Lewis Wickes Hine Drift Mouth, Sand Lick Mine, near Grafton, West Virginia 1908

“China’s corporate debt stands at 160% of gross domestic product, twice that of the United States..”

• China Producer Price Index Falls For 40th Straight Month (Reuters)

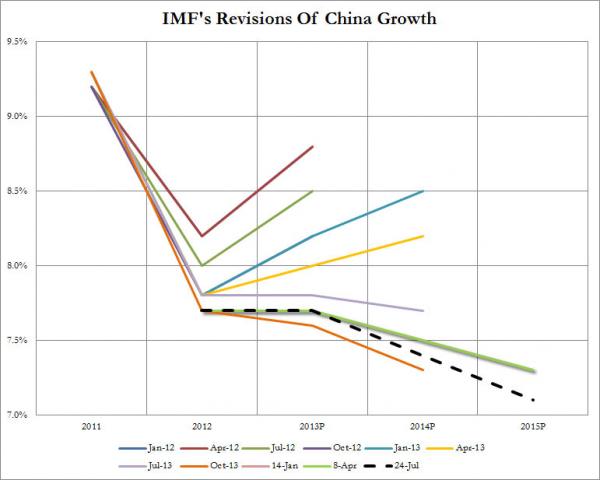

China is under growing pressure to further stimulate its economy after disappointing data over the weekend showed another heavy fall in factory-gate prices and a surprise slump in exports. Producer prices in July hit their lowest point since late 2009, during the aftermath of the global financial crisis, and have been sliding continuously for more than three years. Exports tumbled 8.3% in the same month, their biggest fall in four months, as weaker global demand for Chinese goods and a strong yuan policy hurt manufacturers. “Policy focus is definitely the (producer) deflation at this stage,” said Zhou Hao at Commerzbank. He said China’s central bank would likely need to further cut interest rates again, having already cut four times since November in the most aggressive easing in nearly seven years.

The gloom may only deepen in the coming week with a raft of economic data forecast to show renewed weakness in factories, investment and domestic spending. The world’s second-largest economy is officially targeted to grow at 7% this year, still strong by global standards, but some economists believe it is growing at a much slower pace. Economists expect the central bank to cut rates by another 25 basis points this year, and further reduce the amount of deposits banks must hold as reserves by another 100 basis points, according to a Reuters poll last month. The producer price index fell 5.4% from a year earlier, the National Statistics Bureau said on Sunday, compared with an expected 5.0% drop. It was the worst reading since October 2009 and the 40th straight month of price decline.

Falling producer prices are worrying because they eat into the profits of miners and manufacturers and raise the burden of their debts. China’s corporate debt stands at 160% of gross domestic product, twice that of the United States, according to a Thomson Reuters study of over 1,400 firms. In line with the sluggish economy, annual consumer inflation remained muted at 1.6% despite surging pork prices, in line with forecasts and slightly higher than June’s 1.4%.

It’s like one of those layered cakes..

• Peak Insanity: Chinese Brokers Now Selling Margin Loan-Backed Securities (ZH)

One of the reasons why the Chinese dragon quite often appears to be chasing its own tail is that the country is trying to re-leverage and deleverage at the same time. Take China’s local government debt refi effort for instance. Years of off-balance sheet borrowing left China’s provincial governments to labor under a debt pile that amounts to around 35% of GDP and thanks to the fact that much of the borrowing was done via LGFVs, interest rates average between 7% and 8%, making the debt service payments especially burdensome. In an effort to solve the problem, Beijing decided to allow local governments to issue muni bonds and swap them for the LGFV debt, saving around 400 bps in interest expense in the process.

Of course banks had no incentive to make the swap (especially considering NIM may come under increased pressure as it stands), and so, the PBoC decided to allow the banks to pledge the new muni bonds for central bank cash which could then be re-lent into the real economy. So, China is deleveraging (the local government refi effort) and re-leveraging (banks pledge the newly-issued munis for cash which they then use to make more loans) simultaneously. We can see similar contradictions elsewhere in China’s financial markets. For instance, Beijing has shown a willingness to tolerate defaults – even among state-affiliated companies. This is an effort (if a feeble one so far) to let the invisible hand of the market purge bad debt and flush out failed enterprises.

