Henri Cartier Bresson Greenfield, Indiana 1960

Absolute must read.

“Economics failed the economy by telling us that everything that could be traded should be traded, since trade is always beneficial to humankind.”

“..the economic growth that the US has chased so desperately, so furiously, never actually existed at all.”

• How Economics Failed the Economy (Haque)

When, in the 1930s, the great economist Simon Kuznets created GDP, he deliberately left two industries out of this then novel, revolutionary idea of a national income : finance and advertising. Don’t worry, this essay isn t going to be a jeremiad against them, that would be too easy, and too shallow, but that is where the story of how modern economics failed the economy and how to understand how to undo it should begin. Kuznets logic was simple, and it was not mere opinion, but analytical fact: finance and advertising don t create new value, they only allocate, or distribute existing value in the same way that a loan to buy a television isn’t the television, or an ad for healthcare isn’t healthcare. They are only means to goods, not goods themselves. Now we come to two tragedies of history.

What happened next is that Congress laughed, as Congresses do, ignored Kuznets, and included advertising and finance anyways for political reasons -after all, bigger, to the politicians mind, has always been better, and therefore, a bigger national income must have been better. Right? Let’s think about it. Today, something very curious has taken place. If we do what Kuznets originally suggested, and subtract finance and advertising from GDP, what does that picture -a picture of the economy as it actually is reveal? Well, since the lion’s share of growth, more than 50% every year, comes from finance and advertising -whether via Facebook or Google or Wall St and hedge funds and so on- we would immediately see that the economic growth that the US has chased so desperately, so furiously, never actually existed at all.

Growth itself has only been an illusion, a trick of numbers, generated by including what should have been left out in the first place. If we subtracted allocative industries from GDP, we’d see that economic growth is in fact below population growth, and has been for a very long time now, probably since the 1980s and in that way, the US economy has been stagnant, which is (surprise) what everyday life feels like. Feels like. Economic indicators do not anymore tell us a realistic, worthwhile, and accurate story about the truth of the economy, and they never did -only, for a while, the trick convinced us that reality wasn’t. Today, that trick is over, and economies grow , but people’s lives, their well-being, incomes, and wealth, do not, and that, of course, is why extremism is sweeping the globe. Perhaps now you begin to see why the two have grown divorced from one another: economics failed the economy.

Now let us go one step, then two steps, further. Finance and advertising are no longer merely allocative industries today. They are now extractive industries. That is, they internalize value from society, and shift costs onto society, all the while, creating no value themselves. The story is easiest to understand via Facebook’s example: it makes its users sadder, lonelier, and unhappier, and also corrodes democracy in spectacular and catastrophic ways. There is not a single upside of any kind that is discernible -and yet, all the above is counted as a benefit, not a cost, in national income, so the economy can thus grow, even while a society of miserable people are being manipulated by foreign actors into destroying their own democracy. Pretty neat, huh?

It was *because* finance and advertising were counted as creative, productive, when they were only allocative, distributive that they soon became extractive. After all, if we had said from the beginning that these industries do not count, perhaps they would not have needed to maximize profits (or for VCs to pour money into them, and so on) endlessly to count more. But we didn’t. And so soon, they had no choice but to become extractive: chasing more and more profits, to juice up the illusion of growth, and soon enough, these industries began to eat the economy whole, because of course, as Kuznets observed, they allocate everything else in the economy, and therefore, they control it.

Discuss. Do social media make you depressed?

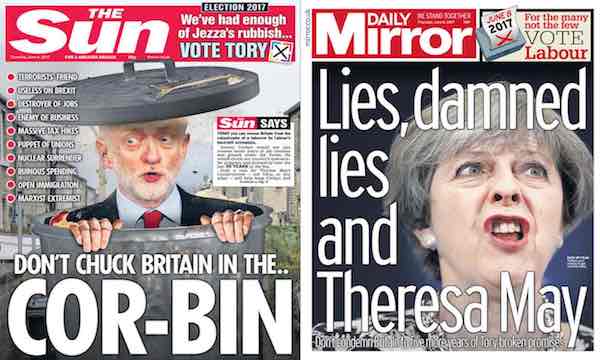

• How Did The News Go ‘Fake’? When The Media Went Social (G.)

