John M. Fox “The new Hudson” 1948

“There will never be a good time to raise rates off zero when you’ve been there for six years..”

• How The Fed Is ‘Screwed,’ And What Happens Next (CNBC)

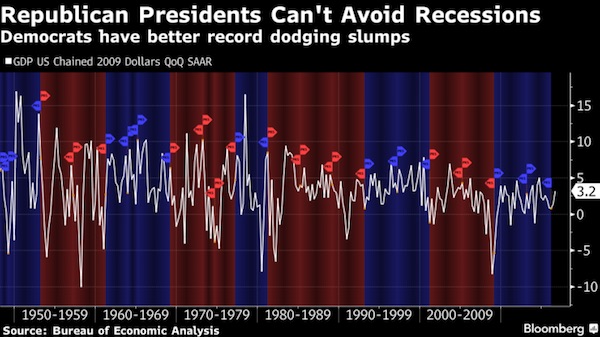

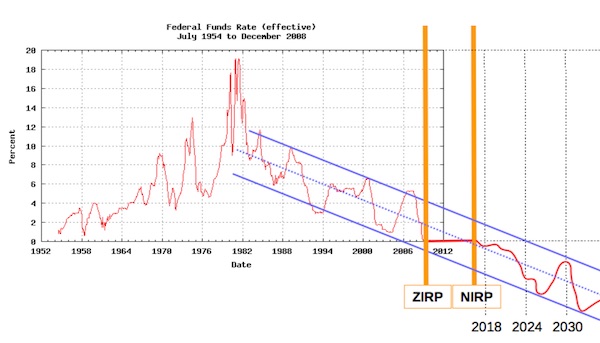

Call it a box, or perhaps even a paradox, but the Federal Reserve finds itself in an uncomfortable position heading into its first rate-hiking cycle in nearly a decade. A central bank that has prided itself on transparency during its ultra-easy cycle following the financial crisis is now doing an awkward dance with a market not quite sure what to make of the road to tightening financial conditions. The essential problem is this: When the Fed could have raised rates it didn’t want to. Now that it wants to raise rates, it may not be able to, at least not without causing substantial turmoil in the same financial markets it has sought so strenuously to soothe. The Fed hasn’t raised rates since June 2006. “There will never be a good time to raise rates off zero when you’ve been there for six years,” Peter Boockvar at The Lindsey Group, told CNBC. “The Fed’s screwed, essentially.”

The extension of the central bank’s dilemma, or box, or paradox, goes like this, as highlighted in Boockvar’s argument: Zero interest rates were a response to the worst U.S. economic crisis since the Great Depression. The economy, though, is far removed from its crisis days. The recession ended in mid-2009, gross domestic product has been on a steady if uninspiring march higher and financial markets, which have received by far the most benefit from Fed programs, have soared. While all that happened, the Fed could have begun the tightening process without disrupting the recovery. What’s left now, though, is a point where the Fed has indicated a desire to tighten at a time when its biggest global counterparts are easing. That’s resulted in a firming of the dollar, a looming earnings recession in which U.S. profits are forecast to decline in two consecutive quarters—and could well turn negative for the year—and first-quarter GDP gains that could be anemic or nonexistent.

“Zero … is just an unnatural rate six years into a recovery.” Boockvar said. “But the problem is that GDP growth hasn’t averaged more than 2.5% (during the recovery), so they’re stuck in this lackluster, mediocre-type growth rate.” Investors have recoiled amid the current conditions. Outflows from equity-based funds have reached their highest level since the darkest days of 2009, just as the recession was ending and the Fed was kicking its zero interest rate policy and quantitative easing into high gear. The central bank expanded its balance sheet to $4.5 trillion during QE as it bought bonds and injected liquidity into the capital markets.

Read more …

“..your chances of marrying outside your income bracket have been dropping since the 1950s because of something called assortative mating..”

• Cinderella’s New Moral: Be Rich Or Be A Pumpkin (Lynn Stuart Parramore)

Once upon a time, during a brief egalitarian period in postwar America, people of different classes did not live in separate worlds. The promise of mobility and prosperity was alive throughout the land. In 1950, Walt Disney Productions was saved from bankruptcy with its smash hit Cinderella, which audiences cheered at a time when the future looked bright and it was still possible for the dream of marrying up to come true. A new Disney film of Cinderella is a big box-office success today, but how different things look! Cinderella marriages are getting to be as rare as golden coaches. Economist Jeremy Greenwood has found that your chances of marrying outside your income bracket have been dropping since the 1950s because of something called assortative mating, which means that we are increasingly drawn to people in similar circumstances.

Since the 1980s, inequality has grown and mobility has stalled. Today, the rich forge their unions in exclusive social clubs, Ivy League colleges and gated communities. Unless you have a fortune or a fairy godmother, you’re probably out of luck. Without that magic, the gates remain closed. At first glance, Kenneth Branagh’s remake of the classic Disney film seems to offer a sunny romp through the magic kingdom. But a closer look reveals a troubling economic message. Economists like Thomas Piketty have been warning that if we don’t do something to stop growing income inequality, we may end up back in a 19th-century world, where hard work won’t lift you up the economic ladder because the income you can expect from labor is no match for inherited wealth. This is the world of the new Cinderella.

More so than the original Disney film, Branagh’s version highlights what happens when people are forced to compete for illusive rewards in a harsh economy. Families turn on each other, chances to get ahead are few and you’d better hope for a magic wand. Subtle changes to the story bring the point home. In the original animated version, the father is a gentleman, a widower who remarries and then promptly dies, leaving a jealous stepmother and her mean-girl daughters to torment his beloved only child. But in Branagh’s film, the father is a merchant, and his death deprives the family of his income — leaving them all in straitened circumstances.

The stepmother’s first thought on hearing of her husband’s demise is entirely practical: How shall we survive economically? Her answer: Turn Cinderella into a servant and search for wealthy matches for her two daughters. The marriage market illustrated in the movie reflects what economists like Robert H. Frank describe as a tournament, a “winner-take-all” game associated with economies where wealth is increasingly concentrated at the top. In these cutthroat markets, only a handful of people can win big, while the rest are left with little.

Read more …

He makes it up afresh every morning.

