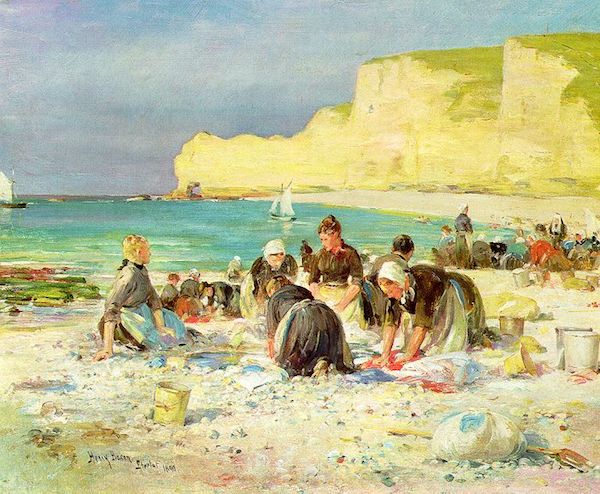

Henry Bacon� Étretat �1890

The only thing today that mentions Trump.

• The Dogs of Vengeance (Jim Kunstler)

History has a velocity of its own, and its implacable forces will drag the good, the bad, the clueless, the clever, the guilty, the innocent, the avid, and the unwilling to a certain fate. One can easily see a convergence of vectors shoving the nation toward political criticality this autumn. Mr. Trump is like some unfortunate dumb brute of the ancient Teutonic forests with a bulldog clamped to his nose, the rest of the pack close behind snapping at his hamstrings and soft, swaying underbelly. His desperate bellowing goes unanswered by the indifference of the trees in forest, the cold moon above, and all the other furnishings of his tragic reality.

As these things tend to happen, it looks like the exertions of Robert Mueller have turned from the alleged grave offenses of a foreign enemy to the sequela of consort with a floozie. Down goes Mr. Trump’s private attorney, Michael Cohen, in his personal swamp of incriminating files and audio recordings. Enter, stage left, one David Pecker, publisher of the venerable National Enquirer — the newspaper of wreckage — on his slime-trail of induced testimony. And there is your impeachable offense: an illegal campaign contribution. One way or another, as Blondie used to sing, I’m gonna getcha, getcha, getcha.

Some in this greatest of all possible republics may be asking themselves if this is quite fair play, given the hundreds of millions of dollars washed-and-rinsed through the laundromat known as the Clinton Foundation, and related suspicious doings in that camp of darkness. But remember, another president, Jimmy Carter, once declared to the shock of official Washington that “life is unfair.” What I wonder is what these dogs of vengeance reckon will happen when they achieve their goal of bringing down the bellowing bull and pulling his guts out. Perhaps a few moments of tribal satisfaction, one last war dance around the fire, and when the fire dies out, they will find themselves under the same cold indifferent moon with blood on their snouts and an ill wind blowing in the tree tops.

Why there’s still support for the White Helmets.

• Chemical Attack Being Staged To Frame Damascus – Russia MoD (RT)

The US and its allies are preparing new airstrikes on Syria, the Russian Defense Ministry said, adding that militants are poised to stage a chemical weapons attack in order to frame Damascus and provide a pretext for the strikes. The attack would be used as a pretext for US, UK and French airstrikes on Syrian targets, Russian Defense Ministry spokesman, Major General Igor Konashenkov said. USS ‘The Sullivans,’ an Arleigh Burke-class Aegis guided missile destroyer, was already deployed to the Persian Gulf a couple of days ago, he added. The destroyer has 56 cruise missiles on board, according to data from the Russian Defence Ministry.

A US Rockwell B-1 Lancer, a supersonic bomber equipped with 24 cruise missiles, has also been deployed at the Qatari Al Udeid Airbase. The provocations are being prepared by militants from Al-Nusra Front (now known as Tahrir al-Sham) in Idlib province, northwestern Syria, In order to stage the attack, some eight canisters of chlorine were delivered in to village near Jisr al-Shughur city for the terrorists’ use, he added. A separate group of militants, prepped by private British security company Olive, have also arrived in the area. The group will be disguised as volunteers from the White Helmets group and will simulate a rescue operation involving locals purportedly injured in the attack, according to the military official.

