Esther Bubley Soldier treats his date to a coke, Idaho Hall, Arlington Farms, VA June 1943

Let’s take another look at debt. We’ve probably all gotten so used to huge debt numbers that we’re losing sight of what they actually mean. In the following article, Tyler Durden made me rethink both the debt issue and the perverse consequences of 7 years of zero interest policies (ZIRP) and/or ultra low interest rates. The destruction to society is far greater than anyone seems to be willing to let on. But that doesn’t make it any less real. Here goes:

Here Is The Mystery, And Completely Indiscriminate, Buyer Of Stocks In The First Quarter

According to the most recent CapitalIQ data, the single biggest buyer of stocks in the first quarter were none other than the companies of the S&P500 itself, which cumulatively repurchased a whopping $160 billion of their own stock in the first quarter! Should the Q1 pace of buybacks persist into Q2 which has just one month left before it too enters the history books, the LTM period as of June 30, 2014 will be the greatest annual buyback tally in market history. And now for the twist. Unlike traditional investors who at least pretend to try to buy low and sell high, companies, who are simply buying back their own stock to reduce their outstanding stock float, have virtually zero cost considerations: if the corner office knows sales and Net Income (not EPS) will be weak in the quarter, they will tell their favorite broker to purchase $X billion of their shares with no regard for price.

The only prerogative is to reduce the amount of shares outstanding and make the S in EPS lower, thus boosting the overall fraction in order to beat estimates for one more quarter. Compounding this indiscriminate buying frenzy is that ever more companies (coughaaplecough… and IBM of course) are forced to issue debt in order to fund their repurchases. So since the cash flow statement merely acts as a pass-through vehicle and under ZIRP companies with Crap balance sheets are in fact rewarded (as even Bloomberg noted earlier) the actual risk of the company mispricing its stock buyback entry point is borne by the bond buyer who in chasing yield (with other people’s money) serves as the funding source for these buybacks.

Corporations buy back their own shares in order to fool investors about their performance numbers. It’s a profitable undertaking for them because they can borrow at next to nothing. A very simple calculation: if we buy and borrow $1 billion worth, what’s the effect on our balance sheet? How about $10 billion? The essence: there is a reason junk bonds are so popular: there are no ‘normal’ yields left because of central banks’ ZIRP. That’s not to say Apple issues junk, but the principle is the same. Bond buyers, e.g. money market funds, will buy anything. VIX volatility is ultra low, everyone’s doing it, what could go wrong? Well, the answer to that question might to a large extent lie in private and public debt numbers. If only because much of the money corporations borrow to do buybacks has in turn also been borrowed.

When you follow the dots, you must wonder where there is still any ‘money’ left that has not been borrowed. You may even want to wonder whether you have any of it. And you might ask how it is possible that while any and all borrowing is supposed to be collateralized, it’s hard to find ‘hard’ collateral anywhere in the cycle. We can understand that when a Chinese state owned enterprise uses one load of iron ore, bought with credit, as collateral for the next one, something’s amiss. But do we also understand that in our own economies, despite the huge existing debt, and because of ZIRP policies, there is more borrowing instead of less, as would seem to be the smart thing to do. ZIRP thus leads to more debt, and – inevitably – exponentially more bad debt. You can’t heal a sick economy with more debt if it already has historically high levels of it, but that’s still exactly what central bankers claim they try to do.

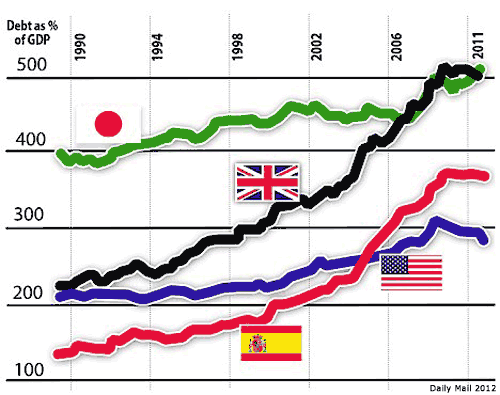

First, a Daily Mail graph from 2012 gives an indication of total debt numbers for a handful of countries

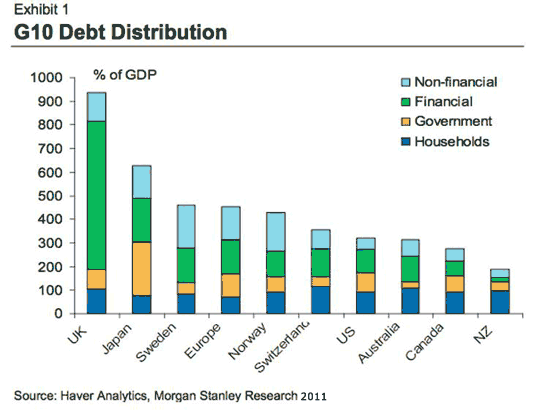

And if you think that looks bad (not that it doesn’t, mind you), there’s this 2011 Haver/Morgan Stanley one we’ve seen before here:

In which total debt for the US, but even more for Japan and especially the UK, are much higher than in the first graph. This may largely be due to underestimating debts in the financial sector, though it’s hard to say. And for the argument I’m trying to make, it doesn’t even matter all that much. Though I would like to say that it’s crazy that we have no better insight in bank debt than we have. We’re asked to recognize that some of our banks are so big they could bring down our entire economies, but we’re not supposed to know how close they are to doing just that. Honesty would kill us, apparently. The 2nd graph shows a huge, 600% of GDP, debt for the UK, but only perhaps 100% for the US. Oh, really? Let’s see the books.

