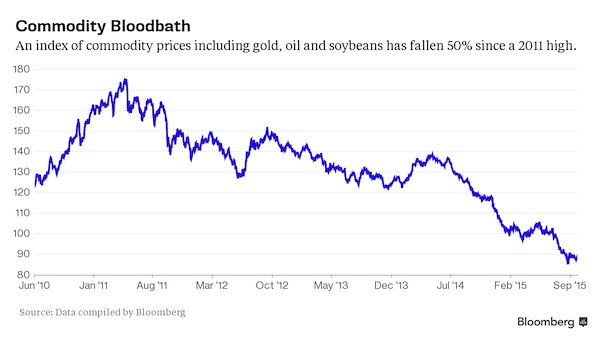

Stonehenge 1897

Vote for independence, get the opposite. A feature not a flaw in the EU.

• Spanish PM Dissolves Catalan Parliament And Calls Fresh Elections (G.)

The Spanish government has taken control of Catalonia, dissolved its parliament and announced new elections after secessionist Catalan MPs voted to establish an independent republic, pushing the country’s worst political crisis in 40 years to new and dangerous heights. Speaking on Friday evening, the Spanish prime minister, Mariano Rajoy, said his cabinet had fired the regional president, Carles Puigdemont, and ordered regional elections to be held on 21 December. Rajoy said the Catalan government had been removed along with the head of the regional police force, the Mossos d’Esquadra. The Catalan government’s international “embassies” are also to be shut down. “I have decided to call free, clean and legal elections as soon as possible to restore democracy,” he told a press conference, adding that the aim of the measures was to “restore the self-government that has been eliminated by the decisions of the Catalan government.

“We never, ever wanted to get to this situation. Nor do we think that it would be good to prolong this exceptional [state of affairs]. But as we have always said, this is not about suspending autonomy but about restoring it.” The actions came hours after Spain’s national unity suffered a decisive blow when Catalan MPs in the 135-seat regional parliament voted for independence by a margin of 70 votes to 10. Dozens of opposition MPs boycotted the secret ballot, marching out of the chamber in Barcelona before it took place and leaving Spanish and Catalan flags on their empty seats in protest. Minutes later in Madrid, the Spanish senate granted Rajoy unprecedented powers to impose direct rule on Catalonia under article 155 of the constitution. The article, which has never been used, allows Rajoy to sack Puigdemont and assume control of Catalonia’s civil service, police, finances and public media.

Finland, Argentina, perhaps Scotland, who’s next?

• Finland Prepares Parliamentary Vote To Recognize Catalonia (Exp.)

Finland could be the first country to officially recognise Catalonia as a republic state, in a move that would put the Scandinavian country in direct opposition to the EU. The country’s MP for Lapland Mikko Karna has said that he intends to submit a motion to the Finnish parliament recognising the new fledgling country. Mr Karna, who is part of the ruling Centre Party, led by Prime Minister Juha Sipila, also sent his congratulations to Catalonia after the regional parliament voted earlier today on breaking away from the rest of Spain. Should Finland officially recognise the new state of Catalonia this will be yet another body blow to the the EU which has firmly backed the continuation of a unified Spain under the control of Madrid. European Commission President Jean-Claude Juncker warned today that “cracks” were appearing in the bloc due to the seismic events in Catalonia that were causing ruptures through the bloc.

Donald Tusk, the President of the European Council, said earlier today that for the EU nothing changes despite the Catalan parliament voting to breakaway from Spain. He said that the EU would continue to only speak with Spain. If Finland recognised Catalonia then this would make a mockery of the EU’s refusal to acknowledge the region’s new status. A statement from the European Union on October 2 read: “Under the Spanish Constitution, yesterday’s vote in Catalonia was not legal. [..] Argentina could also formally recognise the Republic of Catalonia and reject the intervention of the Spanish Prime Minister Mariano Rajoy who has moved to implement Article 155 which will permit Madrid to take over control of the semi-autonomous region. Socialist Left Argentine MP Juan Carlos Giordano, who represents Buenos Aires Province said that he would present a bill in parliament for the South American country to recognise Catalonia.

The Scottish Government has also sent a message of support, saying that Catalonia “must have” the ability to determine their own future. [..] “The European Union has a political and moral responsibility to support dialogue to identify how the situation can be resolved peacefully and democratically.”

