Alex Bush Make a paying crop leave the land better, Camden, Wilcox County, Alabama March 25, 1937

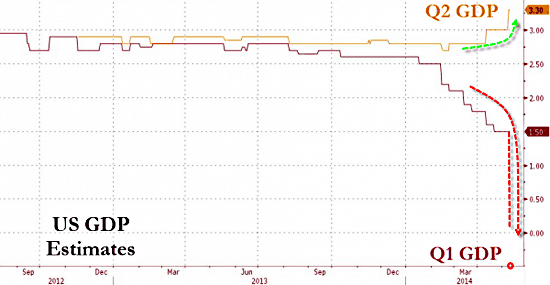

I want to share two graphs that Tyler Durden posted yesterday and let you make up your own mind as to what they mean. We’ve all been able to see how US Q1’s official GDP growth was revised to 0.1%, after which Goldman Sachs and JPMorgan said they put the number at -0.6% and -0.8%, respectively. But Goldman, not to be outdone by itself, or that’s the impression, then comes out with a new prediction for Q2, for a rise of no less than 3.9%, or 4.5 % above their own Q1 number. Durden caught that one too:

Humiliated On Its Q1 GDP Prediction, Goldman Doubles Down, Boosts Q2 Forecast To 3.9%

Goldman, it would appear, are desperate to not be forced to admit they are wrong once again. On the heels of their dramatic and humiliating swing from expectations of a +3.0% Q1 GDP growth rate at the start of the year to a current -0.6% expectation, the hockey-stick-believers are out with their latest piece of guesswork explaining how growth will explode to 3.9% in Q2 (a full percentage point higher than their previous estimate).The platform for this v-shaped recovery – “consumer spending will probably grow strongly, while the housing market should gradually improve.” So ‘probably’ and ‘should’ it is then.

By now, and I guess we’re all supposed to blame the weather one last time for the difference between reality and prediction (or hopium, if you prefer), the consensus among experts, analysts and mere talking heads in the industry calls for a 3.3% Q2 GDP growth number, which is evidently still not enough for Goldman, even though they were off by 3.6% between their initial prediction and their eventual assessment of Q1.

What’s good to note in this next graph is that GDP looks sort of fine until January 1 at 2.5%, and only then started falling. But the winter weather that gets the blame for everything didn’t only start on January 1, did it? It looks more like an entire recalibration of sorts.

The Miracle Of Modern-Day Keynesian Dreams

With various extremely well paid sell-side economist slashing Q1 expectations for growth even further, we though it would be worth a glance at the ever-rising estimates for Q2 (that Goldman started this morning). Consensus for Q2 has now spiked to +3.3% (its highest since tracking began) as the Keynesian hockey-stick-believers have gone full bounce-tard now… Well they did nail Q1!!

And it’s useful also to look at how global GDP numbers are being revised downwards all the time, though they seem to have a hit a bump up just when the snow hit the US. There’s a little video at the link that I took out, but which you can find if you scroll down, of Saxo’s Steen Jakobsen talking about the hurting economies of China and Europe.

Saxobank Warns China Is Exporting Deflation

With global growth expectations for 2014 having just collapsed to new lows … and on the heels of mixed inflation data last night in China (and stubbornly low-flation in Europe), Saxobank’s Steen Jakobsen [..] argues that both the Eurozone and China are at the centre of a slowing world economy which will see stagnation for the immediate future and ECB action, or lack of it, can’t do a thing to change the status quo.

The question becomes: how realistic is it to presume that the US consumer will go on the mother if all shopping sprees in this climate (pun very much intended)? We know housing won’t be a part of that spree, new home sales and mortgage applications won’t allow it. So you tell me what could make it happen. What are they going to be buying? More Obamacare? I don’t see where that kind of growth would come from, Durden doesn’t, and neither does Steen Jakobsen. You?

