Marion Post Wolcott Works Progress Administration worker’s children, South Charleston, West Virginia 1938

Fear mongering goes into overdrive.

• France Scrapping The Euro Could Go Beyond A ‘Lehman Moment’ (CNBC)

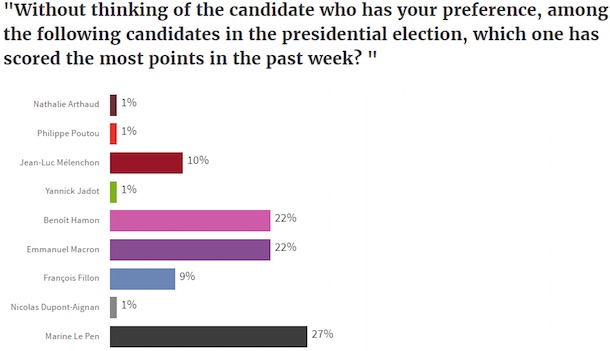

Past performance is no guide to future returns, as investors are so often told, but the French electorate runs the risk of creating a crisis worse than the fall of Lehman Brothers if it follows the U.K. in instigating a referendum on EU membership, according to analysts at Deutsche Bank. As the French presidential race heats up ahead of the first round of voting in April, the German bank has warned of the pitfalls of using the U.K.’s Brexit vote as a model for a potential “Frexit”, as touted by nationalist candidate Marine Le Pen. Le Pen, who is currently leading the race according to the latest BVA-Salesforce opinion poll, has vowed to hold a French referendum on EU membership if she is successful in winning France’s two-round leadership race.

Pointing to the U.K., which has – so far – felt a relatively benign impact from its Brexit vote, Le Pen has relied on it as a basis for rallying support during her campaigning, saying: “They told us that Brexit would be a catastrophe, that the stock markets would crash … The reality is that none of that happened.” However, Deutsche Bank has warned of the inconsistencies of likening the two votes. An EU referendum in France, one of the founding members of the economic bloc, runs the risk of undermining the euro, the currency shared by 19 of the EU’s 28 member states. “Make no mistake, there is the world of difference between tearing up bilateral and multilateral trade agreements, and, unwinding a monetary union as far reaching in scope as the EMU (economic and monetary union) project,” Deutsche Bank said in a note Tuesday.

“It is the difference between a benign global risk event and something that has the potential to go beyond a ‘Lehman’s moment’.” The frictionless interaction enjoyed by countries within the European Monetary Union would turn into it a “nightmare”, says Deutsche Bank, as a lack of a currency hedge would make all EMU members vulnerable to currency weakness. The bank estimates that assets shared between the economic bloc plus liabilities totaled €46 trillion at the end of the third quarter 2016. This it describes as an “upper bound estimate of EMU exposure that would have no hedge, and be exposed to currency risk in the event of an EMU break-up.”

And many people all over Europe will say she’s damn right.

• Le Pen Says French Foreign Policy Must Be Decided in Paris (BBG)

French foreign policy should be decided solely in Paris, French presidential candidate Marine Le Pen said, calling for a reversal of her country’s quest over past decades for tighter ties with European Union allies. Laying out her foreign-policy vision in a speech in Paris, Le Pen spoke of a world based on nation states that pursue their own interest and preserve their own cultures without interference. “To assure the freedom of the French, there is no price too high too pay,” Le Pen said. “The foreign policy of France will be decided in Paris, and no alliance, no ally, can speak in her place.” Her first move as president would be to renegotiate EU treaties as an initial step toward creating a “Europe of Nations,” she said. She saluted Britain’s vote to leave the EU, and said she’d withdraw from NATO’s military command.

“I rejoice in Europeans claiming back their freedom against the attempts to create an artificial super-state,” she said. “The European Union is not the solution, it’s the problem.” Polls show that Le Pen would win the most votes in the April 23 first round of the elections, but would lose the May 7 run-off against whoever she faces. On the U.S., she said she was hopeful President Donald Trump would reverse what she described as interventionist policies of President Barack Obama. She listed support for rebels in Libya and Syria as “mistakes” that have undermined world peace. “The U.S. is an ally but sometimes an adversary,” she said, adding that she was encouraged by Trump’s early days in office.

