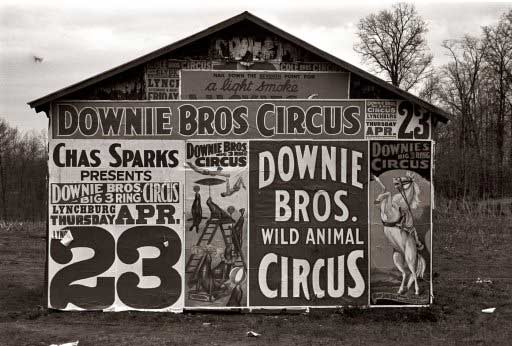

Walker Evans for FSA Wild Circus near Lynchburg, South Carolina 1936

Arguably, the US lost its first PR war over Vietnam. When its young and hopeful started dying on live TV, it was over. Never again, swore spin doctors on all sides of Capitol Hill. Over the past 40-odd years, PR and spin techniques have been substantially refined, and the media – both written and TV -, hard as it may have seemed at the time, have moved much closer to the government’s PR interests. So much so that one can figuratively speaking expect to be burned at the stake for suggesting Edward Snowden is anything like today’s Woodward and Bernstein.

As I was watching John Kerry land in Kiev today, and walk with his insane security detail to places where protesters were shot, only very recently, the lost PR war of 4 decades ago came to mind. G-d knows they’re still trying with all their might, just watch CNN, and read the WaPo, but it looks very much like a lost cause. The WaPo runs a long piece entitled Behind the West’s Miscalculations in Ukraine; the basic tenet is that the US left it to Europe to deal with Ukraine and Yanukovych, and the EU screwed up, so now John Kerry has to step in and they will never leave this kind of important project up the Europeans again.

And granted, the EU probably didn’t do a great job either, but A) who would believe Washington would leave a project of the geopolitical magnitude of Ukraine up to others, and B) the article doesn’t name Assistant Secretary of State Victoria Nuland even once. While it’s very clear from recordings that she was pivotal in bringing “Yats” to power – she about hand-picked him – and keeping “Klitsch” out. If you’re the WaPo, and you run a long story on the “West’s Miscalculations in Ukraine”, but you neglect to mention the number one – public – US operative, then what does that say about Woodward and Bernstein’s legacy? For Peep’s sake, Nuland is walking in Kiev with Kerry on live TV as we speak, but you just ignore her in your article?

The “Haircut In Search Of A Brain” Kerry (as Jim Kunstler adequately christened the Secretary of State) came traveling with the promise of a $1 billion loan to the self-appointed new Kiev government. He better make sure the documents are iron clad, in case “Yats” is outta there in a few weeks time and the next government refuses to pay up. That $1 billion number was what Yanukovych turned his back on in negotiations with Europe last fall, presumably when the absolutely full of themselves EU crew started attaching ever more IMF and World Bank conditions to it, and Putin had offered him $15 billion. Apparently, that took everyone by surprise, including the US as represented by Nuland and ambassador Pyatt. And now Kerry comes a-carrying the same $1 billion again, undoubtedly with more strings attached than a spinning wheel. The entire western circus is just drowning in its own hubris.

NATO holds a special meeting today. So do the EU foreign ministers. And they’re all of them on the phone with the White House all the time. They’re extremely busy looking at bans and sanctions. And what do we have so far? The US has halted military cooperation with Russia. Yeah, that’ll hurt … A secret document in Britain that the Guardian got hold of calls for any sanctions to leave rich Russians’ investments in London real estate alone. That’s got to have made Putin chuckle.

Economic sanctions? I bet you you can’t find anyone who can assure you those would hurt Russia more than it does the west. So count them out. Like what, we’re not going to buy your oil and gas anymore, Vlad? I see estimates of high (60 days) EU gas reserves after a very mild winter across the continent, but so what? Are Germany et al going to risk first banning Russian gas, and then start buying again, in the hope that Putin will have learned his lesson? For all they know, he’ll just double the price. Apart from all that, don’t forget that contracts have been signed, and you can’t just break those. Moscow sells $180 billion worth of mostly oil and gas to Europe, and Europe sells Moscow $120 billion in machines and various other items.

And whatever you may think of Putin, he’s consistent in his message: Russia reserves the right to protect the Russians and ethnic Russians who live in Ukraine. And despite all sorts of denials in western media that these people are under threat, why should they, or we for that matter, feel sure about that? We’ve seen the anti-Russian sentiments. And If you don’t know what that looks like, try 12 Videos Showing Why Ukraine Fears And Stands Up To Radical Nationalists.

Putin also said today that Yanukovych in his view has no political future, something he indicated last week when he refused to meet with the ousted president. However, Putin maintains that Yanukovych is the only legitimate president of Ukraine, even if he fled to save his life. Which was in serious danger, little reason to doubt that. Russia simply doesn’t recognize the “Yats”-led self named new government in Kiev. And that probably means “Yats” won’t be in power long. Kerry and his EU counterparts better prepare for that, and support a next PM, certainly before the May elections, if those take place.

No matter what you think, if you pay attention, it seems undeniable that Putin is winning the PR war on this one. No matter that Angela Merkel and Madeleine Munster Albright (who dug her up?) say he’s delusional and lives in another world, or Obama states he’s on the wrong side of history. Riddle me this: if you want to have a constructive discussion with someone, to what extent does it help to say such things? And what is the person you’re saying it about supposed to make of it? Anyone notice that Putin doesn’t stoop to such levels? It seems that only the losers do.

The best assessment I saw today came from Russian/American journalist Vladimir Pozner on CNN, who said that whatever Putin does, he is always demonized by western media.

Pozner also remarked that there’s no such thing as one Ukraine, there are many different peoples gathered together under one flag. They of course have the same right to self-determination that all peoples are guaranteed under UN law. And if the millions of Russians living in Ukraine feel threatened, and ask Putin for protection, should he deny that request? What would the US do if it had that kind of number of Americans under threat, and requesting aid, somewhere in the world, let alone on its own borders, like Mexico or Canada? I think we know the answer to that one.

Washington and Brussels would live to get a hold of the pipelines under Ukraine soil. And that they haven’t yet is certainly not for lack of trying. But they’re choking on their own hubris circus, and besides they should understand that Russia will never allow them control over those pipelines, because they keep the Russian economy alive.

It looks like a very real possibility that Ukraine will not survive in its present shape and form for much longer. And even though it would first of all be silly to blame that on Russia, even if Ukraine would split according to the wishes of its separate population segments, the pro west western part of the country should never get it into its head to as much as touch the pipelines. Because that would carry with it a serious risk of warfare. It’s time for the westworld to wake up from its hubris induced dreams of what once was. You don’t win a war with a Haircut In Search Of A Brain, not even a PR war. Those days are gone.

• US hypocrisy over ‘Russian aggression’ in Ukraine (RT)

As divisions deepen between the eastern and western regions of Ukraine, the backers of the putsch regime in Kiev portray Russia as a reckless aggressor to absolve their own responsibility for engineering the crisis.

While denunciations of Moscow have streamed out of western capitals in recent days over the standoff in Crimea, it should be understood that the political crisis currently unfolding in Ukraine could have been wholly avoided. In attempts to defuse unrest and maintain legal and societal order, ousted President Yanukovich offered remarkable concessions in his proposal to install opposition leaders in top posts in a reshaped government, which was rejected.

Russia expressed readiness to engage in tripartite negotiations with Ukraine and the European Union with the hope that both Moscow and Brussels could play a positive role in Ukraine’s economic recovery, but the EU was unwilling to accept such a proposal. The February-21 agreement was mediated by Russia, France, Germany and Poland and aimed to end the bloodshed in Kiev by reducing presidential powers and establishing a framework for a national unity government, in addition to electoral reform, constitutional changes, and early elections.

There was clearly no shortage of opportunities to ease the polarization of the Ukrainian state through an inclusive political solution, and yet the opposition failed to uphold its responsibilities, resulting in the ouster of Ukraine’s democratically elected leader to the detriment of the country’s political, economic, and societal stability.

