Pablo Picasso The rescue 1936

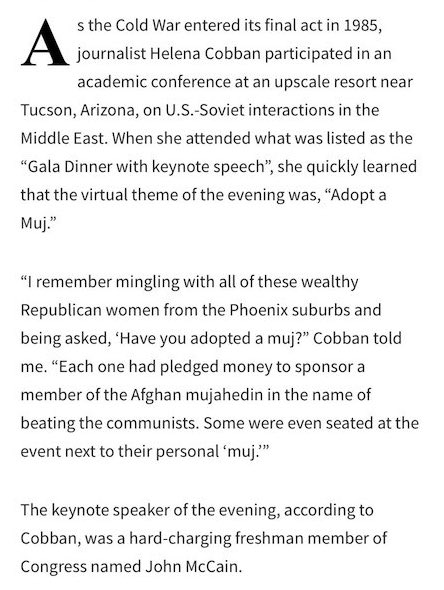

The “Golden Pin-up Boys For Klaus Schwab”

“Kindness is the language the deaf can hear and the blind can see.”

-Mark Twain

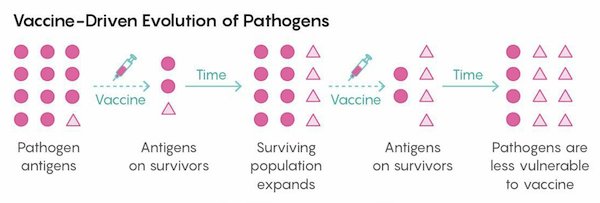

Comedian

Everyone in the world needs to watch this. Every man woman and child. pic.twitter.com/wIm5Hrk3f3

— Erin Elizabeth at Health Nut News (@ErinHNN) July 6, 2022

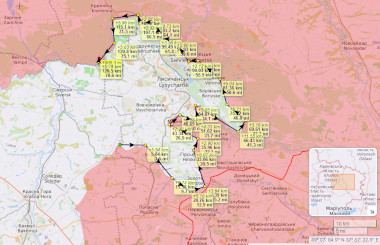

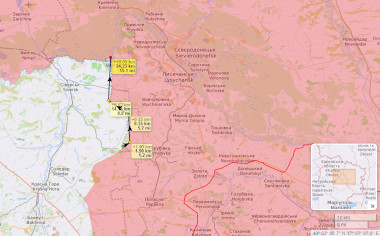

“Russia needed some 25 BTCs to cover the frontline on June 21. It now needs only 5 BTC to cover the current line.”

• ‘Western’ Media Spread Copium To Prolong The War In Ukraine (MoA)

The war in Ukraine is clearly progressing in Russia’s favor. That is why I am appalled by the incompetent descriptions in ‘western’ media of past and current operations in that war. Consider this June 21 map of the Lysichansk cauldron as it was developing. The frontline extended over 125+ kilometers (78 miles).

Fourteen days later and the map looks like this.The frontline has been shortened to 25 kilometer (15 miles). On Sunday the Russia Defense Ministry announced that it troops had ‘liberated’ 184 square kilometer over the last 24 hours.

When I was in the military my tank battalion was expected to operate on a generally five kilometer (3 miles) wide frontline. That was of course just a rule of thumb depending on the terrain and other circumstances. But we can expect that a Russian Battalion Tactical Group (BTC) has similar abilities of frontline coverage. Russia needed some 25 BTCs to cover the frontline on June 21. It now needs only 5 BTC to cover the current line. There were and now are of course additional reserve troops and some BTC are rotated out as rested ones come in just as Russia’s president has ordered them to do: “Shoigu told Putin that “the operation” was completed Sunday after Russian troops overran the city of Lysychansk, the last stronghold of Ukrainian forces in Luhansk. Putin, in turn, said that the military units “that took part in active hostilities and achieved success, victory” in Luhansk “should rest, increase their combat capabilities.”

In a week or two those BTCs which now rest and resupply will be back. They will create a new cauldron around Siversk and maybe Bakhmut, decimate the Ukrainian forces within it to then capture the whole area. Despite this obvious path to progress for the Russian side the Associate Press headlines: “High Cost Of Russia Gains In Ukraine Could Limit New Advance” The only purported evidence of high Russian costs are the assertions of a ‘military analyst in Ukraine’ who claims that some Russian units lost half of their soldiers. I have seen nothing that would support such a claim. The AP writer then adds this: “The limited manpower has forced the Russian commanders to avoid ambitious attempts to encircle large areas in the Donbas, opting for smaller maneuvers and relying on heavy artillery barrages to slowly force the Ukrainians to retreat.”

Please. Look at the above maps. What did Russia just do? It had made an ambitious attempt to encircle a large are in Donbas and succeeded with the effort in just a few days. The Ukrainian army threw everything it had available into the cauldron and lost thousands of men while the Russian army avoided direct men against men fighting to minimize its own casualties.

Scary dude.

• Ukraine’s Ambassador to Germany Touts Nazi War Criminal As A Hero (AT)

In Europe, the past never goes away, and that’s certainly true in Central and Eastern Europe. We’ve already heard about the openly Nazi brigades in the modern Ukraine army. Now, to make it worse, the Ukrainian Ambassador to Germany just touted as one of Ukraine’s greatest freedom fighters Stephan Bandera, who helped murder 800,000 Ukrainian Jews and 40,000-100,000 Poles. That didn’t surprise me at all. It’s what I expected. From the start of Russia’s assault on Ukraine, I’ve been ambivalent. On the one hand, I was horrified as all people of conscience must be when they see a military power brutally attack an innocent civilian population.

On the other hand, having some familiarity with both Ukrainian and Russian history, I knew that (a) this was a fight going back centuries, (b) that we had no business getting involved in a regional war, and (c) that I don’t have particularly warm feelings for either combatant. Both Ukraine and the USSR behaved horribly during WWII, including allying with the Nazis. Ukraine was especially gleeful as it joined the Nazis in slaughtering Jews within its territory. It did so with such vigor that even the Nazis were shocked. Nor does it matter to me that the current President of Ukraine is nominally Jewish. So were the Kapos in the concentration camps and George Soros. The worst antisemites in the world have been Jews (see, e.g., Karl Marx, whose father had him convert as a small boy, and who went on to bake antisemitism into the socialist cake).

That’s why I wasn’t at all surprised to read David P. Goldman’s article about Andrej Melnyk, who insisted during an interview with Germany’s Die Welt that Bandera was nothing more than a freedom fighter: Germany’s leading center-right newspaper Die Welt posted a banner headline at the top of its page last Friday evening just before Shabbat came in here in New York: “[Ukrainian Ambassador to Germany Andrej] Melnyk’s statement trivializes the Holocaust.” In a radio interview last week, Melnyk compared Ukrainian Nazi leader Stephan Bandera to Robin Hood and vehemently denied—in the face of massive historical documentation—that Bandera had helped to murder 800,000 Ukrainian Jews during World War II. The Banderites also helped to murder between 40,000 and 100,000 Poles.

