Harris&Ewing Motorcycle postman, Washington, DC 1912

You don’t say!: “The slowdown in tax collections suggests some cooling in labor market activity..”

• US Deficit Up for First Time Since 2009 on Spending Surge (BBG)

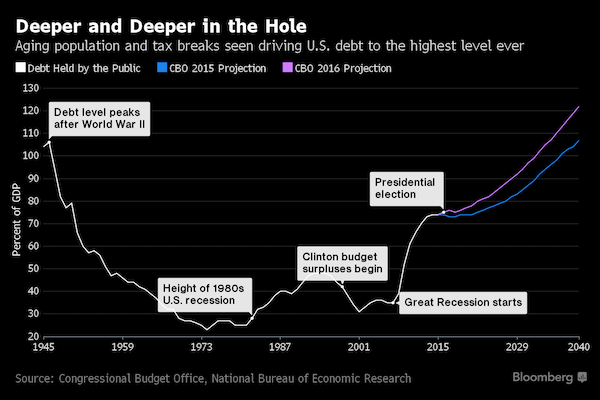

The U.S. budget deficit as a share of the economy widened for the first time in seven years, marking a turning point in the nation’s fiscal outlook as an aging population boosts government spending and debt. Spending exceeded revenue by $587.4 billion in the 12 months to Sept. 30, compared with a $439.1 billion deficit in fiscal 2015, the Treasury Department said in a report released Friday. That was in line with a Congressional Budget Office estimate on Oct. 7 for a shortfall of $588 billion. As a share of gross domestic product, the shortfall rose to 3.2% from 2.5% a year earlier, the first such increase since 2009, government figures show. “The slowdown in tax collections suggests some cooling in labor market activity,” said Gennadiy Goldberg at TD Securities in New York. He sees the higher budget deficits implying more borrowing needs by Treasury.

Accepting that today’s reality is normal, and boom times are not, is at least a first step.

• Why the Economy Doesn’t Roar Anymore (WSJ)

The U.S. presidential candidates have made the usual pile of promises, none more predictable than their pledge to make the U.S. economy grow faster. With the economy struggling to expand at 2% a year, they would have us believe that 3%, 4% or even 5% growth is within reach. But of all the promises uttered by Donald Trump and Hillary Clinton over the course of this disheartening campaign, none will be tougher to keep. Whoever sits in the Oval Office next year will swiftly find that faster productivity growth—the key to faster economic growth—isn’t something a president can decree. It might be wiser to accept the truth: The U.S. economy isn’t behaving badly. It is just being ordinary. Historically, boom times are the exception, not the norm.

[..] It is tempting to think that we know how to do better, that there is some secret sauce that governments can ladle out to make economies grow faster than the norm. But despite glib talk about “pro-growth” economic policies, productivity growth is something over which governments have very little control. Rapid productivity growth has occurred in countries with low tax rates but also in nations where tax rates were sky-high. Slashing government regulations has unleashed productivity growth at some times and places but undermined it at others. The claim that freer markets and smaller governments are always better for productivity than a larger, more powerful state is not one that can be verified by the data.

Here is the lesson: What some economists now call “secular stagnation” might better be termed “ordinary performance.” Most of the time, in most economies, incomes increase slowly, and living standards rise bit by bit. The extraordinary experience of the Golden Age left us with the unfortunate legacy of unrealistic expectations about our governments’ ability to deliver jobs, pay raises and steady growth. Ever since the Golden Age vanished amid the gasoline lines of 1973, political leaders in every wealthy country have insisted that the right policies will bring back those heady days. Voters who have been trained to expect that their leaders can deliver something more than ordinary are likely to find reality disappointing.

Q: “How low could it get?”

A: “If I told you Mark, you’d hang up”.

• Jim Rogers: Sterling Is In Serious Decline, Could Go Below Dollar (Ind.)

International investor Jim Rogers has warned that the value of the pound could go under one dollar within three to four years if Scotland was to leave the UK. His comments came on the day that Nicola Sturgeon said declaring independence could help Scotland escape the uncertainty triggered by UK’s vote to leave the EU. Rogers, who co-founded the Quantum Fund with George Soros, said the UK is facing serious problems. Speaking to the BBC, Rogers said: “If Scotland leaves they are going to take their oil with them and the pound could go down a great deal. It would certainly go down under one US dollar.”

