DPC Real Estate Exchange from Dime Bank building, Detroit 1918

Someone should shut up George Soros. The Financial Times offers him a podium because he’s rich, and if you’re rich, people today think you must be smart, and right, as well. We admire money, not brains; indeed, we confuse the two.

George is not right. George is much more old than right. George writes a plea for the United Kingdom and the European Union that misses on just about every single point. Because George lives in the past. When he was not yet so old.

If the Scots want to break free from the United Kingdom, that is their god – or UN, whichever comes first -given right. And people like Soros need to butt out of that discussion.

Britain Needs Greater Unity Not A Messy Break-up

This is the worst possible time for Britain to consider leaving the EU – or for Scotland to break with Britain. The EU is an unfinished project of European states that have sacrificed part of their sovereignty to form an ever-closer union based on shared values and ideals. Those shared values are under attack on multiple fronts. Russia’s undeclared war against Ukraine is perhaps the most immediate example but it is by no means the only one. Resurgent nationalism and illiberal democracy are on the rise within Europe, at its borders and around the globe.

The EU is not an unfinished, but a failed project. It wasn’t, and isn’t, based on values and ideals, but on money. It may have once been a good idea, but it’s run many a mile off the rails. The EU, like NATO, should be disbanded. They are both organizations that have accumulated so much power that this can only possibly backfire on the people they represent.

They’re organizations in which power accumulates by itself, they can’t stop accummulating ever more of it because there are no backstops and no breaks built into their statutes. ‘Resurgent nationalism’, in Europe and elsewhere, is a direct effect of this, and the very last thing that should happen, if we know what’s good for us, is for the EU and NATO to be employed to fight against it.

How do we know, how can we be so sure? This is how: While the EU announces new sanctions against Russia, to go into effect tomorrow, and NATO builds up its ‘presence’ on Russia’s borders, Amnesty releases a report that even gets covered by the mother of all MSM’s, Newsweek:

Ukrainian Nationalist Volunteers Committing ‘ISIS-Style’ War Crimes

Groups of right-wing Ukrainian nationalists are committing war crimes in the rebel-held territories of Eastern Ukraine, according to a report from Amnesty International, as evidence emerged in local media of the volunteer militias beheading their victims. Armed volunteers who refer to themselves as the Aidar battalion “have been involved in widespread abuses, including abductions, unlawful detention, ill-treatment, theft, extortion, and possible executions”, Amnesty said.

The organisation has also published a report detailing similar alleged atrocities committed by pro-Russian militants, highlighting the brutality of the conflict which has claimed over 3,000 lives. Amnesty’s statement came before images of what appeared to be the severed heads of two civilians’ started circulating on social media today, identified by Russian news channel NTV as the heads of rebel hostages.

There are over 30 pro-nationalist, volunteer battalions similar to Aidar, such as Ukraina, DND Metinvest and Kiev 1, all funded by private investors. The Aidar battalion is publicly backed by Ukrainian oligarch Ihor Kolomoyskyi, who also funds the Azov, Donbas, Dnepr 1, Dnepr 2 volunteer battalions, operating under orders from Kiev. Last spring Kolomoyskyi offered a bounty of $10,000 of his own money for each killed Russian “saboteur”.

That is not nothing. That is a very strong condemnation of a whole range of private armies that have been executing war crimes against Ukraine citizens, private armies ‘operating under orders from Kiev’. Financed by ‘us’. And yes, Newsweek mentions ‘alleged atrocities’ committed by rebel forces (still called pro-Russian so we can imply Putin being involved). But even if that is true, it does not, not now and not ever, make our support of private armies beheading their own co-citizens ‘alright’.

These people have been able to commit their crimes because we, the US, EU and NATO, have backed them. This is not about, as George Soros claims, ‘Russia’s undeclared war against Ukraine’, this is about Kiev’s loudly declared war on its own people. Which ‘we’, along with a bunch of slumdog warlord billionaires, encouraged. And paid for.

That is why and how we know that the EU and NATO should no longer be allowed to exist. If we don’t disband both, we will, so to speak, never go to heaven, because if there is a god, (s)he will not look down kindly upon this. NATO and EU inflict too much damage on too many people, in the case of the EU economically (PIIGS), politically and now militarily (Ukraine), and in the case of NATO – obviously – militarily around the globe. NATO has degenerated from a keeper of the peace into a war mongering force, a.k.a. a means for the US to make other nations pay for its global hegemony dreams.

