Marjory Collins Cooperative grocery store, Greenbelt, MD May 1942

Let me start off by saying that I don’t mean any disrespect to the families and loved ones of the passengers and crew on board the missing Malaysian plane. I just wish I didn’t have the insistent impression I’m the only one who doesn’t mean disrespect. But if this story can teach us one thing it’s that we have further mastered the art of all too easily turning genuine human misery into a made for 24/7 TV void. Channel after channel treats its emptiness-hungry viewers to hour after hour of experts, graphs, maps, photographs, and they all manage to show us absolutely nothing.

CNN might as well be airing footage of the Great Lakes, it wouldn’t make one iota of difference. Dozens of camera teams talking heads and pundits are sent to interminable Kuala Lumpur press ops where nothing is said simply because there is nothing to be said, while dozens of other teams are sent to cover search and rescue missions in any part of any ocean that any expert may have mentioned as a possible site to find debris. Any debris.

When Ted Turner started CNN there was no such thing as reality TV. And it still took a remarkably long time for TV makers to clue in on the most important lesson 24-hour news had in store: that people simply love to watch absolutely nothing, as long as it’s on, and the screen flickers. That this is perhaps a little disrespectful to the potential victims and their families and friends is something that doesn’t seem to occur to neither viewers nor TV makers. The camera crews and everyone around them probably even feel by now that they’re part of the story, and that they’re helping in getting the mystery solved.

So here goes another aerial shot of the Indian Ocean, or the Pacific, or the local pond, that shows what might be a piece of the plane, or it might not, with the same grainy resolution and clarity that we’ve come to know from the snapshots taken by holiday goers who claimed that dot in the middle was the monster of Loch Ness.

Disgrace, embarrassment, shame.

I’m not the biggest Ron Paul fan on the planet, I think he’s alright but he exhibits a few too many traits of a fossil for my taste. But today America should be proud they have the man, because he’s the only one in the crowd who dares speak truth to power, and does so in the elegant, concise and eloquent manner used exclusively by those who have nothing to hide and therefore don’t need to choose their words with the utmost care. Dr. Paul needs only 1:20 min to explain what is going on in Ukraine: “I think it was wrong for us to get involved and participate in the overthrow of their government. We spent over $5 billion with our NGOs to agitate and get rid of an elected government [..] … it would be best for us to stay out.” Listen to Ron Paul, America, and remember what he says next time Obama or any other politician talks about Ukraine and Russia:

As I said, I think Dr. Paul is a bit of a fossil, but in my book he’s 1000% better than that other Fossil on the Hill, John McCain, who compared Putin to Stalin and Hitler, both of whom as we all know he knew personally, and forgot to mention Genghis Khan and Attila the Hun, presumably because he’s repressed the memories of the time he spent as their PoW. McCain has now outlived Methuselah by a century or two, with a brain degraded enough to fool himself into thinking he’s still serving the American people, and you just sense in the air that he’s desperate to throw some bombs on someone’s head one more time. It’s the very desire that might be keeping him alive.

And there are many Americans who believe McCain and all the rest of them when they talk about how bad a man Putin is. And what an awfully illegal act it was for the Crimeans to hold a referendum on where they want their land to belong. And what a great thing it is for Washington to declare sanctions against Putin’s cabal of oligarchs, even though most of them were installed by Washington itself in the early 1990s when Yeltsin held his boozed up yardsale, and it was Putin who reined them in.

Ron Paul says that “the best part about this whole story is that the market is going to overrule the rhetoric of both sides”, but I’m afraid that may be a while yet. Watching EU leaders like Van Rompuy and Barroso announce their version of sanctions gives me the eerie feeling they’re wallowing far too much in their new found sense of power, that allows them to finally harm someone else than a few down on their luck Greeks or Italians, and they may long for more of the same.

These guys are well capable of painting Europe into a corner they won’t be able to walk out of without more, and more severe, damage being done. And they find kindred spirits in McCain and many other US “leaders” who see this as an opportunity to live out the same power fantasies they satisfy twice a week as they have their naked sorry asses whipped in one of Madame X’s dungeons. There is a reason why these people rise to their positions of power, and it’s not intelligence. And the fact that they are where they are is dangerous; the mindset that makes them rise to those positions is the same one that loves to inflict pain .

