Johannes Vermeer Woman (in Blue) Reading a Letter 1662-3

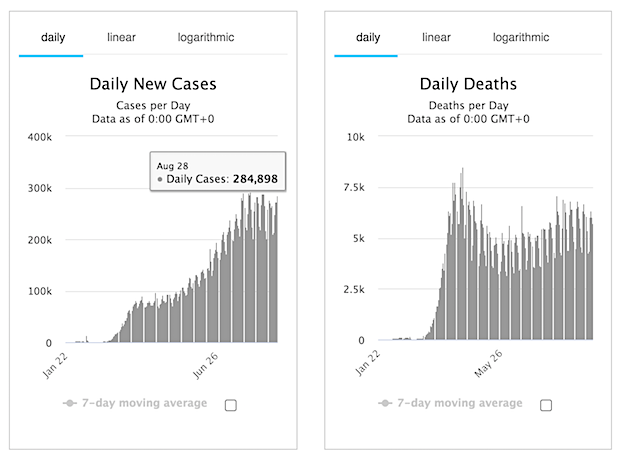

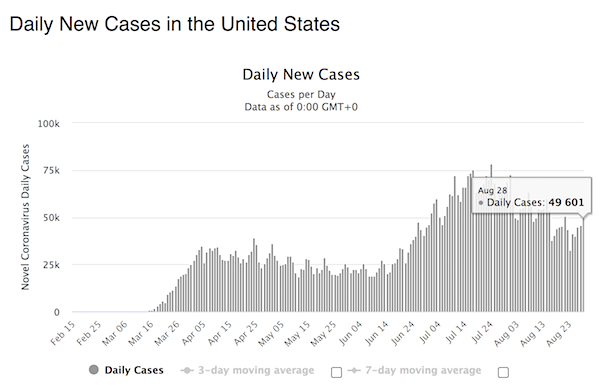

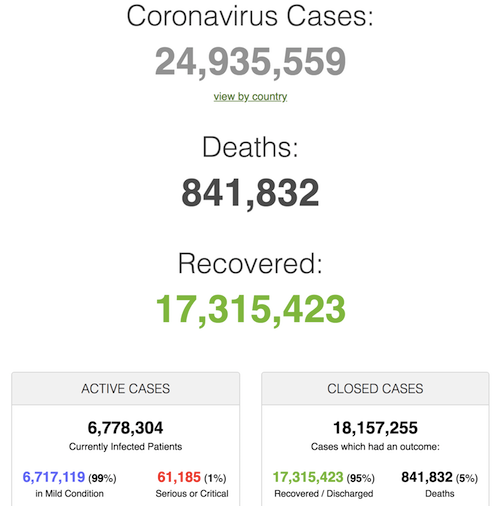

There are serious infection problems popping up in Europe, exposing even more incompetence.

The Dark Side Of Social Media

On this week’s #FridaysWithFrank, I talked to @TristanHarris who explained how social media hijacks our brains and keeps us addicted to emotion.

Watch the trailer to his upcoming Netflix documentary #TheSocialDilemma below, and our full conversation here: https://t.co/fQjolsjxqi pic.twitter.com/BIbyRx4gbP

— Frank Luntz (@FrankLuntz) August 29, 2020

It’s coming from within. It comes from the realization across -social- media that people’s sub-conscious can be easily manipulated into generating fear and anger.

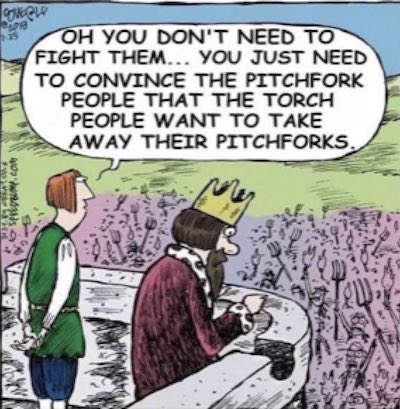

• The US Social Fabric Is Fraying Severely, if Not Unravelling (Greenwald)

The year 2020 has been one of the most tumultuous in modern American history. To find events remotely as destabilizing and transformative, one has to go back to the 2008 financial crisis and the 9/11 and anthrax attacks of 2001, though those systemic shocks, profound as they were, were isolated (one a national security crisis, the other a financial crisis) and thus more limited in scope than the multicrisis instability now shaping U.S. politics and culture. Since the end of World War II, the only close competitor to the current moment is the multipronged unrest of the 1960s and early 1970s: serial assassinations of political leaders, mass civil rights and anti-war protests, sustained riots, fury over a heinous war in Indochina, and the resignation of a corruption-plagued president.