So we have that Amnesty report about Kiev-directed war crimes, and what do you think the Kiev parliament has as an answer to that? Well, this:

War Crimes Acceptable? Parliament Mulls Amnesty For Kiev’s Troops In East Ukraine

The Ukrainian parliament is to debate a law on amnesty for Ukrainian troops who have committed war crimes in the course of military actions in Eastern Ukraine. A bill on amnesty for military personnel who committed war crimes during the military crackdown in Eastern Ukraine was introduced in the Rada (the Ukrainian parliament) on Wednesday, its website says. The bill assumes the discharge of legal responsibility and punishment of military staff and “other people” for the actions which “bear the marks of war crime.”

The Amnesty researchers interviewed dozens of victims and witnesses of the abuses and crimes, as well as local officials, police and army commanders in Lugansk area. The watchdog pointed out that while formally operating under the command of the Ukrainian security forces combined headquarters in the region, members of the Aidar battalion act “with virtually no oversight or control, and local police are either unwilling or unable to address the abuses.”

If you live in the west and you aspire to go to heaven, you better make sure this kind of stuff, and these kinds of people, are no longer backed up by those you elect to represent you and spend you tax money. And even if you don’t believe in heaven, you should at least have an inch of decency left in your life, and that too would make it imperative that you stop these atrocities being committed in your name.

Which brings me back to Soros.

Britain Needs Greater Unity Not A Messy Break-up

Since world war two the European powers, along with the US, have been the main supporters of the prevailing international order. Yet, in recent years, overwhelmed by the euro crisis, Europe has turned inward, diminishing its ability to play a forceful role in international affairs. To make matters worse, the US has done the same, if for different reasons. Their preoccupation with domestic matters has created a vacuum that ambitious regional powers have sought to fill.

No George, you have things upside down. It’s the ‘prevailing international order’ that has caused the crisis. Not prevented it.

The resulting breakdown of international governance has given rise to a plethora of unresolved crises around the globe. The breakdown is most acute in the Middle East. The sudden emergence of the Islamic State in Iraq and the Levant, or Isis, provides the most gruesome example of how far it can go and how much human suffering it can cause. With the Russian invasion of Ukraine, military conflict has spread to Europe. Two radically different forms of government are competing for ascendancy. The EU stands for principles of liberal democracy, international governance and the rule of law.

Again, no George. And again, you got it upside down.. It’s not the breakdown of international governance – in the model of it we have today – , but its very existence that ‘has given rise to a plethora of unresolved crises around the globe’. There’s nothing wrong with international governance by itself, the problem is in the way we’ve set it up, and what we thus have allowed it to turn into.

Too much power gets concentrated at the top – this is just as true for the US as well -, and the shit that floats to the top of that should never be trusted with that kind of power. They should at best be allowed to run rural Five and Dimes, and only under strict supervision.

In Russia, President Vladimir Putin maintains the outward appearance of democracy by exploiting a narrative of ethnic and religious nationalism to generate popular support for his corrupt, authoritarian regime.

It’s not Putin who started this, George, no matter how much your past may have warned you off about Russians. Putin is not the Stalin you once knew. It’s ‘us’ who started this.

As a major power and global financial centre, Britain ought to be centrally involved in crafting a European response to this threat. But like the US and the EU itself, Britain has also been distracted by internal matters. David Cameron has been persuaded by anti-European zeal – not least within his own party – to put UK membership in the EU to a vote in 2017. A poll on Scottish independence is only days away. Just when Britain should be confronting grave threats to its way of life, it is preoccupied with divorce of one type or another. Divorce is always messy.

What can I say, George? Where do you think this ‘anti-European zeal’ comes from? As for that divorce thing, how many wives have you had? You of all people should know a divorce is not necessarily all that bad. Messy, perhaps.

For Scotland and the rest of the UK to enter into a currency union without a political union, after the euro crisis has demonstrated all the pitfalls, would be a retrograde step that neither side should contemplate. Yet without it, an independent Scotland could not benefit from the low interest rates that a strong pound has brought. These considerations ought to outweigh whatever possible benefits independence might bring.

