Peter Beard Francis Bacon on his Roof at 80 Narrow Street, London 1972

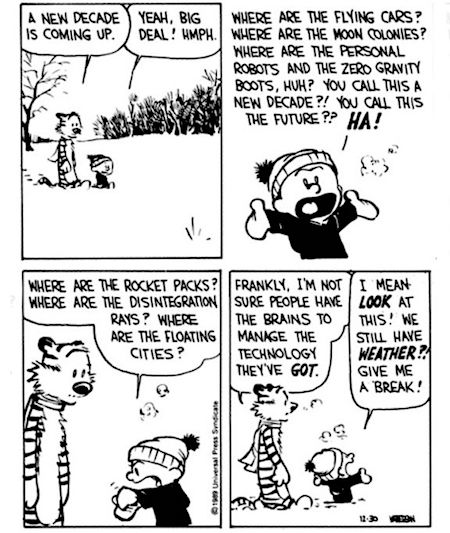

Leave it to Reuters to turn this into a bland story. Oh, and just you watch the next decade.

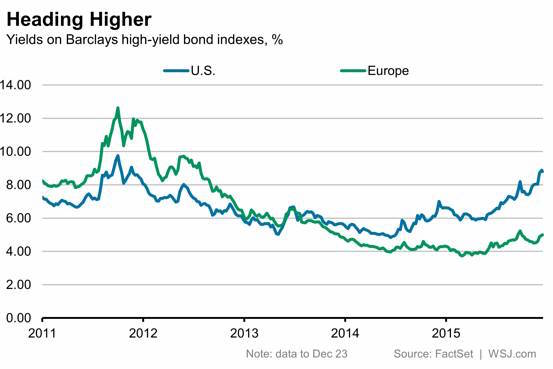

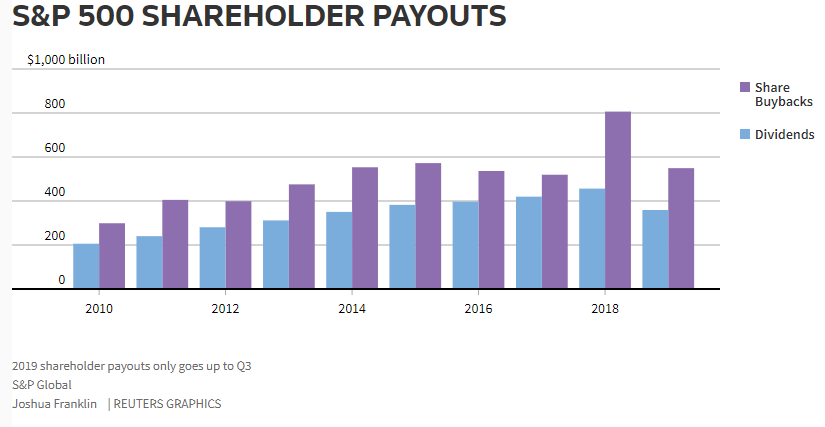

Whatever nickname ultimately gets attached to the now-ending Twenty-tens, on Wall Street and across Corporate America it arguably should be tagged as the “Decade of Debt.” With interest rates locked in at rock-bottom levels courtesy of the Federal Reserve’s easy-money policy after the financial crisis, companies found it cheaper than ever to tap the corporate bond market to load up on cash. Bond issuance by American companies topped $1 trillion in each year of the decade that began on Jan. 1, 2010, and ends on Tuesday at midnight, an unmatched run, according to SIFMA, the securities industry trade group. In all, corporate bond debt outstanding rocketed more than 50% and will soon top $10 trillion, versus about $6 trillion at the end of the previous decade.

The largest U.S. companies – those in the S&P 500 Index – account for roughly 70% of that, nearly $7 trillion. What did they do with all that money? It’s a truism in corporate finance that cash needs to be either “earning or returning” – that is, being put to use growing the business or getting sent back to shareholders. As it happens, American companies did a lot more returning than earning with their cash during the ‘Tens. In the first year of the decade, companies spent roughly $60 billion more on dividends and buying back their own shares than on new facilities, equipment and technology. By last year that gap had mushroomed to more than $600 billion, and the gap in 2019 could be just as large, especially given the constraint on capital spending from the trade war.