“Eva Kaili MEP, an advocate of fintech innovation who was a politician in Greece at the time of the crisis, recounts that the plan was taken seriously. “We talked about leaving the eurozone, finding another currency,” said Kaili. “There was even a ‘Plan B’, which involved essentially hacking into everyone’s accounts and replacing all their money with Bitcoin.”

• Catalonia Looks To Estonia’s E-Residency, Considers Cryptocurrency (IBT)

As Spain is poised to seize control of the Catalan government and stop the region’s bid for independence, an initiative is underway to emulate Estonia’s innovative e-residency programme. Technology advocates in Catalonia, which is reputed to be ahead of the rest of Spain in areas like fintech, are also reportedly touting the possibility of a national cryptocurrency or digital token, something Estonia has also been considering. An article in Spain’s main daily newspaper El Pais reports that digital transformation experts working for the Government of Catalonia, the Generalitat de Catalunya, have visited Estonia several times to gather tips on how to implement an e-residency programme. Dani Marco, director of SmartCatalonia, who appears to be heading up the initiative, pointed out that the Estonians “started from scratch, with all the possibilities they were offered to build a model of economic development.”

The article goes on to namecheck Vitalik Buterin, inventor of the next generation public blockchain Ethereum, who was attending a technology conference in Barcelona. The takeaway was that Catalonia could follow Estonia’s proposal to issue some flavour of national blockchain tokens – a decentralised store of value in other words. Most of the time you hear about banks stating that cryptocurrencies like Bitcoin are only good for criminals, or that they are too slow, or volatile to be of any real use. However, issuing digital currency without the need for a central bank is undoubtedly a bona fide use case. Moreover, the mere mention of Estonia in this context is somewhat incendiary: the digitally advanced Baltic nation recently proposed issuing a national cryptocurrency – the so-called “Estcoin”.

This would make it the first nation to carry out an initial coin offering (ICO), a new way of funding technology projects by issuing tokens on a blockchain. A blogpost on the subject garnered so much interest and media attention that in the end ECB chief Mario Draghi publicly slapped down the proposal. “No member state can introduce its own currency; the currency of the eurozone is the euro,” he said. The other thing that Estonia has perfected across its 1.3 million e-residents is a secure and tamper-resistant e-voting system. [..] It was not widely reported, but during the years of punishing austerity that followed the banking bailouts, Greece considered a desperate measure called “Plan B”, which essentially involved switching from the euro to Bitcoin.

Eva Kaili MEP, an advocate of fintech innovation who was a politician in Greece at the time of the crisis, recounts that the plan was taken seriously. “We talked about leaving the eurozone, finding another currency,” said Kaili. “There was even a ‘Plan B’, which involved essentially hacking into everyone’s accounts and replacing all their money with Bitcoin. “Plan B was quite well drafted. Move all accounts into to Bitcoin, establish Bitcoin ATMs – it’s scary, and of course it goes against the ethos of Bitcoin and being in control of your own assets. But look what happened in Cyprus; sometimes you are not safe from your own government.”

“..the European Union is about unifying Europe — this is a great example of it actually causing Europe to fragment.”

• EU Economic Failures Are To Blame For Catalonia Mess – Steve Keen (Sp.)

Sputnik: Quite extraordinary scenes this afternoon in Catalonia. Are you surprised it’s come to this? Steve Keen: No, I am not. One thing that we tend to forget is that the last fascist dictator to die in his sleep was the last fascist ruler of Spain. So there’s a deep tendency for authoritarian reactions in that country. But in the meantime, the real story I think is the impact of the euro causing effectively depressions through southern Europe. And areas that were rich before the euro came are the ones that are leading revolts against it right now. Catalonia, of course, is the prime example!

Sputnik: People see this as a problem for Spain, but isn’t it a bit of a problem for the EU too? Steve Keen: Absolutely! The EU has completely sided with Spain, the only thing it did was acknowledge that the actual referendum was illegal. It didn’t make any mention of the heavy-handed treatment by the Spanish police and of the enforcing of that judgment. They should have been far more sensible simply ignoring it. The EU has aligned itself here with basically suppressing democratic tendencies inside its own member countries. Sputnik: Do you think that’s actually recognized by the European public? Or has it gone unnoticed?

