DPC REO Mountaineer, New York to San Francisco and back, 10 months June 1906

We hugely underestimate what it means not to have a functioning financial system and economy. It even feels sort of fine for a while, both to the richer part of our population who get richer, and to the rest who fall for the dream that things in their lives will get better again soon. But there is still a big difference between what things look like, and what they really are. And one day we will need to snap out of the dream and face reality.

Because there will come a point when people across the board will want to know what things are truly worth, not what someone wants them to think they are. People will want to find out what the prices is they pay to maintain the illusion. And the rich will want to keep getting richer; that urge is built into the system.

Volatility is awfully low, and that makes it impossible for some people to make money; betting against certain stocks or companies or bonds is no longer possible, even if their values don’t represent what goes on beneath the veil. Companies and countries that are not doing well at all, cannot be ‘punished’ for their poor performance. They can instead go out and borrow even more, and cheap, so their underlying numbers only get worse while they look to be sitting pretty.

Back in March, Tyler Durden posted a piece by Seth Klarman of Baupost Group, who wrote the stock market resembles a Rorschach test: “what investors see in the inkblots says considerably more about them than it does about the market.” And it’s really a Truman Market, with the Fed as “creators”:

Welcome to “The Truman Show” market. [..] The world Truman inhabits turns out to be phony: a gigantic sound stage created for a manufactured “reality.” As Truman starts to unravel the truth, his anger erupts and chaos ensues. Ben Bernanke and Mario Draghi, as in the movie, are the “creators” who have manufactured a similarly idyllic, if artificial, environment for today’s investors. They were the executive producers of “The Truman Show” of 2013. A global audience sat in rapt attention before this wildly popular production. Given the U.S. stock market’s continuing upsurge, Bernanke is almost certain to snag yet another People’s Choice Award for this psychological “thriller.” Even in “The Truman Show,” life was not as good as this for investors.

But there is one fly in the ointment: in Bernanke’s production, all the Trumans – the economists, fund managers, traders, market pundits – know at some level that the environment in which they operate is not what it seems on the surface. The Fed and the Treasury openly discuss the aim of their policies: to manipulate financial markets higher and to generate reported economic “growth” and a “wealth effect.” Inside the giant Plexiglas dome of modern capital markets, just about everyone is happy, the few doubters are mocked and jeered, bad news is increasingly ignored, and markets go asymptotic. The longer QE continues, the more bloated the Fed balance sheet and the greater the risk from any unwinding. The artificiality of today’s markets is pure Truman Show. According to the WSJ, the Federal Reserve purchased about 90% of all the eligible mortgage bonds issued in November.

Like a few glasses of wine with dinner, the usual short-term performance pressures on most investors to keep up with the market serve to dull their senses, which makes it a bit easier to forget that they are being manipulated. But what is fake cannot be made real. As Jim Grant recently noted on CNBC, the problem is that “the Fed can change how things look, it cannot change what things are.” According to John Phelan, a fellow at the Cobden Centre in the U.K., “the Federal Reserve has become an enabler of the financial havoc it was designed (a century ago) to prevent.”

Durden returned to the Klarman piece when commenting on the demise of another hedge fund, Emrys Partners. Whatever you think about hedge funds, and I’m sure for many there’s no love lost there, if all is well they do perform an important function in keeping the system healthy. Emrys’ Steve Eisman says that is no longer possible, and so he closes the doors.

“Making Investment Decisions Based On Fundamentals Is No Longer A Viable Philosophy”

Yet another in a long stream of relatively esteemed hedge fund managers has decided enough-is-enough and is shuttering his firm. The reason? Same as the rest… As WSJ reports, Steve Eisman, who emerged as one of the stars of the financial crisis with a winning bet against mortgages, has wound up his fund because he believes that “making investment decisions by looking solely at the fundamentals of individual companies is no longer a viable investment philosophy.” As WSJ reports,

Steve Eisman, who emerged as one of the stars of the financial crisis with a winning bet against mortgages, is shuttering his hedge-fund firm, according to people familiar with the matter. [..] While Emrys gained 3.6% and 10.8% in 2012 and 2013, respectively, its performance lagged behind that of the bull market. It was down this year, one of the people said. Mr. Eisman’s profile grew at the hedge-fund where he previously worked, FrontPoint Partners, which was once owned by Morgan Stanley and where he had managed more than $1 billion.

Besides his bet against mortgages, he was known for shorting, or betting against, for-profit education companies and lobbying against the industry in Washington. He was featured in the best-selling book about the financial crisis, “The Big Short.” [..] In a May regulatory filing, the firm wrote it believed that “making investment decisions by looking solely at the fundamentals of individual companies is no longer a viable investment philosophy.” Instead, Emrys echoed what many stockpickers have said in recent years about larger factors affecting their ability to invest as they had historically. “While individual company analysis will always be important,” it said, “the health, or the change in the health, of the financial system is the starting point of all analysis.”

The reason the Fed has become an enabler of the financial havoc it was – allegedly – designed to prevent is that large part of the banking system have never recovered from the 2007-8 crisis. Greenspan, Bernanke et al should have held all banks against a bright light, and cut out those pieces that were (are) in a too advanced state of decomposition. Doing so, however, would have been a danger to many banks around the globe, and to many of the global financial and political movers and shakers. With less and less parties available to shout that the emperor is naked, the system can only deteriorate further. All we have to wait for is for the return large investors demand on their investments, interest rates, yields, profits, to start rising.

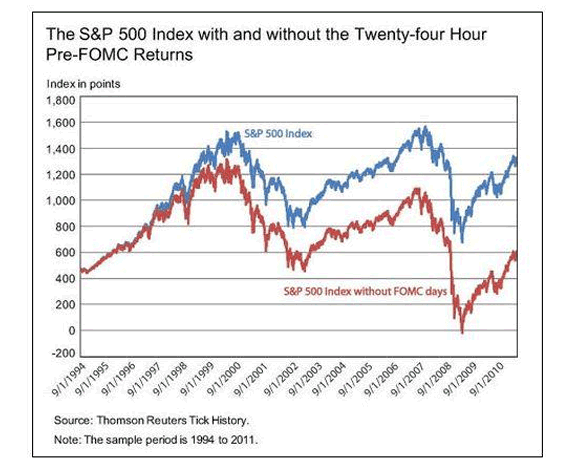

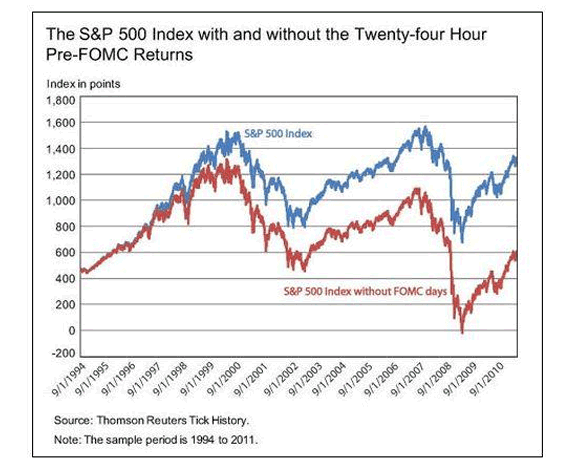

Part of what happens then can be seen in this graph published by the New York Fed in 2012. It doesn’t go beyond 2011, so QE3 is not even included yet, but the overall idea is clear: at least 50% of present stock valuations have been produced by the Fed. Says the Fed itself.

