Jack Delano Mother of three, wiper at the roundhouse. Chicago & North Western R.R.” 1943

“America’s Investment In Its Own Future Is In A Depression”. As epitomized by share buybacks. Which in turn are simply an expression of ‘the thing that shall not be mentioned’: a lack of confidence in growth, and in the economy as a whole. Why invest when there will be no return?

• America’s Biggest Economic Problem: Nobody Is Investing For Tomorrow. (MW)

The U.S. economy, by some measures, has recovered from the Great Recession: The unemployment rate is only half what it was at the worst, real gross domestic product is about 10% larger than the previous peak, and personal wealth has risen by more than $20 trillion as the stock market and the housing market have bounced back. But everyone knows the recovery has been uneven. Total employment may have grown by 6 million since the recession began in 2008, but employment in manufacturing is down nearly 1.5 million. Real disposable incomes may be up by 16%, but because most of the increase has been captured by the richest sliver of society, the median family’s annual inflation-adjusted income is still down more than $3,000.

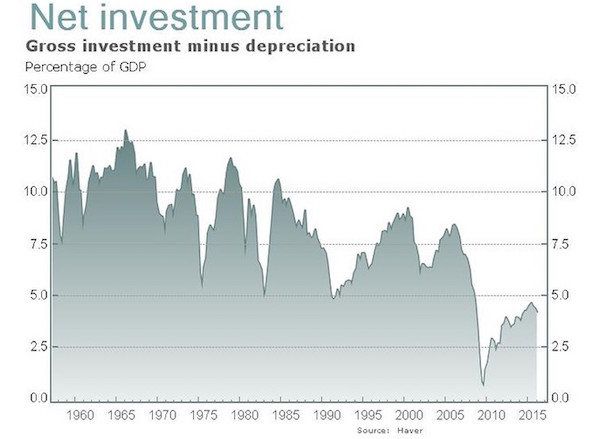

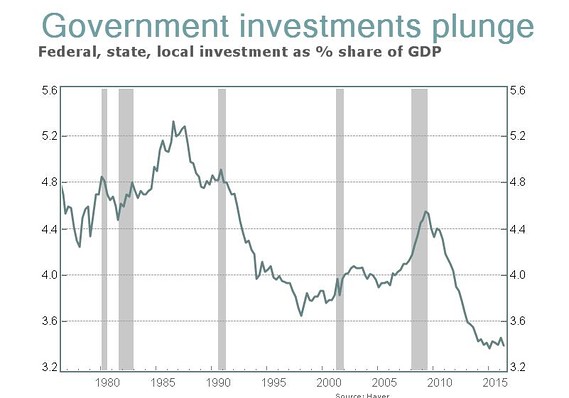

Most troubling, there’s still very little investment in the buildings, equipment and intellectual property that we ought to be putting into place today as the foundation of our prosperity tomorrow. Who’s preparing the United States for the 21st century? Nobody, really. Not the 22 million private businesses, not the 118 million households, and not the 90,000 state, local or federal government agencies. Since the recession, investments have fallen sharply, and they haven’t gotten back up again. It seems that everyone is still scarred by the Great Recession, and by the collapse of asset bubbles in 2000 and 2006. Gross domestic investment totaled about $3.6 trillion in the second quarter of 2016, about 20% of gross domestic product. That may seem a large sum, but it’s the lowest share of GDP, except during recessions, since 1947.

And, unfortunately, even that weak number grossly exaggerates the actual contribution of this investment in creating new productive capacity for the economy. Why is the figure exaggerated? Because these data are reported on a gross basis, without subtracting the depreciation of capital assets such as equipment, buildings, software and the like. After you subtract the capital that’s used up, net investment totaled only about $750 billion in the second quarter, or 4% of GDP, about half of the average over the post-war period. In fact, net investment has been running at the lowest rates since the Great Depression of the 1930s, suggesting that U.S. investment itself is in a depression.

Makes some sense, but relies too much on the assumption that policy makers know what they do. They don’t.

• The Stimulus Our Economy Needs (Da Costa)

All told, nearly 9 million jobs were lost during the 2007-2009 slump, not counting the new jobs that were needed to keep up with population growth. The unemployment rate more than doubled to a peak of 10.2% in October 2009 and took seven years to get back to around 5%, seen as normal. Even the current 4.9% rate is seen as a poor depiction of the U.S. labor market’s actual ongoing weakness. So what would a constructive pro-jobs policy of employment insurance look like? It could take many forms, and, despite any central bank role in funding the stimulus, the decision on how to spend the money would remain fully accountable to the democratic process — in the hands of elected lawmakers.

