Marjory Collins Italian-American banner parade, Mott Street, NY Aug 1942

The UN said earlier this week that in east Ukraine over 1000 people – a conservative estimate – were killed during the last fortnight in the battles over Donetsk and Luhansk. Today, there are again reports of more heavy shelling by the Ukraine “army”, and dozens more deaths, while the Russian aid convoy is still not – allowed – anywhere near the cities.

At this rate, who’s going to be left to receive any of the food and generators and sleeping bags? I have a dark suspicion that if we don’t resolve this issue, and fast, we’re going to regret that for a very long time.

For “us” to be subsidizing this sort of military operation, a policy largely underwritten and justified by unsubstantiated blame claims in a media-wide campaign about a tragic plane crash 4 weeks ago to the day, is not something even a single one of us should be proud about, let alone happy.

We should all feel deep shame and guilt. How can we at the same time denounce one genocide and sponsor another? Our leaders may not care about a dead body or two more or less, but that doesn’t mean we shouldn’t either.

And how many hundreds of American soldiers are already back on the ground in Iraq again, while their army commanders emphasize the limited scope of air strikes? Are we supposed to just wait for the PR spin to serve up the justification for boots on the ground in their thousands? What’s it going to be this time? And how wrong is Ron Paul in suggesting this is a trap?

Whatever it is, we better make it fast, and step on the gas, or Europe will no longer be of much help. Well, either that or their domestic problems will; become the very driver for their involvement in warfare abroad. Even the Germans are sending support in Iraq now, right after the US announced they found there are far less Yazidi people on Mount Sinjar than someone told them there were. Perhaps they should all ask Putin to help. With both aid and intelligence.

And grout. The Mosul dam was built on gypsum and needs daily injections of grout – a liquified cement – or it falls to pieces. No need to bomb it. And that would mean flooding Baghdad – and the US multi-billion Green Zone. Mission accomplished.

However that may be, 6-7 years into the famed recovery, of which we’ve, come to think of it, seen about as little evidence as of the alleged rebel/Russian involvement in the plane crash, Germany’s GDP drops. Now, you’re thinking, so did US GDP earlier this year, and we spun our way out of that without a glitch. All under control, Captain, my Captain.

But Germany has 27 weaker vassal states on its back, and if it can’t even carry its own weight anymore, then what’s next? Obviously, there are plenty of experts claiming it’s a temporary thing, but when temporary gets to mean 6 years and more, it becomes meaningless.

Then again, so much in the propaganda machine we live in, that dictates what we think about the economy and about politics, is devoid of any real meaning, and the machine’s still going strong, fueled by the people’s unquestioning ignorance and their fear of losing their comfy plush caves. Baby, it’s cold outside. Older than Rome.

Spain was supposed to be the leading example of what weaker European brothers could do. Turns out, that was also just spin. Industrial production does not fall in economies recovering from gutter scraping circumstances. France is a basket case. A basket increasingly filled with stale bread and cheap wine.

Other EU nations report actual growth, but why should we believe any of them? Why should we believe any of this has to do with anything but appearances?

One country where keeping up appearances simply doesn’t work anymore – and that’s saying a lot these days – is Italy. A new young prime minister was elected on big promises – and already failed miserably. Nothing can save Italy as long as it’s part of the Eurozone. Or Greece, or Portugal, or Spain. Policies will be set according to what the richer nations want and need, and while the disadvantages of that can be hidden in times of plenty, they stand out all the more in poorer days.

On the surface, Italy doesn’t even seem to do that bad. It has a primary surplus, for one thing. It’s just that, as Ambrose Evans-Pritchard writes:

Output has collapsed by 9.1% from the peak, back to levels last seen 14 years ago. Industrial production is down to 1980 levels. [..] Bank loans to business are still falling at a rate of 4.5%. [..] The debt ratio may test 140% by the end of the year, uncharted waters for a country that effectively borrows in D-Marks.

It’s the debt that does in Italy, at least as long as it’s denominated in euros. Tempted by manufactured low yields on its bonds, Rome lets the debt soar on:

Ambrose calls for spending, he’s a Keynes man. To him, the failure is the resistance to more spending, in the spirit of the Fed, and Tokyo and Beijing, by Brussels – or Berlin.

But I think it would be, and would always have been, borderline lethal, since it would be like throwing debt on top of the debt Himalayas. There is a limit beyond which more spending cannot possibly be of any help, and the entire western world passed that limit many years and many trillions of dollars and yen and euros and liras ago. What’s left is the interest payments that are certain to burden us like so many Quasimodo’s for many years to come.

No, Ambrose has it right in some of his other comments

Mr Renzi is on his own. He faces an ECB that has fundamentally violated its contract with Italy, letting EMU-wide inflation fall to 0.4% knowing that this causes the Italian crisis to metastasise.