As the new self-appointed authorities in Kiev dictate terms and push legislation through a rump parliament, the reluctance of western capitals to address the clearly dubious legitimacy of the new regime suggests that the US and EU condone what is effectively a coup d’état with no constitutional validity.

The leaked phone call between Assistant Secretary of State Victoria Nuland and the US Ambassador to Ukraine, Geoffrey Pyatt, is a testament to Washington’s proclivity for foreign meddling and its brazen disregard of Ukraine’s sovereignty. It is no coincidence that Arseniy Yatsenyuk – handpicked by Nuland for the role of prime minister – now occupies that position in Kiev’s new leadership, and much like the reckless agitation strategies employed by the US elsewhere, extremist groups were manipulated to allow the nominal moderates to seize power on Washington’s behalf.

In order to maintain enough momentum to oust Yanukovich, Ukraine’s opposition leaders relied on allies in the radical camp such as fascist groups like Svoboda, Trizub, and the Right Sector. These organizations espouse ethnic hatred against Jews and Russians and promote neo-Nazi ideals. The foot soldiers of these movements laid the groundwork for the putsch by occupying the Maidan [Independence Square], storming government offices, and attacking riot police with Molotov cocktails, firearms, and other lethal weapons.

Members of these far-right groups have been integrated in so-called ‘self-defense forces’ that now patrol Kiev and other major cities, and have been seen wearing symbols that include the Celtic cross, which has replaced the swastika for many modern white-power groups, the wolf-hook SS insignia, and other occult symbols associated with the Third Reich. In his capacity as prime minister, Yatsenyuk has relinquished control of Ukraine’s national security forces to the heads of these radical organizations, who have openly used threatening and bigoted language to incite ethnic hostility, in addition to calls for Russians and Jews to be either destroyed or expelled from Ukraine.

The political ascent of radical forces that represent a minority of Ukrainian public opinion has alarmed minority communities, indicated by Ukrainian Rabbi Moshe Reuven Azman’s calls for Kiev’s Jews to flee the country in light of recent political developments. Regions in the east and southeast of Ukraine, where many ethnic Russians and Russian speakers reside, are experiencing the Maidan protests in reverse, as protestors plant Russian flags atop government buildings in rejection of the new leadership in Kiev.

Since seizing power, the putsch regime in Kiev has attempted to pass laws against the official use of Russian and other languages throughout the country, fueling social unrest and secessionist sentiment in some quarters that culturally and linguistically identify themselves as Russian. Fast-moving developments in Kiev and actions taken by the new regime have enflamed the crisis, and any Russian intervention should be seen against the backdrop of eastern and southeastern Ukraine’s rejection of an unconstitutional transfer of power that directly threatens the integrity of the state.

The request by the legitimate President Yanukovich and the government of the Autonomous Republic of Crimea to bring a limited contingent of Russian forces into the region to ensure the safety of ethnic Russian citizens living within Crimean territory is a reasonable request in light of the chaotic socio-political situation currently facing Ukraine. It should be understood that the movements of Russian forces in Crimea have been entirely lawful, and within legal boundaries established by existing security pacts with Ukraine. For western capitals to threaten sanctions and accuse Russia of a belligerent ‘invasion’ of Ukraine is completely unjustifiable, and tinged with political bias.

US Secretary of State John Kerry’s statements alluding to Russia behaving like a 19th century power by ‘invading’ Ukraine on a trumped up pretext encapsulates Washington’s infinite potential for hypocritical double standards and pathological dishonesty. The egregious violations of international law by the United States and its NATO allies are abundant and need not be evoked to rebut Kerry’s desperate and deceptive accusation.

The outrage expressed by western capitals over the so-called ‘Russian aggression’ is in stark contrast to the restraint showed when Saudi Arabia militarily intervened in Bahrain in 2011 to put down peaceful protests. Recent interventions by France in its former colonies, Mali and the Central African Republic, have roused no international condemnation, despite notable local sentiment in those countries that view Paris as an aggressive actor.

The western stance on when intervention is and isn’t legitimate is highly selective, and for the interventionist countries to use their soft power monopoly to portray Russia as a meddler intent on aggressively undermining Ukraine’s sovereignty is truly a politically loaded and dangerous notion.

The Obama administration, in an attempt to offer President Putin ‘a face-saving way out of the crisis,’ has proposed that European forces take the place of Russian forces in Crimea to guard against threats to the population, knowing full well that Moscow would never accept such an arrangement in a region like Crimea, which shares historic political, economic, cultural, and strategic military ties.

The area in which Kiev’s new authorities need Washington and Brussels most is in dealing with Ukraine’s impending debt crisis, and indications suggest that any economic assistance from the West would come with punishing terms and conditions, structural adjustments and austerity measures that would generate widespread social discontent in the country, and threaten the already shaky legitimacy of the putsch authorities.

Internal divisions within the defense sector and the bureaucracy of Ukraine, such as the prominent defection of the newly appointed head of Ukraine’s navy, Admiral Denis Berezovsky, and other significant figures in support of Crimea’s pro-Russian stance suggests that the anti-Kiev sentiment is deepening and showing no signs of abating.

Residents of the Crimea will take part in a referendum on March 30 to reevaluate the status of the peninsula, and the outcome is widely expected to result in the region seeking greater autonomy from Ukraine with a move towards federalism. If Russian authorities feel that all possibilities for dialogue have been exhausted, and a peacekeeping mission must be launched in earnest, there is every indication that Moscow will act within international law and show maximum restraint.

Just as radical forces have become empowered as a result of western policy elsewhere, the result of the illegitimate putsch in Kiev is that those countries who claim to defend the post-World War II international order have empowered forces that sympathize with, and seek to propagate, fanatical prejudice and extremism, on the false notion that such radical groups will move aside peacefully to allow nominal western-aligned moderates and neoliberals to rule. It hasn’t worked elsewhere, and it won’t work in Ukraine.

• Behind the West’s Miscalculations in Ukraine

U.S. Had Let Europe Take Lead in Guiding Westward Drift of Former Soviet Republic

The U.S. ambassador was waiting in the office of then-Ukrainian President Viktor Yanukovych in November, anxious for a decision that would cinch closer ties with the West, when he ran across a staffer bearing unwelcome news. “I can’t believe it. I just came from seeing the president. He’s told me we’re going to put the European project on pause,” Mr. Yanukovych’s chief of staff, Serhiy Lyovochkyn, told U.S. Ambassador Geoffrey Pyatt, according to a person who was present.

The ambassador asked how the president intended to explain the turnabout to 46 million Ukrainians expecting a new pact with the European Union. “I have no idea,” Mr. Lyovochkyn said. “& I don’t think they have a Plan B unless it’s a dacha on the outskirts of Moscow.”

The exchange made clear the U.S. would have to come up with its own Plan B. For the previous two years, the Obama administration had sought to let Europe take the lead in guiding the westward political and economic drift of the former Soviet republic, with the U.S. in a supporting role.

Now, the U.S. has been drawn front and center at a far more difficult time after blood has been shed, battle lines drawn and Russian ire provoked. Locked today in the very East-West standoff the administration had hoped to avoid, “The U.S. is now in the lead,” a senior U.S. official said.

Many European diplomats felt that while the U.S. portrayed itself as acting tough in recent weeks, the Americans had left them alone on the Ukraine issue for far too long, preferring to prioritize Washington’s own ties with Moscow.

The White House decision to rely on Europe to cement ties with Ukraine was shaped by a foreign-policy doctrine meant to give international partners more responsibility for the world’s challenges, U.S. officials said. By divvying up responsibilities, these officials said, the U.S. could focus on issues at home after more than a decade of costly wars abroad. There also was initial skepticism within the Obama administration that Mr. Yanukovych was serious about moving toward Europe. Few administration policy makers believed Ukraine should be an American responsibility because the issue was more important to Russia and Europe than to the U.S.

Strategically, the Obama administration decided to take a back seat to Europe because of concerns that assuming the lead in Ukraine might backfire if Russia saw the European Union pact as a part of a superpower “Great Game” competition.