One approach might see Congress adopt a mandate similar to the one it assigned the Fed itself — to maintain low and stable prices while striving for maximum sustainable employment. Such a goal would offer clearer guidelines for when a program of budget spending aided by central bank intervention might be needed, like determining what thresholds of economic pain might trigger its launch. Rather than relying on a spotty, limited system of jobless benefits that can leave the unemployed in or close to poverty, wouldn’t it be better to directly create government jobs in areas where the private sector appears to be falling short?

Employer-of-last-resort-type policies, as proposed by the economist Hyman Minsky, where the government generates employment in socially useful sectors that are underserved by the private sector alone — including infrastructure, education, health care, child and elderly care, and the arts — could be optimal. After all, most people would agree instinctively with Article 23 of the Universal Declaration of Human Rights, adopted by the U.N. in 1948, which states, “Everyone has the right to work, to free choice of employment, to just and favourable conditions of work and to protection against unemployment.”

Same difference: no investments in the future.

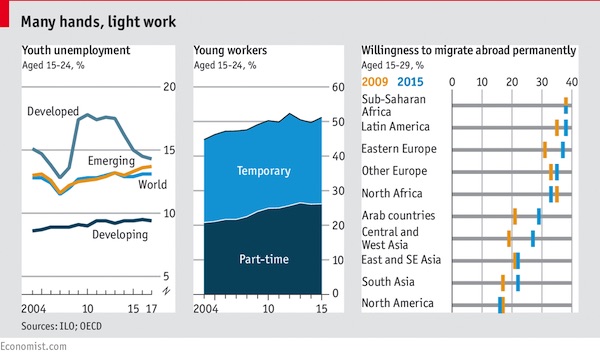

• Grim Employment Prospects For Young People Around The World (Economist)

A new report from the International Labour Organisation has provided a snapshot of job prospects for young people around the world. Things have worsened this year following a period of slight improvement. Unemployment among 15-24-year-olds has risen to 13.1% in 2016 and is close to its historic peak of 2013. The rate is highest in Arab countries, at 30.6%, and lowest in East Asia, at 10.7%. The report also finds that even where jobs are available to young people, they often fail to provide secure incomes.

Youth unemployment is typically lower in poorer countries than in rich ones. This is because workers in less-developed countries have to take work just to make ends meet and, with few choices, end up in low-paid jobs with no security. Even in richer countries, the young often end up in less-secure employment than the older generation. In 2015, 25% of young workers in OECD countries were in temporary jobs and 26% were employed part-time, often on an involuntary basis. Those rates are more than twice as high as for workers aged 25 to 54.

In fact, young people with jobs are now at greater risk of living in poverty than the elderly in some rich countries. This is especially true in places where there has been a sharp economic shock, such as Greece, Romania and Spain. The need to work to supplement household income in the short-term creates a vicious cycle in which the young forgo training in the skills required for better long-term job prospects. Given the bleak future faced by many, it is little surprise that 40% of 15-29-year-olds in Africa, eastern Europe and Latin America would countenance a permanent move abroad.

“Friday, almost six years to the day, marked the anniversary of former Fed Chairman Ben Bernanke’s address to the Jackson Hole confab, at which he outlined the second phase of quantitative easing [..] Since then, Wilshire Associates estimates the value of U.S. equities has increased by over 100%, some $13.3 trillion..”

The Fed has fueled the populism that has thrown this year’s U.S. elections into an unprecedented tizzy, the Journal wrote in more considered terms in a page-one feature on Friday. While the central bank dealt forcefully with the 2007-08 financial crisis, it failed to anticipate it and subsequently failed to bring about a recovery worthy of the name. What it has accomplished is a massive inflation, not of consumer prices—as officially measured, at least—but of asset prices. Friday, almost six years to the day, marked the anniversary of former Fed Chairman Ben Bernanke’s address to the Jackson Hole confab, at which he outlined the second phase of quantitative easing (central bank–speak for securities purchases to pump money into the financial system), which was popularly dubbed QE2.

Since then, Wilshire Associates estimates the value of U.S. equities has increased by over 100%, some $13.3 trillion. Since Bernanke outlined QE3 in September 2012, U.S. equities are up about 50%, or $8.6 trillion, by Wilshire’s reckoning. In the process, interest rates have hovered at or near record-low levels, tonic for asset values but poison for savers. The uneven impact of the Fed’s policies among the haves and have-nots has further stoked resentment against the monetary authorities. Low yields and inflated asset prices mean modest future returns for all. But though it is equally illegal for the beggar and the king to sleep under the bridge, low returns are less of a burden for those who have already accumulated wealth than for those who have not.