Italy must look after itself. It can recover only if it breaks free from the EMU trap, retakes control of its sovereign policy instruments and renominates its debts into lira, with capital controls until the dust settles. Italy would not face an immediate funding crisis since it has a primary budget surplus. Its net international investment position is -32% of GDP, compared with -92% for Spain and -100% for Portugal.

There is no easy way to leave the euro. The interlocking structures of monetary union have gone much further than a fixed exchange peg. Vested interests are powerful and merciless. But it is not impossible either.

The matter will surely come to a head as Italy’s debt trajectory hits the danger zone. This time it may not be quite so clear that the country wishes to be rescued on European terms. Mr Renzi may appropriately conclude that the only possible way to deliver on his Risorgimento for Italy, and to craft his own myth, is to gamble all on the lira.

I don’t see Matteo Renzi crafting his own myth, I don’t see him sticking around long enough. Someone’s got to take the blame, and no matter how much choice Italy has by now, there’s always room for one more.

But I do think that at some point Italy will see there are no other choices left but to be its own boss.

It’s just that the sooner it does, the better it would be by far. It’ll be much harder when everyone else is running for cover too.

It would seem however, that Italy’s own propaganda machine needs to be silenced first. And that’s never easy.

• Japan And Italy Break New Sovereign Debt Load Records (Zero Hedge)

With Japanese and Italy 10Y bond yields hitting all-time record lows (0.505% and 2.626% respectively), one could be forgiven for thinking that all-is-well as term or devaluation premia are oddly missing. However, as the following two charts show, Japan and Italy just broke another record – sovereign debt loads (1.038 quadrillion JPY and 2.17 trillion EUR respectively). Japan – having topped 1 Quadrillion early in the year – is marching ahead…

and Italy is not looking back – just look at that ‘austerity’…

Keynes would be proud…

• Italy’s Renzi Must Bring Back The Lira To End Depression (AEP)

Italy has been in depression for almost six years. The slump has been punctuated by false dawns, overwhelmed each time by the monetary amateurs in charge of EMU policy. The latest recovery fizzled after a single quarter. The economy is in technical recession again. Output has collapsed by 9.1% from the peak, back to levels last seen 14 years ago. Industrial production is down to 1980 levels. It takes spectacular policy errors to bring about such an outcome in a modern economy. Italy did not suffer anything like this during the Great Depression, clocking up growth of 16% between 1929 and 1939. But not even Mussolini was maniacal enough to pursue his Gold Standard delusions until the bitter end. The Italian authorities discern flickers of recovery, like fortress guards in Dino Buzzati’s Desert of the Tartars, deceived by optical illusions on the lifeless horizon. Bank loans to business are still falling at a rate of 4.5%. Moody’s says the economy will contract by 0.1% this year. Societe Generale is pencilling in -0.2%.

The property slump has not yet touched bottom. The Bank of Italy said the number of months needed to sell a house has risen to 9.4, from 8.8 late last year. The number reporting worsening market conditions has jumped from 19.6% to 34.7% in three months. “We can’t keep going any longer,” said the Taranto branch of Italy’s business lobby, Confindustria, in an open letter to the country’s president. The region is becoming an “industrial desert”, it warned, with small companies on the brink of mass closures and lay-offs. The lethal mix of economic contraction and zero inflation is causing Italy’s debt trajectory to spiral upwards, despite austerity and a primary surplus of 2% of GDP. Public debt jumped to 135.6% in the first quarter from 130.2% a year earlier. This is a mechanical effect, the result of a compound interest burden on a static nominal base. Real interest rates on Italy’s €2.1 trillion stock of debt – with an average maturity of 6.3 years – is actually rising as deflation draws closer.

• German GDP Contracts as French Economy Stagnates (WSJ)

Germany’s economy contracted while France’s stagnated in the second quarter, indicating the euro zone’s yearlong recovery may have stalled, and likely pressuring policy makers to come up with some new ideas for boosting growth. The euro zone’s largest economy contracted 0.2% in the three months to June, Germany’s federal statistics office said, the first decline in output since the start of 2013. Compared with the second quarter of 2013, output was up 1.2%. Economists polled by The Wall Street Journal last week said they expected the economy to shrink 0.1% on the quarter and grow 1.4% in annual terms. Destatis said that net trade was a drag on growth, as import growth outpaced export growth. Construction investment declined, but Destatis said this was due to projects being pushed forward because of the unusually mild winter. Both private and public consumption rose compared with the first quarter, the statistics office said.

Earlier on Thursday, figures from France’s statistics agency showed the euro zone’s second-largest economy failed to record any growth for the second successive quarter in the period April through June. Economists polled by the Journal had expected a 0.1% expansion in gross domestic product in the second quarter from the first. Compared with the same period of 2013, GDP was up just 0.1%. Figures published earlier this month showed Italy’s economy also contracted in the second quarter, by 0.2%. The data released Thursday mean that none of the euro zone’s three largest economies—which account for two thirds of the currency area’s output—expanded in the three months to June, making it unlikely that the euro zone as a whole managed to generate any growth.

