Arthur Rothstein “Migrant agricultural workers, Deerfield, Florida” January 1937

I know you thought you’d seen some crazy stuff, but it’s going to get better, promise!

On the one hand you have Greek politicians claiming their economy is doing so well, they’ll present the troika with a big feel good surprise. On the other, Greek unemployment reached a new high at 28%, with youth unemployment now at 61.4%. That’s almost 2/3 of young people. What is to become of them?

On the one hand Italy sold debt today at record low rates, on the other its bickering and infighting government is teetering on the edge. Wonder who’s been buying the debt. Could one of the super Mario’s be involved?

On the one hand folks claim that the emerging market problems will have little effect on US financial markets, on the other US companies are starting to feel serious pain from those same problems. Not only do sales in developing markets fall, they’ve also invested a lot of money in them, anticipating huge growth potential. Oops.

On the one hand the UK government boasts a strong recovery and claims that is due to their brilliant economic policies, on the other BOE Governor Carney says he can’t lift interest rates because the recovery is “neither balanced nor sustainable”.

On the one hand the Yellen Fed stays a tepid taper course despite all the US recovery stories, without daring to even ponder interest rate rises, on the other Chinese official powers have gotten so spooked by the size and leverage of the shadow bank system they get real about tightening and interest rates, in the face of a sharp fall in auto sales growth, and an ominous default of a shadow bank investment product backed by a loan to a flat broke coal company.

On the one hand the OECD has been pushing rosy forecasts about anything anyone wanted to hear, on the other they are now forced to admit those forecasts were, essentially, made up out of thin air. Still, what looks like a great way to disqualify oneself :“Challenges were compounded by the unusually high speed and depth of cross-country interconnections between real and financial developments, the increased variability of economic growth compared with the pre-crisis period, the lack of timely data on many important financial factors, and the limited understanding of macro-financial linkages … “, will instead undoubtedly only be used to keep on churning out the nonsense. That’s both its MO and the reason it’s so royally funded, after all.

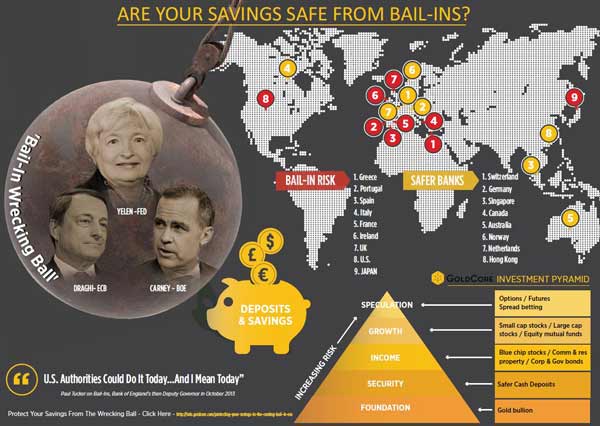

But the grand crazy stuff prize for the day goes to the Reuters article that details a leaked European Commission report in which Brussels considers confiscating (not their word of choice) 500 million Europeans’ personal savings and use them “to fund long-term investments to boost the economy and help plug the gap left by banks since the financial crisis.”.

“The economic and financial crisis has impaired the ability of the financial sector to channel funds to the real economy, in particular long-term investment ..”. That’s right, after all the bail-outs and nationalizations and stimuli, there’s still so much – bad – bank debt hidden in shady ledgers, there’s nothing left to lend out.

But wait, there is a source of wealth left. People have savings in bank accounts, and those are all registered digitally, so we know exactly what everyone has. We’ll take that, give them some sort of guarantee they will think is valid, and hand it to the banks. Who can then lend it out to the same people whose savings these are in the first place, and charge interest for the privilege. That’ll boost the economy!

Now, of course, if you’re like me, you first wonder what the root of the word “savings” is again, and then you’re also thinking, hold on, we’re talking about the same savings deposits the banks have used as collateral for their highly leveraged wagers, that they then lost. Right?