She said Russia has an “essential balancing role to keep world peace” and “has been badly treated by the European Union.” In Africa, French policy would be one of “non-intervention, but not indifference.” Le Pen said communism and liberal capitalism have both been delusions, and that “people are trying to escape, and find in the nation the best way to protect themselves. Each country should be free to follow its interests, choose its allies, preserve its culture, and France supports that right for all nations.”

Hornets nest.

• Obamacare Just Hit Its Highest Popularity Ever (BI)

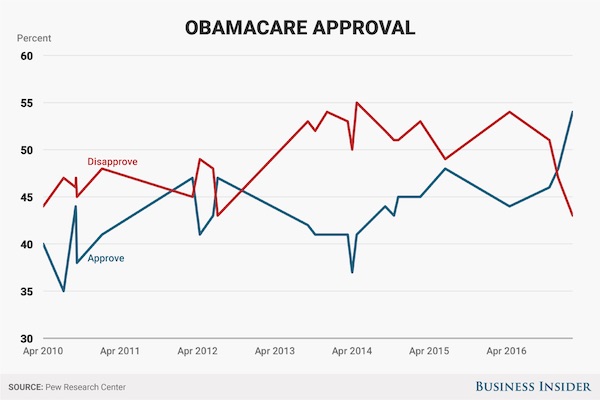

Americans are learning to love the Affordable Care Act, better known as Obamacare. As the law faces possible repeal and replacement by Republicans, a new poll from the Pew Research Center shows that the ACA’s popularity is soaring and has hit its highest point since it was passed. 54% of respondents in Pew’s survey said they approve of the law, with just 43% disapproving. This is better than the 48% approve, 47% disapprove margin from December 2016. Additionally, of the 43% against the law, only 17% of people the total surveyed want Republicans to repeal the way entirely while 25% want the law modified instead, according to Pew.

Every age group, ethnic group, and education level saw increased support for Obamacare between Pew’s current poll and one conducted in October 2016. The result also matches up with other recent polls from a variety of outlets that show President Barack Obama’s signature health law becoming ever-more popular with Americans. House Speaker Paul Ryan said that the GOP plans to introduce a repeal and replace bill for the ACA soon after the week-long President’s Day break. Dissent among Republicans and recent pushback from constituents at town halls, however, has indicated that a repeal may be less than smooth than originally anticipated. Even former GOP House Speaker John Boehner said Thursday that repeal is “not going to happen.”

A 6-year sentence but no hard time?

• Former IMF Chief, Dozens of Former Bank Execs Sentenced to Jail in Spain (DQ)

The unimaginable just happened in Spain: two former bank CEOs, Miguel Blesa (CEO of Caja Madrid) and Rodrigo Rato (CEO of Bankia) were just awarded prison sentences of six years and four-and-a-half years, respectively, for misappropriation of company funds. Rato was also Managing Director of the IMF from 2003 to 2007. He was succeeded by another luminary, Dominique Strauss Kahn. Now, the question on everyone’s mind is will Blesa and Rato actually serve the sentence (more on that later). Dozens more former Caja Madrid senior executives, most of whom are closely connected to either, or both, of the country’s two main political parties and/or unions also face three to six years in prison. They were found guilty by Spain’s National High Court of misusing company credit cards.

Those cards drained money directly from the scarce funds of Caja Madrid, which at the height of Spain’s banking crisis was merged with six other failed savings banks into Bankia, which shortly thereafter collapsed and ended up receiving the biggest bail out in Spanish history, costing taxpayers over €20 billion, to date. Between 2003 and 2012 Caja Madrid (and its later incarnation, Bankia) paid out over €15 million to its senior management and executive directors through its “tarjeta negra” (black card) scheme. According to accounts released by Spain’s bad bank, FROB, much of that money went on restaurants, cash withdrawals, travel and holidays, and the like. The amounts – which did not show up on any bank documents, job contracts, or tax returns – may be small, given the magnitude of the misdeeds that led to the Spanish bank fiasco, but it’s the principle that counts.