• Eurozone Woes Deepen As Spain’s Industry Slumps (Guardian)

Hopes for a recovery in the eurozone suffered another blow on Wednesday with figures showing industrial output fell for a second successive month. Production declined across the 18 eurozone members by an average 0.3%, with a return to growth in France and Italy offset by falls in Ireland and the Netherlands and slow progress in Germany, which struggled to 0.2% growth. Spain was the worst hit of the currency bloc’s major economies with a 0.8% drop in industrial production. It also suffered the sharpest drop in shop prices for five years, undermining Madrid’s claim that a rebound in employment last month was a clear indication of the country’s return to sustained growth. Spanish consumers have proved reluctant to spend on the high street while unemployment remains at around 25%, forcing shops to offer bigger discounts in July than June.

Weakness across the manufacturing, energy and mining sectors will pose a problem for Brussels and the European Central Bank (ECB), ahead of second-quarter GDP figures on Thursday that are expected to show a further slowdown from the 0.2% growth in the first three months of the year. The €9.6tn economy is struggling to gain momentum with its recovery a year after exiting recession. High unemployment, sluggish reforms and the fallout from conflict in Ukraine, Gaza and Iraq are holding it back. The latest sign of just how fragile the eurozone’s economic rebound remains came this week, after German investor sentiment dropped to its lowest level since December 2012 on concerns that European sanctions against Russia will harm exports.

A worldwide new metric?!

• German GDP Set To Swell On Sex, Drugs And Weapons (DW)

What do research and development, prostitution, drug smuggling and arms trafficking have in common? They are all seen as economic activities, and starting Sept. 1, they will be counted as part of Germany’s annual economic performance, or gross domestic product, in line with new calculation standards. The new figures include revenues from prostitution and the sale and smuggle of illegal drugs. “All relevant economic activities should be counted without any moral judgement,” Norbert Räth from Germany’s statistical office, Destatis, told DW. According to official estimates, there are around 400,000 prostitutes in Germany, 20,000 of whom are men. Altogether they earn €14.6 billion ($19.5 billion) a year. Minus various expenses, such as rent in brothels, work attire and condoms, and the statisticians get a gross value added of roughly €7.3 billion. For drugs, it is the same story. Surveys commissioned by the Federal Health Ministry allow officials to estimate the prevalence of drug use in Germany.

This figure is then multiplied by the respective prices on the black market – something Germany’s Federal Criminal Police Office knows very well. Even the amount of money the state spends on armaments is now subject to the new rules. “The production of weapons has, of course, always been included,” Räth said. But until now those costs had always been written off as a state expense. Now they are considered an investment. Now countries in the EU have a uniform method of calculating their GDPs. And when new items are added to GDP calculations, it grows. One could speculate that there is an ulterior motive behind the new system, namely one that sugarcoats Europe’s sovereign debt. Even if overall debt is not reduced, the debt ratio sinks when GDP increases. “We are going to have to categorically deny that,” said Norbert Räth from Germany’s statistical office, Destatis. “The whole process is not politically motivated. It hasn’t been all along.”

“Could debt diabetes be right around the corner?”

• The Shale Sugar Lick (EnergyPolicyForum)

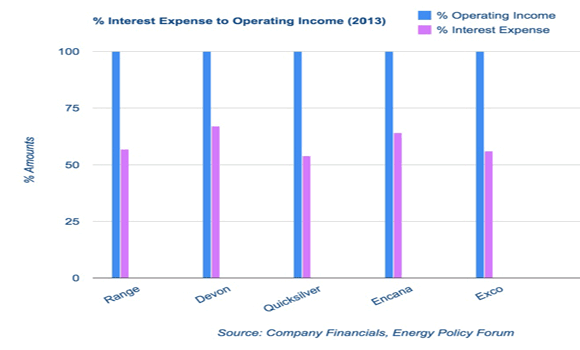

A well known American comedian, Ron White, quips about the amount of sugar Americans eat by suggesting that certain restaurants install a sugar lick. Patrons can “belly up” and take their fill at the trough. Such an analogy might be apropos of some shale operators with regard to their addiction to debt. A useful metric when evaluating a company is to look at the ratio between interest expense and operating income. A low ratio means that the company has not needed to borrow great sums of money to keep going. It generates sufficient cash to fund future operations without exorbitant levels of debt or shareholder dilution from issuing more stock. Examining a selection of shale operators who are active in various plays in the US, one sees an interesting pattern. Perhaps it would be useful to define operating income. Operating income is gross income minus day to day costs of running the business including salaries and then subtracts depreciation. It is a metric that investors use to determine how much potential profit a company might generate.

