Arnold Genthe “Diamond antique store, Royal Street, New Orleans” 1920

An interesting government commissioned report came out yesterday in Britain, prepared by a commission under oil veteran Sir Ian Wood, and dealing with the prickly issue of what to do with the fast dwindling oil and gas production – and tax revenue – that comes from the British North Sea patch. What probably “worries” the government most of all at this point is that the oil and gas industry is threatening to leave any further investment and exploration alone because it is no longer – sufficiently – profitable.

Sir Ian therefore proposes/demands the government should invest, and make North Sea exploration profitable once again for Big Oil. Which has made huge profits on the exploitation for many years but never provisioned for re-investing those profits in leaner times, even though they always knew such times would come. No, as soon as the big profits stop, it’s up to the taxpayer to come up with the cash, that is if (s)he wishes to keep her feet warm and dry. Let’s all sing the praises of the free market, while the market itself sings the praises of industry friendly governments and their pockets filled with tax revenues.

Of course, it’s easy to say in hindsight, but shouldn’t a contract have been drawn right at the start to cover the entire exploitation process and timeframe, forcing oil companies to reserve early profits to make sure no assets would be left unnecessarily stranded, without that costing taxpayers even more money at the end of the line? Guess that would have spoiled the party.

A few details from the article:

• North Sea oil industry needs ‘urgent’ government help; exploration at all-time low (Telegraph)

North Sea oil exploration is at a “worrying” all-time low and needs urgent government action such as tax breaks to stimulate drilling, Sir Ian Wood has warned. In a government-commissioned report, the industry veteran said that up to 16 billion barrels of oil could be left untapped in the ground if exploration remained at current low rates. He also warned the North Sea would continue to see steep declines in oil and gas output unless government and industry tackled a series of problems, including falling productivity and rising costs.

Production in the region has fallen by 38% over the last three years and hit a low of 1.4 million barrels of oil and gas last year. Investment levels would halve in the latter part of the decade from last year’s record £14 billion, unless significant new discoveries or developments are made, he said. Ed Davey, the energy secretary, vowed to implement Sir Ian’s recommendations, which include creating a new North Sea regulator to drive collaboration between energy companies. [..]

[..] … the industry believed “the fiscal regime failed to provide sufficient incentive to explore”. He said there was a “fundamental view” in the industry that the 62% tax rate for new oil and gas fields was “too high” [..]

Other issues highlighted by the report included a slump in productivity, to 60% efficiency from 70% in 2010, costing the UK economy £6 billion.

A 12-13% annual drop in production is certainly nothing to sneeze at. And you got to love terminology like a “fundamental view”in the industry that tax rates are too high. These guys know spin in a way that few politicians do.

In December 2013, a preliminary draft of the report was released, and our dear friend Euan Mearns, Honorary Research Fellow at the University of Aberdeen, wrote about it at the time in Compel firms to extract North Sea oil in the nation’s interest . Euan has some more numbers – and graphs – to enhance the picture. According to Euan:

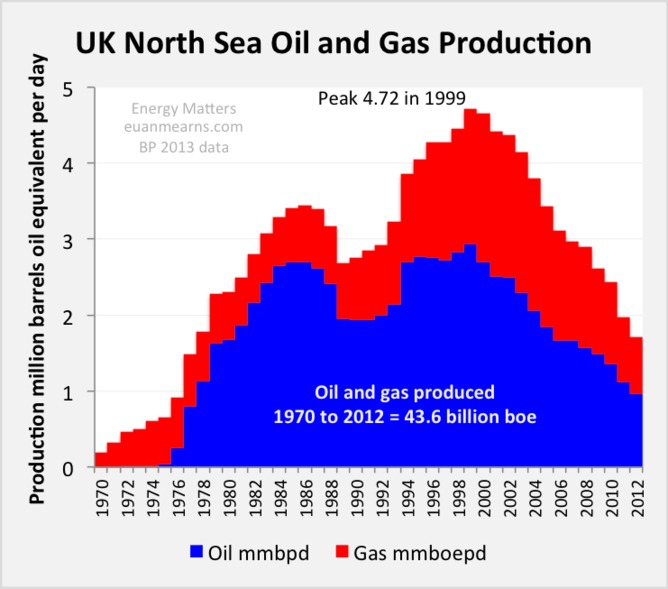

• UK North Sea oil and gas production peaked at the equivalent of 4.72 million barrels per day (of oil equivalent) in 1999 and has been in an accelerating decline since.

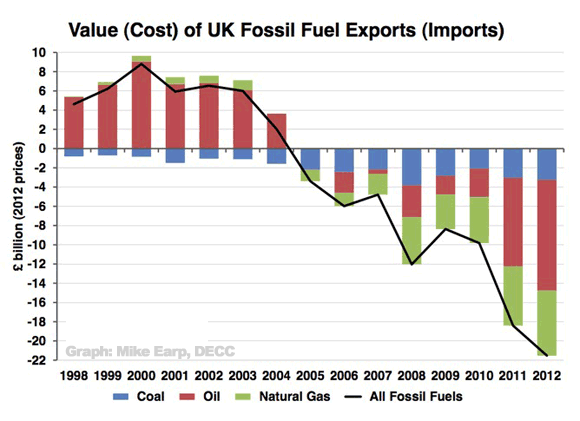

• These days the UK is a net importer of oil and gas, and coal, accounting for £22 billion of the £59.8 billion deficit in the 2012 balance of payments.

• 43.6 billion barrels of oil equivalent (based on BP’s conversion ratio of 1 billion cubic metres of gas = 6.6m barrels of oil) have been produced so far, with max 10 billion barrels left.

Let’s catch that in a few graphs. First, Euan’s own graph on total production:

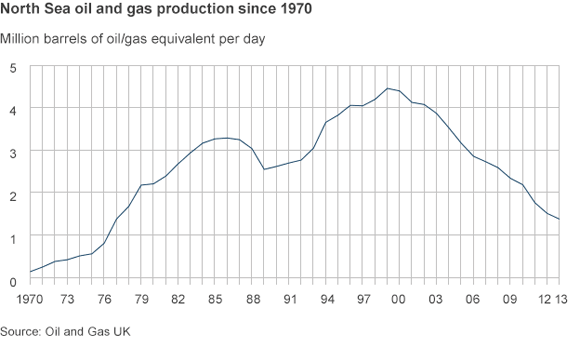

Which in a smoother version looks like this:

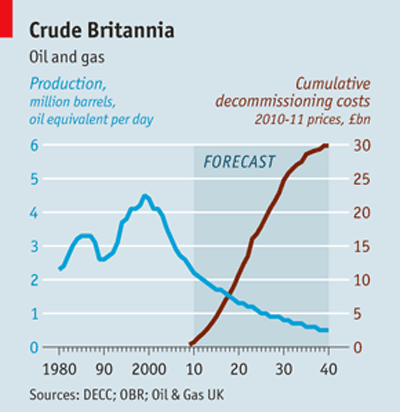

The Economist added a nice detail in 2012: cumulative decommissioning costs. Wonder who’s going to pay those.