Instagram shapes the world.

• Half Of Millennials Take Out Car Finance To Match Social Media Dreams (Ind.)

Forget fashion, music or gadgets. The desire to live up to social media aspirations has pushed more than half of millennials to buy a car for its status value, new figures suggest, and almost 40 per cent said Instagram or Facebook played a part in deciding which motor they went for. With two thirds of younger drivers reliant on credit to fund the purchase – twice the number of 37- to 54-year-old generation Xers – research from Admiral has revealed the new, expensive face of social media influencing. Younger drivers were found to be more reliant on credit, with 64 per cent taking car finance to fund a purchase compared with 38 per cent of 37- to 54-year-olds.

The consequences have financial implications on younger generations too, as more than half of drivers aged 19 to 36 admit feeling pressure to buy a specific car for status or prestige. More than one in 10 millennials said famous faces played a part in their choice of car, compared with just 4 per cent of gen-X drivers. They may currently own a Ford Fiesta, Vauxhall Corsa, VW Golf or Polo, but millennials dream of BMW i8s, Audi R8s, Ford GTs and Aston Martin Vantages.

Car finance and food stamps?

• Majority Of Young Americans Live In A Household Receiving Welfare (ZH)

New analysis from CNS News finds that the majority of Americans under 18 live in households that take “means-tested assistance” from the US government. The study, based on the most recently available data from the Census Bureau, leads with the question: Will they be called The Welfare Generation? The data presented by CNS editor Terrence Jeffrey shockingly reveals that in 2016 “there were approximately 73,586,000 people under 18 in the United States, and 38,365,000 of them — or 52.1 percent — resided in households in which one or more persons received benefits from a means-tested government program.”

It’s a slim majority, but a majority which nonetheless presents an extremely worrisome trend regarding the number of young Americans and possibly young families who’ve experienced some level of government dependency. To put it in another, perhaps more alarming way, if you’re under 18 the data shows you are more likely that not to be living in a home that receives some form of taxpayer-financed largesse. In terms of the country’s total population of 319.9 million Americans, the data finds that 114.8 million, or about 36 percent, lived as part of a household in which someone collected welfare. Jeffrey continued, “When examined by age bracket persons under 18 were the most likely to live in a household receiving means-tested government assistance (52.1 percent), while those 75 and older were least likely (18.8 percent).”

You can’t have banning and shadowbanning on social media decided by opaque terms overseen by geeks. Just like you can’t ban people from having a phone, radio, TV just because you don’t like them.

• Twitter CEO Jack Dorsey To Testify On Conservative “Shadowbans” (ZH)

Twitter CEO Jack Dorsey is scheduled to appear before the House Energy & Commerce committee on September 5th, after several GOP lawmakers demanded action in response to reports of conservatives being “shadow banned” by the San Francisco-based social media giant. “Twitter is an incredibly powerful platform that can change the national conversation in the time it takes a tweet to go viral,” wrote committee Chair Greg Walden (R-OR) in a Friday statement. “When decisions about data and content are made using opaque processes, the American people are right to raise concerns. This committee intends to ask tough questions about how Twitter monitors and polices content, and we look forward to Mr. Dorsey being forthright and transparent regarding the complex processes behind the company’s algorithms and content judgement calls,” the statement continues.

