Jack Delano “Untitled” near Durham, North Carolina 1940

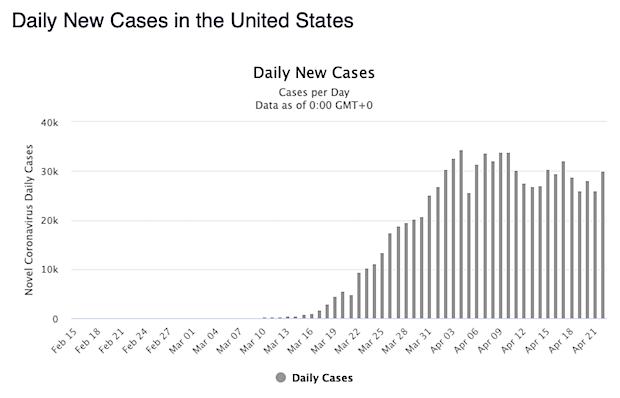

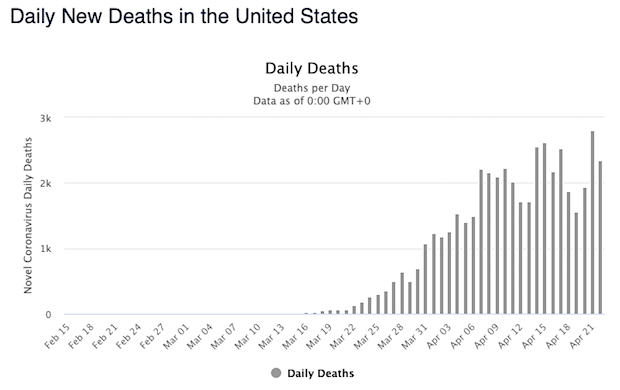

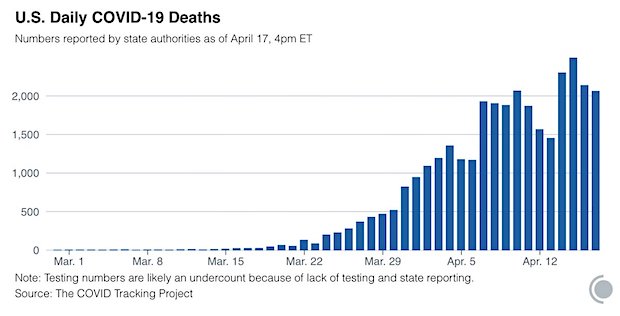

Daily US coronavirus death toll down sharply in past 24 hours to 1,258, the lowest daily toll in the country in nearly three weeks: Johns Hopkins

4/24/20 – Top 12 State Cases

New York: 271,590

New Jersey: 102,196

Mass : 46,023

Illinois: 39,658

California: 39,254

Pennsylvania: 38,652

Michigan: 36,641

Florida: 30,174

Louisiana: 26,140

Connecticut: 23,921

Texas: 22,806

Georgia: 22,147

• “At least 30 New Yorkers ingested household cleaners in the 18 hours since the president suggested using it to fight #coronavirus”

• “The timing on the bleach stuff is interesting, since the DOJ started cracking down on MMS, the diluted form of bleach being sold as a miracle cure for any disease under the sun on social media… six days ago.”