The Collins Dictionary word of the year for 2017 is, disappointingly, “fake news”. We say disappointingly, because the ubiquity of that phrase among journalists, academics and policymakers is partly why the debate around this issue is so simplistic. The phrase is grossly inadequate to explain the nature and scale of the problem. (Were those Russian ads displayed at the congressional hearings last week news, for example?) But what’s more troubling, and the reason that we simply cannot use the phrase any more, is that it is being used by politicians around the world as a weapon against the fourth estate and an excuse to censor free speech. Definitions matter. Take, for example, the question of why this type of content is created in the first place.

There are four distinct motivations for why people do this: political, financial, psychological (for personal satisfaction) and social (to reinforce our belonging to communities or “tribes”). If we’re serious about tackling mis- and disinformation, we need to address these motivations separately. And we think it’s time to give much more serious consideration to the social element. Social media force us to live our lives in public, positioned centre-stage in our very own daily performances. Erving Goffman, the American sociologist, articulated the idea of “life as theatre” in his 1956 book The Presentation of Self in Everyday Life, and while the book was published more than half a century ago, the concept is even more relevant today. It is increasingly difficult to live a private life, in terms not just of keeping our personal data away from governments or corporations, but also of keeping our movements, interests and, most worryingly, information consumption habits from the wider world.

The social networks are engineered so that we are constantly assessing others – and being assessed ourselves. In fact our “selves” are scattered across different platforms, and our decisions, which are public or semi-public performances, are driven by our desire to make a good impression on our audiences, imagined and actual. We grudgingly accept these public performances when it comes to our travels, shopping, dating, and dining. We know the deal. The online tools that we use are free in return for us giving up our data, and we understand that they need us to publicly share our lifestyle decisions to encourage people in our network to join, connect and purchase.

But, critically, the same forces have impacted the way we consume news and information. Before our media became “social”, only our closest family or friends knew what we read or watched, and if we wanted to keep our guilty pleasures secret, we could. Now, for those of us who consume news via the social networks, what we “like” and what we follow is visible to many – or, in Twitter’s case, to all, unless we are in that small minority of users who protect their tweets. Consumption of the news has become a performance that can’t be solely about seeking information or even entertainment. What we choose to “like” or follow is part of our identity, an indication of our social class and status, and most frequently our political persuasion.

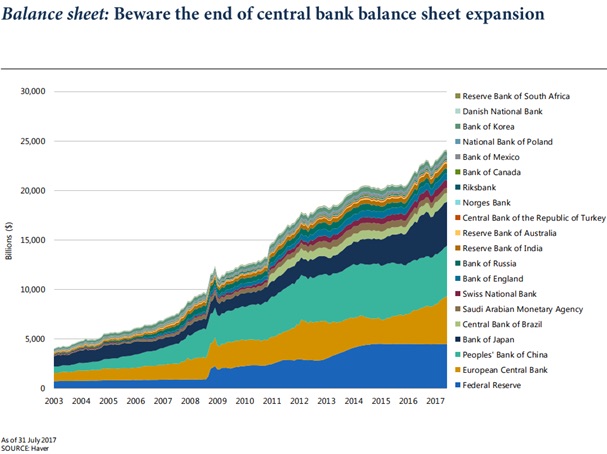

The Fed is not the biggest player anymore.

• Global Economy: Communication Breakdown? (R.)

A flattening of government bond yield curves that may presage an economic downturn could prompt verbal interventions in the coming week by central bankers still struggling to hit this cycle’s inflation targets. ECB chief Mario Draghi, U.S. Fed Chair Janet Yellen, BOJ Governor Haruhiko Kuroda and BOE head Mark Carney will form an all-star panel on Tuesday at an ECB-hosted conference in Frankfurt. The subject? “Challenges and opportunities of central bank communication.” Curve-flattening on both sides of the Atlantic, but more markedly in the United States, suggests investors have doubts over the future path of inflation and may be starting to price in a downturn just as the global economy picks up speed.