• The ECB’s Put – Explained By Draghi (CNBC)

Investors in euro-denominated assets can get very useful insights from important points that European Central Bank (ECB) President Mario Draghi made last week while addressing several committees of the Italian Parliament. At the outset, Draghi pointed out that the main purpose of the ECB’s asset purchase program (“quantitative easing”) was to create a more favorable environment for structural reforms. These reforms are an absolutely essential part of freeing up market mechanisms in Europe’s rigid economies and bloated welfare systems. They are supposed to create conditions necessary for steady and balanced economic growth. The rub is that the short-term impact of these reforms also creates flammable socio-political problems of rising unemployment and falling revenues.

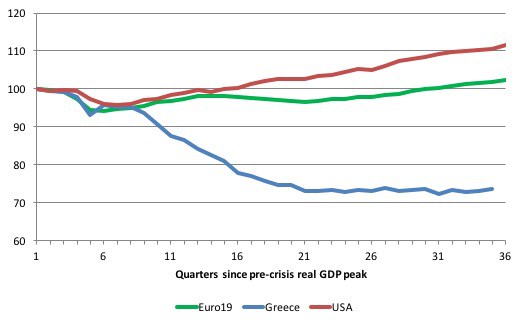

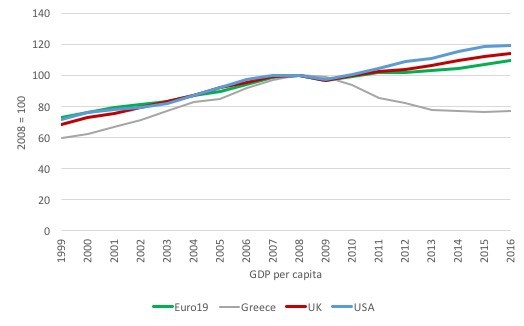

No euro area government has a mandate for such policy outcomes. Those who tried sank to oblivion. Witness the social turmoil and political changes in Greece, France, Italy, Spain and Portugal. All of these countries are currently experiencing a powerful pushback to reforms and austerity policies. The new leftwing government in Greece got an overwhelming popular vote to roll back most of the socially painful structural reforms and accompanying austerity policies. Last week’s regional elections in France showed a similar result. Spain’s Podemos party, an upstart anti-austerity movement, is breaking up the country’s traditional two-party system, leading to a huge defeat of the center-right government in regional parliamentary elections a week ago.

And tens of thousands of people were marching in Rome last Saturday to protest against new regulations introducing a bit of much-needed flexibility to an excessively rigid Italian labor market. These are the people Mario Draghi was addressing while speaking two days earlier to Budget, Finance and European Affairs Committees of the Italian Parliament. What he said there is that the ECB can help with expansionary monetary policies to ease the (short-term) pain of structural reforms, but that without these reforms the euro area recovery will peter out, bringing the economies back to stagnation, falling output and rising unemployment. [That reminded me of a good old Spanish proverb: “Pan de hoy, hambre de mañana,” literally translated as “bread today, hunger tomorrow”.]

Elaborating on this argument, Draghi told Italian legislators that the encouraging signs of improving economic activity in the euro area are mainly the result of falling energy costs, cheap credit (and the sinking euro)and favorable effects of structural reforms in some member countries. But he warned that what he sees is a “cyclical recovery” rather than a more sustainable “structural recovery,” which rests on flexible markets, rising productivity and an increasing non-inflationary growth potential.

Read more …

Emerging countries are no longer that.

• Angola Joins Venezuela Among Biggest Losers Of Oil’s Tumble (CNBC)

Plunging oil prices have been an economic windfall for U.S. consumers, primarily through greater savings at the pump. In energy-reliant countries around the world like Angola, however, the effect has been far less beneficial. Social and economic turmoil in countries like Venezuela and Russia—largely because of the swoon in global oil prices—has drawn attention away from Angola, an OPEC member that is Africa’s second-largest oil producer. The country churns out 1.75 million barrels of oil per day, according to the Energy Information Agency (EIA). The sub-Saharan country is hugely dependent on oil production to generate revenue for its economy, which the International Monetary Fund (IMF) says accounted for 97% of total export revenues in 2012, marginally more than Venezuela’s 95%.

Although Angola’s economic tumult is not as bad as Venezuela’s, the situation in the country is pretty grim. Last year, Angola saw net oil export revenue plunge by more than 12% to $24 billion, due to tumbling production and crude prices, EIA data notes. Its oil exports account for 50% of its domestic economy, and Angola had to drastically slash its 2015 oil price assumptions to $40 per barrel, from $81 per barrel. The tumble in black gold has precipitated massive created wrenching adjustment in the country, which Rabah Arezki, head of the commodities research team at IMF, said puts upward pressure on domestic oil prices, resulting in “social unrest” and a recently proposed $14 billion in budget belt-tightening.

The massive budget cuts “is of course a huge shock,” Arezki told CNBC, suggesting that “the government may decide to cushion the shock using fiscal buffers.” And not unlike Venezuela, Angola’s oil crisis has created a crisis that has sent its currency, the Kwanza, to an all-time low. Arezki points out that is likely to hinder the effectiveness of monetary policy. The situation has put Angolan president Jose Eduardo dos Santos in the crosshairs of public anger. Luanda has been forced to reach out to international lenders for at least $1 billion in loans, the Financial Times reported recently, and is reportedly soliciting banks like Goldman Sachs for millions in private loans.

Read more …

China saw the west lying about its wealth and thought: why stop there?

• China’s Developers Face More Price Pain (FT)

Chinese property developers are finding themselves forced to sacrifice profits to boost sales, as the downturn in the housing market saddles them with bulging inventories and limited access to new funding. Most listed mainland homebuilders recorded a steady rise in revenue last year but sharp declines in profit for many are a symptom of aggressive price-cutting designed to shift stock and generate much-needed cash in the debt-laden sector. Revenue at Agile Property increased 8% in 2014, the company said in its latest earnings report yet profits sank 11%. Profit fell by 15% at Guangzhou R&F and by 8% at Yuzhou Properties, even as both reported growth in sales. “We expect prices will remain under pressure over the next few months as developers continue to offer price incentives for their projects,” Moody’s analysts wrote in a report.

Margins at some of the more successful companies also have come under pressure. Country Garden’s income rose by more than a third last year, yet profit was up by only a fifth. Still, China Vanke – the country’s largest builder by sales – reports earnings on Monday, and is expected to show operating profit rising by over 30%. Weakness in the housing market has been a key factor in China’s broad slowdown. The economy grew 7.4% last year, the slowest pace in more than 20 years, as the government sought to reduce dependence on credit-fuelled construction. Overall home sales dropped 8% last year, according to official figures.

