Frederic Edwin Church The Parthenon 1871

Bad theater. But not releasing the memo is no longer an option.

• FBI Opposes Memo Release Due To “Inaccurate Information” (ZH)

Update 1240ET: In what CNN described as a “rate public warning,” the FBI released a statement Wednesday saying it has “grave concerns” over the accuracy of the House Intel Committee’s memo describing purportedly egregious FISA abuses. “With regard to the House Intelligence Committee’s memorandum, the FBI was provided a limited opportunity to review this memo the day before the committee voted to release it. As expressed during our initial review, we have grave concerns about material omissions of fact that fundamentally impact the memo’s accuracy,” the FBI said in a statement.

* * *

Update 1130ET: Bloomberg reports that FBI Director Christopher Wray told the White House he opposes release of a classified Republican memo alleging bias at the FBI and Justice Department because it contains inaccurate information and paints a false narrative, according to a person familiar with the matter. Of course, given the allegedly terrible picture the memo paints of The FBI, it is perhaps not entirely surprising that Wary would oppose its release, however, if this sourced reporting proves correct, it plays very badly for Republicans as it would seem to confirm Rep. Schiff’s accusations.

* * *

As we detailed earlier, just before President Trump headed to the Capitol for last night’s “State of the Union”, the Washington Post reported that top Justice Department officials made a last-ditch plea on Monday to White House Chief of Staff John Kelly about the dangers of publicly releasing the memo. Shortly before the House Intelligence Committee voted to make the document public, Deputy Attorney General Rod J. Rosenstein warned Kelly that the four-page memo prepared by House Republicans could jeopardize classified information and implored the president to reconsider his support for making it public. But those pleas from Rosenstein – who isn’t exactly the West Wing’s favorite lawman, and whose name apparently appears in the memo – have apparently fallen on deaf ears.Last night, President Trump promised a lawmaker that the memo would “100%” be released now that the House Intel Committee has voted to approve its release. And during a Fox News Radio interview with Brian Kilmeade, Chief of Staff John Kelly added that the memo would be publicly released “pretty quick.” “I’ll let all the experts decide that when it’s released. This president wants everything out so the American people can make up their own minds,” he said.

He should know, he created them both.

• Alan Greenspan Sees Bubbles in Stocks and Bonds (BBG)

The man who made the term “irrational exuberance” famous says investors are at it again. “There are two bubbles: We have a stock market bubble, and we have a bond market bubble,” Alan Greenspan, 91, said Wednesday on Bloomberg Television with Tom Keene and Scarlet Fu. Greenspan, who led the Federal Reserve from 1987 until 2006, memorably used the phrase to describe asset values during the 1990’s dot-com bubble. Greenspan’s comments come as stock indexes remain near record highs, despite selling off in recent days, and as the yields on government notes and bonds hover not far from historic lows. Interest rates are expected to move up in coming years as the Fed continues with a campaign to gradually tighten monetary policy.

“At the end of the day, the bond market bubble will eventually be the critical issue, but for the short term it’s not too bad,” Greenspan said. “But we’re working, obviously, toward a major increase in long-term interest rates, and that has a very important impact, as you know, on the whole structure of the economy.” The Fed on Wednesday opted to leave rates unchanged and markets are pricing in an increase at the central bank’s March meeting. Greenspan sounded an alarm on forecasts that the U.S. government deficit will continue to climb as a share of GDP. He said he was “surprised” that President Donald Trump didn’t specify how he would fund new government initiatives in Tuesday’s State of the Union speech. The president last month signed into law about $1.5 trillion in tax cuts that critics say will further balloon the budget gap.

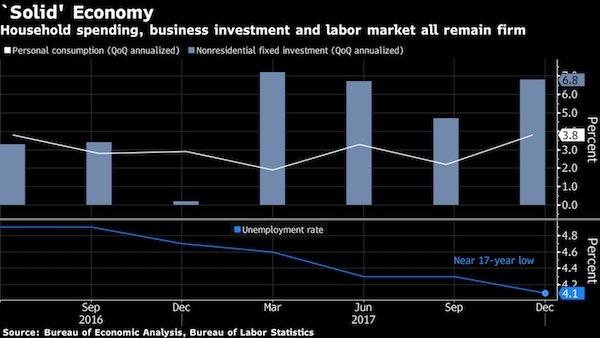

The nonsense is deafening. Great solid economy, but no rate hikes.

