Copenhagen 1965

Step away from the confrontation and still get what you want. Maybe not that stupid.

• US Urges China to Open Trade After Sparing It Manipulator Tag (BBG)

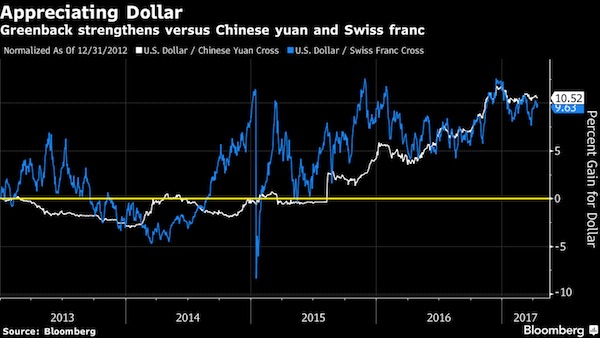

The U.S. stopped short of branding China a currency manipulator, but urged the world’s second-largest economy to let the yuan rise with market forces and embrace more trade. No major trading partner is manipulating its currency for an unfair trade advantage, according to the first foreign-currency report released by the Treasury Department under President Donald Trump on Friday. It kept China, South Korea, Japan, Taiwan, Germany and Switzerland on its foreign-exchange monitoring list. “China currently has an extremely large and persistent bilateral trade surplus with the United States, which underscores the need for further opening of the Chinese economy to American goods and services,” as well as quicker reforms to boost household consumption, according to the Treasury report.

Trump declared on Wednesday that he’ll back away from a campaign promise to name China a currency manipulator, a move that would have created friction between the world’s largest economies as they try to boost trade cooperation and address North Korea’s nuclear threat. Trump, in a Wall Street Journal interview, said China hasn’t manipulated the yuan for months, while accusing nations that he didn’t identify of devaluing their currencies and saying the dollar is getting too strong.

Germany must increase domestic demand? How? Housing bubble?

• US: China, Germany Must Do More To Cut Trade Surpluses (AFP)

Even though China has not moved to keep its currency weak in the past three years, the country “has a long track record of engaging in persistent, large-scale, one-way foreign exchange intervention, doing so for roughly a decade,” the Treasury Department said. That “distortion in the global trading system… imposed significant and long-lasting hardship on American workers and companies.” With a trade surplus in goods with the United States of $347 billion last year, and continued policies that restrict free trade and foreign investment, “Treasury will be scrutinizing China’s trade and currency practices very closely.” The large goods surplus “underscores the need for further opening of the Chinese economy to American goods and services, as well as faster reform to rebalance the Chinese economy toward greater household consumption.” Beijing also will need to prove that the recent stance of not trying to weaken the currency is “a durable policy shift,” even if the renminbi begins to appreciate again.

The Treasury Department said Germany should take steps, notably spending policies, “to encourage stronger domestic demand growth,” something the country’s trading partners and the IMF have been urging for some time. Increased demand “would place upward pressure on the euro… and help reduce its large external imbalances,” increasing domestic consumption, including of imported goods. Those imbalances include its $65 billion goods trade surplus with the United States last year, and what the department calls “the world?s largest current account surplus at close to $300 billion.” The report also called on Japan to do more “to revive domestic demand and combat low inflation while avoiding a return to export-led growth.” This would include more “flexible” government spending policies, and continued reforms to boost the labor market and increase productivity of the Japanese economy.

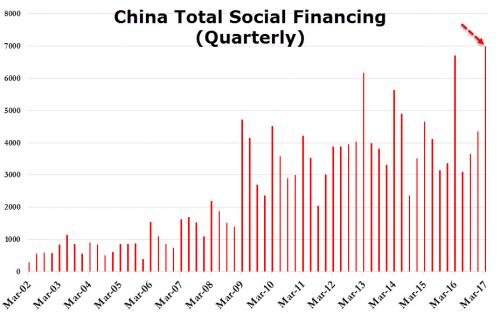

“Social financing”. Sure. Sounds good, right? But it‘s all shadows.

• China Shadow Banking Rebounds In March, Household Loans Surge (R.)