“You’ve got a lot of debt, you’ve got a serious balance of trade problem which shows no signs of being corrected. I don’t see anything to make sterling go up.“ Rogers warned that the City of London is now going to be under serious pressure as Europe is hoping to attract as much business leaving London as possible. His warning came as the pound fell below $1.22 against the dollar in early trading on Friday, pushed down by comments from the President of the European Council Donald Tusk and the French finance minister Michel Sapin. Sterling was still below the $1.22 mark at market closing time.

Not bad as an analysis in itself, but the conclusion that America needs “progressive internationalism” is a goal-seeked illusion, and useless. As is wishing for “massive private sector growth”.

• What The United States Needs (Varoufakis)

When the world faced Armageddon in the 1940s, in the form of Hitler’s atom bomb program, Washington responded with the Manhattan Project. In effect, they gathered the best scientists, gave them as much money as they needed in fully-appointed facilities, and said to them: “You have two years to deliver the bomb.” Today, we face similar threats to the planet: climate change, rising seas, water shortages, etc. Our cities are less sustainable than ever. Commuters waste more and more of their lives in stationary cars. America needs a new Manhattan Project, one located on hundreds of campuses around the United States, that helps put to work the idle trillions of dollars, our scientists, and the next generation of youngsters (who must be educated with government subsidies to end the student debt scandal).

The joint effort would produce technologies that could lead to a cost-effective green transition. Who will pay for it? Just as the government-funded Internet spurred massive private sector growth – and taxes – so would the technologies that could spring out of a new Manhattan Project. But first the initial investment must come from government. To do this, the United States needs to collect more taxes. It is scandalous, for instance, that the IRS does not exercise its right to tax the earnings of corporations like Apple, Google and Gilead for intellectual property rights developed on American soil, letting them park billions upon billions of dollars in tax havens, including Ireland.

Overall, US federal taxes must rise from the present ultra-low 17% of GDP to at least 25%, with all of the increase coming from the top 1%. This is what logic and justice demands. What stops America from doing this service to itself? It is the 30-year-old bipartisan class war waged against America’s working class and shrinking middle class. Republicans automatically gravitated to tax cuts for the rich. Democrats served Wall Street and exhausted their talents at finding ways to curtail welfare. Both burdened the young with unbearable student debt. The US has reached a point where sensible policies, that the nation needs, are off the table.

What’s German for bail-in?

• German Government Has Ruled Out Taking Stake in Deutsche Bank (WSJ)

Aides to Angela Merkel have told lawmakers the state wouldn’t take a stake in Deutsche Bank if it were to issue new stock to shore up its thin capital cushion, one person who attended the briefing said. The fact that Berlin appears to have ruled out any aid for the embattled lender as both unnecessary and politically unfeasible could put Deutsche Bank under renewed pressure as it works to stabilize its share price and stay out of the news while negotiating an acceptable settlement in a U.S. misconduct investigation. In a closed-door briefing with a small group of lawmakers last week, Chancellery aides and senior Finance Ministry officials said it was “inconceivable for the state to take a stake in Deutsche Bank,” said one person.

“We have a different bank resolution system than in 2009 and this must apply to us in Germany too,” the government officials said according to this person. This referred to recent legal changes that now force European governments to bail-in creditors—and in some cases depositors—before they shore up a struggling bank with taxpayer money. Deutsche Bank is currently negotiating with the U.S. Justice Department to bring down a settlement in several investigations over the mis-selling of mortgage-backed securities. Last month, The Wall Street Journal reported that U.S. authorities had floated a $14 billion amount as an opening bid, sparking a rout in the bank’s share price. The bank has said it would not pay anywhere near this amount, which would wipe out nearly all of its existing capital.

It is still unclear whether Deutsche Bank will need to increase capital and, if it does, whether it would need the government to pitch in. But the fact that Ms. Merkel’s government has ruled out any aid for the bank will come as a negative surprise to investors, given widespread expectations in the market that the state would offer some form of last-resort assistance given the scale of Deutsche Bank and the shock its failure could inflict on Europe’s financial system.

That Greece would have made some official request, that they would have asked Putin himself, and that he would have called up Hollande to tell him that, it’s all not very credible.

