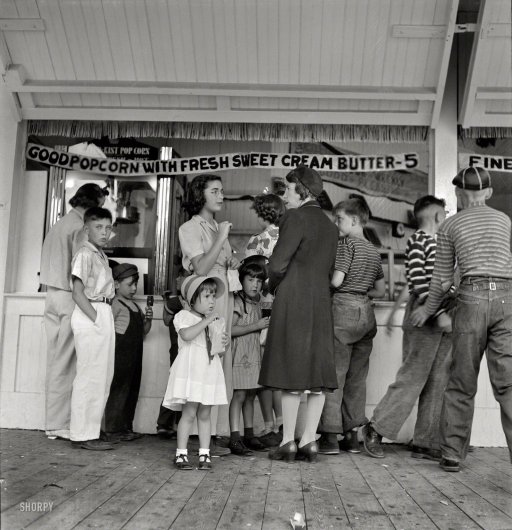

Russell Lee Columbia Gardens outdoor amusement resort, Butte, Montana Aug 1942

The folks at Bloomberg put this piece up today with the intriguing title‘Predictors of ’29 Crash See 65% Chance of 2015 Recession’, and I thought: wait a minute, that’s what people, lots of people, actually think, that there’s going to be recession. While still others will trust Morgan Stanley and Goldman Sachs, who, as the article put it, “posit an expansion that has plenty of room to run.”

For the vast majority of those in the world of finance, and probably in a much wider world, those are the options, because that’s how they think. Either more of the same, or a recession, as we know it in a cyclical sense, where the economic cycle goes up and down but in the end keeps turning up. And where any sudden moves are telegraphed well in advance by monetary authorities for the grace and benefit of them, the investors, so they don’t lose too much and can instead profit at every step, whether it’s up or down.

And then it dawned on me, which took a few seconds because that’s not how I see the financial system at all, I see neither a recession nor a helpful and friendly Fed, that this is why so much money is going to be lost by so many people. But then, from where I’m sitting, that’s the game, isn’t it? In a functioning market, someone needs to lose for someone else to gain. And the smartest prevail.

And y’all you want a real market, don’t you? One that reflects what’s really going on in the real economy?! Just so, you know, you’re not going to buy shares in companies that report numbers painted with big fat strokes of bright pink or shiny red lipstick on your porkchop.

The problem with this is that whatever money you manage to save in a collapse is money the major banks won’t be making. They’d much rather take it from you than let you keep it. And who do you think the Fed will turn out to be more friendly with, you or Jamie Dimon and the Oz behind his curtain?

if you take a good hard look at how the US – and EU and Japan – economies have developed over the past decade, there’s only one possible conclusion you can draw. Which is that these countries no longer have functioning markets. Without the multiple trillions in stimulus share prices would have been at a fraction of where they are now.

And then the question is how much longer that pretty much blind market support can continue. Well, it won’t be infinite. Because that would bankrupt nations too fast even for Wall Street’s international banks, but more importantly because those same banks are not making nearly enough money in the present set-up. And that’s the clincher.

But apart from what the Fed wants or doesn’t want, the fact remains that it has been instrumental in blowing the bubbles of the Dow and S&P to unforeseen heights. And that this has happened because through time investors started believing the Fed has their back. Countless ‘experts’ today will tell you that if markets start falling tomorrow, the Fed will step back in.

Really? To what end? If that were true, they might as well never have tapered. Because if anyone knows how the Fed has distorted the markets, it’s the Fed itself. So for all I know, they may simply think they’re done distorting. And that they can sit back and watch the, after all inevitable, collapse unwind.

Inevitable because the alleged progress and recovery we’ve seen since US QE started brings tears to your eyes when you look past the partly massaged and partly plainly made-up numbers that go into GDP and jobs reports. Wipe off all the lipstick from the American pig, and you’re left with no more than a handful meager slices of diet bacon.

The Fed knows this, I know this, and now you do too, but many investors don’t seem to be catching on. They are, instead, talking about the probability of a recession. But that’s not what lies ahead. We’re well, and fast, on our way to a deep depression. Nothing cyclical, unless perhaps you’re talking Kondratieff’s 70-year cycles.

Recession is a useless discussion by now. The US is a painted pig, the EU needs to let countries go or they’ll go to war, Japan hung its head in a noose for Halloween and China has its 32nd consecutive month of falling factory-gate prices.

Lower oil prices may for now hide some of the pain, but even that is too much for Japan, because of the deflationary effect of even less consumer spending. And it’s that lack of spending that’s everyone’s worst enemy. But you can’t solve that with central bank stimulus. The formerly rich world is loaded with burger flippers, food stamps and underwater homes, and that means less, not more, spending.

And we all know, though perhaps not by how much, that all ‘formerly rich’ governments have historically unequaled spin doctors on their payroll, so the real numbers across the board are much much worse even then what we are ‘allowed’ to know. And what we do know is already awful once you sweep away the propaganda. You’re only going to be OK as an investor if the Fed continues to hold your hand and lead you softly through the ups and downs. You really think they will?

Recession? In your dreams.

Home › Forums › Are You Expecting A Recession?