Meanwhile, Beijing is enacting new policies designed to encourage risky lending. In April for instance, the PBoC indicated it was set to remove a bureaucratic hurdle from the ABS issuance process, which means that suddenly, trillions in loans which had previously sat idle on banks’ books, will now be sliced, packaged, and sold. Specifically, the PBoC said regulatory approval would no longer be required to issue ABS (hilariously, successive RRR cuts have served to reduce banks’ incentive to package loans, but we’ll leave that aside for now). Once again, deleveraging (tolerating defaults) and re-leveraging (making it easier for banks to get balance sheet relief via ABS issuance), all at once.

There’s a parallel between this dynamic and what’s taking place in China’s equity markets. That is, a dramatic unwind in the half dozen or so backdoor margin lending channels (a swift deleveraging) has been met with a government-backed effort to prop up the market via China Securities Finance Corp., which has been transformed into a state-controlled margin lending Frankenstein that could ultimately end up with some CNY5 trillion in dry power (a mammoth attempt at re-leveraging). Now, the PBoC will look to supercharge efforts to re-engineer a stock market bubble via leverage by pushing brokerages to issue ABS backed by margin loans.

“Even with last year’s 4.5% drop in housing prices, more than 60 million apartments in China remain empty. ”

• China Cancels $17.6 Billion Construction Projects ‘To Protect Environment’ (RT)

China has rejected 17 construction projects with a total investment of $17.6 billion, attempting to bolster environmental protection strategies and fight corruption. The projects were among 92 examined by the Ministry of Environmental Protection (MEP), involving a total of more than 700 billion yuan ($112.6 billion) in investment, the Xinhua news agency reported on Friday. The projects’ rejection was said to improve the environmental impact assessment system and fix loopholes that allow corruption. The protection ministry has ordered all the environmental impact assessment agencies cut their links to government at all levels by the end of 2016. It has also launched random inspections of agencies and disqualified dozens of agencies and engineers, according to Xinhua.

MEP has speeded up approval of major projects such as railways and irrigation. Construction of major projects in China has been the main tool for boosting investment and sustaining growth since the beginning of 2015. Investment in the railways rose 22.6% year on year by the end of April. Beijing said in the next two years it would boost investment to foster technological progress in six manufacturing industries, including railway equipment, new-energy vehicles and medical equipment. The country is trying to upgrade its manufacturing sector and stimulate sluggish economic growth. China’s real economy cooling and a 30% stock market slump since the middle of June make it a tough task for Beijing to reach the aimed seven-percent growth in 2015.

Another key factor behind the project’s cancelation may be the real estate market, which has to stay healthy for the country’s targeted growth level. The Chinese government has engineered a property boom during the financial crisis to compensate for the weakness in overseas demand. Later it implemented tightening measures to cool the heated property market. Even with last year’s 4.5% drop in housing prices, more than 60 million apartments in China remain empty. While the real estate sector accounts for about 25-30% of China’s GDP, it’s impossible for the country to prop up the economy without reviving this vital industry.

Something tells me these analysts have as little overview of the shadow banks as Beijing has.

• China’s Stock Crash Is Spurring a Shakeout in Shadow Banks (Bloomberg)

China has been struggling to tame its shadow banks for years. Now, a stock market crash has hamstrung some of the fastest growing ones in a matter of weeks. Loans from sources such as online lenders for equity purchases have plunged by at least 700 billion yuan ($113 billion), a drop of 61% from this year’s peak, after authorities banned them from funding stock buying in July, according to a Bloomberg survey conducted last month. Peer-to-peer Internet lending for the purchases had more than tripled to 8 billion yuan in the second quarter, data from research firm Yingcan Group show. The reversal has helped cull riskier lenders in China’s online market, which was surging before the equity rout wiped out more than $4 trillion.

President Xi Jinping has already curbed traditional forms of unregulated funding – such as trust loans – as part of his effort to wean the economy from debt-fueled growth after corporate defaults mounted. “The new regulations are making the industry more disciplined and transparent,” said Wei Hou at Sanford C. Bernstein. “There may be short-term pain of a number of small players closing down. But it’s good for the industry in the long term.” Peer-to-peer lending was pioneered in the U.S. by companies such as LendingClub Corp., but China is where it’s really taking off. Origination of such loans totaled the equivalent of $41 billion in 2014 and will exceed $332 billion by 2017, according to Maybank Kim Eng. That compares with only $6 billion in the U.S. last year.

“The point that I’m making is that it’s over.”

• Stocks Are A ‘Disaster Waiting To Happen’: Stockman (CNBC)

David Stockman has long warned that the stock market is on the verge of a massive collapse, and the recent price action has him even more convinced than ever that the bottom is about to fall out. “I think it’s pretty obvious that the top is in,” the Reagan administration’s OMB director said Thursday on CNBC’s “Futures Now.” The S&P 500 has traded in a historically narrow range for the better part of 2015, having moved just 1% higher year to date. “It’s just waiting for the knee-jerk bulls, robo traders and dip buyers to finally capitulate.”