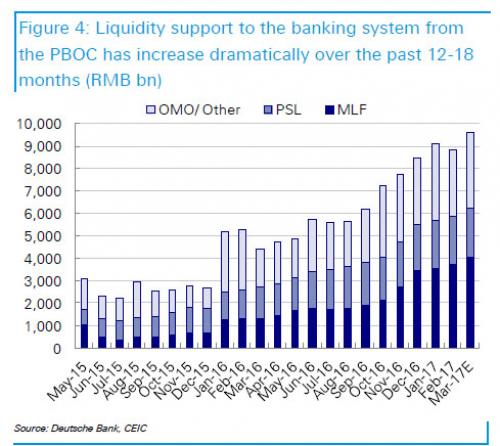

China’s banks unexpectedly extended less credit in March than in the previous month as the government tries to contain the risks from an explosive build-up in debt and an overheating housing market. But aggregate financing, which includes bank loans as well as off-balance sheet lending, surged in March and was a record in the first quarter, raising doubts about the effectiveness of official efforts so far to clamp down on risks in the financial system. A surge in household lending in March also added to worries about whether authorities will be able to get the frenzied property market under control, even as cities roll out increasingly stringent curbs on home buying.

The central bank has raised interest rates on money market instruments and special short- and mid-term loans several times in recent months, most recently in mid-March, to contain debt risks and discourage speculation, though it is treading cautiously to avoid hurting economic growth. Outstanding bank loans grew at the slowest pace since July 2002 in March at 12.4%, while M2 money supply growth hit a more than 6-month low, reflecting the moderately tighter policy stance by the People’s Bank of China (PBOC). On the surface, the level of March new loans fell, also suggesting authorities are making some headway in weaning borrowers off endless cheap credit and coaxing debt-laden companies to deleverage.

China’s banks made 1.02 trillion yuan ($148.15 billion) in new loans in March, data showed on Friday, down from 1.17 trillion yuan in February and well below the 1.25 trillion yuan that analysts had predicted in a Reuters poll. However, banks still extended the third highest loans on record for a single quarter, totaling 4.22 trillion yuan in January-March. The first quarter is usually the busiest of the year for Chinese banks, when they have a fresh annual quota and look to lock up key clients. Loans to households surged to 797.7 billion yuan in March, according to Reuters calculations using PBOC data, accounting for 78% of all new loans in the month. That was much higher than either January or February and even the 50% of new loans in 2016.

[..] China’s total social financing (TSF), a broad measure of credit and liquidity in the economy, rocketed to 2.12 trillion yuan in March from 1.15 trillion yuan in February. For the first quarter, TSF reached a record 6.93 trillion yuan – roughly equivalent to the size of Mexico’s economy – and well above last year’s first quarter total. For analysts, that suggests a surge in off-balance sheet lending, likely in the less regulated shadow banking system, despite repeated attempts by authorities to target riskier lending in past years. Loans to companies totaled 368.6 billion yuan in March, less than half the amount of household lending, PBOC data showed. That could be an ominous signal for the economy, unless firms were finding other sources of funding.

Bubble dynamics.

• Record High US Multi-Family Construction Set To Wreak Havoc On Rents (ZH)