Obviously it gives a more accurate picture of a firm’s profitability than simply gross income because costs have been removed. But not interest expense. Recently, the oil and gas industry’s appetite for debt has exploded primarily because cash is not being generated by the underlying business proportional to its needs. This is particularly true of some shale operators. EIA, the forecasting arm of the US Department of Energy, quantified this appetite for debt. EIA stated: “The gap between cash from operations and major uses of cash has widened in recent years from a low of $18 billion in 2010 to $100 billion to $120 billion during the past three years.” To demonstrate how this phenomenon translates to a company’s financial statement, one need only to examine the ratio between interest expense and operating income. The following chart shows the percentage of total operating income, or potential profit, that is being eaten up by nothing more than interest paid on debt at Range Resources, Devon Energy, Quicksilver Resources, Encana and Exco.

Shale operators have, indeed, parked themselves at the sugar lick debt trough for quite some time now. Could debt diabetes be right around the corner?

• Ron Paul: “This Is Exactly What Osama Bin Laden Wanted” (RT)

Even if the US abandons its efforts, Paul added, assistance provided to other groups throughout the region may end up sabotaging attempts to dismantle the Islamic State if weaponry trickles downs into the hands of militants. Firepower already provided by the Pentagon in and around Iraq has found itself in the wrong hands, Paul said, and the only solution to prevent further unintended consequences is to keep America out of international conflicts altogether. “I would stick to the basic principle that we have a strong national defense, we defend our national security, we don’t get involved in fights around the world, we don’t get involved in civil strife and civil wars and especially what was going on in the middle east,” he said, “so no, I think the argument stands on its own merits that we shouldn’t be involved in doing this.”

“I think the sooner we get out of there the better,” Paul told David. “We don’t have a moral responsibility; we don’t have a constitutional responsibility. It has nothing to do with our national security. It in jeopardizes our national security and is bankrupting our country.” What’s more, Paul added, is that the US government’s ongoing meddling in the Iraqi affair and other incidents is falling exactly in line with Al-Qaeda. According to Paul, terrorists have long intended to take the US down by wasting its resources on campaigns, the likes of which have been called fodder for some by further fanning the flames of anti-American sentiments through military action carried out in far apart countries. “This is exactly what Osama bin Laden wanted,” Paul said. “He wanted to engage us over there because he said, ‘I’ll bring you down like I brought the Soviets down.’ We are doing the same thing because we flat out can’t afford it. It’s a failed policy. I think after so many years and so many decades we ought to admit the truth.”

• Another War In Iraq Won’t Fix The Disaster Of The Last (Guardian)

The media and political drumbeat is growing louder for Britain to move from humanitarian aid drops to join the military campaign. France has announced it will be arming Iraqi Kurdish forces. There are already 800 US troops back on Iraqi territory. Without a trace of irony, Colonel Tim Collins, who famously claimed on the eve of the 2003 invasion that British troops were occupying Iraq to “liberate” it, yesterday led the call for yet another military intervention. If ever there was a case for another Anglo-American bombing campaign, some say, this must surely be it. Graphic reports of the suffering of tens of thousands of Yazidi refugees on Mount Sinjar and the horrific violence that has driven the Christians of Qaraqosh from their homes have aroused global sympathy. The victims of this sectarian onslaught need urgent humanitarian aid and refuge.

But the idea that the states that invaded and largely destroyed Iraq at the cost of hundreds of thousands of lives should claim the cause of humanitarianism for yet another military intervention in Iraq beggars belief. If the aim were solely to provide air cover for the evacuation of Yazidis from Sinjar, there are several regional powers that could deliver it. The Iraqi government itself could be given the means to do the job – something its US sponsors have denied it until now. In fact, the force that has done most so far to rescue Yazidis has been the Kurdish PKK, regarded as a terrorist organisation by the US, EU and Turkey. But after decades of lawless unilateralism, any armed intervention for genuine humanitarian protection clearly has to be authorised by the United Nations to have any credibility. As the Labour MP Diane Abbott put it, that’s what the UN is for – and authorisation could be quickly agreed by the security council. But of course it’s not just about the Yazidis or the Christians.

As Obama has made clear, they’re something of a side issue compared with the defence of the increasingly autonomous Iraqi Kurdistan – long a key US and unofficial Israeli ally – and American interests in its oil boom capital Irbil, in particular. The US is back in Iraq for the long haul, the president signalled, spelling out that his aim is to prevent IS establishing “some sort of caliphate through Syria and Iraq” – which is exactly what the group regards itself as having done. The danger of the US, Britain and others being drawn again into the morass of a disintegrating state they themselves took apart is obvious. IS, then known as al-Qaida in Iraq, itself effectively arrived in the country in 2003 on the backs of US and British tanks. The idea that the states responsible for at least 500,000 deaths, 4 million refugees, mass torture and ethnic cleansing in Iraq over the past decade should now present themselves as having a “responsibility to protect” Iraqis verges on satire.