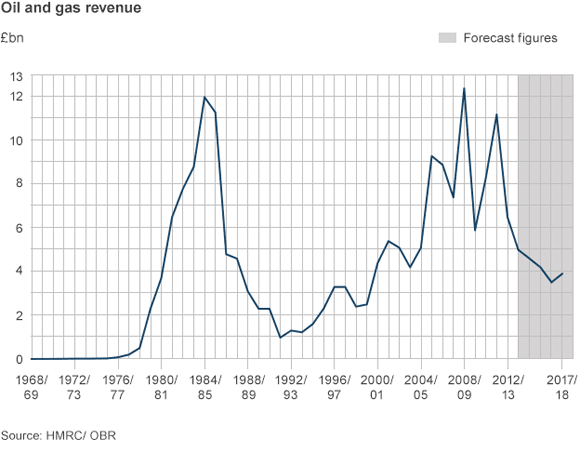

The picture for UK government income has of course changed drastically since the 1999 production peak.

Looking at this, you can’t help wondering to what extent successive British governments have ensured adequate reserves and provisions for such a development (which was entirely foreseeable, but may still not have been foreseen). Because here’s the consequence of being forced to shift from exports to imports: it hits hard, and it’s irreversible.

A few more words from Euan Mearns, which leave some room for questions:

The interim report suggests there is the potential to extract at least 3 to 4 billion barrels of oil more than would otherwise be recovered, worth around £200 billion to the UK’s economy at today’s prices. One of my main criticisms of the report is that it does not define what “would otherwise be recovered” actually means.

I have suggested that UK Oil and Gas Reserves would produce about 4.5 billion barrels at current extraction rates, similar to proven reserves reported by DECC and BP. So “3-4 billion more” would mean around 8.5 billion barrels if Sir Ian’s recommendations were to be implemented, totalling perhaps 10 billion if we reasonably allow a further 1-2 billion more in reserves yet to be found. There will be one or two undiscovered giant fields lurking out there somewhere.

Sir Ian is explicit about where this additional oil comes from, naming enhanced oil recovery (1-6.5 billion in best case scenario), increased exploration (1-1.5 billion), better use of infrastructure (0.5-2 billion), and postponing decommissioning by five years (1 billion). But Sir Ian also estimates “a further 12-24 billion” barrels, without giving any reference or figures. If state regulation of the North Sea and operating practises of the companies are to be overhauled then there must be a means for measuring the effectiveness of Sir Ian’s changes. [..]

Enhanced oil recovery is necessary to retrieve the remnants of oil from mature fields. The bulk of the oil is left behind as micro-droplets either stuck to mineral grains or encased by water in rock pores. A variety of chemical methods can be used to get this oil moving up to the surface. For example, BP injects methane gas in the Magnus Field, and is proposing to inject fresh, as opposed to salt, water in their west of Shetland fields. Potentially the greatest reward comes from injecting CO2. In my opinion, the government would do well to divert its attention from carbon capture and storage to using CO2 for enhanced oil recovery.

As for as yet to be recovered oil and gas, let’s make clear first of all that it’ll be far less than what has already been won. Euan doesn’t seem to be willing to go beyond 10 million barrels, while Sir Ian throws out “a further 12-24 billion” barrels without reference, but that is probably from the Department of Energy and Climate Change (DECC), a number the Economist also quoted could be produced over the next 30 years.

But by then the government would be paying most of the costs, while exports would need to rise hugely only to run in place. But whenever someone talks about something that’s supposed to happen 30 years from now, credibility wanes with the years.

I came to think of all this because I saw an item on Dutch business TV channel RTLZ this morning about Royal Dutch Shell, which I haven’t found back in the English language press, so I’ll walk you through it:

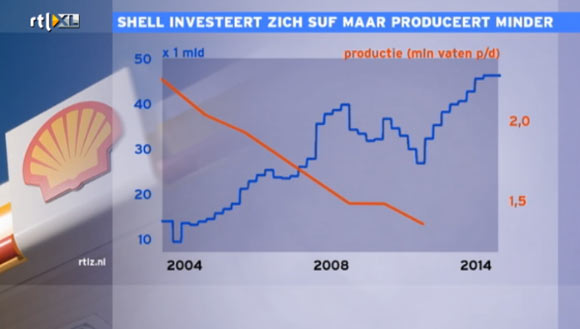

They talked about Shell and its present set of problems, and that particualr set appeared to me to be very much like the UK North Sea situation, only with a sort of extra twist. First, Shell production has fallen off a cliff. And that’s despite investments having gone through the roof and beyond.

Blue=investment (I assume in €), orange=production (in Mbd).

You see that investments went, in just 10 years time, from €10 billion to €45+ billion. While production has fallen even much steeper than the UK North Sea patch, they lost 2/3 of production from 2004 to 2011. In my humble view, that’s insane!

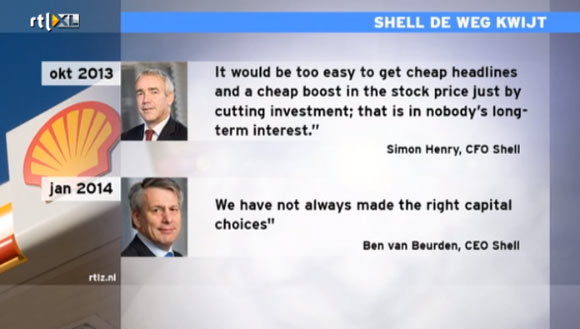

The picture painted from investors changed even faster:

Granted, the new CEO only came in on January 1, but there’s a major shift they’re making, if not to say a bombshell (pun intended).

Shell has decided to wind down its investments. It has figured out that no matter how much capital it was throwing at the wall, nothing stuck anymore.

In 2015, Shell will pay more in dividend than it generates in cash!

And while that can be seen as simply a business decision, or even merely a way to make investors happy, you do have to wonder what the future holds for what has been one of the biggest global companies for a long time – and for its investors -.

Here are a few details:

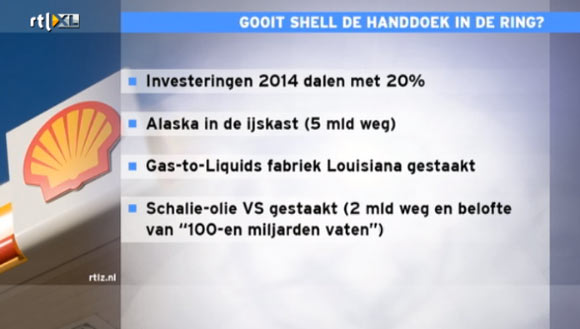

• Shell to cut investments by 20% in 2014

• They put their Alaska projects “in the freezer”, at a cost of €5 billion

• They quit a gas-to-liquids (i.e. diesel) plant in Louisiana

• – from last year – Shell wrote down €2 billion in US shale assets (not sit on them for a while, or try to sell them, just write off as a clean loss)

Moreover, Shell is urged to keep out of the Arctic too by principled investors. So where should the company turn to make a buck?