• Varoufakis, Others Deny Hollande’s Russian Drachma-Printing Claim (Kath.)

Former finance minister Yanis Varoufakis on Friday hastened to dismiss claims made by French President Francois Hollande in a new book that Russian President Vladimir Putin had told him he had been approached by Greek officials a day after a referendum on the country’s third bailout agreement on July 5, 2015, and asked whether Athens could print drachmas in Russia. “I can confirm that during my tenure at the Finance Ministry there were no thoughts of printing a new currency, let alone overtures to third parties at home or abroad,” Varoufakis said in a statement on Friday. Parliament Speaker Nikos Voutsis also denied the existence of such a plan on Friday, dismissing the discussion as being irrelevant, while Alternate Defense Minister Dimitris Vitsas brushed off the claims as “nonsense.”

Speaking on Skai TV on the same day, however, ruling SYRIZA MP Sakis Papadopoulos admitted that the leftist-led government had discussed a possible Greek exit from the eurozone in the days building up to the referendum and just after it. “This information did not come out of the blue,” he said. In “A President Shouldn’t Say That,” based on a series of interviews with Hollande by two journalists from daily Le Monde, the French president is quoted as saying he received a call from Putin, who allegedly told him that “Greece asked us to print drachmas in Russia because they no longer have a printing machine to do so.”

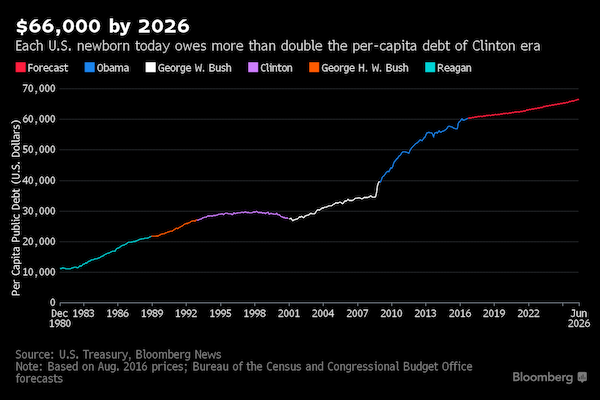

How about forgiving each new born the $66,000 (s)he owes, as a first step toward debt restructuring?!

• A Child Born Today Comes Into the World With More Debt Than You (BBG)

Each newborn’s share of the national debt today is more than double what it was in the 1990s. In the past 35 years, the national debt on a per capita basis has increased with each U.S. president. Under President Bill Clinton, the debt grew at the slowest pace — with a net increase of 1.4% over his two terms. After reducing the slope of public debt in his first term, he shrunk it in his second. Under current law, U.S. inflation-adjusted debt per person is expected to reach the $66,000 milestone by April 2026, based on Bloomberg calculations of Congressional Budget Office and Census Bureau data. So what would the debt path look like under either a Hillary Clinton or Donald Trump presidency? It would be pretty bleak in either case, according to a report released by the Committee for a Responsible Federal Budget.

And while the committee is non-partisan, they do have a policy bent on fixing the national debt and improving the way the budget is developed. The committee projects debt held by the public to grow by $9 trillion over the next decade under current law. Economic proposals put forth by both presidential candidates would add to the national debt, and Trump’s would add even more than Clinton’s. The report estimates that Clinton’s policies would increase the national debt by $200 billion over the next decade, while Trump’s proposals would add $5.3 trillion.

Again, the WSJ diverging from the rest of the mainstream press. “.. the “vast majority” of [FBI] career agents and prosecutors working the case “felt she should be prosecuted” and that giving her a pass was “a top-down decision.”

• The Press Buries Hillary Clinton’s Sins (WSJ)

If average voters turned on the TV for five minutes this week, chances are they know that Donald Trump made lewd remarks a decade ago and now stands accused of groping women. But even if average voters had the TV on 24/7, they still probably haven’t heard the news about Hillary Clinton: That the nation now has proof of pretty much everything she has been accused of. It comes from hacked emails dumped by WikiLeaks, documents released under the Freedom of Information Act, and accounts from FBI insiders. The media has almost uniformly ignored the flurry of bombshells, preferring to devote its front pages to the Trump story. So let’s review what amounts to a devastating case against a Clinton presidency.

