Esther Bubley Passengers on Memphis-Chattanooga Greyhound bus 1943

“.. the market acted like it hit an air pocket.”

• Shanghai Stocks Slide 3.6% As China Markets Tumble (MW)

Chinese stocks plunged in trading, with more than 1,000 stocks in Shanghai retreating into negative territory. The Shanghai Composite Index was last down 3.6%, meaning it was headed for its biggest daily percentage drop since Feb 25., when the benchmark fell 6.4%. China’s smaller Shenzhen Composite Index plunged 4.9%, while the Nasdaq-style ChiNext benchmark dropped 5.6%. Chinese shares had mostly been trending higher since January, so Wednesday’s plunge was a jolt for traders. Overall, the Shanghai benchmark is down about 17% for the year. “What’s most scary is that everyone is guessing about what’s the negative news,” says Deng Wenyuan, analyst at Soochow Securities, “And this magnifies irrational panic mood.”

Bill Bowler, equities trader at Forsyth Barr Asia Ltd. said that once the Shanghai benchmark dipped below the 3,000 level, “the market acted like it hit an air pocket.” The benchmark was last at 2,928.25. Elsewhere in the region, stock markets were mixed. Japan’s Nikkei was up 0.1%, Hong Kong’s Hang Seng was down 1.4%, and Australia’s S&P/ASX was last up 0.4% In China, traders and analysts cited a number of possible reasons for selling, from short-term liquidity pressures to worries about less-than-stellar figures as first-quarter earnings results roll in. A lack of confidence in the recent recovery of the market hasn’t helped, they said. A total of 72 companies have been approved to go public so far this year, stoking expectation for fresh shares on the market. Analysts also expect more Chinese firms currently listed in the U.S. to return to the mainland. Both developments would put further pressure on existing shares.

I’d say it already has.

• China’s Rapid Development Under Communist Party May Be Coming To An End (BBG)

China’s decades of rapid development under tight Communist Party control may be coming to an end, according to Roy Smith, the New York University academic who as a banker in 1990 anticipated Japan’s decline. “China has now arrived at an existential moment after nearly 40 years of extraordinary economic progress,” said Smith, who also warned about budding Japan-like financial strains ahead of the Chinese stock rout in 2015. The country’s “increasingly complex and troubled economic and social system with all its scarcities” will make it tougher for Communist cadres to manage, he said. While President Xi Jinping committed in 2013 to giving markets a “decisive” role in steering the economy, much of the financial system remains dominated by state-owned lenders directing credit toward the leadership’s preferred borrowers.

Restrictive social policies limiting services available to some urban residents who migrated from rural areas have seen little change as yet under Xi. Changes to rural property ownership rules have also been limited. And foreign companies are vocal in criticizing the lack of western-style rule of law in a country where the judicial system is under the Communist Party. Authorities need to “move much further to adopt reforms that allow the country meaningfully to be shaped by market forces in the future,” said Smith, who specializes in international banking and finance at NYU’s Stern School of Business. Xi “has fortified his personal power base to be able to do so, but in the end, his may be a test of whether a ‘red state’ superpower, with all its vulnerabilities, can be made to succeed and endure.”

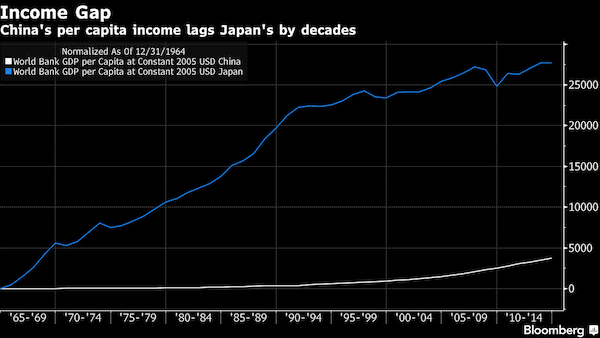

Rising debt adds to the imperative for reform, as do demands from citizens for higher-quality and more expensive health care, improved education and pensions provision. Smith continues to see parallels with Japan’s build-up of bad loans that ended up hobbling the economy. To be sure, there are plenty of differences too. China is at a much lower stage of development compared with Japan in 1990 and, on a per-capita basis, China’s GDP in 2013 was still just half of where Japan was in 1960, according to World Bank data.

