Pablo Picasso The blue room 1901

Xi halts outflows.

• Chinese Property Buyers Are GONE (MB)

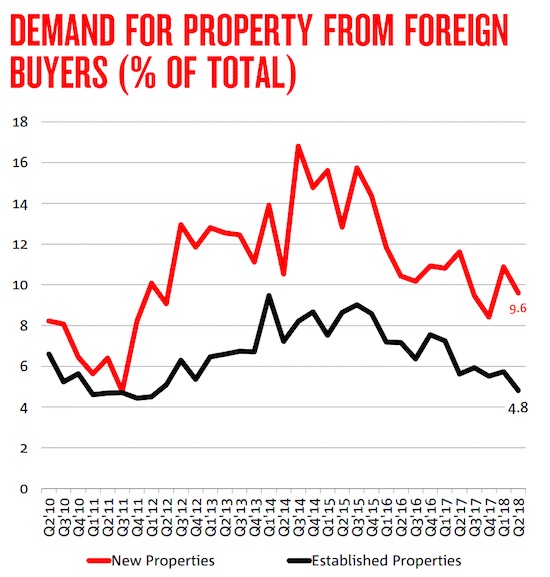

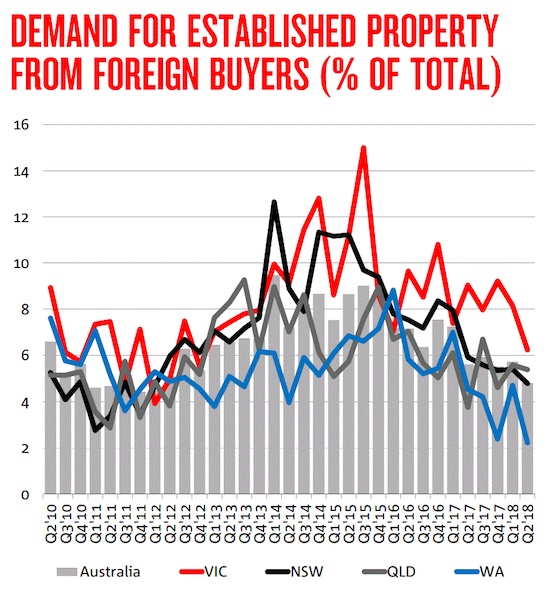

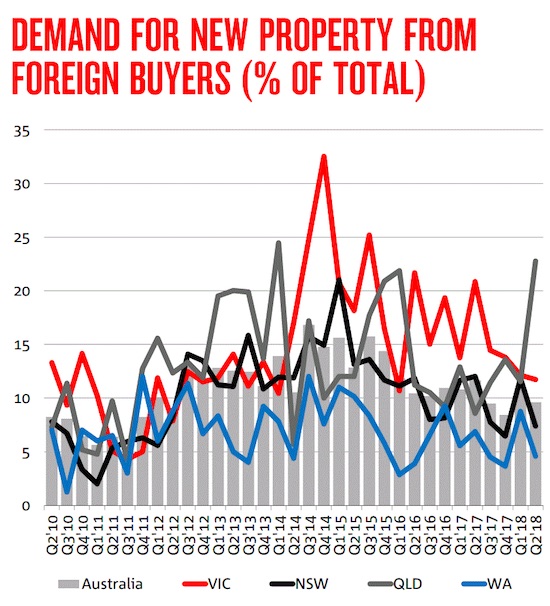

NAB’s survey results have highlighted to a trend decline in foreign buying activity in recent quarters resulting from policy changes in China on foreign investment outflows and tighter restrictions on foreign property buyers in Australia. In Q2 2018, there were fewer foreign buyers in the market for Australian property, with their market share dipping to 9.6% (10.9% in Q1 2018) in new housing markets and to 4.8% in established housing markets (5.7% in Q1 2018 and their lowest share since Q1 2012).

