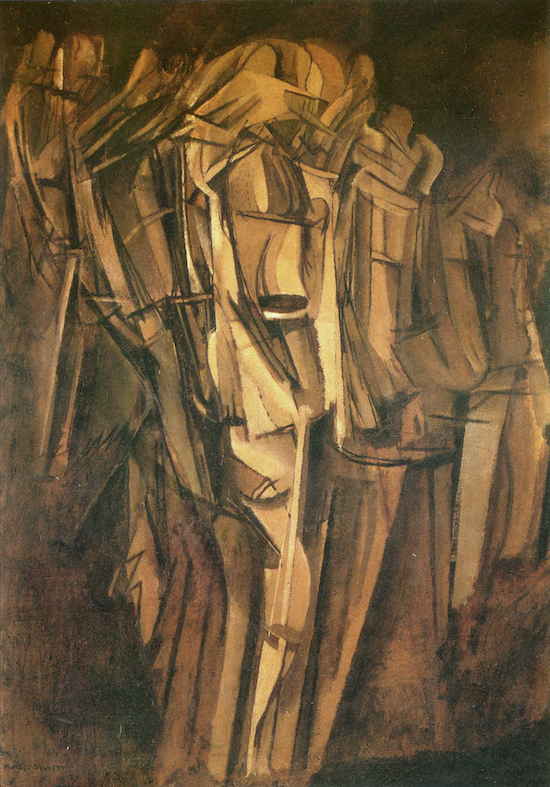

Marcel Duchamp Sad young man on a train – Nude study 1911-12

Longtime Automatic Earth friend Alexander Aston talks about finding himself at Oxford at a point in time when the British themselves appear overcome by a combo of utter confusion and deadly lethargy, and one can only imagine what it must be like for ‘foreigners’ residing in Albion, who face large potential changes to their lives and know there’s not a thing they can do about it, not even vote.

I like the observation that the entire British political system, the place where decisions are made, is the size of a small village. That’s a visual we can all relate to. It’s a physical limit as well as a mental one. I’m all for sovereignty and self-determination, but how’s that going to work if you can’t even see the boundaries of your own territory?

Guys, it’s 4 weeks to D-Day today. How about we call off the landing, get a few pints instead, and talk? First round’s on me.

Here’s Alexander:

Alexander Aston: I arrived in the UK in 2015 to undertake interdisciplinary research at the University of Oxford. I am a child of the Empire, a cultural product of Britannia’s oldest colonies in the British Isles, her most important colony now turned empire as well as one of her youngest, Zimbabwe. The UK is both an intimately familiar society and yet one that is also strangely alien for me, like a wealthy, often charming and deeply abusive parent that sparks both self-recognition and rejection.

The ‘leave’ referendum occurred close to a year after I arrived in the UK and is one of the few political events over the past few years that surprised me. I suppose that I assumed, given the power and wealth afforded to UK elites by the EU, that those who benefited so greatly from the status quo would do anything to manipulate or fudge the results. Nonetheless, history decided to swerve, and over the past four years, I have watched the inhabitants of this island stumble into an profound identity crisis. Having spent a good portion of my life in Greece, I do not have particularly warm and cuddly feelings toward the European Union and was never a natural ‘remainer’.

The single markets and the long peace are significant achievements, and the ability for Europeans to move freely and form new discourses, relationships and endeavours has value that is impossible to quantify. The EU is technocratic, unaccountable and enthralled to a neoliberal ideology that knows only how to extract wealth from the most vulnerable and concentrate it in the hands of the most powerful. I have lived in Athens, I have family in Greece, I have seen well enough the true costs of EU membership.

What strikes me most in my experiences of the United Kingdom are the incredible levels of cognitive dissonance demanded by its media, politics and economics in order for the society to function. I live in one of the most expensive and unequal cities in the entire country. I am surrounded by the grandeur of powerful and wealthy institutions that are older than the Aztec empire and filled with some of the most powerful and elite humans on the planet and their heirs in waiting. Every time that I enter a building, go to a lecture, meet with a colleague, or sit for some grand meal in one of the colleges I must walk past dozens of human beings that are cold, hungry and occasionally dying on the streets.

This is in a country that provides social housing and millions in basic income to a single family, where it is accepted that the most vulnerable people are relentlessly bullied into poverty through cuts, inspections and ever increasing demands of performance. In a country where the Beatles and J.K. Rowling all started their careers on the dole. I don’t know the answers to our predicaments, but the conversation is extremely lopsided and blind to the real misery it is creating. Every time I walk through Oxford, I am filled with a profound sense of guilt and remorse, I marvel and benefit from the treasures surrounding me and I wonder… is this the best we can do? Are these the limits of our social imagination and creativity?