But those events unfolded and built upon one another over the course of a decade. By crucial contrast, the current confluence of crises, each of historic significance in their own right — a global pandemic, an economic and social shutdown, mass unemployment, an enduring protest movement provoking increasing levels of violence and volatility, and a presidential election centrally focused on one of the most divisive political figures the U.S. has known who happens to be the incumbent president — are happening simultaneously, having exploded one on top of the other in a matter of a few months. Lurking beneath the headlines justifiably devoted to these major stories of 2020 are very troubling data that reflect intensifying pathologies in the U.S. population — not moral or allegorical sicknesses but mental, emotional, psychological and scientifically proven sickness.

Many people fortunate enough to have survived this pandemic with their physical health intact know anecdotally — from observing others and themselves — that these political and social crises have spawned emotional difficulties and psychological challenges. But the data are nonetheless stunning, in terms of both the depth of the social and mental health crises they demonstrate and the pervasiveness of them. Perhaps the most illustrative study was one released by the Centers for Disease Control and Prevention earlier this month, based on an extensive mental health survey of Americans in late June. One question posed by researchers was whether someone has “seriously considered suicide in the past 30 days”— not fleetingly considered it as a momentary fantasy nor thought about it ever in their lifetime, but seriously considered suicide at least once in the past 30 days. The results are staggering.

For Americans between 18-24 years old, 25.5 percent — just over 1 out of every 4 young Americans — said they had. For the much larger group of Americans ages 25-44, the percentage was somewhat lower but still extremely alarming: 16 percent. A total of 18.6 percent of Hispanic Americans and 15 percent of African Americans said they had seriously considered suicide in the past month. The two groups with the largest percentage who said yes: Americans with less than a high school degree and unpaid caregivers, both of whom have 30 percent — or almost 1 out of every 3 — who answered in the affirmative. A full 10 percent of the U.S. population generally had seriously contemplated suicide in the month of June.

In a remotely healthy society, one that provides basic emotional needs to its population, suicide and serious suicidal ideation are rare events. It is anathema to the most basic human instinct: the will to live. A society in which such a vast swath of the population is seriously considering it as an option is one which is anything but healthy, one which is plainly failing to provide its citizens the basic necessities for a fulfilling life.

No, I don’t know all the facts. But I’m always wary of people crucifying minors. And I’m intrigued by the interest of Lin Wood in the case, since he took on the defense of Nicholas Sandmann, himself also a minor the media crucified, on completely false and fabricated grounds. It has cost those same media not only millions, but also a great deal of their reputation.

• Kyle Rittenhouse Worked as a Lifeguard in Kenosha the Day of the Shooting (GP)

Kyle Rittenhouse is a community lifeguard who was working in Kenosha the day of the shooting. This simple fact destroys the narrative being peddled by the mainstream media that he had “crossed state lines” to harm the rioters. In a statement by Rittenhouse’s legal team at Pierce Bainbridge, provided to the Gateway Pundit, “after Kyle finished his work that day as a community lifeguard in Kenosha, he wanted to help clean up some of the damage, so he and a friend went to the local public high school to remove graffiti by rioters.” Additionally, the weapon Rittenhouse was using to protect himself and others never crossed state lines. “Later in the day, they received information about a call for help from a local business owner, whose downtown Kenosha auto dealership was largely destroyed by mob violence,” the statement continues.