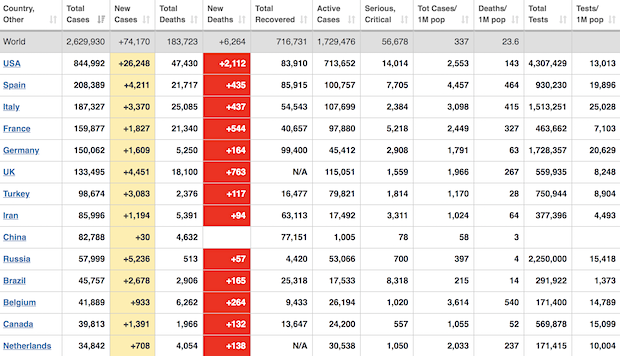

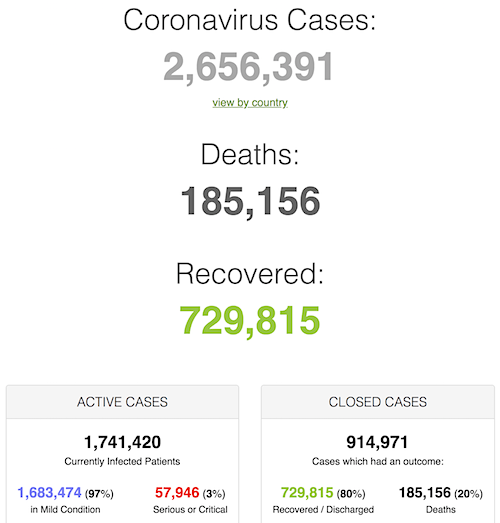

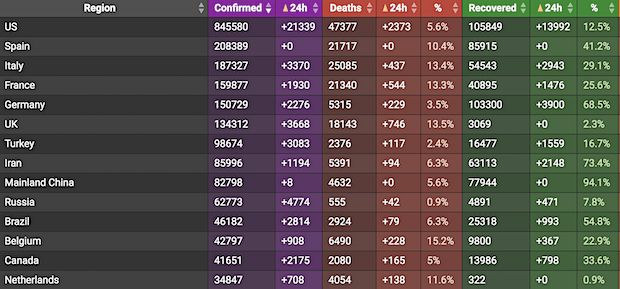

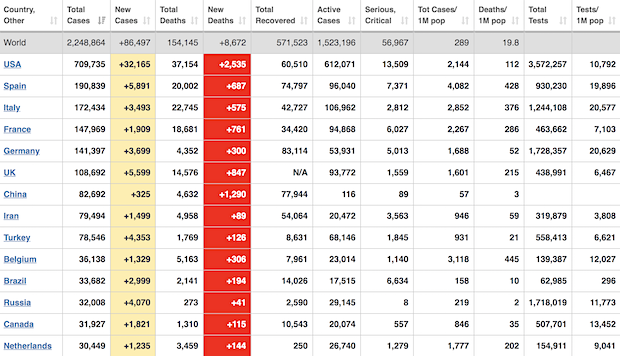

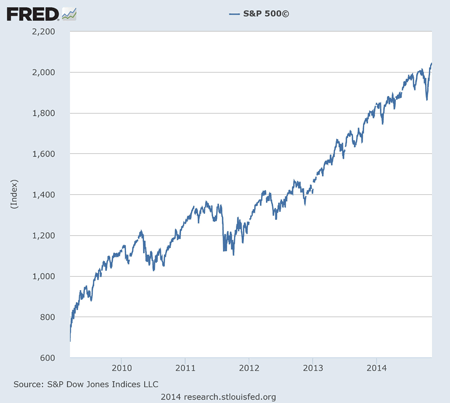

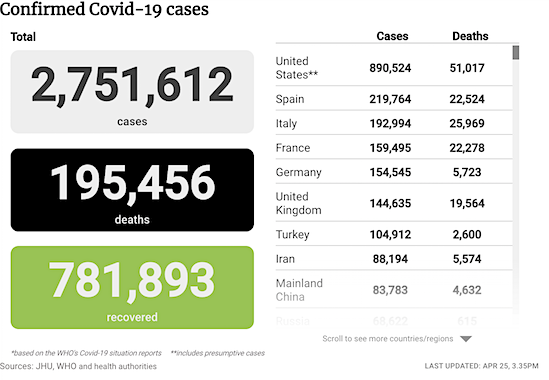

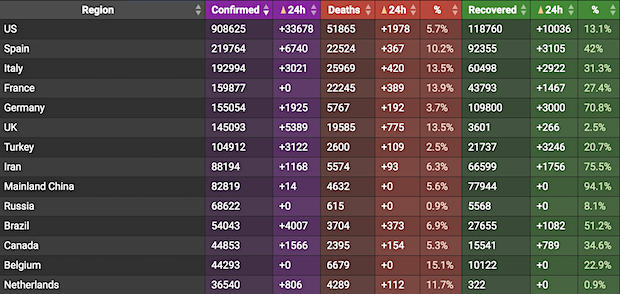

• Cases 2,845,858 (+ 100,389 from yesterday’s 2,745,469)

197,846

• Deaths 191,791 (+ 6,055 from yesterday’s 185,156 )

From Worldometer yesterday evening -before their day’s close-

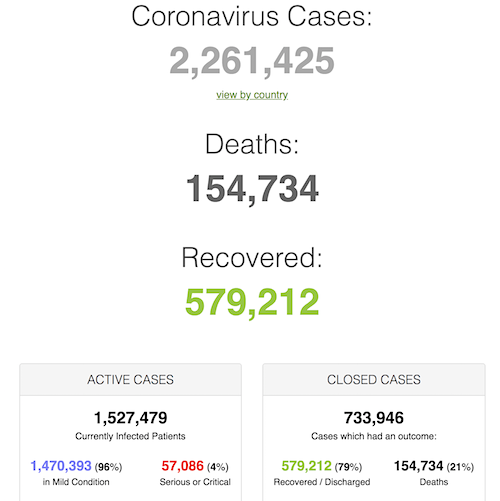

From Worldometer – NOTE: among Active Cases, Serious or Critical fell to 3%. Among Closed Cases, Deaths have fallen to 20%