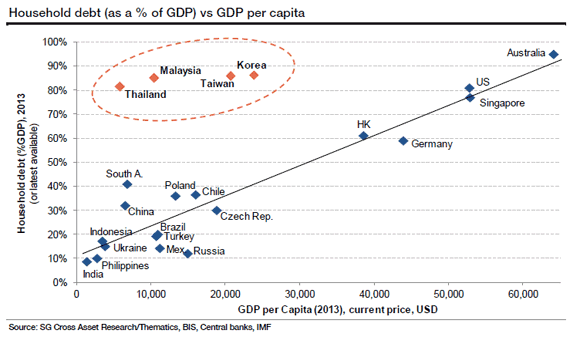

What’s a little easier to figure out concerning all this debt are the household and government parts. Here’s a comparison:

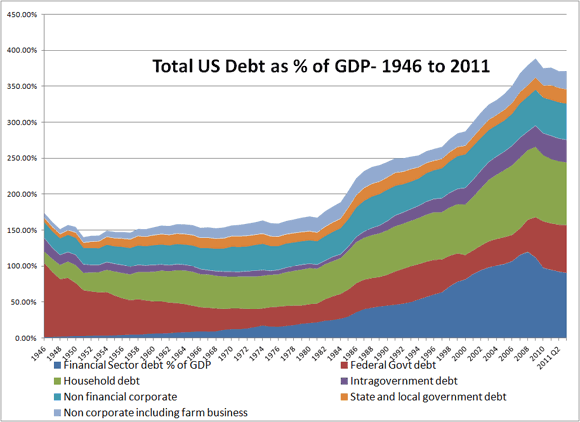

Let’s take the US as an example. There are 300 million Americans, so about 100 million families. 2013 GDP was $16.7 trillion, the graph says household debt was 80%, so there’s $13.3 trillion in household debt, or $133,000 debt per family, $44,333 per capita. That’s just household debt. Now, forgetting about the details, because we would just get stuck in discussions about which graph is better, Let’s move on to a country that stands out when it comes to household debt, the Netherlands. A 2011 Wall Street Journal graph:

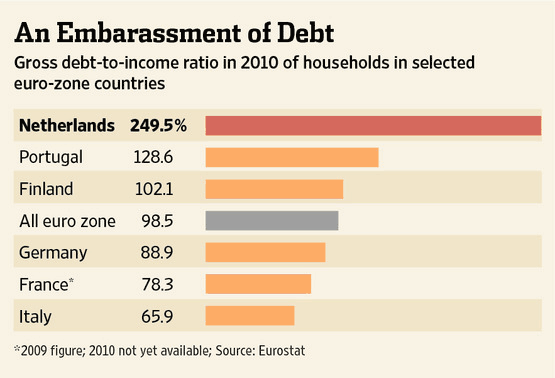

Netherlands GDP is about $800 billion. Household debt is 250% of that, or $2 trillion. Population is 16.8 million, so household debt per capita is $119,000, or $357,000 per family of 3. Again, that’s just household debt. What people, certainly in government, like to say when they see numbers such as there, is that these are just liabilities, and they have even larger assets. That seems reasonable at first sight, and after all The Netherlands hasn’t completely collapsed under its debt load yet, but it doesn’t cover the whole thing.

As Ann Pettifor said recently about Britain: people don’t sell their assets to pay their debts, they pay them out of their income. The Dutch think they have a lot of value in their homes and their pension plans. But that is true only if both retain their values. And to find out whether that is true or not, in a global economy where, as we’re seeing, everything has been borrowed, we’d have to presume that cheap credit will be available as long as these families have mortgages outstanding on their homes, while their pension plans would have to achieve the returns they aim for, which you can bet they won’t if cheap credit vanishes and asset markets sink. What will remain, however, are the debts.

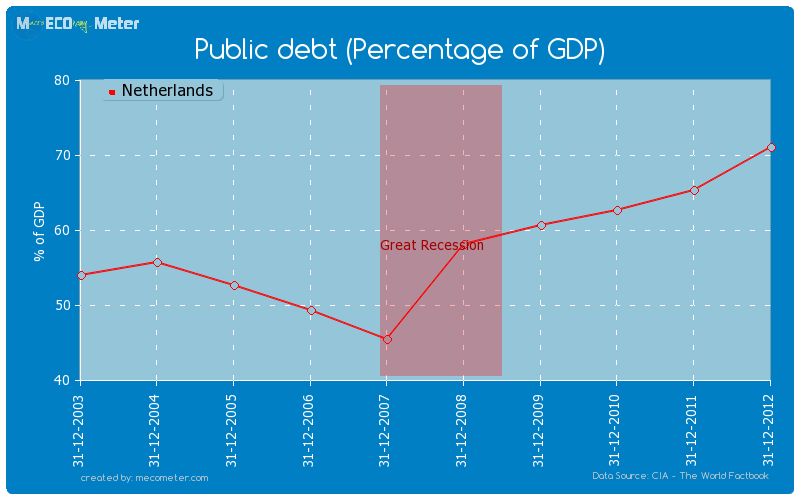

Dutch public debt is relatively benign at about 75% today, $680 billion, $40,476 per capita, $121,428 per family:

Between public and household debt, but before corporate debt, both financial and non-financial, every Dutch household is on the hook for $478.428, and every individual, newborn or 95 years old, for $159,476. That’s quite a welcoming gift into this world. And, even though the debt is divided somewhat differently between various countries, a total debt level of 300-400% of GDP is not unusual. Japan is much higher than that, but Japanese sovereign bonds are sold domestically to a large extent. And British debt is much higher because its banking sector is much bigger. The general picture is bad enough. For instance, US total debt at about 350% of GDP is close to $60 trillion, which means some $200,000 per capita, and $600,000 per family of 3.

The Netherlands is about in that vicinity. Many countries are. Japan is a case to watch. Abenomics is adding a lot of yen to the public debt that is already through the roof. Sweden and Norway look much less healthy than you might think. The Mediterranean nations are – burned – toast as long as they have the euro. China’s in a debt league of its own.