Yet overall debt has grown to almost 2.5 times the economy’s size and is showing few signs of slowing down. A fresh surge in borrowing was needed for policy makers to generate a first-quarter annual growth rate of 6.7%, keeping the pace within the government’s 2016 target of 6.5% to 7%. In Japan’s case, the economy stagnated as banks became impaired by losses in the wake of a property-bubble collapse and manufacturers shifted production overseas. It’s a tale of caution for China, according to the former Goldman Sachs Group Inc. banker. “China has followed Japan’s economic development model, and may now too be facing a financial crisis like Japan’s that it may not be able to control, and that could diminish its ability to become the next Asian superpower,” said Smith.

Add that to the 1.8 million (?!) steel workers and before you know it you have a bit of a problem.

• 1.3 Million Redundant Chinese Coal Workers To Be Relocated (PD)

China aims to cut coal output by as much as 500 million tons in the next three to five years, the State Council said at the start of 2016. Meanwhile, China also plans to consolidate its remaining coal industry, meaning that fewer miners will be employed. Due to the cuts, 1.3 million employees have to be relocated. The central government has earmarked 100 billion yuan to support those relocation efforts. In spite of the government’s financial support, many coal miners have to give much thoughts about a relocation plan. An anonymous employee said that it forces young people to start over again, even if it isn’t so difficult to find a new job in another industry. As for employees who have already spent many years in the coal industry, they are less competitive in the job market as they have developed no other specialized skills.

In response to the current situation, China’s Ministry of Human Resources and Social Security released new guidelines for the relocation of redundant employees in China’s coal and steel industries. Local authorities and organizations are encouraged to provide the laid-off workers with free training and career guidance, and they should give workers training subsidies, the guidelines stated. Authorities have also been asked to enhance trans-regional cooperation in order to help workers relocate to regions with better employment opportunities. In addition, public welfare job opportunities will be offered to older people for whom it is more difficult to find new jobs, as well as to families suddenly lacking a primary breadwinner.

This is turning into a full-blown trade war that nobody dares call by its name.

• As Global Steel Crisis Grips, China Says March Output Was A Record (Reuters)

Under pressure to curb steel output and relieve a global glut, China said on Tuesday its production actually hit a record high last month as rising prices, and profits, encouraged mills that had been shut or suspended to resume production. The China Iron & Steel Association (CISA) said March steel production hit 70.65 million tonnes, amounting to 834 million tonnes on an annualized basis. Traders and analysts predicted more increases in April and May. The data comes as major steel producing countries failed to agree measures to tackle an industry crisis, with differing views over the causes of overcapacity. A meeting of ministers and trade officials from over 30 countries, hosted by Belgium and the OECD on Monday, concluded only that overcapacity had to be dealt with in a swift and structural way.

Washington pointed the finger at China, saying Beijing needed to cut overcapacity or face possible trade action from other countries. “Unless China starts to take timely and concrete actions to reduce its excess production and capacity … the fundamental structural problems in the industry will remain and affected governments – including the United States – will have no alternatives other than trade action to avoid harm to their domestic industries and workers,” U.S. Secretary of Commerce Penny Pritzker and U.S. Trade Representative Michael Froman said in a statement. Asked what steps the Chinese government would take following the unsuccessful talks, Commerce Ministry spokesman Shen Danyang told reporters on Tuesday: “China has already done more than enough. What more do you want us to do?”

“Steel is the food of industry, the food of economic development. At present, the major problem is that countries that need food have a poor appetite so it looks like there’s too much food.” In a monthly report, the CISA said a recent rally in steel prices in China – up 42% so far this year – was unsustainable given the rising production, and it warned that increased protectionism in Southeast Asia and Europe would make steel exports more difficult. “The big rise in steel prices has led to a rapid reopening of capacity that had been shut or suspended … a large rise in output will not be good for the gap between market demand and supply,” the CISA said.

