NPC Grief monument, Rock Creek cemetery, Washington DC 1915

Why does this truth have to come from the right wing press?

• The Eurozone Is Turning Into A Poverty Machine (Tel.)

There are constant bank runs. The bond markets panic, and governments along its southern perimeter need bail-outs every few years. Unemployment has sky-rocketed and growth remains sluggish, no matter how many hundreds of billions of printed money the ECB throws at the economy. We are all tediously aware of how the euro-zone has been a financial disaster. But it is now starting to become clear that it is a social disaster as well. What often gets lost in the discussion of growth rates, bail-outs and banking harmonisation is that the eurozone is turning into a poverty machine. As its economy stagnates, millions of people are falling into genuine hardship. Whether it is measured on a relative or absolute basis, rates of poverty have soared across Europe, with the worst results found in the area covered by the single currency.

There could not be a more shocking indictment of the currency’s failure, or a more potent reminder that living standards will only improve once the euro is either radically reformed or taken apart. Eurostat, the statistical agency of the European Union, has published its latest findings on the numbers of people “at risk of poverty or social exclusion”, comparing 2008 and 2015. Across the 28 members, five countries saw really significant rises compared with the year of the financial crash. In Greece, 35.7pc of people now fall into that category, compared with 28.1pc back in 2008, a rise of 7.6 percentage points. Cyprus was up by 5.6 points, with 28.7pc of people now categorised as poor. Spain was up 4.8 points, Italy up 3.2 points and even Luxembourg, hardly known for being at risk of deprivation, up three points at 18.5pc.

It was not so bleak everywhere. In Poland, the poverty rate went down from 30.5pc to over 23pc. In Romania, Bulgaria, and Latvia, there were large falls compared to the 2008 figures – in Romania for example the percentage was down by seven points to 37pc. What was the difference between the countries where poverty went up dramatically, and those where it went down? You guessed it. The largest increases were all countries within the single currency. But the decreases were all in countries outside it. It gets worse. “At risk of poverty” is defined as living on less than 60pc of the national median income. But that median income has itself fallen over the last seven years, because most countries inside the eurozone have yet to recover from the crash. In Greece, the median income has dropped from €10,800 a year to €7,500 now.

[..] Why should Greece and Spain be doing so much worse than anywhere in Eastern Europe? Or why Italy should be doing so much worse than Britain, when the two countries were at broadly similar levels of wealth in the Nineties? (Indeed, the Italians actually overtook us for a while in GDP per capita.) Even a traditionally very successful economy such as the Netherlands, which has not been caught up in any kind of financial crisis, has seen big increases in both relative and absolute poverty. In fact, it is not very hard to work out what has happened. First, a dysfunctional currency system has choked off economic growth, driving unemployment up to previously unbelievable levels. After countries went bankrupt and had to be bailed out, the EU, along with the ECB and the IMF, imposed austerity packages that slashed welfare systems and cut pensions. It is not surprising poverty is increasing under those conditions.

If you ask me, they’ve got it the wrong way around. If growth hadn’t slowed down, there’d be much less rage.

• Barclays Warns ‘Politics of Rage’ Will Slow Global Growth (BBG)

Brexit, rising populism across Europe, the ascent of Donald Trump in America, and the backlash against income inequality everywhere. A slew of political and economic forces have nurtured a growing narrative that globalization is now on life support—a potential game-changer for global financial markets, which have staged a rapid expansion since the end of the Cold War thanks to unfettered cross-border flows. No more: Trade volumes have stalled while the “politics of rage” has taken root in advanced economies, driven by a collapse in the perceived legitimacy of political and economic institutions, a new report from Barclays warns.

The result, the bank says, is an oncoming protectionist lurch—restrictions on the free movement of goods, services, labor, and capital—combined with an erosion of support for supranational bodies, from the EU to the WTO. “Even mild de-globalization likely will slow the pace of trend global growth,” Marvin Barth, head of European FX strategy at Barclays, writes in the report. “A sense of economic and political disenfranchisement due to imperfect representation in national governments and delegation of sovereignty to supranational and intergovernmental organisations” has generated the backlash, he said. He cites as a major factor the collapse in support for centrist parties in advanced economies and adds that the role of income inequality may be overstated.