Steve Keen: I think it’s gone unnoticed because the real reason to form the European Union was to bring about European unity. And that was, of course, a noble aim after the Second World War. But the mistake was the economic system into which it was imposed. And if you’re trying to bring about economic democracy of a continental level, when you don’t have a treasury at the same time and you don’t have a way of equalising the impact of trade imbalances, which is what removing the flexible exchange rates prior to the euro ended up causing, then you have a system which will end up causing crisis after crisis. Which is, of course, what happened with the global financial crisis leading to great-depression-levels of unemployment in Spain. And they’re still at 17% of the population. For everyone who thinks that the European Union is about unifying Europe — this is a great example of it actually causing Europe to fragment.

It’s getting ugly. And murky.

• Robert Mueller’s First Charges (Atlantic)

The special counsel overseeing the Russia investigation reportedly obtained a sealed indictment on Friday. It’s the end of the beginning for the Russia investigation. Special Counsel Robert Mueller’s team has reportedly filed the first criminal charges as part of the sprawling inquiry into Moscow’s interference in the 2016 presidential election, CNN reported Friday night. Citing “sources briefed on the matter,” the network said a federal grand jury in Washington, D.C., approved the charges, which have been sealed by a federal judge. CNN did not indicate who had been charged, how many people had been charged, or what charges had been filed by Mueller’s team. An arrest could come by Monday. Reuters subsequently confirmed CNN’s reporting.

John Q. Barrett, a St. John’s University law professor and former associate special counsel in the Iran-Contra affair, said that a sealed indictment itself is rare, as is its disclosure to the press. “It’s possible that this could come from sources in the Department of Justice or defense counsel, each of which would have been likely to know that charges were going to be sought and that a sealing order was going to be sought,” he explained. “It’s unusual and would be a serious violation,” Matthew Miller, a former Justice Department spokesman under the Obama administration, said Friday night. “No one outside of the Justice Department or the court—including grand jurors, court reporters and such—should know, with the possible exception of the defendant’s attorney, who might have been briefed to arrange surrender.”

No matter who is indicted, the move will send shockwaves throughout the Trump administration and the nation’s capital. Until now, the Russia investigation has followed President Trump’s first year in office like a shadow, darkening his political fortunes without substantially altering them. A federal indictment of anyone connected to the Trump campaign or the White House would turn that theoretical danger into hard reality.

The problems that crawl up on you in the dark of night.

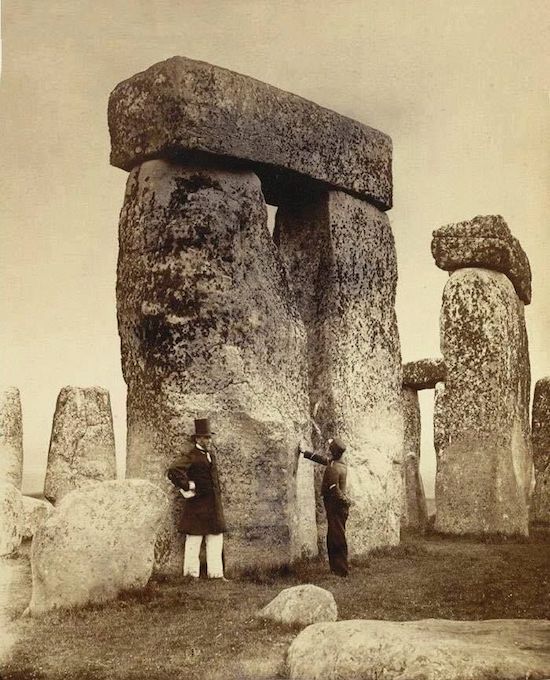

• Large U.S. Cities Struggle With High Fixed Costs (BBG)

Cities across the U.S. often feel the same pinch—trying to manage the typical costs of running a city, such as picking up trash and filling potholes, on top of ballooning retirement obligations and outstanding debts. Several major cities are struggling to keep up. The culprit: As employees age and retire, cities are on the hook for funding more pensions and health-care benefits. In 2016, local governments faced a pension investment gap of $3.7 trillion, according to Moody’s Investors Service. Their predicament only worsens when cities fall behind in making those payments or their investments lag. When you measure those fixed costs against a city’s operating budget, no major city is as embattled as Jacksonville, Florida. In the city of 881,000 people, fixed costs are 31.4 percent of expenses, according to data compiled by Bloomberg.

