Arnold Genthe “Unidentified buildings, possibly movie set” 1920

As events continue and broaden in markets connected in any which way to emerging markets and central bank largesse, there comes a time when we need to consider that at some point it becomes inevitable that all sorts of leveraged bubbles start popping, leaving behind in their wake pools of vanishing virtual turned non-existent leveraged “assets”. The popping bubbles are not the beginning of the process, they’re merely the ingredients that make the long since naked emperor visible to the crowds in all his natural glory.

And as virtual value vanishes, less money/credit is available, and even less is actually being spent. Which is how deflation is properly summarized. Lay that out on top of already very low interest rates and consumer spending numbers in the western world, and it’s time for even the staunchest opponents of the concept to start paying attention.

Ambrose Evans-Pritchard reports on a series of data that look to confirm this: “Eurozone M3 money growth has been negative for eight months“, contracting at a rate of 1.1% over the past quarter. “Bank credit to the private sector has fallen by €155 billion in 3 months“.

He further points to Eurostat data which show that “Italy, Spain, Holland, Portugal, Greece, Estonia, Slovenia, Slovakia, Latvia, as well as euro-pegged Denmark, Hungary, Bulgaria and Lithuania have all been in outright deflation since May“, once tax rises are stripped out. “Underlying prices have been dropping in Poland and the Czech Republic since July, and France since August. ”

The Hungarian forint has been dropping like a stone today. Typically, it’s a different currency every day, until one breaks. The attacks on currencies in global markets are structured to find the weakest amongst the lot, and it’s easy pickings, because there are hardly any strong currencies left. It’s a game the traders can’t lose, there’s money to be made in every step, provided they set their shorts and longs correctly, and in the end they’ll catch a government panicking and lowering their defenses. Then it’s in for the kill. And on to the next one.

Turkey, India and South Africa have already raised interest rates, to little avail, and more will follow. These are moves in which domestic economies are crippled in order to save currencies, which makes the ultimate benefits highly doubtful. Still, the recent rapid increase in dependence on inflows originating with foreign central banks, and the even more recent threat of these inflows no longer being available, has made many governments queasy. For good reason. No economy can be built on bubbles alone, but it’s so easy and tempting to think this time may be different. That is true in both developed and developing nations.

Ambrose gives a poignant example of how things are changing and developing: “it now costs 10% more to produce the Airbus A320 in Tianjing than it does in Toulouse.“. That may come as a bit of a shock for some.

• World risks deflationary shock as BRICS puncture credit bubbles (AEP)

Half the world economy is one accident away from a deflation trap. The International Monetary Fund says the probability may now be as high as 20%. It is a remarkable state of affairs that the G2 monetary superpowers – the US and China – should both be tightening into such a 20% risk, though no doubt they have concluded that asset bubbles are becoming an even bigger danger.

“We need to be extremely vigilant,” said the IMF’s Christine Lagarde in Davos. “The deflation risk is what would occur if there was a shock to those economies now at low inflation rates, way below target. I don’t think anyone can dispute that in the eurozone, inflation is way below target.” It is not hard to imagine what that shock might be. It is already before us as Turkey, India and South Africa all slam on the brakes, forced to defend their currencies as global liquidity drains away. The World Bank warns in its latest report – Capital Flows and Risks in Developing Countries – that the withdrawal of stimulus by the US Federal Reserve could throw a “curve ball” at the international system.

One country after another is now having to tighten into weakness. The longer this goes on, and the wider it spreads, the greater the risk that it will metamorphose into a global deflationary shock. Turkey’s central bank took drastic steps on Tuesday night to halt capital flight, doubling its repurchase rate from 4.5% to 10%. This will bring the economy to a standstill in short order, and may ultimately prove as futile as Britain’s ideological defence of the ERM in September 1992.

South Africa raised rates on Wednesday by half a point to 5.5% to defend the rand, and India raised a quarter-point to 8% on Tuesday, all forced to grit their teeth as growth fizzles. Brazil and Indonesia have already been through this for months to stem a currency slide that risks turning malign at any moment.

China is marching to its own tune with a closed capital account and reserves of $3.8 trillion, but it too is sending a powerful deflationary impulse worldwide. Last year it added $5 trillion in new plant and fixed investment – as much as the US and Europe combined – flooding the global economy with yet more excess capacity.

