Jackson Pollock Shooting Star 1947

Fauci 30 yrs

— illuminatibot (@iluminatibot) September 23, 2023

“..[if they want it] to be on the battlefield, let it be on the battlefield..”

• ‘New World Order’ Vs ’Empire Of Lies’ – Lavrov at UN (RT)

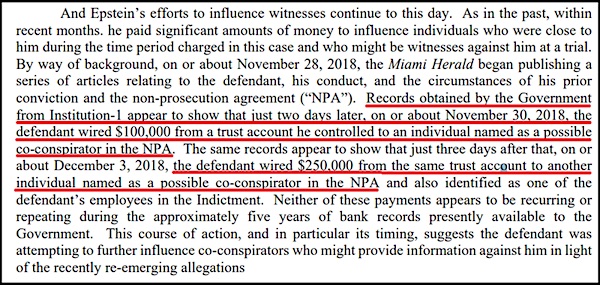

The world has a chance to achieve “authentic democratization” in international relations by establishing a multipolar world order, marking the first such opportunity since the end of World War II, Russian Foreign Minister Sergey Lavrov told the UN General Assembly (UNGA) on Saturday. The US and its Western allies seek to prevent such a development by stirring up new conflicts to divide humanity and keep their “hegemony of the global minority” in place, he added. The US and its allies still reject the principle of equality in international relations, Lavrov said. Americans and Europeans keep looking down on the rest of the world and that leads to their “total intractability” in any negotiations. Washington and its allies “keep making promises left and right” that end up being reneged-on, the Russian minister added. “As Russian President Vladimir Putin put it, the West is now the real ‘empire of lies’,” he said.

NATO activities have reached “unprecedented” levels since the end of the Cold War, the top Russian diplomat believes. The US-led forces of the bloc have conducted drills that involved simulating nuclear strikes against Russia, he claimed, adding that Washington is also actively seeking to project its military might in the Asia-Pacific through establishing military-political “alliances” with nations like Australia, South Korea or Japan and pushing them towards closer cooperation with NATO. Such actions “risk creating a new explosive geopolitical hotspot in addition to the … European one,” Lavrov warned, adding that Western politicians have been so blinded by a feeling of impunity that they’ve lost “the sense of self-preservation.” For the first time since 1945, when the United Nations was established, the world has a chance to establish a truly democratic world order, the Russian foreign minister said.

The “global majority” – ie the nations of Asia, Africa and Latin America – are increasingly seeking independence and equality, as well as respect for their sovereignty in international relations. “It is obvious for Russia that there is no other way,” Lavrov told the UNGA, adding that this fact “encourages optimism in those believing in the rule of international law and wishing to see the UN restored to its role of a central coordinating body of world politics.” The US and its allies seek to stall the onset of a multipolar world order, in particular by “stirring up conflicts that artificially divide humanity into hostile blocs and prevent it from achieving common goals,” the Russian minister pointed out. The West wants the world to “play by its infamous and self-serving rules,” he said, adding that the international community should instead strive for a world where everyone “agrees on how to solve issues together, on the basis of a fair balance of interests.”

Russia is calling for “an immediate and full” lifting of sanctions imposed against such nations as Cuba, Venezuela and Syria, Lavrov said, adding that such unilateral punitive measures “blatantly violate the principle of sovereign equality of nations” and interfere with these countries’ rights to development. “One should put an end to any coercive measures imposed in circumvention of the UN Security Council as well as to the West’s … practice of manipulating its sanctions policies to exert pressure on those deemed undesirable,” he added. Russia’s top diplomat also blasted the US over what he called threats against nations willing to work with Moscow. “It is shameful for a great power to run around like this and threaten everyone and only demonstrating its obsession with domination,” he told journalists after the UNGA session.

Moscow is ready for talks on its ongoing conflict with Kiev at any time, Lavrov told a press conference on the sidelines of the UN assembly. However, Russia will not consider any deals involving a ceasefire, he said, adding that Moscow and Kiev had supposedly almost reached an agreement in the first months of the conflict following a series of talks in Belarus and Türkiye only for this process to be disrupted, supposedly by Ukraine’s Western backers.“Putin said it very clearly: yes, we are ready for talks but we will not consider any ceasefire proposals because we did so once and were deceived.” Russia also respects Ukraine’s sovereignty in accordance with the Ukrainian declaration of independence and its constitution, Lavrov said, adding that both documents also declare the non-aligned status of Ukraine and respect for the Russian language and Russian-speaking minorities.

