profits became one and the same. Corporate power has replaced democracy with oligarchy and justice with a vast militarized penal system.

Instead of innovative production, they plunder people and planet. To achieve this new order, elections and the economy had to be drained of any remaining democratic content. Both Democrats and Republicans were eager to have at it. By the 1990s “Third Way” Democrats like Bill Clinton abandoned what was left of the New Deal to try to outdo the Republicans as the party of Wall Street. The Republicans pioneered election fraud on a national scale in 2000, 2004, and 2016; a lesson the Democrats learned all too well by the 2016 Primary. Neither major party wants election reform since free and fair elections would threaten the system itself. So-called private corporations like Facebook, Google and Twitter control information and manage the 1st Amendment.

The corporate media now broadcast propaganda and play the role of censor once monopolized by the FBI and CIA. The migration of propaganda work to civilian organizations began under Ronald Reagan. While both major parties offer the people nothing beyond austerity and the worst kind of identity politics, the big banks like Goldman Sachs gained positions of real influence with both Republican and Democratic administrations and always with the Department of the Treasury and the Federal Reserve. Without pubic money and political protection the banking system — the headquarters of the mythical free market — could not function.

Yes, this has everything to do with Google, Facebook et al (not just government spies). It involves some $260 billion in digital trade.

• EU Regulators Threaten Court Challenge To EU-US Data Transfer Pact (R.)

European Union privacy regulators have threatened to bring a legal challenge to a year-old EU-U.S. pact on the cross-border transfer of personal data if their concerns about its functioning and U.S. surveillance practices are not resolved by the autumn of 2018, they said in a report. The EU-U.S. Privacy Shield pact was agreed last year after the European Union’s highest court had struck down the previous Safe Harbour Principles agreement which allowed companies to transfer European citizens’ personal data to the United States, due to concerns about intrusive U.S. surveillance of online data. The Privacy Shield pact enables companies to easily conduct everyday cross-border data transfers in compliance with EU data protection rules.

“The WP29 (Article 29 Working Party) has identified a number of significant concerns that need to be addressed by both the (European) Commission and the U.S. authorities,” the regulators – known as the Article 29 Working Party – said in their report. The European Commission, which negotiated the Privacy Shield deal, conducted its first annual review in September and said it was satisfied with the way it was working. It did however ask Washington to improve it, including by strengthening the privacy protections contained in a controversial portion of the U.S. Foreign Intelligence Surveillance Act (FISA), known as Section 702. Section 702 allows the U.S. National Security Agency to collect digital communications from foreign suspects living outside the United States. It is due to expire on Dec. 31 in the absence of congressional action.

It won’t remain stable. Or rather, it never was: poevry is making more victims every day.

• Greek Stability Attracts US Investors Amid Turkey, Middle East Tumult (CNBC)

A series of positive factors for the Greek economy are attracting U.S. investors back to the embattled euro zone nation, a government minister told CNBC. “There are many American investors who are interested in participating in projects in Greece, because every clever investor would be interested in an economy that now starts to have positive growth rates,” Dimitris Tzanakopoulo, Greek minister of state and the government spokesperson, told CNBC Monday. Following a meeting between President Donald Trump and Greek Prime Minister Alexis Tsipras in October, there’s a renewed interest from the U.S. in shoring up its investments in Greece, especially in the energy sector.

Aside from a bounce back in economic growth, Tzanakopoulo said that Greece was “a pillar of stability in a region” and is winning back investors. “(The region) has many, many problems, wherever you look there’s destabilization, there is turbulence,” Tzanakopoulo said in his office in Athens. “We think we are one of the factors which will secure and guarantee stability in the region and this is something everybody knows, from the U.S. to our European partners,” he said. At the crossroads of Europe, Asia, and Africa, Greece is a key ally for many Western countries in the face of escalating tumult in Turkey and the rest of the Middle East.

Apparently Berlin has not given permission to move refugees to the mainland. Shame on you, mutti Merkel.

• Greek Islands Boiling Over As Winter Arrives (K.)

The decision by the Migration Policy Ministry to expand and upgrade hot spots on Chios and Lesvos have cultivated a tense atmosphere, as critics say it will do nothing to ease pressure on the eastern Aegean islands and or to alleviate the situation of thousands of stranded refugees and migrants crammed in camps designed to hold far less people. Moreover, the onset of winter has made a bad situation even worse and the calls for authorities to accelerate asylum applications so as to transfer people to the mainland have become even louder. In the bid to deal with the deteriorating conditions, a team from Medecins Sans Frontiers (MSF) has, since last week, set up operations outside the Moria camp in Lesvos, offering assistance to those in need in cooperation with the Hellenic Center for Disease Control and Prevention (KEELPNO).

In a Facebook post, MSF said the harsh conditions and the cold are posing a serious threat to the health of the some 7,000 people that remain at the Moria hot spot. The group, which has called for the immediate transfer of those living at Moria to the mainland, has set up a mobile unit outside the camp to help children under the age of 16 and pregnant women. MSF is also distributing blankets, mattresses and other basic necessities as the situation, it said, is on the brink of a humanitarian crisis. At the same time, the Migration Policy Ministry is planning to transfer another 65 prefabricated huts to Moria in a bid to increase the camp’s capacity and to improve the living conditions of those that are still staying in summer tents. But the move is set to trigger more acrimony, as islanders and local authorities have said they do not agree with the expansion of the hot spot’s capacity.

That would mean much higher sea levels.

• Scientists Warn Of 93% Chance Global Warming Will Exceed 4°C (Ind.)

Current predictions of climate change may significantly underestimate the speed and severity of global warming, according to a new study. Reappraisal of the models climate scientists use to determine future warming has revealed that less optimistic estimates are more realistic. The results suggest that the Paris Climate Agreement, which aims to keep global average temperatures from rising by 2C, may be overly ambitious. “Our study indicates that if emissions follow a commonly used business-as-usual scenario, there is a 93% chance that global warming will exceed 4C by the end of this century,” said Dr Ken Caldeira, an atmospheric scientist at the Carnegie Institution for Science, who co-authored the new study. This likelihood is an increase on past estimates, which placed it at 62%.

Climate models are vital tools for scientists attempting to understand the impacts of greenhouse-gas emissions. They are constructed using fundamental knowledge of physics and the world’s climate. But the climate system is incredibly complex, and as a result there is disagreement about how best to model key aspects of it. This means scientists have produced dozens of climate models predicting a range of different global warming outcomes resulting from greenhouse-gas emissions. Based on a “business-as-usual” scenario in which emissions continue at the same rate, climate models range in their predictions from a 3.2C increase in global temperatures to a 5.9C increase The new study, published in the journal Nature, sought to resolve this situation and establish whether the upper or lower estimates are more accurate.

To do this, Dr Caldeira and his collaborator Dr Patrick Brown reasoned that the most accurate models would be the ones that were best at simulating climate patterns in the recent past. “It makes sense that the models that do the best job at simulating today’s observations might be the models with the most reliable predictions,” said Dr Caldeira. Their conclusion was that models with higher estimates were more likely to be accurate, with the most likely degree of warming 0.5C higher than previous best estimates.

If I knew for a certainty that a man was coming to my house with the conscious design of doing me good, I should run for my life.

—Thoreau