[..] Melnyk said, “Not just for me, but for many, many Ukrainians, he personifies the freedom fighter… and of course a freedom fighter… There are now written laws for those who fight for freedom. Robin Hood is also respected by everyone, and he also did not work according to the law current at the time.” The astonished German interviewer said, “And you admit that he and his men were involved in the murder of 800,000 Jews?” “No, he was not involved,” said Melnyk The interviewer protested, “But it was his army. That’s what his men did. There is no doubt about that.” Melnyk retorted, “You say, ‘No doubt,’ but there is no evidence. He was not convicted.”

Because of the past. And the future.

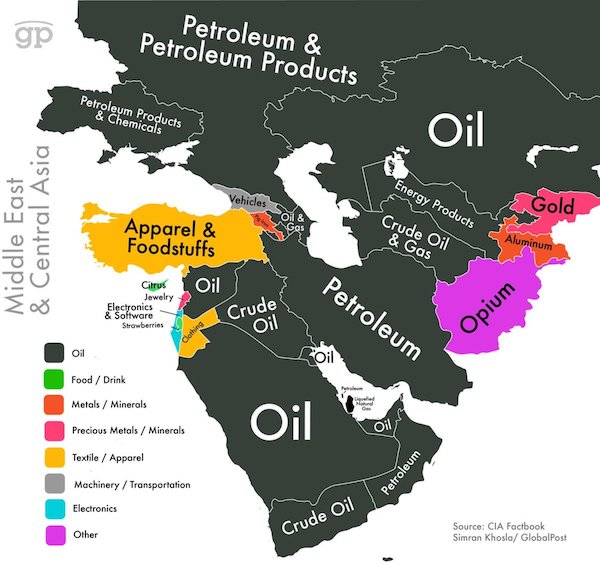

• Why Doesn’t Africa Support The West In Sanctions War Against Russia? (Lumango)

1. Historical memory of colonisation and the struggle for national liberation: Russia, heir to the Former USSR, supported ideologically, politically, economically, and militarily the national liberation struggles of several African countries, which after the achievement of independence, followed the communist model as the basis of their political, social and economic construction. Even though they later adopted Western capitalism, the mentality of the African cosmos is still of Soviet influence, because it was there that most of them did their military and political training and received economic support to finance the liberation wars to put an end to Western colonisation, with direct and indirect help from Cuba as an intermediary in some cases.

The cold war between the USA and NATO against the USSR led to civil wars in African countries to conquer the spaces of influence. After the fall of the Berlin wall and the resurgence of Russia, Westerners looked at the situation as an absolute victory. Despite this, the African cosmos has not forgotten colonisation, the interference of Western countries in their internal affairs, and the rigged processes of massive indebtedness of their economies as a way of controlling their strategic natural resources.

2. Recent memory of wars at the beginning of the 21st century: Beyond colonial issues, the African cosmos has been following since 2001 the behaviour of the West (US, NATO, and EU) in the wars in Iraq, Afghanistan, Libya, Syria, sweetened by the Arab Springs, attempted coups in Turkey, Kazakhstan, Pakistan, Tunisia, Egypt, etc., without forgetting the massacre in Rwanda and the war in Somalia and Yemen. These wars and coups have destroyed thousands of human lives, social infrastructure, jobs, etc. It was a catastrophe for the entire continent and nearby territories like South East Asia.

The existing wars in Somalia, Yemen, Nigeria, Mali, Mozambique, DRC, Ethiopia, etc, allow the African cosmos, even those with strong ties to the West like Morocco, for example, not to act frontally against Russia, a fact verified in the recent votes of the UN General Assembly and the Human Rights Council which suspended it. The expulsion of French forces by the military junta in Mali and their replacement by the Russians through the Wagner group, like the construction of a port for the Russian Nave Arms on the Sudanese Red Sea coast, could be a revealing symptom.

“..disastrous G-7 Summit where the biggest collection of unserious buffoons gathered to ban the sale of Russian gold and contemplate a global price cap on oil..”

• China Queues Up to Join the Davos Beatdown (Luongo)

Fungal Joe is going to lift the Trump tariffs on Chinese imports this week to buy votes by hoping inflation moderates. I’m okay with him doing this trying to right the ship. Tariffs are never the answer, just like sanctions. Notice also this has zero to do with monetary policy and everything to do with supply disruptions caused by government diktat. This change by China signals an intention by the CCP to open China back up to tourism and business development that isn’t likely to be reversed. I expect this to be real and for China to make even more little moves like this as the summer drags on and markets churn in the West.

With that change, capital inflow lessens the pressure on both the Hong Kong dollar (HKD) and the Hang Seng while giving China more cover to loosen monetary policy without necessarily raising rates and creates another place for capital to flow now that the ECB has capitulated. Christine Lagarde’s recent statements about fighting inflation being “more art than science” is just saying the quiet parts out loud. But it was what came out of the ECB’s emergency meeting a couple of weeks ago that finally signaled the end for the euro in the minds of investors. Not only is Germany’s industrial base being literally destroyed gleefully by its government, now the ECB is going to sell German debt to buy Italian and Spanish debt to keep from drowning. This is akin to bailing water out of one end of the boat only to throw it in the other end.

Couple these things with the frankly, disastrous G-7 Summit where the biggest collection of unserious buffoons gathered to ban the sale of Russian gold and contemplate a global price cap on oil. … words fail me. Honestly, after this G-7 the rush into the BRICS Alliance as well the Eurasian Economic Union (EAEU) will be unstoppable. What serious investor with real capital appreciation goals is going to look at this group of committed (and committable) lunatics and think, “Yes! I can trust my money with Boris Johnson, Joe Biden and Ursula Von der Leyen!” No, they are looking at this crap and opening up Tradestation. The fact that Justin Trudeau was even invited should have been your sell signal. While the BRICS were talking about a new trade settlement currency and adding members, the G-7 was talking World War III while getting caught spending more time on photo ops than substantive dialogue.

[..] When you look at the fragility of the EU, the UK, and Canada you realize that the only thing propping up global markets at this point is the hope that the U.S. mid-terms are a complete refutation of the Davos agenda. If that doesn’t happen, if somehow Soros and Davos steal enough seats and put a bunch of RINOs back into Congress and the Senate to freeze any reform of Washington D.C. the collapse of the West will accelerate very quickly.

“..these ideas have been wrapped in humanitarian language. But in reality, they amount to a call for highly risky U.S.-led military action.”