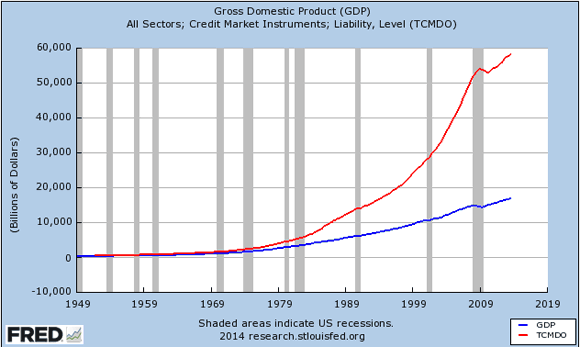

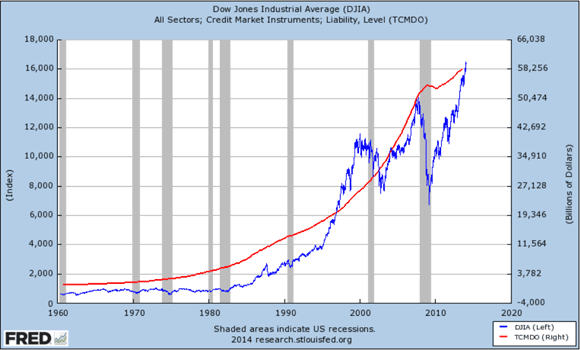

There’s a nice correlation between (TCMDO) total credit market debt and the S&P in this next graph, a pretty eerie way of showing how we keep our economies looking good: by throwing more debt after what we already owe. It’s the only way we seem to have left to look good. That’s what low interest rates are for. They allow more people and corporations to borrow more so they can buy stuff they can’t afford. At those rates, who could refuse?

But it’s not terribly smart to think rates can stay that low forever. And when they start rising, it’ll be like we’re watching the walls of Jericho. The longer rates stay artificially low, the less believable an economy becomes. because there’s no telling who’s healthy and who’s not: cheap credit allows parties to put on a mask. It’s like everyone’s playing with a stacked deck of cards, and everyone’s winning too. But what’s going to happen when governments will need to pay a normal 5% or so on sovereign debt, and when you have to pay 7-8% on your mortgage? Why do you think home sales and mortgage originations are under such pressure? Could it be the air’s exiting the bubble? More important than when that will happen is THAT it will. And when it does, we’ll find out what our assets are worth. We already know what our debts are. And unlike asset values, they won’t vanish. Or be forgiven.

So the title of this article is dead on. Whatever part of your assets you haven’t borrowed yourself, someone else has either borrowed or borrowed against. And the value of your assets will plummet once cheap credit is no longer available and interest rates rise, while your debt stays, household, public and your share of corporate. And that debt is really all yours. A country’s government can only borrow against the assets of its citizens, and their future labor. A corporation can borrow to look better, but it can only continue to look healthy if you buy its products. But what are you going to do that with? What will be left? Debt will.

• Who’s Buying to Raise the S&P to New Records (Zero Hedge)

With the Fed having tapered its liquidity injections into the stock market from $85 billion to “only” $45 billion per month, retail investors getting burned by the recent high beta and momentum stock flame out and “greatly unrotating” into the renewed safety of bonds, not to mention a churning market that until last week was unchanged for the year, and hedge funds ever shorter into this latest ramp, many are asking themselves: who is buying? Here is the answer.

According to the most recent CapitalIQ data, the single biggest buyer of stocks in the first quarter were none other than the companies of the S&P500 itself, which cumulatively repurchased a whopping $160 billion of their own stock in the first quarter! Should the Q1 pace of buybacks persist into Q2 which has just one month left before it too enters the history books, the LTM period as of June 30, 2014 will be the greatest annual buyback tally in market history. And now for the twist. Unlike traditional investors who at least pretend to try to buy low and sell high, companies, who are simply buying back their own stock to reduce their outstanding stock float, have virtually zero cost considerations: if the corner office knows sales and Net Income (not EPS) will be weak in the quarter, they will tell their favorite broker to purchase $X billion of their shares with no regard for price.

The only prerogative is to reduce the amount of shares outstanding and make the S in EPS lower, thus boosting the overall fraction in order to beat estimates for one more quarter. Compounding this indiscriminate buying frenzy is that ever more companies (coughaaplecough… and IBM of course) are forced to issue debt in order to fund their repurchases. So since the cash flow statement merely acts as a pass-through vehicle and under ZIRP companies with Crap balance sheets are in fact rewarded (as even Bloomberg noted earlier) the actual risk of the company mispricing its stock buyback entry point is borne by the bond buyer who in chasing yield (with other people’s money) serves as the funding source for these buybacks.

How ugly does it get?

• Just Two Charts: “Collapsing” and “Unsustainable” (Zero Hedge)

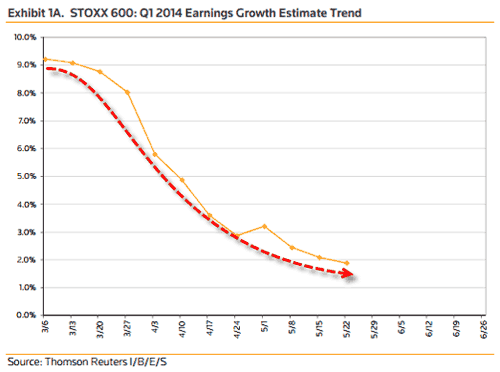

The 2 words “collapsing” and “unsustainable” do not conjure images of confidence-inspiring animal spirits or all-time highs in stocks… and yet European earnings expectations have utterly collapsed from their exuberant early year levels and the gap between earnings growth in the US and revenues tumbling is entirely unsustainable. But then – none of this ‘fundamental’ malarkey matters: we’ve got the Fed ‘put’ and the Draghi ‘promise’. European Earnings expectations… (down is not good)…

Unsustainable US earnings-revenues gap…

Up up and then away.

• Signs Of An Aging Bull Market (STA)

When investors hear “bull markets are bull markets until they aren’t,” their initial response is “no, duh!.” However, if that statement is so obvious, why do we spend so much time in trying to predict the future? It is interesting that we are extremely skeptical of fortune tellers, palm readers and psychics but flock to Wall Street analysts and economists that are nothing more than “fortune tellers” in suits. The reality is that no one is actually prescient. It is all a “best guess” with nothing assured except what “is.” Currently, the bull market cycle that began in 2009 remains intact. It is, what “is.” That trend is clearly shown in the chart below.

However, it is important to understand that what currently “is,” will not always be the case. The reason that “bull market” cycles exist is because of previous excessively negative investor sentiment. Like the snap-back of a rubber band, when investor sentiment is stretched too far in one direction it will eventually “revert” by an equal amount in the opposite direction. This is why for each and every bull market, there is a bear market. Again, this seems quite obvious. However, if it is so obvious then why are investors continually sucked into bull markets believing that they will last indefinitely only to be crushed by the subsequent bear market?

