Inge Morath Street Corner at World’s End London 1954

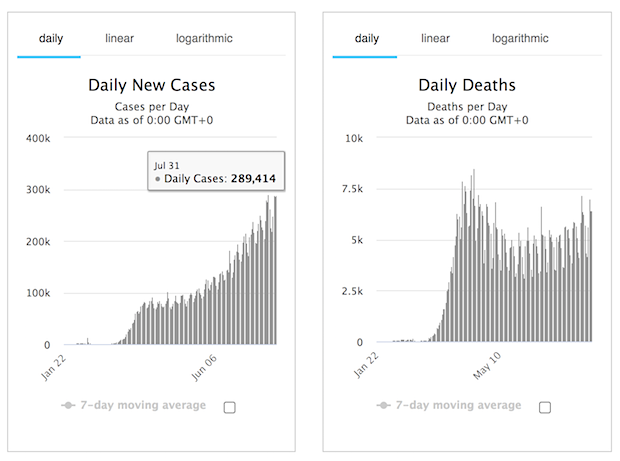

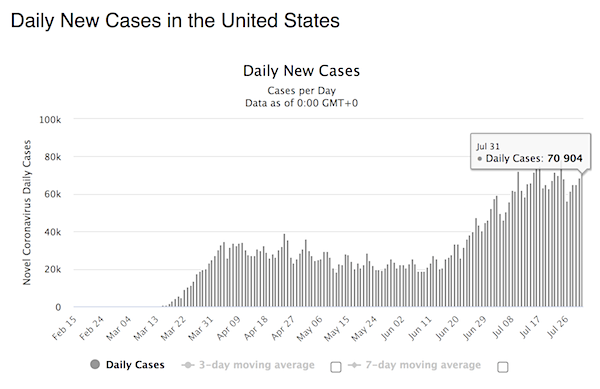

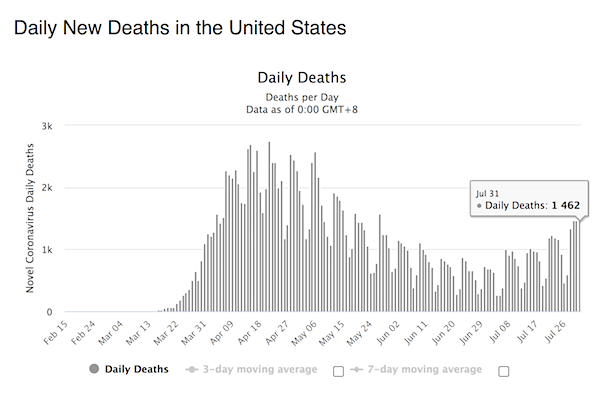

WHO posted a new record, Worldometer is 195 cases short. Numbers remain stubbornly high. US deaths at 1462 vs two consecutive days of 1465. No progress.

Taleb WHO 1

FRAUD!!!!!

If there is a reason to shut down the WHO, here it is.

Cass Sunstein is the poster child of pseudo-empiricism. He failed to get pandemics early on and missed on the difference between additive & multiplicative risks.

FRAUD! https://t.co/ZCh2TaX4YM— Nassim Nicholas Taleb (@nntaleb) July 31, 2020

Taleb 2

3) The Collection of bureaucrats *who meet* for a living and failed to get the risks of the pandemic early on when WE warned, costs us TRILLIONS.

Now what do they do? They ADD more bureaucrats like that fraud Sunstein.

Institutions learn via bankruptcy. WHO must be DEFUNDED.

— Nassim Nicholas Taleb (@nntaleb) July 31, 2020

“We’ve confirmed YMCA Camp High Harbor is the un-named camp in new @CDCgov camp outbreak investigation. 51% of campers ages 6-10 contracted COVID19.”

• 100s Of Georgia Campers Infected With Corona At YMCA Camp In Days – CDC (WSB)

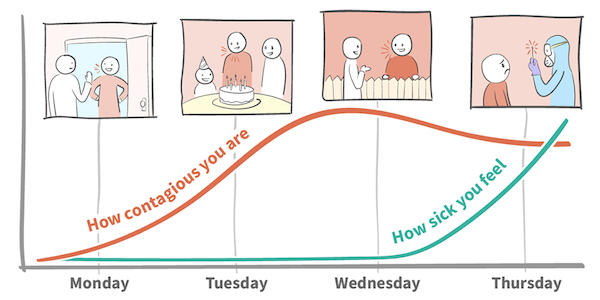

A CDC report released Friday reveals that hundreds of campers at a north Georgia YMCA camp were infected with coronavirus in just days before the camp was shut down. Channel 2 Action News has confirmed that the report documents COVID-19 cases at the YMCA’s Camp High Harbor on Lake Burton in Rabun County. According to the report, of the 597 residents who attended the camp, 344 were tested and 260 tested positive for the virus. The camp was only open for four days before being shut down because of the virus, and officials followed all recommended safety protocols. In total, the virus attacked 44% of the children, staff members and trainees who attended the camp.