That’s driven by pensions, which made up almost 18 percent of expenses in fiscal 2016. Twenty-six other U.S. cities with populations of more than 250,000 have fixed cost ratios above 23 percent. They include Los Angeles and Houston, which could also be on the hook to pay Hurricane Harvey recovery costs that federal funds don’t cover. Smaller cities aren’t necessarily immune. City leaders in Hartford, Connecticut, where fixed costs are 27 percent of expenses, warned last month that the city wouldn’t be able to meet its financial obligations without additional help from the state. State lawmakers passed a budget with additional aid to the capital city on Thursday. Relief may not be around the corner for other areas. City revenues are expected to stagnate in 2017, on average, while expenditures are forecast to rise 2.1 percent, according to a Sept. 12 survey of 261 U.S. city finance officers by the National League of Cities.

Awaiting revisions.

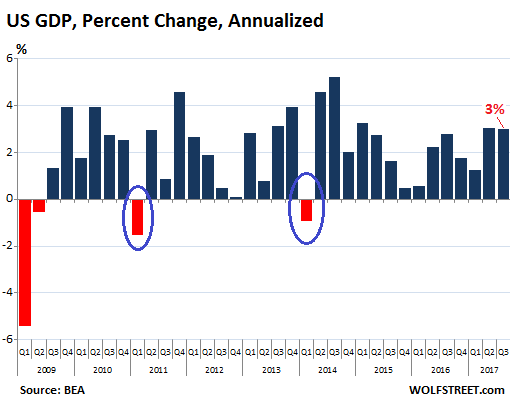

• What You See Is Not What You Get in GDP (WS)

The US economy, as measured by “real” GDP (adjusted for a version of inflation) grew 0.74% in the third quarter, compared to the prior quarter. That was a tad slower than the 0.76% growth in Q2, but up from the 0.31% growth in Q1. GDP was up 2.3% from a year ago. To confuse things further, in the US, we cling to the somewhat perplexing habit of expressing GDP as an “annualized” rate, which takes the quarterly growth rate (0.74%) and projects it over four quarters. This produced the annualized rate of 2.99%, or as we read this morning all over the media, “3.0%.” This was the “advance estimate” by the Bureau of Economic Analysis. The BEA emphasizes that the advance estimate is based on source data that are “incomplete or subject to further revision by the source agency.”

These revisions can be big, up or down, as we’ll see in a moment. The BEA will release the “second estimate” for Q3 on November 28 and the “third estimate” on December 21. More revisions are scheduled over the next few years. So 2.99% GDP growth annualized, or 0.74% GDP growth not annualized, or 2.3% growth from a year ago… is pretty good for our slow-growth, post-Financial-Crisis, experimental-monetary-policy era, but well within the range of that era, that goes from 5.2% annualized growth in Q3 2014 to a decline of 1.5% in Q1 2011. So nothing special here:

[..] In other words, we won’t really know how the economy did in the last quarter until we have a lot more hindsight. Point one: It’s devilishly hard to estimate what’s going on in the vast and complex US economy. The BEA comes up with an “advance estimate” to give economy watchers a feel, but it concedes that there will be many and substantial revisions as more data become available, and that initial “feel” may be wrong. Point two: Equally complex economies, such as China’s, are equally hard to estimate. Yet China’s National Bureau of Statistics comes up with one big-fat figure that is always very near the number the central government had mandated earlier. It publishes its GDP number less than three weeks after the end of the quarter, and a week or more before the BEA’s advance estimate.

For example, on October 18, the National Bureau of Statistics reported that GDP in Q3 grew 6.8% year-over-year. And this figure – however hastily concocted, inflated, or just plain fabricated – becomes etched in stone. No one believes it. At least in the US, after many revisions and years down the road, GDP becomes a credible number. In China, you’ll never get there. And point three: GDP is a terrible measure of the economy. It measures what money gets spent on and invested in. It’s a measurement of flow. Among other shortcomings, it doesn’t include the source of money – whether it’s earned money or borrowed money. This leads to the distortion that piling on debt is somehow good for the economy, when in reality it’s only good for GDP but will act as a drag on the economy down the road.

WTF?