• Iraq’s Mosul Dam Demands 24/7 Maintenance (Zero Hedge)

Last week, the barbaric Islamic State (IS) seized the vitally important Mosul dam, dramatically impacting tactical options against them and potentially changing the future of the Middle East. When the US coalition forces invaded Iraq in 2003, military intelligence developed invasion scenarios. One scenario included Iraqi forces placing detonation charges at the vitally important dam. If US forces were able to safely secure the dam, then they had a contingency plan to operate it and ensure critically important maintenance. The US quickly discovered the necessity for $27 million worth of frantically urgent repairs. Since the dam was completed in the mid-1980’s it has required continuous (daily) maintenance, because it was built on top of gypsum, a soft mineral which dissolves when in contact with water. More than 50,000 tons of materials have been injected into the dam since 1986. The ‘sink hole’ type of cavities that constantly form have to be expeditiously plugged with “grout”, a liquefied mixture of cement and other additives.

A dam break does not require sabotage. Maintenance failure has the same result. In December of 2006, the US Army Corp of Engineers (USACE) detailed a comprehensive report on the dam’s structure. The report called it, “the most dangerous dam in the world”, stating that even water pressure could buckle the flimsy foundation. The Mosul dam is the fourth largest in terms of reservoir capacity in the Middle East with a capacity of 3 trillion gallons or 11.1 billion cubic meters. It is a key component of Iraq’s power grid and source of water for irrigation. It is located 31 miles north of the city of Mosul whose population is 1.7 million and 200 miles north of Bagdad. A dam collapse would release the 360 feet high waterline and reach Mosul in 2 hours. A USACE official wrote a report in 2011 that was published in Water Power magazine estimating that dam failure could lead to as many as 500,000 civilian deaths.

In 2007, General Petraeus wrote a letter to the Iraqi PM warning of the safety concerns in the report and the consequences should the dam fail. In paraphrasing the USACE report, his letter said that “despite continuous grouting… the safety of the dam cannot be assured”. He went on to say that “…an instantaneous failure….could result in a flood wave 65 feet deep at the city of Mosul… and produce flooding all the way to Baghdad”. President Obama recently authorized limited airstrikes in Iraq against IS. He said they were to prevent a humanitarian crisis and to protect American lives and assets in Erbil and Baghdad. He determined that there was risk of ‘genocide’ of the tens of thousands of Yazidis people trapped by IS in the mountains, as well as, risks to the consulate and American workers there, should Erbil be toppled. There is still hope on both fronts.

However, the greatest foreign policy failure to date in trying to prevent a potential ‘genocide’ is arguably allowing IS to take over the dam in the first place. The US has always known the importance of the dam. Furthermore, just as we had the ability to get Bin Laden at Tora Bora and failed to act, US officials knew that the IS leadership was assembled in one place and decided not to take them out.

• Iraq’s Mosul Dam Needs US Boots On The Ground (Kotok)

History is replete with examples of bridges and dams threatened by warfare. The winning side wants to hold them. The losing side wants to destroy them. Or they can be used to gain a military advantage. In the August 12 issue of the Wall Street Journal, there is a map of Iraq that illustrates the situation with Mosul Dam, as reported in “Limits of Airstrikes Hinder U.S. Policy in Iraq.” Think about what happens if IS (Islamic State) loses and has to withdraw from the dam. Their actions will be just what we can contemplate, unless there is an intervention by skilled ground forces that can overwhelm them prior to their blowing the dam. The alternative is that IS prevails and holds the dam, in which case there are very serious implications for the region, including the danger that the dam will fail simply because it is not being maintained properly.

This is a catch-22. In psychological terms, it is an avoidance-avoidance conflict. There are no easily determined good outcomes. Think about oil production in the broader region, the populations imperiled downstream from the dam, and this murderous and merciless foe called IS. We confront a high probability of an adverse outcome regardless of the actions of the combatants on both sides. There is no easy out. A 2006 report by the US Army Corps of Engineers called Mosul Dam “the most dangerous dam in the world.” The dam was so poorly constructed, on such problematic (gypsum-rich) ground, that it requires daily injections of a mixture of cement, sand, and water – grout – into the voids that are forming under the dam. These injections ceased nearly a week ago when IS captured the dam and nearly all dam personnel fled.

So even if IS does not blow the dam, or even if Kurdish or Iraqi forces recapture it, the dam may be so compromised that it ruptures, sending a 65-foot wave down the Tigris River to smash the city of Mosul (just 30 miles downstream) and flood large portions of Baghdad (the US says its embassy there is threatened). The time for easy outs passed some time ago, when the US might still have been able to assert air superiority over the region before IS strengthened. At this point IS is using captured American weapons and financial assets in order to grow even stronger. We can use our targeted bombing to help rescue thousands of civilians. We can attempt to supply and arm the apparent alliances that are anti-IS and that reside in the Kurdish areas. But without the commitment of highly skilled American ground troops in large numbers, we cannot safeguard dams, rivers, or bridges – or the people of Mosul and Baghdad.

Of course.