Retrogade, you said? Am I right to interpret that to say that increased centralization is always a good thing in your view? And as for ‘benefit from the low interest rates that a strong pound has brought’, do you really think that ultra low rates have been such a blessing for the world? Or do you perhaps merely mean to imply they have been for you? In my view, an economy that can exist only through severe central bank manipulation (which is what ultra low rates represent) doesn’t have a long life expectancy.

[..] Britain has always played a balancing role between hostile blocs. Its absence would greatly diminish the weight of the EU in the world.

Oh come on, Britain has always been blood thirsty, that’s how it built an empire. Balancing role my donkey. And as for diminishing the weight of the EU, that’s something I’m all for.

The EU has proved to be the best guarantor of peace and human security since the end of the second world war. The importance of preserving the shared values underpinning a whole way of life far outweigh any possible advantages of independence. The difficult times we are facing call for increased unity, not divorce.

Georgie boy, this is not 1950 anymore. In Ukraine, the EU has proven itself the opposite of ‘the best guarantor of peace and human security’. It has supported, and still does, depraved private armies. The second world war is long gone, there are new problems today.

What has been proven since WWII is that increased unity/centralization is NOT the answer to everything, it indeed turns into a problem all by and of itself. That is what the EU and NATO represent. the problem of ‘increased unity’. Which is that power doesn’t stop accumulating, and the wrong kind of people scoop it up to execute their depraved power games.

[..] to vote for independence from the UK now would be to prematurely surrender Scottish leverage in London, and Britain’s leverage in the world.

Scotland doesn’t want leverage in London, it wants leverage in Edinburgh. Only 7% of the taxes Scots pay get distributed by their own government, the other 93% (!) goes through the hands of London. What’s wrong with no longer wanting that? What’s wrong with a dozen other European regions not wanting it?

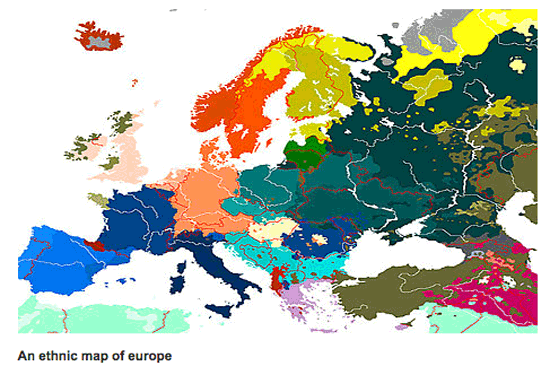

Yes, there are cases in which extreme right will try to decide things in its favor. That may not be a good thing. But US, NATO and EU quite openly encourage just that in Ukraine. So what exactly are we talking about here? Are we going to tell the Scots and Catalans and Basque that they can’t determine their own lives, in the same way we tell that to the Donbass?

George, you’re 84, and your time is up. When it comes to – attempts at – decision making, that is. I hope you’ll live to be over 124, but leave younger people’s decisions alone. This is not 1948 anymore, and it’s not even 1984 either.

The solution to these issues is not in more centralization, be it the UK, the EU, or globalization in general. Centralization will always, of necessity, be a problem in itself. The only thing we can do, no matter how large the setting, is set up a system, based on law, that prevents the wrong kind of people from floating to the top. And the more centralized power becomes, the more harm these wrong people can do.

In the meantime, let’s let Scots be Scots and Catalans, Catalans. The worst they can do by becoming independent is accelerate the demise of an already bankrupt financial and political system.

• Separatists Threaten To Rip Europe Apart (AEP)

Europe is disintegrating. Two large and ancient kingdoms are near the point of rupture as Spain follows Britain into constitutional crisis, joined like Siamese twins. The post-Habsburg order further east is suddenly prey to a corrosive notion that settled borders are up for grabs. “Problems frozen for decades are warming up again,” said Giles Merritt, from Friends of Europe in Brussels. The best we can hope for – should tribalism prevail – is German political hegemony in Europe. The German people so far remain a bastion of rationalism, holding together as others tear themselves apart. The French are too paralysed by economic depression and the collapse of the Hollande presidency to play any serious role. The far worse outcome is that even Germany succumbs to centrifugal forces, leaving Europe bereft of coherent leadership, a parochial patchwork, wallowing in victimhood and decline, defenceless against a revanchist Russia that plays by different rules.