Shortly after I arrived, Jeremy Corbyn was elected to the leadership of the labour party. It was an early prefiguration of the political disruptions that were about to sweep the world. The neoliberal managerialism of New Labour had lost control, and its partisans wage an increasingly desperate guerrilla war with no small amount of aid from the establishment media.

Long before Brexit was a reality I became aware of the repetitious delirium of innuendo, slander and fear-mongering through which the media managed the perspective and narrative in the country, much like the American system but with its own uniquely British aesthetics and sense of authority. This somnambulant fever has only grown as the country has tripped and stumbled through the unexpected circumstances and self-engineered traps of austerity, political deadlock, and delusions of grandeur.

Day in and day out we are subjected to a litany of failure by one of the most incompetent governments in history while the media clucks, puffs and turns a path of ruin into mere spectacle. Yet, day after day we find ourselves in a state of inertia, nothing seems to change as the country hurtles towards historical rupture. The dissonance created between a seizing political system, PR firms masquerading as journalists and a dysfunctional economy requires that the people of the United Kingdom smooth over, ignore or forget the increasing contradictions of their lived experience.

Anthropologically speaking, the nuance of British culture that has perhaps had the most profound impact upon me is the detail to which the English are able to infer region, class and schooling through the voices of their fellow citizens. The subtle encoding of social hierarchies into the dialects and accents of the United Kingdom to degrees that I have never experienced in the rest of the Anglophone world. Despite my ignorance about many intricacies of British linguistics, one thing I do feel relatively confident about is that even though the English have the vast majority of the wealth and power in the United Kingdom, the Celts have received the warmer sense of humour.

For me, one of the few truly positive possible outcomes of Brexit is the potential for Irish reunification and even the chance of an emerging “Celtic sphere” to provide a new counterbalance in the British Isles. The partition of Ireland stems from one of the deepest and oldest wounds inflicted by the British Empire. It is an ironic twist of fate that the Tories now find themselves dependent upon the Unionist partisans and descendants that they so eagerly fostered to maintain dominance over Ireland. The United Kingdom’s mythology of itself has run headlong into the contradictions at the heart of its empire. The country that is partitioning itself from Europe finds its politics paralysed by an older act of partition.

The contradictions of Brexit have riven the political parties and the governing process has ground to a halt. It is an intractable predicament, the interests of the Unionists, Capitalist Utopianists, Neoliberal reactionaries, Political Elites, Nationalists, Independents and Socialists are all pulling in different directions. Consensus is only achieved in moments of near universal rejection, yet with no ability to pass any meaningful legislation the Tories only coalesce in obstinate refusal to change the situation.

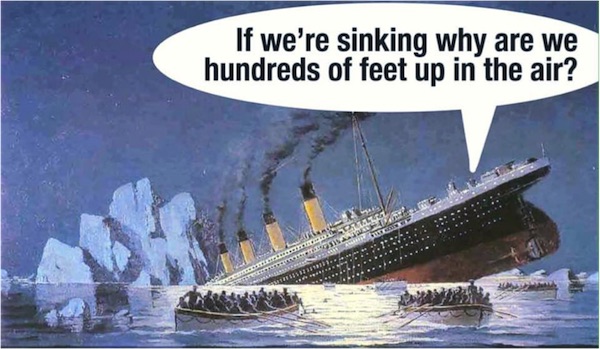

Meanwhile the ship of state drifts towards a political, economic and moral abyss. What I can say from my time at Oxford is that the political masters of this country are indoctrinated with an imperial hubris in a political system that operates like a small village. The institutions of power here produce all too many children with no experience of the daily struggles of common people, that are all together convinced as to their entitlement to rule over millions with a PPE degree in hand.