The CDC said that what happened at High Harbor shows that earlier thinking that children might not be as susceptible to COVID-19 is wrong. According to the report, the age group with the most positive coronavirus tests was 6 – 10 years old. Under Gov. Kemp’s executive orders, overnight summer camps in Georgia were allowed to open on May 31. All campers and staff members had to test negative for the coronavirus before attending. Channel 2 Action News first reported on June 24 that a teenage counselor at the camp tested positive for the virus. Camp officials started sending campers home on June 24 and shut the camp down on June 27. Camp Harbour’s second location at Lake Allatoona in Bartow County was also closed.

“The counselor… passed the mandated safety protocols and screening, inclusive of providing a negative COVID-19 test, before arriving at camp and did not exhibit any symptoms upon arrival,” officials said. “In fact, all counselors and campers attending passed all mandatory screenings.” The Georgia Department of Public Health (DPH) was notified and initiated an investigation. DPH recommended that all attendees be tested and self-quarantine, and isolate if they had a positive test result. By July 10, 85 campers and staff members had tested positive. “These findings demonstrate that SARS-CoV-2 spread efficiently in a youth-centric overnight setting, resulting in high attack rates among persons in all age groups, despite efforts by camp officials to implement most recommended strategies to prevent transmission,” the report said.

Until the first one comes in infected.

• College Students Who Get Tested Every Two Days Can Return To Campus Safely (F.)

A study published today says that college students living on campus can be kept safe from contracting the coronavirus if they are tested every two days for Covid-19. The study pegs the cost at $470 per student per semester. Published in the Journal of the American Medical Association’s Open Network, the study was authored by researchers from the Yale School of Public Health, Harvard Medical School and Massachusetts General Hospital. One interesting finding: Even when tests aren’t 100% accurate, if they are given with the study’s recommended frequency, they ensure a safe environment for students. The researchers used a computer simulation where they took a hypothetical pool of 4,990 healthy students and exposed them to 10 students infected with the virus.

They assumed that students would be on campus for an abbreviated 80-day semester, which is the plan at many schools that have said they are reopening campuses. The study also said students who test positive should quarantine in an isolated setting. The model assumed that students would strictly follow safety precautions like frequent handwashing, wearing masks indoors, “limited bathroom sharing with frequent cleaning, dedensifying campuses and classrooms and other best practices.” But the study’s lead author, A. David Paltiel, a professor at Yale’s school of public health, says he and his team also took into account the fact that students would occasionally deviate from safety protocols. “Colleges aren’t going to be able to create a hermetically sealed, walled garden,” he says.

“We assumed that once in a while students would go to a face-to-face party or a dining hall worker who traveled on the subway would come into contact with a student or somebody would cough on a student.” Even with occasional exposure, getting a rapid-response test every two days would make it safe for students to live on campus, he says. In the Boston area, inexpensive, quick-turnaround nasal swab tests are being made available from the Broad Institute of MIT and Harvard. The tests will be provided at cost, for $25-$30 each. Schools will administer the tests and the institute will process them within 24 hours.

But they can meet up in the pub?!

• Visiting People At Home Banned In Parts Of Northern England (BBC)

Millions of people in parts of northern England are now facing new restrictions, banning separate households from meeting each other at home after a spike in Covid-19 cases. The rules impact people in Greater Manchester, east Lancashire and parts of West Yorkshire. The health secretary told the BBC the increase in transmission was due to people visiting friends and relatives. Labour criticised the timing of the announcement – late on Thursday night. Health Secretary Matt Hancock told BBC Breakfast the government had taken “targeted” action based on information gathered from contact tracing, which he said showed that “most of the transmission is happening between households visiting each other, and people visiting relatives and friends”.

The new lockdown rules, which came into force at midnight, mean people from different households will not be allowed to meet in homes or private gardens. They also ban members of two different households from mixing in pubs and restaurants, although individual households will still be able to visit such hospitality venues. The changes come as Muslim communities prepare to celebrate Eid this weekend, and nearly four weeks after restrictions were eased across England – allowing people to meet indoors for the first time since late March. The same restrictions will apply in Leicester, where a local lockdown has been in place for the last month. However, pubs, restaurants and other facilities will be allowed to reopen in the city from Monday, as some of the stricter measures are lifted.