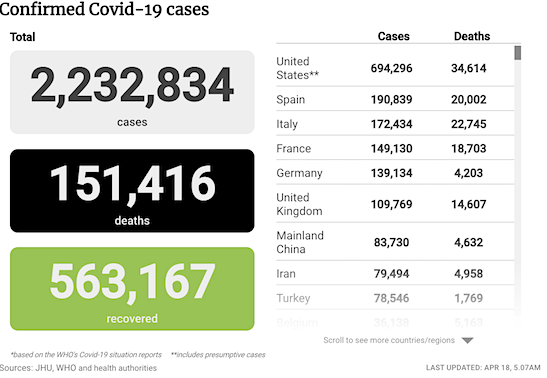

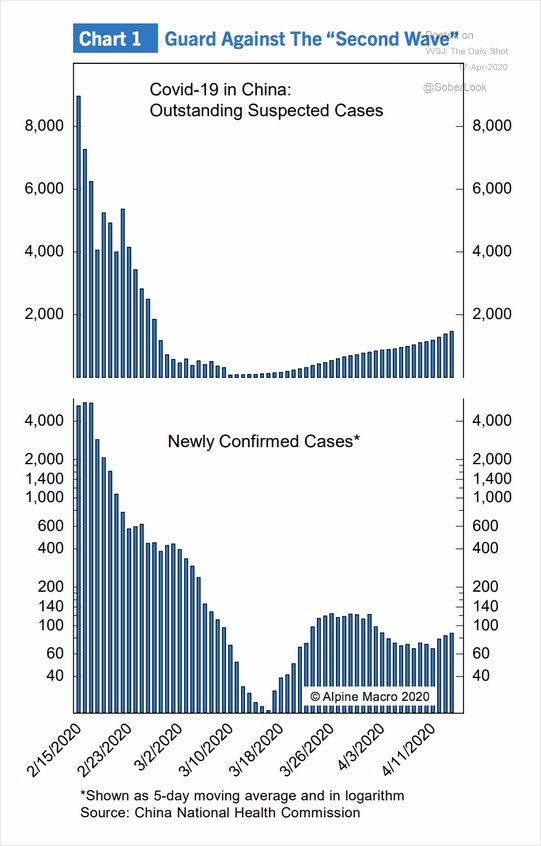

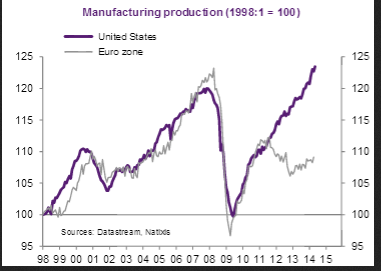

From SCMP:

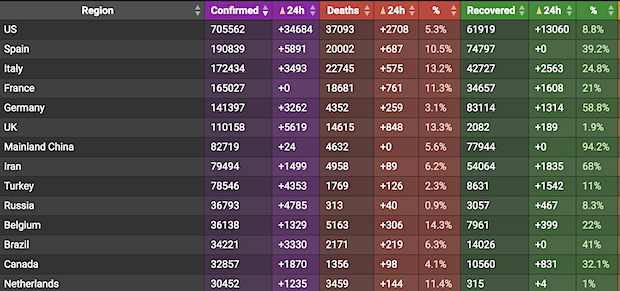

From COVID19Info.live: Note: Turkey, Russia, UK are the biggest risers

Keep it locked down.

• Wuhan Was The Fentanyl Capital Of The World. Then Coronavirus Hit (LAT)

For drug traffickers interested in getting in on the fentanyl business, all roads once led to Wuhan. The sprawling industrial city built along the Yangtze River in east-central China is known for its production of chemicals, including the ingredients needed to cook fentanyl and other powerful synthetic opioids. Vendors there shipped huge quantities around the world. The biggest customers were Mexican drug cartels, which have embraced fentanyl in recent years because it is cheaper and easier to produce than heroin. But the novel coronavirus that emerged in Wuhan late last year before spreading across the planet has upended the fentanyl supply chain, causing a ripple effect that has cut into the profits of Mexican traffickers and driven up street drug prices across the United States.

Few industries — illicit or not — have been unscathed by the pandemic that has upended the global economy and killed more than 190,000 people worldwide. The narcotics trade, which relies on the constant movement of goods and people, has been stymied by lockdowns, travel bans and other efforts to contain the virus, according to government officials, academic researchers and drug traffickers. Mexican production of fentanyl and methamphetamine appears especially hard hit. Both drugs are made with precursor chemicals that are typically sent on planes or cargo ships from China, where despite U.S. pressure to ban them, they continue to be sold legally. That supply chain was shut down in January when authorities in Wuhan enacted a lockdown that forced residents to stay inside for more than two months.

In February, after a major manufacturer of the chemicals closed, vendors began posting apologies on the online sites where chemicals are typically sold, said Louise Shelley, a professor at George Mason University who tracks global fentanyl production. “They were saying: ‘We’re not producing or selling or shipping,’” she said.

The headline says: “racist”. I like everything Winnie.

• ‘Wuhan Plague’ Plaques Are Popping Up Around Atlanta (Vice)

Racist plaques depicting Winnie the Pooh holding a bat with chopsticks have begun to pop up around Atlanta, and police have no leads as to who is responsible. The round, bronze and teal plaques bearing the words “Wuhan Plague,” referencing the Chinese city where the coronavirus originated, first appeared April 13 on an electrical box in Inman Park, according to Atlanta police. Another appeared three days later at a coffee shop in the neighborhood of Reynoldstown. The most recent incident occurred on April 18 at Atlanta’s Candler Park Market. Winnie the Pooh’s association with Chinese culture originated in 2013 when parody comparisons between the cuddly bear and Prime Minister Xi Jinping went viral on social media — and China then banned Pooh images.

The plaques appeared to be glued to the sites where they were posted. Hodgepodge Coffeehouse owner Kristle Rodriguez said her employees alerted her to the plaque at her site. Rodriguez said she immediately called the cops and the building’s landlord, who quickly removed the plaque. “The adhesive was still wet, meaning this happened late morning or early afternoon,” she wrote in a Facebook post Friday. “This isn’t amusing, funny, politically incorrect, edgy, or punk rock. This is super fucking gross and racist. There’s enough xenophobia and ignorance being spouted from this administration, we certainly don’t need street art reinforcing this shit.”

