Jack Delano South Water Street freight depot of the Illinois Central Railroad, Chicago 1943

A hidden crisis in plain sight?!

• US “Transportation Recession” Gets Uglier (WS)

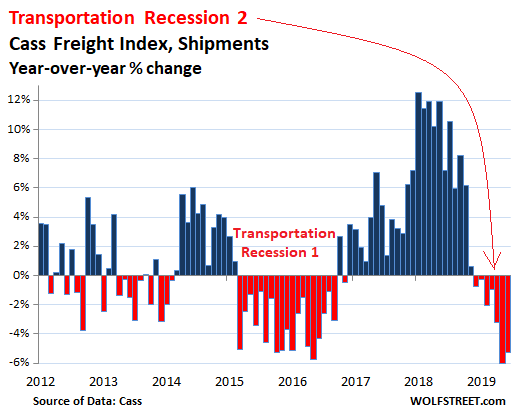

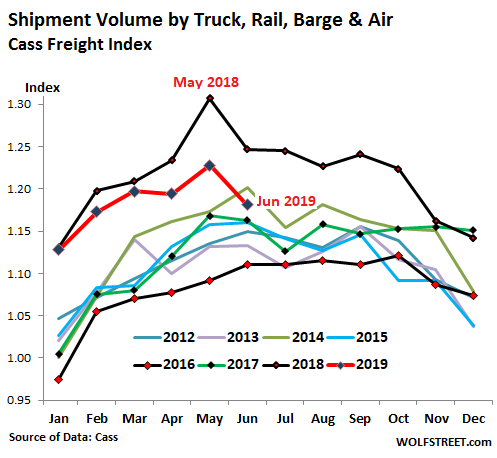

Freight shipments in the US across all modes of transportation – truck, rail, air, and barge – fell 5.3% in June compared to June last year, after having fallen 6.0% in May, the seventh month in a row of year-over-year declines, according to the Cass Freight Index for Shipments. This decline, along with other freight indicators, including orders for heavy trucks, now clearly outline the new Transportation Recession – number 2 since the Great Recession – in this very cyclical business. In terms of freight traffic by rail, the Association of American Railroads (AAR) reported that in June overall, volume fell 6.3% from a year ago. The volume of intermodal freight – containers hauled by truck and then transferred to rail, or semi-truck trailers that piggyback on special rail cars – dropped 7.2% in June.

For the first half, overall freight volume by rail was down 3.2%, with all segments in the red, except Petroleum and Petroleum Products, which was up 23%! Intermodal was down 3.3%. The Cass Freight Index, which tracks shipments of consumer and industrial goods but not bulk commodities such as grains, has now fallen below the June 2014 level. June 2014 had set a record in shipments just before Transportation Recession 1 came along. The boom in 2018 broke the 2014 records, and by a big margin. And now the industry is back in its own recession. In the stacked chart below of the Cass Freight Index, the red line denotes 2019 through June, which has now dipped below June 2014 (green line). Note how much of an outlier the boom of 2018 (black line at the top) had been, though it faded sharply at the end of last year:

“Unlike its counterparts in the UK, the US and Japan, the European Banking Authority (EBA) does not itself calculate the impacts on banks of the adverse scenario; it leaves that up to the banks themselves.”

• Stress Test a Sham, European Court of Auditors Warns (WS)

