Pablo Picasso Portrait of Dora with bun 1937

Brook Jackson, former Regional Director of Operations for Ventavia Research Group, turned whistleblower.

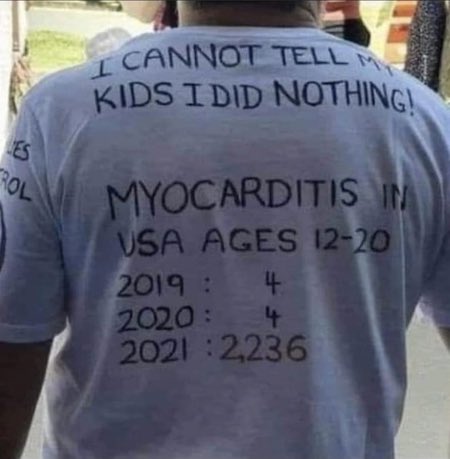

“A new study has found cardiovascular adverse effects in around a third of teens following Pfizer vaccination, and heart inflammation in one in 43, raising fresh concerns about the risks of vaccination for young people. ”

Same script

They couldn't be 'conspiring' against us. Could they? They couldn't all be working for the same people. Could they? They couldn't all be reading the same script. Could they? pic.twitter.com/NlDlVccdTm

— David Wolfe (@DavidWolfe) August 13, 2022

“Either we will have a One World Dictatorship imposed on us by the Western elites, or else we will have Freedom and Peace, Justice and Prosperity.”

• A Tale of Two Cities (Batiushka)

Moscow and Washington. It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair. The opening words of ‘A Tale of Two Cities’. It is the best of times. That which some in Moscow and in the Orthodox Christian world in general have been awaiting for a thousand years is coming to pass. Just as it has been prophesied again and again down the centuries: the West and its ruthless Imperialism are collapsing in the face of the resistance of the long-suffering and long-exploited Rest. This struggle is being led by Russia. What a time to be alive. We did not think we would live to see it.

After the disaster of the Western and Russophobic ideology of Parliamentary Democracy, which was imposed by Great Britain and others on the old Russian Empire in February 1917, and then, as a prime example to the West of blowback, those incompetents passed power into the hands of the equally Western and Russophobic ideology of Marxism, which began genociding its subject peoples in October 1917. It is the worst of times. Nobody likes this Washington-imposed war. People are dying, people are being mutilated both in their bodies and in their souls, people are being exploited and manipulated. Still worse is our pain for the Western peoples, on whom their wealthy elites are about to threaten with death by hunger and death by freezing, with all the civil strife that is hanging over them like black Doomsday.

It is the age of wisdom. Some in Moscow and elsewhere know that this is an existential war not just for the Russian Federation, but for the whole world. Either we will have a One World Dictatorship imposed on us by the Western elites, or else we will have Freedom and Peace, Justice and Prosperity. It is the age of foolishness. The gerontocracy in Washington has imposed a choice. From 330 million Americans, all they could find as candidates to be US President, him who has charge of the nuclear button, is two very elderly men, an ill-reputed, viagra-charged businessman-clown and an ill-reputed double-dealer of dubious personal morality, clearly suffering from the onset of dementia.

“..Joe Biden is using the conflict in Ukraine to engineer “regime change in Russia”and feed the military-industrial complex..”

• Biden Wants Regime Change In Russia – Tulsi Gabbard (RT)

US President Joe Biden is using the conflict in Ukraine to engineer “regime change in Russia”and feed the military-industrial complex, former US representative and 2020 presidential candidate Tulsi Gabbard told Fox News viewers on Friday. Meanwhile, America’s European allies are paying the price as Biden builds his “New World Order.” Filling in for Fox host Tucker Carlson on Friday, the former Congresswoman from Hawaii issued a scathing condemnation of the Biden administration’s anti-Russia sanctions, which she said have only hurt the US and Europe while Russia rakes in record energy profits. “Europe is in a massive energy crisis right now,”she stated, citing record power prices in France, public lighting cutbacks and impending heating shortages in Germany, and restrictions on home and business energy usage in the UK and Spain.