So those savings are already in the banks, but the banks’ “ability to channel funds to the real economy” is still “impaired”. But how can it be that Brussels, when it confiscates the savings, magically solves this impairment? What sleight of hand is this?

Well, they are talking about creating a secondary market for trading corporate bonds in the EU. But that doesn’t guarantee any trades will actually take place. The reason those bonds don’t sell is that not enough people want to buy them.

No, the real Brussels magic consists of reviving securitization markets. The banks will securitize loans and other “products”, which means they’ll slice and dice and tranche them, and sell them on to greater fools. Like you. Only this time, they’ll do so with the – implicit – backing of your savings. And let’s be fair: if you allow them to do this with your savings, you’re a prime candidate for them to sell their “securities” to (in finance, nothing means what it used to, “savings” are not safe and “securities” are anything but secure).

And no, you’re not mistaken: that is indeed the very model that broke the global financial system’s back in the first place.

There is no doubt in my mind that these ideas will be spun in ways that focus on triggering people’s feel good factors to such a degree the vast majority will actually leave their savings in the bank.

If I were you, I would think twice about going that route.

Pic: Gold Core

Here’s Tyler Durden’s version of the EU savings story:

• Europe Considers Wholesale Savings Confiscation (Zero Hedge)

At first we thought Reuters had been punk’d in its article titled “EU executive sees personal savings used to plug long-term financing gap” which disclosed the latest leaked proposal by the European Commission, but after several hours without a retraction, we realized that the story is sadly true.

In a nutshell, and in Reuters’ own words, “the savings of the European Union’s 500 million citizens could be used to fund long-term investments to boost the economy and help plug the gap left by banks since the financial crisis, an EU document says.” What is left unsaid is that the “usage” will be on a purely involuntary basis, at the discretion of the “union”, and can thus best be described as confiscation.

The source of this stunner is a document seen be Reuters, which describes how the EU is looking for ways to “wean” the 28-country bloc from its heavy reliance on bank financing and find other means of funding small companies, infrastructure projects and other investment. So as Europe finally admits that the ECB has failed to unclog its broken monetary pipelines for the past five years – something we highlight every month, the commissions report finally admits that “the economic and financial crisis has impaired the ability of the financial sector to channel funds to the real economy, in particular long-term investment.”

The solution? “The Commission will ask the bloc’s insurance watchdog in the second half of this year for advice on a possible draft law “to mobilize more personal pension savings for long-term financing“, the document said.”

Mobilize, once again, is a more palatable word than, say, confiscate.

And yet this is precisely what Europe is contemplating:

Banks have complained they are hindered from lending to the economy by post-crisis rules forcing them to hold much larger safety cushions of capital and liquidity. The document said the “appropriateness” of the EU capital and liquidity rules for long-term financing will be reviewed over the next two years, a process likely to be scrutinized in the United States and elsewhere to head off any risk of EU banks gaining an unfair advantage.

But wait: there’s more!

Inspired by the recently introduced “no risk, guaranteed return” collectivized savings instrument in the US better known as MyRA, Europe will also complete a study by the end of this year on the feasibility of introducing an EU savings account, open to individuals whose funds could be pooled and invested in small companies.

Because when corporations refuse to invest money in Capex, who will invest? Why you, dear Europeans. Whether you like it or not.

But wait, there is still more!

Additionally, Europe is seeking to restore the primary reason why Europe’s banks are as insolvent as they are: securitizations, which the persuasive salesmen and sexy saleswomen of Goldman et al sold to idiot European bankers, who in turn invested the money or widows and orphans only to see all of it disappear.

It is also seeking to revive the securitization market, which pools loans like mortgages into bonds that banks can sell to raise funding for themselves or companies. The market was tarnished by the financial crisis when bonds linked to U.S. home loans began defaulting in 2007, sparking the broader global markets meltdown over the ensuing two years.

The document says the Commission will “take into account possible future increases in the liquidity of a number of securitization products” when it comes to finalizing a new rule on what assets banks can place in their new liquidity buffers. This signals a possible loosening of the definition of eligible assets from the bloc’s banking watchdog.