The report echoes Harvard University economist Dani Rodrik’s earlier contention that democracy, sovereignty, and globalization represent a “trilemma.” Expansion of cross-border trade links—and the attendant increase in the power of supranational authorities to adjudicate economic matters—is a direct threat to representative democracy, and vice-versa. The veto Monday of the EU’s free trade deal with Canada by the Belgian region of Wallonia—whose leader said the deadline to secure backing for the deal was “not compatible with the exercise of democratic rights”—is a sharp illustration of this trilemma.

Breaking the dollar peg is a dangerous game, given the amount of debt denominated in USD. It can get expensive quite fast.

• China Capital Outflows Highest Since Data Publishing Began In 2010 (BBG)

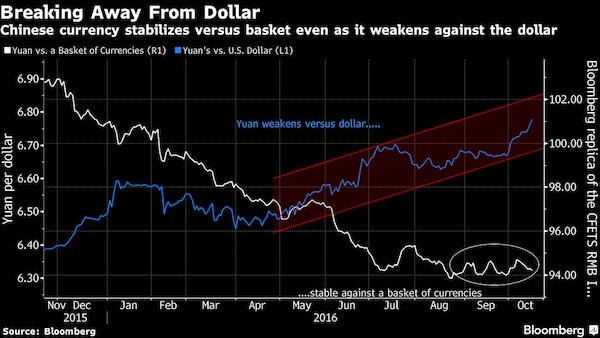

The offshore yuan traded near a record low as Chinese policy makers signaled they are willing to allow greater currency flexibility amid a slump in exports and an advance in the dollar. The exchange rate was at 6.7836 a dollar as of 1:01 p.m. in Hong Kong, after dropping to 6.7885, the weakest intraday level in data going back to 2010. In Shanghai, the currency was little changed at 6.7760, close to a six-year low and past the 6.75 year-end median forecast in a Bloomberg survey. The Chinese currency has come under increased pressure on signs that investors are taking more money out of the country. A gauge of the dollar rose to a seven-month high versus major currencies Monday as traders bet that the Federal Reserve may raise borrowing costs soon.

Unlike the yuan selloff earlier this year which sparked a global market rout, there’s no sense of panic yet as policy makers maintain a steady exchange rate against other currencies. “The central bank is tolerating more orderly depreciation of the yuan,” said Gao Qi, a Singapore-based foreign-exchange strategist at Scotiabank. “But it will step in to avoid market panic arising from a sharp yuan depreciation. The 6.8 level is critical in the near term.” [..] The onshore yuan has weakened 4.2% this year, the most in Asia. It has declined in all but two sessions this month as some analysts speculated that the central bank has reduced support following the yuan’s inclusion in the IMF’s basket of reserves on Oct. 1.

A net $44.7 billion worth of payments in the Chinese currency left the nation last month, according to data released by the State Administration of Foreign Exchange. That’s the most since the government started publishing the figures in 2010. [..] Chinese policy makers have downplayed the importance of the yuan-dollar exchange rate, saying they aim to keep the yuan steady against a broad basket of currencies. A Bloomberg gauge mimicking China Foreign Exchange Trade System’s yuan index against 13 major currencies has been little changed around 94 since August after falling more than 6 percent in the previous eight months.

Imagine my surprise.

• Credit Card Lending To US Subprime Borrowers Is Starting To Backfire (WSJ)

Credit-card lending to subprime borrowers is starting to backfire. Missed payments on credit cards that lenders issued recently are higher than on older cards, according to new data from credit bureau TransUnion. Nearly 3% of outstanding balances on credit cards issued in 2015 were at least 90 days behind on payments six months after they were originated. That compares with 2.2% for cards that were given out in 2014 and 1.5% for cards in 2013. The poorer performance on newer cards pushed up the 90-day or more delinquency rate for all credit cards to 1.53% on average nationwide in the third quarter. That’s the highest level since 2012.