None of this sociology and politics should influence the Fed, but it is an inescapable backdrop to policy decisions. Based on the data on which the central bank professes to depend, the “case for an increase in the federal-funds rate has strengthened in recent months,” Yellen said in her much-anticipated address to the Jackson Hole gathering.

“Credit-enhanced cycles come to worse ends than the normal kind.”

• Bill Gross Says Yellen’s Economy ‘May Never Walk Normally Again’ (BBG)

Bill Gross, the billionaire Janus Capital Group Inc. money manager, criticized Fed Chair Janet Yellen’s suggestion that she could consider further asset purchases as the equivalent of “providing a walker or a wheelchair for an ailing economy.” Yellen, speaking Friday at a conference of central bankers and economists in Jackson Hole, Wyoming, said while the U.S. economy has strengthened to the point that interest rate hikes are possible, further asset purchases must remain part of the Fed’s toolkit. Gross, who runs the $1.5 billion Janus Global Unconstrained Bond Fund, has long criticized central bankers in the U.S., Europe and Japan for keeping interest rates ultra-low and artificially inflating asset prices without adding sustainable economic growth.

“She is opening the door to creating even greater asset bubbles as have the BOJ and ECB and SNB by purchasing corporate bonds and stocks,” Gross wrote Friday in an e-mail response to questions. “This is not capitalism. This is providing a walker or a wheelchair for an ailing economy. It may never walk normally again if monetary policy continues in this direction.” Gross said Yellen’s comments didn’t take a September rate hike off the table, especially if job growth is healthy. The Labor Department reports August employment data on Sept. 2. The probability of a hike at the Sept. 21 Fed meeting has risen to 38% from 15% two weeks ago, according to data compiled by Bloomberg.

“To the extent that next month we see a decent job growth number, then I think for sure or close to for sure, you know, in September we’re going to see a Fed hike of 25 basis points,” Gross said in an interview on CNBC. “The market hadn’t expected that.” Tad Rivelle, chief investment officer of fixed income at TCW Group, warned that central bank intervention to keep rates low and prop up asset prices may worsen the impact of an inevitable end to the current credit cycle. “Every cycle in human history has ultimately come to an end,” Rivelle, who helps oversee $195 billion for TCW, said in a Bloomberg Television interview Friday. “Credit-enhanced cycles come to worse ends than the normal kind.”

“Not since the presidential administration of Lyndon B. Johnson have stocks done so little for so long.”

• Losses Piling Up for S&P 500 as Weekly Drop Is Worst Since June (BBG)

What had been just a sleepy August is turning into an increasingly painful one for U.S. equity market bulls. Notwithstanding an hour-long burst of optimism that followed Federal Reserve Chair Janet Yellen’s policy speech Friday, the buoyancy that lifted stocks for the first half of the summer has now been missing for the better part of a month. The S&P 500 Index fell 0.7% to 2,169.04 this week, the biggest drop since June, to erase its August gains. Not since the presidential administration of Lyndon B. Johnson have stocks done so little for so long. Unable to break out of a 1.5% band for more than 30 days, the market is locked in its tightest trading range since the end of 1965 amid confusion about Federal Reserve policy and the outlook for earnings.

While losses remain tiny day to day, they’re starting to pile up, with the S&P 500 declining in five of the last six sessions. The Dow Jones Industrial Average slipped 157.17 points in the week to 18,395.4, while the Nasdaq Composite Index retreated 0.4% to 5,218.92. At about 5.8 billion shares, daily volume in U.S. exchanges was lower this week than in any non-holiday period since June 2015. “Once we dug into the report from Yellen, it was kind of a non-event, and we’re ending in the same range we started the week,” Chris Gaffney, president of world markets at St. Louis-based EverBank, said by phone. “The data we got this week was mixed. There’s no clear direction and that’s why we’re sitting in these ranges.”

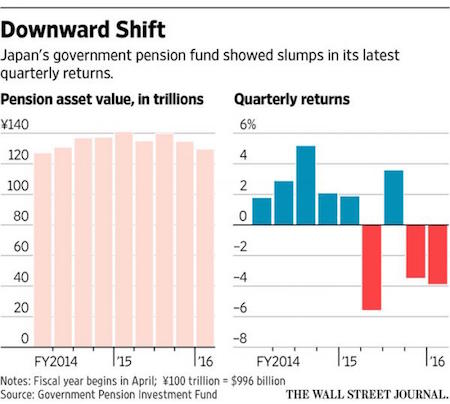

Guess the Japanese simply don’t understand what Abe does to their pensions.