Since the Fed began raising rates in 2015, the difference between long- and short-term U.S. yields has shrunk to levels not seen since before the 2008 financial crisis, reaching 67 basis points – its flattest in a decade – in the past week. That partly reflects uncertainty about the passage of a Republican-sponsored bill to cut U.S. taxes, which has hauled down longer-term projections of inflation while expectations for upcoming rate increases push short-term yields higher. With curve-flattening typically signaling a muted outlook for both growth and inflation, the trend suggests investors see a risk that the Fed’s current monetary tightening cycle will start to slow the world’s biggest economy. A flatter curve, which makes lending less profitable, also poses a risk to the banking sector, nursed back to fragile health by central banks after it nearly collapsed a decade ago. But with crisis-era policies still largely in place, how would central banks cushion the impact of a downturn?

Because of Draghi and Kuroda.

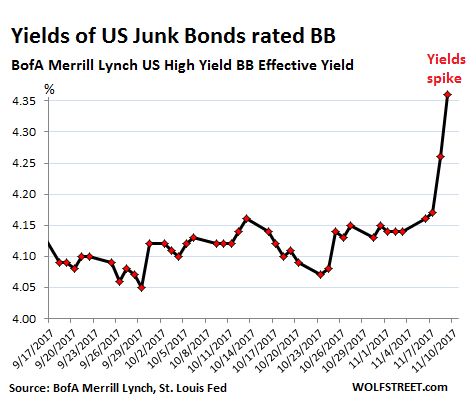

• Financial Markets Are Still Blowing Off the Fed (WS)

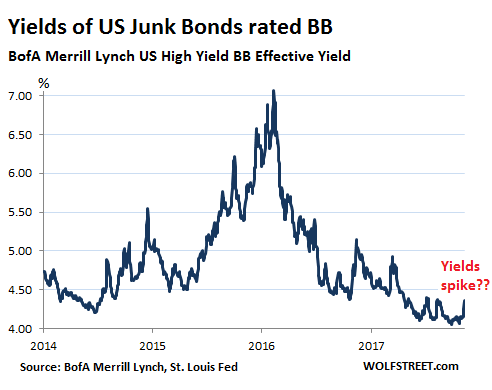

There has been a lot of hand-wringing about junk bonds this week, that they have gotten clobbered, that losses have been taken, that this is a predictor of where stocks are headed, etc., etc., because after a steamy rally in junk-bond prices from the February 2016 low, there has now been a sell-off. When bond prices fall, bond yields rise by definition. And the average yield of BB-rated junk bonds – the upper end of the junk-bond spectrum – did this:

No one likes to lose money, and junk bonds did lose money this week, an astounding event, after all the easy money that had been made since early February 2016. But how far have yields really spiked? The chart below shows the same BofA Merrill Lynch US High Yield BB Effective Yield index, but it puts that “spike” into a three-year context:

For further context, the BB yield spiked – a true spike – to over 16% during the Financial Crisis, as bond prices crashed and as credit froze up. Currently, at 4.36%, the average BB yield is off record lows, but it’s still low, and junk bond prices are still enormously inflated, given the inherent credit risks, and have a lot further to fall before any hand-wringing is appropriate. The low BB yield means that risky companies with a junk credit rating can still borrow money at near record low costs in a world awash in global liquidity that is trying to find a place to go. This shows that “financial conditions” are very easy. The market has now four Fed rate hikes under its belt and the QE unwind has commenced. Another rake hike is likely in December. Tightening is under way. By “tightening” its monetary policy, the Fed attempts to tighten financial conditions in the markets. That’s its goal.