• Yellen Concerned by Housing Slowdown She Has Scant Power to Cure (Bloomberg)

The hesitant housing recovery has surprised and concerned Federal Reserve Chair Janet Yellen and her colleagues at the central bank. It’s not clear how much they can do about it. While the industry is rebounding from a weather-ravaged first quarter, the pickup will probably fall short of previous projections, according to economists at Goldman Sachs and Macroeconomic Advisers. As a result, they trimmed their forecasts for economic growth in the second half of 2014 to about 3.25% from 3.5%. “Housing is a growing worry,” said Macroeconomic Advisers’ senior economist Ben Herzon. Yellen and many of her colleagues agree. The Fed chair flagged the industry as a risk to the outlook in testimony to Congress on May 7, while Federal Reserve Bank of New York President William C. Dudley said last week he had been surprised by how weak it had been recently. He added that he still expects gross domestic product to “get back on a roughly 3% growth trajectory” after stalling in the first quarter.

The trouble from the Fed’s perspective is that many of the forces holding housing back are outside of its control. While the Fed can influence mortgage rates through its conduct of monetary policy, it can’t do much, if anything, to counteract the other causes of faltering demand: lagging household formation, stingy lenders and wary borrowers. “Mortgage financing is extremely tight,” said Ellen Zentner, senior economist at Morgan Stanley in New York. “And that’s not something the Fed can manipulate.” The Fed’s ability to affect the supply of housing is even more limited. Builders are complaining about rising costs and an increasing difficulty in hiring skilled workers. They’re also concentrating on developing bigger, higher-priced projects rather than on the starter homes more buyers can afford. And they too are plagued by tight credit.

• “Pop The Corks, She’s Going Down, Boys” (Zero Hedge)

[Excerpted from Sean Corrigan’s The Baleful Stages of Quankocracy] In equity markets, the great excitement launched by autumn 2012’s 3QE (easing on the part of the Fed, the BOJ, and the PBoC all at once) seems largely to have run its course. Small caps have lost some of their momentum in both absolute and relative terms and the second tech bubble looks suspiciously deflated. As an example of such indices, consider that the Russell 2000 appears to have completed both this smaller pattern by breaking out below its well-defined channel and that it has filled in a nice looking profile from the depths of the post-LEH slump.

Against this, the large caps have not yet suffered any serious reverse, especially the non-financials among them. What neither they – nor their foreign counterparts like the MDAX – have yet done though is a full-bore, clenched-buttock, margin-reducing liquidation, thus keeping the bears hopeful but frustrated as they anxiously watch the VIX and its ilk grinding ever lower and so signalling that nobody really believes that the end might indeed be nigh. By contrast, these indices’ larger cousins have hardly suffered at all, with the OEX, for instance, lying the merest whisker away from the previous grand climax set in early 2000. For its part, the S&P ex-Financials has once again undergone a run of around five years’ extent – much as between 1995-00 and 2002-07 – making new highs in the process.

If the creation of an almost exact replica of the great tech bubble would now take a final, unlikely looking surge of 25% in the space of the next few months, the 175% gains made so far from the GFC lows are nonetheless hardly to be sneezed at. Whatever the controversy over how overpriced stocks may or may not be, one key factor undeniably keeps them bid: the fact that bond yields are indisputably too depressed whether one looks at nominals, ex-post reals, current and implied TIPs, or credit. Even EM bonds have unwound all bar the last 25bps or so of their ~125bps ‘taper tantrum’ widening while swaption vols are not far short of their lowest since the 2008 debacle [likewise stock vols and the forex equivalent: what price risk?].

Nothing sells.

• Retail Results Are Not Better Than Expected, But Worse Than Ever (Stockman)

The ultimate evil of monetary central planning is that it drastically distorts pricing signals in capital markets, thereby inducing vast malinvesments in the real economy—-mistakes that eventually result in uneconomic returns and losses which must be someday written off. Accordingly, what is recorded as a boost to GDP by our Keynesian policy overlords in the front-end of the malinvesment cycle results in a reduction of national wealth when it’s all said and done. Needless to say, if central bank induced financial repression is carried on long enough the level of capital market deformation and main street malinvesment can become monumental. In fact, there are four bell-ringer statistics among the macro-economic data that dramatize perhaps the greatest of these central bank induced investment errors, but they are never published in the main street financial press—–probably because they explain far too much in one glance.

The skunks in one of the nation’s greatest uneconomic woodpiles are: 100k, 1 million, 15 billion and 47 square feet. Those stats measure the collective girth of America’s shopping emporia, and designate, respectively, the number of shopping centers and strip malls across the land; the number of retail stores spread among them; the total retail space occupied by the nation’s shopping machinery; and the amount of space at present for every man, woman and child in the nation. It does not take much analysis to see that these bell ringers do not represent sustainable prosperity unfolding across the land. For example, around 1990 real median income was $56k per household and now, 25 years later, its just $51k—-meaning that main street living standards have plunged by about 9% during the last quarter century.

But what has not dropped is the opportunity for Americans to drop shopping: square footage per capita during the same period more than doubled, rising from 19 square feet per capita at the earlier date to 47 at present. This complete contradiction—declining real living standards and soaring investment in retail space—did not occur due to some embedded irrational impulse in America to speculate in real estate, or because capitalism has an inherent tendency to go off the deep-end. The fact that in equally “prosperous” Germany today there is only 12 square feet of retail space per capita is an obvious tip-off, and this is not a teutonic aberration. America’s prize-winning number of 47 square feet of retail space per capita is 3-8X higher than anywhere else in the developed world!

With 1000 eggs on their faces and noses a mile long, Lagarde and Carney, two of the main enablers of the banking system as it was and is now both pretend to say that ‘they shouldn’t do that’.