Just too juicy.

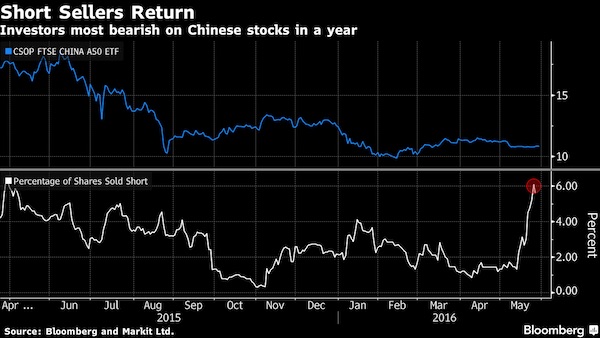

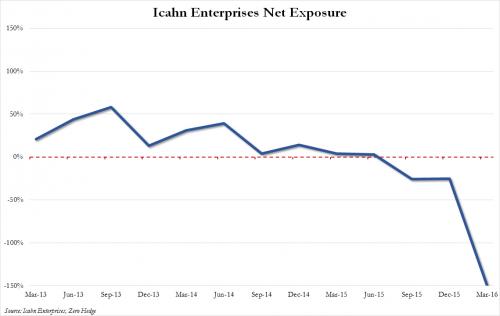

• I, Who Vowed to Never Short Stocks Again, Just Shorted the Entire Market (WS)

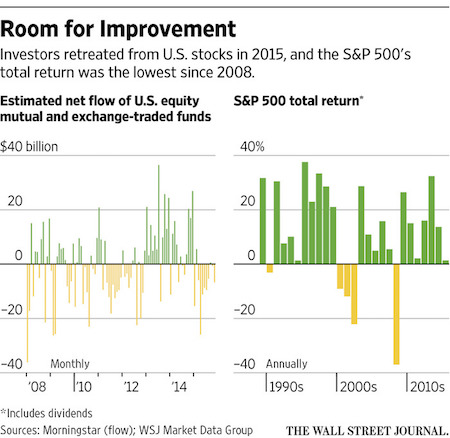

In my decades of looking at the stock market, there has never been a better setup. Exuberance is pandemic and sky-high. And even after today’s dip, the S&P 500 is up nearly 29% for the year, and the Nasdaq 35%, despite lackluster growth in the global economy, where many of the S&P 500 companies are getting the majority of their revenues. Mega-weight in the indices, Apple, is a good example: shares soared 84% in the year, though its revenues ticked up only 2%. This is not a growth story. This is an exuberance story where nothing that happens in reality – such as lacking revenue growth – matters, as we’re now told by enthusiastic crowds everywhere.

Until just a couple of months ago, the touts were out there touting negative interest rates soon to come to the US and thus making stocks the only place to be. Those touts have now been run over by the reality. Now they’re touting QE4 by the Fed, or whatever. And people were looking for any reason to buy. The unanimity of it all was astounding. I’ve seen this before, but not in this magnitude. And there is this: As stocks were surging over the past few months, investors with large gains who wanted to sell didn’t sell before year-end in order to defer that income for tax considerations. So there was reduced selling pressure from that group that would have liked to sell, and that will sell after the new year starts.

So I shorted the stock market today, December 30 – me who is on record of saying repeatedly that I would never ever short anything ever again, after the debacle of November 1999 when I shorted the most obviously ridiculous Nasdaq high-fliers a few months too early. They collapsed to near-zero, but not before ripping off my face.

Turley’s on a roll.

• Pelosi’s Half Right Constitutional Claim Leaves The House All Wrong (Turley)

Harvard law professor Laurence Tribe has penned an editorial column in support of the refusal of Speaker Nancy Pelosi to submit House articles of impeachment to the Senate for trial. Tribe declares this strategy is not just constitutional but also commendable. That view may be half right on the Constitution. However, it leaves Pelosi all wrong on her unprecedented gaming of the system. The withholding of the articles is not only facially inappropriate. It shatters the fragile rationale for the rush to impeach. Tribe focuses on a point on which I agree entirely. We both have criticized the position of Harvard law professor Noah Feldman, who testified with me in the House Judiciary Committee hearings, that President Trump has not really been impeached.