Ukraine’s sovereignty “was destroyed by those who staged and supported a coup, the leaders of which then declared a war on their own people,” Lavrov said, referring to the 2014 Maidan coup. The US and its allies are de-facto engaged in a conflict with Russia, Lavrov told the press conference. “We call it a hybrid war but it does not change things,” he said. Western nations are sending arms to Kiev and training its troops, he explained, so “They are de-facto fighting against us with the hands and bodies of Ukrainians.” Western nations also openly say that “Russia should be defeated on the battlefield,” Moscow’s top diplomat said, adding that Moscow is ready for such a development. “Under such circumstances, [if they want it] to be on the battlefield, let it be on the battlefield,” he said.

https://twitter.com/i/status/1705689214296129785

“The only alternative would then be to activate a gigantic airlift of additional forces into Europe with U.S. cargo planes sitting ducks for destruction en route. Impossible.”

• Is World War III About to Start? Part I: Drift Toward War (Cook)

Now the U.S., with the Neocons firmly entrenched in the State Department and elsewhere, surrounded Russia with military bases and attacked its perimeter with color revolutions in Georgia, Ukraine, and Kyrgyzstan, following on the dismemberment of Yugoslavia in the late 1990s and early 2000s. President Barack Obama then situated the Aegis Missile Defense System in Poland and Romania with the potential to activate missiles that could reach Moscow with nuclear warheads in six minutes. Talk was current of a possible “decapitation” strike against the Russian leadership. Finally, in 2014, with “cookies” Victoria Nuland and Vice President Joe “Burisma” Biden in charge, the U.S. fomented a coup in Ukraine with the aid of paid snipers to drive out a president friendly toward Russia and his replacement with a NeoNazi junta that put Ukraine on a war footing.

In response, Russia annexed the Crimean Peninsula, where Sevastopol is the home of its Black Sea fleet, with 85 percent popular approval, while the eastern Ukrainian Donbass provinces of Donetsk and Lugansk, ethnically-Russian, declared independence. Finally, after eight years of Ukrainian provocations, the death from Ukrainian shelling of more than 10,000 Donbass civilians, and the treachery of Germany and France in failing to uphold the Minsk agreements they had guaranteed, Russia entered Ukraine with its military forces in February 2022. The conflict was on, a conflict that Russia is winning. U.S.-led sanctions against Russia failed to bring down its economy or force regime change against Putin. But each Ukrainian setback on the battlefield has been followed by more weapons and money supplied to the Volodymyr Zelensky regime by the U.S., UK, Germany, France, and other NATO members.

But who was calling the shots? In March 2022, Russian and Ukrainian negotiators reached agreement on a tentative settlement at meetings in Istanbul. UK prime minister Boris Johnson then rushed to Kiev to induce Zelensky to tear up the agreement and continue the war. Western escalation has included billions of dollars worth of heavy tanks and other weapons to Ukraine, along with cluster munitions and depleted uranium projectiles. There have been drone attacks on Russia itself and on Crimea. But the Ukrainian counteroffensive has collapsed, with speculation increasing of a major Russian counterattack, possibly even cutting Ukraine off from the Black Sea.

We have now come full circle. Warnings from Washington continue that Putin had better not go nuclear, which can be read as inviting him to do so. This is obviously a new phase of brinkmanship that could give the U.S. a pretext for themselves moving to nuclear war. Meanwhile, the U.S. understands that it could in no way challenge Russia in a conventional war even with the entire NATO alliance being activated. Even then, divisiveness within NATO and the absence of sufficient military force anywhere in Europe make this impossible at present. Veteran military analyst Scott Ritter writes in Sputnik News on September 21, 2023, that even were the U.S. to activate its entire military force stationed in Europe against Russia, it would be defeated within one to two weeks of intensive combat. The only alternative would then be to activate a gigantic airlift of additional forces into Europe with U.S. cargo planes sitting ducks for destruction en route. Impossible.

“..deep emotions rather than reasoned thought are propelling us toward an avoidable, potentially catastrophic conflict..”

The march to war with China defies all conventional wisdom. After all, it poses no military threat to our security or core interests. China has no history of empire-building or conquest. China has been the source of great economic benefit via dense exchanges that serve us as well as them. Therefore, what is the justification for the widespread judgment that a crossing-of-swords is inescapable? Sensible nations do not commit themselves to a possibly cataclysmic war because China, the designated number one enemy, builds radar warning stations on sandy atolls in the South China Sea. Because it markets electric vehicles more cheaply than we can. Because its advances in developing semi-conductors may outclass ours.

