Gordon Parks A scene at the Fulton Fish Market, New York 1943

A crazy experiment.

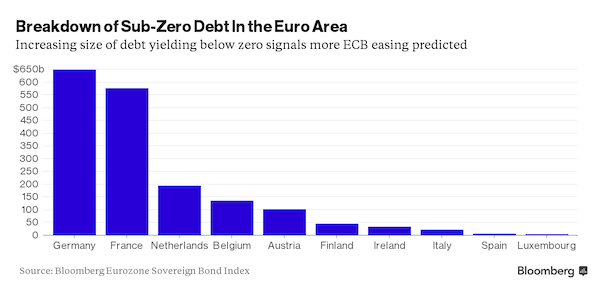

• $1.7 Trillion of Sub-Zero Euro Debt Shows ECB Outlook for 2016 (BBG)

As the ECB wound down its asset purchases for the year, the amount of euro-region government bonds that yield less than zero was at about $1.68 trillion, indicating investors see the potential for further easing of monetary policy in 2016. With QE acquisitions set to resume on Jan. 4, bonds of governments from Portugal to Germany will be supported again by the €1.5 trillion program, which is scheduled to keep running until at least March 2017. Begun in March this year, the purchases continue to push an increasing number of securities off the table – meaning their yields are so low they’re ineligible for buying. The total issued value of bonds that yield less than the ECB’s minus 0.3% deposit rate, and are thus deemed ineligible for acquisition by the ECB, is about $616 billion of the $6.35 trillion Bloomberg Eurozone Sovereign Bond Index.

A slump in oil prices is supporting economists’ view that the ECB is unlikely to veer from its accommodative policy stance as it struggles to achieve its inflation goal of just under 2%, fulfilling a principal aim of the asset-purchase program. So many sub-zero-yielding securities “indicate that there is a belief that there is no real inflationary pressures evident yet, and the ECB will remain ready to do more if required,” said Owen Callan at Cantor Fitzgerald. German two-year note yields were at minus 0.337% as of the 5 p.m. London close on Dec. 23. The price of the 0% security due in December 2017 was 100.665% of face value. The last time the yield was positive was in August 2014. With oil languishing near an 11-year low and the region’s inflation a long way below the ECB’s goal, Callan said “crude oil is probably the leading indicator as regards to where ECB policy and where bond yields go in the start of 2016. That is what most of the markets are looking at the moment.”

“The idea is that the Fed’s tightening will look somewhat benign, and then you’ll realize that rates are rising to 1%. That’s a lot of stress” for markets.”

• Deutsche Bank Sees Taper Tantrum Echo Ahead for US Treasuries (BBG)

Enjoy the holiday slowdown, bond traders. If analysts at Deutsche Bank are right, the market is going to get a lot more volatile. After the Federal Reserve succeeded in nudging borrowing costs up from near zero last week in its first interest-rate increase since 2006, Treasury yields have hardly moved. Now, traders are betting low inflation and slow global growth will encourage policy makers to raise rates slowly in 2016. The lull won’t last, according to Dominic Konstam, global head of rates research for Deutsche Bank in New York. He predicts the Fed will catch bond traders wrongfooted by raising rates in March. That may prompt a smaller version of the market “tantrum” seen in 2013, when the prospect of an end to Fed bond-buying fueled a sharp selloff in Treasuries.

“We call it a ‘baby tantrum,”’ Konstam said. “The idea is that the Fed’s tightening will look somewhat benign, and then you’ll realize that rates are rising to 1%. That’s a lot of stress” for markets. The warning from Deutsche Bank, which has the second-largest share of the interest-rates trading business in the U.S. behind Goldman Sachs, comes as expectations for Treasury-market volatility are tumbling. The Bank of America Merrill Lynch MOVE Index, which gauges implied volatility through options prices, fell to 66.02 this week, the lowest since December 2014. Early signals from the central bank indicate that policy makers may raise rates more quickly than traders expect.

The median of the Fed’s so-called dot plot – a chart sketching out officials’ projections for where rates will be in the future – calls for them to reach 1.375% next year. That would constitute four 0.25 percentage point increases. On Monday, Federal Reserve Bank of Atlanta President Dennis Lockhart also suggested that the Fed may raise rates four times in 2016. Futures prices show traders don’t buy into the Fed’s timeline. The market continues to expect two rate increases in 2016, according to data compiled by Bloomberg. Traders are pricing in a 56% chance that the Fed raises rates at or before its April meeting, based on the assumption that the effective fed funds rate will trade at the middle of the new FOMC target range after the next increase.