• IMF Chief Says Banks Haven’t Changed Since Financial Crisis (Guardian)

The head of the International Monetary Fund has warned that a persistent violation of ethics among bankers and rising inequality pose a major threat to growth and financial stability. Christine Lagarde told an audience in London that six years on from the deep financial crisis that engulfed the global economy, banks were resisting reform and still too focused on excessive risk taking to secure their bonuses at the expense of public trust. She said: “The behaviour of the financial sector has not changed fundamentally in a number of dimensions since the crisis. While some changes in behaviour are taking place, these are not deep or broad enough. The industry still prizes short-term profit over long-term prudence, today’s bonus over tomorrow’s relationship.

“Some prominent firms have even been mired in scandals that violate the most basic ethical norms – Libor and foreign exchange rigging, money laundering, illegal foreclosure.” Lagarde warned the too-big-to-fail problem among some of the world’s largest financial institutions was still unresolved and remained a major source of systematic risk, with implicit subsidies of $70bn (£42bn) in the US, and up to $300bn in the eurozone. In a speech littered with quotations from Winston Churchill to Pope Francis and Oscar Wilde, Lagarde said international progress to reform the financial system was too slow. “The bad news is that progress is too slow, and the finish line is still too far off. Some of this arises form the sheer complexity of the task at hand. Yet, we must acknowledge that it also stems from fierce industry pushback, and from the fatigue that is bound to set in at this point in a long race.”

• Carney Says Capitalism Must Reassess Bankers’ ‘Sense of Self’ (Bloomberg)

Mark Carney wants more “we” and less “me” in global finance. The financial crisis and trading scandals revealed how banks lost their way and staff operated for personal gain without regard to their impact on society, the Bank of England Governor said in a speech yesterday. Rules to prevent such behavior should embody the idea that firms and employees bear responsibility to the system in which they function, he said. “We need to recognize the tension between pure free-market capitalism, which reinforces the primacy of the individual at the expense of the system, and social capital which requires from individuals a broader sense of responsibility for the system,” he said. “A sense of self must be accompanied by a sense of the systemic.”

Carney, speaking at the “Inclusive Capitalism” conference in London, set out a list of steps to repair the financial system’s ethos. He called for governments to complete this year measures to enable all failing institutions to be resolved, and said that tougher bonus rules might need to penalize entire groups of staff in cases of widespread failures in performance or risk management at banks. “The combination of unbridled faith in financial markets prior to the crisis and the recent demonstrations of corruption in some of these markets has eroded social capital,” he said. “When combined with the longer-term pressures of globalization and technology on the basic social contract, an unstable dynamic of declining trust in the financial system and growing exclusivity of capitalism threatens.”

• China’s ‘Golden Era’ for Property Over, Vanke President Says (Bloomberg)

The “golden era” for China’s property market has passed, according to China Vanke, the nation’s biggest developer, which is shifting its focus to homes for owner occupiers rather than investors. “The period in which everybody makes money out of property is gone,” President Yu Liang told reporters May 26 in Dongguan, a southern city in Guangdong province. “Vanke will take a cautiously optimistic approach to face the slowdown and target those buyers who need homes for self-use.” The housing market threatens Premier Li Keqiang’s efforts to put the brakes on a slowdown in the world’s second-largest economy that is projected to grow at the weakest pace since 1990.

Moody’s Investors Service revised its credit outlook for Chinese developers to negative from stable last week, while home sales slumped 10% in the first four months of this year amid tight credit, reversing last year’s 27% jump and prompting developers including Vanke to cut prices. “He should have seen some signs since it’s indeed difficult to make money now compared with before,” said Dai Fang, a Shanghai-based analyst at Zheshang Securities Co. “Growth we’ve seen before is no longer possible and you won’t be seeing blossoms everywhere again,” he added, using a Chinese idiom to refer to the property boom seen in every city.

Will we ever know how bad it is?

• China Banks Bad-Debt Ratio Seen Rising to Most Since 2009 (Bloomberg)

China’s biggest banks are poised to report the highest proportion of bad debts since 2009 after late payments on loans surged to a five-year high, indicating borrowers are struggling amid an economic slowdown. The nation’s 10 largest lenders reported overdue loans reached 588 billion yuan ($94 billion) at the end of 2013, a 21% increase from a year earlier to the highest level since at least 2009. The rise in late payments portends more losses on soured loans for banks in coming months as China’s slowing economy crimps companies’ earnings, while a government crackdown on nonbank funding makes it tougher for borrowers to get new credit or finance older debt.

“Overdue loans are a leading indicator of asset-quality deterioration and show the rising liquidity constraints among borrowers,” said Liao Qiang, a Beijing-based director at Standard & Poor’s. “While we believe Chinese banks’ credit woes will unfold gradually, the disturbing thing is that the end is nowhere in sight.” Overdue loans, those late by at least a day, were 31% greater for the banks as of Dec. 31 than nonperforming ones, which are debts they don’t expect to recoup in full. That’s the biggest gap in at least five years, signaling lenders may be resisting acknowledging the deterioration to avoid setting aside funds to cover potential losses.

Part 2 from Shilling’s newest series.

• China’s Xi Takes On Corruption (A. Gary Shilling)

The shock that forces investors from a “risk on” to a “risk off” strategy could come from a financial crisis in China. In part one of this series, I addressed three problems – slower growth, transitioning from an export-led to a domestic-driven economy and rising militarism – that could deliver such a shock. Here, I look at three more nagging problems: corruption, currency manipulation and shadow banks. Graft, corruption and favoritism are standard fare in developing countries, especially those with concentrated power and little room for public dissent. This certainly has been true in China. Consequently, President Xi Jinping’s anti-corruption campaign is a disruptive attack on officials who manage the economy while feeding lavishly at the public trough. A Pew Research Center poll last October found official malfeasance to be a “very big problem” for half the Chinese respondents, up from 39% in 2008.

This year, the chairman and general manager of China Three Gorges Corp., the operator of the giant hydropower dam, were replaced. An investigation found extravagant spending, expensive vehicles, inappropriate use of company apartments and cronyism on construction-project bids. The Central Military Commission, which controls China’s armed forces, has outlawed numerous practices, including luxury banquets and liquor-soaked receptions. Xi’s frugality campaign is aimed in part at allaying public outrage over the lifestyles of “princelings,” the sons and daughters of top officials.