I saw that graph again in an article for Forbes by our friend and faithful follower Jesse Colombo, who selected 23 graphs that show where the dangers in our economies are. Here’s a few of them; they don’t need any further comment from me.

23 Charts That Prove Stocks Are Heading For A Devastating Crash (Colombo)

Following the bull market pattern of the past five years, the U.S. stock market continues to climb to new highs while shaking off all reasons for pessimism as well as the warnings of skeptics. Stock market bulls are becoming increasingly brazen as they drive the market to nosebleed heights, which is convincing a greater number of people into believing in the economic recovery. Unfortunately, the public is being fooled because the U.S. stock market and economy is experiencing another classic central bank-driven bubble that will end in a calamity, erasing trillions of dollars of wealth. As you will see from the charts in this article, there is so much proof that the bull market is actually a dangerous speculative bubble that it is simply undeniable. Despite what the cold, hard facts show, legions of pundits, economists, and investors are coming out of the woodwork to deny the existence of what is one of the most obvious bubbles in history. This widespread denial is what happens when emotions trump logic and reasoning.

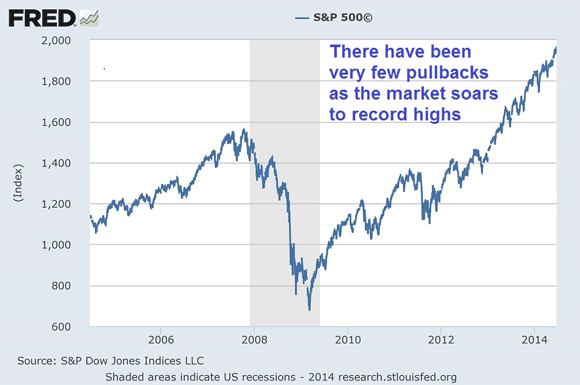

1) Since the current bull run started in early-2009, the stock market has tripled in value while barely experiencing any pullbacks aside from brief corrections in 2010 and 2011, when the Global Financial Crisis was still in full swing. The lack of meaningful pullbacks has emboldened bullish investors as market volatility and risk becomes a distant memory.

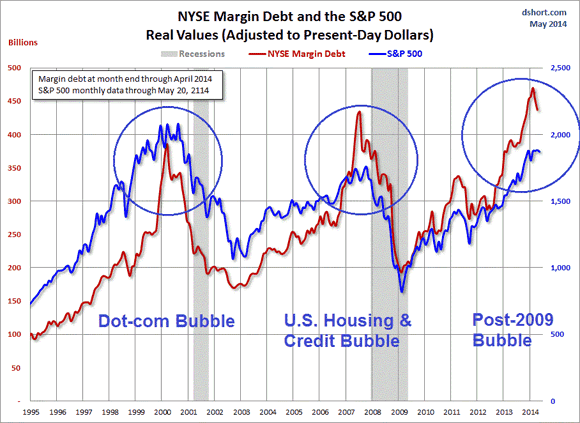

5) Record low borrowing costs and the soaring stock market has encouraged traders to aggressively use margin to finance their stock purchases, which is exactly what occurred during the Dot-com Bubble and the U.S. housing and credit bubble:

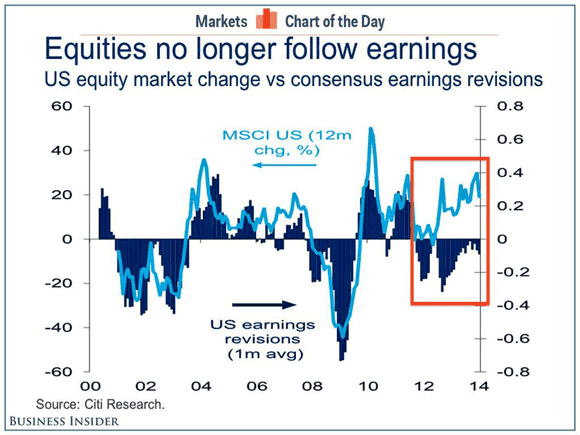

9) Stock markets become overvalued when stock prices rise at a much faster rate than earnings, which is what has occurred for the past several years:

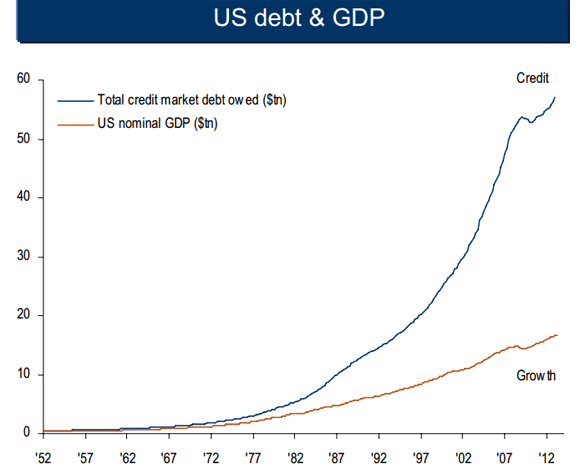

18) Contrary to popular belief, the U.S. economy has not deleveraged or paid down debt after the financial crisis; total outstanding credit is actually hitting new highs, which is helping to drive our ersatz economic recovery:

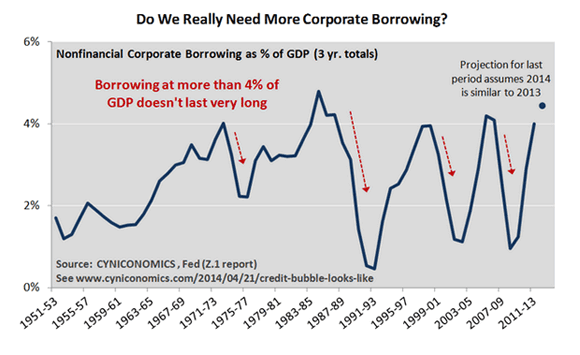

19) Thanks to record low interest rates, total U.S. corporate borrowing is approaching 4% of the GDP – a level that marked the peaks of the last several bubbles, including the housing bubble and the Dot-com Bubble:

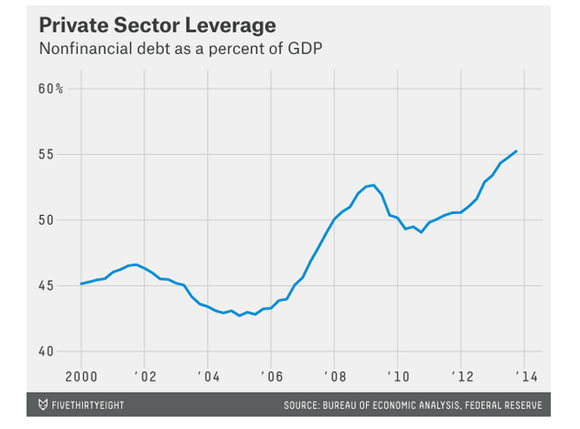

20) U.S. private sector leverage has continued to even higher levels after the financial crisis:

23) The Federal Reserve has actually admitted that U.S. stocks would be 50% lower if it was not for their aggressive stimulation (using a 1994 to 2011 sample period, which is pre-QE3):

Conclusion: At this point, it should be clear that the U.S. stock market is experiencing another bubble that will end in a severe crisis. Please ignore the voices in your mind that may be tempting you to believe that “this time is different” or that “we’ve learned our lesson in 2008, so it can’t happen again.” If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck. The only question that matters now is when will the U.S. stock bubble burst. There are two primary scenarios that I foresee leading to the popping of the U.S. stock bubble, but both involve rising interest rates:

Scenario #1: After several more years of the bubble-driven economic recovery, the Federal Reserve has a “Mission Accomplished” moment and eventually increases the Fed Funds rate (after it ends its QE3 program this year), which pops the post-2009 bubbles that were created by stimulative monetary conditions in the first place. Rising interest rates are what ended the 2003-2007 bubble, which led to the Global Financial Crisis.