Not a chance. Others are even more overvalued.

• Pound Is ‘Most Overvalued Currency In The World’, Analysts Claim (Telegraph)

The pound is one of the most overvalued currencies in the world and will suffer next year as the Government ramps up spending cuts and uncertainty about Britain’s future in the EU weighs on growth. Analysts at Deutsche Bank warned that the Bank of England may not be able to raise interest rates “at all” if Britain’s recovery slows. It believes the pound could fall as low as $1.27 next year and $1.15 in 2017 from about $1.485 today if the US Federal Reserve continues to tighten monetary policy and the Bank of England leaves interest rates on hold. “We have various different ways of looking at currency valuations and what we find is that sterling is the most expensive currency out there at the moment – even including the dollar,” said Oliver Harvey at Deutsche Bank. Earlier this year, the IMF said the pound was between 5pc and 15pc overvalued.

Several Bank policymakers, including Governor Mark Carney and even hawkish rate-setter Martin Weale have played down the prospect of a rate rise in the next few months as a renewed fall in oil prices and weak wage growth keep inflation well below the Bank’s 2pc target. Deutsche Bank said more fiscal consolidation next year relative to this year would make it “challenging” for the Bank of England to raise interest rates if austerity weighed on growth. “[Since November] oil prices have fallen more and the inflation data are showing signs of slowing. So if we don’t have a hiking cycle in the first half of next year, there is a risk that we don’t have a hiking cycle at all.” Markets currently expect the Bank to raise rates in January 2017. Mr Harvey said even if the Bank started to raise rates next year, the path of hikes would be much shallower than in the US, which would push sterling down to at least $1.40 against the dollar by the end of 2016.

And then someone in some government thinks a 3-4-5% surcharge on all transactions is a good idea.

• In Sweden, a Cash-Free Future Nears (NY Times)

Parishioners text tithes to their churches. Homeless street vendors carry mobile credit-card readers. Even the Abba Museum, despite being a shrine to the 1970s pop group that wrote “Money, Money, Money,” considers cash so last-century that it does not accept bills and coins. Few places are tilting toward a cashless future as quickly as Sweden, which has become hooked on the convenience of paying by app and plastic. This tech-forward country, home to the music streaming service Spotify and the maker of the Candy Crush mobile games, has been lured by the innovations that make digital payments easier. It is also a practical matter, as many of the country’s banks no longer accept or dispense cash.

At the Abba Museum, “we don’t want to be behind the times by taking cash while cash is dying out,” said Bjorn Ulvaeus, a former Abba member who has leveraged the band’s legacy into a sprawling business empire, including the museum. Not everyone is cheering. Sweden’s embrace of electronic payments has alarmed consumer organizations and critics who warn of a rising threat to privacy and increased vulnerability to sophisticated Internet crimes. Last year, the number of electronic fraud cases surged to 140,000, more than double the amount a decade ago, according to Sweden’s Ministry of Justice. Older adults and refugees in Sweden who use cash may be marginalized, critics say. And young people who use apps to pay for everything or take out loans via their mobile phones risk falling into debt.

“It might be trendy,” said Bjorn Eriksson, a former director of the Swedish police force and former president of Interpol. “But there are all sorts of risks when a society starts to go cashless.” But advocates like Mr. Ulvaeus cite personal safety as a reason that countries should go cash-free. He switched to using only card and electronic payments after his son’s Stockholm apartment was burglarized twice several years ago. “There was such a feeling of insecurity,” said Mr. Ulvaeus, who carries no cash at all. “It made me think: What would happen if this was a cashless society, and the robbers couldn’t sell what they stole?” Bills and coins now represent just 2% of Sweden’s economy, compared with 7.7% in the United States and 10% in the euro area. This year, only about 20% of all consumer payments in Sweden have been made in cash, compared with an average of 75% in the rest of the world, according to Euromonitor International.

Cards are still king in Sweden — with nearly 2.4 billion credit and debit transactions in 2013, compared with 213 million 15 years earlier. But even plastic is facing competition, as a rising number of Swedes use apps for everyday commerce. At more than half of the branches of the country’s biggest banks, including SEB, Swedbank, Nordea Bank and others, no cash is kept on hand, nor are cash deposits accepted. They say they are saving a significant amount on security by removing the incentive for bank robberies. Last year, Swedish bank vaults held around 3.6 billion kronor in notes and coins, down from 8.7 billion in 2010, according to the Bank for International Settlements. Cash machines, which are controlled by a Swedish bank consortium, are being dismantled by the hundreds, especially in rural areas.