These people are a disgrace, they embarrass everyone they represent, and every European and American should be ashamed of having them speak in their name. And Ron Paul may be a bit of a fossil, but he doesn’t have that mindset, he’s not a power starved psychopath.

• Ron Paul Warns “We’re Just Stirring Up Trouble In Crimea” (CNBC)

“I think it was wrong for us to get involved and participate in the overthrow of the government,” exclaims Ron Paul in this brief clip, adding the US is “stirring up trouble in Crimea.” The American people are “tired of it,” and “it would be best for us to stay out.” The US doesn’t need another war – and certainly can’t afford it – and “we don’t want trade wars.” Simply put, he concludes, “it’s best we stay out.”

• We’re Next In Line For Collapse (SovereignMan)

As any long-time reader of this column knows, we routinely draw from historical lessons to highlight that this time is not different. Throughout the 18th century, for example, France was the greatest superpower in Europe, if not the world. But they became complacent, believing that they had some sort of ‘divine right’ to reign supreme, and that they could be as fiscally irresponsible as they liked.

The French government spent money like drunken sailors; they had substantial welfare programs, free hospitals, and grand monuments. They held vast territories overseas, engaged in constant warfare, and even had their own intrusive intelligence service that spied on King and subject alike. Of course, they couldn’t pay for any of this. French budget deficits were out of control, and they resorted to going heavily into debt and rapidly debasing their currency. Stop me when this sounds familiar. The French economy ultimately failed, bringing with it a 26-year period of hyperinflation, civil war, military conquest, and genocide.

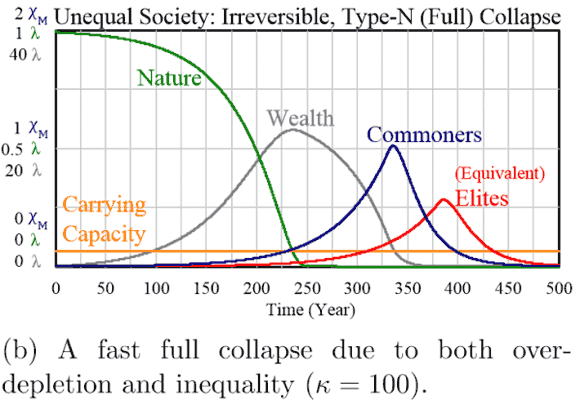

History is full of examples, from ancient Mesopotamia to the Soviet Union, which show that whenever societies reach unsustainable levels of resource consumption and allocation, they collapse. I’ve been writing about this for years, and the idea is now hitting mainstream. A recent research paper funded by NASA highlights this same premise.

According to the authors:

“Collapses of even advanced civilizations have occurred many times in the past five thousand years, and they were frequently followed by centuries of population and cultural decline and economic regression.”

The results of their experiments show that some of the very clear trends which exist today– unsustainable resource consumption, and economic stratification that favors the elite– can very easily result in collapse. In fact, they write that “collapse is very difficult to avoid and requires major policy changes.” This isn’t exactly good news.

But here’s the thing– between massive debts, deficits, money printing, war, resource depletion, etc., our modern society seems riddled with these risks. And history certainly shows that dominant powers are always changing. Empires rise and fall. The global monetary system is always changing. The prevailing social contract is always changing. But there is one FAR greater trend across history that supercedes all of the rest… and that trend is the RISE of humanity. Human beings are fundamentally tool creators. We take problems and turn them into opportunities. We find solutions. We adapt and overcome.

The world is not coming to an end. It’s going to reset. There’s a huge difference between the two. Think about the system that we’re living under. A tiny elite has total control of the money supply. They wield intrusive spy networks and weapons of mass destruction. The can confiscate the wealth of others in their sole discretion. They can indebt unborn generations. Curiously, these are the same people who are so incompetent they can’t put a website together. It’s not working. And just about everyone knows it.

Beijing allows its banks to start borrowing in the bond markets? What a great idea …..