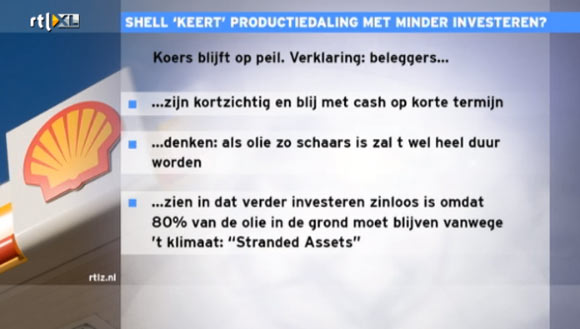

The RTLZ guys were asking why Shell’s shares price didn’t plummet when this became known, and they had a few interesting suggestions:

• Investors are short sighted and happy with a bit of cash in hand

• Investors think that if oil is that scarce, prices will soon surge

• Investors see that climate rules will force 80% of remaining oil to stay in the ground as stranded assets.

Here’s the video, if you like a foreign language.

Now, I don’t know about you, but when I go through numbers and data this way for a few hours, I get a queasy feeling that maybe things are not nearly as positive as we are made to think (or should I say even worse than we already figured), and not just decades from now, but in the near future. If a company like Shell essentially starts to wind down its core business, in the sense that business has been focused to a large extent on exploring as much as producing, what does that mean? Investors may hold on to shares a while longer because they’ve been promised large(r) dividends, but why hold on after that?

And of course, as Shell goes, so do Exxon and BP and all the other former greats. And with them the carbon that built our world. It wasn’t just carbon, it was increasing amounts of it. And cheap. Here’s thinking that over the next decade, or two, you’re going to be keeping your oil company alive in the same exact way, and for the same exact reasons, that you keep your bank alive. And the lifestyles of its executives.

“[..] … stock market investors pretend to believe – or even have to pretend to believe – in those feeble and ephemeral stories because they need those stories to justify (to themselves and their clients) staying in the stock market, given the low returns everywhere else. ”

• This Is No Recovery, This Is A Bubble – And It Will Burst (Guardian)

According to the stock market, the UK economy is in a boom. Not just any old boom, but a historic one. On 28 October 2013, the FTSE 100 index hit 6,734, breaching the level achieved at the height of the economic boom before the 2008 global financial crisis (that was 6,730, recorded in October 2007). Since then, it has had ups and downs, but on 21 February 2014 the FTSE 100 climbed to a new height of 6,838. At this rate, it may soon surpass the highest ever level reached since the index began in 1984 – that was 6,930, recorded in December 1999, during the heady days of the dotcom bubble.

The current levels of share prices are extraordinary considering the UK economy has not yet recovered the ground lost since the 2008 crash; per capita income in the UK today is still lower than it was in 2007. And let us not forget that share prices back in 2007 were themselves definitely in bubble territory of the first order.

The situation is even more worrying in the US. In March 2013, the Standard & Poor 500 stock market index reached the highest ever level, surpassing the 2007 peak (which was higher than the peak during the dotcom boom), despite the fact that the country’s per capita income had not yet recovered to its 2007 level. Since then, the index has risen about 20%, although the US per capita income has not increased even by 2% during the same period. This is definitely the biggest stock market bubble in modern history.

Even more extraordinary than the inflated prices is that, unlike in the two previous share price booms, no one is offering a plausible narrative explaining why the evidently unsustainable levels of share prices are actually justified. During the dotcom bubble, the predominant view was that the new information technology was about to completely revolutionise our economies for good. Given this, it was argued, stock markets would keep rising (possibly forever) and reach unprecedented levels. The title of the book, Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market, published in the autumn of 1999 when the Dow Jones index was not even 10,000, very well sums up the spirit of the time.

Similarly, in the runup to the 2008 crisis, inflated asset prices were justified in terms of the supposed progresses in financial innovation and in the techniques of economic policy.

It was argued that financial innovation – manifested in the alphabet soup of derivatives and structured financial assets, such as MBS, CDO, and CDS – had vastly improved the ability of financial markets to “price” risk correctly, eliminating the possibility of irrational bubbles. On this belief, at the height of the US housing market bubble in 2005, both Alan Greenspan (the then chairman of the Federal Reserve Board) and Ben Bernanke (the then chairman of the Council of Economic Advisers to the President and later Greenspan’s successor) publicly denied the existence of a housing market bubble – perhaps except for some “froth” in a few localities, according to Greenspan.

At the same time, better economic theory – and thus better techniques of economic policy – was argued to have allowed policymakers to iron out those few wrinkles that markets themselves cannot eliminate. Robert Lucas, the leading free-market economist and winner of the 1995 Nobel prize in economics, proudly declared in 2003 that “the problem of depression prevention has been solved”. In 2004, Ben Bernanke (yes, it’s him again) argued that, probably thanks to better theory of monetary policy, the world had entered the era of “great moderation”, in which the volatility of prices and outputs is minimised.

This time around, no one is offering a new narrative justifying the new bubbles because, well, there isn’t any plausible story. Those stories that are generated to encourage the share price to climb to the next level have been decidedly unambitious in scale and ephemeral in nature: higher-than-expected growth rates or number of new jobs created; brighter-than-expected outlook in Japan, China, or wherever; the arrival of the “super-dove” Janet Yellen as the new chair of the Fed; or, indeed, anything else that may suggest the world is not going to end tomorrow.

Few stock market investors really believe in these stories. Most investors know that current levels of share prices are unsustainable; it is said that George Soros has already started betting against the US stock market. They are aware that share prices are high mainly because of the huge amount of money sloshing around thanks to quantitative easing (QE), not because of the strength of the underlying real economy. This is why they react so nervously to any slight sign that QE may be wound down on a significant scale.

However, stock market investors pretend to believe – or even have to pretend to believe – in those feeble and ephemeral stories because they need those stories to justify (to themselves and their clients) staying in the stock market, given the low returns everywhere else.

• North Sea oil industry needs ‘urgent’ government help; exploration at all-time low (Telegraph)

North Sea oil exploration is at a “worrying” all-time low and needs urgent government action such as tax breaks to stimulate drilling, Sir Ian Wood has warned. In a government-commissioned report, the industry veteran said that up to 16 billion barrels of oil could be left untapped in the ground if exploration remained at current low rates. He also warned the North Sea would continue to see steep declines in oil and gas output unless government and industry tackled a series of problems, including falling productivity and rising costs.