“Why is all this happening?” she continued, before answering: “Because of Joe Biden’s sanctions, which are nothing short of a modern day siege. This is a supply problem that Joe Biden created, one that Russia is now profiting from.” The US and EU have imposed multiple rounds of economic sanctions on Russia following the launch of Moscow’s military operation in Ukraine in February. The US has also ended imports of Russian oil and gas, while the EU has begun a phased withdrawal from Russia’s energy exports. However, with several European countries refusing to pay for Russian gas in rubles – as Moscow has demanded – and with the bloc’s sanctions impeding maintenance on gas pipelines, the EU, which depends on Russia for around 40% of its gas, is facing soaring energy costs and inflation.

Meanwhile, Russia is expected to double its gas profits this year. With the US concurrently pumping tens of billions of dollars worth of weapons into Ukraine, Gabbard argued that the conflict there has “never been about morality.” “It’s not about the people of Ukraine or ‘protecting democracy’,” she declared. “This is about regime change in Russia and exploiting this war to strengthen NATO and feed the military-industrial complex.” “To Joe Biden, it’s even about bringing about a new world order. ‘We’ve got to lead it,’ he says, and he’s trying to do just that, even if it means bringing us to the brink of nuclear catastrophe.”

A honest analysis…#TulsiGabbard#TulsiOnTucker pic.twitter.com/KVeLGzbX89

— SAM Volhov (@SAM_Volhov) August 13, 2022

“Talks with Russia today will mean only one thing: Russia has won… Are you ready for that?”

• Zelensky Aide Explains Why Ukraine Won’t Negotiate With Russia (RT)

Ukraine has ruled out peace talks with Moscow under the existing circumstances, comparing any negotiations to “civilizational catastrophe.”Re-starting talks would not contribute anything to Kiev’s goals, Mikhail Podoliak, an aide to President Vladimir Zelensky, told Ukraine’s Babel news media outlet on Friday. “Today, Ukraine has no motives to hold the talks,” Podoliak said, adding that the “opportunity to win this war is much more important than any situational pause.” Starting dialogue under the present circumstances would only “formalize” the defeat of Ukraine and that of Europe, as well as “European values,” he added. Talks with Russia today will mean only one thing: Russia has won… Are you ready for that?

The presidential aide warned that Ukraine’s defeat would also mark the “collapse of the global security system and the system of democratic values.” Reaching a ceasefire now would not stop further conflicts, he said, adding that Russia might launch another attack on Ukraine at some point in the future. Podoliak also compared the idea of starting peace talks with Moscow to conducting talks with Nazi Germany in 1942, when the Nazis occupied large swathes of Soviet territory, including all of Ukraine. “One cannot even imagine it. Any talks at that moment and with that [balance of power] would mean a civilizational catastrophe,” he said.

In early August, the Kremlin signaled its readiness to strike a peace deal with Kiev, while warning that it would achieve the goals of its military operation in Ukraine regardless of Kiev’s willingness to concede. Kremlin spokesman Dmitry Peskov said at the time that the two nations were close to settling their differences in a way that was acceptable to Russia, but the draft agreement prepared during a meeting in Istanbul was torpedoed by Ukraine. Kiev broke off the talks with Moscow after accusing Russia of committing war crimes, an allegation that Russia said was based on fabricated evidence. Former German Chancellor Gerhard Schroeder, who visited Moscow in early August, also said that a negotiated solution is possible and argued that the recent “initial success” of the grain export deal should be used to reach a ceasefire.

Down we go.

• Major Rating Agencies Declare Ukraine In Default (RT)

Global rating agencies S&P and Fitch have lowered Ukraine’s foreign currency ratings to ‘selective default’ and ‘restricted default’, respectively, as the country’s latest debt restructuring is seen as distressed. Earlier this week, state-owned companies Ukrenergo and Ukravtodor requested a two-year freeze on payments on almost $20 billion in international bonds. The country’s overseas creditors agreed to suspend interest payments and postpone the maturity date of the bonds by two years. This is expected to save Ukraine about $6 billion on payments, Ukrainian Prime Minister Denis Shmygal said, commenting on the move. S&P reduced Ukraine’s foreign currency rating to ‘SD/SD’ – meaning selective default – from ‘CC/C’.