Stockman, whose past claims have yet to come to fruition, still believes that the excessive monetary policy from central banks around the world has created a “debt supernova,” and all the signs point to “the end of the central bank enabled bubble,” which could cause a worldwide recession. “The larger picture has nothing to do with the jobs report [Friday] or even the September decision by the Fed,” said Stockman. “It has to do with the the fact that the world economy, including the U.S., is heading into what is clearly going to be an epochal deflation to the likes of what we have never experienced in modern time.” According to Stockman, it’s only a matter of time before the collapse in China trickles down to other markets.

“The whole global economy since 2008 has been driven forward by this massive investment and construction and borrowing spree in China,” said Stockman. “The point that I’m making is that it’s over.” For Stockman, there’s no reversing the artificially inflated bubbles created by the Federal Reserve. “I think what we are seeing is the beginning evidence that the central bank-driven credit economy is over and we are in a new era,” said Stockman. “It’s a huge disaster waiting to happen.”

How risk got financialized.

• The Widening Vortex Of Global Finance (Sampath)

[..] .. rising inequality and sky-rocketing financial profits have paralleled the rise of neo-liberalism — a term used to refer to a cluster of economic policies that includes privatisation, cuts in welfare spending, loosening of labour laws, and deregulation of finance. If there is one common factor that undergirds all these economic policies — it is the rise of global finance, or “financialization”, which also denotes the growing penetration of real economic activity (to do with generating surplus value) by finance capital. In his book, The Everyday Life of Global Finance, the economic geographer, Paul Langley, explains how the common view of global finance as something “out there somewhere” — timeless, spaceless, identified with 24X7 global markets — is fallacious.

It is simply not true that finance operates primarily in a rarefied realm of super-specialists far removed from the world of everyday economic activity such as earning, saving and borrowing. On the contrary, Langley argues, global finance has fundamentally reengineered the ordinary ways we think about and manage money. Till the generation say right up to the 1980s, the future was conceived as a realm of uncertainty, one that held possible harm, for which one provisioned through thrift — specifically, savings and insurance. Financialisation is born when uncertainty is quantified into risk. How we frame risk, calculate it, and manage it, decides what we do with our money. In Langley’s formulation, if risk is calculated and managed as a future harm that requires prudence in the present, it makes for an approach of thrift and savings.

But if it is framed as an opportunity that holds the possibility of immense rewards, it mandates an approach where the most rational form of saving becomes investment. Therefore, at the ideological level, financialisation entails two basic manoeuvres: one, the transformation of nebulous uncertainty into quantifiable risk, which is then managed through an array of calculative technologies; two, a shift in the common sense understanding of risk as something potentially harmful, to something potentially rewarding. Given that risk is essentially a financial category, the current civilisational obsession with data is another testament to the growing supremacy of finance capital (in alliance with technology), which wants every piece of the world’s data on anything and everything in order to be able to manage risk optimally for maximum returns.

Lest we forget… We must, however, be careful where we put the blame for this.

• Greece’s Collapse Was a Reversion to the Mean… Who’s Next? (Phoenix)

Because of the rampant fraud and money printing in the financial system, the real “bottom” or level of “price discovery” is far lower than anyone expects due to the fact that the run up to 2008 was so rife with accounting gimmicks and fraud. The Greek debt crisis, like all crises in the financial system today, can be traced to derivatives via the large investment banks. Indeed, we now know that Greece actually used derivatives (via Goldman Sachs) to hide the true state of its debt problems in order to join the Euro. Spiegel:

Creative accounting took priority when it came to totting up government debt. Since 1999, the Maastricht rules threaten to slap hefty fines on euro member countries that exceed the budget deficit limit of three% of gross domestic product. Total government debt mustn’t exceed 60%. The Greeks have never managed to stick to the 60% debt limit, and they only adhered to the three% deficit ceiling with the help of blatant balance sheet cosmetics… “Around 2002 in particular, various investment banks offered complex financial products with which governments could push part of their liabilities into the future,” one insider recalled, adding that Mediterranean countries had snapped up such products.

Greece’s debt managers agreed a huge deal with the savvy bankers of US investment bank Goldman Sachs at the start of 2002. The deal involved so-called cross-currency swaps in which government debt issued in dollars and yen was swapped for euro debt for a certain period – to be exchanged back into the original currencies at a later date.