Earlier this month, House Majority Leader Kevin McCarthy sent a letter to Walden, requesting that he be allowed to publicly grill Jack Dorsey over recent allegations that the platform limits the reach of some conservative accounts. “Any solution to this problem must start with accountability from companies like Twitter, whose platforms have enormous potential to impact the national conversation — and unfortunately, enormous potential for abuse,” McCarthy said in the letter to House Energy and Commerce Committee Chairman Greg Walden. “In particular, I would like to request a hearing with Twitter CEO Jack Dorsey so that the American people can learn more about the filtering and censorship practices on his platform.” -Kevin McCarthy

McCarthy, who has worked on tech issues for years, has been investigating reports of Silicon Valley tech giants injecting their admittedly liberal bias into the way they enforce speech on their platforms. McCarthy and other Republican leaders met with Facebook staffers in June over their concerns, and as recently as last month McCarthy was running ads on Facebook inviting supporters to join him “and President Trump in defending our conservative voice against social media censoring,” according to the platform’s public database of political ads. This action follows Rep. Matt Gaetz (R-FL) complaint filed with the Federal Election Commission (FEC) against Twitter after he discovered that his account was being ‘shadowbanned’ – the practice of excluding or reducing the visibility of one’s tweets from normal circulation on the platform.

Didn’t we already have this with Trump? This lady needs some educating.

• UK Immigration Minister Blocks Britons Who Sought Help On Twitter (G.)

The immigration minister blocked at least two British citizens on Twitter when they asked for her assistance after the Home Office failed to respond to their complaints or appeals from their MPs. Caroline Nokes’ action, which means the people concerned are unable to read her tweets or contact her, were described by a leading immigration lawyer as suggesting “complete indifference”. Stephen Buck was blocked from following Nokes or seeing her tweets on 11 August after he sent her three tweets in four months, asking for help to prevent his long-term partner, Rusty Goodall, from being deported to Australia. It took the Home Office 13 months to refuse Goodall’s application to extend his visa, during which time the couple received no update on his case.

“I was nothing but polite in my approaches, but having tried all other avenues available to us (ie contacting the Home Office directly, asking our MP for help) and still feeling as though we were in a position where nobody was doing anything and nobody cared about us, contacting Nokes on Twitter felt like the only option left to try and get somebody in power to listen,” Buck said. “The fact that the only response to these pleas to one of the few people who could make a difference in our case was to block me, was truly upsetting, frustrating and insulting.” John Holden, a British citizen who lives in the UK with his Filipino wife, son and three adopted children, was blocked by Nokes on the same day as Buck after also asking for help.

“The Home Office have refused to issue my British children with British passports: they say we need to change the children’s Philippine passports to their new adopted surnames first,” he said. “The problem is that the Philippine authorities won’t do that unless we take the children out of school and return to the Philippines for a process that could take up to 18 months, during which I would have to readopt children who are already mine and are already British.

Singer bankrupts countries.

• Paul Singer, Doomsday Investor (New Yorker)

In 1995, Singer started working with a trader named Jay Newman, who specialized in the government—or sovereign—debt of developing countries. The collaboration led to the legal battle that would publicly define Singer: his fourteen-year fight with the government of Argentina. Like Singer, Newman was a lawyer by training, and, also like Singer, he had no problem making money using methods that others might find distasteful. For many years, sovereign loans were treated by banks and other lenders much the way that subprime mortgages were prior to 2008—as highly desirable, relatively low-risk investments.

But many countries, particularly poorer ones with fragile economies or corrupt governments, borrowed far more than they could realistically repay, and, during the nineteen-eighties, approximately fifty countries defaulted or had to restructure their debt, including Mexico, most of Latin America, Poland, the Philippines, Vietnam, and South Africa. In most cases, the International Monetary Fund would come in, impose budget cuts and other austerity measures, and help the governments renegotiate what they owed. The countries’ debt holders generally traded their old bonds for new ones under reduced terms, which allowed the country to exit default.

Newman saw an opportunity in these financial crises: purchase the defaulted debt at a very low price and then try to negotiate for, or sue the country for, full repayment on the original terms. An investor who pursued this strategy came to be known as a “rogue creditor.” The tactic could prove extremely profitable—as long as you had the stomach for it. Newman said that he never sued a country that couldn’t afford to pay, but critics argue that rogue creditors interfere with a country’s ability to return to the financial markets, exacerbating the poverty and suffering of its citizens. Singer hired Newman, initially offering him thirty thousand dollars a month and 20% of the profits on investments he recommended.