“Given the announced terms and conditions of the restructuring, and in line with our criteria, we view the transaction as distressed and tantamount to default,” the agency said. Meanwhile, Fitch cut the country’s long-term foreign currency rating to ‘RD’ (restricted default) from ‘C’, deeming the deferral of debt payments to be a distressed debt exchange. S&P also said it expects the macroeconomic and fiscal stress caused by Russia’s military operation to weaken Kiev’s ability to service its local-currency debt. It therefore downgraded Ukraine’s domestic currency rating to ‘CCC+/C’, from ‘B-/B’. Fitch, meanwhile, kept the country’s domestic currency rating at ‘CCC-‘.

Ask Sleepy Joe.

• Ukraine Struggles To Find Money To Pay Troops – WSJ (RT)

With Western financial help slow to arrive, Ukraine is forced to print money to pay its troops in the fight against Russia, the Wall Street Journal has reported. Ukrainian Finance Minister Sergey Marchenko told the US outlet on Friday that it’s “a constant headache” for him to keep balancing the cost of the conflict and the lower tax revenues in an economy battered by almost half a year of fighting. With around 60% of the budget being spent on the fighting, the minister said he has had to cut all unnecessary expenditures. But it’s still not enough, as tax revenues only cover 40% of government spending, the WSJ reports. The Kiev authorities earlier said they needed $5 billion per month to run the country, and would not be able to cope without Western help.

However, the grants and loans pledged to Ukraine by its foreign backers have been arriving slower than expected, according to the journal. For example, the EU has so far provided only €1 billion out of €9 billion it promised to Kiev, with Germany resisting the idea of offering low-interest loans backed by guarantees from the bloc’s member states. According to Marchenko, a lot of his time at work is spent trying to persuade Western governments to act faster. “Without this money, the war will last longer and it will damage economies more,” he explained. Rostislav Shurma, an economic adviser to President Vladimir Zelensky, described the situation in harsher terms.

If Kiev acted as sluggishly at the West, “the Russians would be at the Polish border by now,”he told the WSJ. “They don’t feel the war. That’s the problem. The only thing they feel in the EU is high prices,”Shurma said. Due to the lack of funds, the Ukrainian Central Bank has no choice but to print more money to allow the government to pay the troops and purchase arms and ammunition in order to keep fighting.

No, way more than a handful.

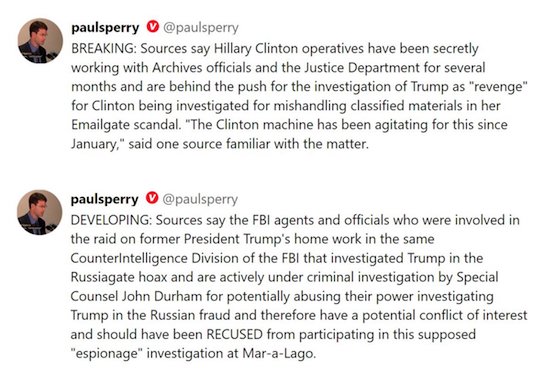

• Former FBI Assistant Director: ‘Handful in Leadership’ Politicizing Bureau (ET)

Years of investigations have led to claims by Republicans of partisan political power plays at the Federal Bureau of Investigation and Department of Justice. A raid on former President Donald Trump’s home on Aug. 8 has sharpened the nation’s focus on what many Republicans have been raising alarms about for years—the politicization of the Justice Department (DOJ) and its law enforcement arm, the Federal Bureau of Investigation (FBI). Republican U.S. Senator Charles Grassley of Iowa has been demanding answers about alleged politicization well before the raid. “Unfortunately, a growing number of Americans have lost confidence in the bureau based on its inconsistent handling of politically sensitive investigations, its lack of cooperation with legitimate congressional oversight inquiries, and its failure to hold its own people accountable for their misconduct,” Grassley told The Epoch Times.