“Business owner needed help to protect what he had left of his life’s work, including two nearby mechanic’s shops. Kyle and a friend armed themselves with rifles due to the deadly violence gripping Kenosha and many other American cities, and headed to the business premises. The weapons were in Wisconsin and never crossed state lines.” When Rittenhouse arrived at the mechanics shop, he and others stood guard to prevent further destruction. Later that night, long after the 8 p.m. curfew had passed, the police began to disperse a group of rioters. His lawyer, John M. Pierce, explains that while dispersing the mob, they maneuvered a mass of individuals down the street towards the auto shops. Rittenhouse and the others were threatened and taunted, but he did not react. “His intent was not to incite violence, but simply to deter property damage and use his training to provide first aid to injured community members,” Pierce says.

After the situation seemed to be diffused, Rittenhouse became increasingly concerned about people who were injured at the gas station, so he went in that direction with his first aid kit. He helped those he could find who were injured, either by administering aid or directing them which way to go for help beyond what he could offer. The statement says that by the final time that Rittenhouse returned to the gas station and “confirmed there were no more injured individuals who needed assistance, police had advanced their formation and blocked what would have been his path back to the mechanic’s shop. Kyle then complied with the police instructions not to go back there. Kyle returned to the gas station until he learned of a need to help protect the second mechanic’s shop further down the street where property destruction was imminent with no police were nearby.”

“As Kyle proceeded towards the second mechanic’s shop, he was accosted by multiple rioters who recognized that he had been attempting to protect a business the mob wanted to destroy. This outraged the rioters and created a mob now determined to hurt Kyle. They began chasing him down. Kyle attempted to get away, but he could not do so quickly enough. Upon the sound of a gunshot behind him, Kyle turned and was immediately faced with an attacker lunging towards him and reaching for his rifle. He reacted instantaneously and justifiably with his weapon to protect himself, firing and striking the attacker,” Pierce explains. Additionally, Rittenhouse stopped to ensure care for his attacker, hardly sounds like someone who had went to the riot with intent to kill.

“Kyle stopped to ensure care for the wounded attacker but faced a growing mob gesturing towards him. He realized he needed to flee for his safety and his survival. Another attacker struck Kyle from behind as he fled down the street. Kyle turned as the mob pressed in on him and he fell to the ground,” his legal team says. “One attacker kicked Kyle on the ground while he was on the ground. Yet another bashed him over the head with a skateboard. Several rioters tried to disarm Kyle. In fear for his life and concerned the crowd would either continue to shoot at him or even use his own weapon against him, Kyle had no choice but to fire multiple rounds towards his immediate attackers, striking two, including one armed attacker. The rest of the mob began to disperse upon hearing the additional gunshots.” Rittenhouse then attempted to turn himself in, but was told to keep moving. He went and turned himself in to his local police that evening.

Lin Wood

“Video eye” does not lie. Kyle Rittenhouse acted in self-defense. Murder charges are factually unsupportable. An egregious miscarriage of justice is occurring with respect to this 17-year old boy. I love truth & justice. I deplore lies & injustice. Had those feelings ALL my life.

— Lin Wood (@LLinWood) August 28, 2020

Tucker Rittenhouse

WATCH: @RichieMcGinniss was back on Tucker Carlson Tonight to talk about what he saw the night of the chaos in Kenosha that resulted in two deaths. pic.twitter.com/rBsThEQnUm

— Daily Caller (@DailyCaller) August 29, 2020

There are no limits anymore.

• CNN Has Turned Itself Into America’s Baghdad Bob (Widburg)

On Tuesday, with its reporter standing in front of a raging fire, CNN ran a ludicrous chyron stating, “fiery but mostly peaceful protests after police shooting.” Ordinarily, this wouldn’t be worthy of reporting three days later. However, for some reason, this chyron was a bridge too far for many people, and the internet is still flooded with memes. It’s apparent that, with this latest denial of objective reality, CNN has finally completed its transformation into Muhammad Saeed al-Sahhaf, whom many Americans remember almost fondly as Baghdad Bob, the Hussein regime propagandist who insisted that Saddam was winning even as U.S. troops entered Baghdad.