Even with Russian troops streaming into Crimea, administration officials said Monday it wasn’t clear if the outcome would have been any different had the U.S. taken a bigger role from the start. “The truth is Yanukovych left, and the new government is much more Western leaning. This is not a win for Russia,” a senior administration official said.

Talks between the EU and Ukraine date to the breakup of the Soviet Union, but in recent years they have focused on a sweeping trade and political pact known as the Association Agreement. In 2012, Ukraine and the EU initialed an agreement that, once final, would draw them closer.

The U.S. thought the Ukrainian leader might be bluffing about signing the Europe pact until mid-2013, when Mr. Yanukovych began taking more concrete steps. To bring Mr. Yanukovych closer to the West without provoking Russia, the U.S. and the EU settled on an informal division of labor, U.S. and European officials said. The EU’s job was to get the pact signed by a November 2013 deadline. The U.S. would work with the International Monetary Fund to get Kiev to agree to tough economic reforms.

The last thing the Obama administration wanted was another flashpoint with Russia. Relations between the two countries were already fraught over Russian President Vladimir Putin’s support for the Assad regime in Syria and the decision to grant asylum to alleged National Security Agency leaker Edward Snowden.

Russia began pressuring Ukraine to resist the pact by reducing Russian imports from Ukraine during the first three months of 2013. Russia followed with a targeted trade war to hurt Ukrainian oligarchs who favored European engagement. Unease was growing within the U.S. administration. The EU wasn’t paying enough attention to Kiev’s economic troubles and pressure from Russia, government analysts privately warned policy makers, U.S. officials said.

Anxiety in Brussels surfaced in September, when Armenia, which had negotiated a similar trade and political deal with the EU, backed out and instead pledged to join the Russian customs union under pressure from Moscow. EU officials saw Armenia, which also faced economic and political pressure from Russia, as a warning sign and stepped up contacts with Ukraine. EU leaders expressed confidence the Ukraine deal would be signed, believing Mr. Yanukovych wouldn’t reverse course after coming this far.

At an October meeting of the Commonwealth of Independent States in Minsk, Mr. Yanukovych made his last strong defense of the European pact. He also had a brief meeting with Mr. Putin that day, and U.S. officials believe that was when a more forceful Russian campaign began.

European divisions over Ukraine, with EU member states worried about antagonizing Russia, weakened the bloc’s ability to influence Kiev’s decisions, some diplomats said. Many member states believed the roadblock to a final agreement wasn’t Russian pressure, but Kiev’s refusal to meet European demands that it release at least temporarily imprisoned former Prime Minister Yulia Tymoshenko to receive medical treatment in Berlin.

U.S. officials believe Russian officials persuaded Mr. Yanukovych to finally reverse course in a series of meetings in Sochi in early November. In one of those meetings, the Russians presented the Ukrainian delegation with a dossier spelling out potential damage to Ukraine’s economy if the government moved ahead with the EU agreement, Mr. Yanukovych’s advisers told U.S. officials. The dossier, U.S. officials said, set out specific financial losses and percentage declines in such sectors as aerospace and defense.

While top European officials were meeting almost weekly with their Ukrainian counterparts, the U.S. had little in the way of high-level contacts. But on Nov. 18, a few days after Ambassador Pyatt’s unexpected conversation with Mr. Lyovochkyn in the presidential office complex in Kiev, Vice President Joe Biden called Mr. Yanukovych, suggesting the U.S. could help counter Mr. Putin’s offer.

Mr. Biden, during a visit to Ukraine in 2009, had gotten along well with Mr. Yanukovych, a senior administration official said. He seemed receptive to Mr. Biden’s blunt style, the official added. Mr. Biden’s message was that the U.S. was prepared to work with both the IMF and the EU “to deliver the support Ukraine needed to get through the economic troubles,” said a senior administration official briefed on the call, which Mr. Biden made while visiting Houston.

The next day, Mr. Yanukovych met Stefan Fuele, a former Czech foreign minister who was the bloc’s point man on the deal, at the presidential palace. As the two officials sipped tea surrounded by top aides, Mr. Yanukovych presented new figures amounting to tens of billions of euros Ukraine would need to see through the reforms embedded in the EU deal. Frustrated by a fumbling translator and determined to convey a clear message to Mr. Yanukovych, Mr. Fuele, who studied in Moscow in the early 1980s, switched into Russian during his response. The EU official rejected the numbers the president was citing and questioned whether Mr. Yanukovych was looking for excuses to justify his reversal. More

Mr. Yanukovych didn’t respond to the appeals. On Nov. 21, the Ukrainian government announced it was putting the EU deal on hold, blaming the EU for failing to offer enough economic support. Even then, some European officials hoped Mr. Yanukovych would make a last-gasp change of heart when he arrived at a summit in the Lithuanian capital on Nov. 28, where he was supposed to have signed the deal. Those hopes were finally dashed that evening in a 75-minute meeting in a sparse meeting room on the ground floor of the Kempinski Hotel in Vilnius’ central square.

Mr. Yanukovych told the EU’s two top officials he could advance the bilateral deal but offered no time frame for signing it, and demanded three-way talks with Russia and the EU in the meantime, according to a person familiar with the discussions. Those were deal-breakers for European Commission President José Manuel Barroso and European Council President Herman Van Rompuy, who refused to give Moscow direct say over the fate of a bilateral EU-Ukraine pact.

The meeting ended in farce the next day. After the summit was formally over and faced with growing protests at home over his U-turn on the EU deal, Mr. Yanukovych rushed over to Mr. Van Rompuy and Mr. Barroso to urge them to agree to a Ukrainian drafted joint statement saying talks would continue. It is too late, the EU leaders told him.

U.S. officials said they believed Mr. Yanukovych was looking for the easiest way to raise cash, regardless of the strings attached. EU officials said they weren’t prepared to match the eventual $15 billion loan package from Moscow. U.S. officials tried to convince Mr. Yanukovych it was a bad deal. Moscow offered Ukraine cheap natural gas for three months. After that, prices would rise and Ukraine would be required to buy more, increasing the country’s dependence on Russia.

In his calls, Mr. Biden warned the besieged Ukrainian leader that he was “behind the curve” and putting himself in an “impossible position,” said a senior administration official briefed on the calls. U.S. officials said Mr. Yanukovych was responsive at times, reversing some of the government’s anti-protest laws after one of Mr. Biden’s calls. “But it would always be grudging and halfhearted and too late,” a senior administration official said.

In Washington, Mr. Biden pushed to “wield the threat of sanctions” if Mr. Yanukovych decided to crack down on protesters, a message the vice president conveyed directly in a Dec. 6 call. But the Europeans were torn about sanctions, arguing against the risk of backing the Ukrainian leader into a corner.

U.S. officials said the tipping point came on Jan. 16, when Mr. Yanukovych pushed through laws that effectively banned peaceful protests and outlawed opposition group activities. State Department officials and intelligence analysts warned the White House that Ukraine could be engulfed in civil war.

In the last week of January, at a Situation Room meeting at the White House, Mr. Biden urged the administration to spell out in more detail what financial aid would be provided if Mr. Yanukovych and the opposition cut a deal, said U.S. officials briefed on the session. Mr. Biden was backed by Secretary of State John Kerry, officials said, and President Barack Obama agreed.

A few days later, Mr. Kerry huddled with senior European officials on the sidelines of a security conference in Munich and delivered Mr. Obama’s message: Get money ready, according to officials briefed on the discussions.

In February, EU foreign ministers closed ranks with the U.S., saying they would respond quickly if the situation deteriorated, and, later, agreeing on sanctions. Mr. Kerry was in Paris in the third week of February for meetings when his French, German and Polish counterparts decided to fly to Kiev to try to broker a deal between Mr. Yanukovych and opposition leaders. The U.S. was skeptical, but Mr. Kerry and Mr. Biden agreed to help behind the scenes.

In the end, U.S. officials said, they believed Mr. Yanukovych got cold feet about the power-sharing proposals, and then he disappeared. Many street protesters, meanwhile, resented the U.S. for saying it wanted to work with Mr. Yanukovych instead of booting him. The Obama administration is now preparing sanctions to respond to Russia’s military intervention. “We’re not putting Europe in the lead on this anymore,” a senior U.S. official said.