Simple is elegant.

Podcast: https://www.econtalk.org/nassim-nicholas-taleb-on-the-pandemic/

• Nassim Nicholas Taleb on the Pandemic (Sav)

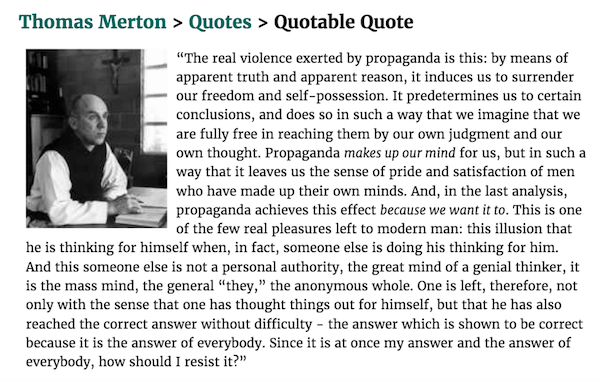

On Societal Risk There’s a big difference between risks that simply lead to different outcomes and risks of ruin, particularly on the systemic level. We should be worrying about multiplicative risks — such as pandemics. On the other hand, car accidents are not a societal risk of ruin, as car accidents don’t lead to other car accidents. If you found out that 1 billion people died in a single year, and didn’t know how, your guess wouldn’t be car accidents. It would be something fat-tailed like nuclear war or pandemics. It’s worthwhile figuring out what the systemic risks that we should be avoiding are — it liberates us and allows us to take lots of risks elsewhere.

On Personal Risk If you don’t behave conservatively, you’ll increase collective risk dramatically because risk due to pandemics doesn’t scale linearly. You wear a mask more for the systemic effect, not to mitigate personal risk. Prudence on the individual level may seem like ‘overreacting’, and it would be ‘rational’ not to overreact. However, it’s important to note that rationality doesn’t scale; what’s rational for the collective may seem irrational for you personally. People doing the right thing will look irrational.

How to Deal With Pandemics Any infectious disease with over 1000 deaths can be considered a pandemic. If the count is below that, you don’t have to worry about it. If above, it means you’re dealing with a fat-tailed event. Treat all pandemics the same way — the moment they kill 1000, take measures. The most effective way to prevent pandemics is to do systemic quarantine. Follow a protocol and don’t take chances — it was foolish to quarantine people only coming from China, as the virus could have came from anywhere (and it did). Reduce connectivity. Close borders. You don’t need cases at 0, just make sure that the cases don’t overwhelm your system. Identify superspreaders. Subways, elevators, big gatherings, things like that. Do this for all pandemics, no matter how impactful, until we figure out the specific properties of the one we’re dealing with.

Absence of Evidence ≠ Evidence of Absence For example, if you have no evidence of cases, it doesn’t mean you have no cases. Or if you have no evidence that masks work, it doesn’t mean that masks don’t work. Err on the side of prudence when dealing with risks of ruin. “If you don’t know if masks work, wear them.”

The central idea of the Incerto is: when you have uncertainty in a system, it makes your decision making much much easier rather than harder. “If I tell you that I’m not certain about the quality of this water, would you drink it?” “If I tell you that we have uncertainty about the pilot’s skills — he could be excellent, but we’re not sure — would you get on the plane?”

The WHO Initially, WHO, CDC, and others said not to wear masks. The WHO made two mistakes. First, they didn’t realize scaling: if the probability of infection is p, if both people wear masks it becomes p squared. For example, if p=0.50, both people wearing a mask would lower p to 0.25. Second mistake: if I reduce the viral load by half, I don’t decrease probability of infection by half — I may decrease it by 99%. That’s because the probability of infection is nonlinear — it’s an S-curve. In addition, they lied because they were worried about a mask shortage. People’s instincts were much better than what the WHO, CDC, etc advised. “All of these people are completely incompetent when it comes to basic things that your grandmother gets.” Have the WHO removed — it’s a bureaucratic organization that has been harmful to mankind by telling people not to wear masks.

Good thing for him that schoolgirls don’t vote.

• Trump Says Will Ban TikTok Through Executive Action As Soon As Saturday (CNBC)

President Donald Trump on Friday told reporters he will act as soon as Saturday to ban Chinese-owned video app TikTok from the United States, NBC News reported. Trump made the comments while chatting with reporters on Air Force One during the flight back to Washington from Florida. “As far as TikTok is concerned we’re banning them from the United States,” Trump said, calling the action a “severance.” Trump did not specify whether he will act through an executive order, or another method. such as a designation, according to NBC News. “Well, I have that authority. I can do it with an executive order or that,” Trump said.