• Saxobank Warns China Is Exporting Deflation (Zero Hedge)

With global growth expectations for 2014 having just collapsed to new lows… … and on the heels of mixed inflation data last night in China (and stubbornly low-flation in Europe), Saxobank’s Steen Jakobsen explains in this brief clip how, thanks to massive over-building and now over-capacity, China is in fact exporting its deflation to the rest of the world – most problematically Europe. What is more worrying for all the optimists, Jakobsen argues that both the Eurozone and China are at the centre of a slowing world economy which will see stagnation for the immediate future and ECB action, or lack of it, can’t do a thing to change the status quo.

Help to Buy in the UK is sort of the same thing.

• The Bubble Expands: “No Money Down” Loans Come To Asia (Simon Black)

Remember all of those credit card and loan offers you used to receive in the mail? Bad credit? No credit? No problem. 0% APR for the first six months. Free balance transfers. No money down. And my personal favorite– no credit check. These were all classic signs that the mother of all liquidity bubbles was upon us. Think about it– would anyone in his/her right mind throw a bunch of money at some random guy on the street to go buy a new digital TV without so much as checking his references or requiring a sizeable down payment? Of course not. But if you and I wouldn’t do something so careless, then why would a bank?

More importantly, why would a bank not only make a loan like that, but do it thousands of times over? And use OUR money to make those loans? They’re supposed to be conservative financial stewards, not drunken sailors. We know how it turned out. This reckless lending spawned by a multitude of freshly printed money on the part of central banks nearly brought down the financial system. Looking at the expansion of credit across the West, though, it’s happening again. Fool me twice, shame on me. But this is a worldwide phenomenon now. My partner Tim Staermose and I were talking about it this morning, as he’s currently traveling in the Philippines. When he went to collect the mail at his old office address yesterday, one of those credit card offers was waiting.

It was sent by a local bank, according to them because Tim is a long-standing customer. Curiously, though, his account at the bank has less than $400. They know nothing about his ability to repay. They have no clue if he is gainfully employed, or even where he lives. But they sent a pre-approved credit offer regardless. Another bank– a Philippine branch of a large US bank, mailed him an offer for a “no questions asked” cash loan of about US$11,000, to be paid back over a period of time of his choosing. And of course, real estate agents are out all over town flogging Philippine investment properties, offering ‘no money down’ deals. People only make such an offer if they 1) Expect everything to keep rising forever [which is a really baaaaad notion], or 2) They have so much money to deploy, they are forced to make rash decisions and assume tremendous risk just to be able to invest.

Yeah yeah.

• NY AG Seeks Info From Major Banks On Dark Pools (CNBC)

New York Attorney General Eric Schneiderman has requested information from Goldman Sachs, Barclays, Credit Suisse and other financial institutions about their use of dark pools, Dow Jones reported Friday. Dark pools are trading systems set up by banks outside regulated exchanges. Supporters of the pools have argued that they provide liquidity for bigger trades that are harder to execute on stock exchanges. Earlier this week, the Commodity Futures Trading Commission said it was preparing a proposed rule for automated trading. The CFTC, which regulates futures and swaps markets, in September put out a study – known as a concept release – into computerized trading that was seen as a possible first step toward drawing up formal rules, according to a Reuters report Tuesday.

Beware. But you knew that.

• Why Millions Are Now More Exposed To Interest Rate Rises (Telegraph)

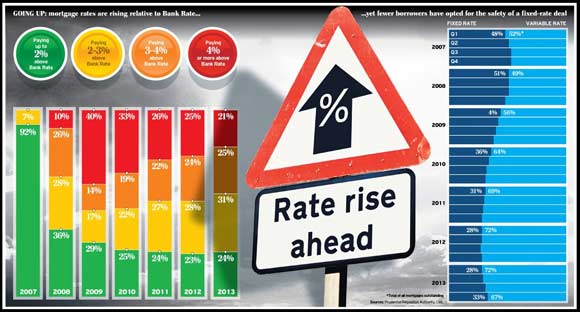

Two out of three mortgage borrowers are vulnerable to a rise in interest rates, analysis of official lending data by the Telegraph’s Your Money has shown. These borrowers have rates which are floating or variable , and likely to rise in response to any increase by the Bank of England to its leading Bank Rate. Our analysis also shows that average mortgage rates have become higher relative to Bank Rate during the period following the banking crisis, adding to the danger that when rates do increase, households monthly payments will quickly climb in tandem.