• China Stocks Rise Most in Four Months on Easing Bank Funding

China’s stocks rallied, sending the benchmark index to its biggest gain in four months, amid speculation the government is loosening funding restrictions for property developers and banks to support economic growth. Shanghai Pudong Development Bank and Industrial Bank both surged at least 6.6%. The China Securities Regulatory Commission said after exchanges closed that lenders can issue preferred shares. China Vanke Co. and Poly Real Estate Group Co. jumped more than 6% after the Shanghai Securities News reported regulators are reviewing financing applications from “many” listed developers.

The Shanghai Composite Index climbed 2.7% to 2,047.62 at the close, the biggest gain since Nov. 18, after reaching record-low valuations yesterday. Policy makers are trying to bolster real estate and financial companies as the economy slows and bad debts increase. Allowing lenders to sell preferred shares would give them a new way to meet long-term fundraising requirements.

“Investors hear talk that banks may be the first to be included in the preferred-shares program,” said Xu Shengjun, analyst at Jianghai Securities in Shanghai. “Investors are hoping this will bring a lot of benefits to the companies, including boosting their capital.” The Shanghai index has dropped 3.2% this year as analysts cut their estimates for 2014 economic growth, the nation suffered its first onshore corporate bond default and an unlisted developer collapsed. Today’s announcement on preferred shares follows a government statement this week that China will speed up construction projects to bolster the economy.

Oh wait, but they already had too much debt …

• Tumbling Chinese Yuan Sets Off ‘Carry Trade’ Rout, Triggers Derivatives Contracts (AEP)

China’s yuan has suffered its biggest one-week fall in 20 years, nearing key trigger levels that threaten a wave of forced selling and mounting stress for those with dollar debts. The jitters come amid reports of fire-sales of Hong Kong property by Chinese investors desperate to raise cash, some slashing their prices by 20pc for a quick sale. A liquidity squeeze in mainland China has already led to the collapse of Zhejiang Xingrun real estate this week with $570m of debts, the biggest property failure so far.

The yuan weakened sharply on Thursday to 6.23 against the dollar and has now lost 3pc since January, a clear break with China’s long-standing policy of slow appreciation. Geoffrey Kendrick, from Morgan Stanley, said the currency has broken through the 6.20 level where a cluster of structured products are triggered. These are known as losses on target redemption funds. The losses have already hit $3.5bn.

The latest move creates a potential “non-linear movement” that could push the yuan rapidly to the next level at 6.38, where estimated losses would reach $7.5bn, and from there jump to 6.50. Mr Kendrick said banks in Singapore, Taiwan and South Korea are heavily exposed, but there could also be a serious fallout for Chinese airlines, shipping and property companies, as well as a nexus of finance built around use of copper and iron as collateral.

Chinese companies have borrowed $1.1 trillion on the Hong Kong markets, a quarter from UK-based banks. There is complex web “carry trade” of positions in which investors borrow in dollars to buy yuan assets, often with leverage. These trades are highly vulnerable to a dollar squeeze as the US Federal Reserve brings forward its plans for rate rises. Morgan Stanley said the Chinese central bank may have to intervene to shore up the yuan by selling some of its US dollar bonds if the slide goes much further. The authorities spent $80bn in June/July 2012 to defend its currency band.

For now China seems to be weakening the yuan deliberately. Mark Williams and Qinwei Wang, from Capital Economics, said the data flow suggests that the central bank bought $25bn of foreign bonds last month in order to force down the currency. The motive is to teach speculators a lesson and curb hot money inflows.

However, suspicions are also are growing that China’s authorities have quietly switched to a devaluation policy to buffer the shock to the economy as they attempt to curb excess credit, even though this would risk a clash with Washington. “The more they undershoot their growth target, the more tempting it may look to have a weaker currency to help out,” said Kit Juckes, from Societe Generale.

Premier Li Keqiang said on Thursday that China would take steps quickly to “stabilise growth and boost domestic demand”, a sign Beijing is worried that tightening may have gone too far. Credit Agricole expects the central bank to slash the reserve requirement ratio for banks by 200 basis points this year.

