Rembrandt van RIjn A Woman Standing with a Candle c.1631

To be honest, I didn’t think it would ever happen, even though it’s been so obvious for so long. But all of a sudden, the conservative voices questioning the Russia collusion narrative and all the investigations that followed from it, are finally figuring out that those behind that narrative and all that resulted from it, are the same people who have been chasing down Julian Assange for many years.

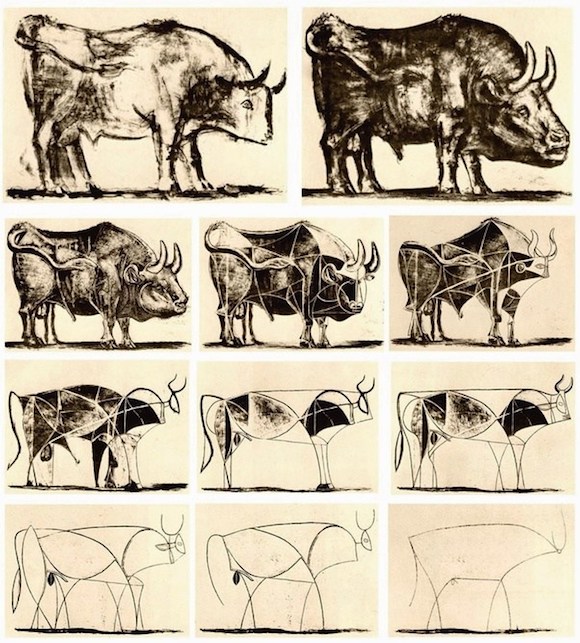

And that to get to the bottom of the hunt for Trump by the DNC, Clinton campaign, US intelligence and last but not least the media in their pockets, the NYT, WaPo, MSNBC, CNN et al, they will have to take a much closer look at what happened to Assange. If they don’t they will never understand. How do we know it’s starting to dawn on them? Look at this illustration at the Last Refuge site yesterday. More on them later.

Note: the mostly left wing Assange supporters would do good to consider the same thing: they in turn must look into the RussiaRussia Trump collusion stories, much as they may not like the president. Because those stories are why Assange has been chased down like so much roadkill. And because the right win of America is their best chance at getting him pardoned/released. The enemy of my enemy is my friend, to put it bluntly. Sometimes you need blunt.

As I’ve pointed out countless times, the Mueller investigation of the Trump campaign -and presidency- may have come up glaringly empty, but the report they issued maintained that “13 Russians” and Julian Assange were responsible for hacking DNC emails. There is no proof of this, but since none of the “accused” can speak out, the report make the claim, and did.

Actually, a source connected to the “13 Russians” that was also named, the firm Concord Management, linked to Internet Research Agency, both owned by “Putin’s cook” Yevgeniy Prigozhin, one of the 13 Russians, did speak out and hired lawyers in the US. The case was quietly dropped when it became clear Mueller had nothing on them. The rest didn’t speak, and hired no defense, so that part of the report, nonsense as it may be, still stands.

Mueller et al could simply have met with Assange, he wasn’t going anywhere as they knew, but they didn’t, because A) the last thing they wanted was confirmation that “the Russians” did not provide any information to WikiLeaks, since that was what little was left of what the entire report was based on, and B) they wanted to make Assange look like an enemy of the US. Meeting with him would have blown both A) and B) out of the water, and he wouldn’t have been any use to them, or the DNC, or the FBI/CIA/DOJ. Assange was useful to them exactly because he could *not* speak.

The wake up call for the right must have been Tucker Carlson’s interview with Glenn Greenwald about Assange this week. Of which I said: “Bless Tucker Carlson for providing the platform. Bless Glenn Greenwald for his eloquent statement. Don’t miss this.” But still, as I also said: “Wonder why it took the right wing so long to wake up to how Julian Assange is linked to the whole machine. Did they really need Tucker Carlson for that?”

Greenwald said Trump could pardon Assange, and Snowden too, and there’s “widespread support across the political spectrum for doing both” (something I never heard anyone confirm, btw), and “the only people who would be angry would be Susan Rice, John Brennan, Jim Comey and James Clapper, because they’re the ones who both of them exposed”. Well, there’s your people. Those are the people who’ve been after both Trump and Assange since at least 2015.

Do both sides realize what they have in common now?

I don’t want to make this too long, and there’s more ground to cover. First, take a look at what Paul Craig Roberts had to say recently. He knows the territory. He worked extensively both as a journalist before that became a tainted term, and served under Ronald Reagan as an Assistant Secretary of the Treasury. Like his views on economics or not, he knows a thing or two about DC. Here’s what he had to say 3 days ago, which ties right into the Assange/RussiaRussia/Mueller/CIA tall tale :

The United States & Its Constitution Have Two Months Left

To stop Kennedy they assassinated him. To stop Trump they concocted Russiagate, Impeachgate, and a variety of wild and unsubstantiated accusations. The presstitutes repeat the various accusations as if they are absolute proven truth. The presstitutes never investigated a single one of the false accusations. These efforts to remove Trump did not succeed. Having pulled off numerous color revolutions in which the US has overthrown foreign governments, the tactics are now being employed against Trump. The November presidential election will not be an election. It will be a color revolution.