• US-Led Naval Escort To Break Russian Blockade Could Risk Wider War (RS)

Since Russia invaded Ukraine in February, relatively few in the Western commentariat have been willing to call for the United States to engage in direct war against Moscow. The reasons for this caution are obvious — Russia is a nuclear state, and has a military that, its recent underperformance notwithstanding, is still vastly more formidable than any recent target of U.S. military intervention. Yet despite — or perhaps because of — this general resistance to direct U.S. involvement, many commentators and politicians have come up with more underhanded proposals for American military intervention. Most notably, this began with widespread calls for the United States and NATO to establish a “no-fly zone” over Ukraine early in the war.

In spite of its innocuous and legalistic name, the Biden administration soundly rejected this proposal as its enforcement would rather obviously entail shooting down Russian aircraft, which in turn would lead to a wider war. More recently, as the danger of a global food crisis made worse by the loss of grain exports from Ukraine and Russia has increased, new calls have emerged for the United States and allies to use naval power to ensure that Ukrainian grain can safely transit the Black Sea. Similar to demands for a no-fly zone, these ideas have been wrapped in humanitarian language. But in reality, they amount to a call for highly risky U.S.-led military action.

Versions of the proposal have been put forward by Lithuania’s foreign minister, retired U.S. military leaders including admiral James Stavridis, general Wesley Clark, and general Jack Keane, as well as Democratic representative Elissa Slotkin and the editorial boards of the Boston Globe and Wall Street Journal. While these proposals vary in detail, all invoke the rhetoric of humanitarian intervention to justify and legitimize the action. The Wall Street Journal calls for a U.S.-led naval escort to be “planned and pitched as a humanitarian operation.” Stavridis referred to his plan as a “humanitarian grain mission” while Slotkin simply called for a “humanitarian escort.” The Boston Globe called its proposal a “human-rights mission” while the Lithuanian foreign minister deemed it a “non-military humanitarian mission.”

Most strikingly, both the Lithuanian foreign minister and the Wall Street Journal have referred to the nations participating in this hypothetical naval escort as a “coalition of the willing,” and odd choice given that phrase’s association with the U.S. war on Iraq and the Bush administration’s efforts to give a veneer of multilateral legitimacy to its illegal invasion.

“..just 8 percent said the U.S. should “ensure a defeat of Russia in Ukraine.”

• U.S. Should Leave NATO, Marjorie Taylor Greene Says (Celente)

Rep. Marjorie Taylor Greene, the Republican from Georgia, came out against the U.S.’s involvement in the Ukraine War and called on Washington to pull out of the Alliance. “The American people do not want war with Russia, but NATO and our own foolish leaders are dragging us into one,” she said in a tweet. Greene said the U.S. is waging a proxy war with Russia that no country can win and can escalate into a nuclear confrontation. There has been near-universal bipartisan support for sanctions against Russia coupled with military aid to Ukraine to fight off the Russian invasion. But Greene, who is considered a firebrand in the party, has been more critical of Ukraine’s role before the war. She said in March that the West was agitating Russia by “poking the bear” with NATO expansion.

She also did not buy the media’s claim early on in the war that Moscow would lose. She broke from her party and said Russia was “very successful” in its invasion. President Joe Biden has worked to present NATO as a united front for good against Russia. His support for Ukraine has no limit. On Friday, the U.S. said it will send Kyiv an additional $820 million in military aid. The U.S. has given Ukraine some $57 billion since the war started on 24 February. This latest injection will go to additional ammunition for High Mobility Artillery Rocket Systems (HIMARS), two National Advanced Surface-to-Air Missile Systems (NASAMS), up to 150,000 rounds of 155mm artillery ammunition, and four additional counter-artillery radars.

Despite the support from Congress, war with Russia is not a popular position among Americans. A YouGov poll found that 40 percent say the U.S. should be less militarily engaged in conflicts around the world. The Ukraine War is also not something that is on the mind of everyday Americans. The poll found that 38 percent think Washington should tackle the surging costs of living while just 8 percent said the U.S. should “ensure a defeat of Russia in Ukraine.” Greene posted on Twitter: “The American people do not want war with Russia, but NATO and our own foolish leaders are dragging us into one. A war that no one will win. Escalation over Ukraine, a non-member nation, risking nuclear war is a power-play endangering the entire world. We should pull out of NATO.”

“That’s why the rotten dogs of war are barking in such a disgusting way.”

• Medvedev Warns US Against Pressing For War Crimes Court (AP)

A top Kremlin official warned the U.S. Wednesday that it could face the “wrath of God” if it pursues efforts to help establish an international tribunal to investigate Russia’s action in Ukraine, while the Russian lower house speaker urged Washington to remember that Alaska used to belong to Russia. Dmitry Medvedev, the deputy secretary of Russia’s Security Council chaired by President Vladimir Putin, denounced the U.S. for what he described as its efforts to “spread chaos and destruction across the world for the sake of ‘true democracy.’” “The entire U.S. history since the times of subjugation of the native Indian population represents a series of bloody wars,” Medvedev charged in a long diatribe on his Telegram channel, pointing out the U.S. nuclear bombing of Japan during World War II and the war in Vietnam.

“Was anyone held responsible for those crimes? What tribunal condemned the sea of blood spilled by the U.S. there?” Responding to the U.S.-backed calls for an international tribunal to prosecute the perceived war crimes by Russia in Ukraine, Medvedev rejected it as an attempt by the U.S. “to judge others while staying immune from any trial.” “It won’t work with Russia, they know it well,” Medvedev concluded. “That’s why the rotten dogs of war are barking in such a disgusting way.” “The U.S. and its useless stooges should remember the words of the Bible: Do not judge and you will not be judged … so that the great day of His wrath doesn’t come to their home one day,” Medvedev said, referring to the Apocalypse. He noted that the “idea to punish a country with the largest nuclear potential is absurd and potentially creates the threat to mankind’s existence.”

“War crimes were duly perpetrated – some of them denounced by an organization led by a sterling journalist who was subsequently subjected to years of psychological torture by the same Empire..”