• World’s Biggest Pension Fund Loses $52 Billion in Q2 Stock Rout (BBG)

The world’s biggest pension fund posted a $52 billion loss last quarter as stocks tumbled and the yen surged, wiping out all investment gains since it overhauled its strategy by boosting shares and cutting bonds. Japan’s Government Pension Investment Fund lost 3.9%, or 5.2 trillion yen ($52 billion), in the three months ended June 30, reducing assets to 129.7 trillion yen, it said in Tokyo on Friday. That erases a 4.1 trillion yen investing return for the previous six quarters starting October 2014, the month it decided to put half its assets into equities. The quarterly decline follows a 5.3 trillion yen loss in the fiscal year through March, the worst annual performance since the global financial crisis.

After benefiting from a surge in Japanese equities and a weaker yen earlier in Prime Minister Shinzo Abe’s term, GPIF has posted losses as domestic stocks tumble and gains in the currency reduce the value of overseas assets. Still, for Sumitomo Mitsui Trust Bank Ltd., that’s no reason to veer from the current approach. “Since its investments are tied to market moves, it’s natural that this would happen and there’s no point looking at it with a short-term view,” said Ayako Sera, a Tokyo-based market strategist at the bank. “GPIF is so big that its losses look huge even though the fluctuations in its investments just mirror the market.”

“Regulators assess a company’s balance sheet and history, mandate an offering price, and then let the market figure out who might be lying or hiding things.”

• Why No One Trusts China’s Markets (Balding)

When China’s top securities regulator said recently that it plans to delist Dandong Xintai Electric for falsifying initial public offering documents, it didn’t grab many headlines. But it suggested some far-reaching changes may be afoot. Xintai is the first company to be expelled from Shenzhen’s ChiNext board for such an offense, and one of only a handful that have ever been delisted in China. Its expulsion suggests that regulators are facing up to some unfortunate truths about China’s capital markets. Those markets are, in important ways, only superficially market-like. In the stock market, the government has intervened on a huge scale to prop up prices. Investment in the bond market is overwhelmingly directed to state-owned enterprises. There’s no derivatives market to speak of.

Financial disclosures are often implausible, suspicions of insider trading are rife and doubts about corporate governance are widespread. All these are symptoms of a common ailment: a regulatory system focused not on disclosure and market mechanics but on setting asset prices and allocating returns. In most countries, when companies are considering an IPO, regulators require them to accurately disclose information, then let markets dictate prices. In China, the reverse holds true: Regulators assess a company’s balance sheet and history, mandate an offering price, and then let the market figure out who might be lying or hiding things. The result is that investors, both domestic and foreign, have lost confidence in China’s markets.

Foreign portfolio investment into China is down 60%, year over year, through July. MSCI has repeatedly declined to include China’s domestic equities in its benchmark indexes. Even the much-celebrated Chinese retail investor is staying on the sidelines: Individual investment accounts holding less than 500,000 yuan declined to 46.8 million last month, from 47.4 million in July 2015. This credibility deficit affects all areas of the markets. Major Chinese commercial banks have been trading at a price-to-equity ratio of about five – compared to an average of about 12 for commercial banks elsewhere – because investors think their loan portfolios are much worse off than they’re letting on.

Somone will try to stop her.

• Theresa May Will Trigger Brexit Negotiations Without Commons Vote (Tel.)

Theresa May will not hold a parliamentary vote on Brexit before opening negotiations to formally trigger Britain’s withdrawal from the European Union, The Telegraph has learned. Opponents of Brexit claim that because the EU referendum result is advisory it must be approved by a vote in the Commons before Article 50 – the formal mechanism to leave the EU – is triggered. However, in a move which will cheer Eurosceptics, The Telegraph has learned that Mrs May will invoke Article 50 without a vote in Parliament It had been suggested – by Tony Blair, the former Labour Prime Minister, and Owen Smith, the Labour leadership candidate, among others – that Remain-supporting MPs could use a Parliamentary vote to stop Brexit.

But sources say that because Mrs May believes that “Brexit means Brexit” she will not offer opponents the opportunity to stall Britain’s withdrawal from the EU. A Downing Street source said: “The Prime Minister has been absolutely clear that the British public have voted and now she will get on with delivering Brexit.” Mrs May has consulted Government lawyers who have told the Prime Minister she has the executive power to invoke Article 50 and begin the formal process of exiting the European Union without a vote in Parliament. Her decision will come as a blow to Remain campaigners, who had been hoping to use Parliament to delay or halt Brexit entirely.