Trump’s comments come as it was reported Friday that Microsoft has held talks to buy the TikTok video-sharing mobile app from Chinese owner ByteDance, one person close to the situation told CNBC. This person characterized the talks as having been underway for some time, rather than being brand new. Trump told reporters that he didn’t support the reported spinoff deal involving Microsoft buying TikTok, NBC News reported. A TikTok acquisition could make Microsoft, a major provider of business software, more concentrated on consumer technology, which Microsoft has moved away from somewhat in recent years, by exiting the smartphone hardware, fitness hardware and e-book markets.

The casino is open and the house always wins.

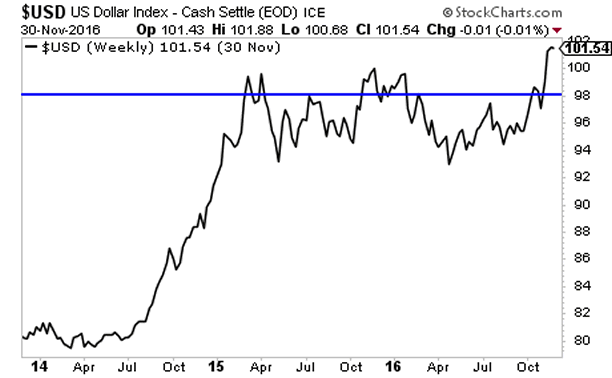

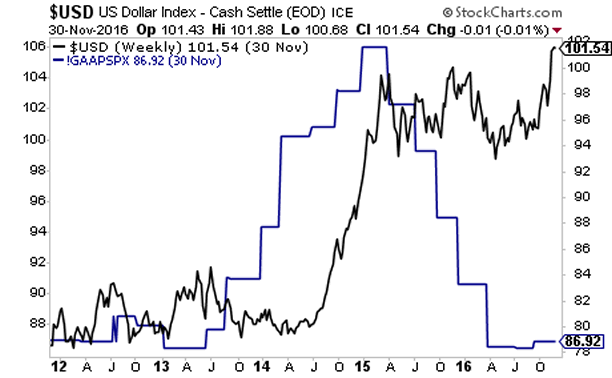

• US Dollar Net Shorts Soar To Highest In Nine Years (R.)

Speculators’ net short U.S. dollar positioning soared to the highest level since August 2011, according to calculations by Reuters and U.S. Commodity Futures Trading Commission data released on Friday. The position hit $24.27 billion in the week ended July 28, up from $18.81 billion the prior period. U.S. net shorts rose for a fourth straight week as bets against the greenback have persisted since mid-March. U.S. dollar positioning was derived from net contracts of International Monetary Market speculators in the Japanese yen, euro, British pound, Swiss franc as well as the Canadian and Australian dollars. In a wider measure of dollar positioning that includes net contracts on the New Zealand dollar, Mexican peso, Brazilian real, and Russian ruble, the U.S. dollar posted a net short position of $24.53 billion, compared with net shorts of $19.37 billion the week before.

This week’s net short position was largest since April 2018, according to Reuters data. In contrast, net euro longs hit a record high, CFTC data showed. Net euro longs were 157,559 contracts this week. The greenback has struggled over the last few months, driven by factors including near-zero interest rates as well as Federal Reserve measures that flooded the international market with dollars via swap lines. The buck was down about 10% from the year’s high hit in March against a basket of currencies. On Friday the dollar fell to its lowest in more than two years. “The combination of falling real rates and rising risk assets has been a dominating force across markets over the past few months, which has likely contributed to the dollar sell-off over the same period,” said Goldman Sachs in a research note on Friday.

And with the euro surging vs the USD, the EU economy is crashing.

Forget about the inflation talk, velocity of money is in the gutter. Sure some prices may rise for a bit, everyone’s trying to stay alive. But who has the money left to afford the higher prices? Or better yet: who will by Christmas?

• Eurozone Economy Records Its Deepest Contraction On Record In Q2 (R.)

The euro zone’s economy recorded its deepest contraction on record in the second quarter, preliminary estimates showed on Friday, while the bloc’s inflation unexpectedly ticked up in July. In the months from April to June, gross domestic product in the 19-country currency bloc shrank by 12.1% from the previous quarter, the European Union’s statistics office Eurostat said in its flash estimates. The deepest GDP fall since the time series started in 1995 coincided with coronavirus lockdowns which many euro zone countries began to ease only from May. The contraction was slightly more pronounced than market expectations of a 12.0% fall, and followed the 3.6% GDP drop recorded in the first quarter of the year.