In established housing markets, the share of sales to foreign buyers fell in all states. They continued to be most active in VIC but their market share of total sales fell to a 4-year low of 6.2% (8.2% in Q1 2018). The decline was even more pronounced in NSW, where their market share fell to 4.8% (5.4% in Q1 2018) – the lowest level in over 6 years. In QLD, foreign buyers accounted for 5.4% of total sales (5.6% in Q1 2018), while in WA their share fell to 2.2% (4.7% in Q1 2018).

In new property markets, the share of sales to foreign buyers fell in all states except QLD where their share jumped to 22.8% (11.5% in Q1 2018). This may have reflected anecdotal reports of increased Chinese property investment associated with record numbers of Chinese student enrolments in the state. In contrast, the share of foreign buyers fell to 11.7% in VIC (down from an average of 14.4% since the survey started), 7.4% in NSW (from an average of 10.2%) and 4.6% in WA from an average of 6.8%.

Sydney house prices down 11-15%.

• It “Hit the Mortgage Market Over the Head with a Baseball Bat” (WS)

Australia’s housing market is getting rattled. The mortgage industry is in turmoil. Banks are battered by incessant revelations of misconduct. Home prices in the Sydney and Melbourne metros, after surging to an astounding degree, are deflating. And the once splendid and vast game of real-estate speculation just isn’t fun anymore. Lindsay David, of LF Economics in Sydney — who has long played a role in exposing misconduct in Australia’s banking system including, in early 2016, by calling for a Royal Commission investigation into the mortgage sector — put some findings of his boots-on-the-ground analysis into a note to clients. Here are some of them:

1. Drop-off in Speculative Demand: “We spent countless hours” in recent months “observing buyer turnouts to scheduled property inspections of houses for sale,” he writes. “While there may still be a small sum of properties on market that continue to see very large turnouts, there was a clear visual drop-off of engaged interest from buyers and indeed ‘property snoops’ across the majority of properties for sale that we had observed.” “On many occasions, we observed either no interested parties, or less than 4 parties inspecting a property across a very decent chunk of offerings on the market,” he writes. “This lower rate of turnouts was something we simply had not observed over the years at such a dramatic scale.”

2. Sharper drop in selling prices than shown in official data: According to CoreLogic (the official data), home prices in Sydney fell 4.6% in June compared to a year ago, with house prices down 6.2%, and prices of condos down 0.7%. In the most expensive quartile, prices fell 7.3%. But Lindsay David writes: “It is our view based on all the resources made available that house prices in the Sydney area have broadly fallen somewhere between 11% and 15% over the comparison period.”

This one stinks.

• No Evidence In Mueller’s Indictment Of 12 Russians (MoA)

The Special counsel Robert Mueller issued an indictment against 12 Russian people alleged to be officers or personal of the Russian Military Intelligence Service GRU. The people, claims the indictment, work for an operational (26165) and a technical (74455) subunit of the GRU. A Grand Jury in Washington DC issued 11 charges which are described and annotated below. A short assessment follows. The first charge is for a “Conspiracy to Commit an Offense Against the United States” by stealing emails and leaking them. The indictment claims that the GRU units sent spearfishing emails to the Hillary Clinton campaign and the Democratic Party organizations DNC and DCCC. They used these to get access to email boxes of John Podesta and other people.

They are also accused of installing spyware (X-agent) on DNC computers and of exfiltrating emails and other data from them. The emails were distributed and published by the online personas DCLeaks, Guccifer II and later through Wikileaks. The indictment claims that DCLeaks and Guccifer II were impersonations by the GRU. Wikileaks, “organization 1” in the indictment, is implicated but so far not accused. Note: There is a different Grand Jury for the long brewing case against Julian Assange and Wikileaks. Assange has denied that the emails he published came from a Russian source. Craig Murray, a former British ambassador, said that he received the emails on a trip to Washington DC and transported them to Wikileaks.

The indictment describes in some detail how various rented computers and several domain names were used to access the DNC and DCCC computers. The description is broadly plausible but there is little if any supporting evidence.

The Special Counsel was for collusion. There is none.