Markets have a touching faith that the same Politburo responsible for a spectacular credit bubble worth $24 trillion – one and a half times larger than the US banking system – will now manage to deflate it gently with a skill that eluded the Fed in 1928, the Bank of Japan in 1990 and the Bank of England in 2007. [..]

Moreover, China is struggling to keep its industries humming at the current exchange rate. Patrick Artus, from Natixis, says surging wages – and falling productivity – mean that it now costs 10% more to produce the Airbus A320 in Tianjing than it does in Toulouse. [..]

Europe has let its defences collapse behind a Maginot Line of orthodox monetary policy. Eurostat data show that Italy, Spain, Holland, Portugal, Greece, Estonia, Slovenia, Slovakia, Latvia, as well as euro-pegged Denmark, Hungary, Bulgaria and Lithuania have all been in outright deflation since May, once tax rises are stripped out. Underlying prices have been dropping in Poland and the Czech Republic since July, and France since August.

Eurozone M3 money growth has been negative for eight months, contracting at a rate of 1.1% over the past quarter. Bank credit to the private sector has fallen by €155 billion in 3 months, according to the latest data from the European Central Bank.

This is a curious title for an article: “Yellen Faces Test Bernanke Failed”. Curious, because it presumes than Bernanke tried, whereas it looks like all he did was blow ever larger bubbles. Until last month’s Fed meeting perhaps. If you’ve ever tried to ease a soap bubble into deflating smoothly, you recognize the issue: bubbles don’t go gently.

• Yellen Faces Test Bernanke Failed: Ease Bubbles (Bloomberg)

Yellen faces two challenges in dealing with bubbles: she has to identify and deflate them before they get too big and dangerous; and she has to manage monetary policy without causing them to burst in a way that causes havoc in financial markets and undercuts the expansion.

The trouble is that the tools she has for the first task, such as raising capital standards for banks or requiring homebuyers to put down more of their own money, are largely untested in the U.S. They are potentially cumbersome to put in place with multiple regulatory bodies involved and could prove politically unpopular.

The money lost in all emerging markets combined must be starting to add up. And there is no end in sight. They don’t have the credit space and foreign reserves left to recover, other than with great difficulty. China may have trillions worth of Treasuries, but its federal debt is many times higher.

• Emerging Stocks Head for Worst Start Since 2008 (Bloomberg)

Emerging-market stocks fell, with the benchmark gauge extending the worst start to a year since 2008, after China’s manufacturing shrank and the U.S. Federal Reserve pressed on with stimulus cuts. Investors are pulling money from exchange-traded funds that track emerging markets at the fastest rate on record, as China’s slowing growth and cuts to central-bank stimulus sink currencies from Turkey to Brazil.

Investors pulled out more than $7 billion from ETFs investing in developing-nation assets this month, the most since the securities were created, as China’s manufacturing activities slowed, Argentina’s unexpected devaluation and surprise rate increase in Turkey and South Africa.

Capital coming – back – in from emerging markets will seek a safe haven. If enough of it reaches Switzerland this time around, its central bank will need to prop up its efforts to protect the Swiss franc. even more. Yay, we get to blow the Bank of Switzerland! While too much reaching Germany may devastate the PIIGS economies it’s so closely linked to. Ironically, a currency union like the Euro has strengths, in that it protects weaker members, but only up to a point, since when circumstances move too far apart in strong vs weak parts, it’s the latter who come under even more pressure.

• Emerging markets crisis sees rush for safe havens (Guardian)

Investors sought out the safe havens of German bonds and the Swiss franc on Wednesday after deep splits in Turkey over interest rate increases meant only the briefest of respites from the escalating crisis in emerging markets. The Turkish lira lost all the gains seen after the central bank raised the cost of overnight borrowing by 4.25 points to 12% once the prime minister, Recep Tayyip Erdogan, strongly attacked a move designed to counter high inflation and halt capital flight.

South Africa became the latest country forced to raise borrowing costs to defend its currency, pushing up the cost of borrowing for the first time since 2008. Brazil, Indonesia and Thailand are seen as the next three most likely emerging market candidates for tighter policy.