Only 4 out of 90 Caja Madrid senior managers, executives, and board members had the basic decency to turn down the offer of undeclared expenses. For the rest, it was an offer they could not refuse. In his last few months at Caja Madrid – just before the whole edifice came crumbling down – Blesa went on a mad spending binge. In one month alone he made purchases on his black card worth €19,000 – more than many Spaniards’ annual salary. This is a man who pocketed over €20 million in salaries and bonuses while at the helm of the bank that he helped destroy. On his departure in 2010, he was awarded a €2.5 million golden parachute. Yet even after his ouster he, like many other Caja Madrid executives, continued making liberal use of his tarjeta negra.

“The unsolvable problem here is that this debt based system is really just an elaborate pyramid scheme predicated on ever increasing amounts of debt in a world where sources of real wealth are finite.”

• Analyzing the Emerging World Order: The Future of Globalism (GR)

We live in a world subdivided by societies: nations and their respective subdivisions. As a matter of fact, there are over 200 nations recognized by the United Nations (UN). We are taught that a society must conform to a binary label such as “free” or “unfree”, “democratic” or “non-democratic” and so on. This is done principally for two reasons – to provide a tautological definition, also for easier control of the masses via manipulation. The current overarching narrative provides that we are divided between the “western” and “eastern” worlds. What does this really mean? We can distill this down to one principal root: economics. What do we mean by economics? We can say that in it’s purest form, it is simply the structured allocation of finite resources.

Today we are observing the transition from a so called unipolar world, one in which a single nation (or group of allied nations) dictates the terms of life for all global citizens, to a more balanced and natural multipolar world. The current dominating group, the “western” bloc of nations, is led by the United States along with numerous vassal states; this order has persisted since the end of the Second World War. This construct is held together using a combination of supranational organizations (UN,WTO,World Bank, IMF, et cetera), propaganda (mainstream media complex), armed might (MIC,NATO, private mercenary forces) and chiefly economics (central banks, corporations). The true “rulers” of this bloc are a cabal of very wealthy and powerful oligarchs that work in the background (shadow banking, dark pool finance, shadow governments, think tanks, NGO’s) to subvert the various sovereignties to their advantage.

These oligarchs are the principal owners of, not just the industries and corporations that front for them, but the governments that rule over the masses. Most importantly this cabal owns the means by which real wealth extraction is carried out: fiat currency, chiefly the “worlds reserve currency”- the United States dollar and it’s derivatives. These currencies are backed not by equitable assets; such as natural resources, precious metals or productive capacities; instead they are backed by the creation of debt. Debt that represents a claim on real assets that virtually all participants in global commerce must pay. How did this cabal come into power? This is a complex question that is subject to many possible answers and interpretations. Briefly, we know from historical fact that a global empire is a central part of this construct, today the United States empire holds that role (previously British, French so on…). This provides the controlling force behind such a cabal.

The privately owned quasi-governmental western central banks are at the heart of this operation. They form the crucial nexus between sovereign governments and the financial world in which they derive their revenue stream, and by extension, their power. The current seat of this construct (United States) was founded as a Constitutional Republic. Unfortunately, the United States Constitution is quite amorphous. Using many acts of legislative, executive and even judicial fiat, this cabal has been able to effectively take over the reigns of the nation. With that feat accomplished, near world domination was made possible. A complex web of regulations, laws, and rules; coupled with a financial system few fully comprehend has been put into place across the west. This became the mechanism by which this “new world order” has been enforced.

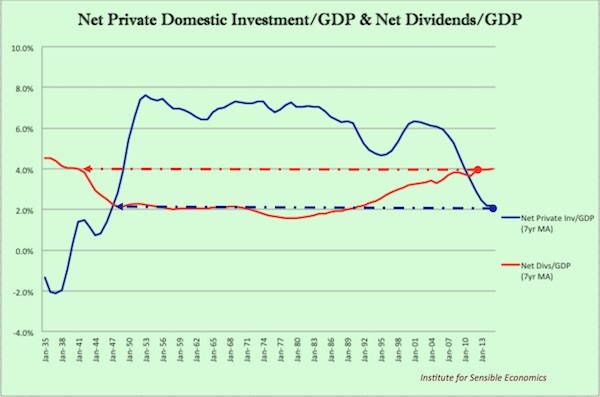

The unsolvable problem here is that this debt based system is really just an elaborate pyramid scheme predicated on ever increasing amounts of debt in a world where sources of real wealth are finite. At present, the growth rate and the total amount of debt issuance, is outpacing the extraction rate and amount of available reserves of resources on the planet.