“With the downward pressure on the economy, the real estate industry will continue to undergo a period of profound correction,” said Cao He, chairman of Hong Kong-listed builder Franshion. “Property developers will face challenges including shrinking profit margins and intensifying competition.” Kiyan Zandiyeh and Daili Wang of Roubini Global Economics warn that the current “supply glut” in Chinese housing is likely to get even more severe. “With companies trying to meet sales growth and defend market share, the incentive has been to keep building – meaning today’s excess supply in the market will only worsen,” they wrote in a report. “Developers will struggle with stronger headwinds from falling house prices, given that most of them are operating with unsustainable levels of inventory and debt.”

Read more …

Spending in China is way down, so deflation is a fact.

• China Central Bank Governor Calls For Vigilance On Deflation (Reuters)

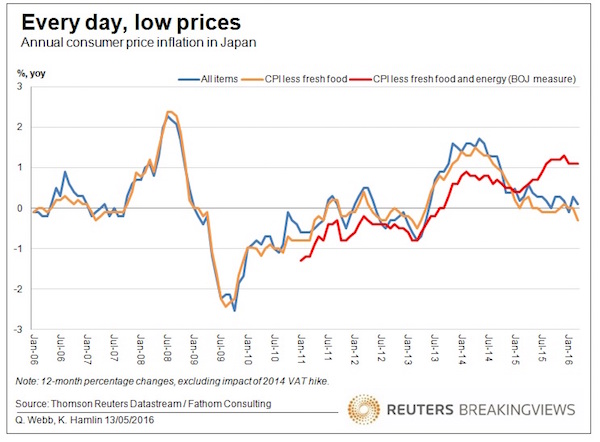

China’s central bank governor Zhou Xiaochuan warned on Sunday that the country needs to be vigilant for signs of deflation and said policymakers were closely watching slowing global economic growth and declining commodity prices. Zhou’s comments are likely to add to concerns that China is in danger of slipping into deflation and underline increasing nervousness among policymakers as the economy continues to lose momentum despite a raft of stimulus measures. “Inflation in China is also declining. We need to have vigilance if this can go further to reach some sort of deflation or not,” Zhou said at a high-level forum in Boao, on the southern Chinese island of Hainan.

Zhou added that the speed with which inflation was slowing was a “little too quick”, though this was part of China’s ongoing market readjustment and reforms. Beijing is determined to keep the world’s second-largest economy from taking the same path of recession and deflation that has blighted its neighbor Japan for the past 20 years. The central bank’s newspaper warned last month that China is dangerously close to slipping into deflation. The People’s Bank of China (PBOC) has cut interest rates twice since November and taken other steps to support growth, but economists believe it will be forced to take more aggressive measures in coming months if prices and the economy weaken further.

Zhou also said China had a “clear direction” in terms of interest rate liberalization – a long-term goal – although he added it was difficult to put a clear timetable on the move. He pointed to comments made last year when he said the country’s deposit rates were likely to liberalized in one to two years. Last week, Zhou said China could undermine structural reforms if it adopts an excessively loose monetary policy, while pledging to relax capital controls to help make the yuan currency fully convertible. Zhou also said on Sunday that China hoped to work on streamlining regulations around foreign exchange this year and that through the adoption of new rules China would eventually be able to achieve capital account convertibility.

Read more …

And they won’t.

• Greece Says Not Backing Down On Debt Relief Goal (Reuters)

– Greece has not given up on its aim to renegotiate its debt to render it manageable, the country’s deputy finance minister said on Monday as talks between Athens and its lenders on reforms to unlock aid continue. “The government has not abandoned any claim regarding its aim to make the country’s debt viable,” Deputy Finance Minister Dimitris Mardas told financial daily Naftemporiki. Greece’s public debt burden reached more than 177% of national output last year. The country’s new government came to power in January promising to demand that its euro zone partners let it write off a large part of that debt.

But it has said little about the issue in recent weeks, as Greece struggles to cope with a cash crunch and the government focuses on reaching agreement with its lenders on reforms that would unlock the remaining funds of the country’s bailout. “The solutions are known — either there will be a haircut or it will be extended, or (repayment) will be linked to an increase in output or exports, or there will be lower interest rates,” Mardas told the paper. He reiterated a plan to link the repayment of Greece’s 318 billion euros of debt with economic growth or exports, along the lines of a deal applied for post-World War Two Germany.

Read more …

“The ECB has always been the most powerful but least accountable player in bail-out talks”.

• How Greece Pushed Europe’s Creditors To The Edge (Telegraph)