Late in July, Grassley sent a searing letter to Attorney General Merrick Garland and FBI Director Christopher Wray that stated that if allegations the senator has received from FBI whistleblowers are true, “The Justice Department and the FBI are–and have been—institutionally corrupted to their very core”. But not all agree. In an exclusive interview with The Epoch Times, former Assistant Director for Intelligence of the FBI Kevin Brock said Grassley’s statement didn’t “fit the facts” and that “it is dangerous to plant seeds in the minds of the American people that the FBI is corrupt.” While Brock said that Grassley’s claims about the FBI went too far, he is also highly critical of the actions of what he refers to as a “handful in leadership” who he said are politicizing the bureau and doing damage to its image.

In response to the raid on former Trump’s residence at Mar-A-Lago, Brock told Epoch Times: “The use of armed agents to execute an invasive search warrant does not match up with the relatively low-level offense—for anyone—let alone a former and possible future president. Most Americans recognize this extraordinary search for what it is: an attempt by one political party that temporarily controls the DOJ to eliminate an adversary from the other party.” [..] About the same time the DOJ decided not to pursue charges against Clinton, the now infamous “Crossfire Hurricane” probe was being opened against then-candidate Trump. While the predicate for that investigation has been debunked, the claim that Russian President Vladimir Putin preferred Trump over Clinton is frequently referenced as fact by Democrats and some in the news media.

Former Assistant FBI Director Brock disagrees with that conclusion, citing eight years of Obama and four years of Secretary of State Clinton’s appeasement of Putin. “If Putin preferred Trump over Clinton he’s a bigger idiot than anyone thought,” Brock said, referring to a list of things the Obama Administration did to appease Putin and Russia. The list included Clinton’s “reset” with Russia, withdrawing missile defense systems from strategic allies Poland and Czech Republic, the return of ten Russian spies in 2010 before the FBI could interrogate the sleeper cell, and being conciliatory following Russia’s 2014 invasion of Crimea. Brock says “it is in the face of all that it is beyond the scope of imagination” that Putin would have preferred Trump.

“..former IRS official Lois Lerner, Bill Clinton’s national security adviser Sandy Berger, and even Hillary Clinton allegedly mishandled and destroyed classified information but avoided raids by the FBI.”

• FBI Sends ‘Clear Message’ to Trump, His Supporters (ET)

The FBI raid on former President Donald Trump’s home at Mar-a-Lago is an escalation of an ongoing attack on anyone who dares to upset the political status quo in Washington, Rep. Warren Davidson (R-Ohio) says. “I think a lot of my constituents were shocked, frankly, across the political spectrum. But obviously, the more supportive of President Trump, the more upset they were,” Davidson told The Epoch Times and NTD as part of a special report on the raid airing on Aug. 11 on EpochTV at 9 p.m. “I think for anyone who doubted that there was a swamp when Donald Trump was saying ‘drain the swamp,’ now I think there’s true believers. So it’s historic.”

In support of his statement, Davidson pointed out that the FBI still has many of the same people who spent years supporting a Russia collusion narrative that was based on a falsified warrant. More concerning, Davidson says, is that the FBI appears to have wholly ended its pretense of objectivity. Davidson pointed out to The Epoch Times that former IRS official Lois Lerner, Bill Clinton’s national security adviser Sandy Berger, and even Hillary Clinton allegedly mishandled and destroyed classified information but avoided raids by the FBI. He then pointed out that the FBI has taken no action on Hunter Biden, despite a mountain of evidence of suspect business dealings.