Share prices fell on the world’s leading bourses, with investors rattled that the Indian, South African and Turkish currencies all weakened despite attempts by policymakers to shore them up with higher interest rates. In London the FTSE 100 closed slightly lower at 6544 following a 28-point fall, while the dollar weakened against two traditional safe-haven currencies – the Japanese yen and the Swiss franc.

The Russian rouble hit a record low on the foreign exchanges amid speculation that the slow-growing commodity-dependent economy was likely to be one of the next countries to feel the impact of the emerging market sell-off. “The fact that currencies have continued to weaken even in countries that have started to raise interest rates opens up a new, and potentially more worrying, phase of the recent turmoil in EM financial markets in which beleaguered policymakers find themselves unable to defend their currencies,” said Capital Economics.

It’s hard to know which numbers out of China are even remotely true, but it’s obvious the great growth days are gone. Someday some investment instrument will have to go bust, and the longer that’s postponed artificially, the worse it’s all going to get. Manufacturing is contracting, instead of growing at 7%+. How many more empty cities will be built before things start to crumble? There must come a moment when Beijing will either stop making good on losses stemming from the shadow banking system, or admit it’s lost control to that system. Neither choice will bear good tidings for Chinese workers and savers. Remember: “it now costs 10% more to produce the Airbus A320 in Tianjing than it does in Toulouse.“. That’s all you need to know.

• China Manufacturing Index Shows Contraction (Bloomberg)

A Chinese manufacturing gauge signaled the first contraction in six months in January as companies cut jobs and credit-market stresses damped confidence in the world’s second-biggest economy. A Purchasing Managers’ Index fell to 49.5 from 50.5 in December, HSBC Holdings Plc and Markit Economics said in a statement today. The reading compared with the median 49.6 estimate in a Bloomberg News survey of 14 economists. A number below 50 indicates contraction.

The Australian dollar and copper fell as the survey showed manufacturers eliminating jobs at the fastest rate in almost five years. Credit Suisse Group AG this week cut its first-quarter growth forecast for China, citing anecdotal evidence of “surprisingly slow” retail sales ahead of the week-long Lunar New Year holiday, which starts tomorrow.

“China’s growth momentum will continue to weaken in coming quarters,” Dariusz Kowalczyk, senior economist and strategist at Credit Agricole CIB in Hong Kong, said in a note. “The market continues to underestimate the degree of the ongoing slowdown and further negative surprises are in stock as the year progresses.”

Turning China into a manufacturing society will pan out to be have been much easier than turning it into a consumer society too. That has to do with trust and confidence, neither of which have been in ample supply over the Middle Kingdom’s past century (and beyond). It’s the difference between a physical state and a state of mind.

• China Faces Obstacles on Road to Consumer Society (AP)

Combined with an export boom, a flood of spending on new factories, highways and other assets powered the past decade of explosive growth. That helped China rebound quickly from the 2008 global crisis. But it was paid for with a surge in borrowing that economists warn looks like debt booms in other developing countries that spiraled into financial crises.

As urgency for change mounts, so do potential hurdles. Consumer spending accounts for only about 35% of gross domestic product, well below neighboring India’s 60%, and that percentage declined last year. Curbs on investment will mean less money flows to wages in construction and building materials industries such as steel and cement.

“It is a pretty narrow path that policymakers have to push the economy along,” said Mark Williams, chief Asia economist for Capital Economics. “The risk is that if investment spending slows too much, then that starts to undermine consumer spending and you get a downward spiral.”

Forecasts of this year’s growth range from 7 to 8%, far ahead of the United States and Europe but down from China’s double-digit rates of the past decade. Last year’s 7.% growth tied with 2012 for the weakest performance in two decades. And it hit that only after Beijing launched a mini-stimulus in mid-2013 with more spending on building new railways and other public works.

The impact of a government clampdown on lending and construction is showing in slower economic activity, raising the risk of politically difficult job losses.

Britain’s banks exhibit a state of mind as well: the erosion of respect for their customers. And why should they have such respect? People have nowhere else to go to conduct their monetary traffic or deposit their savings anyway. So by all means, close branches and bank machines, till they have to travel so far to get some cash they’ll all be forced to go exclusively plastic.