It comes as forecasters are suggesting Bank Rate may rise sooner than previously thought, in response to the strength of economic recovery, house price inflation and signs of wage growth. The further of the two graphs, right, shows how over the past seven years the proportion of all mortgages on a variable rate has grown from 52pc to 67pc. The alternative to variable rates are fixed rates, where borrowers payments are locked for a period of typically two to five years, irrespective of movements in Bank Rate.

Fixed rate deals are a safer option when, as now, rates are set to increase. These deals have become increasingly popular of late, accounting for around four in five of new mortgages. But because the take-up of new mortgages remains low relative to the pre-crisis years, this is so far having little effect on the wider pool of existing mortgages, which remain largely on a floating rate basis. There are several reasons for the growth in variable rate loans during the post-crisis period, mortgage experts say.

One is that as the Bank Rate fell in response to the crisis it was cut to just 0.5pc in March 2009 where it has remained since many variable rates tumbled, removing borrowers incentive to switch. Another, more worrying explanation is that many borrowers were not in any case able to switch loans, either because they had too little equity in their property, or they had difficulties demonstrating sufficient income to qualify for a new mortgage deal. Many of these borrowers will remain trapped and vulnerable to rate rises.

• Senate Push For US Housing Finance Bill Comes Up Short (Reuters)

A bid by the leaders of the U.S. Senate Banking Committee to secure more support from Democrats for a housing finance reform bill has fallen short, likely dooming their effort to push the legislation to a vote on the Senate floor. Committee Chairman Tim Johnson, a Democrat, and Senator Mike Crapo, the panel’s top Republican, last week delayed a vote on the bill to build more backing for the plan, which would wind down taxpayer-owned mortgage financiers Fannie Mae and Freddie Mac.

But sources familiar with the negotiations said a group of six hold-out Democrats informed the leaders on Thursday they would not vote for the bill, which the panel plans to consider next week. Bloomberg News first reported the decision. Johnson and Crapo still have at least 12 “yes” votes – six Democrats and six Republicans – to get the bill through the committee. However, the lack of stronger Democratic support makes it unlikely they will be able to convince Senate Majority Leader Harry Reid to allow a vote on measure on the Senate floor.

It’s all in the game.

• When $1.2 Trillion In Foreign ‘Hot Money’ Parked At The Fed Dissipates (TPit)

It fits the pattern of gratuitous bank enrichment perfectly, but this time, the big beneficiaries of the Fed are foreign banks. A JPMorgan analysis, cited by the Wall Street Journal, figured that in 2014 the Fed would pay $6.74 billion in interest to the banks that park their excess cash at the Fed – half of that amount, so a cool $3.37 billion, would line the pockets of foreign banks with branches in the US. This is where part of the liquidity ends up that the Fed has been handing to Wall Street through its bond purchases. Currently, the Fed requires that banks keep a minimum balance of $80.2 billion at the Fed.

Banks can keep up to $88.2 billion at the Fed as part of the “penalty-free band.” In theory, as “penalty-free” implies, there’d be a penalty on balances above $88.2 billion. But the total balance was $2.66 trillion in April, up from $2.62 trillion in March and from $1.83 trillion a year ago. The balances in excess of the “penalty-free band” have reached $2.57 trillion. The highest ever. The penalty on that? Forget that. The Fed’s raison d’être is to enrich the banks regardless of what the costs to the economy, the rest of society, and savers. So instead of penalizing banks for these excess reserves, it pays the banks 0.25% interest not only on the required balances but also on all other balances. Spread over the year 2014, as JPMorgan estimated, interest payments on these balances would amount to $6.74 billion.