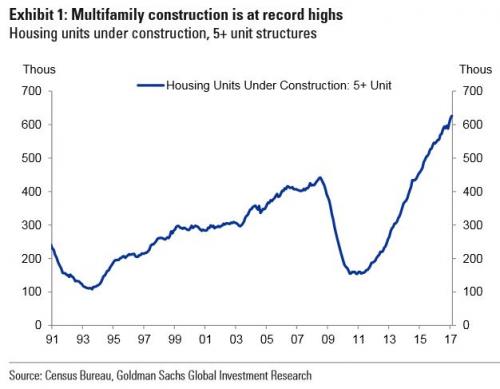

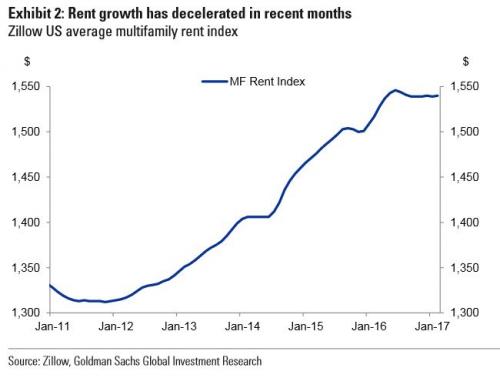

Softening apartment rents, particularly in the massively over-priced, millennial safe-spaces of New York City and San Francisco, have been a frequent topic of conversation for us over the past several quarters…Now, a new report from Goldman’s Credit Strategy Team, led by Marty Young, helps to highlight some of the key data points that suggest that sinking rent will likely not be just an ephemeral problem. To start, an just like almost any bubble, sinking rents are the symptom of a massive, multi-year supply bubble in multi-family housing units sparked by, among other things, cheap borrowing costs for commercial builders. Per the chart below, multi-family units under construction is now at record highs and have eclipsed the previous bubble peak by nearly 40%.

Rents have already started to rollover but we suspect the correction has only just begun.

Consumer spending falls = money velocity goes down = deflation.

• Falling US Retail Sales Cast Doubt On Further Fed Interest Rate Rise (G.)

Falling retail sales and lower inflation in the US have added to signs that the world’s biggest economy has lost momentum in recent months, casting doubt over how many more times the Federal Reserve will raise interest rates this year. Stronger takings at clothing and electronics stores in March were not enough to offset a continued drop in demand for cars, according to figures from the US government (pdf). As a result, retail sales fell for the second month running. The 0.2% drop was deeper than forecasts in a Reuters poll of economists and followed a bigger than previously reported decline of 0.3% in February. Sales were also hurt by lower demand for building materials in March, chiming with a sharp slowdown in construction hiring as parts of the US were hit by severe snowstorms. Petrol station takings also dipped in March as fuel prices fell.

The few bright spots were a 2.6% rise in takings at electronics and appliance stores and a 1% rise in clothing sales. The drop in fuel prices in March echoed a pattern seen in the UK following a fall in global oil prices last month. Cheaper pump prices were also a key factor in softer US inflation. A measure of prices in the US fell for the first time in more than a year, dipping 0.3% in March, according to figures from the Labor Department. It said falling fuel prices and mobile phone charges drove the decline in the consumer price index (CPI) and were only partially offset by rising food prices. As a result, inflation – or the pace of price changes over a year – eased to 2.4% in March from 2.7% in February. Core inflation, which strips out volatile food and energy prices, eased to 2% from 2.2% in February and was the weakest since November 2015.

The retail sales and inflation data follow news of a sharp slowdown in job creation in the US in March as the poor weather, a government hiring freeze and a faltering retail sector all appeared to put a chill on President Donald Trump’s promise to boost hiring. But the unemployment rate declined to 4.5%, the lowest rate in a decade. The latest indications that the economy slowed in the opening months of the year will give policymakers at the US central bank more to debate as they decide when to next raise interest rates.

“Hacker Fantastic @hackerfantastic: This is really bad, in about an hour or so any attacker can download simple toolkit to hack into Microsoft based computers around the globe.”

• Leaked NSA Malware Threatens Windows Users Around The World (IC)

The ShadowBrokers, an entity previously confirmed by The Intercept to have leaked authentic malware used by the NSA to attack computers around the world, today released another cache of what appears to be extremely potent (and previously unknown) software capable of breaking into systems running Windows. The software could give nearly anyone with sufficient technical knowledge the ability to wreak havoc on millions of Microsoft users. The leak includes a litany of typically codenamed software “implants” with names like ODDJOB, ZIPPYBEER, and ESTEEMAUDIT, capable of breaking into — and in some cases seizing control of — computers running version of the Windows operating system earlier than the most recent Windows 10.