The Republic of Peru had defaulted on its debt in 1984; in 1996, the government initiated a debt exchange, and more than ninety per cent of Peruvian debt holders traded in their old bonds for new ones, taking a fifty-per-cent discount on the original value. Singer purchased eleven million dollars of defaulted Peruvian bonds, and then began a protracted legal battle to force the government to pay back the full value. In 1998, after a trial, a federal court found Elliott to be in violation of the Dickensian-sounding Champerty laws, which prohibit buying debt with the sole purpose of bringing legal action. Elliott appealed the case and won. The company later engaged in an intense lobbying campaign to change the Champerty laws in New York State.

It also filed a lawsuit in Brussels, attempting to prevent Peru from paying interest on any of its new bonds until it had paid Elliott. Peru was left with an unpalatable choice: default, again, on its new bonds, or pay what it viewed as a ransom to a New York hedge fund.

What say ye, SEC?

• Tesla To Remain A Public Company, CEO Musk Says (AFP)

Tesla CEO Elon Musk said Friday that the company would continue to be publicly traded, weeks after suggesting that he would take the electric carmaker private. Musk met with Tesla’s board of directors on Thursday “and let them know that I believe the better path is for Tesla to remain public. The Board indicated that they agree,” he wrote on the company blog. Musk surprised markets on August 7 by announcing on Twitter he wanted to take Tesla private at $420 a share. But shares fell more than 20 percent since the announcement. After the announcement the controversial entrepreneur came under extensive scrutiny over his Twitter statements related to the proposal, especially a claim that Tesla had “secured” funding for the move.

However, Musk said Friday that based on talks with current shareholders, as well as an assessment by financial advisers Silver Lake, Goldman Sachs and Morgan Stanley, “it’s apparent that most of Tesla’s existing shareholders believe we are better off as a public company.” Even though the majority of shareholders “said they would remain with Tesla if we went private, the sentiment, in a nutshell, was ‘please don’t do this,'” he wrote. “I knew the process of going private would be challenging, but it’s clear that it would be even more time-consuming and distracting than initially anticipated.”

Insane story. Hollywood must have already bought the rights.

• The Great Chinese Art Heist (GQ)

The patterns of the heists were evident only later, but their audacity was clear from the start. The spree began in Stockholm in 2010, with cars burning in the streets on a foggy summer evening. The fires had been lit as a distraction, a ploy to lure the attention of the police. As the vehicles blazed, a band of thieves raced toward the Swedish royal residence and smashed their way into the Chinese Pavilion on the grounds of Drottningholm Palace. There they grabbed what they wanted from the permanent state collection of art and antiquities. Police told the press the thieves had fled by moped to a nearby lake, ditched their bikes into the water, and escaped by speedboat. The heist took less than six minutes.

A month later, in Bergen, Norway, intruders descended from a glass ceiling and plucked 56 objects from the China Collection at the KODE Museum. Next, robbers in England hit the Oriental Museum at Durham University, followed by a museum at Cambridge University. Then, in 2013, the KODE was visited once more; crooks snatched 22 additional relics that had been missed during the first break-in. Had they known exactly what was happening, perhaps the security officials at the Château de Fontainebleau, the sprawling former royal estate just outside Paris, could have predicted that they might be next. With more than 1,500 rooms, the palace is a maze of opulence. But when bandits arrived before dawn on March 1, 2015, their target was unmistakable: the palace’s grand Chinese Museum.

Created by the last empress of France, the wife of Napoleon III, the gallery was stocked with works so rare that their value was considered incalculable. In recent years, however, the provenance of those treasures had become an increasingly sensitive subject: The bulk of the museum’s collection had been pilfered from China by French soldiers in 1860 during the sack of Beijing’s Old Summer Palace. In the low light before daybreak, the robbers raced to the southwest wing and shattered a window. They climbed inside, stepping over broken glass, and swiftly went to work dismantling the empress’s trove. Within seven minutes, they were gone, along with 22 of the museum’s most valuable items: porcelain vases; a mandala made of coral, gold, and turquoise; a Chimera in cloisonné enamel; and more.