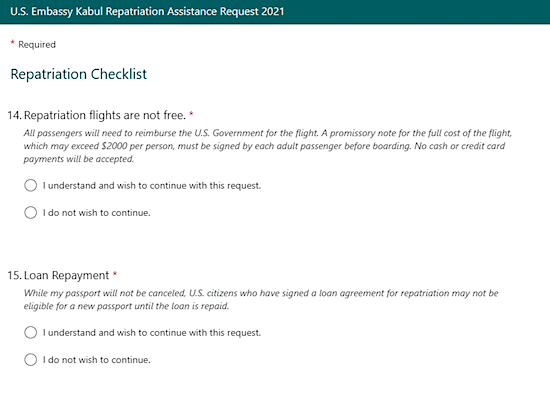

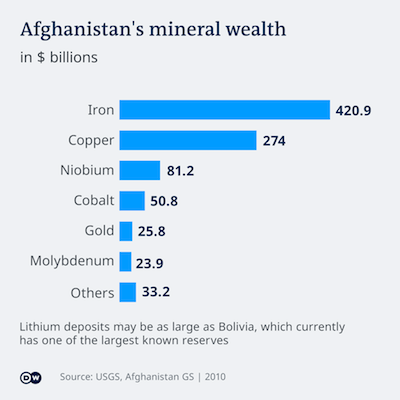

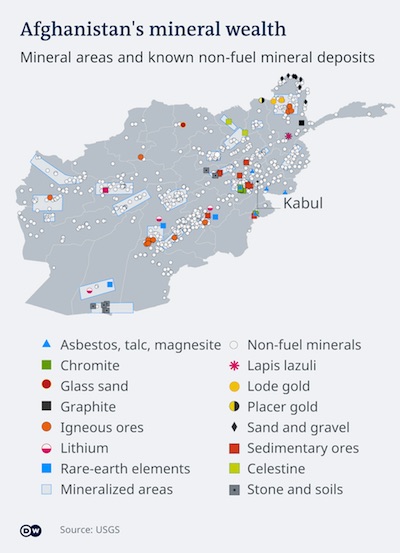

• The Empire Is Not Done Torturing Afghanistan (Escobar)

Once upon a time, in a galaxy not far away, the Empire of Chaos launched the so-called “War on Terror” against an impoverished cemetery of empires at the crossroads of Central and South Asia. In the name of national security, the land of the Afghans was bombed until the Pentagon ran out of targets, as their chief Donald Rumsfeld, addicted to “known unknowns,” complained at the time. Civilian targets, also known as “collateral damage,” were the norm for years. Multitudes had to flee to neighboring nations to find shelter, while tens of thousands were incarcerated for unknown reasons, some even dispatched to an illegal imperial gulag on a tropical island in the Caribbean.

War crimes were duly perpetrated – some of them denounced by an organization led by a sterling journalist who was subsequently subjected to years of psychological torture by the same Empire, obsessed with extraditing him into its own prison dystopia. All the time, the smug, civilized ‘international community’ – shorthand for the collective west – was virtually deaf, dumb, and blind. Afghanistan was occupied by over 40 nations – while repeatedly bombed and droned by the Empire, which suffered no condemnation for its aggression; no package after package of sanctions; no confiscation of hundreds of billions of dollars; no punishment at all. At the peak of its unipolar moment, the Empire could experiment with anything in Afghanistan because impunity was the norm.

Two examples spring to mind: Kandahar, Panjwayi district, March 2012: an imperial soldier kills 16 civilians and then burns their bodies. While in Kunduz, April 2018: a graduation ceremony receives a Hellfire missile greeting, with over 30 civilians killed. The final act of the imperial “non-aggression” against Afghanistan was a drone strike in Kabul that did not hit “multiple suicide bombers” but instead eviscerated a family of 10, including several children. The “imminent threat” in question, identified as an “ISIS facilitator” by US intelligence, was actually an aid worker returning to meet his family. The ‘international community’ duly spewed imperial propaganda for days until serious questions started to be asked.

Steve Bannon via Robert Malone’s site.

• Interview With Archbishop Carlo Maria Viganò (Bannon)

YOUR EXCELLENCY, after the psycho-pandemic, we now have the Russian- Ukrainian crisis. Are we in “phase two” of one single project, or can we now consider the Covid farce to be over and concern ourselves with the increase in energy prices?