It’s a marvelous system. The banks’ cost of funds, given the heroic efforts the Fed has undertaken to repress interest rates, is near zero. Banks can borrow short-term from their depositors – that’s you and me – and from money-market funds – that’s you and me again – at near zero cost, so maybe 0.10%. Instead of lending it out, banks put that money on deposit at the Fed to earn 0.25%. It’s the laziest no-brainer in banking history. A pure gift from the Fed.

But there’s a kink. Non-US-charted banks with branches in the US benefit even more. The Bank for International Settlements, the umbrella organization for the world’s largest central banks, revealed how these non-US banks were taking advantage of the new FDIC insurance charges on wholesale funding (borrowing from other banks, short-term repos, or funding from affiliates outside the US). They’d figured out that these extra costs didn’t apply to them. They only applied to US-chartered banks.

• Putin’s Export Machine Rolls Right Over Sanctions (Bloomberg)

Vladimir Putin’s incursion into Ukraine and the international condemnation that followed haven’t put a dent in Russia’s exports of gas and raw materials. The world’s largest energy producer shipped 2% more gas to Europe in the first three months of 2014 than it did in the same period last year, government data show. Diesel output for export increased, while cargoes of grains, palladium and nickel either climbed or were about the same. Russia’s crude oil exports fell 0.2% from last year. Economic sanctions from the U.S. and European Union haven’t dimmed demand for what Russia can sell even as price increases betray investors’ anxiety over future supplies.

Any plan to pinch the country’s trade to punish Putin for his March annexation of Ukraine’s Crimea peninsula would have to overcome Europe’s dependence on Russian gas and China’s appetite for the country’s metals. “Investors are paying more for those commodities where there’s perceived to be a greater risk of supply disruption,” said Caroline Bain, an analyst at Capital Economics in London. “The data prove it hasn’t happened yet, and if tensions subside, those risk premiums could diminish.” Last year, Russia produced 42% of the world’s palladium, used in pollution-control devices in cars, and was the second-largest source of refined nickel, a component in stainless steel. At the same time, China was the world’s biggest metal importer.

So, Bloomberg, what IS happening with Russia? Rolling over sanctions or desperate for Chinese money?

• Putin Going After Chinese Money to Sustain Sagging Russian Economy (Bloomberg)

Russian President Vladimir Putin plans to open the door to Chinese money as U.S. and European sanctions over Ukraine threaten to tip the economy into recession, according to two senior government officials. The move would roll back informal limits on Chinese investment as Russia seeks to stimulate growth, said the officials, who have direct knowledge of talks and asked not to be identified as the information isn’t public. The government wants to lure cash from the world’s second-biggest economy into industries from housing and infrastructure construction to natural resources, they said.

The Chinese won’t be welcome in all areas: Russia plans to set “red lines” around significant gold, platinum-group metals, diamond mining and high-technology projects, the officials said. Putin is turning to Asia as financing from the U.S. and EU tightens and capital outflows surge amid the worst standoff since the fall of the Iron Curtain. The U.S. and the EU have accused Putin of fomenting unrest in Ukraine’s easternmost regions after annexing the Crimean peninsula in March, threatening to widen the sanctions to target the economy unless Russia helps ease tensions.

• Canada Unexpectedly Loses Jobs in April (Bloomberg)

Canadian employment declined for the second time in three months in April, casting doubt on the Bank of Canada’s forecast for a rebound this quarter. Employment fell by 28,900 in April, Statistics Canada said today in Ottawa. The unemployment rate remained at 6.9% as 25,600 people also left the labor force, reducing the participation rate to the lowest since November 2001. Economists surveyed by Bloomberg News projected a 13,500 job increase and a jobless rate unchanged at 6.9%, according to median forecasts.

