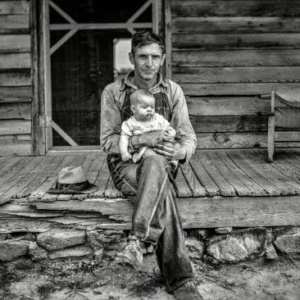

Russell Lee Levee at Bird’s Point, MO during the height of the flood January 1937 Mostly, it feels like a useless waste of time to wonder why everyone, and certainly economists of all flavors, no matter what gross incompetences they may accuse each other of, so blindly and slavishly talk only of different ways towards the one and same overarching goal: growth. There is a lot of talk about Keynes and stimulus and QE, as well as the pros and

Read More...