“No accountability for Hunter Biden, no action on that; no action on any number of things that they could have taken action on, like for example, targeting of Supreme Court justices,” Davidson said. He added it is really hard to believe that the bureau believes that it’s objective. Davidson says the message the FBI is sending is clear. “Hey, if you support the cause, we got your back. But if you’re working against us, as [current Senate Majority Leader] Chuck Schumer promised Donald Trump, they have six ways to Sunday to wreck you. “And they seem to have been very focused on doing that to Donald Trump.”

“..it is Russia and the Russians that the “international community” hates with a passion. Why else would they ban Russian athletes, journalists and even ordinary citizens?”

• Will The West’s Greed And Hatred Lead To The End Of The World? (Mirzaei)

It can certainly be said that the risk for nuclear war is far greater today than it was less a year ago. Ever since the conflict in Ukraine began, the collective West and its vassals, also known as the “international community” have been engaged in a hybrid war against Russia, stopping just short of direct confrontation. Although some EU leaders like Borrell seem to think that the West is an active combatant in the conflict. “We must explain to our citizens that this is not someone else’s war,” Borrell said in an interview published by newspaper El Pais on Thursday. “The public must be willing to pay the price of supporting Ukraine and for preserving the unity of the EU.” “We are at war. These things are not free,” he added.

The same Borrell offered his thoughts on Western hypocrisy and double standards in international affairs, with regards to the Zionist slaughter of Palestinians in Gaza this past week. “We are often criticized for double standards. But international politics is to a large degree about applying double standards. We do not use the same criteria for all problems,” he told El Pais newspaper, as cited on Thursday. A rare piece of honesty for a man who makes his living by lying and deceiving others. Yet he failed to mention why those double standards exist. International politics is only about applying double standards when you’re an imperialist and colonizer. Of course he wouldn’t mention that they don’t “use the same criteria for all problems” when it is his masters in Tel Aviv that are the ones waging war on defenceless people.

So this proves that the West throwing tantrums to the left and right over Ukraine really has nothing to do with concern for civilian lives lost. Because when the Zionists massacre children with impunity, the “international community” is pretty silent. Illegal sanctions, rabid Russophobia, and supplying Kiev with heavy weaponry despite the known dangers of doing so, all show the West’s deeply rooted hatred of Russia. If anyone was still delusional to think that this hatred had anything to do with President Putin only, then these past months should’ve proven that it is Russia and the Russians that the “international community” hates with a passion. Why else would they ban Russian athletes, journalists and even ordinary citizens? Of course, the case would’ve been much different had Russia given up on its sovereignty and offered its territory to Washington. Only a non-sovereign and non-independent Russia can be considered “democratic” in the eyes of this “international community.”

“..under the Constitution’s separation of powers, Congress, has no legitimacy even to hold a criminal investigation: that power belongs to the Judiciary..”

• US: The New Real Hoaxes? (Hoekstra)

The investigative reporting by these two organizations [the New York Times and the Washington Post] was so thorough and groundbreaking it turned up things that were not even there. For having refused to rescind these awards, the Pulitzer Committee should receive its own Pulitzer — for fraud. The real hoax appears to have been the CCP’s ostensible good behavior and the now-hugely-discredited initial reporting on the virus. Or how about the Hunter Biden laptop cover-up? Once again, On October 14, 2020, just weeks before the 2020 presidential election, a critical story of possible extensive influence-peddling with senior intelligence officers in the CCP, Russia and Ukraine by the son of a presidential candidate. The contents of the laptop raised questions that the candidate at the time, Vice President Joe Biden, could be compromised.

The entire subject was decisively pushed aside, along with the potential threat to national security that such an eventuality might entail. Also not allowed during the January 6th hearings have been any witnesses for the defense, any cross-examination, or any exculpatory evidence. One wonders, for instance if the January 6th Committee will consider the July 29, 2022 tweet by General Keith Kellogg, that on January 3, 2021, Trump, in front of witnesses, did indeed ask for “troops needed” for January 6. Kellogg wrote: “I was in the room.” The January 6th Committee has also not released any information about government informants or FBI undercover law enforcement officers who might have been in the crowd, and Pelosi is also said to be blocking access to a massive quantity of documents.