Feldman insists that impeachment occurs only when the articles and a slate of House trial managers are submitted to the Senate for trial. However, there is no support for that interpretation in the text or history of the Constitution. Indeed, English impeachments by the House of Commons often were not taken up for trial in the House of Lords, yet all those individuals still were referenced as impeached. Now for our point of disagreement. The Constitution does not state that the House must submit the articles of impeachment to the Senate at any time, let alone in a specific period of time. Tribe insists this means that the “House rules unmistakably leave to the House itself” when to submit an impeachment for trial. There are, in fact, two equal houses of Congress.

Faced with a House manipulating the system, the Senate can change its rules and simply give the House a date for trial then declare a default or summary acquittal if House managers do not come. It is the list of House trial managers that is necessary for Senate proceedings to commence. The “standing rules of procedure and practice in the Senate when sitting on impeachment trials” are triggered when the House gives notice that “managers are appointed.” The Senate is given notice of the impeachment in the congressional record shared by both houses. The articles are later “exhibited” by the managers at the trial. Waiting for the roster of managers is a courtesy shown by the Senate to the House in preparing its team of managers for the trial.

We have never experienced this type of bicameral discourtesy where the House uses articles of impeachment to barter over the details of the trial. Just as the Senate cannot dictate the handling of impeachment investigations, the House cannot dictate the trial rules.

Feels weak overall, given the contents of his mails to Lisa Page.

• Strzok Claims FBI, DOJ Violated His Free Speech, Privacy Rights (Hill)

Former FBI agent Peter Strzok, a onetime member of former special counsel Robert Mueller’s Russia probe, is claiming the FBI and Justice Department violated his rights of free speech and privacy when firing him for uncovered texts that criticized President Trump. Strzok and his legal team made the claims in a court document filed Monday that pushes back on the Department of Justice’s (DOJ) motion to dismiss the lawsuit he filed in August over his ouster a year earlier. DOJ alleged in its motion to dismiss that Strzok’s role in high-profile investigations meant he was held to a higher standard when it came to speech.

But Strzok’s legal team disputed this in Monday’s filing, saying that the approximately 8,000 other employees in similar positions retain their privacy even when using government-issued devices. “The government’s argument would leave thousands of career federal government employees without protections from discipline over the content of their political speech,” the filing said. “Nearly every aspect of a modern workplace, and for that matter nearly every non-workplace aspect of employees’ lives, can be monitored,” it added. “The fact that a workplace conversation can be discovered does not render it unprotected.”

Strzok’s team also accuses the bureau and DOJ of only punishing those who condemn Trump, as “there is no evidence of an attempt to punish” those who verbally backed the president ahead of the 2016 election. The FBI declined to comment, saying the bureau does not comment on pending litigation. “It doesn’t matter who you are — someone, like Pete, who has devoted his whole life to protecting this country, or a Gold Star family, or a Purple Heart winner, or a lifelong Republican who spent 5 years as a POW in North Vietnam. If you dare to raise your voice against President Trump, he and his allies will try to destroy you,” Strzok attorney Aitan Goelman said in a statement to The Hill.

Trying to please the DNC. Not.

• Tulsi: Impeachment Greatly Increased Likelihood Of Trump Reelection (Hill)

Rep. Tulsi Gabbard (D-Hawaii) predicted Monday that it would be more difficult for House Democrats to remain in control of the House following passage of articles of impeachment against President Trump. In a video tweeted Monday evening, the 2020 candidate for president wrote that Trump’s chances of winning reelection had been “greatly increased” because of the House’s vote. “Unfortunately, the House impeachment of the president has greatly increased the likelihood Trump will remain the president for the next 5 years,” Gabbard says in the video. “We all know that Trump is not going to be found guilty by the U.S. Senate,” she added. The remarks are not the first Gabbard has made warning against Trump’s impeachment. She made similar comments just days ago in New Hampshire, arguing that Trump’s supporters would be emboldened by the House’s move heading in to 2020.