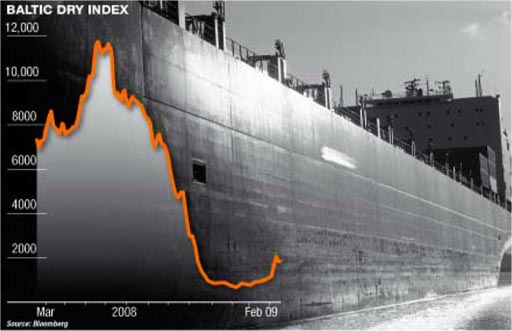

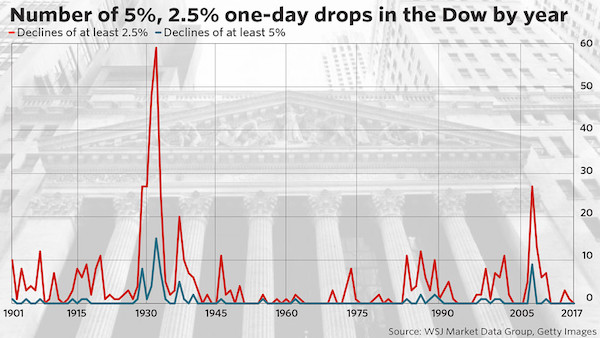

The country is in an intractable prisoners dilemma, the logic of which makes a no-deal outcome highly possible. My fear with a no deal is that this would result in a bond shock, and with economic disruptions in Ireland, the Benelux, a France mired in a political crisis and the financial precarity of Italy all create excellent conditions for an absolutely roaring debt calamity. Yet, the UK blithely dithers on as Theresa May puts on her best performance of Neville Chamberlain and tries, tries again. The fact is that the government has lost all political legitimacy and Parliament is an omnishambles.

Those that lead us are so committed to their own narratives, so convinced of their acumen and power, so insulated by their privilege that they will sacrifice the health and prosperity of this nation in the absolute conviction that they are right and that all their problems are the fault of stupid people that don’t listen and do what they are told. The folks in the ERG think they only need sit on their hands and they can, they will, find themselves in a libertarian Aristocracy sea steading off the shores of Europe.

The London centric remainers think that they can paper over the past four years with a second referendum and that all can go back to normal and Brexit can be safely tucked away as a terrifying aberration. I am reminded of the H.L. Mencken quote that “for every complex problem there is an answer that is clear, simple and wrong.”

The only pathway I can see to restoring political legitimacy at this point is a general election. Only after an extension of article 50 and a new government has negotiated an alternative deal is it really feasible to begin speaking about holding further referendums that won’t cause great harm to democratic society. Citizen assemblies would need to be formed and plans for three referenda drawn up, a choice between Mays and the Alternative deal followed by a decision between the winning deal and a no-deal option which would culminate in a final choice between a popularly demanded type of Brexit and remaining within the European Union.

I, as the rest of us, have no idea where our current moment in history will lead. However, there are a few things that I feel confident are occurring. The long twentieth century that began in 1914 is at the end of its cycle. Whatever comes next will be something new, a difficult and demanding opportunity for profound creativity and the chance to step out of the long shadow of our past. In all ecosystems, diversity generates resilience. It is the reason and the strength of building consensus. Yet we cannot build consensus if we refuse, alienate and straw man the voices of others and refuse to examine and discuss the contradictory predicaments in which we find ourselves.

Those that lead us are blind, they are blind because they are true believers and they lack either the wit or compassion to imagine something different beyond more wealth extraction and violence. We have seen Neoliberalism’s Capitalist Utopia and it has failed. Only open and honest discourse coupled with pragmatic action will allow us to navigate to a new shore. I feel strongly about these things, that and that no matter what ones political persuasion, voting for the Tories should be beneath anyone’s dignity at this point.

To be awake from this collective dissonance we must approach our predicament with humility and honesty. Without a democratic commitment to an open and honest discussion, pragmatic decision making processes and a functioning political system capable of mitigating the worst damage, this country will become a mere serfdom ruled by Lilliputian lords.

“For we each of us deserve everything, every luxury that was ever piled in the tombs of the dead kings, and we each of us deserve nothing, not a mouthful of bread in hunger. Have we not eaten while another starved? Will you punish us for that? Will you reward us for the virtue of starving while others ate? No man earns punishment, no man earns reward. Free your mind of the idea of deserving, the idea of earning, and you will begin to be able to think.”

– Ursula K. Le Guin, The Dispossessed

Alexander Aston is a doctoral candidate in archaeology at the University of Oxford and is on the board of directors with the Centre for Cognitive Archaeology at the University of Colorado in Colorado Springs. He has prior degrees in philosophy and history. His work lays at the intersection of Cognitive Archaeology, Deep History and Natural Philosophy, examining the relationship between ecology, material culture and social cognition. Alexander grew up between Zimbabwe, Greece and the United States. He has worked as a stone mason, community organiser and collaborative artist focused on issues of sustainability, alternative education and economic justice for nearly two decades. He has helped to establish community collectives, free schools, participatory art projects, sustainability and education programs in several international projects.