Former Nato chief Lord Robertson warns that a British break-up is doubly dangerous, setting off “Balkanisation” dominoes across Europe, and amounting to a body blow for global security at a time when the Middle East is out of control and China is testing its power in Asian waters. He warns that the residual UK would be distracted for years by messy divorce, a diminished power, grappling with constitutional wreckage, likely to face a resurgence of Ulster’s demons. Scotland’s refusal to allow nuclear weapons on its soil means that no US warship would be able to dock in Scottish ports, while its withdrawal from all power projection overseas would push British fighting capability below the point of critical mass. “The world has not yet caught up with the full and dramatic implications of what is going on. For the second military power in the West to shatter would be cataclysmic in geopolitical terms. Nobody should underestimate the effect this would have on existing global balances,” he said.

[..] The Scottish precedent threatens – or promises, depending on your view – to set off a chain reaction. “If the Scots votes Yes, it will be an earthquake in Spain,” said Quim Aranda, from the Catalan newspaper Punt Avui. Madrid has declared Catalonia’s secession to be illegal, if not treason. Premier Mariano Rajoy has resorted to court action to stop Catalonia’s 7.5m people – the richer part of Spain – holding a pre-referendum vote for independence on November 9. Barcelona is already covered with posters calling for civil disobedience, some evoking Martin Luther King, some more belligerent. There is a hard edge to this dispute, with echoes of the Civil War. One serving military officer has openly spoken of “1936”, warning Catalan separatists not to awaken the “sleeping lion”. The association of retired army officers has called for treason trials in military courts for anybody promoting the break-up of Spain, a threat since disavowed by the current high command. Rioja’s premier, Pedro Sanz from the ruling Partido Popular, seemed to threaten a massacre, warning Catalans that they “will die” (morirán) if they persist in playing with fire. That will not stop 1m or more taking to the streets this week for Catalonia’s “Diada”, the national day, evoking the fall of Barcelona to the Bourbons in 1714.

Read more …

• Catalans Today Demonstrate And Demand Right To Hold Referendum (Guardian)

Hundreds of thousands of Catalans will take to the streets on Thursday, the National Day of Catalonia, to demand the right to hold a referendum on their future, with some hoping that the sudden surge in support for Scottish independence might boost their cause. The demonstration will take the form of a huge “v” in the north of Barcelona, where two major thoroughfares converge. The v stands for via, vote and voluntat (will), though implicitly for victory, too. While victory may not be at hand, the separatists are gaining in confidence as their ranks continue to grow, helped by the obduracy of the Madrid government, which refuses to discuss the issue. The Catalan government has called a referendum on independence for the region of 7 million people on 9 November. Madrid said the vote will be illegal. Retired teacher Oriol Canals said: “The government treats the referendum as illegal and unconstitutional. It has subjected the independence movement to every kind of pressure, coercion and threats. As a result, the movement has grown by 20% in the past four years.”

Support for independence now stands at between 40-45%. 11 September marks the 300th anniversary of their loss of independence. Many eyes are now on Scotland and there is much talk about how the outcome of the referendum will influence the course of events here. “There are many similarities, such as the uncertainties about the economy, the currency or whether we will belong to the European Union or Nato,” said Larry Magrinyà, a Catalan who is married to a Scot. “On the other hand, Scotland enjoys greater recognition as a nation and it has, for example, its own football and rugby teams.” Magrinyà said that, while a yes vote would put wind in the separatists’ sails, it would very likely make the Spanish government even more determined to prevent a similar outcome in Catalonia. “The fact that the British government is allowing the referendum to go ahead shows that it is far more democratic than Spain,” said Mar Carrera, a communications specialist. “An key difference with Scotland is here the independence movement is capitalising more effectively on social and cultural discontent. “It’s important to bear in mind that the Catalan independence movement is heterogeneous, ranging from members of the rightwing governing party to the far left.”