• Stated Income Loans Make Comeback As Mortgage Lenders Seek Clients (Reuters)

Mortgage applicants who can’t provide tax returns or pay stubs to show their income are getting stated income loans again as companies such as Unity West Lending and Westport Mortgage chase customers they can no longer afford to ignore. Lenders say these aren’t the same products as the so-called “liar loans” that were pervasive before the housing bust. Instead, the loans are going to borrowers such as small business owners or investors buying properties they intend to rent who can demonstrate an ability to repay, verifiable through bank or brokerage statements. Lenders said they look for enough assets to pay six to 12 months of payments, while also demanding high down payments to reduce the chance of default. “This is not a return to the wild and wooly days of, if you fogged the mirror, you can have a loan,” said Paul Lebowitz, founder of Westport Mortgage. “They have a smarter edge to them now.”

Some rival lenders said the stated income loans on offer could be abused if borrowers fudge bank statements or don’t have enough money to repay the loan. None of the three biggest banks offer them. Sam Gilford, a spokesman for the Consumer Financial Protection Bureau, said the agency is concerned, though he wouldn’t say whether it is investigating them. The CFPB’s rules don’t give specific minimums for assets required to demonstrate an ability to repay a mortgage, but critics said a year’s worth of payments for a three-decade loan may not be enough. “It’s easier to falsify bank statements than income tax returns,” said Julia Gordon, director of housing finance and policy at the Center for American progress. To avoid the housing-bust taint, the new stated income loans are being called such things as “alternative documentation loans,” “portfolio programs,” “alternative-income verification loans” and “asset-based loans.”

The banks rule in Japan as much as in Europe and the US.

• Japan Megabanks’ $800 Billion Cash Pile Shows Abe Task (Bloomberg)

Prime Minister Shinzo Abe has succeeded in wrestling down the yen and snapping a 15-year deflationary spiral. The challenge of spurring lending by the country’s cash-hoarding megabanks remains. The nation’s three largest lenders increased their cash and deposits with other financial institutions 5.7 percent in the quarter to June to 82 trillion yen ($800 billion) from the previous three-month period, earnings data show. New loans by Mitsubishi UFJ, Mizuho Financial Group and Sumitomo Mitsui Financial Group fell 329 billion yen to 239.1 trillion yen. Abe needs to spur lending after the world’s third-largest economy shrank at an annualized 6.8 percent in the second quarter due to an April sales-tax increase aimed at curbing the world’s biggest debt burden.

While the banks can no longer park excess cash in sovereign debt amid expectations for higher yields, falling loan rates have narrowed the spread over deposit payments to levels that discourage extending credit, according to Moody’s Investors Service. “The big three are at a turning point,” said Graeme Knowd, an associate managing director who oversees corporate and financial institutions at Moody’s in Tokyo, in an interview. “They haven’t really taken credit risk for a long time. If Abenomics works, they need to reorient the business model.” Deposits at Japanese financial institutions exceeded loans by 192.5 trillion yen last month, according to Bank of Japan data. The surplus reached a record high 194.2 trillion yen a month earlier.

Not stagflation, deflation.

• Stagflation Stalks Abenomics (Bloomberg)

Maybe it’s time to stop dismissing the risk of stagflation in Japan. I’ve raised this risk a couple of times during the last 12 months as inflation rose without commensurate increases in wages or productivity. But yesterday’s ugly gross domestic product report suggests it’s a clear and present threat to Japan’s best chance at economic recovery in more than a decade. The collective reaction yesterday to the 6.8% plunge in second-quarter growth seemed to be: “Relax, it could’ve been worse.” After all, many economists were braced for a 7%-plus contraction following an ill-timed and ill-conceived consumption-tax increase in April. Yet the detail of the report – and the balance of other recent data – point toward a period of sluggish growth, at best, and continued inflation gains.

Thanks to the Bank of Japan’s unprecedented easing and the yen’s 16 percent drop during Prime Minister Shinzo Abe’s term, consumer prices rose 3.6% in June from a year earlier. That wouldn’t be a problem if incomes and productivity weren’t walking in place.The 5% drop in inflation-adjusted consumption in the second quarter, meanwhile, was even greater than the recession-causing sales-tax hike of 1997, observes Richard Katz, publisher of the Oriental Economist Report. There’s evidence, too, that the gains in corporate profits that the weaker yen delivered to manufacturers is fading. Last week, Toyota stuck with a forecast for net income to drop from last year’s record $17.8 billion. Now, Japan’s largest carmakers are hunkering down for slumping domestic sales, highlighting the damage to demand by the 3 percentage point increase in the sales levy. Panasonic also is struggling as its fixed costs rise and demand for electronics in Japan wanes. Optimism that deflation has been defeated ignores the sources of today’s price increases. With the nation’s nuclear reactors switched off for safety reasons, Japan is importing expensive energy with devalued yen. This, along with doubts about the trajectory for household demand, helps explain why companies aren’t increasing wages to offset the effects of inflation.