In 2020, we will have a new president in the White House. How many of you do NOT want that to be Donald Trump? I certainly don’t. Unfortunately, the House impeachment of the president has greatly increased the likelihood Trump will remain the president for the next 5 years … pic.twitter.com/FRRlbWHyo7

— Tulsi Gabbard (@TulsiGabbard) December 31, 2019

“..the Golden Golem of Greatness himself, rises in his pajamas and tweets that, at long, long last, he has finally got “woke,” changed his name to Donatella..”

• Forecast 2020 — Whirlin’ and Swirlin’ (Kunstler)

[..] a venerable institution such as The New York Times can turn from its mission of strictly pursuing news and be enlisted as the public relations service for rogue government agencies seeking to overthrow a president under false pretenses. The overall effect is of a march into a new totalitarianism, garnished with epic mendacity and malevolence. Since when in the USA was it okay for political “radicals” to team up with government surveillance jocks to persecute their political enemies? This naturally leads to the question: what drove the American thinking class insane?

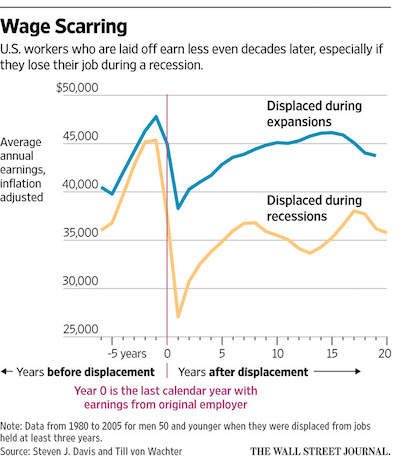

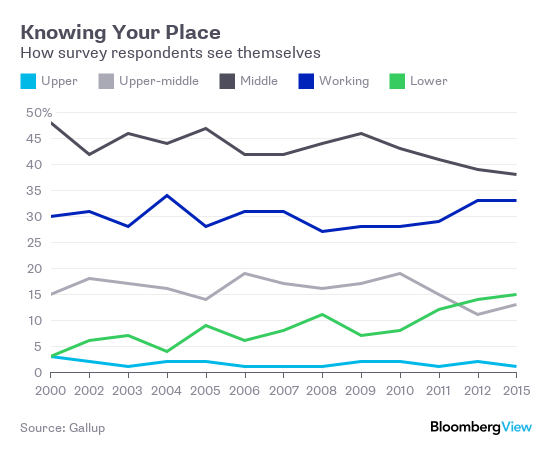

I maintain that it comes from the massive anxiety generated by the long emergency we’ve entered — the free-floating fear that we’ve run out the clock on our current way of life, that the systems we depend on for our high standard of living have entered the failure zone; specifically, the fears over our energy supply, dwindling natural resources, broken resource supply lines, runaway debt, population overshoot, the collapsing middle-class, the closing of horizons and prospects for young people, the stolen autonomy of people crushed by out-of-scale organizations (government, WalMart, ConAgra), the corrosion of relations between men and women (and of family life especially), the frequent mass murders in schools, churches, and public places, the destruction of ecosystems and species, the uncertainty about climate change, and the pervasive, entropic ugliness of the suburban human habitat that drives so much social dysfunction.

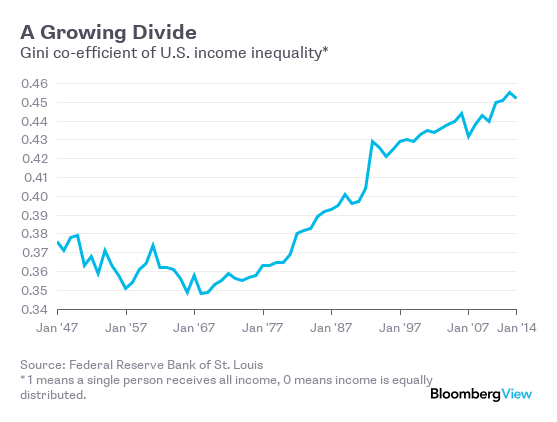

You get it? There’s a lot to worry about, much of it quite existential. The more strenuously we fail to confront and engage with these problems, the crazier we get. Much of the “social justice” discontent arises from the obvious and grotesque income inequality of our time accompanied by the loss of meaningful work and the social roles that go with that. But quite a bit of extra tension comes from the shame and disappointment over the failure of the long civil rights campaign to correct the racial inequalities in American life — everything from attempts at school integration to affirmative action (by any name) to “multiculturalism” to the latest innovations in “diversity and inclusion.”