Finally, according to attorney Mark Levin, under the Constitution’s separation of powers, Congress, has no legitimacy even to hold a criminal investigation: that power belongs to the Judiciary. The entire proceeding is illegitimate and a usurpation of power. Is it surprising that after the Pulitzer decision, the Russia collusion hoax, the Whitmer kidnapping hoax, the Covid origin hoax, the Hunter Biden laptop hoax, and now the January 6th Committee hoax, that many Americans believe there is something wrong with the system? Recently former US President Donald Trump challenged the award of Pulitzer Prizes to the New York Times and the Washington Post for their investigative reporting on alleged collusion between the 2016 Trump campaign and Russia.

Kissinger, Orban and Bolsonaro are the voices of reason these days.

• Kissinger Explains How The World Was Brought To ‘The Edge Of War’ (RT)

Former US Secretary of State Henry Kissinger told the Wall Street Journal that Washington has rejected traditional diplomacy, and in the absence of a great leader, has driven the world to the precipice of war over Ukraine and Taiwan. Kissinger previously courted controversy for suggesting that Kiev abandon some of its territorial claims to end the conflict with Russia. “We are at the edge of war with Russia and China on issues which we partly created, without any concept of how this is going to end or what it’s supposed to lead to,” Kissinger said in the interview, published on Saturday. Kissinger, now 99 years old, elaborated on the West’s role in the Ukraine conflict in a recent book profiling prominent post-WWII leaders. He described Russia’s decision to send troops into the country in February as motivated by its own security, as having Ukraine join NATO would move the alliance’s weapons to within 300 miles (480km) of Moscow.

Conversely, having Ukraine in its entirety fall under Russian influence would do little to “calm historic European fears of Russian domination.” Diplomats in Kiev and Washington should have balanced these concerns, he wrote, describing the current conflict in Ukraine as “an outgrowth of a failed strategic dialogue.” Speaking to the Wall Street Journal a month after the book’s publication, Kissinger stood by his insistence that the West should have taken Russian President Vladimir Putin’s security demands seriously, and refused to signal that Ukraine would one day be accepted into the NATO alliance. In the runup to its military operation in Ukraine, Russia presented the US and NATO with written outlines of its security concerns, which were rejected by both receiving parties.

Kissinger, who in the late 1960s and early 1970s held extensive negotiations with Vietnamese communists even as the US military waged war against them, said that modern American leaders tend to view diplomacy as having “personal relationships with the adversary,” and in words paraphrased by the Wall Street Journal, “tend to view negotiations in missionary, rather than psychological terms, seeking to convert or condemn their interlocutors rather than to penetrate their thinking.” Instead, Kissinger argued that the US should seek “equilibrium” between itself, Russia, and China. This term refers to “a kind of balance of power, with an acceptance of the legitimacy of sometimes opposing values,” Kissinger explained. “Because if you believe that the final outcome of your effort has to be the imposition of your values, then I think equilibrium is not possible.”

WEF test case?!

• UN War On Fertilizer Began in Sri Lanka (Shellenberger)

The United Nations Environment Programme (UNEP) describes itself as “the global authority that sets the environmental agenda… and serves as an authoritative advocate for the global environment.” Through its “Economics of Ecosystems and Biodiversity for Agriculture and Food” program launched in 2014, the UNEP advocates that nations “steer away from the prevailing focus on per hectare productivity.” But today the world is in its worst food crisis since 2008. The number of people suffering acute food insecurity increased by 25% since January 2022 to 345 million, according to the United Nations World Food Programme. Why, then, is the UNEP trying to steer nations away from fertilizers that increase food production? The UNEP’s Acting Director in 2019 said the reason was humankind’s “long-term interference with the Earth’s nitrogen balance.”