• Putin: Russia has right to use force in Ukraine (AP)

Accusing the West of encouraging an “unconstitutional coup” in Ukraine, Vladimir Putin said Tuesday that Moscow reserves the right to use all means to protect Russians there. The Russian leader’s first comments since Ukraine’s fugitive president fled to Russia last month came just as U.S. Secretary of State John Kerry was flying to Kiev to meet with Ukraine’s new government. Putin also declared that Western actions were driving Ukraine onto anarchy and warned that any sanctions the West places on Russia for its actions in Ukraine there will backfire.

Tensions remained high Tuesday in Crimea, with troops loyal to Moscow firing warning shots to ward off protesting Ukrainian soldiers. Russia took over the peninsula on Saturday, placing its troops around the peninsula’s ferry, military bases and border posts. Yet world markets seemed to recover from their fright over the situation in Ukraine, clawing back a large chunk of Monday’s stock losses, while oil, gold, wheat and the Japanese yen have given back some of their gains. “Confidence in equity markets has been restored as the standoff between Ukraine and Russia is no longer on red alert,” David Madden, market analyst at IG, said Tuesday.

Speaking from his residence outside Moscow, Putin said he still considers fugitive President Viktor Yanukovych to be Ukraine’s leader and hopes that Russia won’t need to use force in predominantly Russian-speaking eastern Ukraine. “We aren’t going to fight the Ukrainian people,” Putin said, adding that the massive maneuvers he ordered last week had been planned earlier and were unrelated to the situation in Ukraine.

Putin also insisted that the Russian military deployment in Ukraine’s strategic region of Crimea has remained within the limits set by a bilateral agreement on a Russian military base there. He said Russia has no intentions of annexing Crimea, but insisted that its residents have the right to determine the region’s status in a referendum set for this month.

Earlier Tuesday, the Kremlin said Putin had ordered tens of thousands of Russian troops participating in military exercises near Ukraine’s border to return to their bases. The massive military exercise in western Russia involving 150,000 troops, hundreds of tanks and dozens of aircraft was supposed to wrap up anyway, so it was not clear if Putin’s move was an attempt to heed the West’s call to de-escalate the crisis.

Putin accused the West of using Yanukovych’s decision in November to ditch a pact with the 28-nation European Union in favor of closer ties with Russia to encourage the months of protests that drove him from power and putting Ukraine on the verge of breakup.

“We have told them a thousand times: Why are you splitting the country?” he said. Yet he acknowledged that Yanukovych has no political future and Russia gave him shelter only to save his life. Ukraine’s new government wants to put the fugitive leader on trial for the deaths of over 80 people during protests last month in Kiev.

Ukraine’s dire finances have been a key issue in the protests that drove Yanukovych from power. On Tuesday, Russia’s state-controlled natural gas giant Gazprom said it will cancel a price discount on gas it sells to Ukraine. Russia had offered the discount in December following Yanukovych’s decision to ditch a pact with the European Union in favor of closer ties with Russia. Gazprom also said Ukraine owes it $1.5 billion.

The new Ukrainian leadership in Kiev has accused Moscow of a military invasion in Crimea. The Kremlin, which does not recognize the new Ukrainian leadership, insists it made the move in order to protect Russian installations in Ukraine and its citizens living there. [..]

At the United Nations in New York, Russia’s ambassador to the U.N., Vitaly Churkin, said Monday that Russia was entitled to deploy up to 25,000 troops in Crimea under the agreement. Churkin didn’t specify how many Russian troops are now stationed in Crimea, but said “they are acting in a way they consider necessary to protect their facilities and prevent extremist actions.”

Russia is demanding the implementation of a Western-sponsored peace deal that Yanukovych signed with the opposition that set presidential elections for December. Russian envoy at those talks did not sign the deal. Yanukovych fled the capital hours after the deal was signed and ended up in Russia, and the Ukrainian parliament set the presidential vote for May 25.

• Yanukovych has no political future, says Putin (AFP)

Russian President Vladimir Putin said Tuesday that Ukraine’s ousted president Viktor Yanukovych remained its only legitimate leader despite fleeing to Russia but conceded he lacked any political future. “I think he has no political future — I told him that. As for playing a role in his fate, we did that purely from humanitarian reasons,” Putin said of Yanukovych, who took refuge in southern Russia after crossing from Ukraine in a way that has not been made public. Putin said Russia viewed Yanukovych as legally Ukraine’s president. “The legitimate president, purely legally, is undoubtedly Yanukovych,” Putin said.

Crucially, Putin said this meant Russian intervention in Ukraine would be justified because Moscow had received a request for protection of its citizens from Yanukovych. “We have a direct request from the acting and legitimate — as I have already said — president Viktor Yanukovych about using armed forces to protect the lives, health and freedom of Ukrainian citizens,” Putin said. Russia’s ambassador to the United Nations, Vitaly Churkin showed the letter dated March 1 at Security Council talks on Monday.

Putin spoke scornfully of his erstwhile ally Yanukovych, who drew his supporters from the Russian-speaking part of Ukraine and in November agreed to scrap a deal with the European Union under pressure from Russia. “Do you sympathise with him?” one journalist asked. “No, I have completely different feelings,” Putin said.

But he said he believed Yanukovych had risked being killed by protesters when he fled Kiev late last month. “Death is the easiest (way) to get rid of a legitimate president. That would have happened. I think they would have just killed him,” Putin said. Yanukovych said he fled Ukraine after he and his family received death threats and his car was shot at as he drove out of Kiev.

Putin said that Yanukovych had essentially handed over his powers on February 21 by signing agreements with the opposition leaders last month, counter-signed by international mediators. He “practically gave up all his powers anyway. And I think he — and I told him this — had no chances of being re-elected,” Putin said. He said he understood peaceful protesters against Yanukovych: “Of course people wanted changes.”

Asked about a rumour reported in Ukrainian media on Tuesday that Yanukovych had died from a heart attack, Putin denied it. “After he came to Russia, I saw him once, that was literally two days ago. He was alive and healthy. He will catch a cold yet — at the funerals of those who spread that information,” Putin added with characteristic black humour.

• US-Europe rifts surfacing as Putin tightens Crimea grip (Guardian)

A rift appeared to be opening up on Monday night between the US and Europe on how to punish Vladimir Putin for his occupation of Ukraine’s Crimea peninsula, with European capitals resisting Washington’s push towards tough sanctions. With the Americans, supported by parts of eastern Europe and Sweden, pushing for punitive measures against Moscow, EU foreign ministers divided into hawks and doves, preferring instead to pursue mediation and monitoring of the situation in Ukraine and to resist a strong sanctions package against Russia.

On Monday night the White House announced it was suspending military ties and co-ordination with Russia, covering bilateral activities such as exercises and port visits. Barack Obama said the White House was “examining a whole series of steps – economic, diplomatic – that will isolate Russia and will have a negative impact on Russia’s economy and status in the world”.

Obama said the US state department was reviewing its entire portfolio of trade and co-operation with Moscow, including preparing a raft of possible measures targeting senior government and military officials implicated in the invasion of the peninsula. Obama said the condemnation from other countries aimed at Russia “indicates the degree to which Russia’s on the wrong side of history on this”.

The president is expected to use his executive authority to bypass Congress to quickly target senior Russian officials. But Washington is clearly aware it may struggle to rally support for punitive measures from Europe. “The most important thing is for us – the United States – to make sure that we don’t go off without the European community,” the majority leader in the Senate, Democrat Harry Reid, told Politico. “Their interests are really paramount if we are going to do sanctions of some kind. We have to have them on board with us.”

But at an emergency meeting in Brussels the foreign ministers of Germany, France, Italy and Spain resisted calls for trade sanctions, instead limiting discussion to freezing long-running talks with Russia on visa liberalisation that would have made it easier for Russians to visit Europe. Washington is also threatening to kick Russia out of the G8 group of leading economies, but Berlin opposes that.