The vulnerable Windows versions ran more than 65% of desktop computers surfing the web last month, according to estimates from the tracking firm Net Market Share. The crown jewel of the implant collection appears to be a program named FUZZBUNCH, which essentially automates the deployment of NSA malware, and would allow a member of agency’s Tailored Access Operations group to more easily infect a target from their desk. According to security researcher and hacker Matthew Hickey, co-founder of Hacker House, the significance of what’s now publicly available, including “zero day” attacks on previously undisclosed vulnerabilities, cannot be overstated:

“I don’t think I have ever seen so much exploits and 0day [exploits] released at one time in my entire life,” he told The Intercept via Twitter DM, “and I have been involved in computer hacking and security for 20 years.” Affected computers will remain vulnerable until Microsoft releases patches for the zero-day vulnerabilities and, more crucially, until their owners then apply those patches. “This is as big as it gets,” Hickey said. “Nation-state attack tools are now in the hands of anyone who cares to download them…it’s literally a cyberweapon for hacking into computers…people will be using these attacks for years to come.”

Russia and China are close to launching their own competitor to SWIFT. Good timing. This is nuts.

• Hackers Release Files Indicating NSA Hacked SWIFT, Global Bank Transfers (R.)

Hackers released documents and files on Friday that cybersecurity experts said indicated the U.S. National Security Agency had accessed the SWIFT interbank messaging system, allowing it to monitor money flows among some Middle Eastern and Latin American banks. The release included computer code that could be adapted by criminals to break into SWIFT servers and monitor messaging activity, said Shane Shook, a cyber security consultant who has helped banks investigate breaches of their SWIFT systems. The documents and files were released by a group calling themselves The Shadow Brokers. Some of the records bear NSA seals, but Reuters could not confirm their authenticity. Also published were many programs for attacking various versions of the Windows operating system, at least some of which still work, researchers said.

In a statement to Reuters, Microsoft, maker of Windows, said it had not been warned by any part of the U.S. government that such files existed or had been stolen. “Other than reporters, no individual or organization has contacted us in relation to the materials released by Shadow Brokers,” the company said. The absence of warning is significant because the NSA knew for months about the Shadow Brokers breach, officials previously told Reuters. Under a White House process established by former President Barack Obama’s staff, companies were usually warned about dangerous flaws. Shook said criminal hackers could use the information released on Friday to hack into banks and steal money in operations mimicking a heist last year of $81 million from the Bangladesh central bank. “The release of these capabilities could enable fraud like we saw at Bangladesh Bank,” Shook said. The SWIFT messaging system is used by banks to transfer trillions of dollars each day.

“..if those analysts were properly consulted about the claims in the White House document they would have not approved the document going forward.”

• The ‘Smoking-Gun’ Quote On The Recent Syrian Gas-Attack (Zuesse)

After detailed decimation of President Trump’s ‘intelligence’ ‘justifying’ his invasion of Syria, the MIT specialist on such intelligence-analysis, Dr. Theodore Postol, concludes:

“I have worked with the intelligence community in the past, and I have grave concerns about the politicization of intelligence that seems to be occurring with more frequency in recent times – but I know that the intelligence community has highly capable analysts in it. And if those analysts were properly consulted about the claims in the White House document they would have not approved the document going forward. I am available to expand on these comments substantially. I have only had a few hours to quickly review the alleged White House intelligence report.

But a quick perusal shows without a lot of analysis that this report cannot be correct, and it also appears that this report was not properly vetted by the intelligence community. This is a very serious matter. President Obama was initially misinformed about supposed intelligence evidence that Syria was the perpetrator of the August 21, 2013 nerve agent attack in Damascus. This is a matter of public record. President Obama stated that his initially false understanding was that the intelligence clearly showed that Syria was the source of the nerve agent attack.

This false information was corrected when the then Director of National Intelligence, James Clapper, interrupted the President while he was in an intelligence briefing. According to President Obama, Mr. Clapper told the President that the intelligence that Syria was the perpetrator of the attack was “not a slamdunk.” The question that needs to be answered by our nation is how was the president initially misled about such a profoundly important intelligence finding?

The U.S. ‘news’media hid from the public Dr. Postol’s disproof of the Obama regime’s still-continuing assertions that the 21 August 2013 sarin attack was from Syria’s government instead of from the ‘moderate rebels’ (jihadists) whom the U.S. supported. Will they hide from the U.S. public his disproof of the U.S. regime’s latest such scam backing the actual perpetrators of a war-crime — will they do now as they did then?