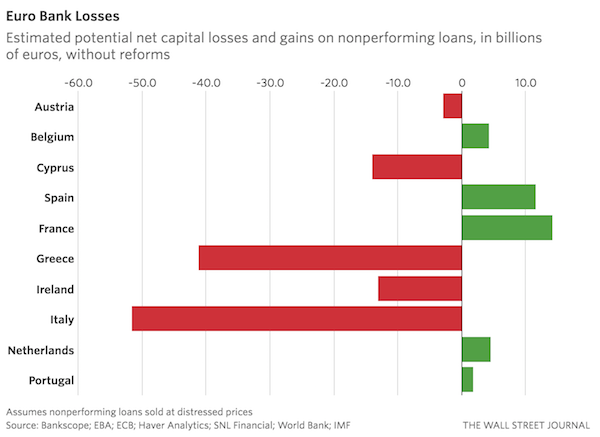

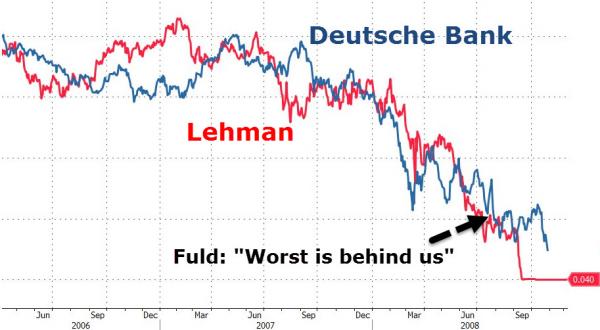

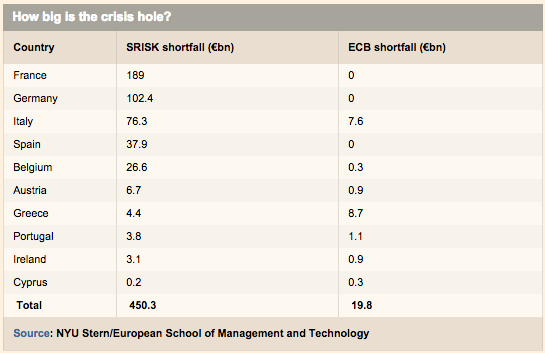

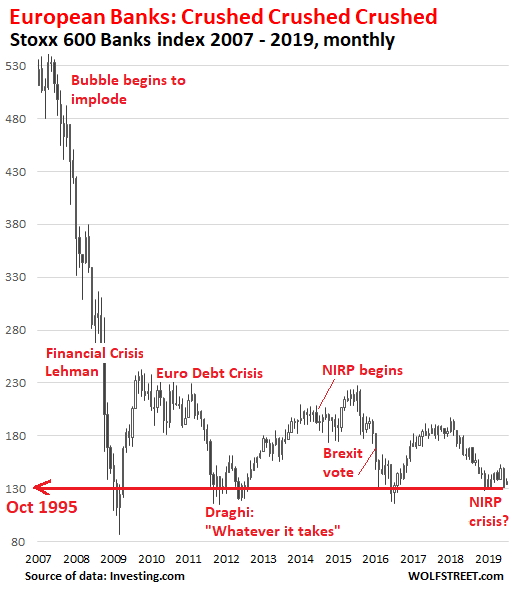

European bank stocks continue to get hammered near multi-decade lows by a slew of problems, including the ECB’s monetary policies, particularly its negative-interest-rate policy (NIRP), festering nonperforming loans, and a well-deserved lack of confidence by investors. This was just exacerbated by a scathing new report from the European Court of Auditors (ECA) highlighting a litany of problems and shortcomings with the European Banking Authority’s latest stress test. Among other things, the test ignored some of the most common factors that cause a bank to fail, excluded many of Europe’s most fragile banks, and used simulations that were a lot more benign than the last financial crisis.

Banking stress tests are supposed to gauge the resilience of a banking system by imposing a hypothetical shock — or “adverse stress scenario” — on a large share of the system’s banks. The problem in Europe is that the European Banking Authority’s stress tests have tended to ignore, rather than identify, many of the worst stress points in the banking system, which is probably why many of the Continent’s worst banking failures, including Bankia BFA, Dexia and Banco Popular, have happened shortly after the banks in question had passed a stress test. Unlike its counterparts in the UK, the US and Japan, the European Banking Authority (EBA) does not itself calculate the impacts on banks of the adverse scenario; it leaves that up to the banks themselves. It does not even corroborate the information provided or conduct on-site inspections.

What a surprise. I would dump the entire 737 name.