Interestingly, 100,000 bloated and inefficient state-owned enterprises contribute about 25% of industrial output and have near-oligopolies in energy, transportation, banking and other crucial sectors. So far, they have been excluded from the austerity program. These businesses, which vigorously resist reform, have close relationships with political leaders. Many government officials were executives at state-owned enterprises and now oversee their former companies. A successful anti-corruption and efficiency campaign could involve reforming the politically powerful enterprises and ousting the government officials overseeing them. Plenty of push-back is to be expected.

Puh!

• ECB Stress Test Won’t Free Banks From Creditor Losses (Bloomberg)

Junior bondholders of European Union banks that struggle in a stress test this year won’t avoid losses if the lenders need government help, according to the bloc’s regulatory arm. The test, carried out in the euro area by the European Central Bank, won’t allow banks to skirt EU policy on government assistance for banks, said Gert-Jan Koopman, the European Commission’s deputy director-general for state aid. ECB Vice President Vitor Constancio has said exemptions from the rules may be suitable for some banks shown to have capital shortfalls. Under a law passed this year, governments can provide “precautionary” aid, without triggering resolution, to banks unable to raise funds privately after a stress test.

Yet that won’t alter existing state-aid rules, which force losses on shareholders and junior creditors before public money can flow, Koopman said in an interview in his Brussels office. “Precautionary recap is only relevant to a very limited number of cases, essentially where banks are not at the point of failing, but still cannot raise private capital,” Koopman said. “You’re outside of the resolution context, and the only thing that applies is state-aid rules, which basically then require burden-sharing. So they still require junior creditors to pay.” As the ECB prepares to take over direct supervision of about 130 euro-area lenders from BNP Paribas SA to National Bank of Greece SA starting in November, regulators have sought to compile the toughest stress tests yet in a bid to repair credibility damaged by assessments in 2010 and 2011 that didn’t uncover weaknesses at banks that later failed.

• Exchanges Can Ruin High-Frequency Trading Benefits (Bloomberg)

Exchanges risk making it harder for investors to get the best price by facilitating ever-faster trading, according to academics who examined Nasdaq OMX Group Inc. venues. When Nasdaq sped up its markets in Copenhagen, Helsinki and Stockholm in 2010 by introducing its INET software platform, it spurred a race for profits among high-frequency traders, according to the report from VU University Amsterdam’s Albert Menkveld and his student, Marius Zoican. That competition reduced earnings. To compensate, the traders widened the spread between prices they were willing to pay to buy and sell shares, making it more expensive for most investors to trade stocks.

High-frequency traders using computers to automatically buy and sell have become the dominant market makers on exchanges around the world, supplanting human traders. Menkveld and Zoican’s paper says that when exchanges get faster, such as when Nasdaq reduced the reaction time of its Nordic markets to 250 microseconds from 2,500 microseconds in early 2010, they encourage not just helpful, liquidity providing high-speed traders, but also speculative “bandits.” “You’ve got these two types of high-frequency trading firms dueling, and if you speed up the market, it is more of a game between these two players and less of a game between them and investors,” Menkveld said during a phone interview. “In this game, those putting out quotes are more prone to making losses. This is compensated for by them making wider spreads, which means end investors pay higher spreads.”

Concern about the role of high-frequency firms intensified after the plunge known as the flash crash, when the Dow Jones Industrial Average sank almost 1,000 points in a matter of minutes on May 6, 2010. In his book “Flash Boys” published in March, author Michael Lewis argues that the U.S. stock market is rigged when high-frequency traders with advanced computers make tens of billions of dollars by jumping in front of investors. A previous paper by Menkveld, cited by the U.S. Securities and Exchange Commission in March, found that spreads dropped 15% when a large high-frequency trader entered the Dutch market, providing evidence that the practice helps investors as a whole. Peter Nabicht, a spokesman for the Modern Markets Initiative, a lobbying group made up of high-frequency traders, said in March that the industry lowers the cost of trading.

They’ll fight on for months. Just so nothing will change.

• Merkel Blows Open Race For Top Brussels Job (FT)

Angela Merkel, the German chancellor, blew open the race for the European Union’s most high-profile job on Tuesday night, saying a “broad tableau” of candidates should be considered for the European Commission presidency. The declaration by Ms Merkel, made after nearly five hours of talks in Brussels, deals a serious blow to the presumptive frontrunner in the race, former Luxembourg prime minister Jean-Claude Juncker, the top candidate, or Spitzenkandidat, for Ms Merkel’s own centre-right grouping in Brussels, the European People’s party.

Mr Juncker was nominated by the EPP as its candidate for the commission presidency with Ms Merkel’s backing just two months ago and the EPP emerged as the largest party in the new parliament after last week’s elections, with 213 of the chamber’s 751 seats. But Ms Merkel said “automaticity … is not in the letter and spirit of the [EU] treaties”, and said more candidates than just Mr Juncker should be considered. “Although the EPP is the strongest political force and Jean-Claude Juncker is our top candidate, none of the parties has a majority of its own,” Ms Merkel said. “So we do have to look at a somewhat broader tableau of suitable persons.”

The move, which took diplomats by surprise, is a major victory for Ms Merkel’s British counterpart, David Cameron, who had been working desperately behind the scenes to block Mr Juncker’s candidacy – both because he is viewed as an old-school EU federalist and because he opposes the prerogative for choosing the post being taken out of the hands of Europe’s prime ministers. “[We] of course need people running these organisations who … can build a Europe that is about openness, competitiveness and flexibility, not about the past,” Mr Cameron said as he arrived in Brussels. Although she did not mention Mr Cameron by name, Ms Merkel noted that the opinions of EU leaders who were not members of the EU’s mainstream party groupings needed to be taken into account. Mr Cameron pulled his Tory party out of the EPP in 2009.

Solid.

• Speaking Truth To Monetary Power (Lew Rockwell)

Until Ron Paul raised the issue at the national level in 2007, the Federal Reserve System had been treated with the kind of lazy indifference or acquiescence with which the public gradually comes to accept any institution of long standing. To be sure, most of the public still treats it that way. They have not lost sufficient confidence in the so-called experts, despite the debacle of 2008, to give the Fed a second (or even a first) look. But a skeptical minority is growing sizable enough to influence the debate. Whether any major change to our monetary system will take place of course remains to be seen. What we can know for sure is that the kind of scrutiny of the Fed we have seen over the past several years is not going away. Monetary policy will forever take place against the backdrop of an articulate and expanding segment of the population that dissents from Fed policy not because it is too tight or too expansionary, but because it exists in the first place.