• Janet Yellen’s Fed Era Ends With Unanimous Vote of No Rate Hike (BBG)

Federal Reserve officials, meeting for the last time under Chair Janet Yellen, left borrowing costs unchanged while adding emphasis to their plan for more hikes, setting the stage for an increase in March under her successor Jerome Powell. “The committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate,” the policy-setting Federal Open Market Committee said in a statement Wednesday in Washington, adding the word “further” twice to previous language. The changes to the statement, collectively acknowledging stronger growth and more confidence that inflation will rise to their 2% target, may spur speculation that the Fed will pick up the pace of interest-rate increases.

Officials also said inflation “is expected to move up this year and to stabilize” around the goal, in phrasing that marked an upgrade from their statement in December. At the same time, the Fed repeated language saying that “near-term risks to the economic outlook appear roughly balanced.” “It opens the door to four hikes for them, but I don’t think they have walked through it,” said Michael Gapen at Barclays in New York. “It closes the door to two hikes.” Fed officials penciled in three rate moves this year in quarterly forecasts they updated last month, according to their median projection.

With her term ending later this week after President Donald Trump chose to replace her, Yellen is handing the reins to Powell, who has backed her gradual approach and is widely expected to raise interest rates at the FOMC’s next meeting for the sixth time since late 2015. Fed officials are hoping to keep a tight labor market from overheating without raising borrowing costs so fast that it would stifle the economy. “Gains in employment, household spending and business fixed investment have been solid, and the unemployment rate has stayed low,” the Fed said, removing previous references to disruptions from hurricanes. “Market-based measures of inflation compensation have increased in recent months but remain low.”

People won’t understand their pensions are Ponzis until there are no payments.

• Two Out Of Three UK Pension Schemes Are In The Red (Yahoo)

Two out of three pension funds are in the red – to the tune of a combined £210 billion, it has been revealed. Some 3,710 schemes are in deficit according to the Pension Protection Fund watchdog, putting a serious question mark over the retirement plans of millions of workers. The PFF has been called into action on two high profile occasions of late – working with Toys R Us to secure a near £10m injection into its ailing fund to protect the company’s short-term future and also sorting through the debris of the Carillion collapse. The giant contractor folded earlier this month with debts of above £1.3bn, including an estimated £800m hole in its pension fund. The PFF monitors the health of 5,588 pension pots, with some of the biggest names on the FTSE 100 running schemes with major shortfalls.

The biggest include £9.1billion at BT, as well as deficits of £6.9billion at Royal Dutch Shell, £6.7billion at BP and £6.6billion at both Tesco and BAE Systems. Sir Steve Webb, a former pensions minister under the recent coalition government, said Carillion would not be the last big company to fold leaving its pension scheme in jeopardy. “The question isn’t if there will be another Carillion – it’s when,” said Webb, who is now director of policy at pensions group Royal London. “With two-thirds of schemes in deficit it is inevitable there will be more insolvencies and more schemes ending up in the PPF.”

They had more than 60 active working groups.. And thought it’d remain secret? Anyone going to jail?

• Secret Price Fixing Among German Carmakers (Spiegel)

The Federal Cartel Office suspects that major carmakers and a few of their suppliers have been fixing prices for years, and possibly even decades. It’s not the prices at which the companies sell their cars or car parts that is at issue, but rather a significant component of the prices they pay for steel. “The aim of the suspected collusion,” the court ruling that granted the search warrants read, was to “unify the purchasing price for steel in the automobile industry and, by doing so, create a commonality of costs.” The Federal Cartel Office believes that the alleged collusion existed back in the 1990s and that “it existed again from March 2007 until February 2013.” Investigators have also found indications there may have been collusion in 2016.

Collusion of that nature is the antithesis of competition. It means that VW, Daimler and BMW were no longer competing to buy steel cheaper than their rivals and passing their savings down to customers – as is normally the case in a functioning market economy. And steel is one of the most important supplies purchased by carmakers. The nationwide searches didn’t remain secret, with the media quickly reporting on them. But until now, the background and details of the raids have remained largely unknown, the case having been overshadowed by a European Commission investigation into another case that also involves the automobile industry – a case that DER SPIEGEL exposed last summer.