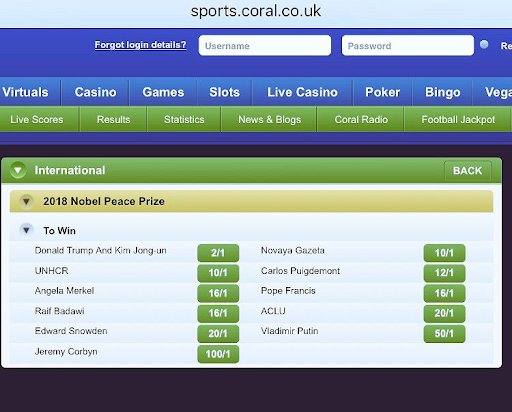

• Lawmakers Press Trump To Cancel Putin Summit After Mueller Indictments (CNBC)

Lawmakers are calling on President Donald Trump to cancel a meeting with Russian leader Vladimir Putin after special counsel Robert Mueller charged against 12 Russians for interfering in the 2016 U.S. Presidential election Friday. Democratic leadership in the Senate and House of Representatives, alongside a growing list of other Democratic lawmakers, called on the president to abandon the meeting, which is scheduled to take place Monday in Helsinki, Finland. In their statements, many Democrats said they did not trust Trump, who has often expressed a desire to improve U.S.-Russia relations, to confront Putin about Russia’s role in the 2016 election.

They were joined by at least one high-profile member of the opposing party: Republican Sen. John McCain of Arizona, a frequent Trump critic and a Russia hawk, called on the president to cancel the summit if he is “not prepared to hold Putin accountable.” But the Trump administration appears unlikely to do so. White House press secretary Sarah Huckabee Sanders told NBC News on Friday afternoon that the summit is “still on.” The White House downplayed the significance of the indictment, noting there were no allegations against members of Trump’s campaign team. The president’s lawyer, former New York City Mayor Rudy Giuliani, said the charges were “good news for all Americans” and called on the special counsel to end his investigation and declare the president innocent.

“Rosenstein knows that he needs no evidence, because the accused will never be brought to trial.”

• Trump Should Fire Rosenstein Immediately (PCR)

Does Deputy Attorney General Rod Rosenstein’s indictment of 12 Russian military intelligence officers for allegedly hacking Hillary’s emails and interfering in the US election have any purpose other than to throw a monkey wrench in President Trump’s upcoming summit with Putin? Don’t forget that Rosenstein is implicated in the orchestration of Russiagate as a weapon against Trump, a weapon that serves the interests of the Democratic Party and the military/security complex about which President Eisenhower warned us 56 years ago to no avail. Rosenstein’s indictment of 12 Russians for allegedly hacking computers is a political indictment aimed at President Trump. The indictment is otherwise pointless as the Russian government will certainly not turn over its military personnel to a Washington kangeroo court.

The indictment serves no purpose except to poison the atmosphere of the summit. If you read the indictment, you will see that it consists of nothing but improbable accusations. There is no way on earth that the US Justice (sic) Department would be able to acquire the information in this fictional story that Rosenstein has presented. Moreover, there is no sign whatsoever of any evidence in the indictment. Rosenstein knows that he needs no evidence, because the accused will never be brought to trial.

Rosenstein has thrown red meat to the presstitutes, who are assets of the military/security compex and Democratic Party, and the presstitutes will pressure the Republicans to get behind Rosenstein’s call for a united front against Russian interference. You can imagine what would happen if Trump and Putin were to have a successful summit and normalize the relations that Washington ruined between the two countries.

“As a rule, American presidents have departed for summits with bipartisan support and well-wishes.”

• Summitgate and the Campaign vs. ‘Peace’ (Stephen Cohen)

As a rule, American presidents have departed for summits with bipartisan support and well-wishes. Trump’s upcoming meeting with Russian President Putin, in Helsinki on July 16, is profoundly different in two respects. US-Russian relations have rarely, if ever, been more dangerous. And never before has a president’s departure—in Trump’s case, first for a NATO summit and then the one with Putin—been accompanied by allegations that he is disloyal to the United States and thus cannot be trusted, defamations once issued only by extremist fringe elements in American politics. Now, however, we are told this daily by mainstream publications, broadcasts, and “think tanks.”