• UK seeking to ensure Russia sanctions do not harm City of London (Guardian)

Britain is drawing up plans to ensure that any EU action against Russia over Ukraine will exempt the City of London, according to a secret government document photographed in Downing Street. As David Cameron said Britain and its EU partners would put pressure on Moscow after it assumed control of Crimea, a government document drawn up for a meeting of senior ministers said that “London’s financial centre” should not be closed to Russians. It did say that visa restrictions and travel bans could be imposed on Russian officials.

The picture of the document was taken by the freelance photographer Steve Back, who specialises in spotting secret documents carried openly by officials entering Downing Street. The document was in the hands of an unnamed official attending a meeting of the national security council (NSC) called by the prime minister to discuss the Ukrainian crisis.

The document said Britain should:

• “Not support, for now, trade sanctions … or close London’s financial centre to Russians.”

• Be prepared to join other EU countries in imposing “visa restrictions/travel bans” on Russian officials.

• “Discourage any discussions (eg at Nato) of contingency military preparations.”

• Embark on “contingency EU work on providing Ukraine with alternative gas [supplies] if Russia cuts them off”.

• Specific threats to Russia should be “contingent and used for private messaging” while public statements should “stick to generic” point.

• Draw up a technical assistance package for Ukraine “ideally jointly with Germany”.

• Pursue the “deployment of OSCE and/or UN (but not EU) monitors in Crimea and eastern Ukraine”.

• Push the “UN secretary general Ban to take the lead in calling and creating a forum for engaging Russia on Ukraine”.

• Accept an emergency summit of EU leaders to discuss Ukraine. This will now be held in Brussels on Thursday.

Government officials said that no decisions were taken at the meeting of the NSC, but they confirmed that the call in the document for London’s financial centre to kept open to Russians reflected the government’s thinking that it wanted to target action against Moscow and not damage British interests.

How aggressive will Beijing be in addressing its shadow threat? We may soon find out. It will need to push hard, and risk a fall over the edge.

• China Banks Show Too-Connected-to-Fail Link to Shadow Loans (Bloomberg)

As China’s top legislators start their annual meeting in Beijing tomorrow to set economic targets, efforts by policy makers to crack down on unregulated lending threaten to undermine financial stability. “The failure of one product could lead to defaults of many others in a chain reaction,” said Christine Kuo, a Hong Kong-based analyst at Moody’s Investors Service. “The fall of shadow banking, starting with trusts, will spill over to the whole financial system, trapping banks and other stakeholders. That’s why the government is extremely cautious for fear that any misstep may trigger a systemic crisis.”

At stake is what the China Trustee Association, an industry trade group, estimates are $1.8 trillion of products developed by trust companies. Lenders also created $1.6 trillion of high-yield wealth-management investments, up 40% in the nine months through Sept. 30, according to JPMorgan.

Banks have more than their reputations on the line. They have channeled their own capital as well as clients’ money through trusts to risky borrowers they’re normally prohibited from lending to, such as coal mines and property developers, according to the Trustee Association. About 5.3 trillion yuan of trust products will come due this year, up from 3.5 trillion yuan in 2013, Haitong Securities Co. estimated in January, warning that the trust industry can no longer shoulder risks tied to offering implicit guarantees, as companies lack sufficient capital to bail out investors.

At least 20 trust products have run into difficulty making payments since 2012, according to Beijing-based China Securities Co. All have avoided default as issuers or third parties such as state-owned bad-loan managers and guarantee firms eventually repaid investors in full. “The government is faced with a dilemma,” Moody’s Kuo said. “It knows that the implicit guarantee cannot last forever, but at the same time it is very worried about triggering a systemic crisis.”

China’s trusts are unique in that they can invest across all asset classes from loans and real estate to bonds and commodities, under China Banking Regulatory Commission supervision. Cooperating with trusts helped banks get around regulatory restrictions to expand lending and offer new products to yield-hungry investors. It also helped the trust industry take off after six periods of ups and downs since its inception in 1979.

Before 2010, lenders used trusts to offer off-balance-sheet loans directly to property developers and local-government financing vehicles. At the end of 2010, more than half of China’s 3 trillion yuan in trust assets originated from banks, mostly funded by wealth-management products sold to banks’ clients, Trustee Association data show.

Regulators intervened in January 2011 by requiring banks to reduce such tie-ups and bring business with trusts onto their balance sheets. Trust firms were told to hold capital against certain loans. As a result, the official level of cooperation between banks and trusts fell to 20% of the total 10.9 trillion yuan in trust assets at the end of last year, Trustee Association data showed.

The decline masked the extent of banks’ exposure to trusts as lenders responded by creating new, more-intricate structures that allow them to invest clients’ funds as well as their own capital in high-yielding trusts that divert money to riskier corporate and local-government borrowers, according to Stephen Green, Standard Chartered Plc’s Hong Kong-based head of China research, and Bernstein’s Werner.

The practice often involves so-called trust-beneficiary rights, which are the legal rights to trust products. Typically, another company will be brought in to buy the trust product and then sell the rights to the bank, enabling it to book the loan as a financial asset held under a repurchase agreement.

Such assets require a capital charge of 25% compared with 100% for booking a loan, Green wrote in a November note. Sometimes another bank will be brought in as an intermediary to create an interbank exposure that allows for lower risk-weightings and credit costs than a standard loan.

Credit-underwriting criteria for such loans, with most going to industries such as mining, property development and local-government borrowing arms, are often more lax than those applied by banks or debt capital markets, making them vulnerable in an economic slowdown, according a November report by McKinsey & Co. and China Ping An Trust Co. Trusts are arguably the second-most risky financing channel for companies, after underground financing, Zhang Zhiwei, an economist for Nomura International Hong Kong Ltd., wrote in a Jan. 28 note.

Fewer than 10% of trust firms are formed by the private sector, with the rest owned by large state-owned enterprises, financial conglomerates and local governments, the McKinsey and Ping An Trust report said. The state-owned companies often own each other’s shares, and the government is involved in appointing the heads of these firms.

• Shaky debt, shady deals threaten China investors (Satyajit Das)

China’s shadow banking is an important source of financing, but this system poses great risk to the country’s financial health. The credit quality of borrowers from shadow banks is uneven, as is the collateral securing these loans. Many loans are tied to real estate, while others are backed by industrial machinery and even commodities. In some cases, lenders seeking to foreclose loans have discovered that the underlying collateral has been pledged more than once or does not actually exist.

Interconnections between the shadow banking system and the traditional banking system create additional risk and moral hazards. Banks frequently use shadow banking to shift loan assets off their balance sheets and “window dress” financial statements for regulators and investors. Banks also use proxies, namely trust companies and retail-oriented wealth management products to make high-interest loans to companies, such as property developers, which they would otherwise be unable to service. Banks increasingly rely on these proxies to maintain market share and earnings, via fees and commissions received from shadow banking products.

The connection between traditional banks and shadow banks is intricate. Banks sell acceptance bills or risky loans to a trust, and the loans then find new life as a wealth management product sold to bank clients. Banks, trusts and wealth management products sometimes pool deposits, as well as assets or securities from different products. Moreover, new products are created to raise funds to meet repayments of maturing products. In principle, the risk of these wealth management products rest with the investors, who bear the financial shortfall if assets funded by the pool default. But the ultimate responsibility for defaults is more complicated.

Investors in trusts may believe that they are protected because the trust companies risk losing their operating license if their products suffer losses. In recent years, trust companies have sometimes concealed losses by using their own capital, arranging for state-owned entities to take over impaired loans or using proceeds from new trusts to repay maturing investments. Investors may also believe that banks will guarantee repayment and returns on shadow banking investments.

Chinese securities regulators should be concerned. Failure of a wealth management product may impair the ability to issue fresh products or for investors to withdraw funds, requiring sponsoring banks to support these vehicles — as was the case in 2008 in the U.S. The resulting losses and cash outflows could trigger wider problems in the financial system, which would affect solvent businesses and economic growth.

Policymakers have taken steps to slow the rapid growth in debt and the expansion of the shadow banking system. They’ve increased reserve requirements, for example, to reduce bank lending. Other measures, including specific restrictions on certain types of loans, have been used to control borrowing.