Scenario #2: The Fed loses control of longer-term interest rates after investors sell their Treasury bond holdings en masse in fear of a sharp decline in the U.S. dollar’s value after years of money printing.

• 23 Charts That Prove Stocks Are Heading For A Devastating Crash (Colombo)

Following the bull market pattern of the past five years, the U.S. stock market continues to climb to new highs while shaking off all reasons for pessimism as well as the warnings of skeptics. Stock market bulls are becoming increasingly brazen as they drive the market to nosebleed heights, which is convincing a greater number of people into believing in the economic recovery. Unfortunately, the public is being fooled because the U.S. stock market and economy is experiencing another classic central bank-driven bubble that will end in a calamity, erasing trillions of dollars of wealth.

As you will see from the charts in this article, there is so much proof that the bull market is actually a dangerous speculative bubble that it is simply undeniable. Despite what the cold, hard facts show, legions of pundits, economists, and investors are coming out of the woodwork to deny the existence of what is one of the most obvious bubbles in history. This widespread denial is what happens when emotions trump logic and reasoning.

• Investing Based On Fundamentals Is No Longer A Viable Philosophy (Zero Hedge)

Yet another in a long stream of relatively esteemed hedge fund managers has decided enough-is-enough and is shuttering his firm. The reason? Same as the rest… As WSJ reports, Steve Eisman, who emerged as one of the stars of the financial crisis with a winning bet against mortgages, has wound up his fund because he believes that “making investment decisions by looking solely at the fundamentals of individual companies is no longer a viable investment philosophy.” As WSJ reports,

Steve Eisman, who emerged as one of the stars of the financial crisis with a winning bet against mortgages, is shuttering his hedge-fund firm, according to people familiar with the matter. [..] While Emrys gained 3.6% and 10.8% in 2012 and 2013, respectively, its performance lagged behind that of the bull market. It was down this year, one of the people said. Mr. Eisman’s profile grew at the hedge-fund where he previously worked, FrontPoint Partners, which was once owned by Morgan Stanley and where he had managed more than $1 billion.

Besides his bet against mortgages, he was known for shorting, or betting against, for-profit education companies and lobbying against the industry in Washington. He was featured in the best-selling book about the financial crisis, “The Big Short.” [..] In a May regulatory filing, the firm wrote it believed that “making investment decisions by looking solely at the fundamentals of individual companies is no longer a viable investment philosophy.” Instead, Emrys echoed what many stockpickers have said in recent years about larger factors affecting their ability to invest as they had historically. “While individual company analysis will always be important,” it said, “the health, or the change in the health, of the financial system is the starting point of all analysis.”

• Corporate Bonds Will Be Exploding All Along Wall Street Soon (Stockman)

Corporate bonds are the financial IEDs (improvised explosive devices) of monetary central planning. The Fed’s sustained, heavy-handed financial repression has generated the greatest ever scramble for yield, and it is now entering its seventh year. Consequently, speculators and bond fund managers are all in the same side of the boat. And all but the most intrepid traders are scared to death to short the Fed, fearing that any day it might uncork yet another round of bond market repression.

So we have basically a highly artificial one-way market in corporate bonds—both investment grade and high yield. Very recently yields in the latter touched an all-time low of 4.87%, meaning that after inflation and taxes there is virtually no room for losses on securities that are called “junk bonds” for a reason. Likewise, the investment grade index yield is down to 2.97%, leaving almost no margin for risk relative to the allegedly risk free rate on treasuries. What this means is that the $5 trillion corporate bond market is badly mispriced. Yet history proves time and again that sub-economic yields do not stay that way indefinitely.

But the Fed has now taken financial repression to such an extreme that it has caused the corporate bond market to triple in size, even as Dodd-Frank has resulted in a considerable shrinkage of dealer inventories and market liquidity. Accordingly, the exits will be jammed like never before when the corporate bond self-off inexorably arrives. The speed and violence of the impending re-pricing is only hinted at by the thundering collapse of securitized mortgages that occurred in the fall of 2008.

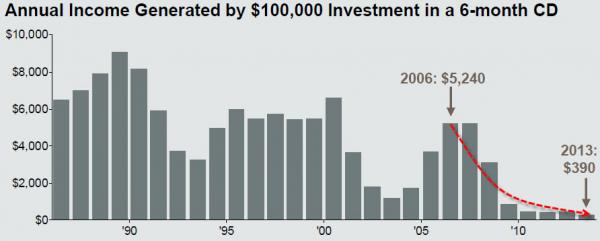

• Charting The Death Of The Saver (Zero Hedge)

Euthanasia of the rentier appears to be increasingly the modus operandi of the central planning caste of the world. As we noted previously, Bernanke’s (and now Yellen’s) plan to exterminate savers is wholly unsustainable, The Fed’s insistence that “our savers collectively have to hold all the assets of the economy and a strong economy produces much better returns in general” must be juxtaposed with comments from a money manager that “I don’t think that’s a fair-trade” for money intended to be invested safely.” By removing the last shred of hope for a rise in savings rates anytime soon, the Fed is once again creating the potential for major unintended consequences as the collapse in interest income for US savers from the 2008 peak forces them to extend duration (TSYs), lower quality (corporate bonds), and/or increase leverage/risk (equities). No matter how hard they herd the masses, the elderly (and still working) respond, “At our age, we can’t be a risk taker anymore.”

• Robust Job Gains Mask Soft Spots in Economy (Dow Jones)

The U.S. economic expansion is entering its sixth year with a shiny exterior after the best stretch of job growth in almost a decade. But under the hood, the recovery’s engine continues to sputter. Overall job growth in June, when employers added 288,000 jobs, showed businesses gaining confidence and shedding the caution that has defined the labor market in the five years since the recession ended. The nation’s jobless rate fell to 6.1%, the lowest level since September 2008, the Labor Department said Thursday, pushing the rate closer to what many economists consider full employment.

Yet those gauges of the labor market don’t capture other weaknesses in the employment spectrum. Nor do they explain the mysteries of an economy that has been struggling to gain enough velocity to shake off its many ailments long after the recession ended. Overall economic growth in the second quarter of the year may not prove robust enough to offset the first quarter’s weather-induced 2.9% annualized rate of contraction. Consumer spending remains weak, a consequence of a labor market delivering new jobs but skimpy wage growth. And the share of Americans working or looking for work–the so-called labor- force participation rate–still hovers near its lowest levels since the late 1970s, despite steady hiring.

PMW Technologies Inc., a supplier of human-resources software called PeopleMatter, highlights the divide in the economy. The Charleston, S.C., firm has added 50 higher-paid software engineers and salespeople over the past year, boosting the company’s benefits package to attract and retain high-skilled workers. It plans to add 100 positions over the next year, bringing its total headcount to 250. Yet the company is witnessing the choppiness among its clients in the retail and food-services sectors. “The economy’s very fragile,” said Chief Executive Nate DaPore. “We’re in a muddle-through economy.”