Start with a June 2015 email to Clinton staffers from Erika Rottenberg, the former general counsel of LinkedIn. Ms. Rottenberg wrote that none of the attorneys in her circle of friends “can understand how it was viewed as ok/secure/appropriate to use a private server for secure documents AND why further Hillary took it upon herself to review them and delete documents.” She added: “It smacks of acting above the law and it smacks of the type of thing I’ve either gotten discovery sanctions for, fired people for, etc.” A few months later, in a September 2015 email, a Clinton confidante fretted that Mrs. Clinton was too bullheaded to acknowledge she’d done wrong. “Everyone wants her to apologize,” wrote Neera Tanden, president of the liberal Center for American Progress.

“And she should. Apologies are like her Achilles’ heel.” Clinton staffers debated how to evade a congressional subpoena of Mrs. Clinton’s emails—three weeks before a technician deleted them. The campaign later employed a focus group to see if it could fool Americans into thinking the email scandal was part of the Benghazi investigation (they are separate) and lay it all off as a Republican plot. A senior FBI official involved with the Clinton investigation told Fox News this week that the “vast majority” of career agents and prosecutors working the case “felt she should be prosecuted” and that giving her a pass was “a top-down decision.”

[..] Voters might not know any of this, because while both presidential candidates have plenty to answer for, the press has focused solely on taking out Mr. Trump. And the press is doing a diligent job of it.

Not a bad analysis. At all.

• Donald Trump Uncensored: This Is America’s “Moment Of Reckoning” (ZH)

Sometimes, you just have to listen…

“There is nothing that the political establishment wil not do; no lie they will not tell, to hold their prestige and power at your expense… and that’s what’s been happening. The Wasshington establishment – and the financial and media corporations that fund it – exists for one thing only… to protect and enrich itself.”

“For those who control the levers of power in Washington and for the global special interests – they partner with these people that don’t have your good in mind – our campaign represents a true existential threat… like they haven’t seen before. This is not simply another four-year election; this is a crossroads in the history of our civilization that will determine whether or not we, the people, reclaim control over our government.”

Turn off MSNBC, CNBC, CNN, and NBC and listen – away from the spectacle – to some uncomfortable deep state realities…

It’s more the failure of the Republican party than of Trump, if you read Matt well.

• The Fury and Failure of Donald Trump (Matt Taibbi)

Trump’s early rampage through the Republican field made literary sense. It was classic farce. He was the lewd, unwelcome guest who horrified priggish, decent society, a theme that has mesmerized audiences for centuries, from Vanity Fair to The Government Inspector to (closer to home) Fear and Loathing in Las Vegas. When you let a hands-y, drunken slob loose at an aristocrats’ ball, the satirical power of the story comes from the aristocrats deserving what comes next. And nothing has ever deserved a comeuppance quite like the American presidential electoral process, which had become as exclusive and cut off from the people as a tsarist shooting party The first symptom of a degraded aristocracy is a lack of capable candidates for the throne.

After years of indulgence, ruling families become frail, inbred and isolated, with no one but mystics, impotents and children to put forward as kings. Think of Nikolai Romanov reading fortunes as his troops starved at the front. Weak princes lead to popular uprisings. Which brings us to this year’s Republican field. There wasn’t one capable or inspiring person in the infamous “Clown Car” lineup. All 16 of the non-Trump entrants were dunces, religious zealots, wimps or tyrants, all equally out of touch with voters. Scott Walker was a lipless sadist who in centuries past would have worn a leather jerkin and thrown dogs off the castle walls for recreation. Marco Rubio was the young rake with debts. Jeb Bush was the last offering in a fast-diminishing hereditary line. Ted Cruz was the Zodiac Killer. And so on.

The party spent 50 years preaching rich people bromides like “trickle-down economics” and “picking yourself up by your bootstraps” as solutions to the growing alienation and financial privation of the ordinary voter. In place of jobs, exported overseas by the millions by their financial backers, Republicans glibly offered the flag, Jesus and Willie Horton. In recent years it all went stale. They started to run out of lines to sell the public. Things got so desperate that during the Tea Party phase, some GOP candidates began dabbling in the truth. They told voters that all Washington politicians, including their own leaders, had abandoned them and become whores for special interests. It was a slapstick routine: Throw us bums out!