According to a representative of the Clintons’ Center for American Progress, “Trump is going to sell out America and its allies.” The New York Times and The Washington Post also feature “experts”—they are chosen accordingly—who “worry” and “fear” that Trump and Putin “will get along.” The Times of London, a bastion of Russophobic Cold War advocacy, captures the mainstream perspective in a single headline: “Fears Grow Over Prospect of Trump ‘Peace Deal’ with Putin.”

An anti-“peace” Washington establishment is, of course, what still-unproven Russiagate allegations have wrought, as summed up by a New York magazine writer who advises us that the Trump-Putin summit may well be “less a negotiation between two heads of state than a meeting between a Russian-intelligence asset and his handler.” The charge is hardly original, having been made for months at MSNBC by the questionably credentialed “intelligence expert” Malcolm Nance and the, it seems, selectively informed Rachel Maddow, among many other “experts.” Considering today’s perilous geopolitical situation, it is hard not to conclude that much of the American political establishment, particularly the Democratic Party, would prefer trying to impeach Trump to averting war with Russia, the other nuclear superpower. For this too, there is no precedent in American history.

The fear of peace.

• The Globalist Elite Fears Peace, Wants War (Pieraccini)

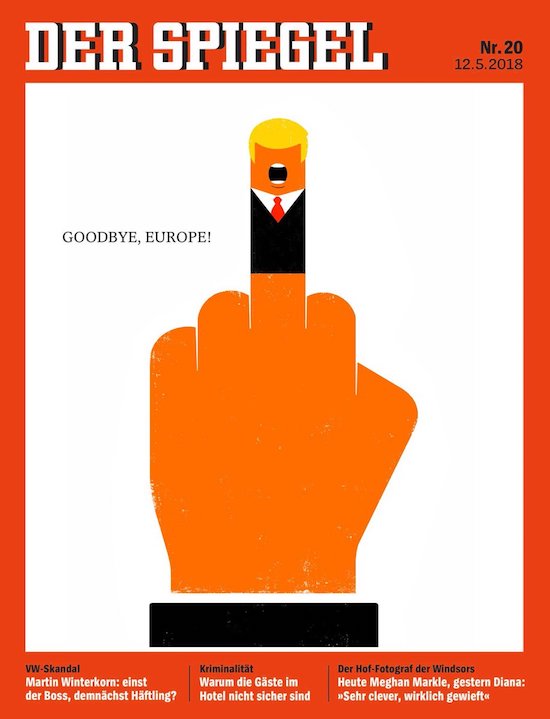

Sometimes reality is stranger than fiction. The following so stretches credulity that sources will have to be cited and an exact quotations given to be believed. A case in point is the following title: “Fears growing over the prospect of Trump ‘peace deal’ with Putin”. The Times does not here fear a military escalation in Ukraine, an armed clash in Syria, a false-flag poisoning in England, or a new Cold War. The Times does not fear a nuclear apocalypse, the end of humanity, the suffering of hundreds of millions of people. No, one of the most authoritative and respected broadsheets in the world is fearful of the prospect of peace! The Times is afraid that the heads of two nuclear-armed superpowers are able to talk to each other.

The Times fears that Putin and Trump will be able to come to some kind of agreement that can help avert the danger of a global catastrophe. These are the times in which we live. And this is the type of media we deal with. The problem with The Times is that it forms public opinion in the worst possible way, confusing, deceiving, and disorienting its readers. It is not by accident the world in which we live is increasingly divorced from logic and rationality. Even if the outcome of this meeting does not see any substantial progress, the most important thing to be achieved will be the dialogue between the two leaders and the opening of negotiation channels for both sides. In The Times article, it is assumed that Trump and Putin want to reach an agreement regarding Europe.

The insinuation is that Putin is manipulating Trump in order to destabilize Europe. For years now we have been inundated with such fabrications by the media on behalf of their editors and shareholders, all part of the deep state conglomerate. Facts have in fact proven that Putin has always desired a strong and united Europe, looking to integrate Europe into the Eurasian dream. Putin and Xi Jinping would like to see a European Union more resistant to American pressure and able to gain greater independence. The combination of mass migration and sanctions against Russia and Iran, which end up hurting Europeans, opens the way for alternative parties that are not necessarily willing to Washington’s marching orders.