The recent increase in subprime lending is one of the big contributors. Lenders ramped up subprime card lending in 2014 and have been doling out more of these cards recently. They issued just over 20 million credit cards to subprime borrowers in 2015, up some 20% from 2014 and up 56% from 2013, according to Equifax. Separately, missed payments in states with large oil or energy sectors continue to worsen. The share of card balances that were at least 90 days past due increased 12% in Oklahoma, 10% in Texas and 20% in Wyoming in the third quarter from a year prior, according to TransUnion.

Really? They thought Carney could save the day?

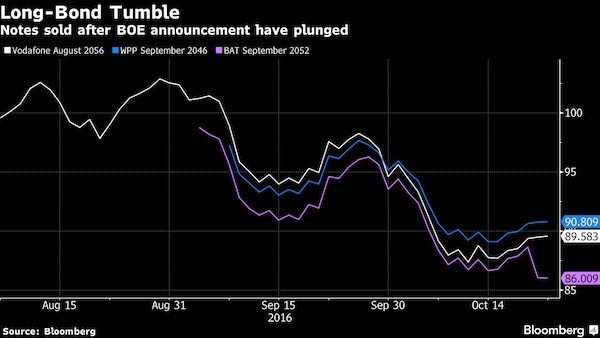

• Bank of England Optimism Evaporates in Long-Term Debt (BBG)

Long-term sterling bonds suggest investors are quickly losing confidence in the Bank of England’s ability to support debt markets through the U.K.’s departure from the EU. Holders have lost about 10% in as little as seven weeks on long-dated notes issued by Vodafone, British American Tobacco and WPP. The bond sales took place after the central bank announced plans in August to buy corporate debt, sparking investor optimism. The mood has since soured because of concerns about a so-called hard Brexit, sterling’s tumble and the outlook for inflation. “With the benefit of hindsight, August was the best time to issue,” said Srikanth Sankaran, head of European Credit and ABS strategy at Morgan Stanley. “The market was more focused on the Bank of England’s support rather than the longer-term Brexit risk.”

McCulley used to be something big at PIMCO. He’s right, but it’s doubtful a change of course would be sufficient at this point. Austerity has killed a lot.

• The Deficit Is Too Small, Not Too Big (McCulley)

[..] while Clinton gets my vote, her insistence at the final debate that her proposed fiscal program will not “add a penny” to the national debt is fouling my wonk serenity this morning. Every penny of new expenditure, she says, will be “paid for” with a new penny of tax revenue. Her deficit-neutral fiscal proposal is, I readily acknowledge, better than the status quo, as her proposed new spending would add 100 cents on the dollar to the nation’s aggregate demand, while her proposed tax increases would not subtract 100 cents on the dollar. Why? Because she proposes getting the new tax revenue from those with a low marginal propensity to spend, or alternatively, a high marginal propensity to save. To wit, from the not poor, including yes, the rich.

Thus, in simple Keynesian terms, there is some solace in her deficit-neutral fiscal package: It would be net stimulative to the economy, because it would – in technical terms – drive down the private sector’s savings rate. In less technical terms, it would take money from people who don’t live paycheck to paycheck, who would still spend the same, but just have less left over to save. And I have no problem with that. What sends me around the bend is the notion that the only way to boost aggregate demand is to drive down the private-sector savings rate, in the context of holding constant the public sector’s savings rate. But, you retort: The public sector, notably at the federal level, has a negative savings rate; it runs a deficit! Are you nuts?

No, I am not. Unless faced with an incipient inflation threat, born of an overheated economy, there is no reason whatsoever that the public sector should ever have a positive savings rate. What it should have is a positive, a bigly positive, investment rate. And in fact, a higher public investment rate and a lower public savings rate are exactly what our economy presently needs. Yes, a larger fiscal deficit. [..] investment drives aggregate demand, which begets aggregate production and thus, aggregate income, the fountain from which savings flow. Thus, if and when there is insufficient aggregate demand to foster full employment at a just income distribution, the underlying problem is a deficiency of investment, not savings. More investment is the solution, and investment is constrained not by a shortage of savings, but literally a deficiency of investment itself.