Curious article, because it’s not true.

• Trump Owed Tens Of Millions To Bank Of China (Pol.)

But Trump himself has taken on debt from China. In 2012, his real estate partner refinanced one of Trump’s most prized New York buildings for almost $1 billion. The debt included $211 million from the state-owned Bank of China — its first loan of this kind in the U.S. — which matures in the middle of what could be Trump’s second term. Steps from Trump Tower in Manhattan, the 43-story 1290 Avenue of the Americas skyscraper spans an entire city block. Trump owns a 30 percent stake in the property valued at more than $1 billion, making it one of the priciest addresses in his portfolio, according to his financial disclosures. Trump’s ownership of the building received a smattering of attention before and after his 2016 campaign.

But the arrangement with the Bank of China in 2012 has gone largely unnoticed. The questions surrounding Trump’s ties to the Bank of China come as his campaign is claiming that Biden would be a gift to the Communist country and America’s chief economic rival. After the first version of this article was published, the Bank of China issued a statement Friday evening stating that it sold its debt on the building weeks after the 2012 loan on the property. Vornado Realty Trust owns 70 percent of the building. “On November 7, 2012 several financial institutions including the Bank of China participated in a commercial mortgage loan of $950 million to Vornado Realty Trust,” said Peter Reisman, managing director and chief communications officer of Bank of China U.S.A.

“Within 22 days, the loan was securitized and sold into the [commercial mortgage-backed securities] market, as is a common practice in the industry. Bank of China has not had any ownership interest in that loan since late November 2012.”

Balding explains.

• Trump Doesn’t Owe Bank of China Money (Christopher Balding)

Let me explain the deal structure and why Trump doesn’t owe Bank of China money. First, Trump is a minority passive owner of a real estate trust. 30% so not nothing and he is the president but it isn’t even his company. He doesn’t manage it even before he became president 1/n

Second, the nitty gritty of the financing goes like this (and this is very common in general especially in real estate) assume Citibank agrees to lend the building $1 billion to refinance their loan in 2012. Rather than lend the entire $1 billion themselves, Citibank will 2/n

get on the phone to other banks to take a piece of the $1b they need to raise. Let’s assume in this case it was five banks of $400m, $200m, $200m, $100m, and $100m. In this case Bank of China is one of the $200m slots. They lend that company the $1b to refinance their other 3/n

loan. However, the banks aren’t done. They don’t want to make a 10 year loan on real estate when they make more money from fee and churn of debt securities. So right after they made they $1b loan, Citibank lawyers (I don’t know if it was Citibank just an example) are 4/n

Drafting offering documents to sell off different pieces of the entire $1b loan to investors. The $1b loan is not actually 5 different loans but 5 different injections into a special purpose vehicle that is capitalized with the loan capital from those banks. The SPV 5/n

Which will receive the annual payments then sells off pieces of the loan in say $10m or $25m increments to investors. The banks then receive all of their original loan back as the entire $1b is sold off piece by piece. Typically, banks will have capital out on these projects 6/n

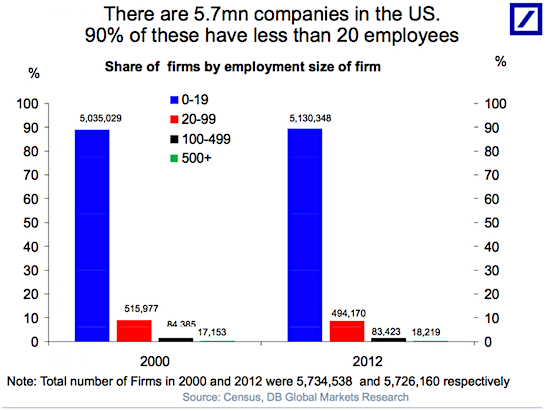

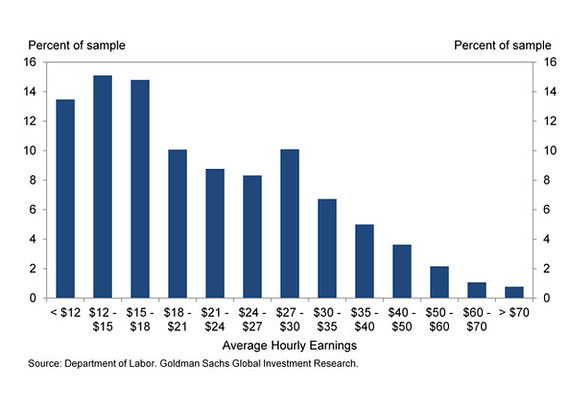

In the US, small is ugly.

• Small Business Owners Asked To Sign PPP Loans Without Forgiveness Pledge (IC)

Randy George had never laid anyone off in his 20 years running his bakery and café in Middlesex, Vermont. But after Vermont Gov. Phil Scott shut down restaurants to slow the spread of the coronavirus, half of his sales disappeared virtually overnight. He’s had to put 28 of the staff of Red Hen Baking Co. on furlough. George decided to sign up for a loan through the Paycheck Protection Program, created by Congress’s CARES Act relief bill to help small business owners stay afloat. At first, the program was funded with $350 billion, an amount that ran out about two weeks after it began; Congress is now working on a deal to add another $320 billion.