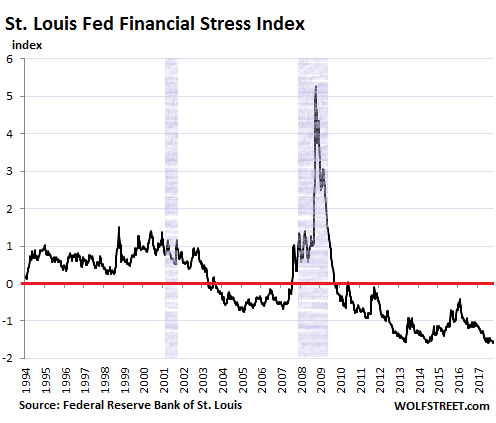

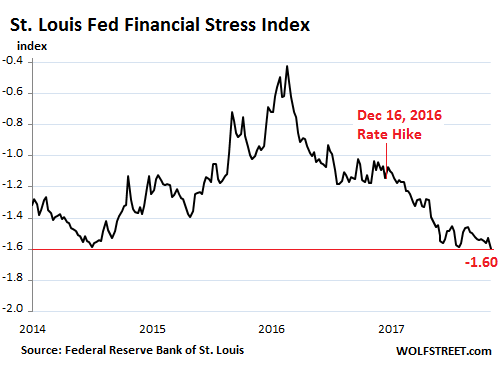

But that hasn’t happened yet. While short-term yields have responded to the rate hikes, longer-term yields are now lower than they’d been at the time of the rate hike in December 2016. Stocks have rocketed higher. Volatility indices are near record lows. And various yield spreads have narrowed sharply – for example, the difference between the 10-year Treasury yield and the 2-year Treasury yield is currently just 0.73 percentage points. In other words, raising money is easy and cheap. And “financial stress” in the markets, as measured by the St. Louis Fed’s Financial Stress Index, has just hit a record low. In the chart below, the red line (= zero) represents “normal financial market conditions.” Values below the red line indicate below-average financial market stress. Values above the red line indicate higher than average financial stress. The latest reading of the index dropped to -1.60, by a hair below the prior record low in 2014:

In other words, financial conditions have never been easier despite the current series of rate hikes, the Fed’s “balance-sheet normalization, and the hand-wringing about junk bonds this week. The chart below shows the Financial Stress Index going back to 2014. In that time frame, all values are below zero. Financial stress in the markets was heading back to normal in late 2015 and early 2016, as a small sector of the total markets – energy junk-bonds – were getting crushed and as the S&P 500 index experienced a downdraft. But in early February 2016, everything turned around:

Europe’s problem is huge: “..the ECB repurchase program exceeds net sovereign bond issuances in the eurozone by more than seven times. Throughout the US QE (quantitative expansion) of the Federal Reserve, it never reached 100% of net issuances.” Thing is, it’s Draghi who keeps the global economy going.

• Is There Any Way Out Of The ECB’s Trap? (Lacalle)

The ECB faces the Devil’s Alternative that Frederick Forsyth mentioned in one of his books. All options are potentially risky. Mario Draghi knows that maintaining the so-called stimuli involves more risks than benefits, but also knows that eliminating them could make the eurozone deck of cards collapse. Despite the massive injection of liquidity, he knows that he can not disguise political risks such as the secessionist coup in Catalonia. The Ibex reflects this, making it clear that the European Central Bank does not print prosperity, it only puts a floor to valuations. The ECB wants a weak euro. But it is a game of juggling to pretend a weak euro and at the same time a strong economy. The EU countries export mostly to themselves. Member countries sell more than two-thirds of their goods and services to other countries in the eurozone.

Therefore, the more they export and their economies recover, the stronger the euro, and with it, the risk of losing competitiveness. The ECB has tried to break the euro strength with dovish messages, but it has not worked until political risk reappeared. With the German elections and the prospect of a weak coalition, the results of the Austrian elections and the situation in Spain, market operators have realized – at last – that the mirage of “this time is different “in the European Union was simply that, a mirage. A weak euro has not helped the EU to export more abroad. Non-EU exports from the member countries have been stagnant since the monetary stimulus program was launched, even though the euro is much weaker than its basket of currencies compared to when the stimulus program began. The Central Bank Trap. This shows that export growth is not achieved by artificial subsidies such as a devaluation, but from added value, something that the EU has stopped looking for.