In early 2014, the Central Government announced measures designed to rein in shadow banks. Banks are to be subject to more rigorous enforcement of existing rules and the prohibition on moving certain loans and assets off-balance sheet. Banks would be required to set up separately capitalized and provisioned units for wealth management businesses. Cooperation between banks and trust companies or security brokers would be restricted. In addition, trust companies would be prohibited from pooling deposits from more than one product or investing in non-tradable assets. Private equity firms would not be allowed to lend to clients.

China’s Central Government also plans three- to five new private banks to increase the capacity of the banking system, outside the dominant state-owned lenders. Authorities have intervened in money markets, draining liquidity and increasing interest rates to restrict excessive credit growth and to improve bank risk-management practices. The actions resulted in a sharp rise in interest rates and increased volatility. They also revealed weaknesses in the structure of the financial system, particularly the instability of the shadow banking system.

The large Chinese state banks control the majority of customer deposits. Other banks tend to have smaller deposit bases. They are more reliant on wholesale funding, particularly from the interbank market. Liquidity in the interbank market depends on the larger banks that are net lenders in this segment and wealth management products invested in money markets.

But reduced liquidity and higher rates can quickly set off a chain reaction. Tighter conditions in the interbank market pressure smaller banks. This also encourages redemption of wealth management products, which further reduces the availability of funding in the interbank markets, setting off a cycle of increasing rates. Unlike large banks, smaller banks hold fewer government bonds, limiting their ability to raise funds using the securities as collateral. As a result, smaller banks could be forced into distressed selling of illiquid assets, causing prices to fall.

The deteriorating financial position of smaller banks would raise their cost of borrowing. Some banks can lose access to funding, due to concerns about their solvency. Yet these interventions so far have had limited success in slowing the growth of borrowing. A key problem is China’s reliance on debt-funded economic growth and the need to expand credit to maintain high levels of economic activity. In addition, the increase in the size and complexity of the shadow banking sector reflects structural problems.

China needs major and wide-ranging economic, financial and structural reform — but this solution is politically unpalatable. Instead, China just adds more debt.

This is an interesting take, but what use is it on a day when markets are up 1.5%-2.5%?

• Corporate insider bearishness at pre-2008 crash levels (MarketWatch)

Corporate insiders nowadays are as pessimistic as they were just before the 2008 market meltdown. Though their bearishness doesn’t necessarily spell an immediate end to the bull market, it can’t be good news — since insiders presumably know more about their companies’ prospects than do the rest of us.

Corporate insiders are a legally-defined group containing a company’s officers, directors, or shareholders owning at least 10% of its outstanding shares. Any time insiders buy or sell shares of their company’s stock, they must report the transaction more or less immediately to the SEC, which makes the data available to the public. But skeptics will no doubt point out that the insiders failed dismally in late 2007 to foresee the imminent downturn not only at their companies, but in the economy overall.

Supporting their argument is the ratio of the number of shares insiders have recently sold to the number recently bought. Lower ratios mean that the insiders on balance are bullish, while higher ratios mean they are more bearish. The historical average for this ratio, according to the Vickers Weekly Insider Report, a publication of Argus Research, is between 2-to-1 and 2.5-to-1. At the top of the bull market in October 2007, just before the Great Recession and the worst bear market since the 1930s, this sell-to-buy ratio stood at a bullish 1.98-to-1. That result certainly doesn’t provide much encouragement to those who would look to corporate insiders for guidance.

So why pay attention to insiders now? Largely because that overall ratio was distorted. Nejat Seyhun, a finance professor at the University of Michigan, has found from his research — conducted well before 2007, I might add — that only some insiders have a consistently accurate view of their companies’ prospects. The insiders worth paying attention to are a company’s officers and directors. Those with relatively little insight, in contrast, are the largest shareholders.

This is a crucial distinction. The largest shareholders in 2007 were mostly bullish even as officers and directors were becoming more bearish. Since the composite statistics were dominated — as they almost always are — by the actions of the largest shareholders, these overall statistics diverted attention from the bearish behavior of insiders with the greatest insight.

Not surprisingly, Prof. Seyhun — who is one of the leading experts on interpreting the behavior of corporate insiders — has found that when the transactions of the largest shareholders are stripped out, insiders do have impressive forecasting abilities. In the summer of 2007, for example, his adjusted insider sell-to-buy ratio was more bearish than at any time since 1990, which is how far back his analyses extended. Ominously, that degree of bearish sentiment is where the insider ratio stands today, Prof. Seyhun said in an interview.

Note carefully that even if the insiders turn out to be right and the bull market is coming to an end, this doesn’t have to mean that the U.S. market averages are about to fall as much as they did in 2008 and early 2009. The one other time since that bear market when Prof. Seyhun’s adjusted sell-buy ratio sunk as low as it was in 2007 and is today, the market subsequently fell by “just” 20%. That other occasion was in early 2011. Stocks’ drop at that time did satisfy the unofficial definition of a bear market, and the insiders’ pessimism was vindicated. And though the 2011 decline wasn’t nearly as bad as the losses in 2008, corporate insiders’ latest behavior, properly interpreted, is worrisome.

We’ve said this many times. But let the details seep in, by all means.

• Our next big crisis will be a retirement crisis (MarketWatch )

Remember how everyone sensible knew the housing market was in a bubble 10 years ago but nobody really focused on what that would mean? I wonder today if we are in a similar situation regarding retirement. Everybody sensible knows we are facing a looming retirement crisis. Tens of millions of baby boomers are starting to retire. They are going to live in old age far longer than previous generations. Tomorrow’s grandma is going to need medical care and nursing care beyond the imagination of grandmothers of yore.

Yet so few people or families have saved anywhere near enough. And our public safety net is poorly managed, ill-thought-out, and threadbare. But even though we know the overall picture doesn’t add up, somehow everyone keeps whistling and hoping for the best. It reminds me of a funny poster someone put up in the offices of the Boston Herald, where I worked, back around 2005. It featured a character made of soap suds called “Mr. Housing Bubble”. He was saying, “If I pop, we’re screwed!” How we laughed.

On retirement, three new reports paint a bleak picture of what the future may look like for Americans when they retire. For example, they may enjoy an overall standard of life well below that enjoyed by retirees in many other developed countries, according to a new analysis by money management giant Natixis (which owns bond firm Loomis Sayles, among others). Natixis looked at a broad array of measures, from economic factors to health care, and found that the U.S. ranked 19th in the world for retirees — far below countries such as Switzerland and Norway, which (apparently) have sorted themselves out, and behind most of the other leading developed nations.

“The United States narrowly holds its spot among the top 20 nations globally in its capacity to need retirement security needs and expectations,” report Natixis researchers. They looked at 20 key performance indicators across four areas: health care, material well-being, finances in retirement, and broader “quality of life” and the environment. As an illustration, Natixis notes that we rank number one in the world — by a country mile — in health spending per capita, but we are only 33rd in life expectancy, 52nd in the number of doctors per capita, and 58th in hospital beds per person.

And, as I have observed here before, even though America in aggregate contains an enormous amount of wealth, that isn’t much help to a lot of people: We have one of the most unequal distributions of income among developed countries in the world. Many people are also in terrible financial shape for their retirement. The Boston College Center for Retirement Research has just updated its “National Retirement Risk Index,” a measure of just how many people can expect to be financially comfortable in retirement.

It doesn’t make for happy reading. According to Boston College, based on current projections, about half the country is at risk of being unable to maintain their standard of living in retirement. Among low-income workers that rises to 60%. But it’s 40% even among the higher-income workers. The picture has improved a bit since 2010, of course, as the economy has recovered somewhat from the financial crisis. But it remains worse than it was in 2007.

One of the stark issues that comes out of the report is how little the stock market boom has helped. As the Boston College researchers note, citing data from the Federal Reserve’s 2010 Survey of Consumer Finances, most people don’t own many stocks. Equities account for just 17% of the wealth of high earners, 6% of middle earners and 2% of low earners. Far more important is the value of housing — which has recovered much less dramatically than the stock market.