This issue presents a challenge to the U.S. ‘news’ media, to finally show some integrity, some honor, and expose the operations of the gang at the U.S. government’s top, instead of simply continuing to pump that gang’s propaganda. Without the continuing cooperation of America’s ‘news’media, we would not now be heading toward World War III — global nuclear war. What would be the time when these ‘news’media will do their job, instead of do what they’re being paid to do, if that time is not now.

Even more lobbyists needed?!

• US Insurers Sue Saudis for $4.2 Billion Over 9/11 (TAM)

Last year’s Justice Against Sponsors of Terrorism Act (JASTA), a bill which allowed Americans to sue Saudi Arabia in US court over their involvement in 9/11, has yielded another major lawsuit yesterday, a $4.2 billion suit filed by over two dozen US insurers related to losses sustained because of the 2001 attack. The lawsuit is targeting a pair of Saudi banks, and a number of Saudi companies with ties to the bin Laden family, accusing them of various activities in support of al-Qaeda in the years ahead of 9/11, and subsequently having “aided and abetted” the attack. The biggest target is the Saudi National Commercial Bank, which is majority state-owned.

The Saudi government heavily pressured the Obama Administration to block the JASTA last year, threatening to crash the US treasury market if it led to lawsuits, but overwhelming Congressional support still got it passed into law. While there were more than a few lawsuits already filed in the past several weeks related to JASTA, this is by far the biggest, and most previous lawsuits are still in limbo as the court and lawyers try to combine them into various class action groups. Historically, US sovereign immunity laws have prevented suits against the Saudi government related to overseas terrorism. With the release of the Saudi-related portions of the 9/11 Report last year, however, such suits were inevitable, and the federal government could no longer protect the Saudis from litigation.

Everybody should know this.

• Understanding Land Value Taxation (Walker)

Back in the 18th and 19th centuries, economists took a dim view of landowners. Influential theorists like Adam Smith, David Ricardo and John Stuart Mill saw them as a drag on economic activity, primarily because they reduced the value of other people’s economic activity (through rent) without any incentive to make an economic contribution themselves. In the late 1800s, American social theorist and economist Henry George started a movement arguing for a single land value tax (LVT) – on the unimproved value of land – to replace other forms of taxation. It was rooted in the idea that if economic activity (labour, trade etc.) is the source of tax revenues, tax inevitably becomes a drag on the very thing that creates it. And while productive members of society earn money to pay their taxes, landowners are unproductive earners who pay their taxes through land rent, which is paid by people who generate economic activity.

Rent and taxes are a ‘double whammy’ on productive people. While productive members of society earn money to pay their taxes, landowners are unproductive earners who pay their taxes through land rent, which is paid by people who generate economic activity. That means rent – like taxes – is a drag on the economy. But unlike taxes, which can be used to stimulate economic activity through public spending, rent disappears into landlords’ pockets. So apart from the relatively small economic impact from landlords’ spending, their rent takes value out of the economy and delivers little value back to it. Understandably, the Georgists (Henry George’s LVT supporters) are still going strong today.

The Vichy comment looks odd; why go there? But do remember: French polls are meaningless by now.

• Le Pen Ready to Be ‘Crucified’ for France (BBG)

Far-right candidate Marine Le Pen pulled all the stops to stem her slide in the polls, saying she’s willing to be “crucified” for her stance on absolving France for the wartime deportation of Jews, and pledging to protect the country from Islamic fundamentalists. In a wide-ranging interview Friday on France Info radio nine days before the first round of the presidential vote, the 48-year-old anti-immigration candidate expressed disappointment at what she said was U.S. President Donald Trump going back on campaign promises, while focusing mainly on well-worn themes that most strike a chord with her electorate: Islam, immigration, national identity and terrorism.