• Pitchforks, Brainwashing And The Mathematics Of Persuasive Deceit (Tanosborn)

Numbers don’t lie, the saying goes, but the have-liars are doing their numbers on the gullible have-nots. And although mathematics is an exact science, it can be used as a practical tool by inexact social scientists working for those trying to influence people at the civic or individual level, call it politics or more accurately, persuasive deceit. That’s where we have been finding ourselves in the United States for more than three decades, sporting a government of the powerful affluent, whether ran by the apostles of Tweedledee, or the disciples of Tweedledum, lying to the citizenship in all aspects that matter, be it their security, human rights or economic health. We might think that Washington is as pitchfork-worthy today as France was in 1787, or Tsarist Russia in 1917; however, we are still likely a few leagues away from the igniting point that sparks a true revolution, where reality sets in and replaces the mirage created by economic-political brainwashing.

Not quite there yet, the number of people struggling to put food on the table, although increasing at an accelerating pace, still only represents about 20% of those privileged in not having to receive SNAP (Supplemental Nutrition Assistance Program) benefits… those contemptible, dignity-stripped food stamps. In the US we live in two interconnected economic worlds; however, we are brainwashed into believing we are a single, if diverse, society, with one economy, one flag, and one common destiny. But we are not; we are a 2-tier society of haves and have-nots with two distinct economies operating side by side. Two economies that must be measured separately if we dare face the economic and social realities that separate us from being one people, one nation… rancor and anger dividing us even when saluting the very same flag.

Still blaming that odious One Percent of capitalists, Knights of Our Economy, when we should be blaming the culprits in all of this, the Nineteen Percent of troglodyte lackeys serving in their roles of squires, helping to keep our downtrodden hoi polloi in check… and we all know who the squires are; what many of those squires don’t seem to understand is the precariousness of being a squire, and how prone they are to join the ranks of the have-nots… as the 80-20 rule becomes 85-15, then 90-10. Perhaps then our revolution will get to ignite, bringing a more benign form of capitalism to this nation, and not the predatory, in your face capitalism which enslaves us today.

• Pope Calls Exploitation Of Environment A Sin Of Our Time (Reuters)

Pope Francis called for more respect for nature on Saturday, branding the destruction of South America’s rain forests and other forms of environmental exploitation a sin of modern times. In an address at the university of Molise, an agricultural and industrial region in southern Italy, Francis said the Earth should be allowed to give her fruits without being exploited. “This is one of the greatest challenges of our time: to convert ourselves to a type of development that knows how to respect creation,” he told students, struggling farmers, and laid-off workers in a university hall.

“When I look at America, also my own homeland (South America), so many forests, all cut, that have become land … that can longer give life. This is our sin, exploiting the Earth and not allowing her to her give us what she has within her,” the Argentine pope said in unprepared remarks. Francis, who took his name from Francis of Assisi, the 13th century saint seen as the patron of animals and the environment, is writing an encyclical on man’s relationship with nature. Since his election in March, 2013, the leader of the world’s 1.2 billion Roman Catholics has made many appeals in defense of the environment. After the university meeting, Francis said mass for tens of thousands of people in a stadium.

• Whales Are Engineers Of Ocean Ecosystems (PTI)

Whales have a powerful and positive influence on the function of oceans, global carbon storage, and the health of commercial fisheries, a new study suggests. “For a long time, whales have been considered too rare to make much of a difference in the oceans,” said University of Vermont conservation biologist Joe Roman. Roman and a team of biologists, who tallied several decades of research on whales from around the world, have found that whales, in fact, make a huge difference. They have a powerful and positive influence on the function of oceans, global carbon storage, and the health of commercial fisheries, they said.

“The decline in great whale numbers, estimated to be at least 66% and perhaps as high as 90%, has likely altered the structure and function of the oceans, but recovery is possible and in many cases is already underway,” Roman and his colleagues wrote in the journal Frontiers in Ecology and the Environment. “The continued recovery of great whales may help to buffer marine ecosystems from destabilising stresses,” the researchers wrote. This recovered role may be especially important as climate change threatens ocean ecosystems with rising temperatures and acidification.

“As long-lived species, they enhance the predictability and stability of marine ecosystems,” Roman said. Baleen and sperm whales, known collectively as the “great whales,” include the largest animals to have ever lived on Earth. With huge metabolic demands – and large populations before humans started hunting them – great whales are the ocean’s ecosystem engineers: they eat many fish and invertebrates, are themselves prey to other predators like killer whales, and distribute nutrients through the water.

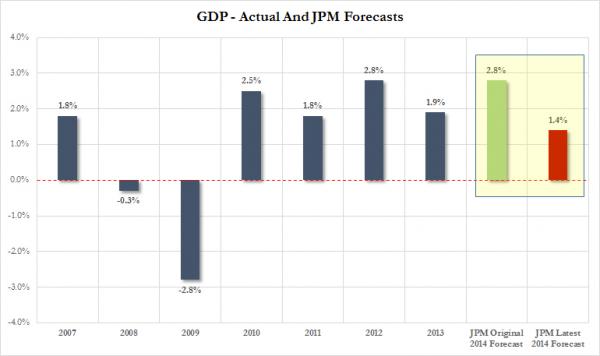

• JPM Cuts 2014 GDP Forecast In Half To 1.4%, Slowest Since 2009 (Zero Hedge)

It was precisely 6 months ago, on January 3, when JPM, blissfully unaware of the powerful snowstorms that were raging outside its office, a condition which would later be branded with the technical economic term “harsh weather”, predicted that the US economy would grow by 2.5% in the first half and 3.0% in the second, leading to a solid 2.8% annualized growth for 2014, a growth rate which would mean the US economy would grow at the fastest pace since 2005.

Fast forward exactly six months later, when on July 3, “harsh weather” firmly in the rear view mirror (but blissfully unaware of the record drought slamming California, the monsoons about to crush India, and El Nino set to ravage the US in the fall, not to mention two regional civil wars, a China whose housing bubble has popped and whose rehypothecation scandal means Chinese GDP is about to fall off a cliff, and global trade generally grinding to a halt), JPM has just followed with a revised GDP forecast. Its latest (and certainly not least) prophecy for the full year GDP: precisely one half of what it expected 6 months ago, or just 1.4%, following a cut to Q2 GDP to 2.5% from 3.0% (which means negative growth for the entire first half, something in a less insane world would be called a recession), while keeping Q3 and Q4 GDP miraculously at 3.0% for both quarters. From JPM:

GDP growth and job growth go their separate ways: The contrast between weak GDP growth and strong job growth in 1H14 only intensified this week. Real GDP growth in 1Q14 was -2.9% saar, and we are reducing our forecast for 2Q14 to 2.5% (from 3.0%). Real GDP appears to have contracted in the first half. At the same time, payroll employment averaged 231,000 in 1H14, the strongest six-month run of job growth in the expansion to date. The obvious result is a sharp decline in productivity in 1H14 and a surge in 1H14 unit labor cost estimated at about 5% saar.

In other words, instead of above-trend, “escape velocity” GDP, the highest in nearly a decade, in 2014 US GDP is now poised to grow just 1.4% – the lowest annual growth rate since the Lehman crash.