• British banks axing thousands to reduce costs (RT)

Three of the UK’s biggest lenders – Barclays, Lloyds and the Royal Bank of Scotland – plan to massively cut staff and close a large number of branches. British banks are struggling to cut costs, as multi-billion dollar regulatory costs eat their profits. Barclays is to cut a quarter of its 1,600 branches in the UK and fire hundreds of investment banking division employees under the cost cutting program, as it seeks to reduce spending by $2.8 billion (£1.7 billion) by next year, according to the Financial Times (FT).

Another British lender Lloyds Banking Group also said it would cut 1,080 jobs and outsource more in a bid to decrease costs as part of the restructuring plan announced in 2011. The Royal Bank of Scotland, which is expected to be charged another £3bn for mis-selling, will announce its cost-cutting programme next month, according to the Mirror newspaper.

Experts say the cuts also highlight the banks’ efforts to take advantage of fast-developing technology such as smartphone applications and contactless payments to cut their costs, the FT says. “This is a fundamental 100-year transformation of the banking industry, that’s what I think we are seeing,” the FT quotes a person familiar with the Barclays plan.

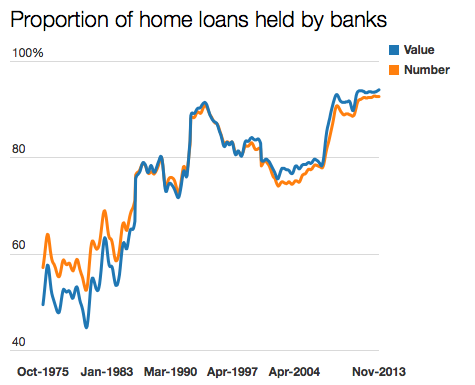

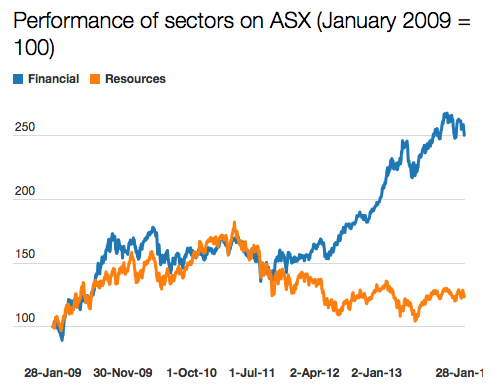

Australia’s banks suffer from the same problem as the British, and as most large banks by now: a complete lack of a balance of power. The universal answer to a crisis caused by banks that were too big for their own good has been to make them bigger. Australia’s banks have clinched an even bigger part of the housing bubble formed after what they call the GFC, and therefore harder for the government, let alone the people, to rein in. If you think those graphs look scary, you’re not alone.

• Are Australia’s banks too big to fail? (Guardian)

The big change happened with the 1990 recession and the collapse of building societies like Pyramid which mirrored somewhat the then “savings and loans” crisis occurring in America. Not surprisingly, when times got tough, people flocked to the safety of the banks. And so by the end of 1994, banks controlled around 91% of all home loans in Australia.

Throughout the 1990s and into the 2000s this figure shrank as wholesale mortgage lenders such as RAMS and Aussie Home Loans came into the market. By the middle of 2007 banks controlled only 78% of the value of the home loan market. Then the GFC hit.

Within 18 months they controlled 91% and the latest figures have the banks accounting for 94.1% of all monies loaned to owner-occupier home buyers. But while the domination of the banking sector is similar to the situation in the early-mid 1990s, the current dominance of the big four is much greater.

According to the Australian Prudential Regulation Authority (APRA) there are 69 banks operating in Australia (admittedly not all take deposits or make home loans), but the big four now control 84.3% of all home loans undertaken by banks and 81% of all household deposits. Ten years ago they controlled less than 75 per cent of both categories.

And given that in 2002 the banking sector accounted for less of the home loan market than it does now, that means that since 2002 the big four have gone from controlling around 58% of Australia’s home loan market to taking up 79.3% today. That’s a big chunk of a $16.3bn monthly pie.