[..] By 2020 Wokesterism has shot its wad and the Wokesters are banished to a windowless room in the sub-basement of America’s soul where they can shout at the walls, point their fingers, grimace spittlingly, and issue anathemas that no one will listen to. And when they’re out of gas, they can kick back and read the only book in the room: Mercy, by Andrea Dworkin. And then, one fine spring morning, after everyone else has given up on it, Donald Trump, social media troll-of-trolls, the Golden Golem of Greatness himself, rises in his pajamas and tweets that, at long, long last, he has finally got “woke,” changed his name to Donatella, and declared his personal pronoun to be “you’all.”

“When a company defaults, there is a clear legal framework for who gets paid back first. This isn’t the case for states, however, as there is no such legal structure, nor much precedent.”

• States Are Already Paying For Unfunded Pensions (Platt)

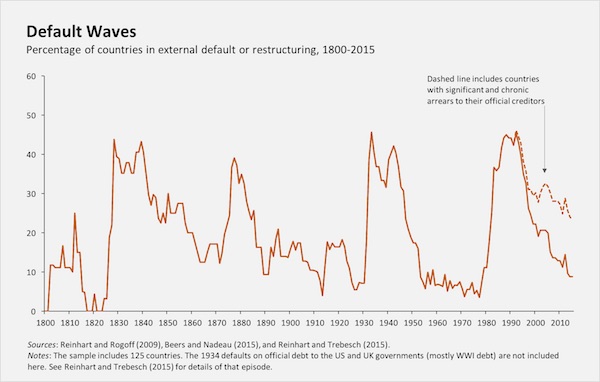

Kicking pension problems into the future is popular with politicians, enabling them to make promises and let voters worry later about borrowing costs. But large, unfunded state pension liabilities are a costly problem—and the cost is already reflected in current bond prices, research by Chicago Booth PhD candidate Chuck Boyer suggests. “The public pension funding crisis is not merely about future insolvency,” he writes. “Future obligations are having an effect on debt spreads right now.” To many Americans, it may seem unimaginable that states would fail to fully pay pensions promised to teachers, firefighters, and other public-service workers.

It has been almost 90 years since the last state default: during the Great Depression, Arkansas owed over $160 million to debt payments, which was nearly half of the state’s annual revenue (and equivalent to roughly $3 billion in 2019 dollars). The debt was restructured and “debtholders were eventually made whole,” Boyer writes in recounting this history. However, pension obligations are mounting in many states, and officials are struggling to cut costs and raise taxes to pay what is owed. And he argues that the effects can be seen in the $3.8 trillion capital market for US municipal bonds, which includes bonds issued by 50,000 state and local governments. When a company defaults, there is a clear legal framework for who gets paid back first.

This isn’t the case for states, however, as there is no such legal structure, nor much precedent. The markets’ expectations, then, are built into bond prices. Bondholders, wary of how a default could play out, demand a premium. Using annual fiscal reports released by state governments, Boyer looked at the ratio of unfunded pension liabilities to GDP from 2002 to 2016 and estimates that every 1-standard-deviation increase is associated with a 27–32 basis-point increase in bond spreads over the Treasury rate, up to a fifth of the average total spread. Unfunded pensions cost US states more than $2 billion in lost bond-issuance proceeds in 2016, he calculates, adding that he considers that a conservative estimate.

But the penalty that a state would essentially pay in the form of higher spreads varies from state to state, providing some indication of how the market thinks a default could play out. States where pensioners have more legal protections and their unions have more bargaining power (and maybe higher public support) are paying higher borrowing costs. In these areas, debtholders see a higher risk of default—perhaps assuming states would take care of pensioners before bondholders, who are mostly high-net-worth and retail investors.