That case was triggered when Daimler and Volkswagen essentially admitted wrongdoing, and since then the Brussels authority has been looking into suspicions that the companies engaged in collusion for several years with BMW, Porsche and Audi, in the form of more than 60 working groups covering areas such as technological development, suppliers and how to deal with environmental protection authorities. The companies had created working groups for almost every part of a vehicle. They existed for “gasoline engines,” “diesel engines,” “car body,” “chassis,” “total vehicle” and many more areas. With five brands involved – Daimler, BMW, Audi, Porsche and VW – the groups were referred to internally as “groups of five.” All together, they met more than 1,000 times in past years.

Say no more: “Desired ambiguities..”

• Germany Reaches Limit of Support for Macron’s Europe Plans (BBG)

French President Emmanuel Macron will be disappointed if he expects Germany’s next government to drum up more goodwill for his European reform plans in this week’s talks, according to four people familiar with the current coalition negotiations. Angela Merkel’s Christian Democratic Union-led bloc and its prospective Social Democratic Party partner are not planning any fundamental changes to their proposals on Europe’s future as set out in a preliminary agreement reached Jan. 12, according to the people, who represent all three parties involved in the talks. All asked not to be named as the negotiations are private and ongoing. Representatives of Merkel’s CDU, its Christian Social Union sister party and Martin Schulz’s Social Democrats met in the Chancellery in Berlin on Wednesday to discuss Europe policy.

While Schulz hailed the outcome as a “fresh start” for Europe, details were in short supply. The negotiators didn’t go much beyond those measures already agreed, one of the people attending the meeting said. These include higher German contributions to the EU budget; expanding the European Stability Fund (ESM) into a European Monetary Fund; and a European framework for minimum wages. The SPD proposed giving the EU its own means to raise revenue, whether by taxes or tolls, prompting Merkel’s bloc to warn against a debate over tax increases. On a visit to Macron in Paris on Jan. 19, Merkel said the coalition’s common Europe plans contained “desired ambiguities,” since any attempt to agree on the final details now would reduce the room to negotiate.

In reality, her CDU/CSU and the SPD, as the Social Democrats are known in German, have different interpretations of the proposals, and these divergent positions are likely to bubble up in the coming months in the debate over euro-area reform.

Hungary won’t be easy to strong-arm. But Brussels will try. The only people who want more Europe are politicians.

• Hungary Rejects Macron’s ‘Arrogance’ as EU Reform-Fight Looms (BBG)

French President Emmanuel Macron’s plan to bring to heel renegade European Union nations as part of a drive to reform the bloc smacks of arrogance and will fail, a senior Hungarian ruling party official said. Unanimity is required both to change the EU constitution and approve a multi-year, post-2020 EU budget. That means proposed sanctions on countries like Hungary and Poland for alleged rule-of-law violations won’t gain traction, according to Gergely Gulyas, parliamentary leader of Hungarian Prime Minister Viktor Orban’s Fidesz party. Governments are drawing battle lines as the EU mulls plans to re-invent itself, with some members saying the euro crisis, Brexit, the biggest refugee influx since World War II and ex-communist members ditching the bloc’s liberal values have necessitated a revamp.

Macron has presented the most ambitious proposals, with a plan to deepen integration in everything from defense to the economy. He has also called for sanctions against member states seen as backsliding on democracy. “If we’re going to play the game that western European countries want to launch rule-of-law procedures against eastern European countries because of differences over values, then that’s not going to work,” said Gulyas, 36. “That would destroy the Union.” Hungary received 3.6 billion euros ($4.5 billion) in net EU funding in 2016. That made it the fourth-biggest beneficiary in the 28-member bloc after Poland, Romania and Greece and underscores the risk to its economy if Macron can make good on his pledge. Gulyas dismissed proposals aimed at punishing Hungary and Poland, arguing that France has for years failed to meet EU spending limits yet has escaped penalties for fiscal offenders.

Under an alleged left-wing government.

• More Than One Million Greeks Trapped In Tax Payment Scheme Nightmare (K.)