Because there is nothing quite like securitizing feta cheese-backed securities and selling it to a whole new batch of widows and orphans.

And topping it all off is a proposal to address a global change in accounting principles that will make sure that an accurate representation of any bank’s balance sheet becomes a distant memory:

More controversially, the Commission will consider whether the use of fair value or pricing assets at the going rate in a new globally agreed accounting rule “is appropriate, in particular regarding long-term investing business models”.

To summarize: forced savings “mobilization”, the introduction of a collective and involuntary CapEx funding “savings” account, the return and expansion of securitization, and finally, tying it all together, is a change to accounting rules that will make the entire inevitable catastrophe smells like roses until it all comes crashing down.

So, aside from all this, Europe is “fixed.”

The only remaining question is: why leak this now? Perhaps it’s simply because the reallocation of “cash on the savings account sidelines” in the aftermath of the Cyprus deposit confiscation, into risk assets was not forceful enough? What better way to give it a much needed boost than to leak that everyone’s cash savings are suddenly fair game in Europe’s next great wealth redistribution strategy.

Money quote:” … there is a risk that in chasing growth they, and their shareholders, have lost sight of just how volatile emerging-market economies can be”

• A Big, Bad World for America Inc. (WSJ)

Although emerging-market woes have played a part in the drop in the U.S. stock market this year, worries they could cause serious financial market problems in the U.S. have been subdued. Unlike the Mexican peso, Asian financial and Russian debt crises of the 1990s, banks’ emerging-market exposures seem well managed.

And investors have shied away from the types of heavily leveraged, multiple-country bets that led to the Fed-supervised bailout of Long-Term Capital Management in 1998. In her inaugural testimony as Fed chairwoman Tuesday, Janet Yellen said that the central bank isn’t viewing the recent volatility in global financial markets as a threat to the U.S.

[..] … while the risk of financial-market contagion from emerging markets has lessened, their role in the global economy has grown. Countries outside of the Organization for Economic Cooperation and Development nations that the World Bank classifies as high-income generated 61% of global gross domestic product, on a U.S. dollar basis, in 2012. That was up from 53% in 2000. [..]

A broad set of data from the Commerce Department on U.S. multinationals’ majority-owned foreign affiliates paints a similar picture. In 2011, countries outside of the high-income OECD members accounted for 34% of sales at U.S. multinationals’ majority-owned foreign affiliates. That compared with 25% in 2000.

Emerging markets’ role in companies’ expansion plans has been even more pronounced. In 2011, non-OECD countries accounted for 42% of capital spending at multinationals’ foreign affiliates, versus 30% in 2000. In other words, not only do emerging markets now represent a greater share of sales, they are where companies have put bigger stacks of their chips.

Given the pace of emerging markets’ growth over the past decade, and the promise of what they may become, it isn’t hard to see why U.S. companies have done this. But there is a risk that in chasing growth they, and their shareholders, have lost sight of just how volatile emerging-market economies can be.

Money quote: ” … far too much for the world economy to absorb.”

• World Asleep As China Tightens Deflationary Vice (AEP)

China’s Xi Jinping has cast the die. After weighing up the unappetising choice before him for a year, he has picked the lesser of two poisons. The balance of evidence is that most powerful Chinese leader since Mao Zedong aims to prick China’s $24 trillion credit bubble early in his 10-year term, rather than putting off the day of reckoning for yet another cycle.

This may be well-advised for China, but the rest of the world seems remarkably nonchalant over the implications. Brazil, Russia, South Africa, and the commodity bloc are already in the cross-hairs. “China is getting serious about deleveraging,” says Patrick Legland and Wei Yao from Societe Generale. “It is difficult to gently deflate a bubble. There is a very real possibility that this slow deflation may get out of control and lead to a hard landing.”