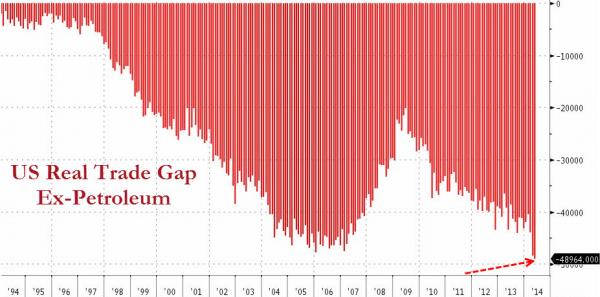

• Excluding Oil, The US Trade Deficit Has Never Been Worse (Zero Hedge)

Remember when in January 2010 Obama promised that he should double US exports in five years in a bid to collapse the US trade deficit? Not only that, but in his 2010 SOTU address, Obama doubled down by saying “It’s time to finally slash the tax breaks for companies that ship our jobs overseas and give those tax breaks to companies that create jobs in the United States of America.” Back then, Jennifer R. Psaki who was still a simple White House spokesperson, said that the White House “had been working for several months on a policy to increase exports. She said the plans included the creation of an export promotion cabinet and steps to help small and medium-size businesses tap markets in other countries. ” Well, it isn’t quite five years later (he still has six months), but we doubt that anyone would have expected what the outcome of Obama’s export boosting campaign would be. We show it below in the following chart which captures the US trade deficit, excluding oil.

What this chart shows is that when it comes to core manufacturing and service trade, that which excludes petroleum, the US trade deficit hit some $49 billion dollars in the month of May, the highest real trade deficit ever recorded! In other words, far from doubling US exports, Obama is on pace to make the export segment of the US economy the weakest it has ever been, leading to millions of export-producing jobs gone for ever (but fear not, they will be promptly replaced by part-time jobs). It also means that the collapse in Q1 GDP, much of which was driven by tumbling net exports, will continue as America appear largely unable to pull itself out of its international trade funk, much less doubling its exports. What’s perhaps just as bad, is that the chart above shows that global trade continues to collapse: just recall the near standstill in Chinese trade, both exports and imports, that took place earlier this year.

We wonder: is the fact that the world is trading with each other at the slowest pace since the Lehman collapse also due to harsh winter weather? Yet while core trade is the worst ever, overall US trade is not all that bad. Why? Because of the shale revolution of course, and the fact that net US petroleum imports have plunged. Note, this does not imply the US is a net exporter of petroleum, especially considering the recent news surrounding the easing of the oil export ban. That simply won’t happen as was explained previously. What it does show is that oil imports as a percentage of the total US trade deficit continue to decline, even if the US still remains a net oil importer. Which is curious because as Bloomberg reports, “the U.S. will remain the world’s biggest oil producer this year after overtaking Saudi Arabia and Russia as extraction of energy from shale rock spurs…

U.S. production of crude oil, along with liquids separated from natural gas, surpassed all other countries this year with daily output exceeding 11 million barrels in the first quarter, the bank said in a report today. The country became the world’s largest natural gas producer in 2010. The International Energy Agency said in June that the U.S. was the biggest producer of oil and natural gas liquids.” So even with the world’s biggest crude production, the US still needs to import nearly $9 billion in petroleum goods every month? That is hardly enough to offset the massive loss of jobs experienced in other non-energy sectors of the economy which unlike oil, have never seen a worse trade deficit. Furthermore, even as the energy sector soaks up some $200 billion in capex or some 20% of the total private fixed-structure spending, the US shale renaissance will only persist for another 5 or so years before the output rates peak and resume their downward direction:

U.S. oil output will surge to 13.1 million barrels a day in 2019 and plateau thereafter, according to the IEA, a Paris-based adviser to 29 nations. The country will lose its top-producer ranking at the start of the 2030s, the agency said in its World Energy Outlook in November.

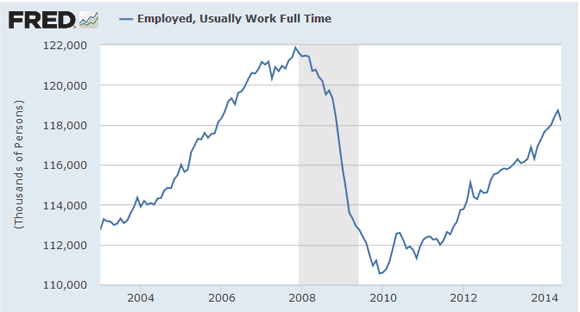

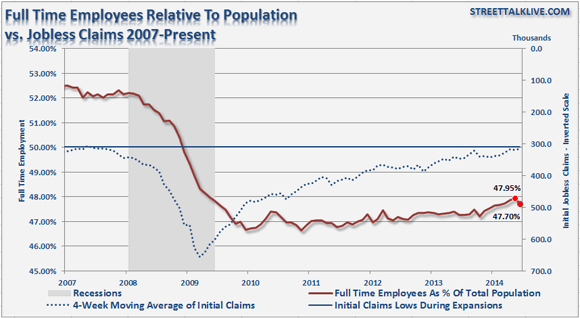

• Trends in US Full-Time Employment vs. Population (Mish)

This month’s job report showed a seasonally-adjusted decline in full-time employment of 523,000. Let’s dive a little deeper and look at full-time employment vs. the civilian non-institutional population. The latter is non-seasonally adjusted, yet shows no seasonal variations, so we can compare to seasonally-adjusted employment numbers. Full-time employment was 121,875,000 right at the onset of the recession in November 2007. Today full-time employment is 118,204,000. The difference is 3,671,000. In the last month, full-time employment declined by 523,000 while voluntary part-time employment rose by a whopping 840,000. Meanwhile, those wanting full-time employment (but only finding part-time employment) rose by 250,000.

• 5 Things To Ponder Under The Surface (STA)

Alas, all good things must come to an end. As the kids summer vacation trip comes sadly to an end, it is only fitting that the final edition of “Thoughts From The Beach (TFTB)” would be this weekend’s “5 Things To Ponder.” This week was very busy with economic data. For the most part, the majority of the data came basically inline with expectations. However, the internals of the various reports were much less encouraging. The most noteworthy report, and the least important from an investment standpoint, was the monthly employment report which came in at 288,000 jobs for the month.

As with the bulk of other reports, the more important details were lost to the headlines. The average number of hours worked made no gains, and hourly earnings growth remains muted. The bulk of the job creation remained focused in the lower wage paying areas of the economy such as retail and transportation. Most importantly, full-time jobs fell by roughly 500k. As I discussed in “Jobless Claims And The Issue Of Full Employment,” there is only one analysis of employment that matters. That is full-time jobs relative to the population. Full-time employment is what fosters household formation and long-term economic growth. As shown in the chart below, full-time employment relative to the working age population has remained primarily stagnant since the financial crisis and actually fell in the latest month. This is a key reason why economic growth continues to struggle.

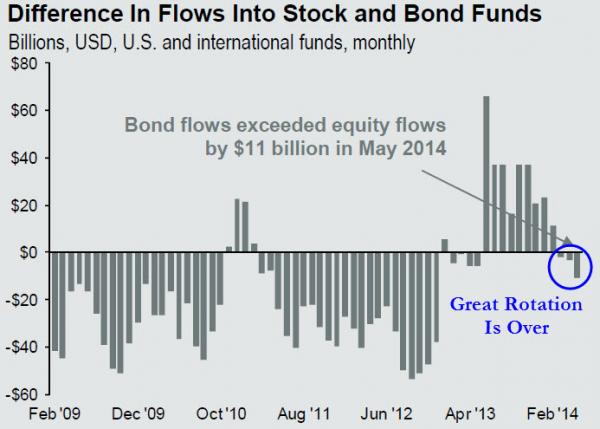

• The Great Bonds/Stocks Rotation Is Over (Zero Hedge)

We’re going to need another meme… the great pretense of the great rotation as ‘investors’ dump bonds and buy stocks with both hands and feet as they realize growth has reached escape velocity and its time to BTFATH… has failed. As the following chart from JPMorgan shows, the brief period of net flows to stocks over bonds has ended. If a rally like this can’t get the animal spirits flowing in anyone but the C-Suite of your local share-buyback-ing corporation, when will it?