“..this endgame of competing impossibilisms..”

• Theresa May Is Approaching Her Zero Dark Thirty Moment (G.)

Donald Trump’s outburst may have done Theresa May a fleeting favour. Had the grand Shrek not delivered every imaginable insult (short of impugning St Gareth of Southgate) to his host country yesterday, the story in the spotlight this weekend would have been on the growing disquiet around May’s handling of the Chequers agreement on Brexit, and the darkening mood that has descended on her own benches. As it turned out, May rode out the turbulence. But with the awkward visitor gone, the stony road to Brexit – “a tough deal”, as the US president observed – resumes. What started a mere week ago as applause for the prime minister in facing down her most troublesome ministerial insurgents has slipped into acute agitation.

It turns in part on the convoluted deal itself – but also on a fresh bout of panic about her ability to lead when the pressure is on. The departures of Boris Johnson and David Davis disconcerted Brexiteers – but did not unleash rebellion. Thursday’s white paper was another matter. Its use of the term “association agreement” (not used previously) was a red rag to many bulls. Given that the last one the European Union signed was with Ukraine, it hardly takes a marketing genius to see the problem. In this endgame of competing impossibilisms – hard Brexit versus a byzantine arrangement of near-customs-union “associations”, segmented agreements on goods and services, and somewhat indeterminate reassurance for the City on how its practices will be affected – the prime minister’s nightmare is that both enemy camps conclude they don’t want whatever she is offering.

This is the Zero Dark Thirty moment at which a serious move to oust May becomes probable – unless she can take back control of her disputatious party. May is not quite at that point – but perilously close. As one recently departed senior figure put it, there is no such thing as summer relief “because Graham Brady’s letter box is open over the recess”. Brady is the chair of the backbench MPs’ committee to which no-confidence votes would be submitted.

It’s gotten far too big.

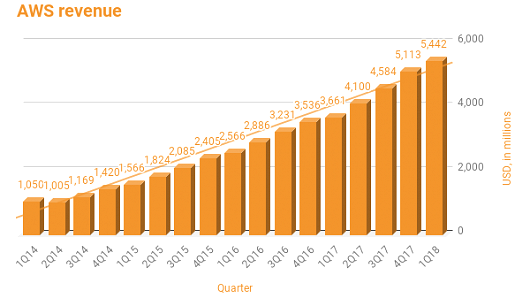

Amazon is a Goliath in very different sectors. One is the internet cloud, a booming business. Amazon Web Services has evolved into the single largest player offering cloud computing services to companies, governments, and individuals. In the first quarter, AWS owns 33% share of the cloud infrastructure market, ahead of Microsoft with a 13% share, and Google with a 6% share. Being the biggest kid on the block, it has become the shoo-in for a multi-year $10-billion Pentagon contract. That business is highly profitable.

Less profitable are Amazon’s e-commerce operations. But in terms of magnitude, Amazon totally rules. According to a report from eMarkter, cited by CNBC, Amazon’s online sales in the US are expected to surge 30% in 2018 compared to a year earlier, to $258 billion. This would boost Amazon’s share of US e-commerce sales of 49.1%! The other combatants are fighting over the crumbs in terms of market share. The next nine largest e-commerce operations combined grab about 22% of the market: eBay (EBAY): 6.6% Apple (AAPL): 3.9% Walmart (WMT): 3.7% Home Depot (HD): 1.5% Best Buy (BBY) 1.3% QVC Group (QVCA): 1.2% Macy’s (M): 1.2% Costco (COST): 1.2% Wayfair (W): 1.1%

That leaves 29% of e-commerce for all the other retailers with online operations, from Bed Bath & Beyond (BBBY) to the tiniest home-office operations, millions of them. Amazon online sales fall into two categories: its “direct sales” and the sales from other sellers that use Amazon’s platform and execution (“Marketplace sales”). Both are growing in leaps and bounds, but Marketplace sales are growing the fastest. In 2018, Marketplace sales are expected to account for 68% of Amazon’s e-commerce sales, and direct sales for 32%, according to eMarketer estimates. Overall, e-commerce sales in the US have soared 16% in the first quarter from a year ago and are on track to exceed $500 billion this year.