Sounds good, but …

• Small Chinese Cities Swap GDP For Quality Of Life Metrics (FT)

More than 70 Chinese smaller cities and counties have dropped gross domestic product as a performance metric for government officials, in an effort to shift the focus to environmental protection and reducing poverty. The move, which follows a directive issued by top leaders last year, is among the first concrete signs of China switching its blind pursuit of economic growth at all costs towards measures that encourage better quality of life. Analysts say that adherence to GDP as a performance metric – thus linking it to local officials’ promotion – has contributed to environmental degradation and urban sprawl as officials encouraged heavy industry and bulldozed agricultural land to build housing developments.

“Using GDP as the main assessment method has caused a lot of problems, like unequal income distribution, problems with the social welfare system and environmental costs,” said Xie Yaxuan, head of macroeconomic analysis at China Merchants Securities in Shenzhen. Hebei, a steelmaking province north of Beijing, and Ningxia, an impoverished ethnic minority region in northwest China, have cancelled GDP-based assessment for poor counties and cities, the official Xinhua news has reported in recent months. Evaluation will instead be based on raising living standards for poor residents and reducing the number of people living in poverty.

Does Beijing control it all? I think not.

• China’s Credit Slowdown: A Default Risk? (CNBC)

China’s sharp credit growth slowdown in July may signal rising default risks in some parts of the economy, analysts said. “The phase of unchecked shadow banking growth is over, while the housing downturn is not,” Wei Yao, an economist at Societe Generale, said in a note Wednesday. China’s debt levels – which soared to 250 percent of gross domestic product (GDP) according to some estimates – have been a major concern for years, spurring fears that the borrowing surge is fueling a dangerous property bubble and overcapacity in many industries, including steel, mining and solar energy, any of which could face collapse as the economy slows and Beijing tries to choke off overinvestment. In July, the total social financing (TSF) aggregate fell to 273.1 billion yuan ($44.34 billion), indicating the amount of money flowing into China’s economy slowed to the lowest monthly reading since the October 2008 depths of the global financial crisis.

Some are concerned about the decline in new shadow banking, particularly for the trust funds. “The trust fund industry is the single largest funding provider behind the wave of leveraging up among the local governments and property developers over the recent years,” Dong Tao, an economist at Credit Suisse, said in a note Wednesday. Tao cited data from the China Trust Industry Association which showed the trust industry’s assets under management hit a record high of 12.48 trillion yuan in the second quarter, but asset growth was only 6.4 percent from the previous quarter, the slowest since data became available. “The decline in capital influx for trust funds will likely have direct implications on funding for infrastructure and property projects,” Tao said. “It also threatens the ability of debt repayment of these players when the debt matures.”

They already have new loan provisions, just more sneaky ones.

• China Seen Taking Steps to Aid Growth After Credit Plunge (Bloomberg)

China’s plunge in credit expansion last month and unexpected slowdown in investment spending flashed warnings on growth that investors and economists bet will spur policy makers to expand stimulus. Barclays is forecasting two second-half interest-rate cuts, while Australia & New Zealand Banking Group said a reduction in banks’ reserve requirements is imminent. A front page story today in the official China Securities Journal said monetary policy will continue to “lean towards relaxation amid a stable stance.” A property slump and dangers from rising bad loans are making it tougher for Premier Li Keqiang to sustain the fastest growth in the Group of 20 nations. Any stimulus would build on measures this year to expedite railway spending, free up money for loans for small businesses and channel funds toward building low-income housing.

“The top concern right now is to make sure the economy can be reasonably smooth in its growth, rather than controlling the risks,” said Li Daokui, a former PBOC academic adviser who’s a professor at Tsinghua University in Beijing. Aggregate financing was 273.1 billion yuan ($44.4 billion) in July, the central bank said yesterday, contrasting with a Bloomberg LP gauge that showed China loosened monetary conditions last quarter at the fastest pace in almost two years. The PBOC measure includes bank loans, corporate bonds and shadow-finance categories such as entrusted loans. The credit number compared with the 1.5 trillion yuan median estimate of economists, while new local-currency loans of 385.2 billion yuan were half of projections. M2 money supply grew a less-than-anticipated 13.5 percent from a year earlier. “It is important for both monetary and fiscal policy easing to continue in the coming months,” Shen Jianguang, chief Asia economist at Mizuho Securities Asia Ltd. in Hong Kong, said in an e-mail.

Not surprised.

• 1 in 3 US Soldiers May Not Get Post-Trauma Help Under New Rules (Bloomberg)

Some U.S. soldiers suffering from post-traumatic stress disorder after service in Iraq and Afghanistan may not be diagnosed with the condition because of new guidelines to assess the illness, a study found. About 1 in 3 soldiers found to have PTSD under the previous diagnostic standards were missed by the new criteria, according to today’s research in the journal the Lancet Psychiatry. About 5.2 million adults in the U.S. suffer from post-traumatic stress disorder each year, according to the U.S. Department of Veterans Affairs. Today’s study, one of the first to compare the two sets of diagnostic standards in infantry soldiers, shows that more research is needed to determine how the new rules will affect patient care, said Charles Hoge, the lead study author and a senior scientist at Walter Reed Army Institute of Research in Silver Spring, Maryland.