In October of that year, the UNEP hosted a meeting in the capital of Sri Lanka, Colombo and issued a “road map” to push nations to cut nitrogen pollution in half. But the Netherlands proves that nations can slash nitrogen pollution from livestock by 70% while also increasing meat production. Same for crops. Since the early 1960s, the Netherlands has doubled its yields while using the same amount of fertilizer. While rich nations produce 70 percent higher yields than poor nations, they use just 54 percent more nitrogen. One month after the Colombo meeting in 2019, which generated significant media attention in Sri Lanka, voters in that nation elected an anti-fertilizer president, H.E. Gotabaya Rajapaksa, who claimed, without scientific evidence, that synthetic fertilizers were causing kidney diseases. In April 2021, he banned fertilizer imports.

In June, 2021, two months after the fertilizer ban, Sri Lanka hosted a UN-sponsored “Food System Dialogue” aimed at influencing the UN’s broader anti-fertilizer agenda for the world. “Sri Lanka’s inaugural Food System Dialogue is part of a series of national and provincial dialogues conducted by the Ministry of Agriculture ahead of the 2021 UN Food System Summit set to take place in New York later this year.” In his statement to the UN Food System Summit in New York in September, Sri Lankan President Rajapaksa repeated his claim that “chemical fertilizers… led to adverse health and environmental impacts.” He said, “My Government took the bold step to restrict imports of these harmful substances earlier this year,” and blamed farmers for resisting his fertilizer ban, saying that “changing the mindset of farmers long accustomed to using chemical fertiliser has proven challenging.”

In fact, the fertilizer ban was causing a crash in agricultural production. After the fertilizer ban, 85% of Sri Lankan farmers experienced crop losses. Rice production fell 20%, prices rose 50 percent, and the nation had to import $450 million worth of the grain. In Rajanganaya, where farmers operate on just a hectare (2.5 acres), of land on average, families reported producing half their normal crop harvest. There were other factors behind the government’s fall, but those factors affected many other nations and none fell. Covid lockdowns hurt tourism. The government borrowed too much. Oil prices rose. All were factors and none were decisive. What made the difference was Sri Lanka’s ban on fertilizers.

Return to real money, only after everything else has failed.

• Zimbabwe Hails Gold Coin Success And Wants To Issue More (BBC)

Gold coins used as currency in Zimbabwe will soon be available in smaller denominations, the central bank says. Sky-rocketing inflation saw people rushing to cash in their Zimbabwean dollars for US dollars, to stop their savings losing value. This led to a shortage of US currency and drove up exchange rates, so the central bank reacted by halting loans. But it soon changed tack, and last month issued gold coins worth US$1,800 instead, to ease demand for US dollars. Those higher-value gold coins are available to buy at approved banks and are tradeable locally. The average yearly salary in Zimbabwe for a civil servant is US$2,600, and according to the state-affiliated Herald newspaper 4,475 gold coins have been sold since their introduction last month.

This makes it a success in the eyes of the central bank. The lower value US$180 gold coins are to be released in November, the Herald reports. Zimbabwe’s current economic woes are not as grave as in the early 2000s when hyper-inflation reached record levels and local currency was abandoned altogether. Nor has the country quite reached the levels of 2008, when many ordinary people’s pensions and savings were wiped out after the Zimbabwean dollar crashed. However President Emmerson Mnangagwa, who succeeded Robert Mugabe after his ousting by the military in 2017, has failed to revive the national economy despite promising to raise it to what the World Bank calls a “middle income country” by 2030.

Zimbabwe still uses two main currencies, the US and the Zimbabwe dollar, with most people preferring to exchange their local dollars for foreign currency to maintain value. Inflation topped 256% in July – and the local currency tumbled in worth from Z$108.66 to US$1 at the start of the year, to Z$481.85 to US$1 in August. Reaction to the coins has been mixed. Some say they are good for companies wanting to maintain value of their money, but others say the majority of Zimbabwean workers will still not be able to afford them.

Wolves

When we let nature be nature amazing things can happen.

Protect nature in all its forms. #ActOnClimate #ClimateAction #climate #energy #nature #rewilding pic.twitter.com/cN4RTwQCnc

— Mike Hudema (@MikeHudema) August 13, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.