Morgan Stanley said China is approaching a “Minsky Moment”, a turning point when credit bubbles implode under their weight. “There is evidence that this debt growth has become excessive and non-productive. It now takes four renminbi of debt to create one renminbi of GDP growth from a nearly 1:1 ratio in the early and mid-2000s.” “It is clear to us that speculative and Ponzi finance dominate China’s economy at this stage. The question is when and how the system’s current instability resolves itself,” said the bank. “A disorderly unwind could take Chinese growth down to 4pc in a shorter time frame with potentially disastrous consequences for levered Chinese assets (banks, property) and the entire commodity supply chain,” it said.

Governments serve to make bad situations worse.

• China Moving Closer To Unleashing Fresh Stimulus (CNBC)

China’s slowing economy has stoked chatter among economists that Beijing is moving closer to unleashing fresh monetary and potential fiscal stimulus measures as soon as next quarter. There are increasing concerns over growth among the leaders, said Zhiwei Zhang, chief China economist at Nomura, citing discussions at the State Council’s weekly meeting on Wednesday.

In a statement following the meeting, Premier Li Keqiang said the government should roll out measures as soon as possible to stabilize growth and boost domestic demand, according to state news agency Xinhua. “This reinforces our view of policy easing picking up in the second quarter,” Zhang said.

Nomura expects the People’s Bank of China (PBoC) will cut banks’ reserve requirement ratio (RRR) – or the amount of cash they must set aside as reserves – by 50 basis points in the second quarter and by another 50 basis points in the third quarter. The central bank last cut its RRR in May 2012. The RRR now stands at 20%, near its record level of 21.5%. The likelihood of an interest rate cut is rising as well, said Zhang. However, he noted that it is not yet in the bank’s baseline forecast.

Societe Generale holds a similar view, forecasting a 50 basis point RRR cut early in the second quarter, in order to offset potential capital outflows. “The recent economic deceleration has indeed been more than what Beijing is willing to tolerate in the short term,” the bank said.

According to some market watchers, the PBoC’s decision to widen the yuan trading band over the weekend – following a spate of disappointing economic data – could also be part of the government’s efforts to stabilize growth. Economic indicators such as retail spending and industrial output for January-February, for example, came in well below market expectations.

“While band widening itself has little impact on the economy, the possible consequence could be used to stabilize the growth. The weak economic data implies that it is unlikely to see CNY appreciation and capital inflows after the band widening,” said Haibin Zhu, chief China economist at JPMorgan wrote in a report over the weekend. If this is the case, “CNY depreciation could support exports, and capital outflow will drain domestic liquidity and open the window for RRR cuts by the PBoC,” he said.

Too much debt? Well, you can bet against that. And hope it’s not another too big to fail set-up.

• Global Funds Double China Bond Holdings as Default Starts (Bloomberg)

Foreign investors boosted purchases of China’s onshore bonds by 16% this year as some funds look at the yuan’s drop as a buying opportunity. They increased their holdings to a record 384.1 billion yuan ($62 billion) as of Feb. 28 from 331.9 billion yuan at the end of 2013, according to data from China Central Depository & Clearing Co. and the Shanghai Clearing House. Schroder Investment Management Ltd. says renminbi debt is attractive after the currency’s 2.8% loss this year, Stratton Street Capital LLP is applying to enter the onshore market and Western Asset Management Co. doesn’t expect long-term depreciation.

“It has definitely become interesting at these levels to accumulate currency positions,” said Rajeev De Mello, who manages $10 billion as Singapore-based head of Asian fixed income at Schroder. He is considering adding to his yuan holdings after paring them in February.

Policy makers in the world’s second-largest economy are seeking to discourage the accumulation of debt by allowing companies to default and by introducing more volatility in exchange rates and borrowing costs. JPMorgan Chase & Co. said in a note after the central bank doubled the yuan’s daily trading limit to 2% on March 17 that the currency will strengthen to 5.95 per dollar by the end of this year from 6.2275 yesterday. China’s 10-year sovereign bond yield is 4.52%, compared with 2.77% for similar U.S. Treasuries.

“Yields at 4% and the currency’s appreciation prospects make Chinese government bonds extremely attractive compared to the nations with the same rating elsewhere in the world,” said Andy Seaman, London-based partner and fund manager at Stratton Street, which oversees $1.5 billion. Overseas investors currently hold just 1.3% of the total 28.9 trillion yuan of onshore debt, with 77% of that either sovereign bonds or notes issued by China’s three policy banks, according to Bloomberg calculations. In the U.S., overseas buyers account for 47% of Treasuries.