“..the demonization of Russia – a way more idiotic exercise than the McCarthyite Cold War hysteria..”

• Welcome to the George Orwell Theme Park of Democracy (Jim Kunstler)

If Trump loses, I will essay to guess that his followers’ next step will be some kind of violence. For the moment, pathetic as it is, Trump was their last best hope. I’m more comfortable about Hillary — though I won’t vote for her — because it will be salutary for the ruling establishment to unravel with her in charge of it. That way, the right people will be blamed for the mismanagement of our national affairs. This gang of elites needs to be circulated out of power the hard way, under the burden of their own obvious perfidy, with no one else to point their fingers at. Her election will sharpen awareness of the criminal conduct in our financial practices and the neglect of regulation that marked the eight years of Obama’s appointees at the Department of Justice and the SEC.

The “tell” in these late stages of the campaign has been the demonization of Russia – a way more idiotic exercise than the McCarthyite Cold War hysteria of the early 1950s, since there is no longer any ideological conflict between us and all the evidence indicates that the current state of bad relations is America’s fault, in particular our sponsorship of the state failure in Ukraine and our avid deployment of NATO forces in war games on Russia’s border. Hillary has had the full force of the foreign affairs establishment behind her in this war-drum-banging effort, yet they have not been able to produce any evidence, for instance, in their claim that Russia is behind the Wikileaks hack of Hillary’s email.

[..] The media has been on-board with all this. The New York Times especially has acted as the hired amplifier for the establishment lies – such a difference from the same newspaper’s role in the Vietnam War ruckus of yesteryear. Today (Monday) they ran an astounding editorial “explaining” the tactical necessity of Hillary’s dishonesty: “In politics, hypocrisy and doublespeak are tools,” The Times editorial board wrote. Oh, well, that’s reassuring. Welcome to the George Orwell Theme Park of Democracy.

Absolute must read by Stoller, American history you didn’t know.

• How Democrats Killed Their Populist Soul (Matt Stoller)

While not a household name today, Wright Patman was a legend in his time. His congressional career spanned 46 years, from 1929 to 1976. In that near-half-century of service, Patman would wage constant war against monopoly power. As a young man, at the height of the Depression, he challenged Herbert Hoover’s refusal to grant impoverished veterans’ accelerated war pensions. He successfully drove the immensely wealthy Treasury Secretary Andrew Mellon from office over the issue. Patman’s legislation to help veterans recoup their bonuses, the Bonus Bill—and the fight with Mellon over it—prompted a massive protest by World War I veterans in Washington, D.C., known as “the Bonus Army,” which helped shape the politics of the Depression.

In 1936, he authored the Robinson-Patman Act, a pricing and antitrust law that prohibited price discrimination and manipulation, and that finally constrained the A&P chain store—the Walmart of its day—from gobbling up the retail industry. He would go on to write the Bank Secrecy Act, which stops money-laundering; defend Glass-Steagall, which separates banks from securities dealers; write the Employment Act of 1946, which created the Council of Economic Advisors; and initiate the first investigation into the Nixon administration over Watergate.

Far from the longwinded octogenarian the Watergate Babies saw, Patman’s career reads as downright passionate, often marked by a vitality you might see today in an Elizabeth Warren—as when, for example, he asked Fed Chairman Arthur Burns, “Can you give me any reason why you should not be in the penitentiary?” Despite his lack of education, Patman had a savvy political and legal mind. In the late 1930s, the Federal Reserve Board refused to admit it was a government institution. So Patman convinced the District of Columbia’s government to threaten foreclosure of all Federal Reserve Board property; the Board quickly produced evidence that it was indeed part of the federal government.

Kind of like a second chapter to Stoller’s piece above.

• Hillary Clinton Is The Republican Party’s Last, Best Hope (Heat St.)