Because of its treatment of an ethnic minority in western China. Because it follows our example in funding NGOs that promote a positive view of their country. Because it engages in industrial espionage just the way the United States and everybody else does. Because it wafts balloons over North America (declared benign by General Milley last week). None of these are compelling reasons to press hard for a confrontation. The truth is far simpler – and far more disquieting. We are obsessed with China because it exists. Like K-2, that itself is a challenge for we must prove our prowess (to others, but mainly to ourselves), that we can surmount it. That is the true meaning of a perceived existential threat. The focal shift from Russia in Europe to China in Asia is less a mechanism for coping with defeat than the pathological reaction of a country that, feeling a gnawing sense of diminishing prowess, can manage to do nothing more than try one final fling at proving to itself that it still has the right stuff – since living without that exalted sense of self is intolerable.

What is deemed heterodox, and daring, in Washington these days is to argue that we should wrap up the Ukraine affair one way or another so that we might gird our loins for the truly historic contest with Beijing. The disconcerting truth that nobody of consequence in the country’s foreign policy establishment has denounced this hazardous turn toward war supports the proposition that deep emotions rather than reasoned thought are propelling us toward an avoidable, potentially catastrophic conflict. A society represented by an entire political class that is not sobered by that prospect rightly can be judged as providing prime facie evidence of being collectively unhinged.

Second, amnesia may serve the purpose of sparing our political elites, and the American populace at large, the acute discomfort of acknowledging mistakes and defeat. However, that success is not matched by an analogous process of memory erasure in other places. We were fortunate, in the case of Vietnam, that the United States’ dominant position in the world outside of the Soviet Bloc and the PRC allowed us to maintain respect, status and influence. Things have now changed, though. Our relative strength in all domains is weaker, there are strong centrifugal forces around the global that are producing a dispersion of power, will and outlook among other states. The BRICs phenomenon is the concrete embodiment of that reality. Hence, the prerogatives of the United States are narrowing, our ability to shape the global system in conformity with our ideas and interests are under mounting challenge, and premiums are being placed on diplomacy of an order that seems beyond our present aptitudes. We are confounded.

Yeah, America loves flip-floppers.

• McCarthy Reverses Course, Maintains Ukraine Aid in Pentagon Funding Bill (Sp.)

In a surprising shift, Speaker Kevin McCarthy (R-CA) announced he will keep $300 million in Ukraine aid within the Pentagon funding bill, going back on his earlier decision to remove it due to opposition from Rep. Marjorie Taylor Greene (R-GA). McCarthy’s decision was explained during a press briefing at the Capitol, where he revealed that he had reconsidered after realizing that another spending measure, which is set to be considered next week and funds the State Department and Foreign Operations, also includes financial support for Ukraine. Stripping Ukraine aid from the State Department and Foreign Operations bill became “more difficult to do,” leading McCarthy to choose to maintain the funding for Ukraine in both appropriations measures.

The House is scheduled to take a procedural vote next week to advance four appropriations bills, including those that fund the Pentagon and the State Department and Foreign Operations. McCarthy acknowledged that despite his decision to retain Ukraine aid in both bills, there will still be votes on amendments to remove the aid from both spending bills, according to Rep. Garret Graves (R-LA). However, these votes may not take place if lawmakers block the measures from being debated. A coalition of House conservatives had previously opposed the rule for the Pentagon appropriations bill twice this week, preventing the legislation from advancing to debate and a final vote.

These unexpected failures to pass the rule have presented challenges for McCarthy, who is trying to advance spending bills ahead of the September 30 government funding deadline. The Pentagon funding bill includes $300 million earmarked “to provide assistance, including training; equipment; lethal assistance; logistics support, supplies and services; salaries and stipends; sustainment; and intelligence support to the military and national security forces of Ukraine… for replacement of any weapons or articles provided to the Government of Ukraine from the inventory of the US.” McCarthy is facing threats of a “vote to vacate” from members of his own party, which would boot him from his speaker position.

NYT appears to lead the change in MSM narrative.

• Kiev’s Counteroffensive Unlikely To Achieve Its Goals – US Officials (RT)

Officials in Washington have suggested that Ukraine’s military forces won’t be able to cut Russia’s land bridge to Crimea as part of their counteroffensive or achieve other key goals, the New York Times has reported. “Some American officials have said that the Ukrainian counteroffensive appears likely to fall short of its strategic goals,” the paper reported in an article on Friday. Kiev’s forces are struggling to achieve the aim of reaching the Sea of Azov in Russia’s Zaporozhye Region, because the minefields set up by Moscow’s forces, they say, have proven to be “a potent defense,” the Times added. According to US officials, conducting offensive operations would also soon become even more difficult for Ukraine “as the ground becomes soft and muddy”in the region.