• IRS Apologizes For Aggressive Scrutiny Of Conservative Groups (NPR)

In a legal settlement that still awaits a federal judge’s approval, the IRS “expresses its sincere apology” for mistreating a conservative organization called Linchpins of Liberty — along with 40 other conservative groups — in their applications for tax-exempt status. And in a second case, NorCal Tea Party Patriots and 427 other groups suing the IRS also reached a “substantial financial settlement” with the government. Attorney General Jeff Sessions announced the two settlements Thursday. The Justice Department quoted him as saying of the IRS activity: “There is no excuse for this conduct. Hundreds of organizations were affected by these actions, and they deserve an apology from the IRS. We hope that today’s settlement makes clear that this abuse of power will not be tolerated.”

It’s “a historic victory,” said Jay Sekulow of the American Center for Law and Justice, a conservative nonprofit legal group representing the Linchpins plaintiffs. Sekulow, who is also on President Trump’s personal legal-defense team, said the IRS agreed to stop “the abhorrent practices utilized against our clients.” The Linchpins case, in federal circuit court in Washington, D.C., has no monetary settlement. The two sides agreed to bear their own legal fees. The consent order says the IRS admits it wrongly used “heightened scrutiny and inordinate delays” and demanded unnecessary information as it reviewed applications for tax-exempt status. The order says, “For such treatment, the IRS expresses its sincere apology.” [..] The controversy began in 2013 when an IRS official admitted the agency had been aggressively scrutinizing groups with names such as “Tea Party” and “Patriots.”

It later emerged that liberal groups had been targeted, too, although in smaller numbers. The IRS stepped up its scrutiny around 2010, as applications for tax-exempt status surged. Tea Party groups were organizing, and court decisions had eased the rules for tax-exempt groups to participate in politics. Groups sought tax-exempt status as 501(c)(3) charities, where the organization and its donors get tax write-offs, and 501(c)(4) “social welfare” organizations, where donors’ contributions are not tax deductible. After the IRS confession in 2013, its top echelons were quickly cleaned out. Conservative groups sued. Congressional Republicans launched what became years of hearings, amid allegations the Obama White House had ordered the targeting.

Economics is designed to distort our view of the economy.

• J is for Junk Economics – Michael Hudson (Ren.)

The main goal of neoliberalism is to create an economic model for a parallel universe that seems plausible, says economist, Michael Hudson, Professor of economics at the University of Missouri in Kansas City and a researcher at the Levy Economics Institute at Bard College. “It seems that it would work very nicely, if the world where that day,” he tells host and co-founder, Ross Ashcroft. “But economics does not have a relationship to the real world. “The function of neoliberal economics is to distract attention away from how the economy really works: Why it’s polarising, why people are having to work harder despite the fact that productivity is increasing, and why the economy is polarising between the 1% and the rest of the economy.” It’s classic cognitive dissonance.

And though there have been many economists who have accurately explained the world, the economist says very little empirical research has been factored into classical economic modelling. “Everyone from Adam Smith, through even Malthus and Ricardo – had the basic concepts of value and price theory correct, for instance” said Professor Hudson. “John Stuart Mill gets even better marks, though he was a little optimistic about where capitalism was going. Then Thorstein Veblen caps-it-off. These are people Americans haven’t heard very much of: The institutionalist, Simon Patton for instance, was the first Professor of Economics at America’s first business school – the Wharton School – who became the intellectual mentor of economics turning into sociology early in the 20th century.

“There is an enormous amount of analysis, all of it based on history, on empirical analysis, on statistical analysis – and all of that is excluded from the curriculum – so there’s no way to fit economic reality into the academic curriculum of neoclassical economics.” [..] “What happens is that people who criticise financialisation – for instance, modern monetary theorists – find that they can’t get published in the major refereed journals. And without that, they can’t get promoted within academia. Universities are systematically detouring students away from economic reality.” [..] When Professor Hudson was teaching at the New School 50 years ago, he said his graduate students were dropping out of economics because they couldn’t fit reality into the curriculum.

The economist, famed for sacking Alan Greenspan back before the days he was appointed to the Chair of the US Federal Reserve, criticised him for claiming he was “shocked” by the self-interest lending of institutions to protect shareholders equity. “He knew who paid him,” said Hudson. “When I was on Wall Street in the 1960s, banks were afraid to hire him because he was known for saying whatever the client wanted to be said. He’s a public relations person. “The fact is universities are teaching the economics of public relations for the corporate sector. That’s why, underlying this theory, is a theory of how an economy would work without government, or any governmental regulation, where taxation is seen as a burden.”