Read more …

• Scotland Nationalists Claim U.K. Oil in 40-Year Campaign (Bloomberg)

The discovery of North Sea riches in the 1970s planted the seed of modern-day Scottish nationalism as supporters of independence cried “It’s our oil!” Four decades later, nothing will be more important to the economic future of Scotland than the oil industry should the country vote to end the 307-year union with the rest of the U.K. Reserves of oil and gas would be split, possibly along the so-called median line, already used to allocate fishing rights. The division would hand the Scots about 96% of annual oil production and 47% of the gas, according to estimates for 2012 by the University of Aberdeen’s Alex Kemp and Linda Stephen cited by the Scottish government.

With a week to go before the Sept. 18 referendum and opinion polls showing the result is too close to call, the question is whether oil production, which has plummeted about 40% in four years, could finance a newly created state. “There’s a lot of talk of massive new developments in the North Sea but the trend in output has been downwards for the last 10 years at least,” David Bell, professor of economics at Stirling University, said in an interview on Sept. 9.

Read more …

• Energy Minister: Half of Scottish Oil Reserves Yet to Be Exploited (RIA)

Mark Hirst – Scotland’s oil and gas sector is facing a bright future as half of oil reserves remain to be exploited, the Scottish Government’s Minister for Energy, Enterprise and Tourism Fergus Ewing said Wednesday, commenting on a new study. Earlier, world leading oil expert Professor Alex Kemp, by using detailed financial modelling, predicted significant discoveries in Scottish oil sector made over the next 30 years. “His new predictions – based on that modelling – show a bright future for Scotland’s oil and gas sector for decades to come – with 99 new economic discoveries over the next three decades,” Ewing told RIA Novosti.

The minister said the new findings, contained in a new paper entitled, “Illuminating the Future Potential from the North Sea”, showed that half of the remaining wealth from Scotland’s oil remains to be exploited. “In value terms half the wealth from Scotland’s oil remains and by grabbing the independence opportunity later this month we can put an end to poor UK stewardship of this vital resource,” Ewing said. “Scotland deserves better and only a Yes vote on September 18 will deliver the powers needed to get the maximum benefit from Scotland’s natural resources,” Ewing added.

Read more …

• Oil Demand Growth Slips To ‘Remarkable’ 2.5-Year Low (CNBC)

Demand growth in the oil markets will be more subdued than previously expected, according to the International Energy Agency, which has once again downgraded its projections for the rest of the year. “The recent slowdown in demand growth is nothing short of remarkable,” the IEA said in a new monthly report on Thursday morning. “While demand growth is still expected to gain momentum, the expected pace of recovery is now looking somewhat more subdued.” Its latest statistics show that demand growth slowed to below 500,000 barrels per day (b/d) in the second half of 2014 on a yearly basis. This was its lowest level in two and a half years, it added, leading the organization to revise demand projections downwards for the third quarter.

Additionally, global oil demand growth for has been lowered to 900,000 million b/d in 2014 and 1.2 million b/d for 2015. The pronounced slowdown in demand growth and a weaker outlook for Europe and China underpinned these changes, it said. In August, the IEA lowered its forecast for 2014, to 1.0 million b/d. “While festering conflicts in Iraq and Libya show no sign of abating, their effect on global oil market balances and prices remains muted amid weakening oil demand growth and plentiful supply,” it said in the report. “U.S. production continues to surge, and OPEC (Organization of the Petroleum Exporting Countries) output remains above the group’s official 30 million b/d supply target.” The euro zone was singled out for particular attention, with the IEA saying that the “macroeconomic malaise” experienced across much of Europe has been the dominant downside influence in terms of global demand.

Read more …

• Saudis Cut Oil Production as Brent Slips Below $100 a Barrel (Bloomberg)

Saudi Arabia, the world’s biggest crude exporter, said it cut production by 408,000 barrels a day last month amid signs of a supply glut and Brent oil trading below $100 a barrel. The Saudi reduction came as other members such as Nigeria and Kuwait said they increased output in submissions to the Organization of Petroleum Exporting Countries, according to the group’s monthly oil market report yesterday. Total production by the 12-member group climbed by 231,000 barrels a day to 30.347 million last month, based on secondary sources, the report showed. The Saudi decline is the largest monthly drop in production since December 2012, according to data compiled by Bloomberg. Other estimates collated by OPEC, based on secondary sources, show that the kingdom cut output by 55,200 barrels to 9.86 million a day last month.