Production in the region has fallen by 38% over the last three years and hit a low of 1.4 million barrels of oil and gas last year. Investment levels would halve in the latter part of the decade from last year’s record £14 billion, unless significant new discoveries or developments are made, he said. Ed Davey, the energy secretary, vowed to implement Sir Ian’s recommendations, which include creating a new North Sea regulator to drive collaboration between energy companies.

Sir Ian said his suggestions should “significantly enhance” output, delivering at least an extra 3-4 billion barrels of oil and gas that would otherwise be left in the ground. But the industry veteran also made clear that his remedies alone would not be enough to halt the steep forecast declines and said the Treasury must deliver tax breaks to stimulate investment. “I have no doubt there will need to be fiscal changes to achieve maximised recovery,” Sir Ian told the Telegraph. Sir Ian said the industry was united in believing that “something has to happen” urgently to tackle an “all-time low” in exploration activity.

“In the last two years less than 150 million barrels [of oil and gas] has been discovered and if this trend continues, the UK will fail to recover even a small proportion of exploration potential that still remains across the UK continental shelf, which the Department of Energy and Climate Change estimate to range from 6 billionn to 16 billion barrels [of oil and gas],” the report warned. It called on the Government to “urgently assess the potential to stimulate exploration” and warned that said the industry believed “the fiscal regime failed to provide sufficient incentive to explore”.

“The UK must regain its position as an attractive destination for exploration funds from small and large companies alike, and faces a real challenge to compete against international opportunities,” it said, pointing to generous government support for explorers in the Netherlands and Norway.

Sir Ian suggested tax breaks were needed across the sector, not just in exploration. He said there was a “fundamental view” in the industry that the 62% tax rate for new oil and gas fields was “too high” and suggested more targeted tax relief, such as for high-pressure, high-temperature fields in the central North Sea, would be appropriate. “I hope the Chancellor is going to come out with some clever ideas in the Budget,” he said. Other issues highlighted by the report included a slump in productivity, to 60% efficiency from 70% in 2010, costing the UK economy £6 billion.

Malcolm Webb, chief executive of Oil & Gas UK, echoed Sir Ian’s warning, saying there was a “very serious productivity challenge” and that while there was record capital expenditure in 2013 there had also been “record operating expenditure” due to rising costs. This was a “serious concern”, he said.

China keeps on simmering down. Bookies taking your wagers now.

• Yuan Drops Most Since 2010 on Speculation PBOC Wants Volatility (Bloomberg)

China’s yuan tumbled the most in more than three years on speculation the central bank wants an end to the currency’s steady appreciation to ward off speculators before a possible widening of the trading band. The yuan fell 0.46%, the most since Nov. 1, 2010, to close at 6.1266 per dollar in Shanghai, according to China Foreign Exchange Trade System prices. It slid for a sixth day and reached a six-month low of 6.1310. The spot rate ended the day weaker than the central bank’s reference rate for the first time since September 2012, having been 0.77% stronger on average so far this year. It can diverge by a maximum 1% from the fixing, which was set at 6.1184 today.

The yuan has strengthened in all but three quarters since a dollar peg ended in July 2005 and its 35% advance against the greenback in that time is the best performance among 24 emerging-market currencies tracked by Bloomberg. Two-way capital flows will become the “new norm” for China and the exchange rate is likely to be more volatile as U.S. monetary stimulus is reined in, State Administration of Foreign Exchange said today in a report.

“The PBOC is engineering the yuan declines, which might mean the central bank wishes to change the perception of the one-way bet on yuan gains,” said Kenix Lai, a Hong Kong-based currency analyst at Bank of East Asia Ltd. “It also looks like the PBOC is introducing two-way volatility as it prepares the renminbi for a wider trading band.”

China may double the yuan’s trading limit to 2% in two to three months, JPMorgan Chase & Co. economists led by Zhu Haibin said in a note yesterday, adding that yuan declines will likely be moderate and temporary. The currency is expected to strengthen 2.6% in the remainder of this year, based on the median estimate in a Bloomberg survey of analysts. Mexico’s peso is the only emerging-market currency forecast to do better.

The PBOC plans to expand the yuan’s trading band in an “orderly” manner this year, it said last week. That was the first time the central bank gave such a specific timeframe for the proposed change, Credit Agricole CIB said. The yuan’s band was last widened in April 2012 from 0.5%, and before that from 0.3% in May 2007.

Chinese lawmakers will start annual meetings next week to decide on major economic policies and growth targets. The official Purchasing Managers’ Index (CPMINDX) will probably come in at 50 for February, the dividing line between expansion and contraction in manufacturing, according to the median estimate in a Bloomberg survey before data due March 1. That would be the lowest reading since September 2012.

A weakening of the yuan is a “significant market risk” that may signal the economy is slowing more than indicated, Hao Hong, chief China strategist at BoCom International Holdings Ltd., said in a report today. It could also start a trade war and hurt property developers that have been borrowing funds in dollars, he wrote.

The offshore yuan fell 0.37% to 6.1251 per dollar in Hong Kong, reversing an earlier gain of as much as 0.17%, according to data compiled by Bloomberg. It has dropped 1.4% this month. Twelve-month non-deliverable forwards declined 0.29% to 6.1558, trading at a 0.5% discount to the onshore spot rate. The offshore yuan’s relative-strength index climbed to a record 86 today, signaling to some traders that its drop may be overdone. The currency also broke its 200-day moving average, another technical indicator suggesting it may reverse direction.

• Stocks Wobble Overnight As China Tremors Get Louder (Zero Hedge)

All eyes were on China overnight, where first the PBOC drained a quite substantial CNY 100 billion in liquidity via 14 day repos in the month following the biggest credit injection on record, pushing those worried about China’s credit schizophrenia to the edge, and then things got even more bizarre when in an act of clear PBOC intervention, the CNY dropped to the lowest since August 2013 as concerns about the global carry trade’s impact on China (as noted here previously) start to reverberate.

We will have more to say about China’s Yuan intervention, but what should be noted is that the Shanghai Composite has tumbled nearly 10% in the past week, and was down another 2% overnight and is once again just barely above 2000, a level it can’t seem to get away from for years (which is fine: recall that the real bubble in China is not the stock but the housing market). Chinese property stocks dropped to 8-month lows as concern continues about bank’s withdrawing some liquidity for the asset class.

The USDJPY drifted along and after rising to a resistance level of about 102.600 has since slide just shy of its 102.20 support area which means US equity futures are now in the red, and concerns that the S&P 500 may not close at a new record high are start to worry the technicians.

Fun and central bankers. Yeah, right.