The NYT also said that some in Washington have warned that “within a few weeks, the Ukrainian army will need time to rebuild their stockpile of equipment and to rest forces exhausted by the summer fighting.” The Ukrainian counteroffensive was launched in early June, although Kiev has so far only reported the capture of a handful of small villages some distance away from the main Russian defense lines. President Vladimir Putin said earlier this month that Ukraine has lost more than 71,000 troops and over 540 tanks since the beginning of summer, while failing to achieve any significant results on the battlefield. On Friday, President Vladimir Zelensky told journalists in Washington that Kiev “will do everything not to stop during difficult days in autumn with poor weather and in winter.”

Zelensky claimed that Ukraine has a “very, very comprehensive plan”to “de-occupy” Artyomovsk (known as Bakhmut in Ukraine) and two other cities, which he refused to name, in the coming months. Ukraine suffered huge losses trying to defend Artyomovsk and the strategic city in Donetsk People’s Republic nonetheless fell under Russian control in May, after months of fighting. The NYT pointed out that US intelligence and military had warned the Zelensky government against spending its manpower and resources in Artyomovsk, suggesting that it would be better focused on operations in Zaporozhye Region. “Some American officials say the fight in [Artyomovsk] has become something of an obsession for Mr Zelensky and his military leaders,”the paper said.

‘there’s nothing like that right now in the White House. There’s no communication whatsoever.’

• Jackson Hinkle: Western Elites Want War Against Russia, China (Sp.)

The US establishment is not hesitant to start World War Three to maintain its globalist dominance, American political commentator Jackson Hinkle told Sputnik’s New Rules podcast.” I guess Tucker [Carlson] has got a point when he says, ‘I’m willing to bet my house that Joe Biden is going to start World War Three with Russia,’ because look what they’ve done,” Jackson Hinkle told Sputnik. “These people are insane. Even like, taking [ex-House Speaker Nancy] Pelosi on her jet to go to Taiwan and meet with Taiwanese officials. There was a lot of people, myself included, who were thinking, ‘Goodness, the [Chinese] People’s Liberation Army (PLA) is going to shoot her out of the sky or something right now? Is this going to be how it all begins?’ They’re reckless. They are completely Russophobic and beating the drums of war to go to war with China.”

Moreover, the American elite’s hostility toward Russia has surpassed that of the Cold War era, leading to a worrying breakdown in communications between Washington and Moscow, according to the political commentator. “The level of communication breakdown is so severe compared to the Cold War,” he said. “I got to meet the guy that actually developed the telephone, they had the red hotline telephone between the US and the USSR during the Cold War. And he told me he’s like, ‘there’s nothing like that right now in the White House. There’s no communication whatsoever.’ And we’re not too far off from that same sort of a lack of dialogue with the Chinese, because they want to go to war against the Chinese.”

It did not happen overnight, according to the analyst. Over the past 30 years, Washington and its allies have reneged on all the pledges they made to Moscow at the end of the Cold War. One of them was a verbal promise that NATO would not extend an inch east of Germany. “NATO since then, at the behest of the US, has violated that promise on 16 occasions now,” Hinkle remarked. The transatlantic alliance does not conceal its plans to draw in Ukraine and possibly Georgia, thus moving even closer to Russia’s borders.”

“You won’t see RFK, Jr. tripping on stairs, falling off his bicycle at 5 mph, or saying I have to go to bed now during a news interview.”

• RFK, Jr. As A Third-Party Candidate (AT)

Even as President Joe Biden leads in the 2024 primaries, Democrat presidential contender Robert F. Kennedy Jr. has higher favorability and lower unfavorability numbers than either President Joe Biden and former President Donald Trump, (Trump 43%, Biden 41%, RFK, Jr. 14% unfavorability) according to a new poll by The Economist/YouGov. Rasmussen reports that a survey also revealed that twenty-five percent (25%) of likely Democrat voters would vote for RFK Jr. in the 2023 primaries for President. Three percent (3%) of Democrats favor author Marianne Williamson in the primaries, while seven percent (7%) would vote for another candidate. The Rasmussen Report is based on a national survey of 998 U.S. likely voters conducted September 14 and 17-18, 2023.