When TBTF starts to fail.

• Goldman Posts Weakest Results In 4 Years, Revenue Tumbles 40% (Reuters)

Goldman Sachs reported the worst quarterly results in more than four years on Tuesday as volatile markets kept clients from trading, investing or issuing new securities. Goldman’s report wrapped up a dismal quarter for big U.S. banks. The previous day, its most comparable rival, Morgan Stanley, also said its profit fell by more than one-half due to tough markets. Goldman’s first-quarter revenues tumbled 40%, hit by sliding commodity prices, worries about the Chinese economy and uncertainty about U.S. interest rates. Profit fell even more sharply, emphasizing Goldman’s reliance on the capital markets business, particularly bond trading which can be volatile. Analysts peppered CFO Harvey Schwartz with questions about Goldman’s commitment to bond trading as well as its unusually low returns during the quarter, and his outlook for the rest of the year.

“I certainly would not sit here and tell you we were happy about this quarter,” he said. “But we will do what it takes over time to make sure that we deliver for our clients and maximize the returns for shareholders.” Goldman executives have repeatedly said they believe difficulties in trading are short term and that the business will come back. But as Wall Street approaches its sixth year of weak volumes and unexpected price swings that are hurting results, some investors are wondering how long the pain will last. Overall, Goldman’s profit fell by more than one-half from a year ago and quarterly revenue was the weakest in over four years. Highlighting the challenges, return on average common equity (ROE) – a measure of how well it uses shareholder money to generate profit – was 6.4% in the quarter, down from 14.7% a year earlier.

Hubris rules before the fall.

• Saudi $10 Billion Financial District Is Missing One Thing: Banks (BBG)

Saudi Arabia’s $10 billion financial hub in Riyadh will have gleaming towers connected by sky bridges, cutting-edge climate technology and a monorail that can circle the whole area in 11 minutes. What it doesn’t have yet are banks. Not a single financial institution has agreed to take space in the 73 buildings the state is constructing at the King Abdullah Financial District, according to Waleed Aleisa, chief executive officer and project manager of the district at developer Al Ra’idah. The one lender on the 1.6 million square-meter (17.2 million square-foot) site north of the city center is Samba Financial Group, which bought a plot of land and is building its own tower. “Saudi banks want to own their own buildings and want to pay as little as possible,” Aliesa said in an interview.

“They don’t appreciate the brand as much as we see in the West, where banks will pay a premium to be in financial hubs.” As Saudi Arabia prepares for a post-oil future by boosting other industries, its plan to strengthen Riyadh’s position as a financial center is plagued with delays, cost overruns and a failure to understand the needs of local banks, according to Aliesa. Attracting financial clients now will be challenging given that the work, about 70% finished, has largely ground to a halt and the developer is considering replacing the main contractor. “There will be demand without a doubt, but it is still uncertain as to when the construction will be concluded,” Ramzi Darwish, a consultant with Cluttons LLC, said in an interview. “Once completed, there may be some challenges in filling all of the space because of the huge amount of offices being built.”

The government is looking at ways to lure banks with incentives that could include tax breaks lasting a decade or more as well as separate regulation that makes it easier to hire and issue work visas, Aliesa said. Al Ra’idah, which is developing the district for the Saudi Public Pension Agency, will look for another developer to take over from Saudi Bin Laden Group – which has about half of the project’s contracts by value – if the builder can’t restart construction within about two months, he said Tuesday. “What has been impacting the project progress is the project owner’s non-fulfillment of agreed contractual terms, especially those related to timely payments of our entitlements,” Saudi Bin Laden Group said by e-mail. “Our contractual position is robust and supported with the necessary evidence and documents.”

If there’s money to be made, the ships will be there.