• Laughing all the way to an economic crash (MarketWatch)

Oh how they laughed as the economy was crashing. “There are some critics who say we panicked in response to the market sell-off of that Monday. I do not believe that’s the case, and I don’t believe it’s the case because I find it impossible to believe.” Hilarious. What’s also impossible to believe was that curious bit of logic was spoken by Richard Fisher, president of the Federal Reserve Bank of Dallas, in 2008.

Fisher was speaking at one of several meetings of the Fed’s Open Market Committee in response to a financial crisis that was unfolding. Transcripts of those meetings, more than 1,500 pages worth , were released at the end of last week. And they are a fascinating read. There’s despair, serious discussion, debate and a sense of responsibility. The content of the Fed meetings are reassuring at times, maddening at others and frequently alarming. The conversation is not too far from a J.C. Chandor script .

But they do show that the folks at the Fed kept their spirits up by making fun of themselves and the dire straights facing the nation. Here’s another bit of Texas wisdom from Fisher. ““I liken the Fed funds rate to a good single malt whiskey — it takes time to have its ameliorative or stimulative effect.”

We’ll have to assume Fisher has expertise on the matter. It might be a stretch, however, to say the same of William C. Dudley, head of the open market desk, at one key meeting in June 2008. That month he gave a status report to the committee about Lehman Brothers, which would file for bankruptcy less than 90 days later.

“Lehman’s short-term financing counterparties have generally proved to be patient,” Dudley said. “The financing backstop provided by the Primary Dealer Credit Facility has been cited by many counterparties as a critical element that has encouraged them to keep their financing lines to Lehman in place.” To be fair to Dudley, his assessment wasn’t too far off at the time. The worst of Lehman’s descent didn’t happen until September. Still, the Fed looked flat-footed and out of touch at times.

The transcript is full of quips. Here are some of my favorites.

“As somebody who stupidly is just going to contract on a new house because I have to please my wife, I actually thought exactly along these lines and was thinking about pulling out but then decided that my marriage was more important.” — Gov. Frederic Mishkin on falling housing prices and his marriage.

“There’s a very fine line between getting ahead of the curve and creating a sense of panic.” — Fisher.

Fed economist Michael Gibson on credit ratings: “This is what I call the Barry Bonds solution — put an asterisk on the rating if you have doubts about the quality.”

Fed Gov. Kevin Warsh on whether ratings agencies will ever be prompted to change their methods: “There will be nothing like three months of public hearings, if not hangings.”

Former San Francisco Fed president, now Fed Chairwoman Janet Yellen, on housing prices and the tumbling economy March: “Sales of cheap wine are soaring.”

Chairman Ben Bernanke in March: “Housing weakness has implications for employment, for consumer spending, and for credit conditions. It also leads to 21 miles of empty boxcars.”

Fisher on considering a 75 basis-point cut in interest rates: “It’s Jabba the Hutt. They will keep asking for more and more. We have to quit feeding them. I’m in a pizza mode, by the way, in this conversation. I do have a suggestion, however.”

Mishkin: “You mean Pizza the Hutt, not Jabba the Hutt.”

Fisher: “Pizza the Hutt, that’s right.”

In April 2008, the Fed was under pressure from Capitol Hill as it considered multiple drastic measures to inject liquidity (more cash) into the credit markets. Bernanke said, “We would get, I would call it for short, a Wall Street Journal editorial that the ‘Federal Reserve is once again the craven cur and the spineless’ — boy, I am getting good at this — ‘lackey of the Congress by accommodating this request.’”

“I sat next to Paul Volcker when he gave his speech in New York the other day, and he said that the world today feels as it did in the 1970s. I was alive in the 1970s, but only just.” — New York Fed President Timothy Geithner.

Mishkin on household surveys: “If you ask people what TV shows they are watching, they will tell you that they are watching PBS and something classy, but you know they are watching “Desperate Housewives.’”

Bernanke: “What’s wrong with ‘Desperate Housewives?’”

We’re a sad bunch, aren’t we? We can’t even draw the simplest conclusions anymore, let alone act on them.

• Too Big to Fail Is Too Big to Ignore (Bloomberg)

The Federal Reserve’s open market committee transcripts from 2008, released Friday, are a stark reminder of the damage done by the financial crisis and the terrible choices policy makers face when large, complex financial institutions fail.

In one critical meeting on Sept. 16 (the day after Lehman Brothers Holdings Inc.’s bankruptcy), Tom Hoenig, then the president of the Federal Reserve Bank of Kansas City, stated the problem succinctly: “I think we tend to react ad hoc during the crisis, and we have no choice at this point. But as you look at the situation, we ought, instead of having a decade of denying too big to fail, to acknowledge it and have a receivership and intervention program.” Hoenig then warned: “We are in a world of too big to fail, and as things have become more concentrated in this episode, it will become even more so.”

Chairman Ben S. Bernanke agreed and noted, “We need a strong, well-defined, ex ante, clear regime. But we have the problem now that we don’t have such a regime, and we’re dealing on a daily basis with these very severe consequences. So it is a difficult problem.”

The 2010 Dodd-Frank Act created such a regime. Regulators, to their credit, have responded by implementing the law’s prohibition against using taxpayer funds to keep open failed institutions and by creating a transparent, clearly defined process to manage the failures of large, systemic financial companies. Yet, even with meaningful progress, real doubts remain about the end of too big to fail. One reason is that regulators still have many substantive reforms left to deliver before the next failure. But another reason is that the public and the markets simply don’t believe the government can or will let such large companies fail when the time comes.

On the substance, real risks remain. Although Dodd-Frank created a new orderly liquidation authority for potentially systemic institutions, that authority should be just a backstop. The real policy goal must be ensuring that these institutions can fail like all others — in a standard bankruptcy process, without the need for government support. Dodd-Frank makes this clear in Section 165 where it requires regular “living will” filings designed to show that a financial company can credibly fail, without systemic disruptions, in bankruptcy. If a company can’t credibly make that showing, the law allows regulators to limit its activities or break it up.

There is no evidence that these large institutions have made credible progress toward restructuring themselves so they can fail like everyone else. They are still huge, complex, interconnected and entangled in cross-border derivatives. Their failure in bankruptcy would probably disrupt many of the essential services markets need to operate. Similarly, while the orderly liquidation backstop is needed to protect against 2008-style bailouts, important parts of that process remain incomplete. These gaps provide opportunities for counterparties and bondholders to game the system at home, and leave legal uncertainties abroad.

Given all this, we shouldn’t be surprised that markets continue to doubt that these institutions’ investors and counterparties will be fully accountable for their losses. To make matters worse, market doubts can lead to funding advantages that encourage the biggest financial companies to get even bigger — and the industry even more concentrated. In this way, too big to fail can become self-fulfilling.

Ukraine has been a wide region’s breadbasket for many hundreds of years. Black earth. It was to be the number 2 global grain exporter this year. Bigger than Canada, Australia, Russia.