“For military service members and veterans if they’ve been treated for PTSD or are in treatment for PTSD according to the old criteria, their diagnosis isn’t going to change,” Hoge said in a telephone interview. “New people coming into treatment now, it is possible some of those individuals would’ve gotten a diagnosis of PTSD but they are not receiving that diagnosis now.” People who have post-traumatic stress disorder experience flashbacks, nightmares and mood swings that disrupt their daily lives. The disorder is best known for occurring in veterans of war or victims of an assault.

We’ll get wet feet denying it.

• Antarctic Melt May Lift Sea Level Faster in Threat to Megacities (Bloomberg)

Antarctica glaciers melting because of global warming may push up sea levels faster than previously believed, potentially threatening megacities including New York and Shanghai, researchers in Germany said. Antarctica’s ice discharge may raise sea levels as much as 37 centimeters (14.6 inches) this century if the output of greenhouse gases continues to grow, according to a study led by the Potsdam Institute for Climate Impact Research. The increase may be as little as 1 centimeter, they said. “This is a big range, which is exactly why we call it a risk,” Anders Levermann, the study’s lead author, said in a statement. “Science needs to be clear about the uncertainty so that decision makers at the coast and in coastal megacities can consider the implications in their planning processes.”

NASA estimates the glaciers in the Amundsen Sea region contain enough water to raise global sea levels by 4 feet (1.2 meters) and in May said the glacier melt may have become “unstoppable.” The Potsdam institute’s projections for this century’s sea level contribution are “significantly higher” than the latest upper-end projections from the Intergovernmental Panel on Climate Change, it said. “Earlier research indicated that Antarctica would become important in the long term,” Levermann said. “But pulling together all the evidence it seems that Antarctica could become the dominant cause of sea level rise much sooner.”

Death toll is probably much higher.

• African Nations Apply Medieval Measures To Halt Ebola Spread (NY Times)

The Ebola outbreak in West Africa is so out of control that governments there have revived a disease-fighting tactic not used in nearly a century: the “cordon sanitaire,” in which a line is drawn around the infected area and no one is allowed out. Cordons, common in the medieval era of the Black Death, have not been seen since the border between Poland and Russia was closed in 1918 to stop typhus from spreading west. They have the potential to become brutal and inhumane. Centuries ago, in their most extreme form, everyone within the boundaries was left to die or survive, until the outbreak ended. Plans for the new cordon were announced on Aug. 1 at an emergency meeting in Conakry, Guinea, of the Mano River Union, a regional association of Guinea, Sierra Leone and Liberia, the three countries hardest hit by Ebola, according to Agence France-Presse. The plan was to isolate a triangular area where the three countries meet, separated only by porous borders, and where 70 percent of the cases known at that time had been found.

Troops began closing internal roads in Liberia and Sierra Leone last week. The epidemic began in southern Guinea in December, but new cases there have slowed to a trickle. In the other two countries, the number of new cases is still rapidly rising. As of Monday, the region had seen 1,848 cases and 1,013 deaths, according to the World Health Organization, although many experts think that the real count is much higher because families in remote villages are avoiding hospitals and hiding victims. Officials at the health organization and the Centers for Disease Control and Prevention, which have experts advising the countries, say the tactic could help contain the outbreak but want to see it used humanely. “It might work,” said Dr. Martin S. Cetron, the disease center’s chief quarantine expert. “But it has a lot of potential to go poorly if it’s not done with an ethical approach. Just letting the disease burn out and considering that the price of controlling it — we don’t live in that era anymore. And as soon as cases are under control, one should dial back the restrictions.”

Not good.

• Ebola A ‘High Risk’ In Kenya, East Africa, WHO Warns (RT)

The World Health Organization (WHO) has said that Kenya is at “high risk” of the spread of the deadly Ebola virus because it is a major transport hub, with several flights a day to West Africa where the disease is running riot. This is the most serious warning to date that the disease could spread to East Africa. So far it has been limited to West Africa, where it has ravaged Guinea, Sierra Leone and Liberia, killing more than 1,000 people. Nigeria, Africa’s most populous country, is the latest to be hit. The country of over 150 million people has now seen three deaths from Ebola. Although health checks have been stepped up in Nairobi airport in recent weeks, the Kenyan government has said it will not ban flights from the four countries hit by Ebola, because of the porous borders between African countries. There more than 70 flights a week between Kenya and West Africa. “We do not recommend a ban of flights because of porous borders,” said Kenyan health cabinet secretary James Macharia.

Home › Forums › Debt Rattle Aug 14 2014: Life and Times in Propagandistan