The above story for Greece is illustrative of the story for all “emerging markets” starting in 2003: tons of easy money, rampant use of derivatives for accounting gimmick, and the inevitable collapse. From a big picture scenario, in 2003, the global Central Banks abandoned a focus on inflation and began to pump trillions in loose money into the economy. Because large banks could loan well in excess of $10 for every $1 in capital on their balance sheets, global credit went exponential. The effect was sharply elevated asset prices that greatly benefitted tourism-centric economies such as Greece. As I stated in our issue Price Discovery:

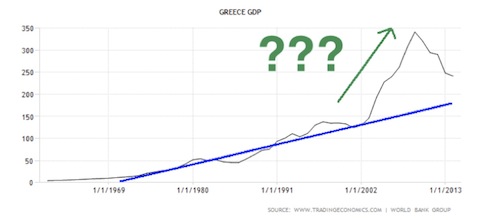

If the foundation of the financial system is debt… and that debt is backstopped by assets that the Big Banks can value well above their true values (remember, the banks want their collateral to maintain or increase in value)… then the “pricing” of the financial system will be elevated significantly above reality. Put simply, a false “floor” was put under asset prices via fraud and funny money. Take a look at the impact this had on Greece’s economy. Below is Greek GDP dating back to the 1960s. Having maintained a long-term trendline of growth the country suddenly saw its GDP MORE THAN DOUBLE in less than 10 years after joining the EU?

In many regards, this “growth” was just a credit binge, much like housing prices, stock prices, etc. By joining the Euro, Greece was able to borrow money at much lower rates (2%-3% vs. 10%-20%). Rather than using these lower rates to pay off its substantial debts, Greece funneled as much money as possible towards Government employees (nearly one in three Greek workers). As a result, Government wages nearly doubled to the point that your typical Government employee was paid 150% more than his or her private sector counterpart. Add to this a pension system in which retirees are paid 92% of their former salaries and you have a debt bomb of epic proportions.

Yes, there are still rich Greeks.

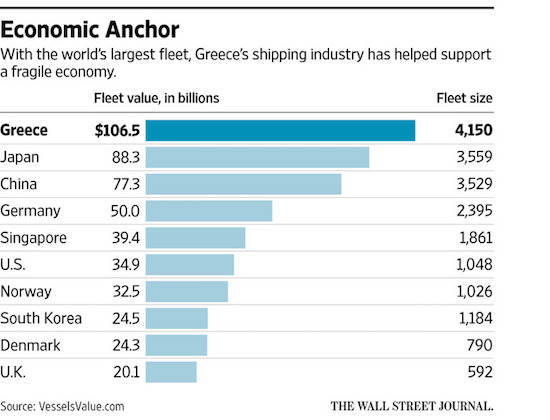

• Greek Shipping Industry Extends Its Dominance (WSJ)

Greece’s shipping magnates, having emerged largely unscathed from both the country’s ravaging financial crisis and one the industry’s longest-ever downturns, are now extending their dominance by snapping up vessels from competitors who haven’t fared as well. The Greek owners, who operate almost 20% of the global fleet of merchant ships, are paying rock-bottom prices because assets once owned by bankrupt shipping lines are now in the hands of creditors, including German banks, who want to clear nonperforming loans from their portfolios. For years, Greece and Germany have been Europe’s shipping powerhouses.

But while the Greeks stuck to a hands-on approach in which the owner arranged everything from financing to chartering and operations, the so-called German KG system largely depended on scores of investors ranging from banks to the country’s wealthy middle class. Many of them put their money into shipping at the peak of the market, before the 2008 economic downturn. “As the global financial crisis took hold and the freight market gradually collapsed, the Greeks stayed above water as they were not overly leveraged and stood on cash generated during the boom years before 2008,” said Basil Karatzas, a New York-based maritime adviser. In Germany, by contrast, a single vessel often had up to 1,000 investors and the system wasn’t strong enough to absorb the market stress, Mr. Karatzas said.

“There were too many conflicts of interest, lopsided market concentration on container ships—which were among the hardest hit—and scores of loans by German banks, which poured billions into new vessels believing that demand will continue to grow,” he said. Analysts say that at the end of 2012, German lenders including HSH Nordbank, Commerzbank and Norddeutsche Landesbank Girozentrale controlled about a third of the $475 billion global ship-finance market. In the past four years, the three banks have set aside more than €3.6 billion in provisions for nonperforming shipping loans as they desperately try to sell vessels once owned by bankrupt shipping lines.