• Ukraine unrest may grind grain markets (MarketWatch)

[..] … the Russians remember Ukraine as a Nazi collaborator, while Ukrainians hold Russia responsible for the robbery of their farms in the 1920s and the famine they suffered in the 1930s. And both wax romantic about their glorious pasts as great powers. This is besides more bad blood that goes back to the 17th century. That is why a smooth breakup in Ukraine is unlikely.

Fortunately, a Yugoslav-type of civil war is also unlikely. Russia will not risk a guerrilla war with some 30 million ethnic Ukrainians, and the Ukrainians will not pick a fight with the Red Army. Moreover, a breakup in Ukraine is simple technically, because it is split between a predominantly Russian east and a predominantly Ukrainian west, separated by the Dnieper River. Economically, however, a breakup would be vexing, especially for the shrunken, “purer” Ukraine whose emergence effectively begun last week.

The current, artificial Ukraine owns about a third of the world’s most fertile soil, the so-called black earth. At the same time, the teetering republic also has a solid industrial base that produces a host of raw materials, from iron to coal, and manufactures cars, trucks, tractors and airplanes. Yet this industrial base is mainly in the Russian part, centering around Donetsk, which is home to metallurgical industries and steel works that are among the largest in the world. The country’s main seaports, in Odessa and Sebastopol, would also fall in Russian Ukraine and so would the Black Sea resort peninsula of Crimea.

It follows, that if the Kremlin concludes it cannot turn the clock back and install a puppet regime in Kiev, its fallback strategy will be to demand that Ukraine part with its pro-Russian south and east. Russian politicians in these regions are already calling for secession from Ukraine. The permanent presence on Sebastopol of a large Soviet fleet, based on a long-term lease, underscores this rationale.

The Ukrainian rift was arguably caused by the European Union’s demand that in turn for a trade deal, Kiev avoid joining a Russian-led customs union stretching from Belarus to Kazakhstan. It was a militancy Brussels may yet lament. Breakup would leave the EU with a Pyrrhic victory, for two reasons: first, the demand to secede will be based on the same democratic principles with which Europe has been challenging Russia; and secondly, the EU will have severed Ukraine from its industrial heartbeat and also from its main maritime outlet.

Considering that about one third of Ukraine’s gross domestic product of $176 billion comes from its industries, and only $17 billion from agricultural exports, a post-Russian Ukraine would be economically stressed. At the same time, a schism’s dynamics and atmosphere might impact commodity markets.

Ukraine exported an estimated 22 billion tons of grains last year, a figure that was forecast by the International Grains Council to grow this year by more a third, to 31.8 billion tons. That would have placed Ukraine second in the world, behind the U.S. and ahead of Canada, Australia, Argentina and Russia. Alas, these forecasts were made before the turmoil in Kiev, when Ukraine said it was preparing ambitious modernization and privatization of extensive farmland.

Unlike its industrial heartland, Ukraine’s farmland stretches across its ethnic divide and in fact continues deep into Russia. Begging mechanical renewal and administrative overhaul, plans for massive privatization have yet to be implemented. The current mayhem promises to push them further back. Worse, if tensions continue to grow, shipments through Russian seaports might be obstructed. Russia already played this kind of game with Ukraine when it shut its gas supply as part of its arm-twisting of the country it saw as a rebellious proxy.

If logic prevails, Moscow, Brussels, and Kiev will all understand that whatever they do politically, economically they should encourage modern cultivation of the black-soil continuum that runs from Ukraine’s two halves through Russia into Siberia. Then again, had logic prevailed, 88 Ukrainians who last week were alive and well would have still been with us today.

Oh well, shale. That will save everyone … I like lines like this: ”In relative terms, shale activity in Poland is by far the most active, though it’s still very much in the exploration/”science experiment” stages.” Poland shale is dead. But Barron’s has the faith.

• Can Ukraine Find Freedom in Shale Gas? (Barron’s)

Dramatic, fast-moving political events over the weekend saw what amounts to a revolution in Ukraine, with scenes reminiscent of Egypt in 2011. Weeks of protests in Kiev, which had turned violent in recent weeks, culminated in the impeachment of President Viktor Yanukovych, his flight from the capital to an undisclosed location, and the appointment of an opposition figure as acting president to run the government until early elections can be held in May.

No one issue is solely responsible for the Ukrainian revolution: examples include high-level corruption, Ukraine’s relationship with the European Union, and underlying cultural tensions between the country’s western half and its eastern, Russian-speaking half. But quite possibly nothing has played as big a role as natural gas: that is to say, Ukraine’s unique geostrategic position as the primary conduit of gas between Russia and the EU, and a huge gas importer in its own right.

In April 2010, Russia and Ukraine signed the so-called Kharkiv Accords, which effectively exchanged a 25-year extension of Russia’s lease on the naval base in the Black Sea port of Sevastopol for a long-term 30% discount on Gazprom’s [Russia’s state monopoly] sales to Ukraine. The agreement was ratified by Ukraine’s parliament, though only after massive controversy. This, however, was nothing compared to the public uproar after the Ukrainian-Russian “action plan” of December 2013. This agreement provided for a further gas-price reduction to $268 per thousand cubic meters ($7.59 per thousand cubic feet (Mcf)), as well as a $15 billion loan to Ukraine, following (and in an important sense, because of) Yanukovych’s refusal to ratify a trade deal with the EU, thus increasing Russia’s economic sway over Ukraine. This was the last straw for Ukraine’s pro-western politicians and directly led to the Euromaidan street protest movement that culminated in this past weekend’s revolution.

Ukraine’s gas consumption in 2012 was approximately 5.5 billion cubic feet (Bcf) per day — somewhat less than the U.S. on a per-capita basis, though considerably more relative to GDP. This amount was down by half since 1991 because of post-Soviet deindustrialization, but 80% of it was imported, primarily from Gazprom. As such, purchases of Russian gas represent the single largest component of the country’s trade deficit, which has led to chronic borrowing from both Russia and the International Monetary Fund (IMF). Even pro-Russian politicians such as Yanukovych have stated the need to reduce dependence on Gazprom, but domestic production has continued to decline. Shale development is seen as the main growth opportunity — the U.S. Energy Information Administration estimates resources at 42 trillion cubic feet (Tcf), third-largest in Europe behind France and Norway — though activity has been minimal thus far.

In 2012, Ukraine’s central government (under Yanukovych) selected Shell and Chevron as the winning bidders for two multi-Tcf shale-gas concessions. The Yuzivska concession, won by Shell, is located in eastern Ukraine; the Olesska concession, won by Chevron, is in the west, near Poland. As is the case across Europe, shale drilling has faced some controversy in Ukraine, but regional councils have voted overwhelmingly to approve the deals. The Shell deal alone is estimated to entail long-term investment of $10 billion, though commercial-scale production is not expected until 2017 at the earliest. The government’s target — which doesn’t strike us as particularly aggressive — is for 2030 shale-gas production of 0.2 to 0.4 Bcf per day, less than 10% of current consumption levels.