• Iran Struggles To Find Enough Ships For Oil Exports (Reuters)

Iran faces a struggle to increase oil exports because many of its tankers are tied up storing crude, some are not seaworthy, and foreign shipowners remain reluctant to carry its cargoes. Tehran is seeking to make up for lost trade to Europe following the lifting of EU sanctions imposed in 2011 and 2012, which deprived it of a market that accounted for over a third of its exports and left it relying completely on Asian buyers. Iran has 55-60 oil tankers in its fleet, a senior Iranian government official told Reuters. He declined to say how many were being used to store unsold cargoes, but industry sources said 25-27 tankers were parked in sea lanes close to terminals including Assaluyeh and Kharg Island for this purpose.

Asked how many tankers were not seaworthy and needed to go to dry docks for refits to meet international shipping standards, the senior official said: “Around 20 large tankers … need to be modernised.” A further 11 Iranian tankers from the fleet were carrying oil to Asian buyers on Tuesday, according to Reuters shipping data and a source who tracks tanker movements. That was broadly in line with the number consistently committed to Asian runs since sanctions were lifted in January, putting more strain on the remaining available fleet. This means foreign ships are needed for Iran’s plans for a big export push to Europe and elsewhere, to meet its target of reaching pre-sanctions sales levels this year. But many owners, who are not short of business in a booming tanker market, are unwilling to take Iranian cargoes.

The main reason is that some U.S. restrictions on Tehran remain in place and prohibit any trade in dollars or the involvement of U.S. firms including banks – a major hurdle for the oil and tanker trades, which are priced in dollars. Eight foreign tankers, carrying a total of around 8 million barrels of oil, have shipped Iranian crude to European destinations since sanctions were lifted in January, according to data from the tanker-tracking source and ship brokers. That equates to only around 10 days’ worth of sales at the levels of pre-2012, when European buyers were purchasing as much as 800,000 bpd from the OPEC producer. So far no Iranian tankers have made deliveries to Europe, according to data from the tanker-tracking source.

Nice try, and Germany does a lot wrong, but German Christian parties did not cause deflation, which is not a European issue either, but a global one. Moreover, one can argue that German-induced austerity causes deflation, but just as well that it’s QE that causes deflation, which Germany is against.

• Deflation Is A Master From Germany – And The ECB Is Its Victim (Flassbeck)

These days, we are witnessing a tragedy of historic proportions in Europe. A country called Germany stubbornly and almost unanimously refuses to come to terms with the economic consequences of its own mistakes. It blames all the others but never accepts its own responsibility for what is happening. In particular, the Christian parties, who persuaded the German people for decades that independence of the central bank is one of the main achievements and pillars of democracy, show with their rabid attacks on the ECB and its current interest rate policy that they know no principles and that laws do not count for them when it comes to their primitive party interests. The intellectual level of these attacks is very low. The lack of intelligence and insight is being outweighed by far by their political brutality, which has recently been increasing on an almost daily basis.

The personal attacks are more and more directed towards ECB president, Mario Draghi. Where does European deflation, which makes up the core of the whole problem comes from? It is mainly because of increasing deflation that the ECB decided to lower the interest rate to zero. Did deflation fall out of the sky? Did the ECB cause it? Are other European countries responsible for it? Such simple questions should be asked in the critical media in Germany every day. Anyone who is intellectually even halfway honest can answer them immediately. Instead, the majority of the German media continue spreading platitudes, giving the impression that there is still some reason behind the madness (Der Spiegel’s long history in this is a sad case in point).

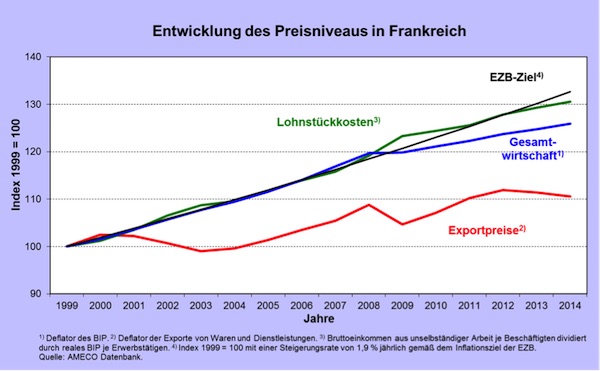

Evolution of price levels in France (green line: labour units costs; black line: the ECB inflation target; red line: prices of goods for exports; blue line: economy in total) (2).