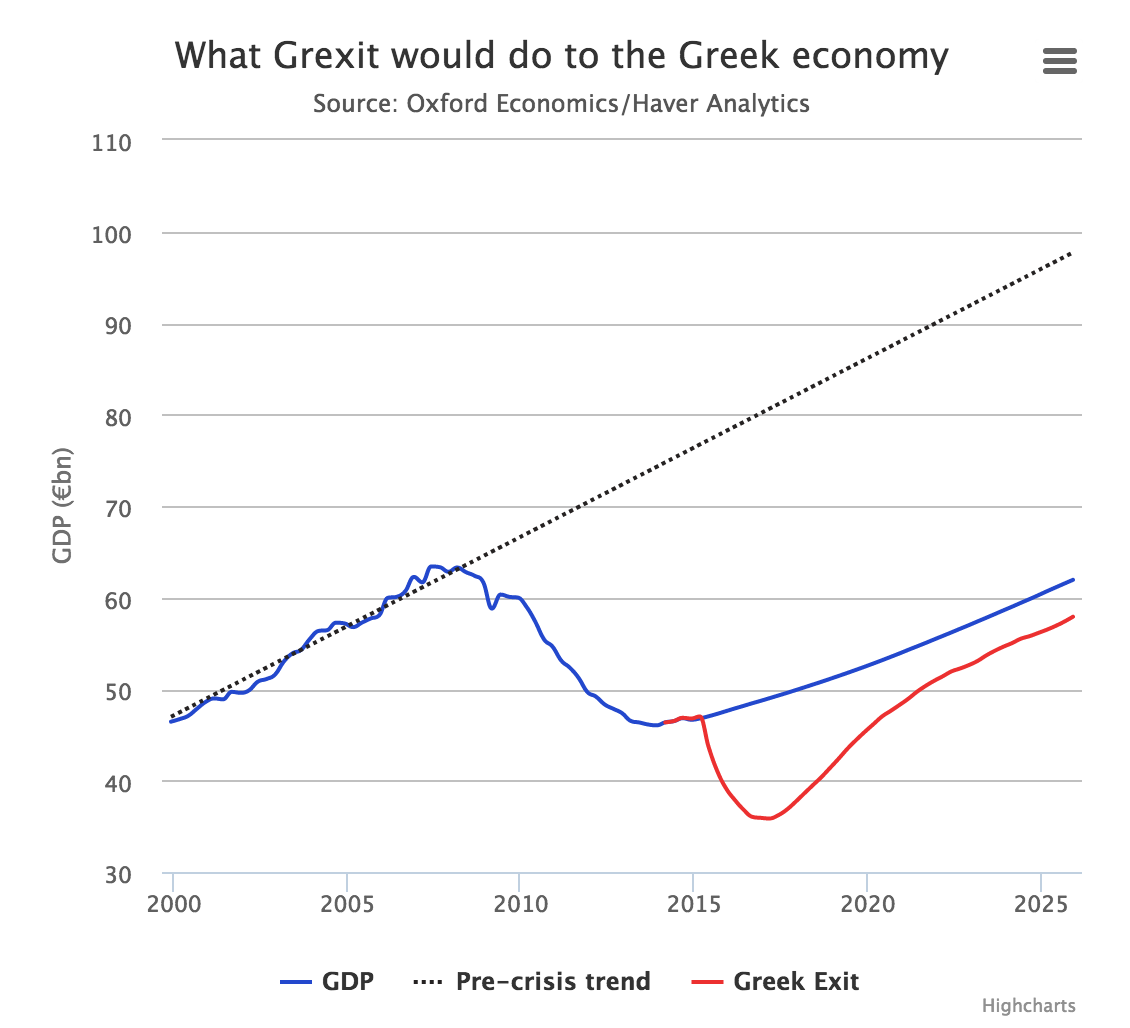

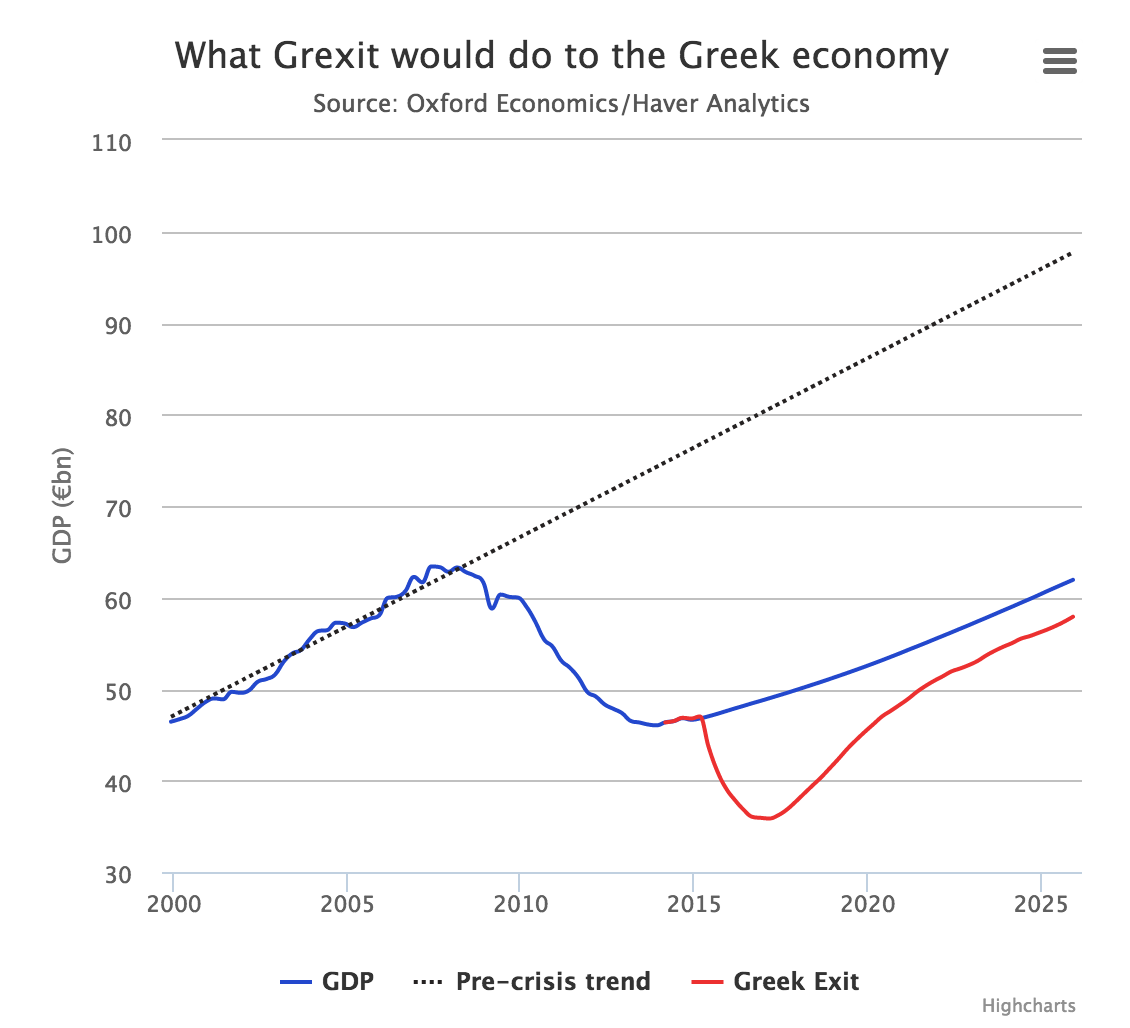

Greece has pleaded for forbearance from its creditors. The parlous state of the government’s coffers has led to fears it could run out of cash to make wage and pensions bill in the coming weeks. After a brief reprieve, deposit flight has resumed apace. A primary budget surplus registered over the same period last year, has disappeared. Ratings agency Fitch slashed the country’s sovereign bonds citing the “tight liquidity conditions” that have put “extreme pressure on Greek government funding”. The spectre of an “accidental” Greek exit – or “Grexident” – now looms over the eurozone. “Grexit will not happen” assured Greece’s central bank governor Yannis Stournaras to an audience at the London School of Economics last week. “The eurozone has all the tools to ensure a Grexident cannot occur.”