More than 1 million Greeks are now trapped in programs to pay off their tax and social security dues in installments, a situation likely to continue for years to come. On Wednesday the Finance Ministry announced taxpayers can apply for a 12- or 24-installment payment scheme, which under certain circumstances can include non-expired dues, on the website of the Independent Authority for Public Revenue. Citizens are resorting to various payment programs offered by the ministries of Finance and Labor because they would otherwise be unable to meet their obligations. In many cases taxpayers are forced to pay additional installments in order not to default on their plans.

The million-plus taxpayers and businesses that are trapped in the various schemes they have entered to pay off the tax authorities and the social security funds have no other choice but to keep paying, otherwise they will have their assets confiscated. The payment schemes are the outcome of the growth in taxation and of social security contributions in recent years. Worse, as of this year, if anyone delays the payment of an installment by more than 24 hours, the debt will be classified as overdue and the process of the monitoring mechanism will be triggered for the state to safeguard its interests. Particularly in the case of the 100-payment program for dues to the tax authorities, missing a deadline means the entire amount due is classified as expired and becomes immediately payable along with fines and penalties.

You mean, monoculture is not the greatest thing ever?!

• Planting Wildflowers Across Farm Fields To Cut Pesticide Spraying (G.)

Long strips of bright wildflowers are being planted through crop fields to boost the natural predators of pests and potentially cut pesticide spraying. The strips were planted on 15 large arable farms in central and eastern England last autumn and will be monitored for five years, as part of a trial run by the Centre for Ecology and Hydrology (CEH). Concern over the environmental damage caused by pesticides has grown rapidly in recent years. Using wildflower margins to support insects including hoverflies, parasitic wasps and ground beetles has been shown to slash pest numbers in crops and even increase yields. But until now wildflower strips were only planted around fields, meaning the natural predators are unable to reach the centre of large crop fields.

“If you imagine the size of a [ground beetle], it’s a bloody long walk to the middle of a field,” said Prof Richard Pywell, at CEH. GPS-guided harvesters can now precisely reap crops, meaning strips of wildflowers planted through crop fields can be avoided and left as refuges all year round. Pywell’s initial tests show that planting strips 100m apart means the predators are able to attack aphids and other pests throughout the field. The flowers planted include oxeye daisy, red clover, common knapweed and wild carrot. In the new field trials, the strips are six metres wide and take up just 2% of the total field area. They will be monitored through a full rotation cycle from winter wheat to oil seed rape to spring barley.

“It’s a real acid test – we scientists are having to come up with real practical solutions,” said Pywell, who led a landmark study published in 2017 showing that neonicotinoids insecticides damage bee populations, not just individual insects. In the new trials, the researchers will be looking out for any sign that drawing the wild insects into the centre of fields, and therefore closer to where pesticides are sprayed, does more harm than good.

Old threat. But a real one.

• Earth’s Magnetic Field Is Shifting, Poles May Flip (ZH)

[..] scientists from the University of Colorado in Boulder are sounding the alarm that the Earth’s magnetic poles are showing signs of reversing. Although the pole reversal, in and of itself, isn’t unprecedented, the solar winds that would take out the power grid and make parts of the globe uninhabitable could cause widespread disasters. The Earth has a fierce molten core that generates a magnetic field capable of defending our planet against devastating solar winds. This magnetic field is vital to life on Earth and has weakened by 15 percent over the last 200 years. This protective field acts as a shield against harmful solar radiation and extends thousands of miles into space and its magnetism affects everything from global communication to power grids.

Historically, Earth’s North and South magnetic poles have flipped every 200,000 or 300,000 years. However, the last flip was about 780,000 years ago, meaning our planet is well overdue. The latest satellite data, from the European Space Agency’s Swarm trio which monitors the Earth’s magnetic field, suggest a pole flip may be imminent. The satellites allow researchers to study changes building at the Earth’s core, where the magnetic field is generated. Their observations suggest molten iron and nickel are draining the energy out of the Earth’s core near where the magnetic field is generated. While scientists aren’t sure why exactly this happens, they describe it as a “restless activity” that suggests the magnetic field is preparing to flip.