The key feature of these loans, which are being run by the Small Business Administration, is that they are supposed to be entirely forgiven if an owner spends most of the money on payroll and doesn’t lay anyone off. The details of how that forgiveness will work, however, are far from clear, making some small business owners wary to use it at all. In bank loan contracts reviewed by The Intercept, owners have been asked to sign onto terms that said that “forgiveness may apply” or “all or part of the Loan may be forgiven” — releasing the banks from liability but giving business owners no contractual guarantee of loan forgiveness, or even guidance on how to comply with the rules or how to pursue it. One didn’t mention forgiveness at all. The application materials, which are produced on SBA letterhead, have even fewer details.

“Loan forgiveness will be provided for the sum of documented payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities,” most applications read. No other information is offered about what “covered” means. The CARES Act contains some details about how these are defined, but it’s buried in an almost 900-page bill. And no concrete information has been given to small business owners about how they should go about getting their loans forgiven. Some owners were told that to gain forgiveness, they’d have to submit a request to their banks. Others were told that they have to go straight to the SBA. That’s left many people questioning whether the loans will indeed be converted to grants at all. “The keystone, the cornerstone of this program is not assured,” George said.

Won’t surprise a single soul.

• Small Business Rescue Earned Banks $10 Billion In Fees (NPR)

Banks handling the government’s $349 billion loan program for small businesses made more than $10 billion in fees — even as tens of thousands of small businesses were shut out of the program, according to an analysis of financial records by NPR. The banks took in the fees while processing loans that required less vetting than regular bank loans and had little risk for the banks, the records show. Taxpayers provided the money for the loans, which were guaranteed by the Small Business Administration. According to a Department of Treasury fact sheet, all federally insured banks and credit unions could process the loans, which ranged in amount from tens of thousands to $10 million. The banks acted essentially as middlemen, sending clients’ loan applications to the SBA, which approved them.

For every transaction made, banks took in 1% to 5% in fees, depending on the amount of the loan, according to government figures. Loans worth less than $350,000 brought in 5% in fees while loans worth anywhere from $2 million to $10 million brought in 1% in fees. For example, on April 7, RCSH Operations LLC, the parent company of Ruth’s Chris Steak House, received a loan of $10 million. JPMorgan Chase & Co., acting as the lender, took a $100,000 fee on the one-time transaction for which it assumed no risk and could pass through with fewer requirements than for a regular loan. In total, those transaction fees amounted to more than $10 billion for banks, according to transaction data provided by the SBA and the Treasury Department.

As he used a needlelike device to pull out the clot, he saw new clots forming in real time around it.

• People In Their 30s And 40s, Barely Sick With COVID19, Die From Strokes (WP)

Thomas Oxley wasn’t even on call the day he received the page to come into Mount Sinai Beth Israel Hospital in Manhattan. There weren’t enough doctors to treat all the emergency stroke patients, and he was needed in the operating room. The patient’s chart appeared unremarkable at first glance. He was male, no medications, no history of chronic conditions. He had been feeling fine, hanging out at home during the lockdown like the rest of America, when suddenly, he had trouble talking and moving the right side of his body. Imaging showed a large blockage on the left side of his head. Oxley gasped when he got to the patient’s age and covid-19 status: 44, positive.

The man was among several recent stroke patients in their 30s to 40s who were all infected with the virus. The median age for that type of severe stroke is 74. As Oxley, an interventional neurologist, began the procedure to remove the clot, he observed something he had never seen before. On the monitors, the brain typically shows up as a tangle of black squiggles – “like a can of spaghetti,” he said – that provide a map of blood vessels. A clot shows up as a blank spot. As he used a needlelike device to pull out the clot, he saw new clots forming in real time around it. “This is crazy,” he remembers telling his boss.

Reports of strokes in the young and middle-aged – not just at Mount Sinai but in many other hospitals in hard-hit communities – are the latest twist in our evolving understanding of the mysteries of covid-19. Even as the virus has infected nearly 2.8 million people worldwide and killed 195,000 as of Friday, its origins, biological mechanisms and weaknesses continue to elude top scientific minds. Once thought to be a pathogen that primarily attacks the lungs, it has turned out to be a much more formidable foe – affecting nearly every major organ system in the body.

Foreseen by @barabasi https://t.co/bwqBRTiVEn

— Nassim Nicholas Taleb (@nntaleb) April 25, 2020

Small is beautiful. A lot of the solutions will have to come from communities.

• South Dakota County Offers Drive-Through Covid-19 Testing Friday (Strong)

A health center in Stanley offered one of the first COVID-19 test drive through services in the state that did not require symptoms or pre-screening. As southern Mountrail County continues to be a hotspot for COVID-19, one medical center stepped up to offer free drive through testing without an appointment. At least 160 cars came through the testing site in Stanley from 10 a.m. to 2 p.m., with some holding as many as nine people who wanted to be tested. “We’re preparing probably to do between three and 400 tests,” said Dr. Rich Laksonen. Stanley is not in the southern part of the county, but Laksonen said the center wanted to help the state learn more about where the virus is spiking in the county.