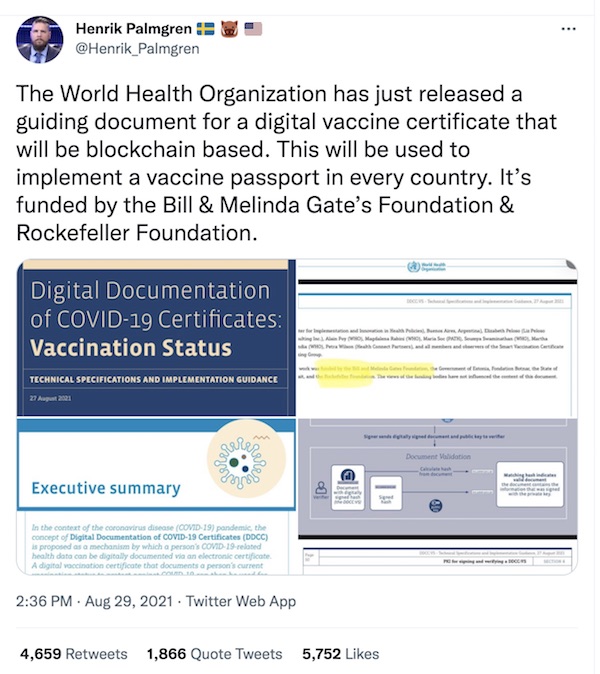

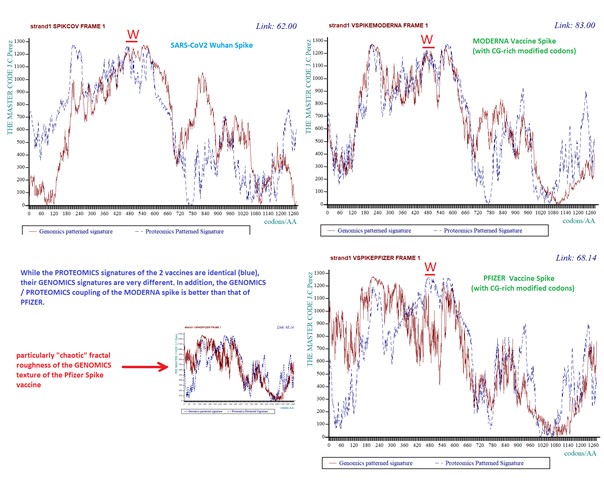

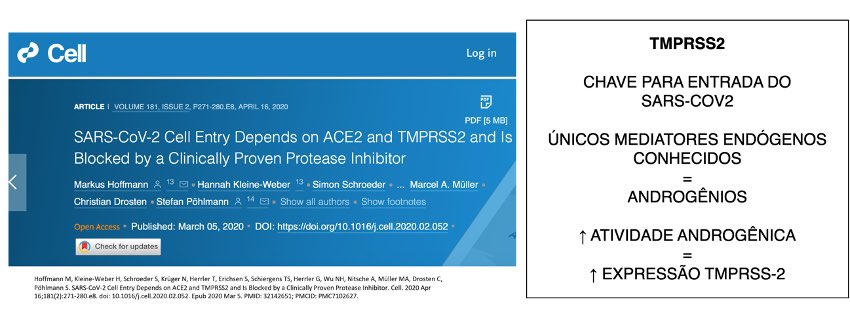

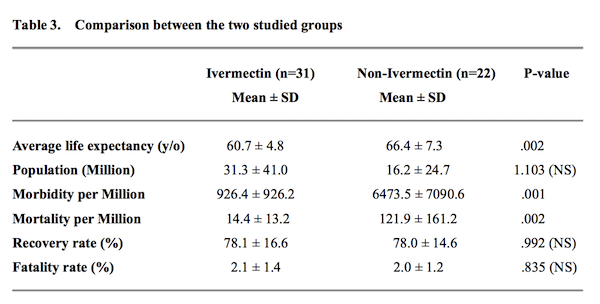

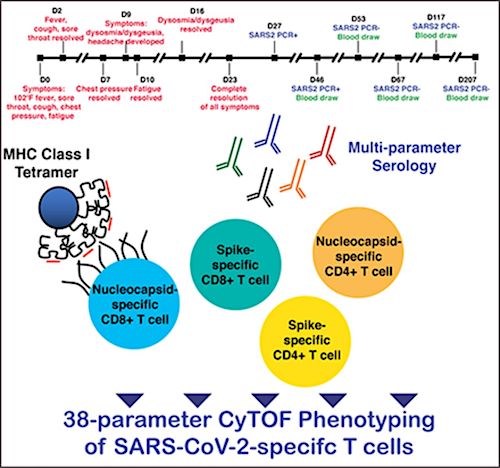

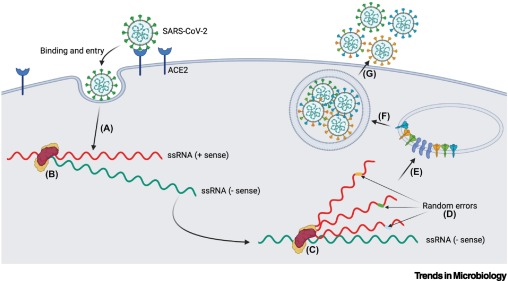

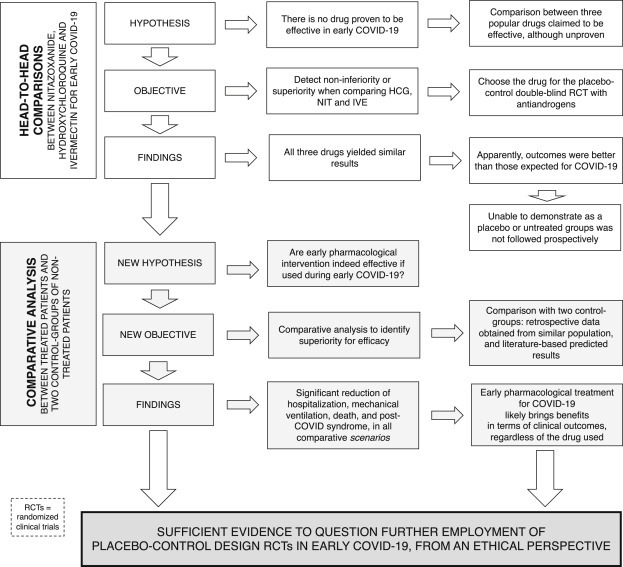

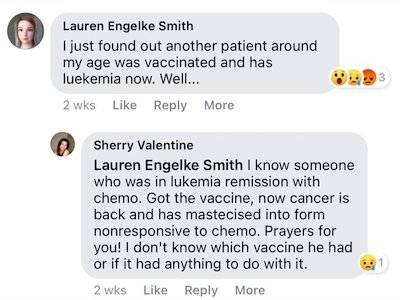

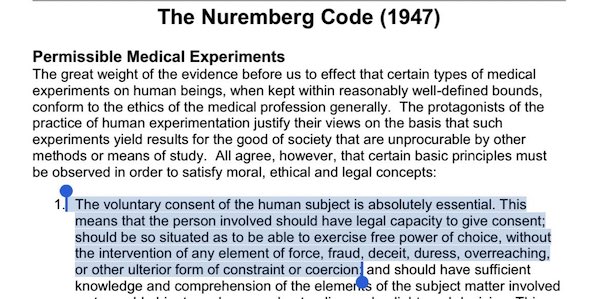

If in the last two years we had been faced with a true pandemic, caused by a deadly virus for which no other cures existed except for a vaccine, we would be able to think that the emergency was not intended. But this is not what happened: the SARS-CoV-2 virus is nothing but a seasonal flu that could have been cured with existing treatments and effective prevention based on strengthening immune defenses. The prohibition of treatment, the discrediting of the effectiveness of drugs that have been in use for decades, the decision to hospitalize the elderly who became sick in nursing homes and the imposition of an experimental gene treatment that has been demonstrated not only to be ineffective but also harmful and often fatal – all this confirms for us that the pandemic has been planned and managed with the purpose of creating the greatest damage possible. This is a fact that has been established and confirmed by the official data, despite the systematic falsification of that same data. Certainly, those who wanted to manage the pandemic in this way are not disposed now to yield easily, also because there are billionaire interests behind all of it. But what “they” want does not always necessarily happen.

In your opinion, Your Excellency, was the pandemic managed in this way due to inexperience? Or was it due to the corruption of those in positions of control who are in a conflict of interest because they are paid off by the pharmaceutical industry?

This is the second element to consider: the response to the pandemic was the same all over the world, where health authorities slavishly adapted to health protocols that were contrary to the scientific literature and medical evidence, instead following the directives of self-proclaimed “experts,” who have a record of sensational failures, apocalyptic predictions completely divorced from reality, and very grave conflicts of interest. We cannot think that millions of doctors all over the world have lost their basic knowledge of the art of medicine, believing that a flu should be allowed to evolve into pneumonia and then be treated with tachypirin or by placing patients on ventilators. If they have done this, it is due to pressure – even to the point of blackmail – by health authorities over medical personnel, with the help of a scandalous campaign of media terrorism and with the support of Western leaders.

Most of these leaders are members of a lobby – the World Economic Forum – that trained them and placed them at the highest levels of national and international institutions in order to be certain that those who govern would be obedient. Klaus Schwab has publicly boasted, on many occasions, of being able to interfere even with religious leaders. These too are documented facts in all the nations that followed the directives of the WHO and the pharmaceutical companies. There is clearly a single script under a single direction: this demonstrates the existence of a criminal design and the malice of its creators.

“The only way to achieve the cover is by smashing the price of physical gold by the alchemical production of ‘paper gold’.”