It’s important to check how ‘pure’ these experiments are. If they’re screwed up from the start, they just serve to ‘prove’ what a bad idea it all is.

• Dutch City Plans To Pay All Citizens A ‘Basic Income’ (Guardian)

It’s an idea whose adherents over the centuries have ranged from socialists to libertarians to far-right mavericks. It was first proposed by Thomas Paine in his 1797 pamphlet, Agrarian Justice, as a system in which at the “age of majority” everyone would receive an equal capital grant, a “basic income” handed over by the state to each and all, no questions asked, to do with what they wanted. It might be thought that, in these austere times, no idea could be more politically toxic: literally, a policy of the state handing over something for nothing. But in Utrecht, one of the largest cities in the Netherlands, and 19 other Dutch municipalities, a tentative step towards realising the dream of many a marginal and disappointed political theorist is being made.

The politicians, well aware of a possible backlash, are rather shy of admitting it. “We had to delete mention of basic income from all the documents to get the policy signed off by the council,” confided Lisa Westerveld, a Green councillor for the city of Nijmegen, near the Dutch-German border. “We don’t call it a basic income in Utrecht because people have an idea about it – that it is just free money and people will sit at home and watch TV,” said Heleen de Boer, a Green councillor in that city, which is half an hour south of Amsterdam. Nevertheless, the municipalities are, in the words of de Boer, taking a “small step” towards a basic income for all by allowing small groups of benefit claimants to be paid £660 a month – and keep any earnings they make from work on top of that.

Their monthly pay will not be means-tested. They will instead have the security of that cash every month, and the option to decide whether they want to add to that by finding work. The outcomes will be analysed by eminent economist Loek Groot, a professor at the University of Utrecht. A start date for the scheme has yet to be settled – and only benefit claimants involved in the pilots will receive the cash – but there is no doubting the radical intent. The motivation behind the experiment in Utrecht, according to Nienke Horst, a senior policy adviser to the municipality’s Liberal Democrat leadership, is for claimants to avoid the “poverty trap” – the fact that if they earn, they will lose benefits, and potentially be worse off.

The idea also hopes to target “revolving door clients” – those who are forced into jobs by the system but repeatedly walk out of them. If given a basic income, the thinking goes, these people might find the time and space to look for long-term employment that suits them. But the logic of basic income, according to people to the left of Horst, leads only one way – to the cash sum becoming a universal right. It would be unthinkable for those on benefits to be earning and receiving more than their counterparts off benefits. Horst admitted: “Some municipalities are very into the basic income thing.”

How the CIA is funded.

• The Man Who Exposed The Lie Of The War On Drugs (Observer)

We hear much these days about the pros and cons of legalising drugs, but very little about narco-traffic as political economy. Now, Saviano articulates and demonstrates what many of us who write about mafia have been trying for years to shout from rooftops, only none of us climbed high enough, cried as loud, or crystallised it like he does. Here it is, the lie of any dividing line between legal and illegal. Here it is, laid bare: cartel as corporation, corporation as cartel; cocaine as pure capitalism, capitalism as cocaine, known in its purest form as zero-zero-zero – a wry reference to the name of the best grade of flour, ideal for pasta. Saviano writes in his own distinct style of narrative literary reportage, at once factually informative and impressionistic.

He opens Zero Zero Zero with a scathing tragicomic reflection on who in your life uses cocaine: “If it’s not your mother or father… then the boss does. Or the boss’s secretary… the oncologist… the waiters who will work the wedding… If not them, then the town councillor who just approved the new pedestrian zones.” Within three-score pages he has stripped bare the system whereby – and why – the white powder got up their noses. “Cocaine,” he concludes, applying the logic of business school, “is a safe asset. Cocaine is an anticyclical asset. Cocaine is the asset that fears neither resource shortages nor market inflation.” Of course, cocaine capitalism – as brazenly as any other commodity, possibly more so – has “both feet firmly planted in poverty… [and] unskilled labour, a sea of interchangeable subjects, that perpetuates a system of exploitation of the many and enrichment of the few”.