“Being that we are the facility that services the count, we saw that need to determine where in Mountrail County these hotspots are located,” said Laksonen. Laksonen said they were compelled to drop restrictions on the site making it “no appointment, or symptoms necessary.” It’s one of the only in the state. “We also wanted our residents in northern Mountrial County to come in and get a test whether we have symptoms or not,” he said. Laksonen said the community was appreciative of the effort. Medical staff say it is too soon to tell how many will test positive. It will take 24 to 48 hours for the dozens of people that came out Friday to know their results.

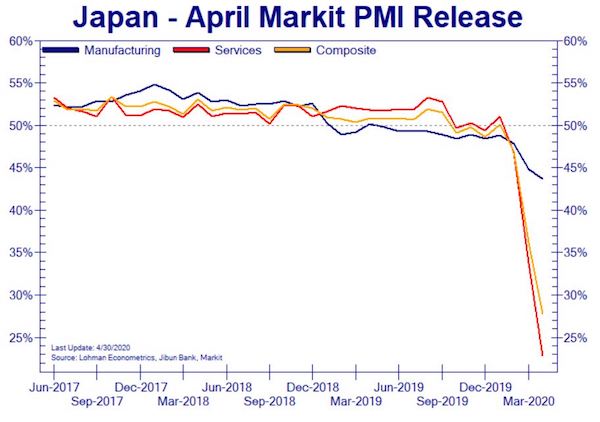

It’s fitting this should be in Japan again.

• Nearly 60 New Coronavirus Cases Confirmed On Cruise Ship In Japan (R.)

Nearly 60 new cases of coronavirus infections were confirmed among crew members of an Italian cruise ship docked in Japan, domestic media reported on Saturday. With testing of all crew members now complete, the new number, reported by public broadcaster NHK, brings the total infections onboard the Costa Atlantica to around 150, roughly one quarter of the vessel’s 623 crew members. TV Asahi said 57 crew members tested positive. The infection cluster onboard the vessel docked in Nagasaki comes as hospitals are running out of beds in some parts of Japan, where the national tally of virus cases has risen above 12,800. Some 345 people have died.

Of those infected onboard the Costa Atlantica, only one crew member has been admitted to hospital, NHK said, while others remain on board, having shown slight or no symptoms. The vessel has been docked in Japan since February for repairs and maintenance after the pandemic prevented scheduled repairs in China. Nagasaki authorities had quarantined the vessel on arrival, and ordered its crew not to venture beyond the quay except for hospital visits. But prefecture officials said earlier this week that some of the crew had departed without their knowledge, and sought detailed information on their movements.

And China refuses an international investigation.

• China Pressured EU To Drop COVID19 Disinformation Criticism (R.)

China sought to block a European Union report alleging that Beijing was spreading disinformation about the coronavirus outbreak, according to four sources and diplomatic correspondence reviewed by Reuters. The report was eventually released, albeit just before the start of the weekend Europe time and with some criticism of the Chinese government rearranged or removed, a sign of the balancing act Brussels is trying to pull off as the coronavirus outbreak scrambles international relations. The Chinese Mission to the EU was not immediately available for comment and China’s Foreign Ministry did not immediately respond to faxed questions about the exchange. An EU spokeswoman said “we never comment on content or alleged content of internal diplomatic contacts and communication with our partners from another countries.”

Another EU official said that the disinformation report had been published as usual and denied any of it had been watered down. Four diplomatic sources told Reuters that the report had initially been slated for release on April 21 but was delayed after Chinese officials picked up on a Politico news report hat previewed its findings. A senior Chinese official contacted European officials in Beijing the same day to tell them that, “if the report is as described and it is released today it will be very bad for cooperation,” according to EU diplomatic correspondence reviewed by Reuters. The correspondence quoted senior Chinese foreign ministry official Yang Xiaoguang as saying that publishing the report would make Beijing “very angry” and accused European officials of trying to please “someone else” – something the EU diplomats understood to be a reference to Washington.

The four sources said the report had been delayed as a result, and a comparison of the internal version of the report obtained by Reuters and the final version published late Friday showed several differences. For example, on the first page of the internal report shared with EU governments on April 20, the EU’s foreign policy arm said: “China has continued to run a global disinformation campaign to deflect blame for the outbreak of the pandemic and improve its international image. Both overt and covert tactics have been observed.”

Yeah, let’s buy us some shale.

• US Weighs Taking Equity Stakes In US Energy Companies – Mnuchin (R.)

The U.S. government is considering taking equity stakes in U.S. energy companies as it seeks to help the nation’s oil and gas sector amid the coronavirus outbreak, Treasury Secretary Steven Mnuchin said on Friday. President Donald Trump, speaking at a White House event with Mnuchin, said he wants to help industry and suggested the federal government could buy fuel for the country in advance as well as purchase airline tickets in advance. “We’re looking at a whole bunch of alternatives,” Mnuchin said. “You can assume that’s one of the alternatives, but there’s many of them,” Mnuchin said, referring to possible equity stakes.