Zhang Yichen from CITIC Capital said the denouement will be a ratchet effect since China has capital controls and banks are an arm of the state, but that does not make it benign. “They are trying to deleverage without blowing the whole thing up. The US couldn’t contain Lehman contagion, but in China all contracts can be renegotiated, so it is very hard to have a domino effect. We’ll see a slow deflating of the bubble ,” he said.

What is clear is that we are dealing with a credit expansion of unprecedented scale, equal in size to the US and Japanese banking systems combined. The outcome may matter more for the world than anything that the US Federal Reserve does over coming months under Janet Yellen, well signalled in any case.

Societe Generale has defined its hard landing as a fall in Chinese growth to a trough of 2%, with two quarters of contraction. This would cause a 30% slide in Chinese equities, a 50% crash in copper prices, and a drop in Brent crude to $75. “Investors are still underestimating the risk. Chinese credit and, to a lesser extent, equity markets would be very vulnerable,” said the bank.

Such an outcome – not their base case – would send a deflationary impulse through the global system. This would come on top of the delayed fall-out from China’s $5 trillion investment in plant and fixed capital last year, matching the US and Europe together, and far too much for the world economy to absorb.

Mish is one of the few people out there who share our view of deflation vs inflation. And once again, he’s dead on.

• Misguided Fed Policy Ensures The Return of Deflation (Mish)

The fact is, we currently have massive inflation. However, instead of inflation being visible in the form of higher consumer prices, inflation is visible in the form of asset price bubbles. To see inflation, all you have to do is open your eyes and look at lofty valuations of stocks and bonds.

Don’t hold your breath waiting for a surge in “inflation”. We already had it. Instead, expect various equity and corporate bond bubbles to implode. With the busting of various bubbles, asset prices will drop, and so will credit marked-to-market on any loans banks made on those asset bubble.

In an absurd attempt to prevent price deflation on consumer goods, the Fed has spawns asset bubble after asset bubble, each with a greater amplitude. Given exceptionally poor jobs and wage growth, the very thing consumers need to survive is falling prices! Yet, the Fed tries to prevent just that, all based on the idiotic premise “A persistent drop in prices prompts households to delay purchases in anticipation of even lower costs”.

Bubbles make people feel wealthy, and that exuberance spawns all sorts of poor economic decisions about what people can afford. When asset bubbles collapse (as they always do), that’s when people finally realize they spent too much and pull in their shopping horns.

Those expecting a huge pickup in price inflation, a spike in US GDP, or a big boom in housing, all based on misguided perceptions of “pent-up housing demand” or equally misguided theories about “excess reserves”, fail to understand how Fed boom-bust and bank-bailout policies preclude such outcomes. The Fed’s attempt to spur inflation in a deflationary world causes the very thing the Fed fears most (an economic slowdown caused by a collapse in asset prices). In turn, a collapse in the valuation of assets causes bank losses and reduces desirability and even ability of banks to lend.

The Fed is fighting the wrong battle. It’s a collapse in asset prices (not consumer prices) that will restrict bank lending and cause consumers to hold off on consumer purchases. The only correct approach is to not spawn bubbles in the first place. The current “feel-good” effect will not last forever, look out below when it wears off. Deflation, in terms of consumer prices, asset prices, and credit will return. Misguided Fed policy ensures that outcome.

These people “earn” grand salaries for producing reports that are absolutely devoid of any meaning other than they make people feel good and fall asleep.

• OECD Admits Overstating Growth Forecasts (Guardian)

A failure to spot the severity of the eurozone crisis and the impact of the meltdown of the global banking system led to consistent forecasting errors in recent years, the Organisation for Economic Co-operation and Development admitted on Tuesday.

The Paris-based organisation said it repeatedly overestimated growth prospects for countries around the world between 2007 and 2012. The OECD revised down forecasts at the onset of the financial crisis, but by an insufficient degree, it said. “Forecasts were revised down consistently and very rapidly when the financial crisis erupted, but growth out-turns nonetheless still proved substantially weaker than had been projected,” it said in a paper exploring its forecasting record in recent years.