• Boeing 737 Max Ordered By Ryanair Undergoes Name Change (G.)

A Boeing 737 Max due to be delivered to Ryanair has had the name Max dropped from the livery, further fuelling speculation that the manufacturer and airlines will seek to rebrand the troubled plane. Photos have emerged of a 737 Max in Ryanair colours outside Boeing’s manufacturing hub, with the designation 737-8200 – instead of 737 Max – on the nose. The 737-8200 is a type name for the aircraft that is used by aviation agencies. The Max aircraft remains grounded worldwide after two crashes in Indonesia and Ethiopia killed a total of 346 people. Boeing has yet to convince regulators that modifications to its software are sufficient to ensure its safety.

Ryanair has 135 of the 737 Max models on order, the first five of which are due for delivery in the autumn, once regulators have declared it safe. The airline’s fleet order is comprised entirely of a larger version of the Max 8, with 197 seats, which it has until now referred to in official Ryanair announcements as the 737 Max 200. Neither Ryanair nor Boeing has commented on nor confirmed the substitution of the 737-8200 for the better known brand Max, as seen on the photographs taken at Renton in Washington, US, and posted on social media by Woodys Aeroimages. In previous photos from the same source, new Ryanair 737 Max 200 planes from Boeing are shown with 737 Max on its nose. It is understood that what is painted on the plane is a matter for the airline rather than the manufacturer. According to sources reported in the Wall Street Journal, the Max plane is unlikely to return to the skies before 2020.

“Shale oil was a neat stunt. Turns out you can produce a helluva lot of it by paying more to pull it out the ground than you get from selling it.”

• What Looms Behind (Kunstler)

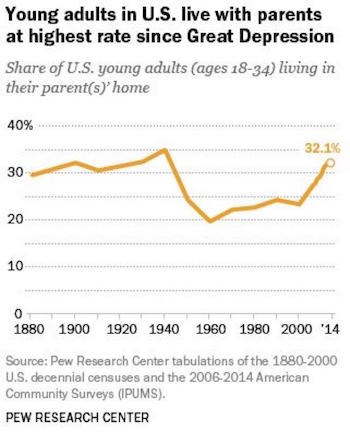

Don’t hold your breath waiting for a coherent pre-election debate about the mother-of-all-issues facing this republic, namely, that we can’t afford the living arrangements Americans think of as “normal” anymore. This quandary has stalked us since the millennium turned. It thunders through all the activities of daily life, and the tensions emanating from it are so agonizing and difficult to face that our politics have deflected off into the kind of hysteria spawned by bad dreams. As the great Wendell Berry pointed out years ago, this is about the nation’s home economics: energy and resources in, production out, surplus wealth saved.

America had a brush with reality in 2008 when all the distortions of our home economics came together and whapped the country between the eyes with a two-by-four. Our energy-in was faltering. US oil production had fallen to a new low of under 4 million barrels a day and we were importing around 15 million. We papered over the problem with borrowed money in ever-larger amounts. This dynamic prompted ever riskier work-arounds on Wall Street, especially “innovations” in securitized debt, which invited criminal shenanigans. It blew up badly. Wealth vaporized. Industries collapsed. Homes and jobs were lost. Lives ruined.

The fairy-tale narrative since then is that technology rode to the rescue. The shale oil miracle “solved” the energy-in problem. Sure seems like it. But lots of things aren’t what they seem to be. Shale oil was a neat stunt. Turns out you can produce a helluva lot of it by paying more to pull it out the ground than you get from selling it. You can goose the process nicely by paying for it with borrowed money. And so it has gone. America now produces a new record of over 12 million barrels a day, and most of the companies doing it can’t make a red cent. And since it is increasingly obvious that they won’t ever pay back the money they borrowed before, they are unlikely to get new loans to continue their profitless operations.

Even if she pulls it off, it will be by the slimmest of margins. Pretty ridiculous.