But of the all the institutions that has pushed his country to the brink, it is the European Central Bank’s role in the saga that has come under the fiercest criticism from Athens. The ECB has long disbanded providing its ordinary loans to Greece’s banks, who have been reliant on emergency funding to keep themselves alive. The limits on this lifeline have been repeatedly hit as deposits flee the country. ECB funding for Greek banks has now topped €100bn. “The ECB has always been the most powerful but least accountable player in bail-out talks” says Raoul Ruparel, head of economic research at Open Europe. “As in Cyprus, they have the power to squeeze liquidity, but it’s a power that has never been properly scrutinised. It’s a concern the eurozone is not paying attention to,” adds Mr Ruparel.

Moves to withdraw a collateral waiver on Greek bonds, and officially ban banks from increasing their holdings of treasury debt has led to accusations the central bank is acting “ultra vires”. When asked about the Bank’s position, the ECB’s chief economist Peter Praet chose to exercise “verbal constraint in a moment of crisis” – itself a tacit admission that the Greek saga still has a way to run before the ECB will alleviate the funding pressures on the nascent government. In a drama littered with soft deadlines, Greece has now promised to present a final list of fleshed out reforms to creditors on Monday. Yet the pattern of over-promising and under-delivering is one that may well repeat itself in April, says Mr Ruparel. “Negotiations have gone in such a way that Greece presents the reforms, and the list underwhelms. This could well happen again – the key is where the eurogroup now draws the line. Maybe the Greeks have convinced them the situation is now dire enough.”

Read more …

Well, what a surprise.

• Greek Bailout Proposals Lack Necessary Detail, Officials Say (WSJ)

Greek proposals for a revised bailout program don’t have enough detail to satisfy the government’s international creditors, eurozone officials said, making it more likely that Athens will need to go several more weeks without a new infusion of desperately-needed cash. Officials from Greece’s leftist government were in Brussels over the weekend to present the proposals to officials from the European Commission, the European Central Bank and the International Monetary Fund—the trio of institutions representing the government’s creditors. Getting their thumbs-ups is crucial for Athens to regain access to bailout funds and restore normal lending from the ECB. The Greek government is facing a dire shortage of cash: It must pay salaries and pensions at the end of the month and repay debts to the IMF on April 9.

While talks over the weekend were friendly, officials said, mistrust at a political level continues to stew between the outspoken government in Athens and the rest of the eurozone. Following a meeting last week between Greek Prime Minister Alexis Tsipras and German Chancellor Angela Merkel, Greece said it would submit a list of bailout proposals to its creditors on Monday. Officials hoped that discussions over the weekend would ensure the list is roughly in line with the creditors’ demands. But officials say crucial details were again missing from the Greek proposals after talks that started Friday night, lasted all day Saturday and continued on Sunday. “The proposals were piecemeal, vague and the Greek colleagues could not explain technically what some of them actually implied,” a eurozone official said. “So, let’s hope that they present something more competent next week.”

Read more …

Sure, real scary.

• Investors Fear Greece Will Impose Capital Controls (AFR)

Will Athens be able to avoid imposing capital controls? That’s the question anxious investors are asking as they wait to see whether the long-awaited reform package proposed by the radical leftist government of Alexis Tsipras does the trick in terms of unlocking billions of euros in badly needed cash. Representatives of Greece’s Troika lenders spent the weekend debating the draft list of economic reforms sent through by Athens on Friday. The approval of the “Brussels Group” (formerly known as the “troika”), followed by the blessing of eurozone finance ministers, will be needed for Athens to be able to tap the frozen aid money and stave off bankruptcy.

The list of reforms include 18 measures aimed at boosting state revenues by €3 billion in 2015, and allowing the country to achieve a primary budget surplus (which excludes debt servicing costs) of 1.5% of GDP. The Greek government is counting on economic growth of 1.4% this year. The main thrust of the reforms is aimed at combating tax evasion and increasing the amount of tax paid by the wealthy. The government’s coffers will also be boosted by measures such as raising the sales tax on certain luxury products, and forcing Greek television chains to pay licence fees. Although Athens has previously ruled out lifting the retirement age or cutting pension payments, the reform package also includes some restrictions on the payment of early pensions,

In addition, the Tsipras government has agreed to proceed with planned privatisations, even though it wants to retain some management control of the businesses after selling off stakes. Investors are hoping that intensive negotiations between Athens and Brussels over the next few days result in a compromise package that goes far enough to persuade the European Union and the IMF to unfreeze at least some of the €7.2 billion that remains from Greece’s last international bailout, allowing the country to stave off bankruptcy. Cash-strapped Greece is hoping that eurozone finance ministers will meet and approve its reform program this week. The head of the group of eurozone finance ministers, Jeroen Dijsselbloem, has previously signalled that €1 to €2 billion Greece’s remaining aid money could be released quickly if Athens is able to reach agreement with its lenders.

But Brussels is in less of a hurry. EU officials are refusing to call a new meeting of the region’s finance ministers unless Athens is prepared to agree to “significant” reforms. As a result, the crucial meeting of euro zone finance meetings may not take place until after Easter. The Europeans are confident that the immediate risk of a Greek default has receded because the Tsipras government has forced state-controlled corporations and social security funds to transfer their cash reserves to the central bank. As a result, the country now has enough money to pay the €1.7 billion bill for pensions and public-sector wages at the end of March.

Read more …

“The only feasible solution in the absolute extreme would be to turn all the official debt into a perpetual bond so it never gets repaid.”

• Greek Markets Show All at Risk Should Mistake Trigger a Default (Bloomberg)

In Athens, the unspeakable is at risk of becoming the inevitable. Market metrics show Greece is in danger of sinking under the burden of its debt, putting repayments of about €500 billion owed to European taxpayers, rescue funds, banks and bondholders in jeopardy. PM Alexis Tsipras is locked in talks with creditors over measures attached to Greece’s bailout loans and a government official said on Friday the country won’t service its debt if creditors don’t release the funds. The government has also floated a restructuring that would link some future payments to economic growth, reduce interest rates and allow more time for repayments. While their intention is to exclude private bondholders, the danger is that talks collapse and Greece leaves the euro, leaving all parties facing losses.

“The biggest fear now is that Greece exits by mistake,” said Padhraic Garvey at ING in London. “The only feasible solution in the absolute extreme would be to turn all the official debt into a perpetual bond so it never gets repaid.” With the country running out of cash, credit-default swaps indicate a 72% chance of Greece reneging on its debt within five years compared with 67% at the start of the month, according to CMA. Three-year note yields are almost 10 %age points higher than 10-year rates. Typically investors get more to lend for a longer period to compensate for inflation. With Greece, the immediate worry is whether they get their cash back. The price of five-year securities has tumbled to 68% of face value, from almost 100% after they were sold a year ago.