Teddy Roosevelt ran for president in 1912 on the Progressive Party ticket, a third party, against incumbent Republican President William Howard Taft. Taft was elected president in 1908, the successor of Teddy Roosevelt, but was defeated for reelection in 1912 by Woodrow Wilson because Roosevelt’s third party split the Republican vote. The Republicans won in 1920 with a campaign positioned around opposition to Wilson’s policies with Warren G. Harding promising a “return to normalcy.” Sound familiar? The Progressive Party was nicknamed the Bull Moose Party when Roosevelt boasted that he felt “strong as a bull moose” after losing the Republican nomination at the June 1912 convention in Chicago. RFK, Jr. is as strong as a bull moose both physically and mentally. RFK, Jr. is jacked and that is well documented. At 69, he is ripped like few others his age. He’d beat Putin in a Mr. Universe Senior contest. You won’t see RFK, Jr. tripping on stairs, falling off his bicycle at 5 mph, or saying I have to go to bed now during a news interview.

Don’t let spasmodic dysphonia, a neurological disorder that causes involuntary spasms in the larynx, cloud your judgement about RFK, Jr.’s mental acuity or toughness. He lived through the tragedy of his uncle, President John F. Kennedy and his dad’s assassinations, and has had an extraordinarily successful career as an environmental lawyer fighting for sane policies against the U.S. Department of Environment Protection and big business. His ideas on foreign policy, the economy, and other critical issues are clear, logical, and convincing. His detractors want you to believe he is feeding Americans’ hunger for conspiracies. Americans have been fed conspiracies constantly by the extreme Left. The Left bombards us every day with “conspiracy theories” that is if you liken a conspiracy to a lie.

RFK, Jr. explained convincingly the circumstances and facts surrounding his uncle’s death in a recent speech at a private residence New Hampshire. Attend one of his campaign events to find out firsthand that JFK, Jr. is a straight shooter, extremely well versed, and perspicacious on a multitude of topics affecting Main Street America. Can RFK, Jr. win the presidency on a third-party ticket? Who knows? At the very least a third party would in all likelihood obtain enough votes to allow a pro-Main Street America candidate like former President Donald J. Trump. This country needs to return to what made America great: hard work, freedom to choose, and the right to speak without fear of disparagement, or worse.

It’s sort of amusing. But mostly, it’s deeply sad.

• California Democrats Could Guarantee Trump 2024 Win (Seiler)

Trump’s actions on Jan. 6, 2021 supposedly made him the leader of an “insurrection.” The best argument against that was advanced by former U.S. Attorney General Michael Mukasey in the Wall Street Journal: “The use of the term ‘officer of the United States’ in other constitutional provisions shows that it refers only to appointed officials, not to elected ones. In US vs Mouat (1888), the Supreme Court ruled that ‘unless a person in the service of the government … holds his place by virtue of an appointment … he is not, strictly speaking, an officer of the United States. Chief Justice John Roberts reiterated the point in Free Enterprise Fund v. Public Company Accounting Oversight Board (2010): ‘The people do not vote for the Officers of the United States.” ”

Now, here’s where it gets interesting. Hypothetically, what if Mr. Mukasey’s argument doesn’t hold up in the courts? Then California and other states’ attorneys general and governors, or lawsuits by political groups, could throw Mr. Trump off the ballot. Especially critical would be the swing states with Democratic governors: Wisconsin Gov. Tony Evers, Pennsylvania Gov. Josh Shapiro, Michigan Gov. Gretchen Whitmer, Kentucky Gov. Andy Beshear, and North Carolina Gov. Roy Cooper. Or Fulton County (Atlanta) District Attorney Fani Willis, already prosecuting Trump for allegedly interfering in the 2020 election, could do it. But then, Republicans could do it in their swing states, throwing President Joe Biden off the ballot. They could say his alleged bribes from Communist China disqualify him under the 14th amendment’s Section 3 wording for having “given aid or comfort to the enemies thereof.”

Republicans governors invoking that clause could include Glenn Youngkin of Virginia, Brian Kemp of Georgia, Kim Reynolds of Iowa, Joe Lombardo of Nevada, and Chris Sununu of New Hampshire. It would be what in military parlance is called Mutual Assured Destruction. If that happened, neither Mr. Trump nor Mr. Biden would reach the 270 electoral votes needed to win the presidency in the Electoral College. Then what? Then we would have the fourth of what s called a Contingent Election, although the phrase itself isn t in the Constitution. It means the matter is decided by the House of Representatives (or the Senate for vice presidents). There have been three so far: Thomas Jefferson beat Aaron Burr in 1800; John Quincy Adams beat Andrew Jackson in 1825. And in 1837 the vice presidential election was given to Richard Mentor Johnson over Francis Granger.