Escape From The Central Bank Trap explains that the ECB has got itself in a problem that is not easy to solve. The first evidence is that it should have finished its stimuli months ago according to its own plan, but is unable to do it. The second is that, with more than a trillion euros of excessive liquidity, the ECB keeps a figure of repurchases that were clearly unnecessary and that have resulted in the figure of excess liquidity being multiplied by more than ten. The third is that perverse incentives have taken over the European economic policy. Risks are relevant. This week I had the opportunity to speak at the Federal Reserve Bank of Houston and I explained that the ECB repurchase program exceeds net sovereign bond issuances in the eurozone by more than seven times. Throughout the US QE (quantitative expansion) of the Federal Reserve, it never reached 100% of net issuances.

Now that the ECB “reduces” these repurchases to 30 billion euros per month, it will continue to be more than 100% of net issuances. What does that mean? That the US always maintained a healthy secondary market alive, which guaranteed that there would not be huge risks of collapse when tapering started, because the Federal Reserve bought less than what was issued, paying attention to the market accepting the valuations of bonds and financial assets. By extending the repurchase program, the ECB admits that it does not know if there is a secondary market that would buy European government bonds at current yields. Ask yourself a question. Would you buy bonds from a heavily indebted state that has stopped its reform impulse with a 10-year yield of less than 2%, if the ECB did not buy them back? Exactly. No.

What’s needed is a whole overthrow of taxation as we know it. The Paradise Papers point to where the changes should be.

• How to Break Out of Our Long National Tax Nightmare (BW)

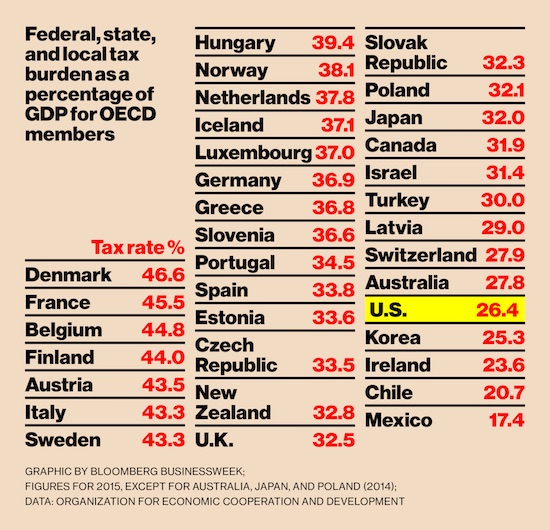

President Donald Trump wanted to call it the Cut Cut Cut Act. Congressional Republicans settled on the less catchy and no more descriptive Tax Cuts and Jobs Act. What the legislation that began making its way through the U.S. House of Representatives in early November actually would do is sharply reduce taxes for business while rearranging the personal income tax with a mix of cuts and increases. House Speaker Paul Ryan called the bill “a game changer for our country.” The president said it was “the rocket fuel our economy needs to soar higher than ever before.” That’s a lot to expect from some changes in the tax code. But then, here in the U.S. we’ve come to expect big things of our income taxes. On the right, cutting them has been portrayed for decades as a near-magical growth elixir. On the left, raising or rearranging them is seen as essential to making society fairer.

And across the political spectrum, economic and social policies have come to rely on carving credits, deductions, and other exceptions out of the tax code to favor this or that behavior. It can sometimes feel, in fact, as if “we have lost sight of the fact that the fundamental purpose of our tax system is to raise revenues to fund government.” That was the lament of President George W. Bush’s Advisory Panel on Federal Tax Reform in November 2005. But this bipartisan group of worthies couldn’t agree on how to raise those revenues either, instead offering two plans with differing priorities. Both were mostly ignored by Congress at the time, though some of the recommendations—such as shrinking the tax deductions for mortgage interest and state and local taxes—have found their way into this year’s bill. Overall, though, it appears that the legislation will only make it harder to raise revenue to fund government.