While Trump has pushed a populist, anti-free trade message, Hillary champions the large multinational corporations that create jobs for everyday Americans. As secretary of state, she worked tirelessly to advance the Trans-Pacific Partnership, the “gold standard” of trade agreements. As a candidate, she expertly silenced the gullible radicals supporting Bernie Sanders by pretending she won’t sign TPP into law as president. (She will.) Hillary’s disdain for left-wing agitators does not end there. She has also gone to bat for the heroes in America’s fracking industry, telling environmentalists to “get a life” in emails uncovered by Wikileaks. [..]

One of the greatest sources of frustration for Republicans during the Obama presidency has been his weak-sauce, isolationist foreign policy. In the absence of strong American leadership, the world has plunged into chaos. Trump shares Obama’s ideology of avoiding foreign entanglements, even going so far as to question the need for NATO as Putin runs amok unchecked. It is precisely at this moment that America needs the hawkish leadership of Hillary Clinton to defend American exceptionalism and reassert our hegemony on the world stage. Among her fellow neoconservative war hawks, Hillary is admired for her sterling record on foreign policy — from supporting the invasion of Iraq in 2002 to her valiant efforts as secretary of state to persuade Obama to stop being such a pushover on the world stage.

During the Arab Spring in 2011, Hillary impressed upon Obama the need for a U.S.-led “coalition of the willing” to help mold the future of the Middle East in the name of freedom. Muammar Gaddafi wound up dead in a ditch. Later, when the president sought input on Syria, Hillary recommended force and arming rebel groups. Obama’s failure to follow her advice led to the current migrant crisis and ongoing tragedy in Syria. Bashar al-Assad is still alive and well. Imagine our enemies cowering in the shade as President Hillary’s massive drone armada blocks out the sun en route to visit death upon the enemies of freedom. Slay Queen, indeed. Voters looking for a reliable pro-business, conservative hawk to undo eight years of Obama’s feckless progressivism and combat the cancer of Trumpism need look no further than Hillary Rodham Clinton. She is the GOP’s last, best hope.

Incredible. Just incredible.

• Clinton Ally Aided Campaign of FBI Official’s Wife (WSJ)

The political organization of Virginia Gov. Terry McAuliffe, an influential Democrat with longstanding ties to Bill and Hillary Clinton, gave nearly $500,000 to the election campaign of the wife of an official at the FBI who later helped oversee the investigation into Mrs. Clinton’s email use. Campaign finance records show Mr. McAuliffe’s political-action committee donated $467,500 to the 2015 state Senate campaign of Dr. Jill McCabe, who is married to Andrew McCabe, now the deputy director of the FBI. The Virginia Democratic Party, over which Mr. McAuliffe exerts considerable control, donated an additional $207,788 worth of support to Dr. McCabe’s campaign in the form of mailers, according to the records.

That adds up to slightly more than $675,000 to her candidacy from entities either directly under Mr. McAuliffe’s control or strongly influenced by him. The figure represents more than a third of all the campaign funds Dr. McCabe raised in the effort. Mr. McAuliffe and other state party leaders recruited Dr. McCabe to run, according to party officials. She lost the election to incumbent Republican Dick Black. [..] Dr. McCabe announced her candidacy in March 2015, the same month it was revealed that Mrs. Clinton had used a private server as secretary of state to send and receive government emails, a disclosure that prompted the FBI investigation. At the time the investigation was launched in July 2015, Mr. McCabe was running the FBI’s Washington, D.C., field office, which provided personnel and resources to the Clinton email probe.

That investigation examined whether Mrs. Clinton’s use of private email may have compromised national security by transmitting classified information in an insecure system. [..] At the end of July 2015, Mr. McCabe was promoted to FBI headquarters and assumed the No. 3 position at the agency. In February 2016, he became FBI Director James Comey’s second-in-command. As deputy director, Mr. McCabe was part of the executive leadership team overseeing the Clinton email investigation, though FBI officials say any final decisions on that probe were made by Mr. Comey, who served as a high-ranking Justice Department official in the administration of George W. Bush.

“Di Maio was also ironic about the endorsement of the reform received by Renzi from President Obama during a recent visit to Washington. “Let’s say it is not the first time Obama has intervened concerning a referendum in another country, he supported ‘Remain’ in England and ‘Brexit’ won. Now he is backing the Yes vote and so the No front should be reassured..”