And it will yet get crazier.

• BleachBit Brags It “Stifled FBI Investigation” Of Hillary Clinton (ZH)

Yesterday we noted that South Carolina Representative Trey Gowdy revealed that Hillary had used a software called “BleachBit” to wipe her servers clean. Gowdy, appearing on Fox News, suggested that using a software like “BleachBit” undermines her claims that she only deleted innocuous “personal” emails from her private server. Specifically, Gowdy told Fox News:

“If she considered them to be personal, then she and her lawyers had those emails deleted. They didn’t just push the delete button, they had them deleted where even God can’t read them. “They were using something called BleachBit. You don’t use BleachBit for yoga emails.” “When you’re using BleachBit, it is something you really do not want the world to see.”

Now, the BleachBit team is using the whole controversy as a marketing tool with a note on their website entitled “BleachBit stifles investigation of Hillary Clinton.” The site even incorporates the now-famous Clinton gaffe where she asked reporters if they wanted to know whether she had wiped her servers clean “like with a cloth or something” pointing out that “it turns out now that BleachBit was that cloth.”

Last year when Clinton was asked about wiping her email server, she joked, “Like with a cloth or something?” It turns out now that BleachBit was that cloth.

The BleachBit team also points out that they have not been served with any warrants or subpoenas at this time even though it doesn’t really matter because the “cleaning process is not reversible.”

As of the time of writing BleachBit has not been served a warrant or subpoena in relation to the investigation. BleachBit is free of charge to use in any environment whether it is personal, commercial, educational, or governmental, and the cleaning process is not reversible.

Finally, BleachBit points out they’re receiving overwhelming interest from folks looking to permanently erase yoga and bridesmaid emails and/or other similar incriminating information.

Compare that to other EU nations.

• Majority Of Greek Properties Valued Under €50,000 (Kath.)

74% of real estate owners in Greece have property whose taxable value does not exceed 100,000 euros, according to data published on Friday by the Finance Ministry. More precisely, one in two own property that is valued by tax authorities at 50,000 euros or less, while just 8% of real estate owners have property worth between 100,000 and 200,000 euros. The total taxable value of the properties owned by the two groups has been calculated by the ministry, respectively, at 63.6 billion euros and 132 billion euros.

Taleb targets Salafism.

• We Don’t Know What We Are Talking About When We Talk About Religion (Taleb)

People rarely mean the same thing when they say “religion”, nor do they realize that they don’t mean the same thing. For early Jews and Muslims, religion was law. Din means law in Hebrew and religion in Arabic. For early Jews, religion was also tribal; for early Muslims, it was universal[i]. For the Romans, religion was social events, rituals, and festivals –the word religio was a counter to superstitio, and while present in the Roman zeitgeist had no equivalent concept in the Greek-Byzantine East[ii]. Law was procedurally and mechanically its own thing, and early Christianity, thanks to Saint Augustine, stayed relatively away from the law, and, later, remembering its foundations, had an uneasy relation with it. For instance, even during the Inquisition, a lay court handled the sentencing.

The difference is marked in that Christian Aramaic uses a different word: din for religion and nomous (from the Greek) for law. Jesus, with his imperative “give to Caesar what belongs to Caesar”, separated the holy and the profane: Christianity was for another domain, “the kingdom to come”, only merged with this one in the eschaton. Neither Islam nor Judaism have a marked separation between holy and profane. And of course Christianity moved away from the solely-spiritual domain to embrace the ceremonial and ritualistic, integrating much of the pagan rites of the Levant and Asia Minor.

For Jews today, religion became ethnocultural, without the law – and for many, a nation. Same for Syriacs, Chaldeans, Armenians, Copts, and Maronites. For Orthodox and Catholic Christians religion is aesthetics, pomp and rituals, plus or minus some beliefs, often decorative. For most Protestants, religion is belief with neither aesthetics, pomp nor law.

Further East, for Buddhists, Shintoists and Hindus, religion is practical and spiritual philosophy, with a code of ethics (and for some, cosmogony). So when Hindu talk about the Hindu “religion” they don’t mean the same thing to a Pakistani as it would to a Hindu, and certainly something different for a Persian. When the nation-state idea came about, things got much, much more complicated. When an Arab now says “Jew” he largely means something about a creed; to Arabs, a converted Jew is no longer a Jew. But for a Jew, a Jew is someone whose mother is a Jew. (This has not always been the case: Jews were quite proselytic during the early Roman empire). But Judaism, thanks to modernism, somewhat merged into nation-state, and now can also mean a nation.