Under a Contingent Election in the House, all 435 members don’t get to vote. Rather, each state delegation gets one vote, 50 votes total. On Sept. 18 Canadian political writer Stephen Marche wrote an article for the left-wing Guardian titled, Here’s the scary way Trump could win without the electoral or popular vote: In a contingent election, he could lose the popular vote, electoral college and all his legal cases and still end up the legal US president. He calculated: State delegations in the House would favor Republicans as a matter of course. In the struggle for congressional delegates, Republicans would have 19 safe House delegations and the Democrats would have 14, as it stands, with more states leaning Republican than Democrat. So California, by knocking Mr. Trump off the ballot, could guarantee he becomes president.

Again, none of this is likely to happen. If any state tries to keep him off the ballot, the courts almost certainly would put him back on, possibly reasoning along the lines Mr. Mukasey detailed. There’s one thing this whole escapade teaches us: A large number of California’s politicians hold in contempt the Constitution, democracy, and the people of the state they claim to represent. In this train-wreck of a state, with housing, homelessness, drug addiction, schooling, budget, and countless other problems festering—don’t they have anything better to do?

“..guaranteeing the right of the Palestinian people to create an independent state within the 1967 borders..”

• Middle East Security Requires Solution to Palestinian Issue – Saudi FM (Sp.)

Security in the Middle East requires a fair and comprehensive solution to the Palestinian problem, Saudi Foreign Minister Faisal bin Farhan Al Saud said on Saturday. “Security in the Middle East requires an acceleration in the search for a just and comprehensive solution to the Palestinian problem based on international law and the Arab peace initiative, guaranteeing the right of the Palestinian people to create an independent state within the 1967 borders,” the Saudi minister said at the UN General Assembly, adding that his country rejects any actions that impede the resolution of the Palestinian issue Bin Farhan Al Saud also noted the need for de-escalation in Sudan, called for a solution to the Syrian crisis and declared the country’s interest in security and stability in Yemen.

In addition, the minister said that Riyadh is striving to stabilize energy prices. On Wednesday, Saudi Crown Prince Mohammed bin Salman Al Saud said that the country is “getting closer every day” to normalizing relations with Israel. On Friday, Israeli Prime Minister Benjamin Netanyahu said that Israel is on the verge of a historic peace agreement with Saudi Arabia, which will change the face of the Middle East. Relations between Palestine and Israel have been adversarial since the latter’s founding in 1948. Palestinians seek diplomatic recognition of their independent state on the territories of the West Bank, including East Jerusalem, which is partially occupied by Israel, and the Gaza Strip. The Israeli government refuses to recognize Palestine as an independent political and diplomatic entity and continues to build settlements in the occupied areas despite objections from the United Nations.

“..if you’re going to leave your country, go somewhere else.”

• Elon Musk: Media ‘Instructed Not To Cover’ Border Crisis (Fox)

Billionaire and X, formerly known as Twitter, owner Elon Musk on Thursday accused news outlets of ignoring the crisis along the southern border because they were “instructed” not to cover it. FOX News national correspondent Bill Melugin posted on social media how local news networks are covering the migrant crisis more than other national news networks. “Watching the TVs at gym in Eagle Pass. Every single local news station in the San Antonio market, both English & Spanish, are leading their shows and have much of their A blocks centered on the border crisis and the mass illegal crossing in Eagle Pass today,” he wrote. “National networks were MIA at the bridge today, other than @FoxNews.” Musk responded to Melugin’s post by writing, “This gets no coverage because the media NPCs are instructed not to cover it.”

NPC stands for “non-player characters,” meaning scripted characters in video games that are programmed with specific behavior rather than directly controlled by a human being. The term is used online for someone who doesn’t think for themselves. Thousands of predominantly Venezuelan adult illegal immigrants moved into Texas and gathered under a nearby bridge on Wednesday. Texas troopers told FOX News that their initial count of the number of migrants moving across the water into Eagle Pass on Wednesday was about 4,000. The migrants gathered under the bridge and were waiting to be processed by Border Patrol, in the hope of being released into the U.S. Concern about the border has reached a fever pitch in recent weeks as even some Democrats are warning that the crisis has gotten out of control, while other liberal figures still reject those claims.