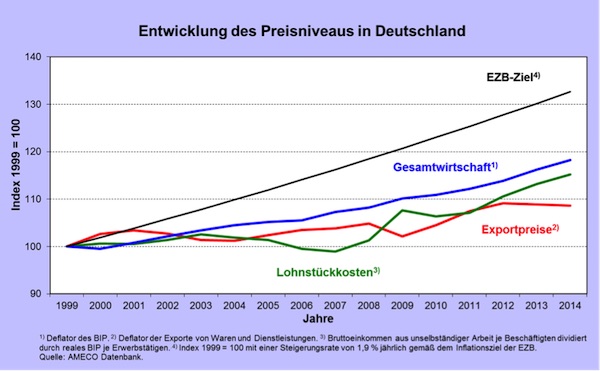

Figures 1 and 2 show the evolution in Germany and in France. They tell you who is responsible for the deflation and the low interest rates. There is no doubt about it that it is Germany. European deflation has its origins in Germany and nowhere else.

Evolution of price levels in Germany (green line: labour units costs; black line: the ECB inflation target; red line: prices of goods for exports; blue line: economy in total) (2).

Deflation is here to stay no matter what.

• German Producer Prices Post Sharp Annual Drop (WSJ)

The prices of goods leaving Germany’s factory gates in March registered their sharpest annual drop in over six years, pulled lower by energy prices, the Federal Statistical Office said Wednesday. Producer prices in March were unchanged from February, but fell 3.1% from March last year, the sharpest annual fall since January 2010. By comparison, economists polled by the WSJ forecast a monthly rise of 0.1%, but an annual decline of 2.9%. The data indicate there is only limited upward pressure on German consumer prices from the production side. Energy prices once again had the largest effect on producer prices, Destatis said. Excluding energy prices, which can be volatile, producer prices in Europe’s largest economy slipped 0.1% from February and declined 0.9% from March last year.

How is this not his cue to step down?!

• EU Has Lost Favour With Citizens, EC President Juncker Warns

Europe’s citizens are increasingly abandoning the European project because the EU has interfered too much with their lives, the commission president has warned. Jean-Claude Juncker told a meeting of the Council of Europe – not an EU body – in Strasbourg that people were “stepping away” from the EU, which he said had “lost a part of its attractiveness”. Juncker said one of the reasons EU citizens were losing faith in the union was because “we are interfering in too many areas of their private lives, and in too many areas where member states are better placed to act”. European commissions had been “wrong to over-regulate and interfere too much in the lives of our citizens”, he said, stressing that the EU’s current executive was trying to cut new legislation to a minimum.

The comments were Juncker’s sharpest since his inaugural state of the union speech in September last year, when he warned the EU was “not in a good place” and that it needed to move far beyond business as usual to address the daunting political challenges facing the bloc. He told the Council of Europe on Tuesday that EU officials were not very popular at home when they pleaded the European cause, and “no longer respected” when they said the EU had to be given priority. Juncker warned that a slowing birthrate and shrinking economic potential meant Europe faced losing respect on the world stage. Europe made up 20% of the world population a century ago, but by the end of this century will account for barely 4%, he said. “We are losing economic clout in a very visible way,” the commission president said, adding that the combination of long-term decline and more immediate crises such as the refugee crisis and Islamist terror attacks left the EU facing “very tough times”.

Vintage Paul Craig Roberts.

• How American Neocons Destroyed Mankind’s Hopes For Peace (PCR)

When Ronald Reagan turned his back on the neoconservatives, fired them, and had some of them prosecuted, his administration was free of their evil influence, and President Reagan negotiated the end of the Cold War with Soviet President Gorbachev. The military/security complex, the CIA, and the neocons were very much against ending the Cold War as their budgets, power, and ideology were threatened by the prospect of peace between the two nuclear superpowers. I know about this, because I was part of it. I helped Reagan create the economic base for bringing the threat of a new arms race to a failing Soviet economy in order to pressure the Soviets into agreement to end the Cold War, and I was appointed to a secret presidential committee with subpeona power over the CIA. The secret committee was authorized by President Reagan to evaluate the CIA’s claim that the Soviets would prevail in an arms race.