Illegal under EU treaties.

• German Trade Surplus To Rise To New Record In 2015 (Reuters)

Germany’s trade surplus is expected to rise to a new record in 2015 thanks to falls in the prices of imported oil and gas, Der Spiegel reported on Saturday. The Finance Ministry is estimating a trade surplus of 8.1% of economic output after 7.6% last year, the magazine said, citing an internal ministry document. The lower cost of imports of oil and gas is expected to boost the trade balance by around 1.2% alone, the document said. Without the decline in oil and gas prices, the trade surplus would have fallen compared with the previous year. Germany has come under international pressure to reduce its trade surplus, which critics say contributes to imbalances in the world economy.

In a report published last month, the IMF said Berlin should focus on bolstering medium–term growth and reducing external imbalances. The European Commission considers trade surpluses that are repeatedly over 6% of economic output as dangerous for stability and has urged Germany to undertake more investment to stimulate imports. Despite a fall in exports in June, the larger net balance between exports and imports meant that the trade surplus widened to a record €24.0 billion, data published on Friday showed.

Let Finland be the one to blow up the edifice.

• Finland Could Stay Out Of New Greek Bailout, Says Foreign Minister (Reuters)

Finland could stay out of a planned third bailout deal for Greece, the Nordic country’s Eurosceptic foreign minister said on Saturday, amid calls from his nationalist party, The Finns, for a more critical stance toward the EU. Finland has taken one of the hardest lines against bailouts among euro zone members, and got even tougher in May when The Finns joined a new center-right coalition. “Of course we can stay out of (the third bailout), that is possible,” Timo Soini told Reuters on the sidelines of his party’s congress. “We’re really out of patience … Our government has a very tight policy on this. We will not accept increasing Finland’s liabilities, or cuts in Greece’s debts.”

Athens is racing to wrap up agreement on a bailout worth up to €86 billion within days, hoping to receive a first disbursement in time to make a debt repayment to the European Central Bank. Finland has said it could accept a deal under which the EU’s bailout fund, the European Stability Mechanism, would be used only within its current capacity. At a meeting of euro zone finance ministers last month, Finland supported the idea of a temporary ‘Grexit’ – Greece leaving the bloc – but eventually accepted that new loan talks could begin. “If we vote against a deal, it goes to the emergency procedure, and a package is implemented regardless of us,” Soini said, referring to a clause in the fund that allows measures to be passed without unanimous approval if stability is deemed to be at risk.

“I don’t believe that this (bailout) policy will provide solutions, and I think that, in the longer term, ‘Grexit’ is the most likely scenario.” Soini’s party, formerly known as True Finns, has risen from obscurity within just a few years to become the second-biggest parliament group in an election last April. Its criticisms of the EU and its calls for tougher restrictions on immigration have resonated among many citizens as Finland struggles with recession and rising unemployment. But the party had to make compromises as it agreed for the first time to enter government, teaming up with millionaire prime minister Juha Sipila’s Centre party and the pro-EU National Coalition party.

All care systems do.

• How England’s Social Care System Fails The Most Vulnerable (Observer)

It is written in the dry language of the bureaucrat. But an inspector’s report published just last week into the red-brick Birdsgrove Nursing Home, near Bracknell in Berkshire, accommodating the elderly and frail, as well as people stricken by dementia still makes for uncomfortable reading. “We spoke with a person who was still in bed in night clothes,” the Care Quality Commission (CQC) inspector writes. “It was mid-morning and the person told the inspector they had been awake since 7am and were waiting for two staff to help move them from their bed to their chair, wash them and help them get dressed. The person said they were unsure if they were going to be washed today as they had not been told. They said: ‘You have to get used to it here, it’s a routine.’

“We left the person’s room and shortly afterwards heard them shouting for help. They were shouting: ‘Please help me’ and ‘Help me, please’. The person was in very obvious distress and their shouts for help were loud enough for any staff nearby to hear them. No staff responded to the person’s calls for help. “We went into their room and reassured the person and they became calm. We said we would get a member of staff to come and help them. One inspector spoke with a care worker on the corridor outside the person’s room and told them the person needed help. The care worker said they were helping another person adding: ‘I’m doing her, I don’t want this one wandering off as well.’

“We left the room as the person remained calm. Shortly after we left the room they began shouting for help again in the same manner. A registered nurse was observed standing in the corridor near to the person’s room not reacting to their cries for help. We had to find another member of staff and ask them to come to help the person. A few minutes later a care worker arrived to assist the person. The person’s cries for help were repeatedly ignored.”