Democratic New York City Mayor Eric Adams made an ominous warning about the immigration crisis at a town hall meeting earlier this month. “I don’t see an ending to this. I don’t see an ending to this. This issue will destroy New York City. Destroy New York City,” he said. MSNBC host Mehdi Hasan responded by ridiculing the mayor in a social media post, referring to him as a “Trump knock-off.” Gov. Kathy Hochul, D-N.Y., similarly faced mockery after telling migrants, “We don’t have capacity, so we have to also message properly that we’re at our limit, if you’re going to leave your country, go somewhere else.”

“..entering the US illegally now ranks up there with “basic American values.”

• What Biden’s Open-Border Agenda Means For The US (Robert Bridge)

The defenders of open US borders like to sell the happy, optimistic narrative that asylum seekers are primarily innocent people looking to build a better life in the United States. The raw data, however, points to a much more complicated story. It’s the rarest occurrence of all when politicians admit that they were wrong, but that’s what is (almost) happening in Democrat-ruled cities, including New York, Chicago and Los Angeles, which are being forced to absorb a continuous influx of migrants, together with a large slab of humble pie. “Let me tell you something New Yorkers, never in my life have I had a problem that I did not see an ending to — I don’t see an ending to this,” New York City Mayor Eric Adams told a hushed audience in Manhattan as he called for federal assistance just days before the anniversary of 9/11. “This issue will destroy New York City.” “We are past our breaking point,” Adams continued with his apocalyptic plot. “New Yorkers’ compassion may be limitless, but our resources are not.”

Back on the campaign trail in 2021, Adams’ campaign posted on what was then Twitter: “We should protect our immigrants. Period. Yes, New York City will remain a sanctuary city under an Adams administration.” Much of the Democratic Party’s headache stems from the creation of so-called ‘sanctuary cities,’ defined as a municipality that limits or rejects cooperation with the federal government in enforcing immigration law. In other words, the sort of neighborhood Antifa would fully endorse. Sanctuary policies have been around since the late 1970s, but they were practically unheard-of until quite recently. The Federation for American Immigration Reform (FAIR) estimated that 564 US jurisdictions had adopted sanctuary policies in 2018. To put that into perspective, there were just 40 such protected zones when Barack Obama was sworn into the White House in 2009.

Not surprisingly, many illegal migrants, without any means of supporting themselves, flock to these ‘arrest-free’ zones where they can take advantage of social services such as housing, health care and public education without any fear of deportation. But it goes beyond just free handouts. Here is how FAIR describes sanctuary cities, and the obstacles they place in front of law enforcement and border patrol: “In their various forms, [sanctuary policies] forbid state and local officials (including law enforcement officers) from asking people about their immigration status; reporting suspected illegal aliens to the federal government; holding criminal aliens for arrest by US Immigration and Customs Enforcement (ICE); or otherwise cooperating with or assisting federal immigration enforcement agents. These policies endanger public safety and enjoy very little public support. Rather, they are the product of intense pressure from well-funded groups that oppose nearly all forms of immigration enforcement, or due to the capitulation by local officials in the face of threatened lawsuits by self-anointed ‘civil liberties’ organizations.”

The ACLU, for example, is of the opinion that the actions of sanctuary cities “represent basic American values: a spirit of inclusiveness and respect for individual rights.” In other words, entering the US illegally now ranks up there with “basic American values.”