Among the countries for which data were available, Spain posted the worst output slump, with its economy shrinking by 18.5% quarter-on-quarter, worse than expected and wiping out all the post-financial crisis recovery of the last six years. GDP in Italy and France also fell sharply but less than forecast, respectively by 12.4% and 13.8%. Germany, the largest economy in the bloc, saw a 10.1% contraction in the second quarter, worse than expectations of a 9.0% slump. Inflation continued instead its upward trend, defying expectations of a slowdown, supporting the European Central Bank’s expectation that a negative headline reading may be avoided. Eurostat said consumer prices in the bloc rose 0.4% on an annual basis in July from 0.3% in June and 0.1% in May. Economists polled by Reuters had forecast a 0.2% increase in July.

Underlying price pressure also accelerated. Excluding volatile food and energy prices, a key measure watched by the ECB, inflation rose by 1.3% from 1.1% in June, Eurostat’s flash estimates showed. An even narrower gauge, which also excludes alcohol and tobacco, jumped to 1.2% from 0.8% in June. The acceleration in headline inflation was driven by higher prices of industrial goods which rose by 1.7% after a 0.2% increase in June. Food, alcohol and tobacco prices went up by 2.0% on the year, but slowed from the 3.2% rise recorded in June. Energy prices fell by 8.3% in July, after plunging 9.3% in June.

The bottom is falling out.

• The End of Housing as We Know It (TNR)

In 2018, 44 percent of New York renter households paid at least 30 percent of their incomes on rent. Half of those were severely rent-burdened, spending more than half of their incomes on housing. Relief is also hard to come by: For a family of three earning less than $30,720 a year—a household that would be classified by the city as “extremely low income”—there are 650 applications for each apartment in the affordable housing lottery. This was before the pandemic. In the months since, an untold number of New York’s working-class immigrants have lost their jobs, with some social service organizations in the city reporting that upward of 90 percent of their immigrant clients are out of work, according to a study by the Center for an Urban Future.

The city comptroller’s office found that 900,000 fewer New Yorkers reported working in May than in February, with job losses mostly concentrated among people of color and young people. Now, with temporary protective measures like rent moratoriums lasting only through the end of the pandemic and enhanced unemployment benefits set to expire (and with millions of undocumented immigrants shut out of many of those protections in the first place), New York City is on the brink of a new phase of its long-festering housing crisis. “They do not have to worry about what we have been through,” Ramirez, who has been on rent strike with other tenants in her building since March, said of the big landlords who own buildings like hers. “They do not worry about what their children are going to eat, what they are going to do, what is going to happen with that.”

[..] A recent report by Americans for Tax Fairness shows that the wealth of New York’s billionaires increased by $77 billion from March to June. Juxtapose that obscene accumulation of wealth to the $9 billion deficit New York City is facing for the 2020-2021 fiscal year. Despite this, Governor Andrew Cuomo balked at calls to tax the wealthy to fill the shortfall that might result in cutbacks to vital services and, after public pressure, offered a mere $100 million in relief through the State Division of Housing and Community Renewal. And instead of providing support for renters, New York City Mayor Bill de Blasio approved a budget that cuts investment in affordable housing by 40 percent.

Nice set of names. Let the denials emerge.

• Judge Rips Into Ghislaine Maxwell As Sealed Documents Begin To Emerge (McC)

A much-anticipated batch of newly unsealed documents from a settled defamation suit began trickling out Thursday night over the objections of Ghislaine Maxwell, the British socialite accused of sex trafficking and alleged to be the madam of disgraced financier Jeffrey Epstein. In a 2015 e-mail Epstein advised Maxwell to return to the high-society world the two had inhabited without any shame. “You have done nothing wrong and i would urge you to start acting like it,” Epstein wrote. “[G]o outside, head high, not as an escaping convict. go to parties. deal with it.” Maxwell, awaiting trial in a federal prosecution, had delayed the planned release of the documents from a 2015 civil suit by filing objections at the last minute, provoking the ire of U.S. District Judge Loretta Preska. The judge ruled last week that the documents should be unsealed.

“The Court is troubled — but not surprised — that Ms. Maxwell has yet again sought to muddy the water as the clock clicks closer to midnight,” Preska wrote in a filing denying a request from Maxwell’s lawyers for an emergency phone conference. They argued, unsuccessfully, that the documents threaten her defense and complained she had already been convicted by the media. The judge had allowed two key depositions to be exempt from release while Maxwell filed an appeal Thursday with the 2nd Circuit Court of Appeals. But Preska ordered a second large tranche of documents from the case settled in 2017 unsealed and released Thursday night.