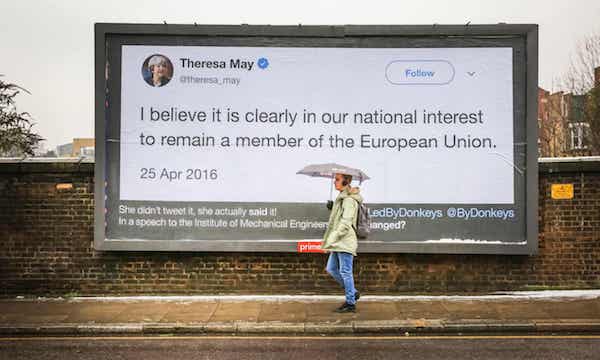

• Von Der Leyen Faces Crucial Vote In Quest To Lead EU Executive (R.)

Germany’s Ursula von der Leyen faces a make-or-break vote on Tuesday in her quest to be the European Commission’s first female leader, and a raft of promises made the previous day may help her win over skeptical European Union socialist and liberal lawmakers. To appease them, von der Leyen pledged more ambitious carbon dioxide emissions targets, a more growth-oriented fiscal policy and taxing big tech companies. She also vowed to create an additional comprehensive European rule-of-law mechanism that includes annual reporting, boost the EU’s border guards earlier than scheduled to deal with the migrant issue, and set a minimum wage for EU workers.

Von der Leyen also suggested scrapping unanimous agreement by all 28 EU countries on climate, energy, social and taxation issues and give Britain more time to negotiate its exit from the bloc. Her pledges came amidst anger among some EU lawmakers over her nomination by EU leaders and their rejection of the “spitzenkandidaten”, the main parliamentary groups’ candidates for the job. Von der Leyen will address the 751-member European Parliament at 0700 GMT, to be followed by a debate and a secret ballot at 1600 GMT. The assembly however is currently four members short which means she needs 374 votes instead of 376.

Draghi gave it all Europe has got.

• Christine Lagarde Must Confront Berlin To Save The Euro (Varoufakis)

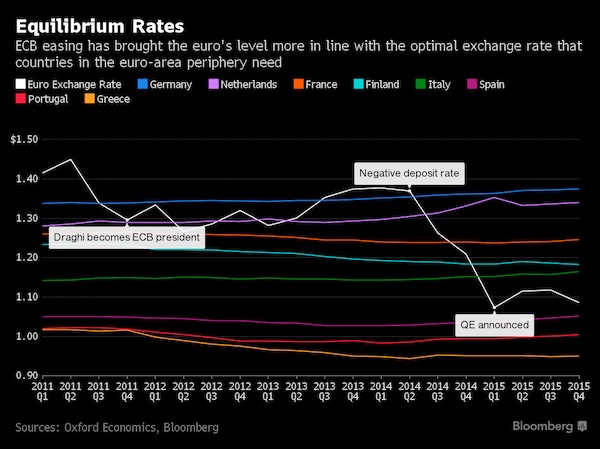

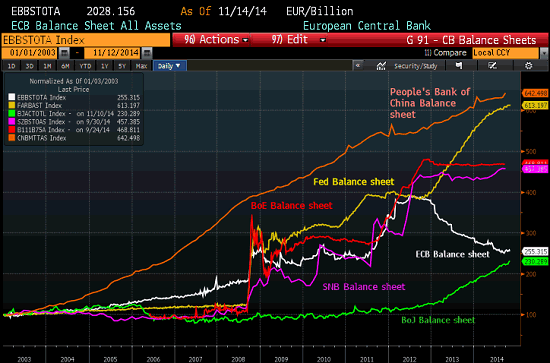

Lagarde’s greatest challenge is that she is replacing a man credited with saving the eurozone by means of policies that are no longer fit for purpose. If she departs from Draghi’s script, she will face fierce criticism. And if she does not, the eurozone’s never-ending crisis will spin further out of the ECB’s control. Draghi saved the eurozone by printing trillions of euros to fund the bankrupt banks and to allow Italy, Spain and other stressed states (though not Greece) to roll over their debts. To do this, he needed to skilfully subvert the eurozone’s rules which, in turn, required painstaking work to co-opt Germany’s Angela Merkel in his great clash with both the Bundesbank, Germany’s powerful central bank, and Wolfgang Schäuble, Germany’s finance minister.