Walking away from a $9 million bond.

• Ex-Nissan Boss Ghosn Says Is In Lebanon, Fleeing Japan’s ‘Rigged’ Justice (R.)

Ousted Nissan boss Carlos Ghosn confirmed he fled to Lebanon, saying he wouldn’t be “held hostage” by a “rigged” justice system and raising questions about how one of the world’s most-recognized executives escaped Japan months before his trial. Ghosn’s abrupt departure marks the latest dramatic twist in a year-old saga that has shaken the global auto industry, jeopardized the alliance of Nissan Motor Co Ltd and top shareholder Renault SA and cast a harsh light on Japan’s judicial system. “I am now in Lebanon and will no longer be held hostage by a rigged Japanese justice system where guilt is presumed, discrimination is rampant, and basic human rights are denied,” Ghosn, 65, said in a brief statement on Tuesday.

“I have not fled justice – I have escaped injustice and political persecution. I can now finally communicate freely with the media, and look forward to starting next week.” Most immediately, it was unclear how Ghosn, who holds French, Brazilian and Lebanese citizenship, was able to orchestrate his departure from Japan, given that he had been under strict surveillance by authorities while out on bail and had surrendered his passports. Japanese immigration authorities had no record of Ghosn leaving the country, Japanese public broadcaster NHK said. A person resembling Ghosn entered Beirut international airport under a different name after flying in aboard a private jet, NHK reported, citing an unidentified Lebanese security official.

His lawyers were still in possession of his three passports, one of his lawyers, Junichiro Hironaka, told reporters in comments broadcast live by NHK. Hironaka said the first he had heard of Ghosn’s departure was on the news this morning and that he was surprised. He also said it was “inexcusable behavior”. [..] Ghosn was arrested at a Tokyo airport shortly after his private jet touched down on Nov. 19, 2018. He faces four charges – which he denies – including hiding income and enriching himself through payments to dealerships in the Middle East. Nissan sacked him as chairman saying internal investigations revealed misconduct ranging from understating his salary while he was its chief executive, and transferring $5 million of Nissan funds to an account in which he had an interest.

Words fail. It’s not just bankers that don’t go to jail.

• How Fentanyl Spread Across the US (Kolitz)

Often lost in the early news reports was the fact that fentanyl alone wasn’t killing people; many different kinds of fentanyl were. Since its invention in 1959 by the Belgian chemist and doctor Paul Janssen, fentanyl has seen more than 1,400 analogues: twists on the original formula whose origins and effects vary widely. Carfentanil, for instance—100 times stronger than fentanyl—was until 2018 FDA-approved for use as an elephant tranquilizer. It is here that the opioid crisis intersects with (and amplifies) a newer scourge: NPS, or new psychoactive substances, molecularly tweaked stand-ins for traditional street drugs. The best-known of these is probably K2, or Spice, the ostensible marijuana substitute whose high bears little resemblance to the real thing and whose side effects include blood-clotting, kidney failure, and instant death.

But there are hundreds more, and likely thousands in development. Mini-pandemics have erupted across the country, as when, in the course of a single week last year, over 100 people in New Haven overdosed on what was later determined to be AB-FUBINACA, yet another synthetic cannabinoid. Ben Westhoff, in “Fentanyl, Inc.: How Rogue Chemists Are Creating the Deadliest Wave of the Opioid Epidemic”, charts this progression in harrowing detail. We are now dealing, he writes, with “the harshest drug challenge in our history.” His book is one of the first to address what the Centers for Disease Control has called the “third wave” of the opioid crisis: first OxyContin, then heroin, and now fentanyl and its analogues.

Earlier accounts of this crisis – Sam Quinones’s “Dreamland: The True Tale of America’s Opiate Epidemic” or Beth Macy’s “Dopesick: Dealers, Doctors, and the Drug Company That Addicted America” – had in Purdue Pharma the benefit, structural and dramatic, of a villain. More or less everyone can agree that pharmaceutical companies should refrain from wantonly pursuing profit at the expense of public health. Dopesick is rarely a pleasant read, but Macy’s account of Purdue’s first major court battle – which culminated in criminal convictions for three executives and $600 million in fines—provided at least some measure of catharsis.