• Shares of Austria’s Biggest Bank Plunge on East Europe Profit Warning (WSJ)

Shares in Erste Group Bank fell more than 16% after the bank issued a profit warning stemming from problems in Romania and Hungary, with some analysts warning of risks to other lenders. The slide in Erste’s stock dragged down Austria’s main stock index by 3% and also leaked into other banks. Raiffeisen Bank’s shares fell by 4.1%. “This has an obvious negative read-across” to other banks including Raiffeisen and KBC Groep NV, wrote analysts at Berenberg Bank in a note to clients. “For the rest of sector, it serves as a warning that market remains too complacent about impact of European Central Bank’s Comprehensive Assessment, including the Asset Quality Review. Do not underestimate the Frankfurt inquisition,” they added. Stocks in KBC fell by 1.6% early Friday.

Erste, Austria’s largest bank by assets, said in an unscheduled statement Thursday that it expects to book a net loss of between €1.4 billion euros ($1.91 billion) and €1.6 billion for 2014 due to increased provisions for its Romanian and Hungarian businesses. The bank is now forecasting 2014 risk provisions of around €2.4 billion, up from a previous estimate of €1.7 billion. J.P. Morgan said it expects the bank’s shares to trade down until visibility improves on Erste Group’s ability to generate capital and improve earnings per share. Goldman Sachs analysts said: “Erste should recover full profitability beyond 2015, but this process may be delayed.” Chief Executive Officer Andreas Treichl said the measures would help Erste Group pass the European Central Bank’s asset-quality review and will help the bank “avoid one-off effects from 2015 onward.” Erste is guiding for a “strongly improved post-revision result and a net profit in 2015.”

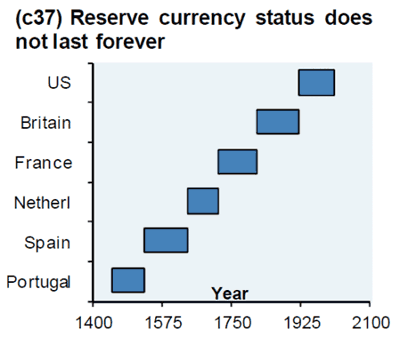

• US BNP ‘Punishment’ Backfires, Accelerates Demise Of The Dollar (Zero Hedge)

Not even we anticipated this particular “unintended consequence” as a result of the US multi-billion dollar fine on BNP (which France took very much to heart). Moments ago, in a lengthy interview given to French magazine Investir, none other than the governor of the French National Bank Christian Noyer and member of the ECB’s governing board, said this stunner at the very end, via Bloomberg: NOYER: BNP CASE WILL ENCOURAGE ‘DIVERSIFICATION’ FROM DOLLAR. Here is the full google translated segment:

Q. Doesn’t the role of the dollar as an international currency create systemic risk?

Noyer: Beyond [the BNP] case, increased legal risks from the application of U.S. rules to all dollar transactions around the world will encourage a diversification from the dollar. BNP Paribas was the occasion for many observers to remember that there has been a number of sanctions and that there would certainly be others in the future. A movement to diversify the currencies used in international trade is inevitable. Trade between Europe and China does not need to use the dollar and may be read and fully paid in euros or renminbi. Walking towards a multipolar world is the natural monetary policy, since there are several major economic and monetary powerful ensembles.

China has decided to develop the renminbi as a settlement currency. The Bank of France was behind the popular ECB-PBOC swap and we have just concluded a memorandum on the creation of a system of offshore renminbi clearing in Paris. We have very strong cooperation with the PBOC in this field. But these changes take time. We must not forget that it took decades after the United States became the world’s largest economy for the dollar to replace the British pound as the first international currency. But the phenomenon of U.S. rules expanding to all USD-denominated transactions around the world can have an accelerating effect.

In other words, the head of the French central bank, and ECB member, Christian Noyer, just issued a direct threat to the world’s reserve currency (for now), the US Dollar. Putting this whole episode in context: in an attempt to punish France for proceeding with the delivery of the Mistral amphibious warship to Russia, the US “punishes” BNP with a failed attempt at blackmail (recall that as Putin revealed, the BNP penalty was a used as a carrot to disincenticize France from concluding the Mistral transaction: had Hollande scrapped the deal, BNP would likely be slammed with a far lower fine, if any). Said blackmail attempt backfires horribly when as a result, the head of the French central bank makes it clear that not only is the US Dollar’s reserve currency status not sacrosanct, but “the world” will now actively seek to avoid USD-transactions in order to escape the tentacle of global “pax Americana.”

• BP Faces Investor Class Action Lawsuit Over Deepwater Horizon (Guardian)

Pension funds from London borough councils and even Shell are among a new group of shareholders suing BP in Texas over the Deepwater Horizon accident. The lawsuit, which could potentially be extremely costly for the oil group, follows recent US court rulings opening the way to challenges from those who bought financial stakes in BP outside the country. The US courts are famously generous in their financial awards compared with their British counterparts. In the past only investors who bought their BP stakes on the New York stock exchange or other US markets could file for compensation payments. A class action specialist, Pomerantz Law, has rounded up 32 major investors seeking financial compensation for the losses they incurred on their shares. The New York-based law firm is taking the case on a no-win, no-fee basis and is hoping that other European investors will join the suit.

The royal borough of Kensington and Chelsea plus City of Westminster council, Cumbria county council and Shell Pension Trust have all put in for claims. A BP spokesman in London said on Friday night: “All of the plaintiffs’ securities claims relating to the Deepwater Horizon accident are meritless and we will continue to vigorously dispute them.” The Deepwater Horizon offshore rig blew up and sank while it was drilling for oil in the Gulf of Mexico in April 2010. Miles of beaches on the southern coast of the US were coated in oil causing widespread damage to tourism and fisheries. The US government estimated that nearly 5m barrels of oil were spilled in the five months it took to get the well under control. BP, as operator of the well, was castigated by the US public and politicians. The group has made payouts of over $30bn (£17bn) already.

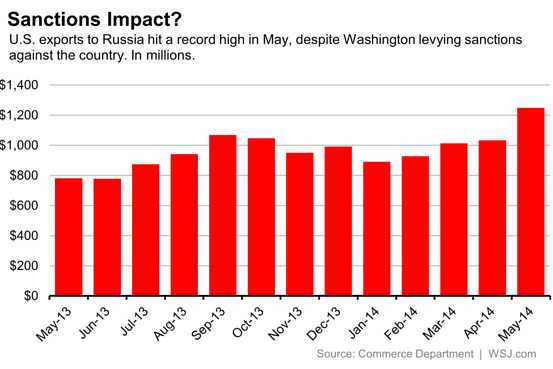

• Even With Sanctions, U.S. Sales to Russia Hit New High (WSJ)

So much for those sanctions. U.S. efforts to penalize Russia for its actions in Ukraine appear to have done little to stem exports of U.S. goods to the country. The U.S. announced targeted sanctions against several Russian companies and individuals in March, but U.S. trade data published Thursday shows exports to the country were the highest on record at $1.2 billion in May. The sanctions, organized with Europe and other major industrialized nations over Moscow’s alleged actions to destabilize its former client state, sparked investor flight out of Russia, led the ruble to tumble and pushed the economy into a recession. Russian markets have since recovered somewhat, but investors have been wary of an escalation in the sanctions battle. Demand for U.S. products apparently hasn’t been hit, however, and in fact jumped 21% from the previous month.