Canadian unemployment will remain stuck at about 7% this year, above the 6.1% recorded in 2008 before the last recession, economists surveyed by Bloomberg predict. Bank of Canada Governor Stephen Poloz has said output growth is being hobbled by weak business investment and exports and that economic slack will persist for about two years. “We aren’t getting the employment gains anymore and this is five years into the recovery,” said David Watt, chief economist at the Canadian unit of HSBC Holdings Plc, and the only person in the Bloomberg survey to predict today’s decline. “The Canadian economy doesn’t have a lot of momentum to it.”

• How Seattle Agreed to a $15 Minimum Wage Without a Fight (BW)

On May 1, Seattle Mayor Ed Murray announced he had brokered a deal to raise the city’s minimum wage for all workers from $9.32 to $15 an hour, the highest in the country. That in itself was remarkable. Even more so was that Murray did it without the anger and political bloodshed that’s pitted employers against workers in other cities and has stalled efforts in Congress to increase the federal minimum wage. In what may be a model for other cities and states, Murray put business leaders, union bosses, and community advocates in a room for months with simple instructions: work out your differences, or else.

The “or else” was that Murray and the city council would do it without them. He had the political momentum to back up the threat. When Murray, a Democrat, took office in January, the region seemed ready for a minimum pay bump. Voters in a small town to Seattle’s south, SeaTac, passed a measure to raise wages for transportation and hospitality workers to $15 an hour. Seattle elected a socialist to the city council on a living wage platform. Rather than push his own proposal through the city council, or risk outside groups bringing ballot initiatives that would likely turn ugly and draw the attention of special interest money, he appointed a 24-member group to reach an agreement. “If you want people to get here in the end, you need to bring them to the table,” he says.

No it won’t.

• Now That Vermont Has Put GMO Labels Into Law, Will Debate Go National? (BW)

It’s not surprising that a liberal haven such as Vermont would become the first state to mandate labeling of genetically modified organisms—take that, California—and Vermont Governor Peter Shumlin singed the measure into law this week as expected, with Ben & Jerry’s chief executive, Jostein Solheim, by his side. The nation’s first foray into GMO labels, if it survives legal challenge and goes into effect in 2016, would pave the way for other states considering labeling laws. In Vermont (population 626,630), the labeling regime offers these designations for foods: “produced with genetic engineering,” “partially produced with genetic engineering,” or “may be produced with genetic engineering.”

Any retailer unsure about a particular product will have to use the third label. The state is already preparing to defend the new requirements and has created a fund to help implement the law, “including costs and fees associated with expected challenge in court by food producers.” The Grocery Manufacturers Association has already announced plans to file suit in federal court against Vermont to overturn the law. In fact, the food industry group wants to settle the matter not just in Vermont, but nationwide. The industry position: If consumers want to avoid GMOs, they should buy organic, for which there already is an established system for labeling (all USDA certified organic foods are GMO free). It instead proposes that the Food and Drug Administration review genetically modified organisms and, if the agency determines there is any health, safety, or nutrition risk, establish national labeling standards so food companies do not have to deal with state-by-state requirements.

• US Court Backs Monsanto Against DuPont In Roundup Patent War (RT)

In the creation of its mass-distributed seed unit Pioneer, DuPont illegally employed technology developed by fellow agrochemical giant Monsanto, a US federal appeals court has ruled, affirming sanctions against DuPont. The US Court of Appeals for the Federal Circuit let a lower court decision stand on Friday, agreeing that DuPont violated Monsanto’s licensed seed technology, known as Roundup Ready, when it was developing its own seed to be tolerant of powerful, commonly-used herbicides. Monsanto’s Roundup Ready seeds are tailored to be able to withstand certain volumes of glyphosate-based herbicide, which Monsanto also makes.