[..] That same transcript also names people who traveled with Epstein. While many of the names have been publicly linked to Epstein before, seeing them in the context of the document was jarring. Giuffre tells of celebrities traveling with Epstein like magician David Copperfield, model Naomi Campbell, former Sony Records President Tommy Mottola and Alexandra Cousteau, granddaughter of the famed undersea explorer Jacques Cousteau. Giuffre also provides a sworn statement about former President Bill Clinton visiting Epstein’s Little St. James Island. “When you say you asked him why is Bill Clinton here, where was he?” Giuffre was asked in her deposition, answering, “On the island.”

In the newly released 24-page transcript of “Document 16,” Giuffre added that two young girls from New York and Maxwell were on the island at the same time as Clinton, who has denied any improper relations. So have the numerous men she identified. The earlier documents also included the names of a number of men whom Giuffre said she and other victims were directed to have sex with, including former U.S. Sen. George Mitchell, former New Mexico Gov. Bill Richardson, Hyatt hotels magnate Tom Pritzker, the late scientist Marvin Minsky, modeling scout Jean-Luc Brunel, and prominent hedge fund manager Glenn Dubin.

Well, she has one win. But it’s Pyrrhic.

• US Appeals Court Delays Release Of Ghislaine Maxwell Deposition (R.)

The 2nd U.S. Circuit Court of Appeals issued the order after last-ditch scrambles by Maxwell to keep potentially embarrassing information, which her lawyer said could make it “difficult if not impossible” to find an impartial jury, out of the public eye. Maxwell’s appeal will be heard on an expedited basis, with oral argument scheduled for Sept. 22. Her deposition had been taken in April 2016 for a now-settled civil defamation lawsuit against the British socialite by Virginia Giuffre, who had accused Epstein of having kept her as a “sex slave” with Maxwell’s assistance. Dozens of other documents from that case were released late on Thursday, after the presiding judge concluded that the public had a right to see them.= The release of Maxwell’s deposition had been scheduled for Monday, pending the outcome of the appeal.

[..] In seeking to keep Maxwell’s deposition sealed, her lawyers said in court papers on Thursday she had been promised confidentiality by Giuffre’s lawyers and the presiding judge at the time, through an agreed-upon protective order, before answering many personal, sensitive and “allegedly incriminatory” questions about her dealings with Epstein. They said further that Maxwell was blindsided when prosecutors quoted from the deposition in her indictment, and accusing Giuffre of leaking the deposition to the government. In a court filing on Friday, Giuffre’s lawyers called Maxwell’s appeal “frivolous, and a transparent attempt to further delay the release of documents to which the public has a clear and unequivocal right to access.” The lawyers also called the allegation Giuffre leaked the deposition “completely and utterly false.”

This is not about something being rotten IN the state, this is a rotten state. It’s the core.

• UK Government Refuses To Release Information About Assange Judge (DecUK)

The United Kingdom’s Ministry of Justice is blocking the release of basic information about the judge who is to rule on Julian Assange’s extradition to the US in what appears to be an irregular application of the Freedom of Information Act, it can be revealed. Declassified has also discovered that the judge, Vanessa Baraitser, has ordered extradition in 96% of the cases she has presided over for which information is publicly available. Baraitser was appointed a district judge in October 2011 based at the Chief Magistrate’s Office in London, after being admitted as a solicitor in 1994. Next to no other information is available about her in the public domain.

Baraitser has been criticised for a number of her judgments so far concerning Assange, who has been incarcerated in a maximum security prison, HMP Belmarsh in London, since April 2019. These decisions include refusing Assange’s request for emergency bail during the Covid-19 pandemic and making him sit behind a glass screen during the hearing, rather than with his lawyers. Declassified recently revealed that Assange is one of just two of the 797 inmates in Belmarsh being held for violating bail conditions. Over 20% of inmates are held for murder. Declassified has also seen evidence that the UK Home Office is blocking the release of information about home secretary Priti Patel’s role in the Assange extradition case.

A request under the Freedom of Information Act (FOIA) was sent by Declassified to the Ministry of Justice (MOJ) on 28 February 2020 requesting a list of all the cases on which Baraitser has ruled since she was appointed in 2011. The MOJ noted in response that it was obliged to send a reply within 20 working days. Two months later, on 29 April 2020, an information officer at the HM Courts and Tribunals Service responded that it could “confirm” that it held “some of the information that you have requested”. But the request was rejected since the officer claimed it was not consistent with the Constitutional Reform Act. “The judiciary is not a public body for the purposes of FOIA… and requests asking to disclose all the cases a named judge ruled on are therefore outside the scope of the FOIA,” the officer stated.