• Hambro: BIS, Central Banks Are Rigging Gold Market Using Paper Gold (BStar)

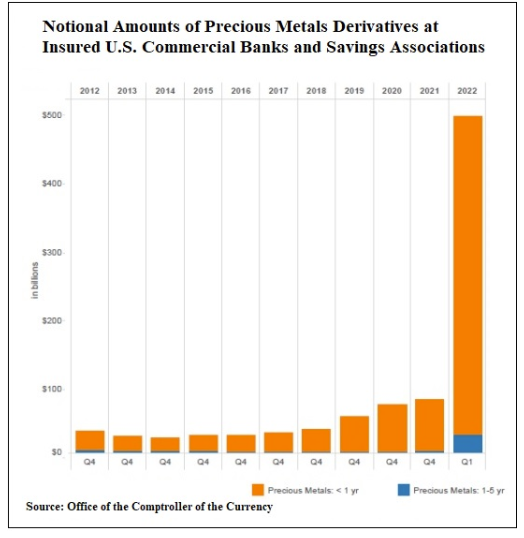

The trigger for Peter Hambro’s article is a recent chart from the US Office of the Comptroller of the Currency (OCC), which due to a data reclassification starting in Q1 2022, now shows the massive extent to which bullion banks such as JP Morgan have amassed precious metals derivatives contracts to hold down the gold price.. Hambro describes this manipulation of the gold price using derivatives as a ‘tinder-box’, which ‘disinformation [has] for many years kept the lid on”.

But who, you might ask, is directing this disinformation and this gold price manipulation? According to Hambro’s bombshell, its the BIS in Switzerland, i.e. the central banks’ central bank. Hambro drops the bombshell that: ”since 2018 the Financial Stability Desks at the world’s central banks have followed the Bank for International Settlements’ (BIS) instruction to hide the perception of inflation by rigging the gold market.” But since the central banks ‘need cover’ and ‘cannot be seen’ to be rigging the gold price, Hambro continues: “The only way to achieve the cover is by smashing the price of physical gold by the alchemical production of ‘paper gold’.” If this has now got your attention, read on, since Hambro elaborates:

“With the help of the futures markets and the connivance of the Alchemists, the bullion traders – yes, that includes me, I was Deputy Managing Director of Mocatta & Goldsmid – managed to create an unshakeable perception that ounces of gold credited to an account with a bank or bullion dealer were the same as the real thing. “And much easier, old chap! You don’t have to store or insure it”. The gold credit which Hambro is referring to here is the LBMA’s infamous ‘unallocated gold’, with ‘the futures markets’ being the COMEX.

WEF.

• Lab-Designed GMO “Carbon Capture Plants” to Replace Pastures (Chudov)

The World Economic Forum has a new proposal (archive): engineered crops whose roots DO NOT ROT when the plants die, and “capture carbon”.

Their plan (per article) is as follows: • Make us stop eating meat: “Decreasing the amount of land devoted to livestock will reduce methane emissions” • Plant genetically engineered crops in place of pastures, that would capture carbon. “By using a molecule found in avocado and cantaloupe skins, these engineered roots can better resist decomposition, minimizing carbon escape.” So, after we stop eating meat, they plan on liquidating pastures and planting those genetically engineered “carbon-capturing” plants on the pasture land. The plants would have genetically altered polymer roots (archive) that will not decompose. Think of these roots, for the purposes of discussing decomposition, as being made of plastic polymers, like plastic fibers or ropes.

Thus, the WEF plan goes, these GM plants would grow in former pastures, grow polymer roots, and die every year, BUT THE ROOTS WILL NOT DECOMPOSE. Since the roots do not decompose, the soil will gradually become firmly permeated by a thickening tangle of never-disappearing polymer roots. Those roots would hold CO2 forever. Great right? Except that I have some questions: • Will this pasture soil be basically permanently condemned to hosting these genetically modified plants, since no other plants could penetrate the tangles of plastic-like polymer roots until the jammed soil no longer supports any growth at all?

• What will happen to the diversity of native pasture plants that never evolved to grow on soil which is blockaded by these genetically modified, never-rotting plants? • What will happen to insects such as bees, living off native pasture plants and their pollen? • What will happen to worms, no longer able to move through the soil? • What will happen to the birds, who eat those insects and worms? • What will happen to burrowing animals, who no longer would be able to burrow in the tangles? • What if, like Sars-Cov-2, these soil-clogging, never-rotting plants escape and outcompete wild plants everywhere else? Before you dismiss that, please realize that these plants have to outcompete natural pasture plants to take root in the former pastures.

“You don’t violate the rules of being a staff aide without consequences, after all.”

• Cassidy Hutchinson Broke Every Rule Of Being A DC Aide (Van Buren)

Trump’s movement away from his January 6 speech went badly. The former president wanted to go to the Capitol but his Secret Service detail felt it was unsafe and, in a rare gesture, overruled him. Trump was upset and took it out on the two guys in charge, Tony Ornato and Bobby Engel. Back at the office, the guys dutifully recounted what happened, with Cassie all ears (Rule 5: as staff aide, you’re not well-briefed enough to overhear things and make sense of them). She heard what may have been a bit of macho exaggeration by the guys, Trump grabbing the steering wheel and all, perhaps a bit of bravado as everyone was cooling down. She misunderstood what she heard (Rule 6, it happens), setting the story in The Beast, the massive armored stretch Cadillac limo that is the official presidential ride, when whatever happened happened in a Secret Service SUV per video records.

A Secret Service agent would never misremember an SUV for The Beast but an aide would. When the January 6 Committee came ’round, Cassie thought she had a tale to tell, Trump out of control in the vehicle and later throwing his lunch during a tantrum, his ketchup dripping down the wallpaper. The thing is, Cassie did not see either happen. She was repeating a Secret Service war story in the first instance and imagining the details in the second (she actually saw the ketchup dripping but not the throw). Any first-year law student will know those are examples of hearsay and secondhand information, immediately inadmissible as evidence. The Secret Service is ready to call Cassie a liar; Trump already did.

Cassie also claimed to have written a note about a potential Trump statement meant to quell the rioting. In fact, the note was written by White House attorney Eric Herschmann, according to his spokesman. “All sources with direct knowledge and law enforcement have and will confirm that it was written by Mr. Herschmann.” Rule 1 again: Cassie isn’t important enough to write notes for the president. Cassie thought this was her big break, the staff aide who was going to change history. Never mind that she must have come across the definition of hearsay somewhere in her education; never mind that steering wheel grabbing and plate throwing are neither criminal nor impeachable offenses. She broke all the rules for her few minutes on TV, allowing herself to be used by a committee that knew damn well she had not witnessed anything and that swearing “under oath” to the truth of something you don’t know first-hand is impossible.

That leaves Cassie in violation of another rule, one most people learn on the playground: nobody likes a snitch. Anyone check in on how Monica Lewinsky’s career in Washington went? After a quick round on the late night shows, Cassie will disappear from DC-land. You don’t violate the rules of being a staff aide without consequences, after all.

Not just childhood vaccines.