Greece sold the current three-year notes in July 2014, its second tap of capital markets within three months, after a five-year debt offering in April that year had been hailed by German Chancellor Angela Merkel as a step toward normalcy. Sales of those securities, which totaled about €6 billion, increased the amount of Greek bonds outstanding to €67.5 billion, of which the ECB and national central banks own about 40%, according to data compiled by Bloomberg. The market was reduced when Greece enacted the biggest-ever debt restructuring in 2012, which saw private bondholders write off about €100 billion. The 10-year yield went as high as 44.21% in March 2012 as the country moved to restructure its debt.

Read more …

Infighting!

• ECB Nerves Fray on Greece as Supervisors Rile Central Bankers (Bloomberg)

Inside the five-month-old union between monetary policy and financial oversight at the ECB, nerves are beginning to fray. As officials seek to replace deposits fleeing Greek banks without blatantly financing the state, the efforts of the institution’s new Single Supervisory Mechanism to do its part are irking the old guard. Central bankers under ECB President Mario Draghi worry that overly-strict orders to lenders could worsen the Greek turmoil. After building an institutional pillar that has supervised the euro area’s largest banks since November, the ECB is now facing one of the worst flare-ups in six years of sovereign-debt crisis. Officials must work out how to align their two policy arms in a way that can find a path through the Greek turmoil and set a template for handling banking turbulence to come.

“Clearly there is tension, and it was obvious from the beginning that there would be,” said Nicolas Veron, a fellow at the Brussels-based Bruegel research group. “But there’s a productive kind of tension, like there was between Treasury Secretary Tim Geithner and Federal Deposit Insurance Corporation Chair Sheila Bair in 2008. It could end up creating the right mix of policy.” Just as those U.S. policy makers in the 2008 financial crisis had to choose between the moral hazard of bailing out banks and the economic chaos of watching them fail, European officials are trapped between giving in to Greek cash demands and the political debacle of letting the country leave the euro.

That stress is bubbling up inside the ECB, affecting the interaction between central bankers in their new premises in Frankfurt’s east end, and bank supervisors installed in a temporary home two kilometers away. SSM Chair Daniele Nouy may give clues on the relationship with the Governing Council when she testifies to the European Parliament on Tuesday. Her officials sought this month to prevent Greek banks from increasing holdings of short-term government debt, hours before critical meetings including Prime Minister Alexis Tsipras and Draghi. The move, which makes it harder for the state to fund itself, initially floundered as the ECB’s Governing Council balked at its severity and the monetary-policy goals that it referred to.

From the supervisory point of view, the proposal reflected the ECB’s restrictions on Emergency Liquidity Assistance for the Greek banking system. Since last month, the Governing Council has approved only small weekly increases in central- bank cash to its lenders, on concern funds might be used directly to buy illiquid government debt, violating European Union law. For some central bankers, the SSM proposal was a clumsy intervention in crisis policy that threatened to upset the Governing Council’s measured strategy of addressing the Greek turmoil, according to officials familiar with the discussions.

Read more …

Angry Bruno!

• Globalist Financiers Fleece Greece (StealthFlation)

Greece was brought to her knees at the hands of its corrupt political class elites with the full support of an avaricious international banking cabal. Please don’t put the blame on the little old lady pushing her Gyro cart up the steep streets of Kolonaki. She was perfectly within her rights to assume that the leadership of her country knew what the hell they were doing whilst managing her distinguished nation’s finances. Yet today, she has taken the full brunt of the fiscal pain, while those most responsible for this massive over leveraged abomination, namely the Greek political family dynasties and their complicit int’l banksters, continue to bask in the sun off of Mykonos on their luxury yachts. Along with the privilege of leadership comes responsibility, it’s way too easy to simply blame the little people. According to Atlantic Media today:

The Greek government might run out of money in two weeks. Or perhaps four. Capital controls are either imminent or a month away. Whatever the case, depositors are draining Greek banks dry, which could hasten a state default and, potentially, ejection from the euro zone altogether. The four-month bailout extension that Greece got in February now seems a distant memory, with €7.2 billion in much-needed funds still contingent on Greece drawing up a detailed list of reforms, which creditors are vetting this weekend. If they don’t like what they see, it might mark the beginning of the end for Greece’s membership in the euro.

The first mandate SYRIZA obtained from a sovereign electorate, who rightly rejected the corrupt old-guard Greek political establishment, was to offer to negotiate a more rational, realistic and productive debt repayment schedule/structure with the TROIKA. That is what Alexis Tsipras & Yanis Varoufakis have tried diligently to accomplish thus far, if they fail because Brussels insists on sucking blood from a rock, then the next momentous mandate will be to leave the Eurozone altogether, and for that they will require a national referendum from the Greek people themselves. Tsipras is much smarter than many give him credit for, he knows that he must be perceived to progress cautiously and as constructively as possible, in order not to be pigeonholed as an extreme radical, which the EU establishment is so desperately trying to paint him as.

Make no mistake, the international banking cartel of our times our are on a mission to dismantle the sovereignty of all people. Greece is the first nation to fully recognize and realize this craven conniving cataclysm, as pain often gives people proper perspective. This Multilateral Central Banking Cabal and its high finance agents are planning to transition to a new international monetary order by devaluing the USD, as they fold it into the SDR world reserve currency, backed by a basket of the existing currencies of the major trading block nations. This will serve to both ease the burden of the most indebted nation in history, the U.S., by permitting its outstanding debt denominated USDs to be debased, as well as appease the creditor nations, who will agree to have their US dollar denominated debt holdings devalued, because they now require a true stake in the globe’s future monetary system moving forward. The only question remaining is will the global economy disintegrate before we get there……..

Read more …

There’s already no interest left on deposits, and now the government wants to take more? Judging from prices on just about everything, but especially alcohol and tobacco, people here may have not much left anyway at the end of the day.