The oil sector has been hit hard by a dramatic drop in demand as the coronavirus has effectively shut down economies around the globe. “The energy business is very important to me, and we’re going to build it up. This really hurt the energy business as much as any other business because it totally knocked out – the supply kept coming,” Trump said. Trump helped negotiate a reduction in output from OPEC and other countries including Russia, but the move has not removed the market’s oversupply. The president encouraged Mnuchin to look at buying oil for later use. “The United States is the largest user of oil. We could buy oil at a great price into the future. That gives them the infusion they need, and we have oil at a great price into the future,” Trump said.

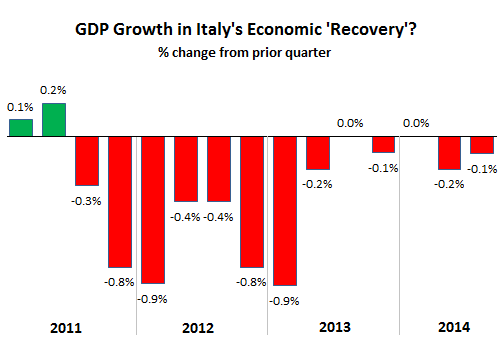

Well, if you wait long enough… Meanwhile, there are no buyers for your products anyway, so why bother?

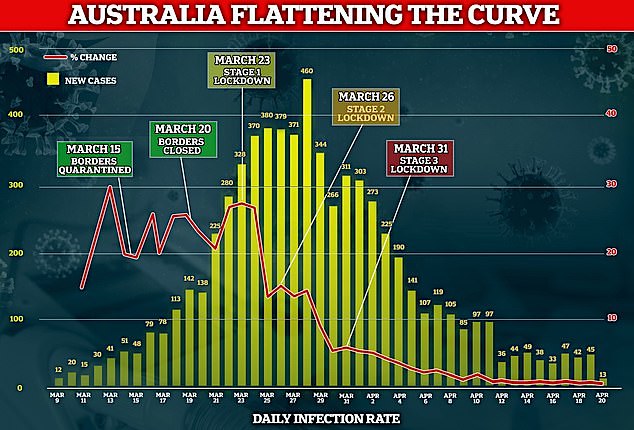

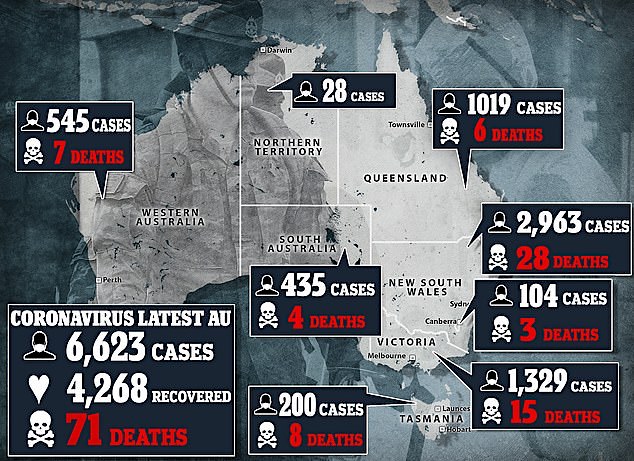

• Economics Professor: Australia Would Be ‘Better Off’ Without Lockdown (DM)

An economics professor has been slammed as ‘cold’ and ‘heartless’ for suggesting Australia prioritised health over the economy by going into coronavirus lockdown. University of New South Wales Professor Gigi Foster sparked outrage from fellow panellists and other economic professors while answering questions about the impacts of shutdown measures on Q&A on Monday. Professor Foster suggested Australia hadn’t properly weighed up the economic consequences of tough restrictions introduced to reduce the death toll, and argued the ‘economy is about lives’ too. ‘What frustrates me is when people talk about the economic costs of the lockdown they often don’t think in detail in terms of counting lives,’ Professor Foster said.

‘Has anyone thought about how would you get a measure of the traded lives when we lock an economy down? What are we sacrificing in terms of lives? ‘Economists have tried to do that and we try to do that in currencies like the value of a statistical life. ‘If you do that kind of calculus you realise very quickly that even with a very, very extreme epidemic, in Australia, we are still potentially better off not having an economic lockdown in the first place because of the incredible effects that you see. ‘Not just in a short-run way but in many years to come.’ Her views prompted a shocked response from fellow panellists on the ABC program.

‘How can you say that?’ ACTU secretary Sally McManus fired back. ‘We’re avoiding what’s happened in the UK, what’s happening in the US, the idea of having our ICUs overrun, our healthcare workers dying as well is just the most horrible thought.’ ‘It’s horrible either way,’ Professor Foster replied. ‘The coronavirus has made the world awful. There’s absolutely no doubt about that. ‘In order to have a proper discussion about trade-offs, you need to think in terms of lives you’re giving up. ‘I know it’s invisible lives and difficult to imagine when we aggregate, for example, all of the health effects and the mental health effects and the effects of people right now who have illnesses other than COVID-19.’

Moro is no Mother Teresa himself.