Glenn Greenwald has been vocal about the Putin hysteria.

• Increasingly Unhinged Russia Rhetoric From A Long-Standing US Playbook (GG)

For aspiring journalists, historians, or politically engaged citizens, there are few more productive uses of one’s time than randomly reading through the newsletters of I.F. Stone, the intrepid and independent journalist of the Cold War era who became, in my view, the nation’s first “blogger” even though he died before the advent of the internet. Frustrated by big media’s oppressive corporatized environment and its pro-government propaganda model, and then ultimately blacklisted from mainstream media outlets for his objections to anti-Russia narratives, Stone created his own bi-monthly newsletter, sustained exclusively by subscriptions, and spent 18 years relentlessly debunking propaganda spewing from the U.S. government and its media partners. What makes Stone’s body of work so valuable is not its illumination of history but rather its illumination of the present.

What’s most striking about his newsletters is how little changes when it comes to U.S. government propaganda and militarism, and the role the U.S. media plays in sustaining it all. Indeed, reading through his reporting, one gets the impression that U.S. politics just endlessly replays the same debates, conflicts, and tactics. Much of Stone’s writings, particularly throughout the 1950s and into the 1960s, focused on the techniques for keeping Americans in a high state of fear over the Kremlin. One passage, from August 1954, particularly resonates; Stone explained why it’s impossible to stop McCarthyism at home when — for purposes of sustaining U.S. war and militarism — Kremlin leaders are constantly being depicted as gravely threatening and even omnipotent. Other than the change in Moscow’s ideology — a change many of today’s most toxic McCarthyites explicitly deny — Stone’s observations could be written with equal accuracy today.

[..] Few foreign villains have been vested with omnipotence and ubiquity like Vladimir Putin has been — at least ever since Democrats discovered (what they mistakenly believed was) his political utility as a bogeyman. There are very few negative developments in the world that do not end up at some point being pinned to the Russian leader, and very few critics of the Democratic Party who are not, at some point, cast as Putin loyalists or Kremlin spies. Putin — like al Qaeda terrorists and Soviet Communists before him — is everywhere. Russia is lurking behind all evils, most importantly — of course — Hillary Clinton’s defeat. And whoever questions any of that is revealing themselves to be a traitor, likely on Putin’s payroll.

As The Nation’s Katrina vanden Heuvel put it on Tuesday in the Washington Post: “In the targeting of Trump, too many liberals have joined in fanning a neo-McCarthyite furor, working to discredit those who seek to deescalate U.S.-Russian tensions, and dismissing anyone expressing doubts about the charges of hacking or collusion as a Putin apologist. … What we don’t need is a replay of Cold War hysteria that cuts off debate, slanders skeptics and undermines any effort to explore areas of agreement with Russia in our own national interest.” That precisely echoes what Stone observed 62 years ago: Claims of Russian infiltration and ubiquity are “the thesis no American dare any longer challenge without himself becoming suspect” (Stone was not just cast as a Kremlin loyalist during his life but smeared as a Stalinist agent after he died).

Turns out, a lot.

• What Does Russia Produce? (Humor)

This past September, in one of his regular interviews with the newspaper Parlamentní Listy, retired Czech Major General Hynek Blasko commented on the possibility of a conflict between Russia and NATO with a following anecdote: “I have seen a popular joke on the Internet about Obama and his generals in the Pentagon debating on the best timing to attack Russia. They couldn’t come to any agreement, so they decided to ask their allies. The French said: ” We do not know, but certainly not in the winter. This will end badly. ” The Germans responded: “We do not know, either, but definitely not in a summer. We have already tried.” Someone in Obama’s war room had a brilliant idea to ask China, on the basis that China is developing and always has new ideas.