China controls access to its domestic markets through the Qualified Foreign Institutional Investors program. As of last month, the State Administration of Foreign Exchange had approved $52.3 billion investment quotas for QFIIs, up from $40.8 billion a year earlier. The foreign-exchange regulator also approved 180.4 billion yuan in investment by Renminbi QFIIs while China Securities Regulatory Commission Chairman Xiao Gang said on March 11 that more foreign institutional investors will be allowed to enter the local market.

“As the world’s second-largest economy, and one that still has a lot of growth potential, China is significantly under allocated in global assets,” said Wang Ming, marketing director at Shanghai Yaozhi Asset Management LLP, which oversees 2 billion yuan of fixed-income investments. “Bonds are a relatively safe choice, and demand will grow as the country further opens its market, perhaps regardless of interest-rate differentials.”

The American illusion of recovery may yet have many unintended consequences. Or is this intentional?

• Emerging Markets Face Ordeal By Fire As Yellen Turns Tough (AEP)

In a normal world the US Federal Reserve would barely cause a ripple by tweaking its interest rate forecast a year or two ahead. But we are not in normal world. We are facing a confluence of events somewhat like 1998 when Fed tightening turned the East Asian crisis into a global credit event. We all forget now that Alan Greenspan told emerging markets to drop dead at his Humphrey Hawkins testimony that year – saying he was more concerned about US inflation – and drop dead is exactly what they then did. (The Fed soon had to slash interest rates to avert a global crash)

Janet Yellen now says interest rates could start rising “around six months” after the Fed stops tapering bod purchases (later this year). This is a minor shock. The markets were expecting a much longer lead time as you can see from the chart below. She tried to wind back comment during her press conference but by then it was too late. Markets were already looking at the Fed’s now famous “dot chart” showing that rates were likely to be 1% by the end of 2015 and 2.25% by the end of 2016, significantly higher than expected.

The market reaction has been swift. Yields on 5-year US Treasuries surged 15% in short order, with ripple effects through the global system. Yields have come down a bit since but then net effect as of writing is a jump in 10-yields by the following amounts in basis points: Philippines 21, Indonesia 15, Turkey 14, US 12, Hong Kong 12, Brazil 12, UK 11, Germany 7.

No doubt other factors are at work in each country but this looks like the start of a global squeeze. All we need now is a serious rise in the dollar and we will start to see the next leg of an emerging market shake-out.

The China carry trade is already going bad as the yuan continues its six-week slide, leaving us wondering what will happen to the $1.1 trillion dollar loans through Hong Kong – clearly now the epicentre of the next storm.EM bulls will argue that developing countries are far less vulnerable this time because their governments no longer borrow in dollars. This debate has become a little stale. The counter-argument – made by the BIS and the IMF – is that private companies in many of these countries do indeed borrow in dollars and on a huge scale. There has been a $4 trillion flow of funds into EM since 2009 and a fair chunk is fickle money chasing yield. [..]

A lot of EU nations will come to regret the day they handed over control of their financial systems to Brussels. But it’ll be too late.

• Europe Strikes Deal To Complete Banking Union (Reuters)

Europe took the final step to complete a banking union on Thursday with an agency to shut failing euro zone banks, but there will be no joint government back-up to pay the costs of closures. The breakthrough ends an impasse with the European Parliament, which persuaded euro zone countries to strengthen the scheme. It completes the second pillar of banking union, which starts at the end of the year when the European Central Bank takes over as watchdog. The accord means that the ECB has the means to shut banks it decides are too weak to survive, reinforcing its role as supervisor as it prepares to run health checks on the still fragile sector.

ECB President Mario Draghi said that plans to allow the new ‘resolution’ or clean-up fund to borrow to top itself up looked promising and that the decision-making scheme to shut a bank had been streamlined. “The point we’ve always made that we need a mechanism that is properly funded and the agreement actually improves the existing funding,” Draghi told journalists as he entered a meeting of European Union leaders. “All in all we made progress for a better banking union.” Michel Barnier, the European commissioner in charge of regulation, said the scheme would help to bring “an end to the era of massive bailouts”. “The second pillar of banking union will allow bank crises to be managed more effectively,” he said.