“Cocaine becomes a product like gold or oil,” he adds in conversation, “but more economically potent than gold or oil. With these other commodities, if you don’t have access to mines or wells, it’s hard to break into the market. With cocaine, no. The territory is farmed by desperate peasants, from whose product you can accumulate huge quantities of capital and cash in very little time. “If you’re selling diamonds, you have to get them authenticated, licensed – cocaine, no. Whatever you have, whatever the quality, you can sell it immediately. You are in perfect synthesis with the everyday life and ethos of the global markets – and the ignorance of politicians in the west to understand this is staggering. The European world, the American world, don’t understand these forces, they don’t have the will to understand narco-traffic.”

In a previous book, soon to be translated, called Vieni Via Con Me – Come Away With Me – Saviano talked about the “ecomafia” for which it is “always fundamental to be looking for terrain and spaces in which to conceal and proliferate itself”, just as a corporation carves out markets. In Zero Zero Zero, he writes about what might be called the genealogy of narco-syndicates, from their paternalistic period of “conservative capitalism” to the lean, mean multinational corporations they have become: buying failing banks, working the credit economy, taking over interbank loans. Permeating the system until they become indistinct from it, until (writes Saviano in Vieni Via Con Me): “democracy is literally in danger”, and we become “all equal, all contaminated… in the machine of mud”.

That’s a lot more than in Britain.

• More Than 100,000 Flee El Niño Flooding In South America (Reuters)

More than 100,000 people evacuated their homes in the bordering areas of Paraguay, Uruguay, Brazil and Argentina due to severe flooding in the wake of heavy summer rains brought on by El Niño, authorities said. The Paraguayan government declared a state of emergency in Asunción and seven regions of the country. Several people were killed by falling trees, local media reported. “[The flooding] was directly influenced by the El Niño phenomenon which has intensified the frequency and intensity of rains,” the national emergencies office said. This year’s El Niño, which is linked to global climate fluctuations, is the worst in more than 15 years, according to the UN’s World Meteorological Organisation (WMO).

“Severe droughts and devastating flooding being experienced throughout the tropics and subtropical zones bear the hallmarks of this El Niño,” said WMO chief Michel Jarraud. In northern Argentina about 20,000 people had to abandon their homes, the government said. “We are going to have a few complicated months, the consequences will be serious,” said Ricardo Colombi, the governor of the Corrientes region, after flying over the worst-affected areas with the national cabinet chief, Marcos Peña. Peña said new president, Mauricio Macri, would visit affected areas and intended to make improving infrastructure to mitigate flooding a priority. In Uruguay more than 9,000 people fled their homes, according to the national emergencies office. At least four people died in Argentina and Uruguay, according to local media reports. One was reported to have drowned while another was electrocuted by a fallen power cable.

But what happens in Britain, too, is stunning.

• Britain Overwhelmed By Widespread Flooding (DM)

Britain was overwhelmed by the most widespread flooding for decades yesterday as the dire weather left a trail of chaos stretching hundreds of miles and affecting 2,000 homes. Huge swathes of the North of England, including parts of Manchester and Leeds and their satellite towns, were under up to 6ft of water after a month’s rain fell in a single day. Thousands of residents were forced to flee their homes and in some cases whole towns were cut off as the misery of flooding spread across Lancashire, Greater Manchester and Yorkshire, and parts of Scotland and North Wales. And for the first time since the waters started rising a month ago, densely populated urban areas were engulfed.

Last night David Cameron tweeted: “My thoughts are with people whose homes have been flooded. I’ll chair a Cobra [emergency committee] call tomorrow to ensure everything is being done to help.” He will visit affected areas tomorrow. Flood waters were predicted to keep rising last night and police were going door-to-door in Salford, Greater Manchester, urging people to evacuate their homes with just what they could carry. Ominously, a severe flood warning was also issued for Leeds city centre, due to the immediate ‘”risk to life in the area”. It came after a day of extraordinary scenes when rivers and waterways broke their banks and continued downpours caused flooding on already saturated ground.

Two streets in Leeds city centre turned into ‘canals’ after the River Aire reached its highest ever level and burst its banks. Elsewhere astonishing pictures emerged of sunken towns which residents said had begun to resemble ‘mini-Venices’. One West Yorkshire town, Todmorden, was cut off completely. Earlier, rescuers on an inflatable dinghy pulled an elderly man from the sunroof of his Land Rover, which drifted through the Yorkshire town of Mytholmroyd almost completely submerged. He was said to be “seconds from drowning” when saved. As Ministers spoke of unprecedented rainfall, people in the worst hit areas were urged to “flee for their lives”. Flood alerts were issued across Greater Manchester where police chiefs told residents to “protect your property by elevating valuable and sentimental items”.