The secret committee concluded that this was the CIA’s way of perpetuting the Cold War and the CIA’s importance. The George H. W. Bush administration and its Secretary of State James Baker kept Reagan’s promises to Gorbachev and achieved the reunification of Germany with promises that NATO would not move one inch to the East. The corrupt Clintons, for whom the accumulation of riches seems to be their main purpose in life, violated the assurances given by the United States that had ended the Cold War. The two puppet presidents – George W. Bush and Obama – who followed the Clintons lost control of the US government to the neocons, who promptly restarted the Cold War, believing in their hubris and arrogance that History has chosen the US to exercise hegemony over the world.

Thus was mankind’s chance for peace lost along with America’s leadership of the world. Under neocon influence, the United States government threw away its soft power and its ability to lead the world into a harmonious existance over which American influence would have prevailed. Instead the neocons threatened the world with coercion and violence, attacking eight countries and fomenting “color revolutions” in former Soviet republics. The consequence of this crazed insanity was to create an economic and military strategic alliance between Russia and China. Without the neocons’ arrogant policy, this alliance would not exist. It was a decade ago that I began writing about the strategic alliance between Russia and China that is a response to the neocon claim of US world hegemony.

The strategic alliance between Russia and China is militarily and economically too strong for Washington. China controls the production of the products of many of America’s leading corporations, such as Apple. China has the largest foreign exchange reserves in the world. China can, if the government wishes, cause a massive increase in the American money supply by dumping its trillions of dollars of US financial assets. To prevent a collapse of US Treasury prices, the Federal Reserve would have to create trillions of new dollars in order to purchase the dumped financial instruments. The rest of the world would see another expansion of dollars without an expansion of real US output and become skeptical of the US dollar. If the world abandoned the US dollar, the US government could no longer pay its bills.

Very interesting angle: “..as Earth warms, our historical understanding will turn obsolete faster than we can replace it with new knowledge..”

Imagine a future in which humanity’s accumulated wisdom about Earth – our vast experience with weather trends, fish spawning and migration patterns, plant pollination and much more – turns increasingly obsolete. As each decade passes, knowledge of Earth’s past becomes progressively less effective as a guide to the future. Civilization enters a dark age in its practical understanding of our planet. To comprehend how this could occur, picture yourself in our grandchildren’s time, a century hence. Significant global warming has occurred, as scientists predicted. Nature’s longstanding, repeatable patterns – relied on for millenniums by humanity to plan everything from infrastructure to agriculture – are no longer so reliable. Cycles that have been largely unwavering during modern human history are disrupted by substantial changes in temperature and precipitation.

As Earth’s warming stabilizes, new patterns begin to appear. At first, they are confusing and hard to identify. Scientists note similarities to Earth’s emergence from the last ice age. These new patterns need many years — sometimes decades or more — to reveal themselves fully, even when monitored with our sophisticated observing systems. Until then, farmers will struggle to reliably predict new seasonal patterns and regularly plant the wrong crops. Early signs of major drought will go unrecognized, so costly irrigation will be built in the wrong places. Disruptive societal impacts will be widespread. Such a dark age is a growing possibility. In a recent report, the National Academies of Sciences, Engineering and Medicine concluded that human-caused global warming was already altering patterns of some extreme weather events.

But the report did not address the broader implication — that disrupting nature’s patterns could extend well beyond extreme weather, with far more pervasive impacts. Our foundation of Earth knowledge, largely derived from historically observed patterns, has been central to society’s progress. Early cultures kept track of nature’s ebb and flow, passing improved knowledge about hunting and agriculture to each new generation. Science has accelerated this learning process through advanced observation methods and pattern discovery techniques. These allow us to anticipate the future with a consistency unimaginable to our ancestors. But as Earth warms, our historical understanding will turn obsolete faster than we can replace it with new knowledge. Some patterns will change significantly; others will be largely unaffected, though it will be difficult to say what will change, by how much, and when.