Thursday’s agreement makes it harder for EU countries to challenge the ECB if the central bank triggers bank closures, and establishes a common 55 billion euro back-up fund over eight years – quicker than planned but far longer than the ECB’s watchdog had hoped. But the new system, which Barnier conceded was not ‘perfect’, has shortcomings. For one, the ‘resolution’ fund is small and would, in the view of the ECB watchdog, be quickly spent. To remedy that the fund will be able to borrow to replenish spent money. Euro zone governments will not, however, club together to make it cheaper and easier for it to do so.

The 18 euro zone countries do not intend to cover jointly the cost of dealing with individual bank failures, a central tenet of the original plan for banking union. Germany resisted pressure from Spain and France to make such a concession. Its finance minister Wolfgang Schaeuble welcomed new rules forcing bank creditors to take losses and that “the mutualised liability … remained ruled out” – a reference to sharing the burden of a bank collapse. Neither will there be any joint protection of deposits.

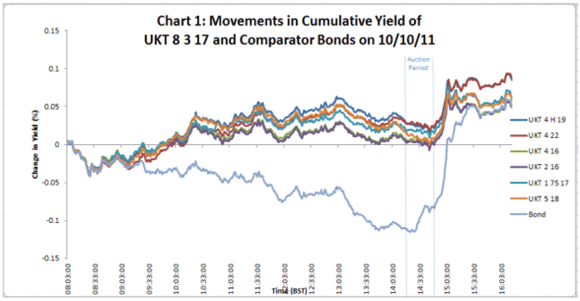

This is a great story. The Bank of England announces a QE program. Which means they’ll start buying bonds at elevated prices. So a trader, in that spirit, raises the price of bonds he intends to sell them, but fumbles the moment he does it. He ends up with losses and a ban instead of free money.

• Trader Banned For Trying To Profit From QE (PA)

A former Credit Suisse trader who saw the Bank of England’s quantitative easing (QE) programme as “cake” to profit from has been fined nearly £700,000 by the City regulator after rigging the price of UK bonds. Mark Stevenson, a bond trader with nearly 30 years’ experience, was also banned from the industry by the Financial Conduct Authority (FCA) after his attempt to exploit the £375bn programme intended to help nurse the economy back to health. The FCA found that he artificially ramped up the price of a £1.2bn holding in a set of gilts hours before he intended to sell them to the Bank.

His unusual trading was reported within 40 minutes and officials at Threadneedle Street decided not to buy the gilt, which it had been due to buy as part of QE. The FCA found the trading had the potential to affect taxpayers, since if the Bank had overpaid for the bond its losses would be shouldered by the Treasury. Details of the episode in October 2011 surfaced publicly last summer when the Bank’s executive director for markets, Paul Fisher, told MPs that claims about the “thoroughly reprehensible” allegations had been referred to the regulator.

On Thursday the FCA announced that Stevenson, who left Credit Suisse last December, had been fined £662,700 after qualifying for a 30% discount from a potential £946,800 fine because he agreed to settle at an early stage. It is the first enforcement action for manipulation of the gilt market, and comes in the wake of a series of market-rigging scandals. Banks have been fined billions for manipulation of the Libor interbank lending rate and world regulators are investigating allegations of foreign exchange rate rigging that threaten to become at least as serious.

Tracey McDermott, the FCA’s director of enforcement, said: “Stevenson’s abuse took advantage of a policy designed to boost the economy with no regard for the potential consequences for other market participants and, ultimately, for UK taxpayers. “He has paid a heavy price for his actions. Fair dealing is at the heart of market integrity. This case sends a clear message about how seriously the FCA views attempts to manipulate the market.” The FCA described Stevenson’s actions as “particularly egregious”. It added that the episode was the action of one trader on one day, and there was no evidence of collusion with other banks.