Is monetary policy inherently destabilizing? Yes and no. Discretionary monetary policy is certainly not destabilizing for institutions on the receiving end of the central bank’s largesse. But it is destabilizing for everyone else. The general public has been led to believe that the economy is a giant number that goes up and down. It is thought to be the role of the monetary authority to push that number back up whenever it shows signs of falling. The only potential drawback to such a course of action, the public is told, is the risk of an increase in consumer prices, which is a chance our policymakers have traditionally been willing to take. But the economy is not a giant number. It is a latticework of interlocking production processes that work in implicit cooperation with one another to produce the diverse array of goods we enjoy. This latticework comes together without the need for central direction.

It is assembled with the aid of the price system to which the free market gives rise. Economic calculation, the profit-and-loss reckoning that a free price system makes possible for the entrepreneur, directs resources into their most value-productive uses, and constantly pushes the economy toward an outcome in which the ever-changing desires of consumers are satisfied in the most cost-effective way in terms of opportunities foregone. “Monetary policy” introduces white noise and confusion into this spontaneous process, and distorts the pattern of resource allocation that would have occurred in its absence. Interest rates on the unhampered market coordinate production across time. When consumers want more of existing products right now, that’s what the market produces. When consumers prefer to save more of their income, the market accordingly gets to work on projects that will mature in the future, when consumers are once again prepared to spend.

Surprised?

• Exxon, BP Defy White House, Sign Russia Deals (Oilprice.com)

Several of the largest oil companies in the world are doubling down in Russia despite moves by the West to isolate Russia and its economy. ExxonMobil and BP separately signed agreements with Rosneft – Russia’s state-owned oil company – to extend and deepen their relationships for energy exploration. The U.S. slapped sanctions on Rosneft’s CEO Igor Sechin in late April, freezing his assets and preventing him from obtaining visas. However, the sanctions do not extend to Rosneft itself, allowing western companies to continue to do business with the Russian oil giant. ExxonMobil signed an agreement with Rosneft, extending its partnership to build a liquefied natural gas (LNG) terminal on Russia’s pacific coast. Known as the Far East LNG project, the export terminal will receive natural gas from Russia’s eastern fields as well as from Sakhalin-1, an island off Russia’s east coast. Rosneft announced the deal in a press release on its website on May 23.

The following day, Rosneft and BP signed an agreement to jointly explore oil in the Volga-Urals region. It will consist of a pilot project in the Domanik formations, and if successful could lead to the development of shale oil in Russia. Rosneft will maintain a 51% ownership of the joint venture and BP will own 49%. The signing of the agreement occurred during a ceremony at the St. Petersburg International Economic Forum. The oil majors attended despite pressure from the White House to boycott the event. Many big name companies chose not to attend even though they have large economic interests in Russia, including PepsiCo, German companies E.ON and Siemens, and some of the biggest banks in the U.S.

By defying the White House, the oil majors salvaged what would have otherwise been an embarrassing event for the Kremlin. The absence of the world’s largest companies would have demonstrated Russia’s increasing isolation. Instead, Russia used the event to detail plans to expand its massive energy sector. “(They’re) eager to continue work on projects in Russia,” Russia’s Energy Minister Alexander Novak said of ExxonMobil and Royal Dutch Shell. BP CEO Bob Dudley emphasized his company’s determination to stick with Russia. “We are very pleased to be a part of Russian energy complex,” he said at the forum. “President (Putin) has urged us today to invest into shale oil… There’s so many natural resources in Russia, the openness and partnerships Russia has with companies from all over the world is a good thing for energy,” Dudley added.

BusinessWeek says unemployment grew,

• German Unemployment Unexpectedly Rises as Growth to Slow (BW)

German unemployment unexpectedly increased for the first time in six months amid signs of a slowdown in Europe’s largest economy. The number of people out of work rose a seasonally adjusted 23,937 to 2.905 million in May, the Nuremberg-based Federal Labor Agency said today. Economists forecast a decline of 15,000, according to the median of 31 estimates in a Bloomberg News survey. The adjusted jobless rate was unchanged at 6.7%, the lowest level in more than two decades. German business confidence decreased this month on concern growth will slow as the 18-nation euro area, the country’s biggest export market, struggles to sustain its recovery.

The Bundesbank has said the nation’s economic expansion this quarter is unlikely to match the pace of the first three months, which was boosted by unusually warm weather.

“The mild winter, which had flattered German economic data a bit in the first quarter with strong gross domestic product growth and job-market gains, is now striking back,” said Christian Schulz, senior economist at Berenberg Bank in London. “Germany’s labor market remains on a strong positive trend despite the slight May setback, however.” The German economy expanded 0.8% in the first quarter, up from 0.4% in the previous three months, after the warmer weather boosted construction and domestic spending.

… while AP says it dipped ………

• German Unemployment Rate Dips To 6.6% (AP)

Germany’s unemployment rate dropped to 6.6% in May, but the traditional springtime decline was smaller than expected. The Federal Labor Office said Wednesday that 61,000 fewer people were without work compared with April, when the unemployment rate was 6.8%. Overall, 2.88 million people were without work in May. When adjusted for seasonal factors, the rate was steady for the third month in a row at 6.7%. Because the mild winter meant the loss of fewer seasonal jobs in previous months, Labor Office head Frank-Juergen Weise said the spring recovery slowed in May, but that “overall the labor market is doing well.” Germany’s economy grew a robust 0.8% in the first quarter of 2014, and is widely predicted to grow about 1.9% this year overall.

Nice video, little preacherish.

• The Religion Of Consumerism (Pollock)

Consumerism allows inverted totalitarianism to exist and in return it provides the masses with the fantasy of being part of a working structure. Unfortunately, consumerism relies on a series of self perpetuating crisis because the fundamental ethos is ecologically and structurally unsustainable. Consumerism also acts as a “modern day religion, a kind of idolatry. The religious nature of consumerism allows for the total voiding of individual requirements to act responsibly to society. The leadership of inverted totalitarianism uses the religion of consumerism to justify large-scale immoral activity. For example, President Bush told people to spend after 9-11 rather than take the time to examine fact and self.