The biggest forecasting errors were made when looking at the prospects for the next year, rather than the current year. The OECD said a failure to predict the path and the impact of the eurozone crisis, and a failure to understand the banking crisis and how interdependent the global financial system had become, were to blame for the errors.

“Challenges were compounded by the unusually high speed and depth of cross-country interconnections between real and financial developments, the increased variability of economic growth compared with the pre-crisis period, the lack of timely data on many important financial factors, and the limited understanding of macro-financial linkages,” it said.

The games Britain’s leaders plays with its people are a disgrace.

• UK Interest Rates On Hold As BOE Says Recovery ‘Unsustainable’ (Guardian)

Britain’s ultra-low interest rates will remain in force until after next year’s general election, the governor of the Bank of England signalled as he warned that economic recovery was “neither balanced nor sustainable”. Mark Carney left the City convinced that borrowing costs would be pegged at 0.5% for the rest of 2014 and beyond after saying that the UK could not cope with an end to the emergency measures adopted five years ago to counter the worst recession since the second world war.

The governor used the launch of the Bank’s quarterly inflation report to reassure businesses and households that even when rates do rise, the increase will be gradual and modest. Carney insisted that the nine-strong monetary policy committee “will not take risks with this recovery” and indicated that it was comfortable with the City’s view that interest rates would not rise before the spring of 2015 and then rise gently to 2% by 2017.

“A few quarters of above-trend growth driven by household spending are a good start but they aren’t sufficient for sustained momentum,” Carney said. “For a sustained and balanced recovery, the degree of stimulus will need to remain exceptional for some time.”

These numbers look really bad. Let’s see what February says.

• China auto market growth slows sharply in January (Reuters)

Growth in China’s auto market slowed to 6% in January, a third of the rate seen in December, partly weighed down by sluggish sales of commercial vehicles likes trucks and buses. The relatively slow growth in the world’s biggest auto market was also due to the week-long Chinese New Year holiday, or Spring Festival, starting at the end of January that resulted in fewer working days compared with 2013, analysts said. Most dealers close during the holiday, which fell in February last year.

The China Association of Automobile Manufacturers (CAAM) said on Thursday passenger vehicle sales rose 7% from a year earlier while commercial vehicle sales, which make up around 15% of the entire auto market, were virtually flat. “Companies typically don’t invest much on commercial vehicles at the start of a year, and that was much more evident in January this year due to the timing of the Spring Festival,” said Wan Dong, analyst at Capital Securities. The overall market grew 17.9% in December last year and ended the 2013 year with a growth rate of 13.9%.

If these defaults and near defaults in China pick up speed, it’ll be women and children first.

• China shadow-bank product defaults as coal company can’t repay (Reuters)

A high-yield investment product backed by a loan to a debt-ridden coal company failed to repay investors when it matured last Friday, state media reported on Wednesday, in the latest sign of financial stress in China’s shadow bank sector.

The product, which raised 289 million yuan ($47.7 million) from wealthy clients of China Construction Bank (CCB) , China’s second-largest lender, was created by Jilin Province Trust Co Ltd and backed by a loan to a coal company, Shanxi Liansheng Energy Co Ltd. “It matured on Feb. 7, but CCB passed on an announcement from Jilin Trust saying ‘We currently can’t be certain when (Liansheng) funds will be returned,'” the official Shanghai Securities News quoted an unnamed investor in the trust product as saying.

Though the maturity date has already passed, producing a technical default, Jilin Trust appears to be working to recover investor funds. “Restructuring isn’t bankruptcy. As far as we know, there is no problem with the firm’s assets. The firm is in negotiations with investors,” the paper quoted an unnamed Jilin Trust official as saying.

Every European citizen should be ashamed of themselves for allowing this to happen.

• Greek unemployment rate reaches record 28%, youth rate 61.4% (ENet)

Crossing a new threshold, the unemployment rate hit another historic high in November, with 28.0% of the workforce without a job, acccording to the Hellenic Statistics Authority (Elstat). The figure was more than the revised 27.7% recorded in the previous month, which was also a record high. This means that for the eight month running, unemployment remains above 27%, the highest rate in the entire European Union.