• The CDC Is Breaking Trust in Childhood Vaccination (Tablet)

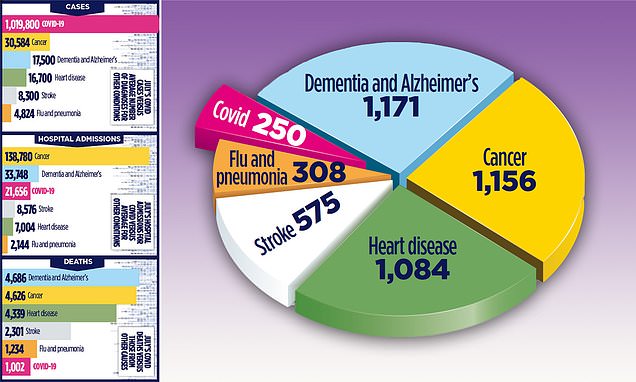

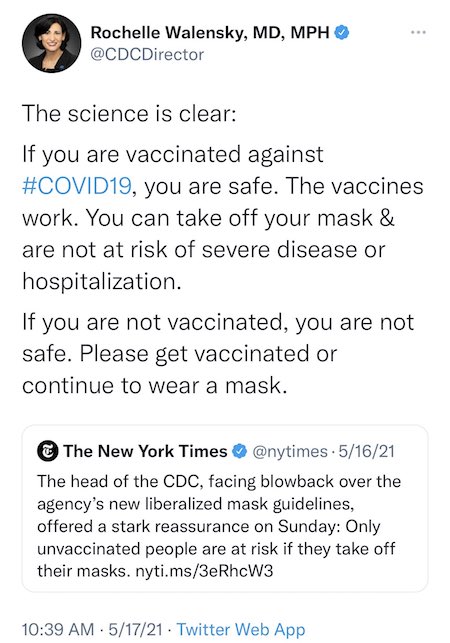

On June 18, the U.S. Centers for Disease Control and Prevention (CDC) officially recommended Pfizer and Moderna COVID-19 vaccines for all children between the ages of 6 months and 5 years. While the Food and Drug Administration (FDA) is the agency responsible for authorizing emergency use of vaccines, it’s the CDC that crafts subsequent messaging, makes specific recommendations, and prioritizes who can, should, or should not get vaccinated. In her briefing, CDC Director Rochelle Walensky strongly urged all parents of the nearly 20 million American children in this age group to vaccinate them as soon as possible. For some parents, Walensky’s briefing came as a huge relief. But if polling from May is anything to go by, a larger number of parents likely greeted the recommendation with skepticism.

Even before the underwhelming trial results came out, only 18% of surveyed parents reported that they planned to vaccinate their babies and toddlers. Nationally, uptake in minors between the ages of 5 and 11 as of June 22, 2022, was 29% receiving two doses, and 36% receiving one, but vaccine requirements for sports, camps, and other activities likely drove an unknown percentage of vaccination in this age group. There remains, moreover, no solid consensus among physicians about the importance of vaccinating healthy children against COVID-19. A survey from December 2021 indicates that as many as 30%-40% may not be recommending COVID vaccination for children ages 5 to 17, to say nothing of infants. A recent editorial in The Lancet expressed uncertainty about whether the benefits of vaccinating healthy 5- to 11-year-olds outweigh the risks, especially in those with a history of infection.

The gap between the CDC’s enthusiasm for vaccinating all children against COVID and that of parents and health care providers is unlikely to be bridged by approval under Emergency Use Authorization. Approval for the COVID vaccines in infants and toddlers is based on two trials that used changes in antibody levels as an estimate of efficacy, but did not assess protection from severe disease, hospitalization, or multisystem inflammatory syndrome in children (MIS-C), important outcomes that parents worry about. In a Food and Drug Administration (FDA) meeting on June 28, Pfizer Vice President for Viral Vaccines Kena Swanson even acknowledged that “there is no established correlate” between antibody levels and protection from disease.

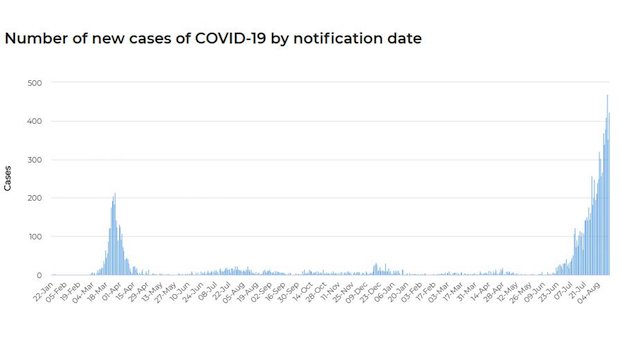

“..it has damaged the health of the vast majority of Australians by making them more vulnerable to infection with Covid..”

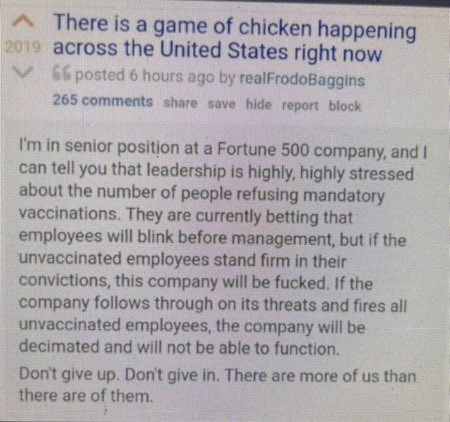

• Vanishing Vaccine Mandates (Spec.au)

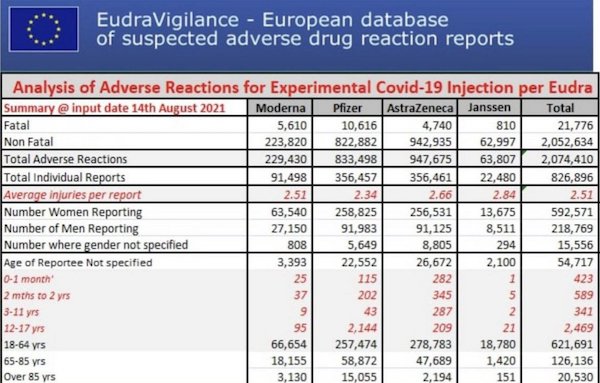

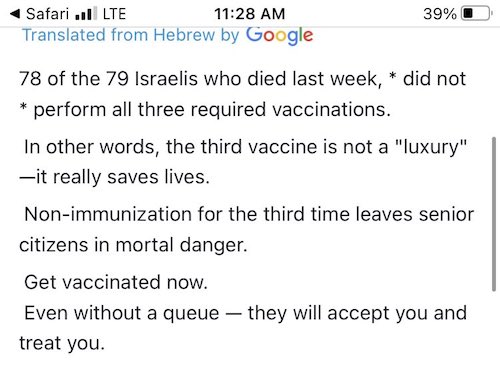

This week, with hardly a whisper from its chief public health officers, Australia largely abandoned its vaccine mandates. For the most part, they remain in force only for those working in health and aged care or with those with disabilities. There has been no explanation given as to why unvaccinated workers can now be ‘welcomed back’ into workplaces. There has been no apology to those who lost their jobs for refusing to be jabbed, or who lost their lives, or their good health, following vaccination. So far, 889 deaths have been reported to the Therapeutic Goods Administration (TGA) which may have been caused by vaccination and almost 133,000 people have reported a vaccine injury including more than 140 heart attacks, 360 myocardial infarctions, 500 strokes, 1,400 cases of deep vein thrombosis and 1,500 pulmonary embolisms.