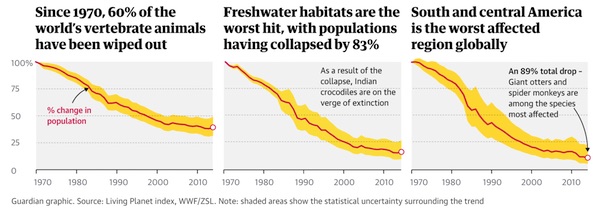

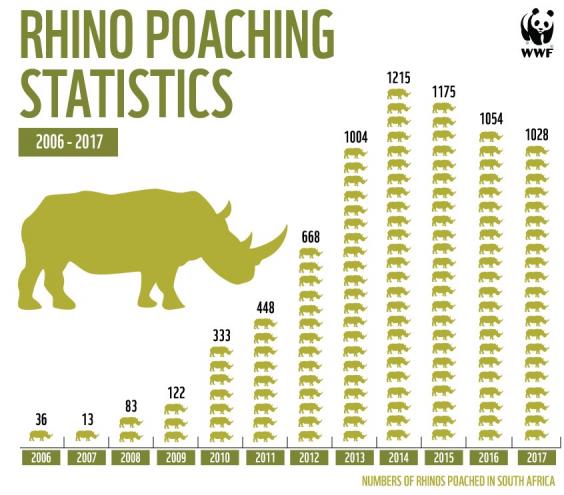

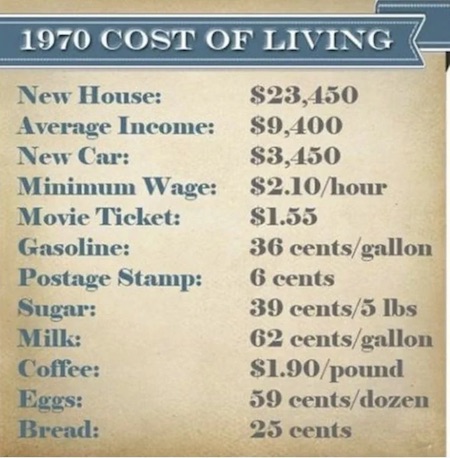

1900: 500,000

1970: 70,000

2022: 23,290

• Rhino Population Increasing In Africa For 1st Time In Decade (RT)

The African rhino population is growing across the continent for the first time in a decade, despite poaching remaining high, the International Union for Conservation of Nature (IUCN) announced. According to the figures released ahead of the World Rhino Day on Friday, there was an estimate of 23,290 total rhinos at the end of 2022, an increase of 5.2% from the year before. Most notably, the number of white rhinos, which were assessed for The IUCN Red List of Threatened Species in 2020, has grown by 5.6% and now stands at around 16,803 animals. This is the first increase since 2012.

“With this good news, we can take a sigh of relief for the first time in a decade. However, it is imperative to further consolidate and build upon this positive development and not drop our guard,” said Dr Michael Knight, Chair of the IUCN African Rhino Specialist Group (AfRSG). According to IUCN’s website, the positive development is attributed to a combination of protection and biological management initiatives by the privately owned Platinum Rhino project, which is aimed at protecting and breeding the species to prevent extinction. Earlier this year, the project was sold to the African Parks Foundation, which plans to rewild 2,000 rhinos over the coming decade. There are five species of rhino in the world, with Africa being a home to the white and black rhinos, while the remaining three – the Sumatran, Javan and Indian rhinos – live in Asia.

Poaching remains a huge problem. According to official figures, 448 rhinos were illegally killed in South Africa in 2022, with neighboring Namibia recording 93 poached rhinos. While the numbers are still concerning, they represent a significant decline from in 2015, when 1,349 African rhinos were poached. At the beginning of the 20th century, about 500,000 rhinos roamed Africa and Asia. Their numbers dropped to just 70,000 by 1970. Despite southern white rhinos currently thriving in protected sanctuaries, the western black rhino and northern white rhinos have recently become extinct in the wild. The only two remaining northern white rhinos are kept under 24-hour guard in Ol Pejeta Conservancy in Kenya.

Dogs ball

https://twitter.com/i/status/1705482313700712594

Elephant

The story of the elephant calf that fell into a manhole, of its mother that continued to breastfeed it risking to die and of the wonderful people who saved them both in the Khao Yai National Park, Thailand pic.twitter.com/NwK8YhjltP

— Massimo (@Rainmaker1973) September 23, 2023

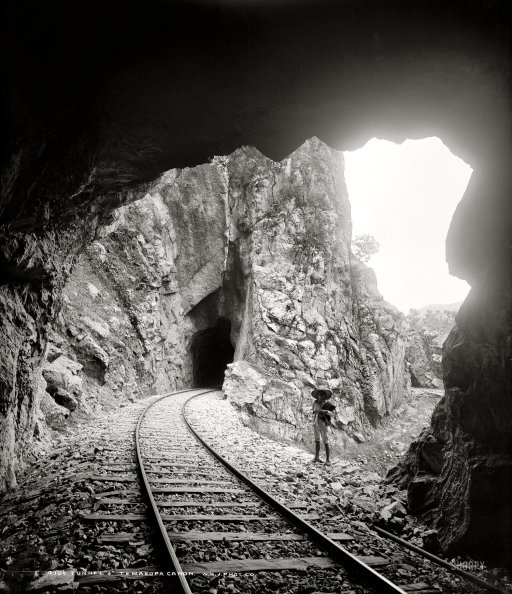

Sandstone

Al-Khazneh ("The Treasury") one of most elaborate temples in Petra, a city of Nabatean Kingdom inhabited by Arabs in ancient times. As with most of other buildings in this ancient town, including Monastery (Ad Deir), this structure was carved out of a sandstone rock face.… pic.twitter.com/nB05m0C0n2

— Archaeo – Histories (@archeohistories) September 23, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.