New Zealand and Canada next?

• Oz FinMin Orders Sale Of Residential Properties Owned By Foreign Nationals (AAP)

Joe Hockey has ordered the sale of six residential properties owned by foreign nationals. The owners live in four countries, with one investor having two in a Perth suburb, the treasurer told reporters in Sydney on Saturday. Some purchased the properties with Foreign Investment Review Board approval but their circumstances have changed, while others have simply broken the rules, he said. Hockey said the purchase price of the properties – in Sydney, on the outskirts of Brisbane and in Perth – ranged from $152,000 to $1.86 million. The investors voluntarily came forward following the amnesty the federal government announced in May. “They now have 12 months to sell the properties, rather than the normal three-month period, and they will not be referred for criminal prosecution,” he said.

There are 462 other cases under investigation, with the treasurer predicting more divestment orders being made in the future. “I expect more divestment orders will be announced in the not too distant future,” he said. The treasurer urged others to come forward before the November 30 cut off, saying he will introduce tighter rules into parliament during the next two weeks. They will include tougher civil penalties, which will see investors lose the capital gain made on the property, 25% of the purchase price or 25% of the market value of the property. “Australia’s foreign investment policy for residential real estate is designed to increase our housing stock, but those who break the rules and purchase established property illegally are doing so to the detriment of all Australians,” he said.

TPP looks dead, TTIP up next?!

• Why Europe And The US Are Locked In A Food Fight Over TTIP (Bonadio)

Black Forest ham, Asiago, Gorgonzola, Gouda, and many other European geographical indications for foodstuffs are at the centre of a TTIP food fight. They are all protected from imitation by other companies in many countries of the world. Not in the US though. And as the details of the Transatlantic Trade and Investment Partnership are negotiated, the EU wants to stop American manufacturers from being able to falsely label their products with their protected names. Part of the EU’s legal framework for protecting regional food products is that they have acquired a strong reputation among consumers the world over. Favourable climates and centuries-old manufacturing techniques rooted in their protected areas have contributed to build up this renown. They are intellectual property rights that identify “products with a story”.

The US plays by different rules, however. There are numerous American companies that use European geographical and traditional names (including Parmesan, Asiago and feta for cheese) to identify products that have not been produced in the relevant European locations – and often do not have the same quality as the originals. This lack of protection – European negotiators stress – allows an unacceptable exploitation of Europe’s cultural heritage, as well as costing EU manufacturers large amounts of revenue. The US is, however, resisting these claims. Its negotiators maintain that their food producers have been using and trademarking European geographical names for many decades, and it would now be unfair to ask them to stop.

The US also claims that many of the geographical terms, such as Parmesan, Fontina, feta, Gouda and Edam, have become the generic names of the relevant products, and cannot be monopolised by anyone, including the European producers located in those areas. Indeed, most US consumers don’t even know that these terms are actually geographical names. To them they just describe the characteristics of a product. EU-style legal protection – the US argument goes – would basically allow rent-seeking by European food producers. It would amount to a trade barrier, which would force many US producers to go through an expensive re-brand, and would increase final prices for consumers. It would take a heavy toll on the US cheese market in light of the US$21 billion in US cheese production that uses European-origin names.

How fitting. In the week that we remember Hiroshima and Nagasaki.

• Be Afraid: Japan Is About To Do Something That’s Never Been Done Before (ZH)

When the words “mothballed”, “nuclear”, and “never been done before” are seen together with Japan in a sentence, the world should be paying attention… As TEPCO officials face criminal charges over the lack of preparedness with regard Fukushima, and The IAEA Report assigns considerable blame to the Japanese culture of “over-confidence & complacency,” Bloomberg reports,

Japan is about to do something that’s never been done before: Restart a fleet of mothballed nuclear reactors. The first reactor to meet new safety standards could come online as early as next week. Japan is reviving its nuclear industry four years after all its plants were shut for safety checks following the earthquake and tsunami that wrecked the Fukushima Dai-Ichi station north of Tokyo, causing radiation leaks that forced the evacuation of 160,000 people.

Mothballed reactors have been turned back on in other parts of the world, though not on this scale – 25 of Japan’s 43 reactors have applied for restart permits. One lesson learned elsewhere is that the process rarely goes smoothly. Of 14 reactors that resumed operations after four years offline, all had emergency shutdowns and technical failures, according to data from the World Nuclear Association, an industry group. “If reactors have been offline for a long time, there can be issues with long-dormant equipment and with ‘rusty’ operators,” Allison Macfarlane, a former chairman of the U.S. Nuclear Regulatory Commission, said by e-mail.