• Italy PM Renzi Hits Back At Bundesbank Chief Over Budget Flexibility (FT)

A simmering battle between Italy and Germany over Rome’s push to ease EU’s budget rules burst into public on Friday when the Italian prime minister lashed out at the head of Germany’s powerful central bank, accusing him of improperly intervening in Italian politics. Italy’s Matteo Renzi, who has spearheaded an effort by centre-left European leaders to gain more flexibility in the rules, said it was not the role of central bankers to weigh in on budget matters. Mr Renzi’s remarks come less than 24 hours after the Bundesbank’s president, Jens Weidmann, singled out Mr Renzi in a speech and criticised countries seeking to loosen the rules. “The Bundesbank does not have among its tasks to take part in the Italian political debate,” Mr Renzi said. “Europe belongs to European citizens, not to bankers, neither Italian nor German bankers.”

Both Mr Renzi and a spokesman for Angela Merkel, German chancellor, attempted to play down differences between the two countries on Friday, with both insisting they are on the same page on the need for the EU to pursue sustainable growth. Mr Renzi attempted to differentiate the messages coming from the Bundesbank and the chancellery, saying he had not heard similar criticisms coming from Ms Merkel or Germany’s political class. In a speech on Thursday, Mr Weidmann criticised Mr Renzi for referring to the EU as a “boring old auntie”, and said an “overly generous interpretation” of the EU’s budget rules would undermine progress made during the crisis.

Although Ms Merkel’s spokesman said there were no differences between the two leaders, Mr Weidmann’s views are shared by several politicians within Ms Merkel’s party. Manfred Weber, the new centre-right leader in the European Parliament and a member of the Christian Social Union, Ms Merkel’s Bavarian sister party, took Mr Renzi to task this week during the prime minister’s appearance in Strasbourg. Mr Weber said that reinterpreting the rules now for Italy would send the wrong message to countries that implemented tough reforms during the eurozone crisis. The spat between Mr Renzi and Ms Merkel’s allies also threatens to spill out into the confirmation of Jean-Claude Juncker, the former Luxembourg prime minister, as the next president of the European Commission.

The vote in the European Parliament is scheduled in just over a week. Mr Renzi on Friday said he continued to back Mr Juncker as long as he lived up to an agreement reached at an EU summit that calls on the new European Commission to make “best use of the flexibility” in the existing rules But members of Italy’s Democratic party (PD) – now the largest bloc in the parliament’s centre-left grouping – are weighing whether to vote against Mr Juncker to signal their unhappiness with the direction the debate over budget flexibility is heading and to press Mr Juncker to agree to their demands. “Renzi is ready to go to war with Germany,” said a senior member of the centre-left bloc in the European Parliament. “Renzi and PD MEPs here are going to certainly try to scare Germany by threatening to vote against Juncker. This isn’t a joke. He’s seriously pissed off.”

• Time To Recalibrate US-China Relationship (Stephen Roach)

This month, senior US and Chinese officials will gather in Beijing for the sixth Strategic and Economic Dialogue. nWith bilateral frictions mounting on a number of fronts — including cyber security, territorial disputes in the East and South China Seas, and currency policy — the summit offers an opportunity for a serious reconsideration of the relationship between the world’s two most powerful countries. The US and China are locked in an uncomfortable embrace — the economic counterpart of what psychologists call “co-dependency”. The flirtation started in the late 1970s, when China was teetering in the aftermath of the Cultural Revolution and the US was mired in a wrenching stagflation. Desperate for economic growth, two needy countries entered into a marriage of convenience.

China was quick to benefit from an export-led economic model that was critically dependent on America as its largest source of demand. The US gained by turning to China for low-cost goods that helped income-constrained consumers make ends meet; it also imported surplus savings from China to fill the void of an unprecedented shortfall of domestic saving, with the deficit-prone US drawing freely on China’s voracious appetite for Treasury securities. Over time, this marriage of convenience morphed into a full-blown and inherently unhealthy codependency. Both partners took the relationship for granted and pushed unbalanced growth models too far — the US with its asset and credit bubbles that underpinned a record consumption binge, and China with an export-led resurgence that was ultimately dependent on America’s consumption bubble.

The imbalances only worsened. China’s three decades of 10% annual hyper-growth led to unsustainable strains — outsize resource and energy needs, environmental degradation and pollution, and mounting income inequality. Huge Chinese current-account surpluses resulted from too much saving and too little consumption. Mounting imbalances in the US were the mirror image of those in China — a massive shortfall of domestic saving, unprecedented current-account deficits, excess debt, and an asset-dependent economy that was ultimately built on speculative quicksand. Predictably, in keeping with the pathology of codependence, the lines distinguishing the two countries became blurred. Over the past decade, Chinese subsidiaries of Western multinationals accounted for more than 60% of the cumulative rise in China’s exports.

In other words, the export miracle was sparked not by state-sponsored Chinese companies but by offshore efficiency solutions crafted in the West. This led to the economic equivalent of a personal identity crisis: Who is China — them or us? In personal relationships, denial tends to mask imbalances — but only for so long. Ultimately, the denial cracks and imbalances give rise to frictions and blame — holding a co-dependent partner responsible for problems of one’s own making. Such is the case with the US and China. America blames China for its trade deficits and the pressures they inflict on workers, citing a massive accumulation of foreign exchange reserves as evidence of an unconscionable currency manipulation. China counters by underscoring America’s saving shortfall — a gap that must be plugged by surplus saving from abroad, a current-account deficit, and a multilateral trade imbalance with more than 100 countries. China blames the US for fixating on a bilateral imbalance as the source of America’s multilateral problem.

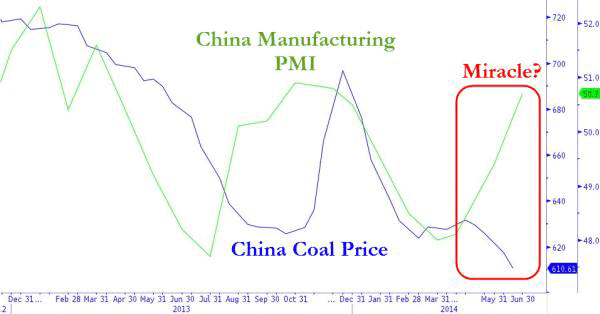

• The “Miracle” Of China’s PMI Resurrection In 1 Uncomfortable Chart (Zero Hedge)

All around Asia, PMIs are tumbling… except for China’s government-sponsored Manufacturing PMI. This week saw Aussie Services PMI (linked significantly to China) tumbled to 2014 lows, Japan’s PMI drop, and China’s own Services PMI disappoint and fade to 2-month lows. So where is all this exuberance coming from in China’s manufacturing industry (despite a 8-month in a row drop in employment)? We don’t know; but the fact that China coal prices just hit a record low hardly supports the smog-choking industry of China being at 7-month highs… Hard data vs soft surveys? You decide. One of these things is not like the other…

CHINA PRESS: Domestic coal prices fell to another record low following recent price cuts by major coal producers. The Bohai-rim Steam-Coal Price Index, a benchmark used by the coal industry, fell 1.7% on-week, to CNY519 per ton on Tuesday, its lowest level since the index series started in 2010. Major coal producers, including Shenhua and China Coal, slashed prices over the weekend with the price cuts coming earlier than market expectations, which are expected to boost domestic coal market share and hurt China’s coal imports. (China Securities Journal)

Of course, not every manufacuring plant needs coal and there are other factors of supply and demand involved but it seems odd that the previously strong correlation between the two would collapse as the Chinese ‘need’ to show a better economy to hide the reality of collapsing real estate markets, a faltering shadow banking system, and lost trust in lending.