More on the Goldman deal for control of Denmark’s energy industry. Bet you the Danish government at this point will have to pay a hefty fine for reneging on the – as yet unsigned – contract. The deal with Goldman was reached in December, whereas half a year earlier pension fund PensionDanmark had made an offer that was 40%(!) higher than Goldman’s. And offered the very same deal again recently. Something rotten in the state alright.

• Goldman Sachs Deal Breaks Down Danish Government Coalition (Bloomberg)

Goldman Sachs’s plan to purchase a stake in Denmark’s state-owned utility risks making Helle Thorning-Schmidt a one-term prime minister.

Goldman’s 8 billion-krone ($1.5 billion) investment in Dong Energy A/S is weakening her coalition, with the Socialists quitting the government today amid opposition to the deal. Parliament’s finance committee is due to vote today on the Wall Street bank’s offer to buy an 18% stake in the Danish utility. A Megafon poll conducted by TV2 showed 68% of Danes are against Goldman holding the stake.

“The Dong share sale is putting more nails in the government’s coffin,” said Christoffer Green-Pedersen, a political science professor at the University of Aarhus. “They won’t survive the next election unless they find a way to highlight their successes.”

Finance Minister Bjarne Corydon, a member of the premier’s Social Democrat party, has fought off growing opposition to the deal from unions, lawmakers and street protesters while maintaining backing from the opposition Liberals and Conservatives. Poul Nyrup Rasmussen, a former Social Democrat premier, publicly urged him to scrap the deal, calling Goldman a “shady partner.”

The Socialist People’s Party — the second-biggest in the three-party government — quit the coalition and its leader, Annette Vilhelmsen, will step down, she said today. At least two of the Social Democrats’ 45 members in parliament have said publicly the government should postpone the Goldman deal.

The Red-Green Alliance, which helps secure the government its majority in parliament, on Jan. 28 grilled Corydon for almost four hours in a hearing, criticizing him for his plans for Dong, the world’s biggest operator of offshore wind farms.

An online petition seeking to block the deal has gathered more than 195,000 signatures, and thousands of protesters gathered outside the parliament in Copenhagen late yesterday to voice their anger. A yellow banner with a drawing of a vampire squid was draped around a statue of King Frederick VII, which stands in front of the parliament’s main entrance.

• Leaked document: Goldman Sachs wasn’t highest DONG bidder (Copenhagen Post)

New information has changed the agenda ahead of today’s parliamentary hearing in which Finance Minister Bjarne Corydon (S) will explain the details of the controversial partial sale of DONG Energy to US investment bank Goldman Sachs. Despite what the government claims, pension fund PensionDanmark’s bid for partial ownership of the state-owned energy company was higher than the bid Goldman Sachs offered, TV2 News reports.

A leaked note revealed that PensionDanmark estimated the stock capital of DONG shares to be 46 billion kroner, a 40% higher rate than the 32 billion kroner Goldman Sachs offered.

On Thursday, parliament will vote on allowing Goldman Sachs to invest eight billion kroner in 19 percent of DONG shares. Critics of the sale are concerned with the investment bank’s plans to establish its DONG Energy partial ownership in global tax havens, as well as conditions of the deal that give Goldman Sachs veto rights over the energy company’s future direction and leadership.

Shell earnings dropped 74%, but because the behemoth announces “restructuring” plans in US shale and Arctic drilling, its shares are actually up today. Peering behind the rosiness, more losses on shale investments (on top of the $2.1 billion write-off on US assets last year) and a clean withdrawal from the Arctic, send one major message more than anything: exploration costs vs expected revenue become less economically viable as we go along. It’s not even so much about dumping risky assets, it’s about ever fewer assets being available to turn a profit.

• Shell 4Q Earnings Fall 74% (AP)

Shell’s earnings have dropped by 74% in the fourth quarter from the same period a year ago, on a mix of higher exploration costs, lower production, and worse refining margins. The company, which warned on Jan. 17 weaker figures were coming, also had more one-time gains in 2013. Net profit for the quarter was $1.78 billion versus $6.73 billion a year earlier.

The earnings report, the first featuring new Chief Executive Ben van Beurden, noted that production was down 5% to 3.25 million barrels per day. Shell said 2 percentage points were due to wells shut in Nigeria for security reasons, Shell said, and the rest due to other maintenance and “asset replacement activities” – old fields fading faster than new projects came online.