History lessons: “If you see me, weep.”

• Drought In Central Europe Reveals Cautionary ‘Hunger Stones’ (NPR)

A lengthy drought in Europe has exposed carved boulders, known as “hunger stones,” that have been used for centuries to commemorate historic droughts — and warn of their consequences. The Associated Press reports that hunger stones are newly visible in the Elbe River, which begins in the Czech Republic and flows through Germany. “Over a dozen of the hunger stones, chosen to record low water levels, can now be seen in and near the northern Czech town of Decin near the German border,” the AP writes. One of the stones on the banks of the Elbe is carved with the words “Wenn du mich siehst, dann weine”: “If you see me, weep.” A team of Czech researchers described that stone in detail in a 2013 paper about the history of droughts in Czech lands.

The stone is also chiseled with “the years of hardship and the initials of authors lost to history,” the researchers wrote: “It expressed that drought had brought a bad harvest, lack of food, high prices and hunger for poor people. Before 1900, the following droughts are commemorated on the stone: 1417, 1616, 1707, 1746, 1790, 1800, 1811, 1830, 1842, 1868, 1892, and 1893.” That particular stone is now a bit of a tourist attraction; it’s one of the oldest hydrological landmarks in central Europe. Also, because of a dam on a tributary of the Elbe, it’s seen more often now than it used to be, according to a Decin tourist site — although the current river levels are still exceptional.

We have 1% of all earth’s water. So of course we’re rapidly poisoning it.

• The Water Crises Aren’t Coming – They’re Here (Esq.)

Water cannot be created or destroyed; it can only be damaged. When Gleick says we’ll never run out, he means that at some point, millions of years ago, there was all the water there is, a result of the law of the conservation of matter. Having evaporated from lakes and rivers and oceans and returned as snow and rain, the water we consume has been through innumerable uses. Dinosaurs drank it. The Caesars did, too. It’s been places, and consorted with things, that you might not care to think about. In theory, there’s enough freshwater in the world for everyone, but like oil or diamonds or any other valuable resource, it is not dispersed democratically. Brazil, Canada, Colombia, Peru, Indonesia, and Russia have an abundance—about 40 percent of all there is.

America has a decent amount. India and China, meanwhile, have a third of the world’s people and less than a tenth of its freshwater. It is predicted that in twelve years the demand for water in India will be twice the amount on hand. Beijing draws water from an aquifer beneath the city. From being used faster than rain can replenish it, the aquifer has dropped several hundreds of feet in the last forty years, and in places the city is sinking four inches every year. As for the world’s stock, however, nearly all of the water on earth is salty; less than 3% is fresh. Some of that is in rivers, lakes, aquifers, and reservoirs—the Great Lakes contain one fifth of the freshwater on the earth’s surface—and we have stored so much water behind dams that we have subtly affected the earth’s rotation; but two thirds of all the freshwater we have is frozen in the earth’s cold places as ice or permafrost, leaving less than 1% of the world’s total water for all living things.

Much of that gets a rough ride. American ponds and streams and lakes and rivers contain fungicides, defoliants, solvents, insecticides, herbicides, preservatives, biological toxins, manufacturing compounds, blood thinners, heart medications, perfumes, skin lotions, antidepressants, antipsychotics, antibiotics, beta blockers, anticonvulsants, germs, oils, viruses, hormones, and several heavy metals. Not all of these are cleansed from water before we drink it.

It’s already there.

• Venezuela Heads For Refugee Crisis Moment Comparable To Mediterranean (R.)