• Australia To Introduce Tax On Bank Deposits (ABC)

The Federal Government looks set to introduce a tax on bank deposits in the May budget. The idea of a bank deposit tax was raised by Labor in 2013 and was criticised by Tony Abbott at the time. Assistant Treasurer Josh Frydenberg has indicated an announcement on the new tax could be made before the budget. The Government is heading for a fight with the banking industry, which has warned it will have to pass the cost back onto customers. Mr Frydenberg is a member of the Government’s Expenditure Review Committee but has refused to provide any details. “Any announcements or decisions around this proposed policy which we discussed at the last election will be made in the lead up or on budget night,” he said. Speaking at the Victorian Liberal State Council meeting Mr Abbott has repeated his budget message, focusing on families and small businesses.

“There will be tough decisions in this year’s budget as there must be, but there will also be good news.” The banking industry has raised concerns about a deposit tax, saying it will have to pass the cost back onto customers. Steven Munchenberg from the Australian Bankers’ Association said it would be a damaging move for the Government. “It’s going to make it harder for banks to raise deposits which are an important way of funding banks. And therefore for us to fund the economy,” he said. “And we also oppose it because particularly at this point in time with low interest rates a lot of people who are relying on their savings for their incomes are already seeing very low returns and this will actually mean they get even less money.”

Read more …

The new off-shore?

• Swiss Banking Model Is ‘Dead’, Says Abu Dhabi Finance Centre Chief (FT)

Abu Dhabi intends to set itself up as a new hub for wealth management, with the head of its nascent international financial centre declaring Switzerland’s old model of private bank secrecy to be “dead”. Abu Dhabi Global Markets is an expression of world ambition, intended to elevate the oil-and-gas-rich emirate to the tables of the most influential global institutions, such as the Basel Committee on Banking Supervision and the Group of 20 Nations, using Singapore rather than Switzerland as its model, its chairman told the Financial Times. “Innovation is coming from this new, emerging market.

This is why Asian financial centres are sitting on Basel committees and legislating for the west, because they didn’t make one mistake in 15 years,” Ahmed Ali al-Sayegh said in London as he set out ADGM’s stall to banks. “We have a similar ambition.” His comments come as the centre of gravity of such institutions has shifted palpably from west to east, and as Asia is developing its own bodies to rival those in the west, such as the China-led Asian Infrastructure Investment Bank. ADGM, which will have its own regulator and courts based on English common law, is an attempt to diversify the UAE capital’s economy. Its heavy-hitting sovereign wealth funds, the Abu Dhabi Investment Authority and Mubadala, will both be based in the free zone, built on al-Marya island in the capital.

That has worried some in neighbouring Dubai, whose own International Financial Centre opened a decade ago, attracting the world’s biggest banks and law firms. Mr Sayegh and his team, which includes Sir Hector Sants, the former head of the UK’s financial watchdog, are adamant that there is room for two financial centres within two hours’ drive of each other, stressing that not only will Abu Dhabi focus specific areas such as wealth management but also that nearby centres can complement each other.

Read more …

Still a crazy story.

• Kim Dotcom Loses $67 Million Of Assets To US Government (RT)

Megaupload streaming service mogul Kim Dotcom has just been slapped with a civil penalty from the US government. The lawsuit will cost him $67 million worth of assets, including cars, property and luxury goods. The victory by the US court comes as he lost the right to contest the seizure of the assets. Dotcom, who is wanted in the United States for copyright infringement through the former file-sharing website, told the Herald on Sunday that this is indicative of the “sad state” of the US justice system. “By labeling me a fugitive, the US court has allowed the US government to legally steal all of my assets without any trial, without any due process, without any test of the merits,” he said, vowing to appeal the decision, which his legal team says would likely not hold up in New Zealand or Hong Kong courts.

“The asset forfeiture was a default judgment. I was disentitled to defend myself,” the internet guru went on. “First the US judge ruled that I can’t mount any defense in the asset forfeiture case because according to him I’m a ‘fugitive’… Think about that for a moment. I have always said that I’m innocent. There was no conspiracy. I have done nothing wrong.” He also claims the US government had to act in this way to spare the New Zealand authorities from having to return all of his assets in mid-April, when he claims he will have gone to the Appeals Court and won them back. “They would have had to return everything. Imagine all of the New Zealand media at the mansion when the police has to return everything, all my cars, my TVs, my servers and me directing them where to put my stuff.”

Read more …

Complicated.

• Who’s Fighting For Whom In Yemen’s Proxy War? (Reuters)

An aerial campaign on Yemen’s capital, launched by a Saudi-led pan-Arab force, has escalated what had in many ways been a proxy war between Iran and Saudi Arabia. While the worsening war in Yemen shares similarities with other conflicts in the Arab world, it is the role of foreign powers in Yemen’s descent into leaderless chaos that is particularly striking. Because Yemen is viewed as the Arab world’s poor brother — inconsequential and with little influence over the region as a whole — it serves as an avenue for the Arab world to push back against Iran. There is little other incentive for Arab governments to become involved with Yemen’s internal quagmire, other than not having a hostile government in a nation bordering the Bab al-Mandeb strait, a highly trafficked shipping line leading to the Suez Canal.

Though Yemen’s domestic power struggle since the end of President Ali Abdullah Saleh’s reign three years ago was based largely on local grievances, these two historical foes, Shi’ite Iran and Sunni Saudi Arabia, worked to use who they could in Yemen for political advantage. The Saudi kingdom long was Yemen’s largest benefactor and held sway over powerful Yemeni tribal leaders. Yet following Saleh’s resignation in November 2011, Iran swiftly worked to increase its influence in Yemen by creating ties with whomever shared a common disdain for Saudi Arabia, including liberal anti-Saleh activists. The Houthi rebels, an oft-ignored militia from Yemen’s far north, were an obvious ally for Iran. Houthi fighters, who follow a sect of Shi’ite Islam known as Zaydism, consolidated power in the wake of the 2011 government collapse.

They are staunchly anti-Saudi. They believe that the Kingdom was involved in the systematic corruption of their distinct Zaydi culture via the promotion of Wahhabism (a strict interpretation of Sunni Islam that began in Saudi Arabia) in the Houthis’ traditional homeland in the north. Then last September, Houthi militia swept into Yemen’s capital, Sanaa, taking over government institutions and effectively forcing the resignation of President Abd- Rabbu Mansour Hadi — a man whose power stemmed from Western governments and the United Nations, which crafted and promulgated the transition agreement that made him president. There was no real attempt at a democratic transition in Yemen. Hadi was propped up by the West despite his lack of leadership experience, local support and political savvy.

Read more …

Only one gets full US support, though.