In 2003, when our military successfully invaded Iraq and quickly captured Baghdad, Muhammad Saeed al-Sahhafk, AKA Baghdad Bob, was Saddam Hussein’s minister of information. As troops neared and then entered Baghdad, al-Sahhaf gave daily press briefings during which he announced the most outrageous lies about the wars. For example, Baghdad Bob insisted that American troops were committing suicide “by the hundreds” and that none had entered Baghdad. Meanwhile, Americans were a few hundred yards away from him, and the audience could hear the sounds of their fighting. On April 8, four days before Americans captured Baghdad, al-Sahhaf was still insisting that U.S. troops “are going to surrender or be burned in their tanks. They will surrender. It is they who will surrender.”

Baghdad Bob was last heard from some years ago, living in the United Arab Emirates. However, it’s entirely possible that he’s currently working for CNN, a former news network and now a sloppy propaganda outlet for the anarcho-Marxists of Antifa and Black Lives Matter. Obviously, things are a bit different here for Bob. Last time, American troops were closing in on Baghdad as Bob spun manifest lies about events. This time, American anarchists and communists are closing in on an American city as CNN spins manifest lies about events. But aside from the details, that chyron running across the bottom of the CNN screen is vintage Baghdad Bob:

14 Mostly Accurate CNN Headlines From The Last 6,000 Years Of Human History https://t.co/2hDXFaRHKw

— The Babylon Bee (@TheBabylonBee) August 27, 2020

Still thinks she wants to win?

• Kamala Harris Promises National Mask Mandate If Elected (NYP)

Kamala Harris said on Friday that a nationwide mask mandate would be among the first orders of business if she and Joe Biden were elected to the White House in November, calling it the “responsible” thing to do. The Democratic vice presidential nominee expanded on the three-month plan that Biden has promised to enact if he won the White House, explaining that every American would be expected to wear a face covering amid the pandemic. “Yes,” Harris, 55, said when asked if that would be one of their first actions in power during an interview on NBC’s “TODAY.” “It’s a standard. I mean, nobody’s going to be punished,” Harris continued when asked how it would be enforced.

“Nobody likes to wear a mask, this is a universal feeling, right? So, that’s not the point,” she said. “The point is this is what we as responsible people who love our neighbor, we have to just do that right now. God willing, it won’t be forever.” The CDC recommends mask-wearing in public when you are unable to stay 6-feet away from others so as to stop the spread of disease. President Trump rejected Biden’s mandate earlier this month during a White House briefing, telling reporters the Democratic nominee had showed an “appalling lack of respect” for the American people. “It’s up to the governors. We want to have a certain freedom,” Trump said. “If the president has the unilateral power to order every single citizen to cover their face in nearly all instances, what other powers does he have?” he asked.

There are dozens of such lawsuits pending.

• Judge Voids 50,000 Absentee Ballot Requests In Iowa County (AP)

A judge ordered an Iowa county Thursday to invalidate 50,000 requests for absentee ballots, agreeing with President Donald Trump’s campaign that its elections commissioner overstepped his authority by pre-filling them with voters’ personal information. Judge Ian Thornhill issued a temporary injunction ordering Linn County Auditor Joel Miller to notify voters in writing that the forms should not have been pre-filled with their information and cannot be processed. Instead, they’ll have to either fill out new requests for absentee ballots or vote on Election Day. The ruling marks an initial victory for Trump’s challenges to absentee voting procedures in three counties in Iowa, which is expected to be competitive in his race against Democratic nominee Joe Biden.

They’re part of an unprecedented legal battle involving dozens of lawsuits nationwide that will shape the rules of the election. Republicans said the ruling would hold a “rogue auditor” accountable and enhance voting security, while outraged Democrats called it an act of voter suppression. Miller said he would abide by the order, pledging to void the returned requests and send out new blank forms to voters next month. At issue was Miller’s decision to send absentee ballot request forms to 140,000 voters in July that were already filled with their personal information, including names, dates of birth and, most significantly, voter identification numbers. Miller, a Democrat, has said his goal was to make it as easy as possible to vote absentee during a pandemic, as the virus spreads uncontrolled across the state.