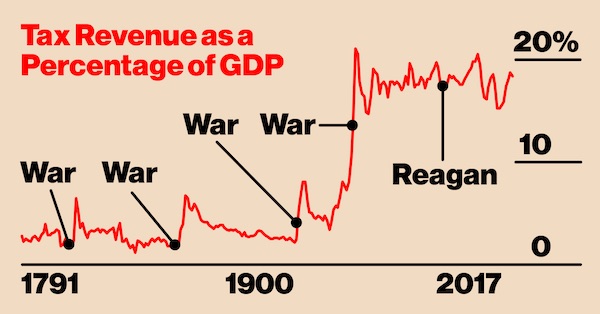

The House and Senate have passed budget resolutions clearing the way for $1.5 trillion in revenue losses over the next decade from the tax changes. That’s $150 billion a year to add to a federal deficit that totaled a sinister-sounding $666 billion, 3.5% of GDP, in the just-ended fiscal year. All of which is a longer way of saying that we’ll almost certainly be back at this once again in the all-too-foreseeable future, trying to figure out a better way to fund the government. Since 1981, the year of President Ronald Reagan’s big tax cut, Congress has passed and presidents have signed 55 bills that the Urban-Brookings Tax Policy Center counts as “major” tax legislation. During the prior 36 years there had been just 18. [..] Ominously, most previous U.S. tax eras ended with major wars that required big increases in government revenue. Let’s hope it doesn’t take that to break us out of the cut-reform-increase-repeat loop we’re currently trapped in.

This will make the next debt round a lot harder, and more expensive.

• Tesla’s Junk Bonds Trading Under Water, Could Spell Trouble For Elon Musk (MW)

Tesla’s first-ever pure corporate bonds are trading under water, boding ill for the Silicon Valley car maker’s next attempt to tap capital markets. Tesla sold $1.8 billion in the senior notes in August at a yield of 5.300%, at the height of excitement about the Model 3 and expectations the sedan’s production ramp would run as smoothly as Chief Executive Elon Musk had predicted. That same month, Tesla shares rose 10% to mark their last monthly gain this year so far. The stock lost 4.2% in September and 2.8% in October. The stock is down 9% so far in November, on the heels of a quarterly miss earlier in the month and news that the company has further pushed out its Model 3 production targets. “Third-quarter results put some pressure on the cash flow needs,” said Efraim Levy, an analyst with CFRA Research.

The wider-than-expected quarterly loss and production delays “makes it harder for them to get a sweeter deal than they had in the past,” on capital raising, be it when selling bonds or equity, he said. The 5.300% notes, which mature in 2025, were trading at 94 cents on the dollar on Friday to yield 6.287%, according to trading platform MarketAxess. On a spread basis, they were trading at 393 basis points above comparable Treasurys. The bonds fell under par within a week of issuance, but were holding above 97 cents for much of October. Wall Street has long seemed to accept that Tesla’s high capital expenses and negative free cash flow will be the reality for the company at least in the short term.

But the weak performance of the bonds may be a sign that bond investors, at least, are starting to disbelieve Tesla’s growth story and will be looking for higher premiums to take on higher risk, said Trip Miller, a managing partner at hedge fund, Gullane Capital LLC. That higher cost of borrowing will have its own negative implications, he said. “Maybe the dam is starting to break for Tesla,” Miller said. Gullane does not have a position in Tesla because “their balance sheet is very, very troublesome for us,” he said.

Everyone’s fighting corruption these days. Time for us to start doing the same?

• China Faces Historic Corruption Battle, New Graft Buster Says (R.)

China must win its battle against corruption or face being erased by history, its new top graft buster said in an editorial on Saturday, underscoring the ruling Communist party’s focus on eliminating corrupt behaviour. Zhao Leji, appointed to the new seven-member politburo standing committee last month and tasked to lead president Xi Jinping’s signature war on corruption, wrote in the state-run People’s Daily that failure would lead to the party’s downfall. “If our control of the party is not strong and party governance is not strict, then the party won’t be able to avoid being erased by history and the historic task the party carries will not be able to be fulfilled,” Zhao wrote. Xi, like others before him, has warned corruption is so serious it could lead to the end of the party’s grip on power.

The president’s corruption fight has ensnared more than 1.3 million officials. At last month’s five-yearly party congress he said it would continue to target both “tigers” and “flies“, a reference to elite officials and ordinary bureaucrats. Zhao, formerly a low-profile official, replaced Wang Qishan, whose sweeping anti-graft campaign had made him China’s second most-powerful politician. “The facts tell us and warn us that the party’s position as the top political leader and power is the foundation of our political stability, economic development, national unity and social stability,” Zhao wrote. Zhao leads the central commission for discipline inspection, having previously been in charge of the party’s powerful organisation department, which is in charge of personnel decisions. He added that there would be no tolerance of people who “just do what they want to do” and ignore orders or carry on with banned behaviours such as trying to get around policy decisions.