• Germany Arrests Suspected Double Agent Accused Of Spying For US (Reuters)

An employee of Germany’s BND foreign intelligence agency has been arrested on suspicion of spying for the United States, two lawmakers with knowledge of the affair told Reuters on Friday. The German Federal Prosecutor’s office said in a statement that a 31-year-old man had been arrested on suspicion of being a foreign spy, but it gave no further details. Investigations were continuing, it said. The case risks further straining ties with Washington, which were damaged by revelations last year of mass surveillance of German citizens by the U.S. National Security Agency, including the monitoring of Chancellor Angela Merkel’s mobile phone. The man, who is German, has admitted passing to an American contact details about a special German parliamentary committee set up to investigate the spying revelations made by former U.S. intelligence contractor Edward Snowden, the politicians said.

Both lawmakers are members of the nine-person parliamentary control committee, whose meetings are confidential, and which is in charge of monitoring the work of German intelligence agencies. The parliamentary committee investigating the NSA affair also holds some confidential meetings. The German Foreign Ministry said in a statement that it had invited the U.S. ambassador to come for talks regarding the matter, and asked him to help deliver a swift explanation. “This was a man who had no direct contact with the investigative committee … He was not a top agent,” said one of the members of parliament, who spoke on condition of anonymity. The suspect had offered his services to the United States voluntarily, the source said. Merkel’s spokesman Steffen Seibert said: “We don’t take the matter of spying for foreign intelligence agencies lightly.”

• Germany Shelves Shale Gas Drilling, Fracking For Next Seven Years (WSJ)

Germany plans to halt shale-gas drilling for the next seven years over concerns that exploration techniques could pollute groundwater. “There won’t be [shale-gas] fracking in Germany for the foreseeable future,” Environment Minister Barbara Hendricks said Friday. The planned regulations come amid a political standoff with Russia, Germany’s main natural gas supplier, and following intensive lobbying from environmentalists and brewers concerned about possible drinking-water contamination. The production of shale gas requires the application of the hydraulic fracturing technology known as fracking, which involves using a high-pressure mixture of water, sand and chemicals to break apart rocks to release the gas. The government plans to ban the use of hydraulic fracturing technology for drilling operations shallower than 3,000 meters (1.9 miles) and hopes to get a bill ready early next year. The government will reassess the ban in 2021.

• Celebrate Independence Day By Opposing Government Tyranny (Ron Paul)

This week Americans will enjoy Independence Day with family cookouts and fireworks. Flags will be displayed in abundance. Sadly, however, what should be a celebration of the courage of those who risked so much to oppose tyranny will instead be turned into a celebration of government, not liberty. The mainstream media and opportunistic politicians have turned Independence Day into the opposite of what was intended. The idea of opposing — by force if necessary — a tyrannical government has been turned into a celebration of tyrannical government itself! The evidence is all around us. How would the signers of the Declaration of Independence have viewed, for example, the Obama Administration’s “drone memo,” finally released last week, which claims to justify the president’s killing American citizens without charge, judge, jury, or oversight?

Is this not a tyranny similar to that which our Founders opposed? And was such power concentrated in one branch of government not what inspired the rebellion against the English king in the first place? The “drone memo,” released after an ACLU freedom of information request, purports to establish the president alone as the arbiter of who is or is not a terrorist subject to execution by the US government. There is no due process involved, just the determination of the president. Thus far the only American citizens killed by the president are Anwar al-Awlaki and his teenaged son, but the precedent has been established, according to the memo, that the president has the authority to kill Americans he believes are terrorists. Even the New York Times, which generally backs whatever US administration is in power, is troubled by the White House’s legal justification to claim the authority to kill Americans. A Times editorial last week concluded that:

…the memo turns out to be a slapdash pastiche of legal theories — some based on obscure interpretations of British and Israeli law — that was clearly tailored to the desired result.

I agree with the New York Times’ conclusion that, “[t]his memo should never have taken so long to be released, and more documents must be made public. The public is still in the dark on too many vital questions.”

• The War To End All Comparisons (Guy Somerset)

When I was a youngster we still had a school assembly at the eleventh hour, on the eleventh day, of the eleventh month and stood silent for a full minute to remember the fallen from World War One. Given the modern world has no time to waste even a second on the dead I would be shocked if this tradition remains in place anywhere. (Well, almost anywhere.) On a holiday commonly misunderstood as glorying in war rather than celebrating freedom from tyranny, it behooves us on July 4th this centennial year to reflect upon some of that other maelstrom’s largely forgotten aspects. One of the more personal yet popularly expunged experiences connected with the Great War was the large number of families in generations afterward who had one or more maiden Aunts in the house. This was due many of their darlings having been slaughtered a decade or more prior.

Aside from the tremendously overpowering tragedy of the millions of lost sweethearts were the subsequent multi-millions of unborn children and their exponential descendants. It was a fact of life now simply forgotten. Another widespread incidence was the shame of many who survived the conflict but were injured. Casually perusing photographs of public gatherings, company picnics and the like in years after the war we might be struck how fortunate a town or parish was to have no one severely crippled. This would be error. Many men at that time had deep feelings of indignity exhibiting their infirmities. Any locality pictures were snapped one can rest assured there were broken men at home embarrassed to be seen.

In a graphic exhibition of combat’s physical cost, after the conflict a project was undertaken in an empathetic attempt at what might now be called “mainstreaming” the maimed. Portraits were commissioned of young men who had given the ultimate sacrifice; not their lives, but living a life after war so crushing many would prefer death. This is to say nothing of millions of “shell shock” survivors. Cultural and artistic tolls upon Europe were extreme. Numerous sites of historic value were destroyed. Several of the scenes in Van Gogh’s paintings but a few decades prior exist now only on canvas, demolished by the incessant intervals of occupying armies. The ambulance driver groups (in which one of my own ancestors served) are often cited as cauldrons of development for writers or industrialists; Cummings, Hemingway, and Maugham being notable examples.

Yet at least as much genius was lost as was gained. Edith Wharton, whose talent had been on the ascent, ceased any notable literary production for the better part of a decade due to numerous relief efforts. Henry James likewise endured a dearth of significant output, writing to a friend of the war’s effect on artists, “…such realities play the devil even with his very best imaginations and intentions.” One of the lesser apprehended aspects of war, further lessened by the romanticism of nascent motion pictures, were unsanitary conditions. Intermittent food, near-universal lice infestation, and a plague of rats which approached the size of housecats were all commonalties in the trenches of either army. Naturally such horrors were later difficult to speak of publicly or transmute to entertaining celluloid.

Disease is another underappreciated aspect of the conflict. In 1917 alone 150,000 French soldiers were discharged from the front as active tuberculosis cases. Due food shortages and sundry unsanitary conditions the rate affected even civilians in Paris with 358 deaths per 100,000 compared to 188 per 100,000 in New York, a city of relatively comparable size outside the theater. During four years of war the combined mortality in France from TB alone was over 290,000. These numbers are for a single nation but are representative of the European Allied powers while Central Powers fared even worse.

Home › Forums › Debt Rattle Jul 6 2014: How Things Look And What They are