We’ll see much more of this kind of loose cannon stuff across Europe next year.

• Czech President: Migrants Should Be Fighting Isis, Not ‘Invading’ Europe (AFP)

The Czech president, Milos Zeman, has called the movement of refugees into Europe “an organised invasion” and declared that young men from Syria and Iraq should stay in their countries to “take up arms” against Isis. “I am profoundly convinced that we are facing an organised invasion and not a spontaneous movement of refugees,” said Zeman in his Christmas message to the Czech Republic. Compassion was “possible” for refugees who were old or sick, and for children, he said but not for young men who should be back home fighting against jihadists. “A large majority of the illegal migrants are young men in good health and single. I wonder why these men are not taking up arms to go fight for the freedom of their countries against the Islamic State,” said Zeman, who was elected Czech president in early 2013.

Fleeing their war-torn countries only served to strengthen Isis, he said. The 71-year-old evoked a comparison to the situation of Czechs who left their country when it was under Nazi occupation from 1939 to 1945. It is not the first time Zeman has taken a controversial stance on Europe’s worst migrant crisis since World War II. In November the leftwinger attended an anti-Islam rally in Prague in the company of far-right politicians and a paramilitary unit. The country’s prime minister, Bohuslav Sobotka, who has previously criticised the head of state’s comments, said Zeman’s Christmas message was based “on prejudices and his habitual simplification of things”. Migrants are not the only target of Zeman’s caustic remarks: he said last week that his country should introduce the euro on the first day after indebted Greece’s departure from the common currency, causing Athens to recall its ambassador.

He also said he was “very disappointed” that talks in the summer to eject Greece from the euro did not come to fruition. Both the Czech Republic and Slovakia, former communist countries that joined the European Union in 2004, have rejected the EU’s system of quotas for distributing refugees amid the current migrant wave. More than a million migrants and refugees reached Europe in 2015, mainly fleeing violence in Afghanistan, Iraq and Syria. The crisis has strained ties within the European Union, with mostly newer members taking a firm anti-migrant stance and some northern countries like Germany welcoming those fleeing war. Few asylum seekers have chosen to stay in the Czech Republic, a Nato member nation of 10.5 million people. Regardless, a recent survey showed that nearly 70% of Czechs oppose the arrival of migrants and refugees in their country.

Wonder how many refugees were rescued in total. We kind of know how many were not.

• German Navy Says It Rescued Over 10,000 Refugees In 2015 (AFP)

Germany’s navy said Saturday it rescued over 10,000 migrants at sea this year, including more than 500 people off the coast of Libya on Christmas day. “The German navy’s ships rescued 10,528 people since May 7, 2015,” when its fleet launched a rescue operation, the Bundeswehr said on its website. One ship went into action at Christmas on Friday some 40 kilometers (25 miles) from the Libyan coast, rescuing 539 people on board three inflatable boats and a wooden vessel. A frigate and a patrol boat from Italy as well as a Maltese tanker assisted in the latest rescue operation. Two German ships are taking part in the European Union’s rescue Operation Sophia. The UN refugee agency and the International Organization for Migration (IOM) said this week more than one million migrants and refugees reached Europe this year, most of them by sea. Nearly 3,700 people drowned or went missing at sea, the IOM said.

More drownings.

• Flow Of Refugees To Greek Islands Continues Over Christmas (Kath.)

The flow of refugees and migrants to and from the Greek islands continued over the Christmas holidays. Some 6,000 people arrived at the port of Piraeus on Christmas Day and Boxing Day on ferries from Lesvos, Chios and Samos. Nevertheless, thousands of refugees and migrants remained on the islands, Lesvos in particular. According to authorities, there were some 6,000 people at the Moria registration camp and another 1,500 at the Kara Tepe camp. Also, on Saturday the International Red Cross opened a new reception center in the area of Eftalou. The center is designed to host around 2,000 people while they wait to leave the island. On Christmas Day, authorities found two drowned migrants, one off Leros and the other near Samos. The coast guard and Frontex also rescued 265 migrants and arrested two suspected traffickers.