While Draghi’s wall of money helped the eurozone perk up, it could not cure its underlying disease and had some pretty nasty side-effects. Stubborn negative interest rates continue to undermine pension funds and insurance companies in Germany and beyond. Rates remain negative because investment is woefully low due to investors’ self-fulfilling pessimism given the prospect of more austerity. This creates deflationary pressures that eat into the savings of the middle class, replace quality jobs with precarious ones and, thus, beget political monsters across Europe.

You’d almost hope he gets out on bail, just to see the reactions.

• Epstein’s Accusers Urge US Judge To Keep Him Jailed Until Trial (R.)

Two women who say they are victims of sexual misconduct by American financier Jeffrey Epstein on Monday urged a U.S. judge to keep him in jail while he awaits trial on charges of sex trafficking dozens of underage girls. “He’s a scary person,” one of the women, Courtney Wild, told U.S. District Judge Richard Berman in federal court in Manhattan. Wild and another accuser, Annie Farmer, spoke at the end of a hearing in which prosecutors argued that Epstein, 66, posed an “extraordinary risk of flight” and danger to the community and must remain in jail. Epstein, who has pleaded not guilty, has asked to be allowed to live under house arrest with armed guard at his expense in his mansion on Manhattan’s Upper East Side, which is valued at $77 million.

The hedge fund manager had a social circle that over the years has included Donald Trump before he became U.S. president, former President Bill Clinton and Britain’s Prince Andrew. Berman said he would probably announce his bail decision on Thursday at 9:30 a.m. EDT (1330 GMT), saying he needed more time to absorb the case. Lawyers for Epstein said their client, who wore dark blue jail scrubs in court, has had an unblemished record since he pleaded guilty more than a decade ago to a state prostitution charge in Florida and agreed to register as a sex offender.

[..] One of Epstein’s lawyers, Martin Weinberg, told Berman on Monday that Epstein needed to be out of jail so he and his lawyers could prepare their defense. In 2016, Berman rejected a similar bail proposal from Turkish-Iranian gold trader Reza Zarrab to let him live in an apartment under the watch of privately funded guards, saying wealthy defendants should not be allowed to “buy their way out of prison by constructing their own private jail.” The judge expressed similar skepticism on Monday, noting that all defendants have the same right to prepare their defense as Epstein. “If that’s the standard, then what are we going to tell all those people who can’t make the $500 or $1,000 bail?” he said.

“..the fatal danger to empires arises not from external foes but from inside the center of power as elite corruption erodes the legitimacy of the state.”

• Epstein and the Explosive Crisis of the Deep State (CHS)

Enter the sordid case of Jeffrey Epstein, suddenly unearthed after a decade of corporate-media/elitist suppression. It’s laughable to see the corporate media’s pathetic attempts to glom onto the case now, after actively suppressing it for decades:Jeffrey Epstein Was a Sex Offender. The Powerful Welcomed Him Anyway. (New York Times) Where was the NYT a decade ago, or five years ago, or even a year ago? Of all the questions that are arising, the signal one is simply: why now? There are many questions, now that the dead-and-buried case has been dug up: where did Epstein get his fortune? Why did he return to the U.S. from abroad, knowing he’d be arrested? Why was the Miami Herald suddenly able to publish numerous articles exposing the scandalous suppression of justice after 11 years of silence?