I still wonder what made Yeltsin turn to Putin. Guilt, a rare moment of lucidity?

• UK MoD Proposed Russian Membership Of Nato In 1995 (G.)

Russia could have become an “associate member” of Nato 25 years ago if a Ministry of Defence proposal had gained support, according to confidential Downing Street files which also expose Boris Yeltsin’s drinking habits. The suggestion, aimed at reversing a century of east-west antagonism, is revealed in documents released on Tuesday by the National Archives at Kew. Presented by Malcolm Rifkind, then defence secretary, to a Chequers strategy summit, the plan was to dispel Kremlin suspicions of the alliance’s eastwards expansion. In 1995, Yeltsin was president and the cold war over. Relations were in flux as a Russia tried to come to terms with shrunken international borders.

Yeltsin was proving an unpredictable ally. Files show that he urged western leaders at a summit in Halifax, Canada to delay Nato enlargement until after Russia’s elections because “public discussion could provoke trouble”. But poor health and heavy drinking jeopardised his authority. The previous year he had notoriously failed to disembark from a plane during a stopover in Ireland amid rumours of alcoholism and a heart attack. In July 1995, the Moscow embassy cabled about Yeltsin going into hospital due to his “longstanding heart condition”. At Hyde Park, the Roosevelt home in New York, according to US diplomats, Yeltsin subsequently appeared “rolling, puffy and red”. He consumed “wine and beer greedily … and regretted the absence of cognac. One of his aides took a glass of champagne from him when the aide felt enough was enough and he was alcoholically cheerful at his press conference with Clinton.”

[..] In a 10-page submission, Rifkind argued that: “A possible solution would be to create a new category of associate member of Nato. Such a status could not involve article V guarantees [which declares an attack on one state is an attack on all members], membership of the IMS [Nato’s International Military Staff] or Russian vetoes and would not therefore change the essence of Nato. “It would, however, give Russia a formal status within Nato, allow it to attend, as of right, ministerial and other meetings and encourage a gradual convergence and harmonisation of policy, doctrine and practice.”

The photos have now all turned red. NOTE: the army still hasn’t been sent in, apparently. The people dying are volunteer firemen.

• Images Of ‘Mayhem’ And ‘Armageddon’ As Bushfires Rage (G.)

Thousands of people fled to the lake and ocean in Mallacoota, as bushfires hit the Gippsland town on Tuesday. The out-of-control fire reached the town in the morning and about 4,000 people fled to the coastline, with Country Fire Authority members working to protect them. The town had not been told to evacuate on Sunday when the rest of East Gippsland was, and authorities decided it was too dangerous to move them on Monday. People reported hearing gas bottles explode as the fire front reached the town, and the sound of sirens telling people to get in the water. By 1.30pm the fire had reached the water’s edge. A local man, Graham, told ABC Gippsland he could see fire in the centre of the town, and 20m high flames on the outskirts where he believed homes were alight.

10:30am update from Dad at the wharf in Mallacoota – “fire front not far away” #Mallacoota #bushfirecrisis pic.twitter.com/MvgeiZqujM

— bluesfestblues (@bluesfestblues) December 30, 2019

“We saw a big burst of very big flames in Shady Gully,” he said. “As I speak to you I’m looking across Coull’s Inlet and there are big flames … and they would be impacting houses. That’s not good at all.” People in Mallacoota posted in community social media groups estimates of about 20 houses lost, with the school, bowling club and golf club also hit. Hundreds more evacuees sheltered in the community centre. “There are a lot of people at the waterfront jetty, in the lake, on the sand spit between the lake and the ocean, and there are people on a sandbar, and some on boats,” Charles Livingstone told Guardian Australia from the community centre. He said there were at least 350 people in the community centre, many with children and pets. He, his wife and their 18-month-old baby were at the jetty on Monday night but moved to the community centre to avoid the heavy smoke.

Please put the Automatic Earth on your 2020 charity list. Support us on Paypal and Patreon.

Top of the page, left and right sidebars. Thank you.