Voters had to review, sign and return the forms to request ballots that will be mailed beginning Oct. 5. About 50,000 requests have been returned in the Democratic-leaning county, which is Iowa’s second largest and is recovering from a derecho that devastated the region Aug. 10. The phone system for the county elections office remained out of service Thursday. Thornhill ruled that Miller’s mailing violated a “clear directive” from Iowa Secretary of State Paul Pate, who told county officials in July that absentee ballot request forms mailed to voters must be blank in order to ensure uniformity.

Both sides will sell this as an affirmation of their views.

• Chairman of Joint Chiefs: No Role For Military In Presidential Election (AP)

The U.S. armed forces will have no role in carrying out the election process or resolving a disputed vote, the top U.S. military officer told Congress in comments released Friday. The comments from Gen. Mark Milley, chairman of the Joint Chiefs of Staff, underscore the extraordinary political environment in America, where the president has declared without evidence that the expected surge in mail-in ballots will make the vote “inaccurate and fraudulent,” and has suggested he might not accept the election results if he loses. Trump’s repeated complaints questioning the election’s validity have triggered unprecedented worries about the potential for chaos surrounding the election results.

Some have speculated that the military might be called upon to get involved, either by Trump trying to use it to help his reelection prospects or as, Democratic challenger Joe Biden has suggested, to remove Trump from the White House if he refuses to accept defeat. The military has adamantly sought to tamp down that speculation and is zealously protective of its historically nonpartisan nature. “I believe deeply in the principle of an apolitical U.S. military,” Milley said in written responses to several questions posed by two Democratic members of the House Armed Services Committee. “In the event of a dispute over some aspect of the elections, by law U.S. courts and the U.S. Congress are required to resolve any disputes, not the U.S. military. I foresee no role for the U.S armed forces in this process.”

Milley’s tone reflects the longstanding views of military leaders who insist that the nation’s military stays out of politics and that troops are sworn to protect the country and uphold the Constitution. But the two Congress members, Reps. Elissa Slotkin of Michigan and Mikie Sherrill of New Jersey, said Friday that Trump’s recent comments and his efforts to use the military to quell protests have fueled their concerns. The two lawmakers released Milley’s answers.

“On Friday, masks were made mandatory outdoors in Paris to fight the rising infections.”

How does that work exactly?

• France Sees ‘Exponential Rise’ In COVID Cases (BBC)

France has recorded its biggest daily rise in coronavirus infections since March, as President Emmanuel Macron raised the possibility of another nationwide lockdown. A further 7,379 cases were confirmed on Friday, bringing the country’s total to 267,077. It was the largest daily spike since 31 March, when 7,578 cases were tallied at the peak of the first wave. France was seeing an “exponential” rise in cases, the health ministry said. The ministry said Friday’s rise follows daily increases of 6,111 on Thursday and 5,429 on Wednesday. Despite the sharp rise, hospital numbers and daily deaths were relatively stable, as young people less vulnerable to the disease make up most of the new infections, the ministry said. Another 20 people were confirmed to have died with Covid-19 on Friday, bringing France’s overall death toll to 30,596.

Shortly before Friday’s figures were released, Mr Macron said a second national lockdown could not be ruled out if infections spiralled out of control. However he said his government was trying to avoid the return of restrictions that would set back the country’s fragile economic recovery. “Containment is the crudest of measures to fight against a virus,” said Mr Macron, urging people to be “collectively very rigorous”. France began easing its eight-week-long lockdown in May. But some parts of the country – including the capital Paris – remained under tighter controls. Local authorities have been given powers to enforce lockdown measures, such as closing down bars and restaurants, in areas where cases are surging. On Friday, masks were made mandatory outdoors in Paris to fight the rising infections.

HCQ OTC

In the US, there has never been a large enough demand for hydroxychloroquine to be made available as an over-the-counter medicine.