“I don’t want France to be damaged, to be humiliated, that it be held responsible when it is not responsible,” Le Pen said. “People can crucify me, I will not change my mind, I will always defend France.” The National Front candidate’s lead in the polls has been whittled away over the last few weeks, leaving her struggling to regain momentum. First-round support for both Le Pen and centrist Emmanuel Macron slipped 0.5 points to respectively 23.5% and 22.5%, according to a daily rolling poll by Ifop on Thursday. Le Pen was at 26.5% in mid-March. [..] In the radio interview, Le Pen maintained her contention that France had no responsibility for the 1942 roundup of Jews in and around Paris by French police at the request of the German occupying forces to be sent to concentration camps.

The candidate, who first made that comment on April 9, was reverting to the long-established party line that shuns any hint of repentance. Le Pen said she is “extremely sensitive to the martyrdom of the Jews,” adding that the only issue was “juridical,” whether the Vichy regime was France or not. “I consider that Vichy was not France. French people can commit crimes without France being criminal.” In the interview, Le Pen criticized Trump for changing his mind on the U.S.’s global role after he said on Wednesday that the North Atlantic Treaty Organization was “no longer obsolete” in fighting terrorism. “Undeniably he is in contradiction with the commitments he had made,” Le Pen said. Trump had said in January that NATO was “obsolete.” Among her key proposals is for France to quit the alliance.

9 days before an election. They’re trying to make her win?!

• French Prosecutors Seek To Lift Le Pen Immunity Over Expenses Inquiry (AFP)

French prosecutors have asked the European parliament to lift the immunity of the far-right presidential candidate Marine Le Pen over an expenses scandal, deepening her legal woes on the eve of the election. The move comes just nine days before France heads to the polls for a highly unpredictable vote, with Le Pen – who heads the Eurosceptic Front National (FN) – one of the frontrunners in the 23 April first round. The request was made at the end of last month after Le Pen, who is a member of the European parliament, invoked her parliamentary immunity in refusing to attend questioning by investigating magistrates. The prosecutors also made a similar request regarding another MEP from Le Pen’s party, Marie-Christine Boutonnet, who also avoided questioning.

Le Pen, who has denied misusing parliamentary funds, shrugged off the move. “It’s totally normal procedure, I’m not surprised,” she told France Info radio. The case was triggered by a complaint from the European parliament, which accuses the FN of defrauding it to the tune of about €340,000 (£290,000). The parliament believes the party used funds allotted for parliamentary assistants to pay FN staff for party work in France. In February, it said it would start docking Le Pen’s pay unless she paid the money back. The allegations appear to have had little impact on Le Pen’s campaign, dwarfed by the bigger scandal engulfing her conservative rival François Fillon.

A day like so many others.

• More Than 2,000 Migrants Rescued In Dramatic Day In Mediterranean (R.)

More than 2,000 migrants trying to reach Europe were plucked from the Mediterranean on Friday in a series of dramatic rescues and one person was found dead, officials and witnesses said. An Italian coast guard spokesman said 19 rescue operations by the coast guard or ships operated by non-governmental organizations had saved a total of 2,074 migrants on 16 rubber dinghies and three small wooden boats. The medical charity Medecins Sans Frontieres (MSF) said in a tweet that one teenager was found dead in a rubber boat whose passengers were rescued by its ship Aquarius. “The sea continues to be a graveyard,” MSF said in a Tweet. The coast guard spokesman confirmed that one person had died but gave no details. MSF said two of their ships, Aquarius and Prudence, had rescued about 1,000 people in nine boats.

Desperate refugees struggled to stay afloat after they slid off their rubber boat during a rescue operation by the Phoenix, a ship of the rescue group Migrant Offshore Aid Station (MOAS). Video footage showed rescuers jumping into the water off the coast of Libya to help them. “In 19 years of covering the migration story, I have never experienced anything like today,” said Reuters photographer Darrin Zammit Lupi, who was aboard the Phoenix. In one operation, the Phoenix rescued 134 people, all from sub-Saharan counties, he said. Those rescued by the MOAS and MSF ships were transferred to Italian coast guard ships, which had rescued other migrants, to be taken to Italian ports. According to the International Organisation for Migration, nearly 32,000 migrants have arrived in Europe by sea so far this year. More than 650 have died or are missing.