Years later, victims recount impact of Jeffrey Epstein abuse. Here’s my outsider’s take: the anti-Neocon camp within the Deep State observed the test case of Harvey Weinstein and saw an opportunity to apply what it learned. If we draw circles representing the anti-Neocon camp and the moralists who grasp the state’s legitimacy is hanging by a thread after decades of amoral exploitation and self-aggrandizement by the ruling elites, we would find a large overlap. But even die-hard Neocons are starting to awaken to the danger to their power posed by the moral collapse of the ruling elites. They are finally awakening to the lesson of history, that the fatal danger to empires arises not from external foes but from inside the center of power as elite corruption erodes the legitimacy of the state.

The upstarts in the Deep State have united to declare open war on the degenerates and their enablers, who are everywhere in the Deep State: the media, the intelligence community, and on and on. Since the battle is for the legitimacy of the state, it must be waged at least partially in the open. This is a war for the hearts and minds of the public, whose belief in the legitimacy of the state and its ruling elites underpins the power of the Deep State. If this wasn’t a war over the legitimacy of the state, the housecleaning would have been discrete. Insiders would be shuffled off to a corporate boardroom or do-nothing/fancy title office, or they’d retire, or if necessary, they’d die of a sudden heart attack or in a tragic accident (if only they knew).

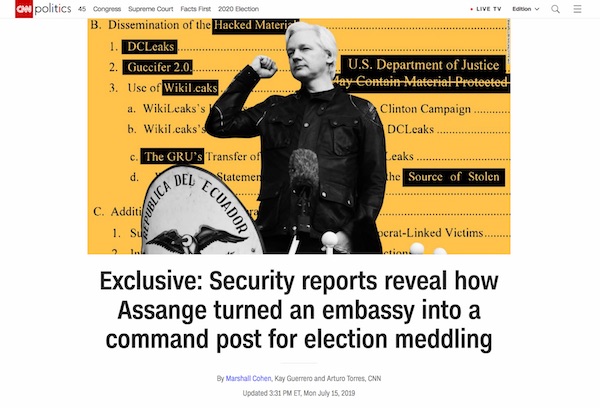

Got to keep the Russia-Assange link alive that never existed. CNn got these files, that El Pais wrote about last week, but still calls them “exclusive”.

• CNN Twists Embassy Surveillance Records To Attack Assange (SP)

Spanish newspaper EL PAÍS reported on July 9 that WikiLeaks founder Julian Assange was spied on by a Spanish private defense and security firm called Undercover Global S.L., when he lived in the Ecuador embassy in the United Kingdom. The report was based on “documents, video, and audio material” that was “used in an extortion attempt against Assange by several individuals.” In May, Spanish police arrested journalist José Martín Santos, who had a record of fraud, and a computer programmer for their alleged involvement in an “attempt to make €3 million from the sale of private material.” Reporters for EL PAÍS found the spying on Assange’s legal defense meetings to be most significant.

They were stunned by the fact that Assange felt he had to hold meetings in the women’s bathroom if he wanted to ensure privacy. And they took note of U.C. Global’s “feverish, obsessive vigilance” toward “the guest,” which became more intense after Lenin Moreno was elected president of Ecuador in May 2017. That is not how CNN viewed the same cache of information compiled by the private security company and eventually used to allegedly extort Assange. Although EL PAÍS makes no mention of meddling in the 2016 presidential election in its coverage, CNN approached the material like analysts at the CIA. They voraciously consumed logs hoping the documents would confirm Assange collaborated with Russian intelligence assets to release emails from John Podesta, Hillary Clinton’s campaign chairman. Compare the two reports, as they appeared on the news organization’s websites:

CNN was unable to find concrete proof, and the words “potentially” and “possibility” do heavy lifting for the media organization. “New documents obtained exclusively by CNN reveal that WikiLeaks founder Julian Assange received in-person deliveries, potentially of hacked materials related to the 2016 US election, during a series of suspicious meetings at the Ecuadorian Embassy in London,” the CNN report reads. It adds, “The documents build on the possibility, raised by special counsel Robert Mueller in his report on Russian meddling, that couriers brought hacked files to Assange at the embassy.”

A suicidal species.