Meanwhile, by suppressing short-term interest rates, the Fed has effectively levied a harsh tax on savers who need income from short-term deposits…like retirees. The picture is similar in a new study by the Employee Benefits Research Institute, a Washington, D.C.-based think-tank. Their Retirement Readiness Rating says that 43% of Boomers and “Generation Xers” are at risk of running out of money in retirement. Among the poorest half of the country, that number rises sharply. Among those in the poorest 25%, EBRI estimates a stunning 83% are at risk.

Do the math: According to an EBRI survey conducted last year, 66% of workers have saved less than $50,000 for their retirement. And 28% have saved less than $1,000. Good luck with that.

The most alarming news, though, is in the fine print. Even these bleak numbers are based on the most rosy financial scenarios. EBRI assumed no changes in Social Security or Medicare. It also assumed wacky financial returns: It estimated people would earn about 8% above inflation each year on their stocks and about 2% above inflation on their bonds — net of fees!

John Hailer, CEO of Natixis, calls the picture worrying. “Individuals need to be concerned about their own retirement needs, and not just be dependent on government and corporations,” he says. He notes that most people don’t even understand the problem. For example, 89% of Americans told Natixis researchers that they were on track to reach their retirement goals — but 54% of them didn’t even have a plan, and 45% of them couldn’t even define those goals. Boston College’s Alicia Munnell, Anthony Webb, and Rebecca Cannon Fraenkel, authors of the risk-index report, warn: “The only way out of this box is for people to save more and/or work longer.” No kidding.

Like the pension issue, energy is one where people will cling to empty hopes and promises. Until they no longer can. Better start keeping your family and neighbors close.

• UK Household Energy Costs Leap 55% In A Decade (Telegraph)

Household spending on energy rose 55% over a decade, excluding the impact of inflation, as soaring prices more than offset a 17% drop in consumption, new data show. Electricity, gas and other household fuels such as heating oil cost a typical household £106 a month in 2012, up from £69 a month in 2002, the Office for National Statistics (ONS) said – with both figures expressed in 2012 money. Energy costs increased from 3.3% of a household’s annual income to 5.1% as a result.

Consumption fell over the same period as cash-strapped consumers responded to the rising prices by cutting back on their energy usage, and as homes were fitted with insulation and energy-efficient boilers. Despite political controversy over household energy price rises in recent years, the ONS said the surge in costs had mostly taken place between 2004 and 2009. Prices in fact peaked at £108 a month in 2009, and stayed relatively steady at between £105 and £106 between 2010 and 2012, it found. [..]

Tom Lyon of price comparison website uSwitch.com said: “Today’s figures highlight that energy is becoming increasingly unaffordable for many consumers. The impact of rocketing bills is clear and consumers are having to ration their energy use; over seven in ten households (73%) have gone without heating at some point this winter because of the cost and over a third (36%) say these cutbacks are affecting their quality of life or health.” Official data from the Department of Energy and Climate Change shows that a typical annual energy bill rose from £570 in 2003 to £1,279 in 2012 – a 124.4% increase in cash terms, not adjusted for inflation.

Beppe is losing quite a few of his parliamentarians because he refuses to negotiate with the new government. Still happening democratically though, everything is subjected to a vote. But he’s always been very clear about his views on the existing system, as he’s been on TV appearances. So those now voted out should have known better. Meanwhile, yeah, they can still try and lock up the leader of the single biggest party in the country over trivialities.

• Beppe Grillo gets jail term for high speed train protest (AFP)

The head of Italy’s anti-establishment Five Star party (M5S), Beppe Grillo, was sentenced to four months in prison on Monday for breaking a police seal on a building during a protest. Prosecutors had requested the former comedian be put behind bars for nine months for breaking into a sealed-off hut near a highly-contested high speed train line between France and Italy. Nine activists of the No TAV movement — accused of entering the hut with Grillo — were given sentences of up to nine months, while 10 other suspects were found not guilty. “Today they sentenced me to four months. I will not give up. Your solidarity really helps,” Grillo wrote to his supporters on Twitter.

The outspoken leader, whose M5S party took a quarter of the votes at last year’s national election, has admitted entering the hut but says there was no seal to break. His lawyer and nephew, Enrico Grillo, said they would wait to read the court’s explanation of the verdict before deciding whether to appeal or not. No-Tav head Alberto Perino, who also received four months in prison, said that “a sentence this severe for a crime of this type is unique in Italy”. “It well illustrates the climate of witch-hunting that exists,” he said. In January, three members of the movement against the high-speed train line were ordered by a court to pay close to 200,000 euros ($275,558) in damages for blocking construction work.

Launched in 2001, the rail link is meant to halve travel times between Lyon and Turin and cut the Paris-Milan journey from seven hours to four, while taking a million trucks off the road and averting three million tonnes of greenhouse gas emissions per year. But the 26-billion-euro ($35-billion) project has faced fierce, sometimes violent opposition in Italy from environmentalists and affected residents who say it is wasteful and unnecessary. It is also running behind schedule, its start date pushed back to 2025 at the earliest.

The problems for Big Oil are finally going mainstream. Must be serious, then.

• The well is running dry for big oil (MarketWatch)

Last week, I mused on the death of cars and big-picture factors working against the auto industry, including urbanization and declining driving rates in younger Americans. Now, I’ll trot out my crystal ball again and offer you another prediction: This is the beginning of the end for Big Oil, too.

Now before you jump down my throat for trolling you again with hyperbole, I will state up front that I don’t expect Exxon Mobil, BP and Chevron to disappear tomorrow any more than I expect I-95 to start sprouting daisies. But as with the decline of automobile ownership — and in part because of it — we may also be witnessing a protracted decline in major energy stocks and fossil fuel demand. That’s bad for big oil, and bad for investors in these stocks.

The first big reason big oil is in trouble: Oil demand keeps dropping. Technology continues to help us do more with less and implement cleaner alternatives to crude oil. Consider that U.S. oil demand fell to a 16-year low in 2012 despite energy-hungry gadgets and the addition of some 40 million people to the total population. Also consider that fuel oil demand was the lowest on record in 2013 and has been steadily declining since the 1970s as the energy source has fallen out of favor for cleaner, greener options.

It’s not just the U.S., either. Even with a bullish outlook for the global economy fueling oil demand this year, the IEA has boosted consumption targets a meager 1.3% as efficiencies in the West offset faster-growing demand in emerging markets. However you slice it, global crude oil appetites simply aren’t what they used to be. Even energy-hungry emerging markets aren’t making up for the weak demand in the developed world.

I don’t pretend to know when supplies in the ground will run out, or whether we are truly living after the era of “peak oil.” But one thing is clear: Oil production is getting much more costly as easy-to-access fields are drilled dry, and new production is reliant on more difficult and costly extraction for the fossil fuel. Take the shale oil boom. Margins are lower thanks to the cost of production. The story is the same for oil sands production , same for offshore drilling, same for oil in Africa as opposed to oil in Canada.

A great example of how the quest for new oil sources has gotten increasingly high-tech and high-cost is Exxon’s partnership with Russia’s Rosneft on an ambitious deep-water project in the Arctic. Even if the company executes perfectly, avoiding the risk of a disaster like the one we saw in the Gulf of Mexico across mid-2010, the costs are going to be huge for this Arctic oil venture because of the work that goes into accessing previously inaccessible reserves.

Unfortunately, there’s not any real alternative to ventures like this for big oil if they want to keep profits and revenue up. Exxon has projected a 1% drop in output in 2014, and its 2013 10-K filing showed 7.51 billion barrels of total proved crude oil reserves — down from 7.74 billion barrels of crude oil liquids in at the end of 2007 . If the company wants to keep oil production up, it has to keep reserves up, too.

Perhaps most telling is that Exxon itself knows that it’s fighting a losing battle on the crude oil front. Hence the $31 billion buyout of natural gas giant XTO Energy in 2009 to pivot away from oil and to its abundant, cleaner-burning cousin. The fact that a giant like Exxon is hedging its bet against oil says a lot about long-term trends.