Sabraw rules again.

• Judge Tells US To Pay Costs Of Reuniting Immigrant Families (R.)

A U.S. judge in California on Friday ordered President Donald Trump’s administration to pay the costs of reuniting immigrant parents with children separated from them by officials at the U.S.-Mexican border, rather than forcing the parents to pay. The U.S. government is working to reunite around 2,000 children with their parents, who were detained and separated as part of Trump’s “zero tolerance” approach to deter illegal immigration. “It doesn’t make any sense for any of the parents who have been separated to pay for anything,” U.S. District Judge Dana Sabraw, who last month ordered that the children be reunited with their parents by July 26, said at a hearing in San Diego.

The government missed a deadline this week for getting the youngest of the children back with their parents. Trump has made his hardline immigration policies a central part of his presidency. His administration adopted the family separation policy as part of its effort to discourage illegal immigration, but Trump bowed to intense political pressure and abandoned the policy on June 20. A lawyer for the American Civil Liberties Union, which has sued the administration over the family separations, said at the hearing that immigrant parents had been told by immigration officials they had to pay for their travel. One parent was initially asked to pay $1,900 to be reunited with a child, according to ACLU court papers.

Trump administration lawyer Sarah Fabian called the judge’s order on paying for the reunifications “a huge ask on HHS,” referring to the U.S. Department of Health and Human Services. Fabian said those decisions were handled at the field level, adding that HHS, which houses the detained children, had limited resources. “The government will make it happen,” Sabraw responded. The judge also agreed to impose timelines on the government for reporting details about its reunification efforts.

Fat Americans can have more tattoos.

• Hope and Change Are At Hand (Kunstler)

It seems unfair that the earnest polymath Elon Musk should go broke in the electric car business while Kylie Jenner becomes a billionaire at age 20 hawking lip gloss on Snapchat, but that’s how the American Dream rolls these late days of empire. Perhaps the lesson here, for all you MBA wannabes, is that Mr. Musk could switch his production facilities from cars to lip gloss. Of course, to successfully market his new line of cosmetics on social media, Elon might have to consider sexual “reassignment” surgery — unless he could persuade American men via Facebook and Twitter, that lip enhancement boosts male self-esteem almost as much as the purchase of a Ford F-450 pickup truck at a laughable fraction of the cost.

Which raises an interesting question: if President Donald Trump’s most winning personal feature is that magnificent golden hair-do, why doesn’t he (or his family) get out of the pain-in-the-ass hotel business, with all its construction and maintenance issues and dirty sheets, and just put out shampoo? He is obviously adept at Twitter marketing and surely scores high in global brand recognition. Which raises any number of other major questions about the proper functioning of the US economy. For instance, millions of Americans, especially of Kylie J’s gen, are wasting their lives working dead-end minimum wage jobs manning (personing?) the nation’s fry-o-lator stations when they could start billion dollar cosmetic companies.

After all, if you really want to be successful in this land of success stories, don’t you have to first look and feel successful? Perhaps that’s all you really need… forget all those pain-in-the-ass products with their vexing assembly-line, packing, and shipping problems. Just get America feeling great about itself, starting with the most important person in the room: YOU! Only two things stand in the way: tattoos and blubber. At the rate our fellow citizens are adorning themselves with inky autobiographies, ever fewer will want to cover up their personal messaging with icky makeup. And the remorseless increase in body size implies a concomitant increase in available epidermal sites for said personal messaging — so maybe the tattoo industry ought to be the basis of the next American economy, not electric cars and journeys to Mars, or even lip gloss. Just think of all those empty brick-and-mortar retail spaces out there begging to become Ink Spots! I may be wrong about this, but I haven’t heard of any tattoo billionaires…yet. Who will dare to be first? (Yet another Kardashian?)