The companies are two of the top agribusiness titans competing for dominance through, among other products, so-called high-yield crops, most of which are genetically-modified organisms. The appeals court agreed with a 2012 decision by the US District Court in St. Louis, finding that “DuPont had abused the judicial process and acted in bad faith,” while adding that DuPont’s actions were not considered “fraud on the court,” Reuters reported. The court’s ruling upholds sanctions against DuPont, though Friday’s ruling did not outline any specifics. Covering Monsanto’s attorney fees are at least part of the deal, according to Reuters.

Keep spraying, guys!

• Honeybee Colony Collapse Disorder Due To Insecticide Use (Guardian)

The mysterious vanishing of honeybees from hives can be directly linked to insectcide use, according to new research from Harvard University. The scientists showed that exposure to two neonicotinoids, the world’s most widely used class of insecticide, lead to half the colonies studied dying, while none of the untreated colonies saw their bees disappear. “We demonstrated that neonicotinoids are highly likely to be responsible for triggering ‘colony collapse disorder’ in honeybee hives that were healthy prior to the arrival of winter,” said Chensheng Lu, an expert on environmental exposure biology at Harvard School of Public Health and who led the work.

The loss of honeybees in many countries in the last decade has caused widespread concern because about three-quarters of the world’s food crops require pollination. The decline has been linked to loss of habitat, disease and pesticide use. In December 2013, the European Union banned the use of three neonicotinoids for two years. In the new Harvard study, published in the Bulletin of Insectology, the scientists studied the health of 18 bee colonies in three locations in central Massachusetts from October 2012 till April 2013. At each location, two colonies were treated with realistic doses of imidacloprid, two with clothianidin, and two were untreated control hives.

“Bees from six of the 12 neonicotinoid-treated colonies had abandoned their hives and were eventually dead with symptoms resembling CCD,” the team wrote. “However, we observed a complete opposite phenomenon in the control colonies.” Only one control colony was lost, the result of infection by the parasitic fungus Nosema and in this case the dead bees remained in the hive. Previously, scientists had suggested that neonicotinoids can lead to CCD by damaging the immune systems of bees, making them more vulnerable to parasites and disease. However, the new research undermines this theory by finding that all the colonies had near-identical levels of pathogen infestation.

• Fukushima Worker Files Historic Lawsuit Over Radiation Exposure (RT)

A worker at the Fukushima No. 1 nuclear plant has filed the first lawsuit from an employee against plant operator TEPCO due to high levels of radiation he was exposed to during the initial days of the plant’s 2011 disaster. “I wish [the utility] had informed us of possible risks in advance,” Japanese newspaper Asahi Shimbun cites the 48-year-old man as saying at a news conference in Tokyo on Wednesday. “I want [operator Tokyo Electric Power Company] to create safer conditions for workers because the decommissioning of the reactors will not finish anytime soon.” The claimant says he was unnecessarily exposed to excessively high levels of radiation due to negligence on the part of TEPCO. He is seeking 11 million yen ($110,000) in compensation from TEPCO.

The lawsuit was filed Wednesday in Fukushima District Court. “After carefully examining the contents of the demand and his arguments, we will sincerely respond to the claim,” TEPCO said in a statement Wednesday. The worker, who asked to be identified only by his first name, Shinichi, due to the social stigma of upsetting the social order in Japan, was part of a team sent to lay electric cables in one of the reactors 13 days after the disaster. Three of the workers waded through contaminated water up to their ankles and were exposed to up to 180 millisieverts of radiation. They were later hospitalized, Asahi Shimbun reports. Although Shinichi did not personally walk through the radioactive water, he worked near a contaminated puddle for 90 minutes. He estimated that he received a radiation dose of at least 20 millisieverts at that time, though he has so far suffered no serious health issues.

Nice little detail.

• Why Adults Can’t Remember Being Infants (Science News)

Unlike the proverbial elephants, babies always forget. Infants’ memories may be wiped clean by the genesis of new brain cells, a study in rodents suggests. The findings offer an explanation for why people can’t recall memories from early childhood, a century-old mystery. The study’s authors “make a very interesting and compelling case,” says neuroscientist and psychiatrist Thomas Insel, director of the National Institute for Mental Health in Bethesda, Md. It’s just truly fascinating,” he says. “Nobody has actually looked at this very carefully before.”