In case you are not worried enough yet…

As problems can arise with long-dormant reactors, the NRA “should be testing all the equipment as well as the operator beforehand in preparation,” Macfarlane of the U.S. said by e-mail. Although the NRA “is a new agency, many of the staff there have long experience in nuclear issues,” she said. Kyushu Electric has performed regular checks since the reactor was shut to ensure it restarts and operates safely, said a company spokesman, who asked not to be identified because of company policy.

“If a car isn’t used for a while, and you suddenly use it, then there is usually a problem. There is definitely this type of worry with Sendai,” said Ken Nakajima, a professor at Kyoto University Research Reactor Institute. “Kyushu Electric is probably thinking about this as well and preparing for it.”

It’s not the first time a nation has tried this..

In Sweden, E.ON Sverige AB closed the No. 1 unit at its Oskarshamn plant in 1992 and restarted it in 1996. It had six emergency shutdowns in the following year and a refueling that should have taken 38 days lasted more than four months after cracks were found in equipment.

“..if I speak, the republic is going to fall.” They could triple the health care budget if they get rid of corruption.

• Petrobras Oil Scandal Leaves Brazilians Lamenting a Lost Dream (NY Times)

Alberto Youssef, a convicted money launderer and former bon vivant, sat in a Brazilian jail cell in March of last year, getting ready to tell his lawyers a story. It was about an elaborate bribery scheme involving Petrobras, the government-controlled oil giant. He opened with a dire prediction. “Guys,” Mr. Youssef said, “if I speak, the republic is going to fall.” To those lawyers, Tracy Reinaldet and Adriano Bretas, who recently recounted the conversation, this sounded a tad melodramatic. But then Mr. Youssef took a piece of paper and started writing the names of participants in what would soon become known as the Petrobras scandal. Mr. Reinaldet looked at the names and asked, not for the last time that day, “Are you serious?”

[..] Oil was central to Brazil’s strategy, and that gave Petrobras a leading role in the nation’s growing influence — and pride of place. At one time it was the sixth-largest company in the world by market capitalization and accounted for roughly 10% of Brazil’s gross domestic product. For perspective, Apple, which has twice Petrobras’s peak market cap, represents 0.5% of the United States’ gross domestic product. The company has lost more than half its value in the last year, about $70 billion in market cap. Part of that stems from the worldwide decline in oil prices, but none of the company’s rivals have been punished as severely. That plunge has had repercussions for investors worldwide. Petrobras had been a favorite investment for big emerging-market bond funds sold to United States investors, for instance.

In Brazil, Petrobras’s plunge is so cataclysmic, according to analysts, that it is a major reason the economy is expected to contract by more than one%age point this year. Unemployment is up, and Standard & Poor’s has cut the nation’s long-term debt rating to one notch above junk status. All of this has provoked something that transcends outrage. Brazilians are in the midst of an identity crisis. Much of Brazil’s recently acquired cachet looks as if it was the product of fraud, and for an added touch of humiliation, a fraud cooked up at a company long regarded as an emblem of Brazil’s success and aspirations. “I’ve never seen my countrymen so angry,” said Maurício Santoro, a political science professor at Rio de Janeiro State University. “We have this sense that the dream is over.”

As always when western media address Russia: beware of hidden political themes.

• How Russian Energy Giant Gazprom Lost $300 Billion (Eurasia.net)

It was not too long ago that Gazprom, Russia’s state-controlled energy conglomerate, was one of the Kremlin’s most powerful weapons. But those days now seem like a distant memory. Today, Gazprom is a financial shadow of its former self. The speed of Gazprom’s decline is breathtaking. At its peak in May 2008, the company’s market capitalisation reached $367bn, making it one of world’s most valuable companies, according to a survey compiled by the Financial Times. Only fellow Exxonmobile and PetroChina were worth more. Gazprom’s deputy chair Alexander Medvedev repeatedly predicted that within a decade the Russian energy giant could be worth $1 trillion.

That prediction now seems foolhardy. Since 2008, Gazprom’s value has plummeted. In early August it had a market capitalisation of $51bn – losing more than $300bn. No company among the world’s top 5,000 has suffered a bigger collapse, Bloomberg Business News reported in April 2014, and by the end of the year net income had fallen by an astonishing 86%. Though share prices have rallied slightly since, indicators suggest Gazprom has further to fall. Lingering uncertainty raises questions about whether it can survive, with production continuing to tumble downward. So what happened? Why is a company with the world’s largest gas reserves, operating in a country bordering China and the European Union – two of the world’s top energy consumers, performing so badly?