It’ll be hard to keep the rich away.

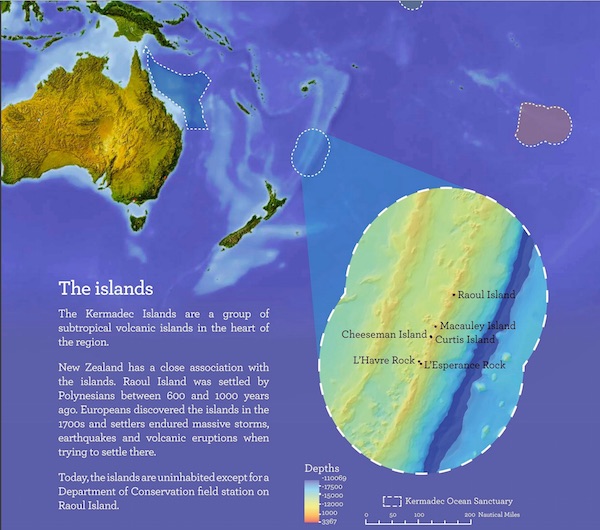

• New Zealand May Tighten Law That Allows Mega Wealthy To Buy Citizenship (G.)

New Zealand’s new Labour government will reconsider legislation that allows wealthy foreigners to effectively buy citizenship, the housing minister has said. In an interview with the Guardian about the housing shortage in New Zealand, Phil Twyford said the law that allowed Trump donor and Paypal co-founder Peter Thiel to become a citizen and buy a bolt hole in the South Island would come under scrutiny. Since coming into power last week, Labour has said it will ban foreigners from buying existing homes, along with a slew of policies aimed at addressing the housing crisis, which has seen homelessness grow to more than 40,000 people. However, the ban will not apply to foreigners who gain citizenship in New Zealand – a loophole that billionaire Thiel used, after spending a total of 12 days in the country.

Thiel’s fast-tracked citizenship allowed him to buy multiple properties in New Zealand, even though he told the government he had no intention of living in the country, but would be an “ambassador” for New Zealand overseas instead, and provide contacts for New Zealand entrepreneurs to Silicon Valley. “That was a discretionary decision that was made at the time [Thiel’s citizenship], and we were very critical. Our policy, banning people would apply to everybody, regardless of how much money they have or what country they come from,” Twyford said. “We haven’t announced policy on that [tightening the investment immigration criteria] but I think it is probably something that we are likely to look at.” Twyford said New Zealand’s ban on foreign buyers was modelled on similar legislation in Australia, and was designed to ensure New Zealanders can once again achieve the Kiwi dream of owning their own home.

We are the tragedy.

• Hopes Dashed For Giant New Antarctic Marine Sanctuary (AFP)

Hopes for a vast new marine sanctuary in pristine East Antarctica were dashed Saturday after a key conservation summit failed to reach agreement, with advocates urging “greater vision and ambition”. Expectations were high ahead of the annual meeting of the Commission for the Conservation of Antarctic Marine Living Resources (CCAMLR) – a treaty tasked with overseeing protection and sustainable exploitation of the Southern Ocean. Last year’s summit in Hobart saw the establishment of a massive US and New Zealand-backed marine protected area (MPA) around the Ross Sea covering an area roughly the size of Britain, Germany and France combined. But an Australia and France-led push this year to create a second protected area in East Antarctica spanning another one million square kilometre zone failed.

Officials told AFP that Russia and China were key stumbling blocks, worried about compliance issues and fishing rights. Consensus is needed from all 24 CCAMLR member countries and the European Union. Greenpeace called for “greater vision and ambition” in the coming year while WWF’s Antarctic program chief Chris Johnson said it was another missed opportunity. “We let differences get in the way of responding to the needs of fragile wildlife,” he said. Australia’s chief delegate Gillian Slocum described the failure as “sad”. She also bemoaned little progress on addressing the impacts of climate change which was having a “tangible effect” on the frozen continent. “While CCAMLR was not able to adopt a Climate Change Response Work Program this year, members will continue to work together ahead of the next meeting to better incorporate climate change impacts into the commission’s decision-making process,” she said.