More than 100 years ago, Sigmund Freud speculated that humans’ tendency to forget their early years, dubbed infantile amnesia, might have a psychosexual origin. Scientists later thought memories might be rooted in language, because kids typically start making long-term memories around the time they start speaking, says study coauthor Sheena Josselyn of the Hospital for Sick Children in Toronto. “But the really weird thing is that most animals show infantile amnesia too,” she says. “So the development of language can’t be the whole explanation.” Inspired by observations of their own toddler, Josselyn and her husband, study coauthor Paul Frankland, wondered why young children couldn’t retain memories of situations or events.

These memories — such as what a person ate for dinner — involve the hippocampus, a skinny seahorse-shaped belt of tissue that stretches from ear to ear and houses a cell-making factory about the size of a few blueberries. This little factory is the only part of the brain that normally cranks out new neurons, which scientists believe help make memories. Josselyn and Frankland knew that such cell production tapers off in childhood. “That’s exactly when we start to be able to form long-term memories,” Josselyn says. She and colleagues wanted to find out whether youngsters’ recollections were somehow tied to brain cell formation. So the team turned to mice, animals that — like humans — harbor blank spots in their early memories. As mice age, the birthrate of neurons slows down. This drop-off matches up with the rodents’ ability to remember scary situations, the researchers report in the May 9 Science.

Yup, war comes with disease.

• Disease Rides the Dogs of War as Polio, Measles, Typhoid Capitalize on Chaos (BB)

The WHO this week declared polio a global health emergency, less than two years after the virus was driven to the brink of extinction. A ban on vaccinations by a Taliban leader in retaliation for U.S. drone strikes, and attacks on health-care workers after a fake vaccination campaign was used to hunt down Osama bin Laden, have hampered eradication efforts and enabled polio to spread inside Pakistan and to Egypt, Israel, Syria and Iraq. “Things got bad when the bin Laden incident happened,” Mohammad Ibrahim, a Taliban negotiator, said in a telephone interview. “The militants are not against the polio drive. The campaign is not being carried out because there is a war-like situation.”

Pakistan isn’t alone in its struggle against a disease that piggybacks on conflict. Somalia last year had 194 polio cases, mostly in areas controlled by Islamist militants, six years after being declared free of the disease. Syria, whose last case was in 1999, reported 35 last year as the health system crumbles and vaccination rates plunge amid its three-year civil war. Nor is polio, the paralyzing infection primarily spread by fecal contact, the only disease to rear its head in countries suffering from war or disaster. Cases of typhoid; hepatitis A; and cutaneous leishmaniasis, a disfiguring skin infection, have been reported in Syria, and at least 930 cases of measles, after vaccination rates fell to 65% from 90% before the war, according to the WHO.

Most of the measles cases are in the northeast governorates such as Deir Ezzour, the same area where polio was detected, where the conflict is fiercest and children are most inaccessible, according to the United Nations Children’s Fund. “As long as we don’t have full and regular access to these children, transmittable diseases like polio and measles will not be contained and they are likely to spread not just within Syria but also to neighboring countries,” Juliette Touma, a Unicef spokeswoman, said in an e-mail.

Measles is also spreading in the Central African Republic, which has been gripped by violence since mainly-Muslim members of the disbanded Seleka militia seized power in March 2013. Medecins Sans Frontieres this week suspended all but emergency care in the country after three of its staff were killed in an attack on a hospital. “There are a number of diseases that lend themselves well to areas where health systems break down,” said Alan Brooks, a special adviser for immunization at the GAVI Alliance, a Geneva-based buyer of vaccines for developing countries. On top of polio and measles, respiratory infections and diarrheal diseases, “will inevitably pop back up in these environments,” he said.

Home › Forums › Debt Rattle May 10 2014: Just How Distorted are Those GDP Numbers?