Ha! Fatih Birol wants Britain to build more nukes instead of fracking. Nice pair of choices!

• No US-style fracking revolution for Britain, says IEA (Telegraph)

The UK should consider building more nuclear power plants and should not expect cheap energy prices to come from a US-style “revolution” in shale oil and gas, the world’s top energy forecaster has warned.

“The UK has significant shale gas resources but people shouldn’t expect a US scale energy revolution in the UK,” Fatih Birol, chief economist and director of global energy economics at the International Energy Agency told The Telegraph in an interview on Thursday. “The economics are not as favourable as in the US.”Mr Birol’s comments come after Energy Minister Michael Fallon unveiled this month a raft of incentives designed to encourage shale gas fracking across the country. The Government hopes that cheap energy from shale will provide a boost to the economy on a scale seen in the US where fracking has played a major part on the nation’s economic recovery.

French energy giant Total gave the fracking industry a boost in the UK this month signing a deal to invest in licences to develop shale resources in Lincolnshire but so far it is the only major international oil company to commit in Britain.

Half of Britain could be opened up for fracking to tap 1,300 trillion cubic feet of gas that is estimated to be locked under ground in the North of England alone.But Mr Birol said that the UK’s shale resources, although significant, are much smaller than in the US, which also benefits from more available land to accommodate fracking sites and drilling operations. Instead of relying solely on tapping the UK’s shale’s oil and gas reserves to provide affordable energy, Mr Birol says that the UK should consider building more nuclear power plants. “Nuclear could have a more positive role to play in the UK,” said Mr Birol.

A bunch of overzealous cops gets whistled back by public outrage. Where is that anger when you really need it, against banks, governments, energy cartels? We now know the British are capable of it. So let’s see it already!

• UK prosecutors drop case against men caught taking food from supermarket bins (Guardian)

Three men caught taking discarded food from bins outside an Iceland store will not now be prosecuted after an explosion of criticism over the decision to bring charges against them, including from the company’s chief executive.

The Crown Prosecution Service said it would drop its case despite having previously said there was “significant public interest” in prosecuting the men. They were caught last year taking tomatoes, mushrooms, cheese and Mr Kipling cakes from the dustbins behind a branch of the high-street retailer. Baljit Ubhey, the chief crown prosecutor for the CPS in London, said: “This case has been reviewed by a senior lawyer and it has been decided that a prosecution is not required in the public interest.”

The Guardian revealed on Tuesday that Paul May, Jason Chan and William James had been charged under the 1824 Vagrancy Act, after being discovered in “an enclosed area, namely Iceland, for an unlawful purpose, namely stealing food”. On Wednesday, Malcolm Walker, the chief executive of Iceland, contacted the CPS to request that the case be dropped, stating that the company had not sought a prosecution.

The retailer took rapid steps to distance itself from the case, attempting to offset a damaging public relations storm as news of the prosecution triggered widespread criticism. Several online petitions were launched, calling on the CPS to reconsider its decision to prosecute.

Yeah, baby penguins. Hey, you can still watch them on TV! Everything dies, baby, that’s a fact. But maybe everything that dies one day comes back. Well, it won’t.

• Climate change is killing baby penguins (AFP)

Climate change means more extreme weather and baby penguins are paying the price with their lives, said a pair of long-term studies out Wednesday. Soaking rainstorms and unusual heat have killed vast numbers of young Magellanic penguins at the bottom tip of South America, said one of the papers published in the journal PLOS ONE.

“It’s the first long-term study to show climate change having a major impact on chick survival and reproductive success,” said lead author Dee Boersma, a biology professor at the University of Washington.

Over the course of 27 years, an average of 65% of chicks died annually, said the study. About 40% starved, while climate change was blamed for killing an average of 7% of chicks per year. However, climate change killed 43 and 50% of all new chicks in two extreme weather years.

The chicks were particularly susceptible when they were nine to 23 days old and too large to be protected by their parents but too young to have grown waterproof feathers. “We’re going to see years where almost no chicks survive if climate change makes storms bigger and more frequent during vulnerable times of the breeding season as climatologists predict,” said co-author Ginger Rebstock.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Jan 30 2014: No More Humming Along