• M5S Blasts Italian Constitutional Reform Proposed By PM Renzi (Amsa)

The anti-establishment Five Star Movement (M5S) will vote No in the December 4 referendum on Constitutional reform because the law “deprives us of democratic rights”, party bigwig and Deputy House Speaker Luigi Di Maio said on Monday. “In our opinion, the title of the law does not in any way reflect its content, in the same way that the title of the Good School law does not in any way reflect the content of that reform,” Di Maio told radio broadcaster Rtl 102.5. The M5S recently lost a legal challenge against the question in the consultative referendum, which echoes the wording of the title of the constitutional law, arguing it amounts to a “deceptive” advertisement for the government’s position in favour of a Yes vote.

On December 4, Italians will be called to answer ‘yes’ or ‘no’ on a question that reads: “Do you approve a constitutional law that concerns the scrapping of the bicameral system (of parliament), reducing the number of MPs, limiting the operating costs of public institutions, abolishing the National Council on Economy and Labour (CNEL), and amending Title V of the Constitution, Part II?”. The reform approved by parliament in April would turn the Senate into a leaner body of indirectly elected regional and local representatives with limited lawmaking powers. Critics of the reform, including M5S and a left-wing faction within Premier Matteo Renzi’s own Democratic Party (PD), say it will actually make procedures more complicated.

Di Maio was also ironic about the endorsement of the reform received by Renzi from US President Barack Obama during a recent visit to Washington. “Let’s say it is not the first time Obama has intervened concerning a referendum in another country, he supported ‘Remain’ in England and ‘Brexit’ won. Now he is backing the Yes vote and so the No front should be reassured,” he said.

There is a reason why Canada is sparsely populated. Let’s not tell them. Don’t spoil the fun.

• 100 Million Canadians By 2100? Key Advisers Back Ambitious Goal (CP)

Imagine Canada with a population of 100 million — roughly triple its current size. For two of the most prominent voices inside the Trudeau government’s influential council of economic advisers, it’s much more than a passing fancy. It’s a target. The 14-member council was assembled by Finance Minister Bill Morneau to provide “bold” advice on how best to guide Canada’s struggling economy out of its slow-growth rut. One of their first recommendations, released last week, called for a gradual increase in permanent immigration to 450,000 people a year by 2021 — with a focus on top business talent and international students. That would be a 50% hike from the current level of about 300,000.

The council members — along with many others, including Economic Development Minister Navdeep Bains — argue that opening Canada’s doors to more newcomers is a crucial ingredient for expanding growth in the future. They say it’s particularly important as more and more of the country’s baby boomers enter their golden years, which eats away at the workforce. The conviction to bring in more immigrants is especially significant for at least two of the people around the advisory team’s table. Growth council chair Dominic Barton, the powerful global managing director of consulting firm McKinsey, and Mark Wiseman, a senior managing director for investment management giant BlackRock, are among the founders of a group dedicated to seeing the country responsibly expand its population as a way to help drive its economic potential.

The Century Initiative, a five-year-old effort by well-known Canadians, is focused on seeing the country of 36 million grow to 100 million by 2100. Without significant policy changes on immigration, the current demographic trajectory has Canada’s population on track to reach 53 million people by the end of the century, the group says on its website. That would place it outside the top 45 nations in population size, it says.

It goes back quite a bit further.

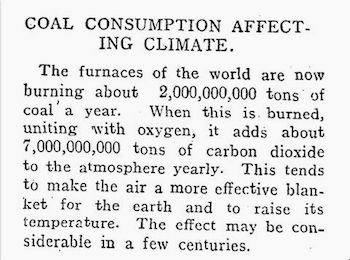

• A 1912 News Article Ominously Forecasted Climate Change (Q.)