A British barrister, who wished to remain anonymous, but who is not involved with the Assange case, told Declassified: “The resistance to disclosure here is curious. A court is a public authority for the purposes of the Human Rights Act and a judge is an officer of the court. It is therefore more than surprising that the first refusal argued that, for the purposes of the FOIA, there is no public body here subject to disclosure.” The barrister added: “The alternative argument on data doesn’t stack up. A court acts in public. There is no default anonymity of the names of cases, unless children are involved or other certain limited circumstances, nor the judges who rule on them. Justice has to be seen to be done.”

“..selling postcards of the hanging..”

• When the Going Gets Weird, the Weird Get Punked (Kunstler)

The election itself is another front in this undeclared civil war. How exactly did the Democratic Party come to settle on a candidate with no credible capacity to serve as president? Who is Joe Biden fronting for, and who do they think they’re fooling? How can he possibly deliver an acceptance speech three weeks from now without giving away the game? That will be something to see — but I doubt we will actually see it. If the Dems don’t switch him out, there is no way Mr. Biden can survive the three-month homestretch of an election campaign. He can barely make it through a ten-minute appearance in front of twenty-three hand-picked partisans in a TV studio. Life imitates art, as Oscar Wilde tartly observed. The Manchurian candidate is truly here.

Mr. Barr is quite correct when he avers that an election by mail-in ballots is an invitation to fraud. The parallel campaign by the news media to ramp up extra hysteria over the corona virus is designed to ensure that scam. Keeping kids out of school is another angle on it, to plant a narrative that parents can’t possibly leave the house to go to a polling station. Wait for it. The result would be an election that can’t be resolved even by the Supreme Court. What will happen then? I’ll tell you how it goes: Donald Trump will stand aside and yield to the military, to some general or committee of generals, and the country will be under martial law until the election is sorted out or re-run. And by then, the election may be the least of our problems, with tens of millions out-of-work, out-of-business, penniless, homeless, and hungry. That’s when they’ll truly be selling postcards of the hanging, as the old song goes. Then comes America’s Bonaparte moment. Yes, things can get that weird.

“..the hearing had as much class as a demolition derby..”

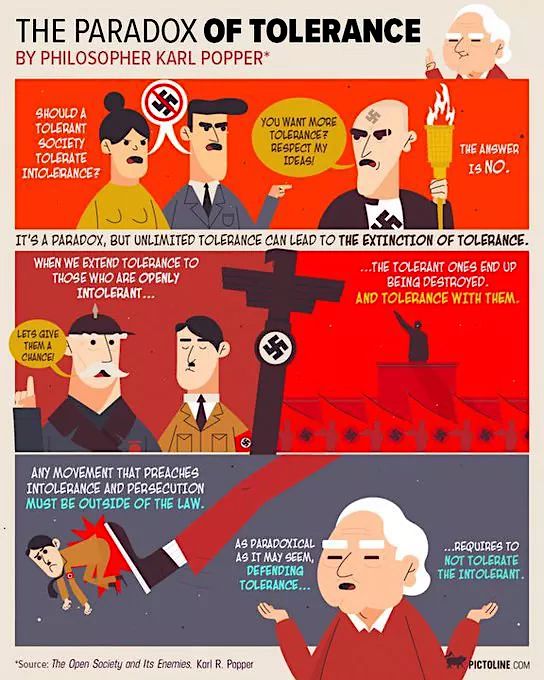

• The Triumph Of Small People In An Era Of Great Events (Turley)

Winston Churchill said, “The best argument against democracy is a five minute conversation with the average voter.” If he knew members of the House Judiciary Committee, he could have cut that time in half, as they might convince people that democracy is a failed experiment. The hearing with Attorney General William Barr had been long awaited for weeks as a way to get answers on issues ranging from the controversial clearing of Lafayette Park, to the intervention in the case of Roger Stone, to the violence across various cities. Instead, the public watched as both parties engaged in hours of primal scream therapy, with Barr for the most part forced to remain as silent as some life size anatomical doll. The videos shown by the rival parties captured the utter absurdity of the day.