[..] How Giuliani isn’t Trump’s running mate, no one will ever understand. Theirs is the most passionate television love story since Beavis and Butthead. Every time Trump says something nuts, Giuliani either co-signs it or outdoes him. They will probably spend the years after the election doing prostate-medicine commercials together.

Adam Curtis has no peers. Available from Sunday at BBCiPlayer (only in Britain?!) Great video excerpt on -some of- Trump’s Atlantic City losses.

• Hypernormalisation: Adam Curtis’ Path From Syria To Trump, Via Jane Fonda (G.)

I struggle to think a more perfect union of medium and message than HyperNormalisation, Adam Curtis’s new film for the BBC iPlayer. Though he’s spent the best part of four decades making television, Curtis’s signature blend of hypnotic archive footage, authoritative voiceover and a seemingly inexhaustible appetite for bizarre historical tangents is better suited to the web, a place just as resistant to the narrative handholding of broadcast TV as he is. Safe in the knowledge that his audience now has the ability to pause and rewind at will, Curtis crafts a mammoth labyrinth of political storytelling in the film, his follow-up to last year’s “war on terror” epic Bitter Lake.

Launching on Sunday, his 165-minute opus makes a feature of its sheer unwieldiness, as Curtis veers from social history to conspiracy theory via the odd rambling bar-room anecdote, like a man who’s two-dozen browser tabs into a major Wikipedia binge. He argues that an army of technocrats, complacent radicals and Faustian internet entrepreneurs have conspired to create an unreal world; one whose familiar and often comforting details blind us to its total inauthenticity. Not wishing to undersell the concept, Curtis begins the film with a shot of a torch shining limply into a thicket, so that viewers find themselves literally unable to see the wood for the trees.

From there, HyperNormalisation tracks a course to the present day, allowing Curtis to weigh in on Trump, Putin and Syria. But those expecting a snappy crash course in our chaotic world (“You won’t believe how this veteran BBC film-maker explains the Islamic State! What happens at 156:34 will shock you!”) clearly aren’t familiar with his methods. The film may address some of today’s most critical global issues, but it also allocates space to Jane Fonda, the fall of the Soviet Union and a supercut of pre-9/11 disaster movies. And unlike Curtis’s earlier work for TV, HyperNormalisation refuses to drop the kind of storytelling breadcrumbs that might anchor a viewer in its overarching narrative.

Not bad from US general with Greek roots. Who’s also a typical 13 in a dozen Putin basher, unfortunately.

• Greece, The Hot Corner (Stavridis)

First and foremost, Greece – perhaps more than any other country – represents the confluence of values in the trans-Atlantic community. These values are fundamental to our societies and cultures: democracy, liberty, freedom of speech, freedom of religion, freedom of education and assembly. They came to us from ancient Greece, passed through the Age of Enlightenment in Western Europe, and washed up on our shores as the principles of the American Revolution. To walk away from a nation that represents the core of those values would be an abiding mistake.

Second, geography continues to matter, and Greece’s position – on the figurative hot corner of Europe – means that without stability there, there will be an open gateway for migrant and refugee populations fleeing the violence in the Levant, the larger Arab world, and northern Africa. As a geographic location, Greece offers the best bases in the NATO Alliance from which to operate in the trouble spots of the Middle East and the Mediterranean. Our military-to-military relations with Greece are exceptionally good and provide us true strategic advantage both unilaterally for the USA and via the NATO Alliance.

A third crucial element that argues for supporting Greece is the excellence and professionalism of the Greek military. It is a relatively large and very technologically advanced force, with fine capabilities at sea, in the air, and via its land army. Greek soldiers, sailors, and airmen have participated in every NATO operation over the past decade: Afghanistan, the Balkans, Libya, and piracy, to name a few. Ensuring Greece’s economic viability will ensure those troops and capabilities are available for future operations as well.

Fourth, Greece has a unique and positive position in the Balkans and elsewhere via its influence in the Orthodox world. Greeks are well established regionally, and have useful connections in most of the Balkan countries (despite some disputes, including, for example over the name of Macedonia). The Greeks also have a relatively good set of relationships with fellow orthodox nation Russia, and are leaders in the broader global Orthodox community, providing a bridge to a variety of nations and communities around the world.

Home › Forums › Debt Rattle October 15 2016