[..] the CIA has controlled the prestige American media since 1950. The American media does not provide news. It provides the Deep State’s explanations of events. This ensures that real news does not interfere with the agenda. The German journalst, Udo Ulfkotte, wrote a book, Bought Journalism, in which he showed that the CIA also controls the European press. To be clear, there are two CIA organizations. One is an agency that monitors world events and endeavors to provide more or less accurate information to policymakers.

The other is a covert operations agency. This agency assassinates people, including an American president, and overthrows uncooperative governments. President Truman publicly stated after he was out of office that he made a serious mistake in permitting the covert operations branch of the CIA. He said that it was an unaccountable government in itself. President Eisenhower agreed and in his last address to the American people warned of the growing unaccountable power of the military/security complex. President Kennedy realized the threat and said he was going “to break the CIA into a thousand pieces,” but they killed him first.

It would be easy for the CIA to kill Trump, but the “lone assassin” has been used too many times to be believable. It is easier to overthrow Trump’s reelection with false accusations as the CIA controls the American and European media and has many Internet sites pretending to be dissident, a claim that fools insouciant Americans.

Indeed, it is the leftwing that the CIA owns. The rightwing goes along because they think it is patriotic to support the military/security complex. After the CIA overthrows Trump, they will use Antifa, Black Lives Matter, and their presstitutes to foment race war. Then the CIA will ride in on the Pale Horse, and the population will submit.

And yes, you are right, Julian Assange got in the way of that. Not because he hated Hillary Clinton, though he detested what she and Obama did to Libya, but because Edward Snowden and Chelsea Manning provided him with material that bore witness to the crimes committed by the US intelligence “cabal”. In Snowden’s case, it was the NSA spying on -the- American people, in Manning’s it was war crimes executed overseas.

The way the “cabal” reacted to all that material -there was/is a lot- was to link Assange to a fictitious story about Russia meddling in US elections, a very convenient link because it tied into what they were already constructing to get rid of Trump.

Here is lawyer “sundance” at the Conservative Treehouse (aka The Last Refuge). The -recommended- article has a lot more info, not just on Assange, but also on the set-up of the “cabal”; he’s been digging for a long time. I know, it’s right wing media. But nobody else will cover this. And we want to get Assange released, don’t we?! So take a listen to how similar this is, written yesterday, to what I, and others, have been saying about the case for a long time.

Again, I have no idea why it took so long for people like “sundance” to catch up, but it’s people like him who may well be our best shot at keeping Assange alive. And people like Tucker, of course; you can bet Trump is watching him, and has seen the Greenwald interview by now.

What’s Behind The DOJ Aggression Toward Julian Assange

Nancy Pelosi previously labeled all Trump supporters as “enemies of the state.” Similarly we note the apparatus of the administrative state labels Julian Assange the same. There’s a good argument that the reason why Assange is considered such a threat to the U.S. is specifically because he could expose the lies of the administrative state.

As a consequence the U.S. intelligence apparatus has targeted the WikiLeaks founder and the Bill Barr DOJ is being extremely aggressive in their effort to get control of him. Tucker Carlson discussed this dynamic last night; albeit stopping short of the brutally honest part. To understand the risk Julian Assange represents to the administrative state, it is important to understand the extent of CIA, FBI and DOJ operations in 2016.

[..] On April 11th, 2019, the Julian Assange indictment was unsealed in the EDVA. From the indictment we discover it was under seal since March 6th, 2018. On Tuesday April 15th more investigative material was released. Again, note the dates: Grand Jury, *December of 2017* This means FBI investigation prior to…. The FBI investigation took place prior to December 2017, it was coordinated through the Eastern District of Virginia (EDVA) where Dana Boente was U.S. Attorney at the time.

The grand jury indictment was sealed from March of 2018 until after Mueller completed his investigation, April 2019. Why the delay? What was the DOJ waiting for? Here’s where it gets interesting…. The FBI submission to the Grand Jury in December of 2017 was four months after congressman Dana Rohrabacher talked to Julian Assange in August of 2017: “Assange told a U.S. congressman … he can prove the leaked Democratic Party documents … did not come from Russia.” [..]

Knowing how much effort the CIA and FBI put into the Russia collusion-conspiracy narrative, it would make sense for the FBI to take keen interest after this August 2017 meeting between Rohrabacher and Assange; and why the FBI would quickly gather specific evidence (related to Wikileaks and Bradley Manning) for a grand jury by December 2017. Within three months of the grand jury the DOJ generated an indictment and sealed it in March 2018.