• Pathologizing Kids, Pharma Style (CP)

Millions of kids today are on meds for conduct disorders, depression, bipolar disorder, oppositional defiant disorder, mood disorders, obsessive-compulsive disorders, mixed manias, social phobia and, of course, ADHD. But according to data from IMS health in a Wall Street Journal article, just as many kids are being treated for non-psychiatric conditions that were often considered “adult diseases.” In fact, 25 percent of children and 30 percent of adolescents now take at least one prescription for a chronic condition said Medco, a pharmacy benefit manager, making the kid prescription market four times as strong as the adult in 2009. Between 2001 and 2009, high blood pressure meds for kids rose 17 percent, respiratory meds 42 percent, diabetes meds 150 percent and heartburn/GERD meds 147 percent.

In one study, 18.6 million children’s doctor visits for sleep problems, resulted in sleeping med prescriptions 81 percent of the time. One reason for Pharma’s pediatric bonanza is kids have become more sedentary and likely to overeat, like their adult counterparts. Over a third of U.S. kids are overweight and 17 percent are obese — which for a 4-foot-10 inch child would be 143 pounds. Obesity predisposes children to diabetes, hypertension, high cholesterol, sleep apnea, gallbladder disease, osteoarthritis and musculoskeletal disorders. But rather than telling kids to unplug the TV or video games, go outside and don’t come back until dinner, parents and medical professionals enable the deleterious lifestyles with the easy out of a pill.

In fact, the Lipitor, already the world’s top selling medication in adults until it went off patent, was approved for US children in 2008 in a chewable form in Europe. Adults on statins are six times more likely to develop liver dysfunction, acute kidney failure, cataracts and muscle damage, says an article in the British Medical Journal. So, give them to kids? “Plenty of adults down statins regularly and shine off healthy eating because they know a cheeseburger and steak can’t fool a statin,” wrote Michael J. Breus, PhD on the Huffington Post. “Imagine a 10-year-old who loves his fast food and who knows he can get away with it if he pops his pills.”

Food should not be an industry. Food production should be part of everybody’s life, we should know where our food comes from.

• The True Cost Of Cheap Food Is Health And Climate Crises (G.)

The true cost of cheap, unhealthy food is a spiralling public health crisis and environmental destruction, according to a high-level commission. It said the UK’s food and farming system must be radically transformed and become sustainable within 10 years. The commission’s report, which was welcomed by the environment secretary, Michael Gove, concluded that farmers must be enabled to shift from intensive farming to more organic and wildlife friendly production, raising livestock on grass and growing more nuts and pulses. It also said a National Nature Service should be created to give opportunities for young people to work in the countryside and, for example, tackle the climate crisis by planting trees or restoring peatlands.

“Our own health and the health of the land are inextricably intertwined [but] in the last 70 years, this relationship has been broken,” said the report, which was produced by leaders from farming, supermarket and food supply businesses, as well as health and environment groups, and involved conversations with thousands of rural inhabitants. “Time is now running out. The actions that we take in the next 10 years are critical: to recover and regenerate nature and to restore health and wellbeing to both people and planet,” said the commission, which was convened by the RSA, a group focused on pressing social challenges. The commission said most farmers thought they could make big changes in five to 10 years if they got the right backing.

“Farmers are extraordinarily adaptable,” said Sue Pritchard, director of the RSA commission and an organic farmer in Wales. [..] Pritchard said the UK had the third cheapest basket of food in the developed world, but also had the highest food poverty in Europe in terms of people being able to afford a healthy diet. Type 2 diabetes, a diet-related illness, costs the UK £27bn a year, she said. The commission also said agriculture produced more than 10% of the UK’s climate-heating gases and was the biggest destroyer of wildlife; the abundance of key species has fallen 67% since 1970 and 13% of species are now close to extinction. To solve these crises, the commission said “agroecology” practices must be supported – such as organic farming and agroforestry, where trees are combined with crops and livestock such as pigs or egg-laying hens.