“..costs of the coal companies range mostly from about $40 to $100 for every dollar in profit”

• The Huge Hidden Costs Of Our Fossil-Fueled Economy (Shiller)

Extracting fossil fuels is a lucrative business. Last year, ExxonMobil made $32.5 billion in profits. But, arguably, it’s a business built on shaky foundations. If we were to account for the full cost of fossil fuels to the environment, it might completely wipe out the industry’s profitability. That’s the conclusion of a new analysis from the University of Cambridge that tallies up the social cost of producing oil, gas and coal products. Across 20 leading companies, it finds “hidden economic costs” that is, costs that aren’t currently paid of $755 billion in 2008, and $883 billion in 2012. Which is several times what the companies reported in earned income in those years. “The 20 companies as a group are highly profitable, with after tax profits of about 8.2 % of revenues in 2008 and 8.6 % in 2012.

However this does not take account of the hidden economic cost to society that is caused when their products are burned and CO2 is emitted to the atmosphere,” says the paper by Chris Hope, Paul Gilding, and Jimena Alvarez. The researchers studied the accounts of major oil and gas groups like BP, Shell, Statoil, and Petrobras as well as several coal producers like Peabody and Coal India. The calculations are based on a U.S. Environmental Protection Agency model that says each ton of CO2 costs society $105 (in 2008 dollars). That’s higher than the working EPA figure of $37 per ton, but below what some other researchers have calculated it should be. The analysis doesn’t include some major state-owned producers such as Saudi Aramco, which don’t publish open public accounts.

Most of the oil and gas companies have hidden costs of $1.5 to $3 for every dollar is post-tax profit, while costs of the coal companies range mostly from about $40 to $100 for every dollar in profit, the paper says. The coal companies are also the most “unprofitable” with economic costs ranging from two to nine times annual revenues (let alone their profits). The point of the paper is to warn investors that they face risks if society ever wants to account for its losses (which doesn’t look likely at the moment, but still). “These results will be a useful starting point for investors seeking to manage their exposure to climate change risk, and for policy makers interested in fossil fuel companies net contribution to society,” the authors say.

Love this sort of thinking.

• Antibiotic Resistance: Zoology To The Rescue (Economist)

Much is made, in academic circles, of the virtues of interdisciplinary research. Its practice is somewhat rarer. But fresh thinking and an outsider’s perspective often do work wonders, and that may just have happened in the field of antibiotic resistance. Adin Ross-Gillespie of Zurich University is a zoologist, not a physician. But his study of co-operative animals such as meerkats and naked mole rats has led him to think about the behaviour of another highly collaborative group, bacteria. He and his colleagues have just presented, at a conference on evolutionary medicine in Zurich, a way of subverting this collaboration to create a new class of drug that seems immune to the processes which cause resistance to evolve.

Antibiotic resistance happens because, when a population of bacteria is attacked with those drugs, the few bugs that, by chance, have a genetic protection against their effects survive and multiply. As in most cases of natural selection, it is the survival of these, the fittest individuals, that spurs the process on. But Dr Ross-Gillespie realised that, in the case of bacteria, there are circumstances when the survival of the fittest cannot easily occur. One of these is related to the way many bacteria scavenge a crucial nutrient, iron, from the environment. They do it by releasing molecules called siderophores that pick up iron ions and are then, themselves, picked up by bacterial cells. In a colony of bacteria, siderophore production and use is necessarily communal, since the molecule works outside the boundaries of individual cells.

All colony members contribute and all benefit. In theory, that should encourage free riders—bacteria which use siderophores made by others without contributing their own. In practice, perhaps because the bacteria in a colony are close kin, this does not seem to happen. But inverting free riding’s logic makes the system vulnerable to attack, for a bug that contributes more than its share does not prosper. Following this line of thought Dr Ross-Gillespie turned to gallium, ions of which behave a lot like those of iron and can substitute for them in a siderophore, making it useless to a bacterium. In fact, siderophores bind more effectively with gallium than with iron, hijacking the whole process. A judicious dose of gallium nitrate can thus take out an entire bacterial colony, by depriving it of the iron it needs to thrive.

The crucial point is that, because siderophores are a resource in common, a mutated siderophore that did not bind preferentially to gallium would be swamped by the others, would fail to benefit the bug that produced it, and therefore would not be selected for and spread. At least, that was Dr Ross-Gillespie’s theory.