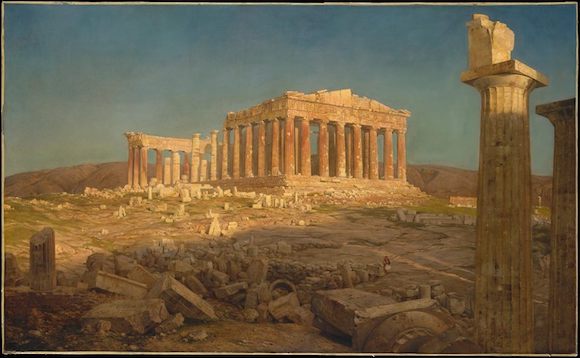

A lot more timeless than most other pics of this.

• ‘Super Blue Blood Moon’ Rises Over The Acropolis (K.)

A ‘super blue blood moon’ rises behind the 2,500-year-old Parthenon temple on the Acropolis hill in Athens on Wednesday evening, when thousands of city residents took to the streets and balconies to witness the rare spectacle. People in many parts of the world caught a glimpse of the moon as a giant reddish globe thanks to a rare lunar phenomenon that combines a total eclipse with a blue moon and super moon. The spectacle – the first in 152 years – has been coined a ‘super blue blood moon’ by NASA. [Petros Giannakouris/AP]

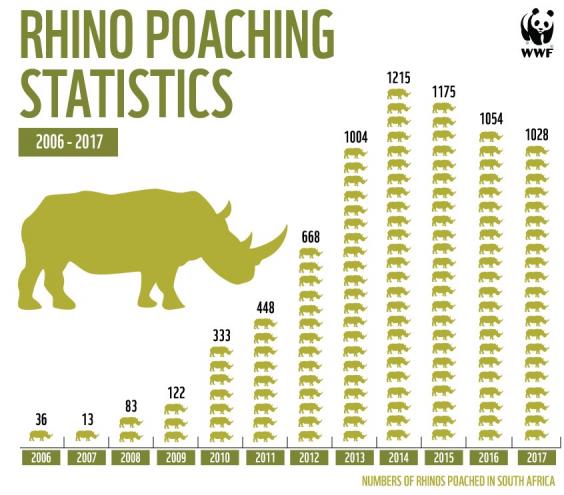

Just refuse to do any trade with any country that imports the horns. For starters.

• Latest Rhino Poaching Figures Show A Decade Of Bloodshed (Ind.)

Dr Ian Player, the veteran South African game ranger and doyen of global rhino conservation, would be turning in his grave today were he to discover that another 1,000 rhinos had been slaughtered in the last calendar year. The African-wildlife warrior died just over three years ago aged 87, at a point when poaching had just exploded to record levels in South Africa – with nearly three rhinos gunned down daily. Annual government statistics announced last week complete the picture of 7,130 rhino carcasses piled up in South Africa over the last decade. Shortly before his death, I visited Player at his home in the KwaZulu-Natal Midlands to ask him about his thoughts on the poaching crisis and the future of one of the “big five” (lion, leopard, rhinoceros, elephant and Cape buffalo) species he devoted most of his life to protecting.

Frail and dispirited, he had reached a point in life where he should have been taking things easy, after more than six decades of service to nature conservation. Instead, his cellphone rang incessantly as colleagues from all corners of the country reported the discovery of yet another rhino butchered for its horns. Having worked so hard to save rhinos from extinction once before, there was no way Player could hang up his conservation boots amidst this new crisis. He also told me about a dream that haunted him. “My dream was about a young white rhino which came to lie down next to me and then gently placed its head on my shoulder. That does not need too much interpretation – the rhinos still need our help more than ever before,” he explained.

Player first came across a rhino in Imfolozi Game Reserve in the early 1950s when he joined the Natal Parks Board as a learner game ranger. A disciple of Carl Jung and Sir Laurens van der Post, Player went on to spearhead a global operation to safeguard the world’s second-largest land animal from extinction. Less than a decade ago, poaching deaths were limited to roughly 20 rhinos per year in South Africa, the country that provides sanctuary to 93% of Africa’s white rhinos and nearly 40% of the continent’s black rhinos. In 2007, only 13 rhinos were poached in South Africa. But in 2008 that tally rose steeply to 80 deaths; to 333 in 2010 and then to a record level of 1,205 during 2014. Last year the death toll topped the 1,000 mark for the fifth year in a row.