The Chinese answered: “The best time for this is right now. Russia is building the Power of Siberia pipeline, the North Stream Pipeline, Vostochny Cosmodrome Spaceport, the MegaProject bridge to Crimea; also Russian is upgrading the Trans-Siberian railroad with a new railway bridge across Lena River and the Amur-Yakutsk Mainline. Russia is also building new sports facilities for the World Cup and athletics, and has in development over 150 production projects in the Arctic … Well, now they really need as many POWs as possible!” So, now, even NATO members’ generals have noticed something peculiar about Russia. According to the myth that is being peddled by Western media, Russia has an underdeveloped economy based on the exchange of raw mineral resources for glass beads… I mean Western produced hi-tech products. Any barber would tell you that even Asians can make iPhones, but Russians can’t.

View from Australia that applies everywhere.

• Career Politicians Aren’t Qualified To Run The Country (Hewson)

When I was leader of the opposition, concerned about the standing of our politicians and failing confidence in our political processes, John Howard used to chip me about the need to recognise politics as a “profession”, and politicians as “professionals”. Now, some 25 years on, the dissatisfaction with our career politicians and the political system is of paramount importance, and fundamental to the drift away from the major parties, whereby now almost one in three direct their votes elsewhere. Politics has become a daily “conflict game”, dominated by career politicians concentrated on winning points on the other side, rather than on developing and delivering good public policy, and good government.

Important issues have been left to drift, or in some cases have been compounded by short-term, populist responses, so that important problems remain unresolved, all having a negative impact on the wellbeing of the average voter, let alone the legacies being left to their children. Minor parties and independents are attracting support in protest, or in the now desperate hope that they will at least shake things up, perhaps even drive governments and oppositions to better economic and social outcomes. But they too are mostly opportunistic, and populist, and often “extreme”, knowing they will never be in a position to have to deliver. Moreover, without experience and the requisite skills, they too may soon be “absorbed” or “defeated” by the system. Unfortunately, the skill sets and experience required of a career politician essentially make them incompetent to govern effectively.

Their career path is often from university, community or union politics, through local government/party engagement, perhaps serving as a ministerial staffer, to pre-selection, then election, and so on. Politics has become the end in itself. Those that make it are mostly qualified just to play the “game”, but not to govern. Increasingly, fewer have ever had a “real job”, or a significant career, before entering politics, and even then that may not qualify them to be a competent minister. It is also not easy to come from outside, as both Trump and Turnbull are finding. Yet, many end up as ministers responsible for significant government portfolios, and large budgets, with little or no relevant experience or skills or commitment to that area, let alone in management. Clearly, if we were to advertise the ministerial posts to attract those with the necessary competence – with the abilities, commitments, knowledge, experience and skills to do the job well – very few indeed, if any, of the current lot would be appointed.

These guys were allegedly directly involved the coup?! Hard to protect.

• Turkish Commandos Ask For Asylum In Greece (K.)

Two Turkish servicemen believed to have been involved in the plot to assassinate Turkish President Recep Tayyip Erdogan during the July coup attempt in the neighboring country, are being held in custody in Alexandroupoli, it was revealed Thursday. The two men, former members of Turkey’s special forces, entered Greece illegally through the Evros border crossing a few days ago and turned themselves in to police authorities in Orestiada. Through a local lawyer, the two commandos applied for political asylum on February 20.They had eluded arrest for months until they entered Greece. The pair are believed to have told Greek investigators that they were indeed involved in a plot to assassinate Erdogan. So far, there has been no Turkish request for their extradition.

Meanwhile, Ankara has submitted a fresh extradition request for the eight Turkish servicemen who Ankara have accused of being involved in the coup attempt. The initial request for their extradition was rejected in January by Greece’s Supreme Court, which said that regardless of whether they were guilty or not, the servicemen would not receive a fair trial in Turkey. In the new request, Ankara provided reassurances that they would receive a fair trial. It also includes what Turkish authorities describe as new incriminating evidence. The request sent to the Greek Foreign Ministry further includes two additional charges, on top of the four included in the first extradition request. The Foreign Ministry has passed on the request to the Justice Ministry.

The curse of carbon comes in many forms. But it’s free, so we can’t resist.

• Synthetic Clothing And Tires Could Be Polluting The Oceans In A Big Way (CNBC)

A new report from the International Union for Conservation of Nature (IUCN) has found that as much as 31 percent of the estimated 9.5 million tonnes of plastic that enters the ocean annually could be from sources such as tires and synthetic clothing. These products can release “primary microplastics”, which are plastics that directly enter the environment as “small particulates”. According to the IUCN, which released the report on Wednesday, they come from a range of sources. These include synthetic textiles, which deposit them due to abrasion when washed, and tires, which release them as a result of erosion when driving.