It’s crazy these people are kept from talking.

• Putin, Trump Agree To Fighting ISIS In Syria, Kremlin Says (R.)

Russian President Vladimir Putin and U.S. President Donald Trump agreed a joint statement on Syria on Saturday that said they would continue joint efforts in fighting Islamic State until it is defeated, the Kremlin said. The White House did not immediately respond to questions about the Kremlin announcement or the conversation the Kremlin said took place on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit in the Vietnamese resort of Danang. The Kremlin said the statement on Syria was coordinated by Russian Foreign Minister Sergei Lavrov and U.S. Secretary of State Rex Tillerson especially for the meeting in Danang. Putin and Trump confirmed their commitment to Syria’s sovereignty, independence and territorial integrity and called on all parties to the Syrian conflict to take an active part in the Geneva political process, it said.

Moscow and Washington agree there is no military solution to the Syrian conflict, according to the text of the joint statement published on the Kremlin’s website. Television pictures from Danang showed Putin and Trump chatting – apparently amicably – as they walked to the position where the traditional APEC summit photo was being taken at a viewpoint looking over the South China Sea. Earlier pictures from the meeting show Trump walking up to Putin as he sits at the summit table and patting him on the back. The two lean in to speak to each other and clasp each other briefly as they exchange a few words. Although the White House had said no official meeting was planned, the two also shook hands at a dinner on Friday evening. Trump has shown little appetite for holding talks with Putin unless there is some sense that progress could be made on festering issues such as Syria, Ukraine and North Korea.

“Companies are hiding behind technology, bogusly classifying people as self-employed so they can get away from paying minimum wage.”

• Uber Loses Appeal In UK Employment Rights Case (G.)

The ride-hailing firm Uber has lost its appeal against a ruling that its drivers should be classed as workers with minimum-wage rights, in a case that could have major ramifications for labour rights in the growing gig economy. The US company, which claims that drivers are self-employed, said it would launch a further appeal against the Employment Appeal Tribunal decision, meaning the case could end up in thesupreme court next year. Drivers James Farrar and Yaseen Aslam won an employment tribunal case last year after arguing they should be classified as workers, citing Uber’s control over their working conditions. Uber challenged the ruling at the tribunal in central London, warning that it could deprive riders of the “personal flexibility they value”. It claims that the majority of its drivers prefer their existing employment status.

The Independent Workers’ Union of Great Britain (IWGB), which backed the appeal, said drivers will still be able to enjoy the freedoms of self-employment – such as flexibility in choosing shifts – even if they have worker status. The union said the decision showed companies in the gig economy – which involves people on flexible working patterns with irregular shifts and minimal employment rights – have been choosing to “deprive workers of their rights”. Farrar said: “It is time for the mayor of London, Transport for London and the transport secretary to step up and use their leverage to defend worker rights rather than turn a blind eye to sweatshop conditions.” “If Uber are successful in having this business model, obliterating industrial relations as we know them in the UK, then I can guarantee you on every high street, in retail, fast food, any industry you like, the same thing will go on.”

Farrar said he was willing to fight the case all the way to the supreme court if necessary but called on Uber’s new chief executive, Dara Khosrowshahi, to intervene instead. “We’ve asked to meet him when he came to London and Uber declined to do that, which tells you everything.” Aslam said: “Today is a good day for workers, we made history. The judge confirmed that Uber is unlawfully denying our rights.” “It’s about making sure workers across the UK are protected. Companies are hiding behind technology, bogusly classifying people as self-employed so they can get away from paying minimum wage. That can’t be allowed to happen.”

Good.