• Banned Trader Did BOE’s Job For It, But Too Well (Bloomberg)

Market manipulation has been on my mind a lot recently so I guess it’s worth explaining what it is. In simple form, market manipulation is:

• buying a lot of an asset,

• with the goal of pushing its price up,

• so you can sell it at that higher price to a price-insensitive buyer.Or vice versa, with selling.1 If you think you’ve spotted market manipulation, a useful question to ask is, “who is the price-insensitive buyer?”2 Because buying a lot of an asset with the goal of pushing its price up and then, just, like, selling a lot of it on the market is not in general a positive expectation strategy.

You know who is a great price-insensitive buyer? A major central bank that has embarked on a program of quantitative easing. The goal of quantitative easing is to push bond prices up (interest rates down), so sort of by definition the bank is not trying to buy bonds cheaply. If it was trying to buy bonds cheaply, it would not announce the quantitative easing in advance. Really, its goals are the opposite: Not only would it rather push prices up than buy cheaply; it would rather push prices up than buy at all. If the Fed could say “quantitative easing, go, move rates down by 50 basis points,” it would be happy to do that without buying bonds.

Here is a U.K. Financial Conduct Authority action against a former Credit Suisse trader who manipulated gilt prices during a Bank of England quantitative easing auction in 2011. The trader, Mark Stevenson, was fined 662,700 pounds and banned from the industry, and, fair enough, he did bad:

Mr Stevenson, an experienced bond trader formerly employed by Credit Suisse Securities (Europe) Limited (“CSSEL”), bought £331 million of the UKT 8.75% 2017 (the “Bond”), a UK government gilt, between 09:00 and 14:30 on 10 October 2011. The Bond was relatively illiquid and Mr Stevenson’s purchases represented approximately 2,700% of the average daily volume traded for the Bond in the previous four months and 92% of the value of the Bond purchased in the IDB market on 10 October 2011. The price and yield of the Bond significantly outperformed all gilts of similar maturity on 10 October 2011, as a direct result of Mr Stevenson’s trading.

He then tendered it into the quantitative easing auction at the end of that day, and … oops! The BOE decided to be price-sensitive, for the only time ever,3 because this bond’s price got really out of whack, and because other dealers called the BOE to complain, as you’d expect them to:

By 09:39 (38 minutes after Mr Stevenson began trading in the Bond), a market participant had telephoned the BOE regarding the Bond’s outperformance. Several other market participants telephoned the BOE throughout the day, suggesting that the Bond had been “squeezed”, “rammed”, and that someone “was messing around with” it.

No honor among thieves etc. So the BOE didn’t buy any of the bond that Stevenson was trading, its price got right back into whack, and Stevenson lost a lot of money:

Remember up is down, so that blue line going down at the beginning of the day was Stevenson pushing up the price of his favorite bond, and that line shooting up at the end of the day was him realizing that he’d made a terrible mistake and dumping his bonds until they got back in line with all the other bonds. You can’t tell for certain, but it sure looks like he sold his bonds at lower prices (higher yields) than he bought them at. Also: Fined and banned from the industry!

One lesson here is, if you’re going to manipulate markets, you should be really sure that your price-insensitive buyer is in fact price-insensitive,4 and a buyer. A bigger lesson is that hogs get slaughtered. [..]

• High-Speed Trading Inquiry Is Going Nowhere Fast (Bloomberg)

New York Attorney General Eric Schneiderman has set himself the noble goal of making financial markets safer for the small investor. Unfortunately, his latest foray into the world of high-frequency trading will achieve little or nothing toward that end.

Schneiderman announced this week that he is scrutinizing what has become a common practice: Some traders get privileged access to market data by paying to place their computer systems inside exchanges’ premises or by subscribing to faster and more detailed data feeds. Because this allows them to act on information that others don’t have, Schneiderman sees it as akin to insider trading.

To put Schneiderman’s view in the proper context, it helps to understand a bit about how high-speed trading works. Consider two securities, both of which are supposed to track the S&P 500 stock index. From one second to the next, their prices move in lockstep. At shorter time intervals, measured in the thousandths of a second, incoming orders might push up the price of one before the other has time to catch up. This creates an opportunity: By selling at the higher price and buying at the lower price, a trader can make a quick profit.