Ukraine’s high dependence on Russian gas is by no means an anomaly. This state of affairs is, in fact, analogous to many other countries in eastern and central Europe: the Baltic states; Poland; Romania; the Czech Republic; Slovakia; and to a lesser extent, Germany. The countries that are EU and NATO members have more political and economic leverage vis-à-vis the Kremlin, but they are certainly not immune from price hikes. Alongside other forms of energy diversification [e.g., renewables and liquefied natural gas (LNG)], conversations about shale-gas development have taken place in all these countries, albeit with very different conclusions.

In relative terms, shale activity in Poland is by far the most active, though it’s still very much in the exploration/”science experiment” stages. The recent Baltic Basin well results from San Leon Energy [listed in London] are encouraging, and ConocoPhillips (COP) in 2013 extended its exploration partnership with 3Legs Resources [listed in London]. On the other hand, some other international operators, including ExxonMobil (XOM), Marathon Oil (MRO) and Talisman Energy (TLM), have been less impressed and exited.

In Lithuania, the government in 2013 conducted a tender for the exploration of the Silute-Taurage prospect — the country’s first identified shale-gas play. Chevron emerged as the winner of the process, but quickly decided to pull out of this acreage, citing an unfavorable regulatory climate. In Romania, under pressure from anti-fracking groups, parliament has voted to ban shale drilling altogether. In Germany, fracking is not formally banned, but the regulators have been so stingy with permits that there is a “de facto” moratorium, impeding operators such as Exxon from moving forward.

Catchy line from teh Telegraph. You figure it out.

• Is Ukraine’s misery the next Black Swan for West’s financial markets?

Is the world about to experience another Black Swan, a seemingly improbable or unpredictable turn of events with deeply negative consequences for financial markets and the economy? Developments in Kiev certainly have the potential to turn into such a catastrophe, for they are not just about Ukraine. Just as the Syrian civil war reflects a wider regional struggle between Iran and Saudi Arabia for political and religious supremacy, Ukraine finds itself the luckless victim of much bigger forces than its own internal divisions – centuries old East/West rivalries and ambitions.

Ukraine’s disgusting kleptocracy deserves to fail; genuine democracy and rule of law in this brutalised nation would be an overwhelmingly positive development. Yet there is something almost Napoleonic about the idealistic fervour with which Europe pursues its eastern ambitions.

At this stage, Western markets are fairly sanguine about the long-term impact of Ukraine’s civil conflict. Ukraine is a relatively small economy that remains profoundly more integrated with Russia than Europe. Indeed, Russia has always regarded Ukraine not just as a vassal state, but essentially as part of the same country. If it were to vanish from the face of the Earth tomorrow, there would undoubtedly be consequences for Russia, but the direct impact on Western economies would be marginal to non-existent.

Yet it is in the nature of Black Swans that they spring from the seemingly insignificant. Europe’s attempts to woo Ukraine have combined with the defensiveness of Vladimir Putin’s Russia to give the situation a potentially highly explosive dynamic. We don’t know how Mr Putin is going to react.

Despite the warm glow of a relatively successful Winter Olympics, it’s unlikely to be kindly. First Ukraine, next Russia; Ukraine is only a mirror image of Russia’s own, corrupt form of semi-totalitarian, gangster capitalism. If Russia’s sphere of influence is not defended in Ukraine, it can only be a matter of time before the wolves will be at Mr Putin’s own door.

Hopes of persuading Russia into some kind of cuddly grand economic bailout with Europe and the US – apparently seriously entertained by those who should know better – are for the birds. Ukraine must choose, and if it chooses “wrongly” there will be consequences. Military intervention, or separation of Ukraine, cannot be ruled out.

The stupidity of Greek recovery laid bare. It goes by the name of Christine.

• Christine Lagarde thinks the troika got it wrong on Greece? (Guardian)

On Thursday, Christine Lagarde made some comments in an interview for Australia’s ABC which have passed largely unreported, Greece no longer being the crisis en vogue. She admitted that the troika – the entity consisting of the European commission, the European Central Bank and the International Monetary Fund, of which Lagarde is the head – was mistaken in its calculations initially and that this led to the wrong economic solutions being applied to the Greek crisis. She claimed, nevertheless, that they had “made sure there was enough of a safety net so that people who were most exposed would not suffer too much”.

I don’t know what Lagarde sees when she visits Greece. Perhaps it is a different country to the one I experience whenever I travel back. After all, for someone on a cool, tax-free $500,000 salary, who no doubt flies first class and is transferred by limousine between five-star hotels and clean, white marble conference buildings, reality may be easy to miss.

Or perhaps there is another, first-class reality, a five-star version of events. Such a visitor is unlikely to see the old women clad in black dresses and scarves, who appear like an ancient Greek chorus as soon as supermarkets have rolled down their shutters, in order to search through the bins for scraps in the evening gloom. Or the thousands queueing up every day for care packages from Médecins du Monde, or the addicts shooting up in the streets, or the body bags of families being wheeled out of flats, suffocated as they burned rubbish in their stove to keep warm. In my own small town of Mykonos – largely insulated by virtue of its popularity as a holiday destination – two people tried to kill themselves last week, due to financial ruin.

On Friday the respected medical journal the Lancet published a report which told quite a different story to that offered by the head of the IMF. It set out the devastating effect austerity has had on the health of the nation. It explained how the drastic reduction in healthcare and social spending combined with the pressure of a higher tax burden, unemployment of nearly 25% and an economy which has shrunk more than 20% in the last few years to create a pincer movement which has caught millions of innocent people in its grip.

It has resulted in 800,000 people with no health coverage, escalations in HIV infection, suicide rates, infant mortality, child abandonment, deaths related to violence and ill health from poor nutrition. All the data were corroborated, and have even deteriorated since being collated for the report.

“In view of this detailed body of evidence for the harmful effects of austerity on health, the failure of public recognition of the issue by successive Greek governments and international agencies is remarkable. Indeed, the predominant response has been denial that any serious difficulties exist”, the Lancet report concludes. “This dismissal meets the criteria for denialism, which refuses to acknowledge, and indeed attempts to discredit, scientific research.”

It is the essence of such denialism which Lagarde exhibits when she says Greece is out of the woods and praises the country for reportedly achieving a primary surplus of more than €1.5bn – a giant amount for such a small economy. This surplus is in itself the subject of very lively debate, with many suggesting it is the result of the same creative accounting techniques that got the country’s economy into trouble to begin with.

This denial is accompanied by a monumental crassness; a lack of even the most rudimentary understanding of Greece’s collective psyche, its people and its history. How else can one explain Lagarde saying that “we can only celebrate now the fact Greece is finally coming out with a primary surplus, as we call it, which hasn’t happened since 1943”?