Are you on the list?

• Greenwald To Publish Names Of Americans NSA Is Spying On (RT)

Glenn Greenwald, who helped Edward Snowden leak sensitive documents about the National Security Agency spying on its citizens, says he’s set to publish his most dramatic piece yet, which will reveal those in the USA who were targeted by the NSA. “One of the big questions when it comes to domestic spying is, ‘Who have been the NSA’s specific targets?’ Are they political critics and dissidents and activists? Are they genuinely people we’d regard as terrorists? What are the metrics and calculations that go into choosing those targets and what is done with the surveillance that is conducted? Those are the kinds of questions that I want to still answer,” Mr. Greenwald told the UK’s Sunday Times.

Greenwald slammed the NSA for its incompetence in allowing Snowden to steal and download 1.7 million sensitive documents, which he believes is further evidence of the country’s inability to guarantee data security. He also lambasted the organization for failing to capture the former NSA contractor, who is now living in Russia, having sought asylum in the country. “There is this genuinely menacing [spy] system and at the same time, [they] are really inept about how they operate it,” Greenwald said, Newsmax reported. “Not only was he out there under their noses downloading huge amounts of documents without being detracted, but to this day, they’re incapable of finding out what he took.”

Greenwald was contacted by Edward Snowden after the former Central Intelligence Agency employee downloaded numerous sensitive documents from the NSA, which showed how the organization had been spying on its citizens in the US. It was later revealed that the NSA had cast their net much further, which included spying on embassy’s around the globe and on world leaders. Spying on US citizens is illegal in America according to the fourth amendment, which prohibits unreasonable searches and seizures and requires any warrant to be judicially sanctioned and supported by probable cause. Initially the NSA claimed they were eavesdropping only on foreign targets.

“It’s been a catastrophe for air pollution, and that’s not too strong a word. It’s a public-health catastrophe.”

• London’s Dirty Secret Pollutes Like Beijing Airpocalypse (Bloomberg)

London has a dirty secret. Levels of the harmful air pollutant nitrogen dioxide at a city-center monitoring station are the highest in Europe. Concentrations are greater even than in Beijing, where expatriates have dubbed the city’s smog the “airpocalypse.” It’s the law of unintended consequences at work. European Union efforts to fight climate change favored diesel fuel over gasoline because it emits less carbon dioxide, or CO2. However, diesel’s contaminants have swamped benefits from measures that include a toll drivers pay to enter central London, a thriving bike-hire program and growing public-transport network. “Successive governments knew more than 10 years ago that diesel was producing all these harmful pollutants, but they myopically plowed on with their CO2 agenda,” said Simon Birkett, founder of Clean Air in London, a nonprofit group.

“It’s been a catastrophe for air pollution, and that’s not too strong a word. It’s a public-health catastrophe.” Tiny particles called PM2.5s probably killed 3,389 people in London in 2010, the government agency Public Health England said in April. Like nitrogen dioxide, or NO2, they come from diesel combustion. Because the pollutants are found together, it’s hard to identify deaths attributable only to NO2, said Jeremy Langrish, a clinical lecturer in cardiology at the University of Edinburgh. “Exposure to air pollution is associated with increases in deaths from cardiovascular disease such as heart attacks and strokes,” Langrish said. “It’s associated with respiratory problems like asthma.” The World Health Organization says NO2 can inflame the airways and worsen bronchitis in children.

This goes on around the globe.

• In the UK Heirloom Seeds Can Be Sold At Private Members Clubs Only (Bennett)

The way we are being pushed and squeezed by regulations that govern every facet of our life, we will soon only be able to defecate when our allotted time slot comes around. The European Commission is currently drawing up a new law to regulate the sale of all seeds, plants and plant material. The latest draft of the law is even more restrictive than the regulations that we have at the moment.

Every single variety of vegetable will have to be registered on an EU list, otherwise it will be illegal to sell it. To be registered on the list, seed varieties have to pass a series of tests demonstrating what is called DUS ‘Distinctiveness, Uniformity and Stability’. It costs nearly £3000 to test & register just one single variety of seed for sale.

Although we have had a system like this for many years, there have been much simpler and cheaper options for what are considered ‘amateur varieties’ for home gardeners, and the rules have never been strictly enforced in the UK. The EU wants to get rid of these simpler and cheaper rules for ‘amateur’ seed, and make sure that every country enforces the rules 100%. Although they say there will be exceptions, in current drafts of the law these are very, very limited. The effect of this new legislation will be to massively limit the choice of vegetable varieties available to home gardeners. This is because if you are selling seed to farmers, you can expect to sell hundreds of tonnes of seed every year, so it is worth the cost of registering the variety. But if you are selling to gardeners, even the biggest seed companies will be selling a few kilos of seed at most, sometimes just a few hundred grammes of more unusual varieties.

It just doesn’t work if they have to pay thousands of pounds to register that variety! So only seed designed for farmers will get registered and be legally sellable. Unfortunately, varieties suitable for farmers often aren’t appropriate for home gardeners and allotment growers. For example: farmers usually want all of their produce to come ready at the same time, so that they can harvest and sell a whole fields worth. Home gardeners usually want their crops to mature over a longer period – we don’t want to eat all our vegetables on one day! Another example: farmers generally don’t want to grow climbing peas, as they need supports and can’t be harvested mechanically. Lots of home gardeners prefer tall pea varieties, as they are more productive in a small space. There are hundreds of examples like this – the needs of gardeners and farmers are very different.

The problem is very simple: If these new laws are passed, there will be fewer and fewer varieties developed for gardeners and small growers. Everybody will have to grow varieties that have been designed for commercial large-scale farming, whether they like it or not. Happily, for the time being at least there is a way around this. You start a seed club, and that way a seed company cannot be prosecuted for selling to the public…they are not they are selling to their members only!

Home › Forums › Debt Rattle May 28 2014: Everything You Think You Own Has Been Borrowed