Published Aug. 14, 1912. (The Rodney and Otamatea Times and Waitemata and Kaipara Gazette)

A short news clip from a New Zealand paper published in 1912 has gone viral as an example of an early news story to make the connection between burning fossil fuels and climate change. It wasn’t, however, the first article to suggest that our love for coal was wreaking destruction on our environment that would lead to climate change. The theory—now widely accepted as scientific reality—was mentioned in the news media as early as 1883, and was discussed in scientific circles much earlier than that. The French physicist Joseph Fourier had made the observation in 1824 that the composition of the atmosphere is likely to affect the climate. But Svante Arrhenius’s 1896 study titled, “On the influence of carbonic acid in the air upon the temperature on the ground” was the first to quantify how carbon dioxide (or anhydrous carbonic acid, by another name) affects global temperature.

Though the study does not explicitly say that the burning of fossil fuels would cause global warming, there were scientists before him who had made such a forecast. The earliest such mention that Quartz could find was in the journal Nature in December of 1882. The author HA Phillips writes: “According to Prof Tyndall’s research, hydrogen, marsh gas, and ethylene have the property to a very high degree of absorbing and radiating heat, and so much that a very small proportion, of say one thousandth part, had very great effect. From this we may conclude that the increasing pollution of the atmosphere will have a marked influence on the climate of the world.” Phillips was relying on the work of John Tyndall, who in the 1860s had shown how various gases in the atmosphere absorb heat from the sun in the form of infrared radiation.

Now we know that Phillips was wrong about a few scientific details: He ignored carbon dioxide from burning coal and focused more on the by-products of mining. Still, he was drawing the right conclusion about what our demand for fossil fuels might do to the climate. Newspapers around the world took those words published in a prestigious scientific journal quite seriously. In January 1883, the New York Times published a lengthy article based on Phillips’ letter to Nature, which said: “The writer who has partially discussed the subject in the columns of Nature has fixed upon 1900 as the date when the earth’s atmosphere will become entirely irrespirable. This is probably a misprint, for unless the consumption of cigarettes increases unlooked-for rapidly the atmosphere ought to remain respirable until 1910, or even 1912. At the latter date all mankind will have perished, and nothing except the hardier plants will be living on the surface of the earth.”

The EU is a failure of historical proportions economically, politically and above all morally.

• Refugee Camp On Lesbos Damaged In Riots As Rumors Fly (Kath.)

Migrants on Monday attacked the premises of the European Asylum Support Office (EASO) inside the Moria hot spot on the eastern Aegean island of Lesvos, completely destroying four container office units and damaging another two during a protest that was contained by riot police. Officials said the protesters, most of them men from Pakistan, threw rocks and burning blankets at the EASO facilities, allegedly frustrated at delays in processing their asylum applications. Riot police were called in to contain the riot. The blaze was put out by the fire service before it could cause further damage. There were no reports of injuries.

The violence at Moria prompted authorities on other migrant-hosting islands, including Chios, Samos, Kos and Leros, to beef up their security measures. Speaking on condition of anonymity, a local government official told Kathimerini that migrant riots were often triggered by rumors. “Refugees and migrants are told that if their facilities are destroyed they will have nowhere to stay and so they will be transferred to the mainland,” the source said.

Victoria Nuland’s neocon and Kiev coup instigator buddy. Bad news for Greece. Wonder what the pressure on Tsipras has been.

• Ex-US Ambassador To Ukraine Geoffrey Pyatt Now Ambassador To Greece (Kath.)

The official welcome ceremony for new US Ambassador to Greece Geoffrey R. Pyatt took place on the US 6th Fleet command and control ship USS Mount Whitney, in the port of Piraeus south of Athens, Monday. Earlier in the day, Pyatt presented Greek President Prokopis Pavlopoulos with his diplomatic credentials at the Presidential Mansion. The ceremony was attended by Foreign Minister Nikos Kotzias. Nominated by President Obama, Pyatt is widely regarded as an experienced diplomat. He previously served as US ambassador in Kiev and had to deal with the fallout of the Ukrainian crisis. His appointment comes at a key time for both Athens and Washington. Recent developments in the wider region have created challenges as well as opportunities for the two NATO allies. Obama is expected to visit Athens in November. Political and military officials have been exchanging visits ahead of the trip.

Home › Forums › Debt Rattle October 25 2016