The figures showed the total number of people employed in November at 3,550,679, the unemployed at 1,382,062 and the economically inactive at 3,376,643. This means that the country’s unemployment figures have grown by a million in five years. In November 2008, a few months before the crisis broke, 384,988 people (7.8%) were recorded as unemployed. The figures also show that about 3.5 million people are working to support more than 4.7 million unemployed and inactive people.

The youth unemployment rate climbed to 61.4%, up from 57.9% in the previous month.

” … a 450% raise in taxes on heating oil in a single blow in 2010″. To be replaced with anything people can get their hands on that burns. I smell the IMF. Disgrace.

• How Greek economic crisis fills Athens sky with smog (CS Monitor)

A brown smog has descended over Greece’s cities. The smell of burned wood is prevalent, and those that suffer from asthma or have heart disease have been advised to stay inside. And in a convoluted way, it’s the Greek economic crisis – or at least, one of the government’s reactions to it – that is to blame.

Tax increases on heating oil have driven the majority of Greeks, even those belonging to the upper-middle class, to turn to burning wood in order to heat their homes. But the practice, which includes burning painted scrap in unsafe braziers, is producing dangerous smog – and has even claimed a few dozen lives. And although exact tallies are unavailable, many have also died in fires caused by braziers and heaters.

Plagued by five years of economic crisis and severe debt, the government has raised taxes across the board multiple times in order to generate revenue, despite the fact that Greeks have lost more than 40% of their income in just four years. Among those increases was a 450% raise in taxes on heating oil in a single blow in 2010. The government claims it was necessary to bring the heating oil’s price in line with that of diesel fuel, in order to stop the illegal market of heating oil.

Before the tax increase, a typical family would use 2.5 tons of heating oil, which would cost $2,500. Today, for the same amount they’d pay $4,440. And with most apartment buildings sharing a single oil furnace, if any one apartment can’t afford their share of oil, the whole building goes without – meaning collectively only one out of five apartment buildings can afford the new oil prices, according to the Fuel Distributors Association. As a result, the tax revenue from the sale of heating oil has fallen by $718 million, as consumption fell 70% in the past two years.

Money quote: “None of the companies, however, has admitted wrongdoing … “

• Oil Companies Accused Of Defrauding States (RT)

Oil companies in the US appear to be getting state funds for cleaning up oil leaks while at the same time concealing insurance payouts they received for the same purpose. The alleged ‘double-dipping’ has prompted dozens of lawsuits countrywide. It all started when Thomas Schruben, a Maryland environmental engineer, who has long worked on cleaning up oil leaks, started to have suspicions that oil companies could have been paid twice for the same job, Reuters reports.

The jobs in question are the cleanups of leaky underground petroleum storage tanks, which were built for gas stations all over the US around half a century ago. The tanks, which corroded over time leaking gas and diesel, have long started to represent a threat to environment and health. Half a million such leaking tanks have been reported in the country since 1988. At the moment 80,000 spills of the kind remain unhandled.

When Schruben started to suspect fraud in spills cleanups, he and Dennis Pantazis, a lawyer specializing in environmental and civil rights cases, set up a team of investigators and experts who uncovered multiple cases of oil companies collecting both special state funds and insurance money for the same tank cleanups. The team eventually helped a number of states to bring their cases against oil companies.

As Reuters found out, nine states have won settlements worth more than $105 million against four companies in the past three years – Chevron, Exxon, ConocoPhillips and its downstream arm Phillips 66, and Sunoco. A third of the sum went to Colorado, which has signed settlement agreements with three companies. “It appears this was a really common practice and it’s very disconcerting,” Colorado Attorney General John Suthers said. “Basically the companies were defrauding the state.”

None of the companies, however, has admitted wrongdoing. “In some instances you might say these were intentional actions,” Dennis Pantazis said. “In some instances it may have been a case of the right hand not knowing what the left hand was doing.”