• Greece Prepares Online Platform for ‘Airbnb Tax’ (GR)

Greece is cracking down on undeclared income of owners leasing residential lodgings on a short-term basis. Tax authorities are creating an online platform where Airbnb lodged properties should be declared, or face a hefty fine. According to a report in Naftemporiki, registration will be mandatory and it will provide property owners with a certification number, which should be declared on any digital platform, website and social media where it is advertised – including the Airbnb website. The platform will demand the declaration of the property, the names of the renters and the duration of the lease, or otherwise face a fine of up to €5,000. Naftemporiki says that income from short-term residential leasing will be taxed based on income.

Specifically, for a taxpayer with a yearly income of up to 12,000 euros, the tax rate for income derived from short-term residential leasing will reach 15%; 35% for a taxpayer with between 12,000 to 35,000 euros in annual income. Above an annual income of 45,000 euros, a taxpayer’s income from short-term residential leasing will reach the astronomical rate of 45%, i.e. nearly one in two euros goes to the state. Tax authorities aim to collect revenue from people who put their property for lease on Airbnb, as many crisis-hit Greeks try to make ends meet by renting their homes to foreign visitors. It is estimated that three million tourists will be hosted in Greek homes in 2017.

He’s lying. They didn’t act to save the Greek banks, but the German and French ones. And he knows it.

• Dijsselbloem: We Saved the Greek Banks but Overlooked Taxpayers (GR)

Outgoing Eurogroup chief Jeroen Dijsselbloem acknowledged on Thursday that Greece’s creditors put too much emphasis on saving the banks at the expense of ordinary taxpayers. In an exchange of views on Greece in the European Parliament’s Employment and Social Affairs Committee, Dijsselbloem was asked if he agrees with the view that Greece’s first bailout programme was designed to support the banks. Dijsselbloem noted that “banks were the biggest problem in all countries,” at the start of the crisis. “We had a banking crisis, a fiscal crisis and we spent a lot of the tax-payers’ money – in the wrong way, in my opinion – to save the banks so that the people criticizing us and saying that everything was being done for the benefit of the banks were to some extent right,” he said.

“This was the reason why we introduced the banking union and the introduction of higher standards, better supervision and a reform and rescue framework when banks have losses…Precisely so that we don’t find ourselves in that situation again,” Dijsselbloem added. Dijsselbloem also claimed that the labour market reforms adopted by Greece had brought “clear improvements” that were reflected in the latest unemployment figures in the country. Referring to the programme as a whole, the outgoing Eurogroup president said the economic situation in Greece had improved as a result of the reforms and stressed the need to conclude the third review on time.

This story gets darker fast. The UK deleted a lot of documents relvant to the Assange accusations AND told the Swedes not to talk to him in London.

• FOIA Litigation Is Shedding Light On The Case Of Julian Assange (Maurizi)

The siege by Scotland Yard agents around the red brick building in Knightsbridge has been gone for two years now. And with Sweden dropping the rape investigation last May, even the European arrest warrant hanging over Julian Assange’s head like the sword of Damocles has gone. Many expected the founder of WikiLeaks to leave the Ecuadorian Embassy in London, where he has been confined for over five years, after spending one and a half years under house arrest. But Assange hasn’t dared leave the Embassy due to concern he would be arrested, extradited to the US and charged for publishing WikiLeaks’ secret documents.

Julian Assange’s situation is unique. Like him and his work or not, he is the only western publisher confined to a tiny embassy, without access to even the one hour a day outdoors maximum security prisoners usually receive. He is being arbitrarily detained, according to a decision by the UN Working Group on Arbitrary Detentions in February 2016, a decision which has completely faded into oblivion. December 7th will mark seven years since he lost his freedom, yet as far as we know, in the course of these last 7 years no media has tried to access the full file on Julian Assange.

That is why next Monday, La Repubblica will appear before a London Tribunal to defend the press’ right to access the documents regarding his case, after spending the last two years attempting Freedom of Information requests (FOI) without success. It is entirely possible, however, that we will never be able to access many of these documents, as last week London authorities informed us that “all the data associated with Paul Close’s account was deleted when he retired and cannot be recovered”. A questionable choice indeed: Close is the lawyer who supported the Swedish prosecutors in the Swedish investigation on Julian Assange from the beginning. What was the rationale for deleting historical records pertaining to a controversial and still ongoing case?