Republicans played what could only be described as eight minutes of virtual “riot porn” for the hard right. By the end, one would think much of the nation is a smoking dystopian hellscape. Democrats then played their alternate reality video showing thousands of protesters chanting together in perfect harmony. Add a soundtrack to the scene and you would have a soda commercial. There was nothing in the middle: either the protests are either our final Armageddon or the Garden of Eden. After testifying recently on the Lafayette Park controversy, I was one of those who had great expectations for answers to significant questions. Instead, Democrats dramatically demanded answers and then stopped Barr from answering by immediately “taking back the time.” It happened over and over during the hearing. Democrats simply did not want to hear any answers that would undermine the popular narratives.

Several Democrats insisted the clearing of Lafayette Park was for the sole purpose of a photo for President Trump in front of Saint John Church. Barr sought to explain that there was no connection between the plan formed the weekend before and the photo, but he was stopped by members like Hank Johnson saying “you clearly will not answer the question” before he could even start to answer. It got more and more bizarre. Barr was repeatedly cut off by Democrats, while Republicans, who have done the same thing to witnesses in other hearings, raged against their colleagues. The result was mayhem. While Barr sarcastically referred to Jerrold Nadler as a “real class act” after Nadler refused a request for a break, the hearing had as much class as a demolition derby.

Lying under oath?!

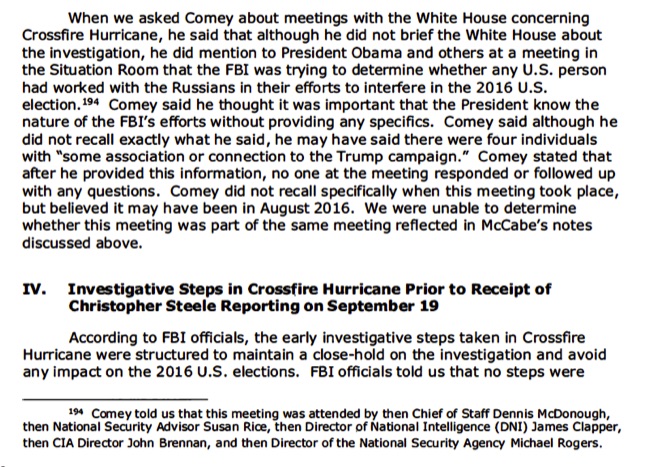

• Susan Rice’s Testimony on Being Out of Russiagate Loop Doesn’t Add Up (RCI)

Rice insisted she knew nothing about the FBI’s counterintelligence probe regarding Trump and Russia, let alone anything that could be characterized as spying on the incoming administration. She had her lawyer, Kathryn Ruemmler, write a letter to Sens. Charles Grassley, Dianne Feinstein, Lindsey Graham, and Sheldon Whitehouse. “While serving as National Security Advisor, Ambassador Rice was not briefed on the existence of any FBI investigation into allegations of collusion between Mr. Trump’s associates and Russia,” Ruemmler wrote, “and she later learned of the fact of this investigation from Director Comey’s subsequent public testimony” – testimony that didn’t occur until March 20, 2017 On Wednesday, September 8, 2017, Rice repeated that she knew nothing of the FBI’s investigation while in the White House. This time she made the claim under oath.

Rice was at the Capitol, sitting in a secure room used by the House Permanent Select Committee on Intelligence. The official reason for the interview was to ask what the Obama administration had done to thwart Russian efforts to interfere in the 2016 presidential election. Behind those questions was a different query: Had Barack Obama’s team used the power of the presidency to spy on and smear the Trump campaign? With the expectation of facing unfriendly questions, Rice arrived with two attorneys from the law firm Latham & Watkins. The Republican staffer running the interview emphasized to Rice the importance of telling the truth: “You are reminded that it is unlawful to deliberately provide false information to members of Congress or staff.” She was asked to raise her right hand and take an oath: “Madam Ambassador, do you swear or affirm that the testimony you’re about to give is the truth, the whole truth, and nothing but the truth?” “I do,” Rice said.

[..] Comey told Horowitz that in August 2016 “he did mention to President Obama and others at a meeting in the Situation Room that the FBI was trying to determine whether any U.S. person had worked with the Russians in their efforts to interfere in the 2016 U.S. election.”“[A]lthough [Comey] did not recall exactly what he said,” Horowitz writes, “he may have said there were four individuals with ‘some association or connection to the Trump campaign.’” This revelation failed to strike anyone at the meeting as remarkable: “Comey stated that after he provided this information, no one in the Situation Room responded or followed up with any questions.” [..] Comey provided Horowitz with a list of those at the meeting. The inspector general shares that list in footnote 194 to his report: President Obama was there, as well as his chief of staff, Dennis McDonough; also present were James Clapper, John Brennan, Michael Rogers and Susan Rice.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you.

Support the Automatic Earth in virustime.