Such opportunities — and other, less-perfect arbitrages — are estimated to be worth billions of dollars a year, but only to those fast enough to seize them. Hence, high-speed traders are willing to spend a lot on being the first to know when an opportunity appears, and to get their orders to the front of the line. Much of that money goes into computer systems, software and ultrafast data links, such as a microwave link that can carry data from New York to Chicago in a matter of several milliseconds. Some also goes to pay for the proprietary data feeds and privileged server parking that trouble Schneiderman. (Bloomberg LP, the parent of Bloomberg News, provides its clients with access to some proprietary exchange feeds.)

The high-speed traders’ advantage might seem unfair, but it’s not unfair in the same way as insider trading. In the latter case, privileged information is available only to a limited group — company executives, for example — who break the law if they use it to make money at the expense of less-informed investors. In the former, the information is available to anyone willing to pay. It’s akin to paying an airline for the privilege to board a flight early, or — just to emphasize a previously disclosed interest — to buying a subscription to a Bloomberg terminal.

On a more practical level, most of the advantage will remain even if Schneiderman manages to make access to information more equal — as he has already done by pressuring news-release distributors Business Wire and Marketwired to get rid of their direct feeds. High-frequency traders will still be a lot faster than investors who don’t make the same investments in technology. Eliminating the advantage would require draconian measures.

The more important issue is whether, in their incessant efforts to identify opportunities and get to the front of the line, high-frequency traders are harming others or presenting a threat to the financial system. Research suggests that they can actually help individual investors by lowering transaction costs and making sure market prices accurately reflect available information. But they might also make trading more expensive for institutions, such as mutual funds and pension plans, by anticipating and piling in ahead of big trades. Most troubling is the possibility that many algorithms interacting at such speed might bring about a market meltdown, of the kind that nearly occurred in the Flash Crash of 2010.

If Schneiderman’s investigation helps answer those questions, it will do investors a service. So far, it seems to be going in a different direction — fast.

• Mt.Gox Says It Found 200,000 Bitcoins In ‘Forgotten’ Wallet (Reuters)

Mt.Gox said on Friday it found 200,000 “forgotten” bitcoins on March 7, a week after the Tokyo-based digital currency exchange filed for bankruptcy protection, saying it lost nearly all the 850,000 bitcoins it held, worth some $500 million at today’s prices. Mt.Gox made the announcement on its website. Online sleuths had noticed around 200,000 bitcoins moving through the crypto-currency exchange after the bankruptcy filing.

The exchange, headed by 28-year-old Frenchman Mark Karpeles, said the bitcoins were found in an old-format online wallet which it had thought no longer held any bitcoins, but which it checked again after its bankruptcy filing. “On March 7, 2014, Mt.Gox confirmed that an old format wallet which was used prior to June 2011 held a balance of approximately 200,000 BTC,” the statement said. It added that it moved the 200,000 bitcoins from online to offline wallets on March 14-15 “for security reasons.” “These bitcoin movements, including the change in the manner in which these coins were stored, had been reported to the court and the supervisor by counsels,” it noted.

Many of Mt.Gox’s 127,000 creditors, who feared they had lost their investments when the exchange filed for bankruptcy, are skeptical about what the exchange has said happened to the bitcoins it had. In its bankruptcy filing, Mt. Gox also said $28 million was “missing” from its Japanese bank accounts.

On Thursday, a U.S. judge in Chicago overseeing a class action against Mt.Gox revised a previous order, allowing some of the exchange’s bitcoin movements to be tracked. “Today in court we got relief … specifically to track the 180,000 bitcoins, which we’ve been monitoring. Hours later, Mt. Gox claimed it “found” these bitcoins … it appears Mt.Gox realized we were close and decided to acknowledge that it owned these 180,000-200,000 bitcoins,” Steven L. Woodrow, a partner at law firm Edelson, told Reuters vin emailed comments.

Edelson is representing Illinois resident Gregory Greene, who proposed the class action over what he claims is a massive fraud. Mt. Gox blamed the loss of 750,000 bitcoins belonging to its customers and 100,000 of its own on hackers who attacked its software. Bitcoin is bought and sold on a peer-to-peer network independent of central control. Its value soared last year, and the total worth of bitcoins is now about $7 billion.

Home › Forums › Debt Rattle Mar 21 2014: A Wealth of Embarrassment