The exodus of migrants from Venezuela is building toward a “crisis moment” comparable to events involving refugees in the Mediterranean, the United Nations migration agency said on Friday. Growing numbers are fleeing economic meltdown and political turmoil in Venezuela, where people scrounge for food and other necessities of daily life, threatening to overwhelm neighbouring countries. Officials from Colombia, Ecuador and Peru will meet in Bogota next week to seek a way forward. In Brazil, rioters this month drove hundreds back over the border. Peru tightened entry rules for Venezuelans, requiring them to carry passports instead of just national ID cards, though a judge in Ecuador on Friday rolled back a similar rule enacted there.

Describing those events as early warning signs, a spokesman for the International Organization for Migration, Joel Millman, said funding and means of managing the outflow must be mobilised. “This is building to a crisis moment that we’ve seen in other parts of the world, particularly in the Mediterranean,” he said. On Thursday, the IOM and UN refugee agency UNHCR called on Latin American countries to ease entry for Venezuelans, more than 1.6 million of whom have left since 2015.

Millions of people moving to Peru and Chile? Maybe helping them at home is a better idea. Get the CIA out of Caracas first.

• Ecuador Opens “Humanitarian Corridor” For Venezuelan Migrants (AFP)

Desperate Venezuelan migrants who made it across the border in time were breathing a sigh of relief hours before Peru’s tightened controls came into effect Saturday, preventing those not carrying passports from entering. “We have been on the road for five days. We traveled by bus and saw people, Venezuelans, walking along the road,” Jonathan Zambrano, 18, told AFP. Thousands of migrants fleeing the crippling economic crisis in their homeland had faced a race against time to cross into Peru from either Ecuador or Colombia after last week’s announcement from Lima that they had one week to enter before a passport would be required.

Until Saturday, a simple identity card was enough for Venezuelans heading south to escape food and medicine shortages, hyperinflation and failing public services back home. At one border crossing, Peruvian officers handed out balloons to exhausted children, but many Venezuelans feared it would be a different story once the new rules come into force. “People arrive with very few resources and after having traveled, five or six days being the shortest. There are people who’ve been traveling for months,” Regine de la Portilla of the United Nations refugee agency UNHCR told AFP.

Ecuador opened a “humanitarian corridor” on Friday and lifted its own entry restrictions to facilitate the Venzuelans’ travels to Peru, one of the region’s fastest growing economies with 4.7 percent growth projected for next year. Ecuadoran Interior Minister Mauro Toscanini said Friday that 35 busloads of migrants were on the move along the route authorities had opened to Peru.

This is Australia. Forget about housing bubbles and yokel PM’s. This is Australia.

• ‘Begging To Die’: Succession Of Critically Ill Children Moved Off Nauru (G.)

A girl suffering “resignation syndrome” and who is refusing all food and water has been ordered off Nauru by an Australian court, as a succession of critically ill children are brought from the island. At least three children have left the island since Thursday, and reports from island sources say at least three more children, as young as 12, are “on FFR” – food and fluid refusal. The current crisis on the island is overwhelming medical staff, who are referring dozens of children for transfer off the island, only to have their decisions rebuffed by Australian Border Force officials on the island or department of home affairs bureaucrats in Canberra. Two children were moved off the island with their families on Thursday.

Early on Friday morning, a 14-year-old refugee boy suffering a major depressive disorder and severe muscle wastage after not getting out of bed for four months, was flown directly from Nauru to Brisbane with his family. There are concerns, doctors say, he may never be able to walk normally again. Later on Friday, in the federal court, Justice Tom Thawley ordered another girl – given the designation EIV18 by the court – to be moved to Australia for urgent medical treatment. Court orders prevent publication of the girl’s age – other than the fact she is a child – her name or country of origin. [..] The girl has been inside the supported accommodation area of the regional processing centre for three weeks, and has been refusing food and water for much of that time.

Before she, too, fell into acute depression and “resignation syndrome”, and refused to eat or drink anything, she had been one of the brightest and most articulate of the refugee children on Nauru. “Before she got sick, she was the best-performing student,” a source familiar with the girl and her condition told the Guardian. “She had a dream to be a doctor in Australia and to help others. Now, she is on food-and-fluid refusal and begging to die as death is better than Nauru.”