“..the big question is how many of these events can it handle? And I think the answer is not many more.”

• Coral Bleaching Hits 93% Of Great Barrier Reef (AFP)

Australia’s Great Barrier Reef is suffering its worst coral bleaching in recorded history with 93% of the World Heritage site affected, scientists said Wednesday as they revealed the phenomenon is also hitting the other side of the country. After extensive aerial and underwater surveys, researchers at James Cook University said only seven% of the site had escaped the whitening triggered by warmer water temperatures. “We’ve never seen anything like this scale of bleaching before,” said Terry Hughes, convenor of the National Coral Bleaching Taskforce. The damage ranges from minor in the southern areas – which are expected to soon recover – to very severe in the northern and most pristine reaches of the site which stretches along 2,300 kilometres of the east coast.

Hughes said of the 911 individual reefs surveyed, only 68 (or 7%) had escaped the massive bleaching event which has also spread south to Sydney and across the country to Western Australia. Researcher Verena Schoepf, from the University of Western Australia, said coral was already dying at a site she had recently visited off the western state’s north coast. “Some of the sites that I work at had really very severe bleaching, up to 80 to 90% of the coral bleached,” she told AFP. “So it’s pretty bad out there.” While Western Australia’s Ningaloo Marine Park appeared to have escaped damage, areas north of Broome were suffering, she said, just one day after scientists revealed coral bleaching had been detected in Sydney Harbour for the first time.

Andrew Baird, from James Cook University’s centre for coral reef studies, said the bleaching was a sign of a global problem. “It’s much bigger than just Australia,” he said, adding that there were reports of bleaching throughout Indonesia and indications it was beginning in the Maldives. But he said he had been surprised by the scale and severity of the event on the Great Barrier Reef, a major tourist drawcard which is teeming with marine life. “We’ve been expecting a really big event for a while I suppose and here it is,” he told AFP. Baird said because the bleaching was far less serious in the southern reaches “lots of the reef will still be in good shape”. “But the reef that’s been badly affected – which is a third to a half of it – is going to take a while to recover”. “And again the big question is how many of these events can it handle? And I think the answer is not many more.”

As Europe looks away…

• Turkish Border Guards Kill 8 Syrians Including Women And Children (DM)

Eight Syrians including women and young children have been shot dead by Turkish border guards while trying to flee their war-torn homeland, it has emerged. The group of refugees were trying to cross into Turkey via a mountain smuggling group when they were gunned down by Turkish forces patrolling the border. As well as those killed, many others are said to have been injured in the firefight including one man who was shot in both of his legs while carrying his young son and another who was shot in the arm. Abdmunem Kashkash, a lawyer from Aleppo who was with the group but managed to cross into Turkey unharmed, said Turkish border guards are ‘killing unarmed people’ every day.

‘There was one little girl who was shot and we could not do more for her for four hours, until nightfall,’ he said. ‘An old man and woman are missing – they have probably been killed too.’ Those who have been injured while desperately trying to flee Syria have been taken to a hospital in Azaz – a rebel-held town next to the Turkish border where 10,000 displaced people are sheltering. The deaths appear to confirm claims made by the Human Rights Watch last week that Turkish guards of opening fire on civilians as they approached the country’s border wall with Syria.

Gerry Simpson, senior refugee researcher at Human Rights Watch, said: ‘As civilians flee ISIS fighters, Turkey is responding with live ammunition instead of compassion. ‘The whole world is talking about fighting ISIS, and yet those most at risk of becoming victims of its horrific abuses are trapped on the wrong side of a concrete wall.’ The Turkish Government has insisted that it is maintaining the same open-door policy at the frontier that it has since 2011, with free access for all Syrians whose lives are in imminent danger. However, a senior official told The Times that ‘certain restrictions may apply due to special circumstances’.