• Ukraine’s Oligarchs Turn on Each Other (Robert Parry)

In the never-never land of how the mainstream U.S. press covers the Ukraine crisis, the appointment last year of thuggish oligarch Igor Kolomoisky to govern one of the country’s eastern provinces was pitched as a democratic “reform” because he was supposedly too rich to bribe, without noting that his wealth had come from plundering the country’s economy. In other words, the new U.S.-backed “democratic” regime, after overthrowing democratically elected President Viktor Yanukovych because he was “corrupt,” was rewarding one of Ukraine’s top thieves by letting him lord over his own province, Dnipropetrovsk Oblast, with the help of his personal army. Ukrainian oligarch Igor Kolomoisky confronting journalists after he led an armed team in a raid at the government-owned energy company on March 19, 2015. (Screen shot from YouTube)

Last year, Kolomoisky’s brutal militias, which include neo-Nazi brigades, were praised for their fierce fighting against ethnic Russians from the east who were resisting the removal of their president. But now Kolomoisky, whose financial empire is crumbling as Ukraine’s economy founders, has turned his hired guns against the Ukrainian government led by another oligarch, President Petro Poroshenko. Last Thursday night, Kolomoisky and his armed men went to Kiev after the government tried to wrest control of the state-owned energy company UkrTransNafta from one of his associates. Kolomoisky and his men raided the company offices to seize and apparently destroy records. As he left the building, he cursed out journalists who had arrived to ask what was going on. He ranted about “Russian saboteurs.”

It was a revealing display of how the corrupt Ukrainian political-economic system works and the nature of the “reformers” whom the U.S. State Department has pushed into positions of power. According to BusinessInsider, the Kiev government tried to smooth Kolomoisky’s ruffled feathers by announcing “that the new company chairman [at UkrTransNafta] would not be carrying out any investigations of its finances.” Yet, it remained unclear whether Kolomoisky would be satisfied with what amounts to an offer to let any past thievery go unpunished. But if this promised amnesty wasn’t enough, Kolomoisky appeared ready to use his private army to discourage any accountability.

On Monday, Valentyn Nalyvaychenko, chief of the State Security Service, accused Dnipropetrovsk officials of financing armed gangs and threatening investigators, Bloomberg News reported, while noting that Ukraine has sunk to 142nd place out of 175 countries in Transparency International’s Corruptions Perception Index, the worst in Europe. The see-no-evil approach to how the current Ukrainian authorities do business relates as well to Ukraine’s new Finance Minister Natalie Jaresko, who appears to have enriched herself at the expense of a $150 million U.S.-taxpayer-financed investment fund for Ukraine. Jaresko, a former U.S. diplomat who received overnight Ukrainian citizenship in December to become Finance Minister, had been in charge of the Western NIS Enterprise Fund (WNISEF), which became the center of insider-dealing and conflicts of interest, although the U.S. Agency for International Development showed little desire to examine the ethical problems – even after Jaresko’s ex-husband tried to blow the whistle.

Read more …

Not so smart.

• Risks Involved In UK Smart Meter Scheme Are ‘Staggering’ (BBC)

The government’s smart meter scheme could be an “IT disaster”, the Institute of Directors (IoD) has said. The risks involved with “the largest UK government-run IT project in history” were “staggering”, a report said. It recommended that the government drastically scale back the programme or abandon it altogether. Smart Energy GB, the independent body set up to publicise smart meters, said the IoD wanted to take the UK “back to an analogue dark age”. Energy-saving digital smart meters, designed to replace existing analogue gas and electricity meters, should help householders to monitor their energy-use far more accurately, and energy companies to do away with estimated bills. By some estimates, the new meters could save us £17bn on our energy bills.

But the IoD believes the government’s plan to roll out smart meters to all 30 million UK households by 2020 is far too ambitious. “The pace of technological innovation may well leave the current generation of meters behind and leave consumers in a cycle of installation, de-installation and re-installation,” it said. Under the scheme, energy companies must begin offering free smart meters to their customers from the autumn. Despite the £11bn estimated cost to the industry, it will not be compulsory to have one. Responding to the IoD report, Sacha Deshmukh, chief executive of Smart Energy GB, said: “The IoD does not understand what’s needed to secure Britain’s energy infrastructure for the future. “The smart meter rollout must be for everybody. It will only deliver the national transformation Britain needs if every home is part of this national upgrade.” Nearly 1.4 million households have already had a smart meter installed, he added.

Read more …

And you’re sitting on your asses watching it happen. What are you thinking, someone else is going to solve it for you?

• Antarctica Recorded Its Hottest Temperature Ever This Week (CP)

The coldest place on Earth just got warmer than has ever been recorded. According to the weather blog Weather Underground, on Tuesday, March 24, the temperature in Antarctica rose to 63.5°F (17.5C) – a record for the polar continent. Part of a longer heat wave, the record high came just a day after the previous record was set at 63.3°F. Tuesday’s temperature was taken at the Argentina’s Esperanza Base, located near the northern tip of the Antarctic Peninsula. The Monday record was from Marambio Base, about 60 miles southeast of Esperanza. Both are records for the locations, however the World Meteorological Organization is yet to certify that the temperatures are all-time weather records for Antarctica.

Before these two chart-toppers, the highest recorded temperature from these outposts was 62.8°F in 1961. Setting a new all-time temperature record for an entire continent is rare and requires the synthesizing of a lot of data. As Weather Underground’s weather historian, Christopher C. Burt, explains, there is debate over what exactly is included in the continent Antarctica, and by the narrowest interpretation, which would include only sites south of the Antarctic Circle, Esperanza would not be part of the continent. According to the WMO, the official keeper of global temperature records, the all-time high temperature for Antarctica was 59°F in 1974. As Mashable reports, the verification process for these new records could take months as the readings must be checked for accuracy.

Even in their unofficial capacity, the readings are stunning. As Burt reports, these temperature records occurred nearly three months past the warmest time of year in the Antarctic Peninsula, December, when the average high is 37.8°F. The average high for March is 31.3°F, making this week’s records more than 30°F above average. Burt also points out that temperature records for Esperanza have previously occurred in October and April, so these spikes are not unheard of. They should also not be unexpected: the poles are warming faster than any part of the planet and rapid ice melt is being observed at increased rates in Antarctica. According to a new study, ice shelves in West Antarctica have lost as much as 18% of their volume over the last two decades, with rapid acceleration occurring over the last decade. The study found that from 1994 to 2003, the overall loss of ice shelf volume across the continent was negligible, but over the last decade West Antarctic losses increased by 70%.

Read more …