So, why the sudden change in policy? Here’s one possibility. An Israeli study of 5.7 million people, published in the New England Journal of Medicine in June, shows that unvaccinated people who gained immunity through infection, were far better protected from Covid than people who were double vaccinated. And while the study did not have enough cases of severe Covid to be definitive, it showed that unvaccinated people with natural immunity were also better protected from severe Covid. Thus, after more than two years of advising premiers to abandon their pandemic plans and paralyse the entire country until everyone was immunised with experimental vaccines, it seems that our public health officers were wrong.

Oops. Not only has Australia wasted billions of dollars on lockdowns, it has damaged the health of the vast majority of Australians by making them more vulnerable to infection with Covid. Increased vulnerability to infection might explain why, in NSW, teachers who were forced to be double vaccinated to retain their jobs were off sick for a combined 430,351 days in the first six months of this year, an increase of 145,491 days compared to pre-pandemic levels. It might also explain why excess mortality continues to run at a record high. Excess deaths in March were still almost 10 per cent above the historical baseline and deaths for the first three months of the year were 17.5 per cent higher than the historical average.

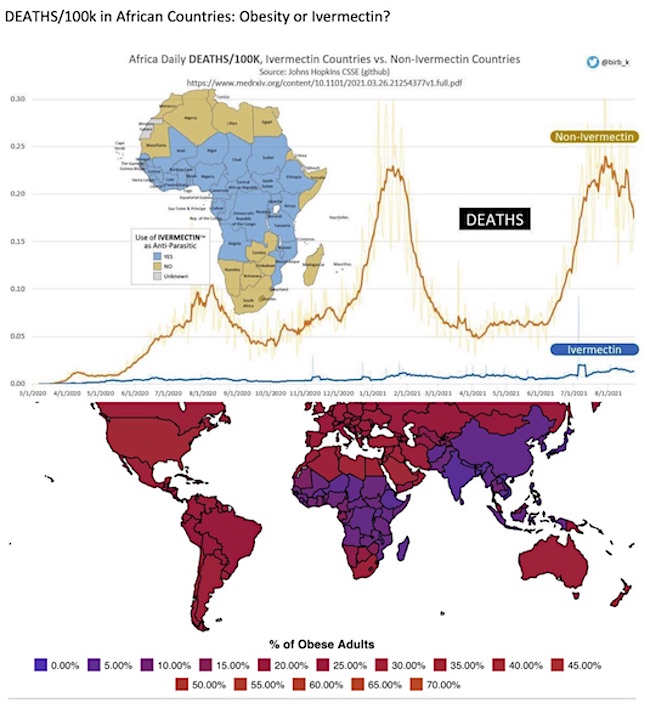

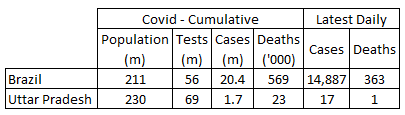

This spectacular public health failure was undoubtedly exacerbated by the failure to heed the lessons of early treatment of Covid-19. This time last year, on 26 June, NSW entered its long Delta lockdown. At that time, India was just emerging from its Delta spike. On 26 June 2021, Covid deaths in India were 284 per million, while in Australia they were only 35 per million. A year later on 26 June, deaths per million in Australia and India are identical – 376 per million. What happened?

But yeah, let’s have aother mandate…

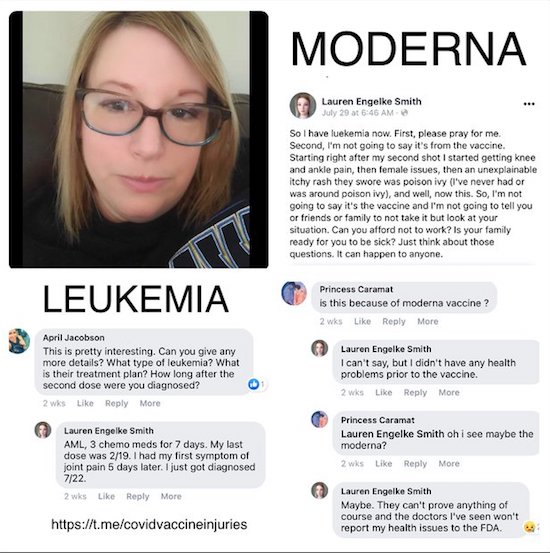

• TWICE as Many Vaccine Deaths as Covid Deaths in US Households (DS)

More than twice as many Americans have lost a household member to a Covid vaccine injury as have lost one to Covid. That’s the shocking finding of a new poll of 1,500 Americans carried out by the polling company Pollfish. While 3.6% of respondents said someone in their household had died from COVID-19, 7.9% said one had died as a result of Covid vaccination. The poll also found that 8.5% said they had been injured by their vaccination, 5% that they had sought medical help and 3.3% that they had been hospitalised, the same proportion who said that as a result of vaccination they were no longer able to work a full day or at all. These are percentages of all respondents. If we look only at the 74.3% vaccinated with at least one dose then the figures, as a proportion of vaccinated persons, are 11.5% injured, 6.8% needing medical help, 4.5% hospitalised and 4.5% unable to work.

While these figures are self-reported and there is no control group, since the unvaccinated were not asked about adverse events, they are still alarmingly high. The poll also found that, among those who reported a Covid death in their household, more than twice as many reported that it occurred after the person was vaccinated than before (2.4% vs 1.1%). The proportion who said they had contracted Covid before their vaccination (17.5%) was very similar to the proportion who said they contracted it afterwards (15.7%). These figures are not indicative of a highly effective vaccine against either infection or death. The people polled were a randomly selected, representative sample of the U.S. public, of whom 74.3% were vaccinated, so the sample was not biased towards or against the reporting of vaccine problems.

Hunter

Here's 3 minutes of news reports showing Joe Biden knew all about Hunter’s foreign business dealings. pic.twitter.com/v6puck4I8b

— RNC Research (@RNCResearch) July 5, 2022

Djokovic

A fundamental truth, eloquently spoken. This is what PRINCIPLE looks like in the flesh

(though most human cattle in Mass Formation have lost the concept) pic.twitter.com/nlLxgtuwTZ— Ivor Cummins (@FatEmperor) July 6, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.