Due to arbitrary restrictions implemented on HCQ, it should be made available prophylactally OTC in the United States. pic.twitter.com/nWL76OnoiD

— Dr. Simone Gold (@drsimonegold) August 28, 2020

Germany, too, has fallen into the trap of allowing one type of protest, but banning another. That’s just politics, nothing to do with health care.

• German Court Overturns Protest Ban (ZH)

Earlier in the week, we reported that authorities in Berlin had banned a series of planned demonstrations against the country’s COVID-19 lockdown measures – claiming they were organized by “right-wing extremists” and would lead to the spread of the virus. The city said it would deploy several thousand police around the German capital this weekend, citing threats. Notably, the German city did not ban a June Black Lives Matter protest in which approximately 15,000 people turned out. Meanwhile, the Assembly for Freedom had 17,000 registered demonstrators for the August 29 event before Berlin shut it down. “We are still in the middle of a pandemic with rising infection figures,” said Berlin Interior Minister, Andreas Geisel.

“This is not a decision against freedom of assembly, but a decision in favor of infection protection,” he continued, adding that Berlin should not be “misused as a stage for corona deniers… and right-wing extremists.” About 20,000 people, including libertarians, constitutional loyalists, far-right supporters and anti-vaccination activists, marched in Berlin on Aug. 1. But now, as Off-Guardian reports, the Berlin Senate’s decision to ban the coronavirus protest planned for this weekend has been overturned by the Administrative Court. That said, the protest will still be under some restrictions – the court ruled that the organizers must follow all the laws and restrictions they are protesting against.

According to a report from Deutsche Welle: “…the judges said protest organizers and participants must provide barriers in front of the stages where speeches will be held – and must regularly remind participants to observe social distancing rules and keep their distance. Wearing masks was not included in the judge’s guidelines for the protest.” The court’s decision can be appealed by the Senate, but given the timeframe that seems unlikely at this stage. Many thousands were reportedly travelling to Berlin regardless, as it was thought the protest organizers intended to go ahead in spite of the ban. A similar protest on August 1st drew tens of thousands of people. The Berlin protest is taking place alongside other events around the world for a global day of action. Protests are planned for London, Ottawa, Paris and Zurich.

“..these types of policies are relatively social at the beginning but they become the most anti-social afterwards..”

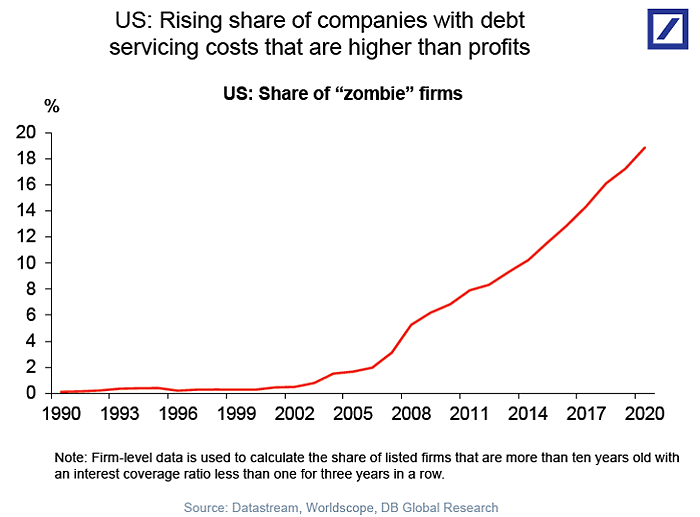

• German Economy Succumbing to Zombie Companies – Lacalle (SL)

Zombie companies are generally defined as companies that have been in business for at least ten years and whose debt servicing costs have exceeded profits for at least the last three years. Such structurally unprofitable companies, once a rarity, now represent a terrifying 18% of publicly traded companies in the US. The trend is growing in Europe as well, and as Mr. Lacalle warns, endless stimulus, low interest rates, and bailouts in the wake of Covid are exacerbating the phenomenon. The end result is a stifling of innovation, lower long term productivity, and decreased economic mobility. Some excerpts from Daniel Lacalle:

“The (German) government has given enormous levels of subsidies to keep companies that had problems in 2018 and 2019, before the pandemic, to keep them alive…” “Huge transfers of public money go to companies that… don’t allow a certain level of creative destruction, which is very important for progress…. The rise of Zombie Companies, which is a big problem in the European Union, is doing three things: It’s stopping innovation…, consumers end up with worse products and services, and the third problem is that these companies don’t hire and invest more…” “Something that looks quite good as a headline can be extremely damaging for jobs, for growth, and for the future development of the economy… The rise of zombie companies inevitably leads to a financial crisis when those companies inevitably become insolvent…”

“The biggest lesson for the United States is that these types of policies are relatively social at the beginning but they become the most anti-social afterwards when higher unemployment, lower growth, and lower productivity become the norm.” Another problem with larger and larger swaths of the economy being taken over by structurally unprofitable companies is taxes. Companies only pay taxes on profits and with governments running deficits like there is no tomorrow, there is simply no feasible tax plan that will come close to balancing America’s budget deficits. The economy is simply insufficiently productive to support current levels of government spending. Keeping money-losing companies in business only makes the matter worse.

This can’t help but make me laugh: “He was widely praised for early “Abenomics..” One look at Japan’s debt-to-GDP tells you all you need to know.

Abe’s political legacy is substantial. After working as cabinet secretary to Prime Minister Junichiro Koizumi, he became prime minister in 2006 but crashed and burned and resigned – officially due to ulcerative colitis – in 2007. He was older, wiser and better advised when he started his second term at the helm in December 2012. In that term, which ended on Friday, he served the longest premiership in Japanese history. In many ways, Abe has overseen a success story. Economically, his inflationary “Abenomics” overcame Japan’s “lost decade” of the 1990s, and socially, as Asia Times recently noted in a review of an Abe biography, the country boasts low unemployment, equal distribution of income, fine infrastructure, minimal public disorder, a low crime rate and low Covid-19 death rates.

Even so, his legacy is mixed. In neighboring countries, he is widely seen as a raging nationalist for his claimed historical revisionism and his moves to empower Japan’s military. However, in terms of trade and tourism, many of his actions in office have been those of an internationalist. He was widely praised for early “Abenomics,” but while its loose monetary and expansionary fiscal policies beat back the deflation that had plagued Japan, it’s “third arrow” – corporate reform – never rose from the deck. He won hosting rights to the Tokyo 2020 Summer Olympics to local acclaim, only to see the multi-billion dollar dream crash amid the pandemic.

Politically, Abe appears to have maintained a balance within the ruling Liberal Democratic Party between its center-right and hard-right elements, and as a result, a true hard-right party has not appeared on Japan’s political scene. There have also been clear failures. Abe talked about “creating a Japan where women can shine,” but according to the World Economic Forum’s annual gender equality ranking, last year Japan placed 121st out of the 153 countries, the worst among G7 economies. Abe has also leaned on media. National broadcaster NHK has been ridiculed as “Abe TV” and Japan’s Freedom Of Press ranking, 22 when he took office, is now 66th. And when it comes to Japan’s biggest national challenge – its ongoing demographic decline – he proved incapable of reversing it.

Abe’s grandfather and a strong personal influence was war criminal Nobuskue Kishi, who was rehabilitated by the US and then became Japan’s prime minister. Many in China and the Koreas, countries which suffered from Japan’s militarism and imperialism in the first half of the 20th century, consider Abe his grandfather’s grandson, a dangerous nationalist. However, he has declined to visit the controversial Yasukuni Shrine since 2013, although his cabinet members, in a sop to Japan’s hard right, have done so. Abe’s oft-stated hopes of rewriting article 9 of Japan’s constitution – a Herculean task – enabling a wider, more expeditionary role for Japan’s Self Defense Forces, came to naught. Even so, during his term, he quietly oversaw the expansion and empowerment of Japan’s military. Notably, the Maritime Self Defense Force took on a far more expeditionary look under his oversight, standing up a marine brigade and green-lighting the conversion of two existing warships into F-35-armed aircraft carriers.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you for your ongoing support.

Support the Automatic Earth in virustime.