The EDVA sat on the indictment while the Mueller probe was ongoing. As soon as the Mueller probe ended, on April 11th, 2019, a planned and coordinated effort between the U.K. and U.S. was executed; Julian Assange was forcibly arrested and removed from the Ecuadorian embassy in London<, and the EDVA indictment was unsealed.

As a person who has researched this three year fiasco; including the ridiculously false 2016 Russian hacking/interference narrative: “17 intelligence agencies”, Joint Analysis Report (JAR) needed for Obama’s anti-Russia narrative in December ’16; and then a month later the ridiculously political Intelligence Community Assessment (ICA) in January ’17; this timing against Assange is just too coincidental. It doesn’t take a deep researcher to see the aligned Deep State motive to control Julian Assange because the Mueller report was dependent on Russia cybercrimes, and that narrative is contingent on the Russia DNC hack story which Julian Assange disputes.

This is critical. The Weissmann/Mueller report contains claims that Russia hacked the DNC servers as the central element to the Russia interference narrative in the U.S. election. This claim is directly disputed by WikiLeaks and Julian Assange, as outlined during the Dana Rohrabacher interview, and by Julian Assange on-the-record statements.

The predicate for Robert Mueller’s investigation was specifically due to Russian interference in the 2016 election. The fulcrum for this Russia interference claim is the intelligence community assessment; and the only factual evidence claimed within the ICA is that Russia hacked the DNC servers; a claim only made possible by relying on forensic computer analysis from Crowdstrike, a DNC contractor.

The CIA holds a massive conflict of self-interest in upholding the Russian hacking claim. The FBI holds a massive interest in maintaining that claim. All of those foreign countries whose intelligence apparatus participated with Brennan and Strzok also have a vested self-interest in maintaining that Russia hacking and interference narrative. Julian Assange is the only person with direct knowledge of how Wikileaks gained custody of the DNC emails; and Assange has claimed he has evidence it was not from a hack.

This Russian “hacking” claim is ultimately so important to the CIA, FBI, DOJ, ODNI and U.K intelligence apparatus…. Well, right there is the obvious motive to shut Assange down as soon intelligence officials knew the Mueller report was going to be public. Now, if we know this, and you know this; and everything is cited and factual… well, then certainly AG Bill Barr knows this.

That is a lot of information in one go, and not much of it is new, at least to me or to regular readers of the Automatic Earth. What is new is that the Conservative press are figuring out that if they want to defend Trump against the “cabal”, they need to look much more deeply into the role Julian Assange has played in the whole story, especially over the past few years.

And as I said above, it would be good if the “Free Assange” side would so something similar, reach out, because the Conservative press may well be the best ally there is for their cause. It’s not about how you feel about Trump, it’s about the “cabal” targeting Trump through Assange, and the other way around.

And in the end it’s real simple: Trump has the power to pardon Assange and set him free, him and Snowden. Would you rather *not* appeal to that power, and leave Julian to rot in Belmarsh and g-d knows where next, or do you think you now understand how the game has been played, and will be going forward? Your pick. But remember: it will take Trump overruling Bill Barr and the DOJ, and the right wing can’t do that alone.

One last thing, something I’ve also tried to explain umpteen times: Whenever you see someone claim that Assange plays to his personal political choices, or that he has something anything to do with the Kremlin, or that he lies about anything at all, please remember this: Julian Assange has always been acutely aware of the one weakness of WikiLeaks which is simultaneously its main strength:

That is, he cannot lie, he cannot align with a political side, he cannot align with any one country or ideology (I would almost write: ”he could not” instead of he cannot, but thank God Julian is alive, so I will not).

The reason for this is that people like Snowden and Manning and many others, who are in possession of highly sensitive evidence of government or intelligence malfeasance, must be sure the material will not be used for -party- political purposes, or to make a country look good, and first and foremost that it is not distorted or lied about in any way, shape or form.

Because if Julian Assange would ever do any such thing, the bond of trust would be broken, for every single potential future source and/or whistleblower, and for all time. He would never be able to repair that. It would be the end of WikiLeaks, right there. Julian would never have allowed that to happen to his brainchild; he would die first. And they all know it, the entire “cabal”; that’s why you read in the press what you do, that’s why the smear campaigns are there. None of which are even remotely true.

A last last thing: Julian Assange is so skilled at the digital side of things that no secret service in the entire world, no matter how many people they put on it, has ever come close to hacking or breaking into WikiLeaks. That should make us all feel safer, and that is why there are all these attempts to make us feel the opposite.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now an integral part of the process.

Thank you for your support.

Support the Automatic Earth in virustime.