The report identified seven “major sources” of primary microplastics: Tires, synthetic textiles, marine coatings, road markings, personal care products, plastic pellets and city dust. “Our daily activities, such as washing clothes and driving, significantly contribute to the pollution choking our oceans, with potentially disastrous effects on the rich diversity of life within them, and on human health,” Inger Andersen, director general of the IUCN, said in a statement on Wednesday. “These findings indicate that we must look far beyond waste management if we are to address ocean pollution in its entirety,” he added.

Are they implying changing the seeds when they talk about reconstituting them, developing climate-resilient crops for generations?

• Arctic ‘Doomsday’ Seed Vault Receives 50,000 New Deposits (AP)

Nearly 10 years after a “doomsday” seed vault opened on an Arctic island, some 50,000 new samples from seed collections around the world have been deposited in the world’s largest repository built to safeguard against wars or natural disasters wiping out global food crops. The Svalbard Global Seed Vault, a gene bank built underground on the isolated island in a permafrost zone some 1,000 kilometers (620 miles) from the North Pole, was opened in 2008 as a master backup to the world’s other seed banks, in case their deposits are lost. The latest specimens sent to the bank, located on the Svalbard archipelago between mainland Norway and the North Pole, included more than 15,000 reconstituted samples from an international research center that focuses on improving agriculture in dry zones.

They were the first to retrieve seeds from the vault in 2015 before returning new ones after multiplying and reconstituting them. The specimens consisted of seed samples for some of the world’s most vital food sources like potato, sorghum, rice, barley, chickpea, lentil and wheat. Speaking from Svalbard, Aly Abousabaa, the head of the International Center for Agricultural Research, said Thursday that borrowing and reconstituting the seeds before returning them had been a success and showed that it was possible to “find solutions to pressing regional and global challenges.” The agency borrowed the seeds three years ago because it could not access its gene bank of 141,000 specimens in the war-torn Syrian city of Aleppo, and so was unable to regenerate and distribute them to breeders and researchers.

“The reconstituted seeds will play a critical role in developing climate-resilient crops for generations,” Abousabaa said.The 50,000 samples deposited Wednesday were from seed collections in Benin, India, Pakistan, Lebanon, Morocco, Netherlands, the U.S., Mexico, Bosnia and Herzegovina, Belarus and Britain. It brought the total deposits in the snow-covered vault — with a capacity of 4.5 million — to 940,000.

“Given the severity of the damage and the slow trajectory of recovery, the overarching vision of the 2050 Plan… is no longer attainable for at least the next two decades..”

• Plan To Save Great Barrier Reef Set Back Decades (AFP)

Australia’s plan to rescue the beleaguered Great Barrier Reef has been set back at least two decades after the fragile ecosystem suffered its worst-ever bleaching last year, experts said Friday. The vast coral reef – which provides a tourism boon for Australia – is under pressure from agricultural run-off, the crown-of-thorns starfish, development and climate change. Last year swathes of coral succumbed to devastating bleaching, due to warming sea temperatures, and the reef’s caretakers have warned it faces a fresh onslaught in the coming months. Canberra updated the UN’s World Heritage committee on its “Reef 2050” rescue plan in December, insisting the site was “not dying” and laying out a strategy for incremental improvements to the site.

But an independent report commissioned by the committee concluded that the government had little chance of meeting its own targets in the coming years, adding that the “unprecedented” bleaching and coral die-off in 2016 was “a game changer”. “Given the severity of the damage and the slow trajectory of recovery, the overarching vision of the 2050 Plan… is no longer attainable for at least the next two decades,” the report said. Last year’s bleaching killed two-thirds of shallow-water corals in the north of the 2,300-kilometre (1,400-mile) long reef, although central and southern areas escaped with less damage. The government has pledged more than Aus$2.0 billion (US$1.5 billion) to protect the reef over the next decade, but researchers noted a lack of available funding, with many of the plan’s actions under-resourced.