Again, Big Oil isn’t exactly going anywhere anytime soon. And if you have been holding stocks in this sector for years with a great cost basis and a yield on cost that is around 10%, you can feel comfortable hanging on. With $420 billion in market cap, Exxon is the second-largest U.S. stock behind Apple. It also is one of just four companies — along with ADP, Microsoft and Johnson & Johnson being the others — with a AAA credit rating. And with roughly $42.3 billion in the bank, there’s plenty of cash to keep the lights on for a while. But stability for entrenched players should not be confused with the prospects of growth. And new money should carefully consider the risks of buying into Big Oil right now.

Once again, let’s look at Exxon — the poster child for big oil. Revenue has been declining slowly since peaking in 2011, and earnings growth has been almost wholly dependent on cost-cutting and stock buybacks between $3 billion and $6 billion per quarter since the Great Recession. Investors clearly haven’t been fooled, since Exxon has seen its stock basically go nowhere since 2008.

Thinking back to what kids represented only 50-100 years ago, and still do in most of the world, you can’t help asking: what happened? What are we doing?

• Why your kids are “economically worthless” (Yahoo!)

Remember when children were an economic asset? No, you probably don’t, because that was back in the 1800s, when kids labored on farms and in factories and kicked in a few pennies to help cover the family expenses. “The more [children] you had, the better off you were,” Jennifer Senior, author of the new book All Joy and No Fun: The Paradox of Modern Parenthood, explains. Since most kids produced a positive financial return for their parents, there was a natural incentive to have more.

The financial implications of having kids have completely changed, needless to say. The average middle-class family these days will spend about $295,000 to raise a typical kid, one reason the average mother now gives birth to just two children, down from three in the 1970s and more before that. With fewer kids, parents tend to dote on them more. Children, Senior writes, have become “economically worthless but emotionally priceless.”

Most parents are okay with that, since child labor is now illegal, after all, and a lot of parents have bigger ambitions for their kids than field worker or factory sweeper. Yet something else is wrong. “The moment children stopped working for adults,” Senior writes, “everybody became confused about who was in charge.”

Now, if you’re a parent, you might earnestly believe that you’re in charge of your kids, instead of the other way around. But if Senior is right, odds are, something about parenting makes you unhappy. It could be the lack of freedom or the unrelenting demands most kids make. If you’re a working parent, you might feel you’re constantly juggling work and parenting duties and never doing either particularly well. “Our kids’ jobs now are homework, and going to soccer practice and violin lessons,” Senior tells me. “That becomes our work.”

To make parenting a bit easier, Senior urges parents to ease up on all the extracurricular activities, especially the ones kids themselves aren’t enthused about. There’s nothing wrong with kids doing chores either – without earning pay or a weekly allowance. “If you’re paying $295,000 to raise them,” Senior argues, “the least they can do is take out the trash.”

And if you feel guilty about leaving your kids while you go to work—don’t. “I hear this all the time, especially from mothers,” Senior says. “They feel this compensatory impulse, and they don’t need to feel that.” If you need convincing, remind yourself that you’re the one out earning a living, not your kids. They have it pretty good.

Nice research, but a bit tricky, since it’s based on “evidence” that no longer exists, since it was washed away.

• On Way to New World, First Americans Made a 10,000-Year Pit Stop (NatGeo)

Sediment cores from Alaska and the Bering Sea support genetic evidence that the first human settlers of the New World spent thousands of years inhabiting Beringia, the region that included the land bridge between Siberia and Alaska, scientists say.

The Bering land bridge measured as much as 1,000 miles (1,609 kilometers) from north to south and as much as 3,000 miles (4,828 kilometers) from west to east. Scientists once thought this vast tract consisted mostly of tundra steppe, a treeless environment incapable of supporting a large human population.

But in recent years paleoecologists—scientists who study ancient environments—have been drilling sediment cores in the Bering Sea and in bogs in Alaska. The samples have yielded plant and insect fossils, as well as pollen, indicating that Beringia’s tundra steppe was dotted with oases of brushy shrubs and even trees such as spruce, birch, willow, and alder.

These woody refuges could have provided fuel for fires, raw material for shelters, and cover for animals such as hares, birds, elk, and moose—game that humans could have hunted for food, said Dennis O’Rourke, an anthropological geneticist at the University of Utah in Salt Lake City.

Writing in this week’s issue of the journal Science, O’Rourke and two colleagues say these new lines of paleoecological evidence are consistent with genetic studies showing that the DNA of Native Americans is distinct from that of their Asian ancestors. Using knowledge of DNA mutation rates, researchers calculated how long it took for the genetic differences to accrue. They concluded that the people who migrated to the New World must have split from their Asian forebears about 25,000 years ago.

But the earliest undisputed evidence of people in the Americas dates back to only about 15,000 years ago. So some scientists speculated that a population of humans, numbering perhaps a few thousand individuals, must have settled down somewhere during that 10,000-year interval.

Furthermore, the migrants must have established themselves somewhere that was sufficiently isolated for their genome to become distinct from that of their Asian ancestors. With massive ice sheets in Alaska and Canada blocking the way east and south, the most likely place for the humans to settle was Beringia.

There’s been one major problem, however, with the so-called Beringia standstill hypothesis: No archeological evidence of human settlements has ever been found. O’Rourke thinks the new paleoecological findings provide a clue as to why. “The evidence we have to date suggests that the refugia were distributed primarily in the lowland area of the Beringia landmass,” he said. As the glaciers melted and sea level rose, these lowland areas became submerged. As a result, “the archeological record that we expected to see isn’t there because the places where people were living are now under water,” O’Rourke said.

Connie Mulligan, an anthropologist at the University of Florida in Gainesville whose previous studies helped build the argument for the Beringia standstill hypothesis, said the paleoecological data “are compelling and certainly support the idea that Beringia was uniquely suited for the standstill population.”

An extended layover in Beringia is also consistent with findings from a recent genetics study, published earlier this month, which demonstrated that all Native American populations share a common ancestry with a young boy who belonged to the Clovis people, one of the earliest widespread cultures in North America. “The idea that the Clovis culture gave rise to at least part of all Native American populations is consistent with an isolated population emerging from Beringia to colonize the New World,” said Mulligan, who is not a coauthor of the Science paper.

O’Rourke said the new insights about Beringia could help archaeologists focus their efforts on the most promising search areas. Mulligan agreed. Remote survey technologies could allow researchers to peer beneath the water and sediment to identify areas that show signs of past habitation. Alternatively, investigating lowland areas in Alaska or eastern Russia that escaped being submerged by rising seas might also reveal evidence of early human settlers. “I’d love to see some archaeological data coming from submerged, or nearly submerged, Beringian sites that would give us a clue if humans did inhabit this area,” she added.

This planet is so f**ked….

• Global Warming Felt To Deepest Reaches Of Ocean (TGDaily)

In the mid-1970s, the first available satellite images of Antarctica during the polar winter revealed a huge ice-free region within the ice pack of the Weddell Sea. This ice-free region, or polynya, stayed open for three full winters before it closed. Subsequent research showed that the opening was maintained as relatively warm waters churned upward from kilometres below the ocean’s surface and released heat from the ocean’s deepest reaches. But the polynya — which was the size of New Zealand — has not reappeared in the nearly 40 years since it closed, and scientists have since come to view it as a naturally rare event.

Now, however, a study led by researchers from McGill University suggests a new explanation: The 1970s polynya may have been the last gasp of what was previously a more common feature of the Southern Ocean, and which is now suppressed due to the effects of climate change on ocean salinity.

The McGill researchers, working with colleagues from the University of Pennsylvania, analyzed tens of thousands of measurements made by ships and robotic floats in the ocean around Antarctica over a 60-year period. Their study, published in Nature Climate Change, shows that the ocean’s surface has been steadily getting less salty since the 1950s. This lid of fresh water on top of the ocean prevents mixing with the warm waters underneath. As a result, the deep ocean heat has been unable to get out and melt back the wintertime Antarctic ice pack.

“Deep ocean waters only mix directly to the surface in a few small regions of the global ocean, so this has effectively shut one of the main conduits for deep ocean heat to escape,” says Casimir de Lavergne, a recent graduate of McGill’s Master’s program in Atmospheric and Oceanic Sciences and lead author of the paper.