If money is the idol of your society, then this is where you will inevitably wind up. It is still your choice, though.

• High-Speed Stock Traders Turn to Laser Beams (WSJ)

As high-speed stock traders push to trade ever faster, their newest move involves harnessing a technology that U.S. military jets use to communicate as they soar across the sky: lasers. In March, a small Chicago communications company plans to switch on an array of laser devices linking the New York Stock Exchange’s data center in Mahwah, N.J., with the Nasdaq Stock Market’s NDAQ +0.57% data center in another New Jersey community, Carteret.

The lasers, perched atop high-rise apartment buildings, towers and office complexes along the 35-mile stretch between the communities, are the first phase of a grid intended to link nearly all U.S. stock exchanges this way, zipping market data and rapid-fire trades.

It is the latest salvo in the “race to zero,” traders’ term for their efforts to whittle away the difference between the speed their orders travel at and the speed of light. Zero, the point at which that difference would disappear, has become a kind of holy grail to computerized traders, for whom nanoseconds—billionths of a second—can spell the difference between profit and loss in their algorithm-driven trades.

In recent years, so-called high-frequency trading firms, which account for about half of U.S. stock trading, have adopted first custom-built fiber-optic cables, then microwave and later millimeter-wave transmissions. Networks built on all three technologies operate today, tying together exchanges around the U.S. Internationally, fiber-optic cables laid across the oceans link America’s markets with Europe’s and Asia’s.

High-speed, computerized firms today trade everything from stocks to oil futures to government bonds, including securities whose prices move instantly when the government releases economic data such as jobs reports. To pare precious fractions of a second off the time it takes to transmit such data, Anova and other communications companies place networking equipment at a data center on 1275 K Street in Washington, physically close to government agencies.

In the latest tactic, some high-speed traders obtain news releases directly from distributors, avoiding the tiny time lag involved in going through the financial news media. Federal regulators are wary of algorithmic traders’ relentless push for speed, worried about the potential for future market shocks such as the “flash crash” of May 6, 2010—when heavy selling and waves of high-speed traders fleeing the market triggered wild stock swings—and the loss of more than $460 million in 45 minutes by electronic-trading firm Knight Capital Group Inc. in August 2012.

In the same way that companies try to get a feel for the potential popularity of a new detergent, the White House finds out what Americans think of US drones killing American citizens abroad.

• Will Obama Kill Unknown American With Secret Memo? (Bloomberg)

Every time you think the war on terror can’t get any weirder, it does. In the latest manifestation, White House officials are leaking to the news media that they are considering whether to use drone strikes to kill an unnamed American in Pakistan. This behavior is bizarre as a matter of national security: If a terrorist really poses an imminent threat, how exactly does the administration have time to test the political waters before taking him out?

But it is the inevitable result of a more fundamental, long-term problem with the U.S.’s use of drone strikes. President Barack Obama’s administration has kept secret the legal justification for such strikes on Americans, as well as the internal procedures to be followed in making the decision. The secrecy shrouds the drone program in a basic sense of illegitimacy. No wonder the administration feels it can’t just kill our enemies, but needs to send up trial balloons first: The whole program is operating under a bad legal conscience. [..]

The white paper argued most prominently that a citizen’s due-process rights are not violated when the drone kills him, as long as a “high-level” government official deems him an imminent threat, capture is infeasible, and the strike satisfies the international laws of war. This argument may sound reasonable enough on the surface, but looked at more closely, it’s full of holes.

“Imminent threat” is defined incredibly broadly, and on the assumption that some parts of al-Qaeda “continually” pose an imminent threat. The word “imminence” has an ordinary constitutional meaning — something is imminent if it is likely to happen soon. The white paper turns that meaning on its head. It says, for example, that if the target has in the past planned attacks and has not resigned from al-Qaeda, the requirement of imminence is satisfied without evidence of, well, imminence.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Feb 13 2014: Are Your Savings Safe From Bail-Ins?