In 1943 Greece was in the middle of a four-year occupation by Nazi Germany, a period during which the country mourned nearly 10% of its population; the victims of violence, execution, disease and hunger. The Great Famine of Athens alone resulted in an estimated 300,000 deaths in the winter of 1942. It’s good to know, however, that the country’s books were balanced.

Are such comments the result of gargantuan thoughtlessness – or do they hide a deeper, uglier message, that Greece does best under foreign rule? One thing is certain: that tragically they play directly into the hands of fascist organisations like Golden Dawn, with its not-really-a-swastika logo, not-really-nazi salute and not-really-criminal parliamentarians. Their central message is one of suffering Hellenism under an economic occupation. Their central promise, to rid Greece of foreign interference. Recent opinion polls have them comfortably in third position. Every time Christine Lagarde decides to comment on Greece, they must cheer.

India subsidizes the heebees out of (or into) its energy imports. That has to bite some day.

• Light Dims for Millions in India as Gas-Price Rise Looms (Bloomberg)

A government plan to double the price of natural gas on April 1 to boost production risks making a fuel that accounts for about a 10th of power-generation capacity too costly. “Gas power is extremely sensitive to gas prices,” N.N. Misra, operations director at state-run NTPC, the nation’s biggest power generator, said in a Feb. 14 interview. “We’re currently running our plants at 35% capacity. It is anyone’s guess what will happen if the price doubles.”

India’s aim is to spur more output from Reliance Industries, operator of the country’s biggest natural gas field, and lure explorers such as Exxon Mobil Corp. by raising prices closer to global rates. The risk is that indebted electricity distributors will demand more coal-fired power instead, even as the country struggles to mine enough of the fuel and nations from China to the U.S. seek cleaner gas-based power.

India in June approved a new formula for calculating the price of gas, which will take it to about $8.4 per million British thermal units from $4.2. The tariff would remain lower than the benchmark import price in the spot market of more than $16. That import rate was at about $8 in 2009. Even as the government pushes ahead with raising the price, it requires power distributors to sell electricity below cost, forcing them to increase debt to pay for supplies.

“There’s a view gas prices above $6 aren’t viable for power plants,” said Ashok Khurana, director general at the Association of Power Producers, which counts non-state generators Tata Power, Adani Power and Reliance Power as its members. “If prices double, the plants will have no buyers and will have to shut.”

Hmmm.

• MtGox Website Disappears Amid $300-$400 Million Bitcoin Theft Claim (AFP)

The website of Tokyo-based bitcoin exchange MtGox went down Tuesday amid reports of a theft of the virtual currency worth hundreds of millions of dollars, dealing a blow to its credibility. The bitcoin community rallied round to defend the unit, with chief executives of several major operators pledging to work together to shore up public faith in the project. Visitors to the www.mtgox.com domain on Tuesday got a blank page when they tried to log on, more than two weeks after the firm suspended cash withdrawals and claimed there was a bug in the software underpinning the crypto-currency.

A widely-shared document purporting to be a MtGox “crisis strategy” said the firm might have lost more than 744,400 bitcoins in a theft that had gone unnoticed for years. That number of bitcoins would be worth more than $300 million, using rates at functioning exchanges Tuesday afternoon. It was not immediately possible to verify the document, which was posted on a blog written by someone who describes himself as “an entrepreneur and former VC who makes the business case for #Bitcoin”.

Consternation has grown since MtGox stopped processing external transactions on February 7, claiming there was a problem with the programme that powers the currency and allows it to be transferred between users or swapped for goods and services.

The value of the unit on MtGox had gone into freefall since then. Around midday on Tuesday, shortly before the shutdown, a bitcoin was worth $135, compared with the $430 quoted by the CoinDesk bitcoin price index, which tracks the price of the currency on major exchanges. Prices among exchanges are not always the same. In January a bitcoin was worth more than $900 at MtGox, one of the world’s first exchanges for the unit.

Hmmm to the power of 1000. It’s like Tepco is under some spell that makes it impossible for them to speak the truth.

• Tepco Says Fukushima Radiation ‘Significantly’ Undercounted (Bloomberg)

Tokyo Electric Power Co. is re-analyzing 164 water samples collected last year at the wrecked Fukushima atomic plant because previous readings “significantly undercounted” radiation levels. The utility known as Tepco said the levels were undercounted due to errors in its testing of beta radiation, which includes strontium-90, an isotope linked to bone cancer. None of the samples were taken from seawater, the company said today in an e-mailed statement.

“These errors occurred during a time when the number of the samplings rapidly increased as the result of a series of events since last April, including groundwater reservoir leakage and a major leak from a storage tank,” according to the statement. It will run new tests of the samples taken from April to September 2013 and will publish corrected beta radiation readings. Outside experts were being sought in Japan and internationally to cross-check analysis results and review Tepco’s measurement methods, the company said. The measurement errors were halted in October 2013 after testing manuals were clarified and other steps taken to ensure accuracy, Tepco said.

More Snowden docs. At The Automatic Earth, none of this looks surprising, I can assure you.

• How Covert Agents Infiltrate the Internet (Glenn Greenwald)

One of the many pressing stories that remains to be told from the Snowden archive is how western intelligence agencies are attempting to manipulate and control online discourse with extreme tactics of deception and reputation-destruction. It’s time to tell a chunk of that story, complete with the relevant documents.

Over the last several weeks, I worked with NBC News to publish a series of articles about “dirty trick” tactics used by GCHQ’s previously secret unit, JTRIG (Joint Threat Research Intelligence Group). These were based on four classified GCHQ documents presented to the NSA and the other three partners in the English-speaking “Five Eyes” alliance. Today, we at the Intercept are publishing another new JTRIG document, in full, entitled “The Art of Deception: Training for Online Covert Operations.”

By publishing these stories one by one, our NBC reporting highlighted some of the key, discrete revelations: the monitoring of YouTube and Blogger, the targeting of Anonymous with the very same DDoS attacks they accuse “hacktivists” of using, the use of “honey traps” (luring people into compromising situations using sex) and destructive viruses. But, here, I want to focus and elaborate on the overarching point revealed by all of these documents: namely, that these agencies are attempting to control, infiltrate, manipulate, and warp online discourse, and in doing so, are compromising the integrity of the internet itself.

Among the core self-identified purposes of JTRIG are two tactics: (1) to inject all sorts of false material onto the internet in order to destroy the reputation of its targets; and (2) to use social sciences and other techniques to manipulate online discourse and activism to generate outcomes it considers desirable. To see how extremist these programs are, just consider the tactics they boast of using to achieve those ends: “false flag operations” (posting material to the internet and falsely attributing it to someone else), fake victim blog posts (pretending to be a victim of the individual whose reputation they want to destroy), and posting “negative information” on various forums.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Feb 25 2014: (Bomb)Shell