• Brazil Justice Minister Resigns Over Bolsonaro’s Investigations Meddling (IC)

As the country slept Friday morning, far-right Brazilian President Jair Bolsonaro fired the Federal Police Director Maurício Valeixo, bringing to a head a long-simmering battle with Justice Minister Sergio Moro. Moro, in turn, promptly resigned — in a new, major episode of deepening chaos in Brazilian politics. The official notice firing the Federal Police head bears Moro’s digital signature, but in a press conference Friday morning, the outgoing justice minister claimed that he was not informed of the move and did not sign the document. This and other revelations made by Moro could serve as grounds for impeachment, if the Brazilian body politic can muster the political will to support such a drastic measure. Members of Congress are already gathering signatures for a congressional inquiry into Moro’s allegations.

In his press conference, Moro suggested that Bolsonaro removed Valeixo because the president opposed investigations being conducted by the Federal Police. “He was concerned about investigations underway in the Federal Supreme Court and that a change would also be opportune at the Federal Police,” Moro said of Bolsonaro’s thinking. Moro said Bolsonaro’s concerns were not a reasonable justification for firing Valeixo, but added that he nonetheless searched for “an alternative solution, to avoid a political crisis during a pandemic.” In the end, Moro said, “I understood that I could not set aside my commitment to the rule of law.”

Notably, the Federal Police are conducting several investigations that could impact Bolsonaro, his politician sons, and several members of their inner circle. Moro loomed large over Brazilian politics during the past several years, even before he accepted Bolsonaro’s offer to serve as justice minister. He was the judge at the center of the influential Operation Car Wash anti-corruption investigation that put former President Luiz Inácio Lula da Silva in prison, removing the popular politician from the 2018 presidential election and clearing the way for Bolsonaro’s victory. When he entered government, Moro was among the most popular political figures in the country and was seen as an important ally for Bolsonaro, but also as a potential rival in the 2022 elections.

The ex-judge’s standing, however, was seriously weakened after The Intercept began publishing an explosive series, in English and Portuguese, on malfeasance and potential illegal actions by Moro and Car Wash prosecutors. As a result of the series, Lula was eventually released from prison.

Is there anything more American?

• Denver Health Execss Get Bonuses 1 Week After Workers Asked To Take Cuts (CBS)

Top executives at Denver Health Medical Center received significant bonuses this month for their performance in 2019, ranging from $50,000 up to $230,000, one week after frontline hospital workers were asked to voluntarily take leave without pay or reduce their hours as the hospital dealt with the financial downturn resulting from the coronavirus pandemic. On April 3, Denver Health CEO Robin Wittenstein emailed hospital workers noting “the current situation will stress us financially.” She announced a hiring freeze and asked employees to voluntarily take leave without pay, use personal time off or reduce their normal work week.

“The goal is to reduce our total salary expense without the need to lay off employees or implement mandatory PTO/furloughs,” wrote Wittenstein. She said the hospital was also considering mandating workers to use their paid time off, mandatory leave without pay and other steps. “The goal is to avoid these extreme measures if at all possible,” she wrote. One week later, on April 10, Wittenstein and her executive staff saw their 2019 Management Incentive Plan bonuses deposited into their bank accounts.

Macron pleasing the unions AND his small businesses.

• Amazon To Be Fined €100K For Every ‘Non-Essential’ Delivery in France (RT)

Amazon will face a fine each time it delivers non-essential goods in France until it improves the safety conditions of its workers amid the Covid-19 pandemic. The company earlier closed its warehouses in protest. On Friday, an appeals court in Versailles, outside Paris, upheld last week’s ruling, which restricted Amazon’s French warehouses to only shipping IT products, health items, groceries and pet food until it ensures the safety of its workers. Jeff Bezos’ e-commerce giant was given 48 hours to comply with the ruling, and will be fined €100,000 ($108,020) for every delivery that doesn’t meet the court’s requirements.

On April 14, a court ruled that Amazon had failed to guarantee the safety of its workers amid the Covid-19 pandemic, and said that the company must submit an updated professional risk assessment before it can resume full operations. Amazon argued that it had already updated its work safety protocols and introduced disease-control measures to prevent its workers from being infected with the coronavirus. Following the ruling on April 14, the company completely shut down its French warehouses until Saturday.

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thanks for your generosity.

SPAIN: 107 year old woman Ana del Valle, who beat the Spanish flu in 1918, has now also beaten a coronavirus infection.

— The Spectator Index (@spectatorindex) April 24, 2020

Trara Reade’s mom called Larry King in 1993.

BREAKING: Is this the mother of Joe Biden's accuser talking to CNN in 1993? pic.twitter.com/rF7jw35s2F

— MediaResearchCenter (@theMRC) April 24, 2020

Merkel is a chemist by trade. She understands a thing or two.

This is how Angela Merkel explained the effect of a higher #covid19 infection rate on the country's health system.

This part of today's press conf was great, so I just added English subtitels for all non-German speakers. #flattenthecurve pic.twitter.com/VzBLdh16kR

— Benjamin Alvarez (@BenjAlvarez1) April 15, 2020

“@nntaleb is actually a lot more correct about stuff than most of us like to admit…@MkBlyth @adam_tooze

https://t.co/FDVQ1h2VNZ pic.twitter.com/gtKK4UbosI— Real Vision (@RealVision) April 25, 2020

https://twitter.com/i/status/1253855510903865345

Support the Automatic Earth for your own good.