“It does illustrate a desire not to oversupply the market, and it does illustrate they are actively defending $100 a barrel,” Mike Wittner, head of oil market research at Societe Generale SA (GLE), said by phone yesterday from New York. “A good chunk of that 400,000 cut was probably in crude exports, which is clearly supportive of prices.” Brent, a benchmark for more than half the world’s oil, fell to a 17-month low this week as supplies from Libya rebounded, and amid speculation of an oversupply. Banks including Citigroup Inc. (C) and UBS AG (UBSN) said the price decline would increase the chances of Saudi Arabia curbing supplies. “No switch gets flipped when the price goes from $100 to $99,” Wittner said. “It’s a soft floor. When they see a period of sustained weakness, and when there’s physical oversupply of light, sweet crude in the Atlantic basin, the Saudis are going to try and balance the market.”

Read more …

• Exxon, Shell Oil Deals With Russia Imperiled by Sanctions (Bloomberg)

The U.S. and European Union are poised to halt billions of dollars in oil exploration in Russia by the world’s largest energy companies in sanctions that would cut deeper than previously disclosed. The new sanctions over Ukraine would prohibit U.S. and European cooperation in searching Russia’s Arctic, deep seas or shale formations for crude, according to three U.S. officials who spoke on condition of anonymity because the measures haven’t been made public. If implemented, they would affect companies from Dallas to London, including Exxon Mobil and BP. EU ambassadors met today and will resume deliberations tomorrow in Brussels on whether to trigger added sanctions or wait longer to see if a cease-fire holds between Ukraine and pro-Russian separatists and if Russia backs moves toward a longer-term agreement.

Once the EU implemented the new ban on sharing energy technology and services, the U.S. would follow suit with a similar package, including barring the export of U.S. gear and expertise for the specialized exploration that the Russians are unequipped to pursue on their own, the U.S. officials said. EU governments agreed on these oil-related sanctions on Sept. 8 as part of a wider package of measures intended to hobble Russia’s finance, defense and energy industries, pending evaluation of the cease-fire declared in Ukraine last week, according to two European officials who also spoke on condition that they not be named. The added sanctions wouldn’t interfere with drilling and production from conventional land-based wells and those along the shallow edges of inland seas, some of which have been pumping crude for decades. The sanctions target reserves that wouldn’t begin providing crude to global energy markets for five to 10 years.

Read more …

• What Petrodollar: Russia, China To Create SWIFT Alternative (Zero Hedge)

If, when in February Victoria Nuland infamously launched a (not so) covert campaign to replace the ruling Ukraine president oblivious to the human casualties, resulting in a civil war in east Ukraine, NATO encroachment along the borders of Russia, and a near-terminal escalation in hostilities between Ukraine, Russian, and various regional NATO members, the US intention was to provoke the Kremlin so hard that the nation with the world’s largest reserves of mineral and energy resources would jettison the US Dollar and in the process begin the unraveling of the USD reserve currency status (as much as Jared Bernstein desires just such an outcome) it succeeded and then some. Because in the end it may have pushed not just Russia into the anti-petrodollar camp… it appears to have forced China in it as well.

According to Itar-Tass, Russia and China are discussing setting up a system of interbank transactions which will become an analogue to International banking transaction system SWIFT, First Deputy Prime Minister Igor Shuvalov told PRIME on Wednesday after negotiations in Beijing. “Yes, we have discussed and we have approved this idea,” he said. But wait: wasn’t it the UK’s desire to force Russia out of SWIFT just two weeks ago? Why yes, and the fact that Russia is happy to do so, and on its own terms, once again shows just who has all the leverage, and who really needs, or rather doesn’t, the US Dollar. More from Tass:

Russian authorities wanted to decrease the financial market’s dependence on SWIFT since the introduction of the first U.S. sanctions, when international payment systems Visa and MasterCard denied services to some Russian banks owned by blacklisted individuals. According to Shuvalov, Russia has been also discussing establishment of an independent ratings agency with China. Concrete proposals will be made by the end of 2014, he said. As regards China’s payment system UnionPay cooperation with the yet-to-be-established Russian national payment system, Shuvalov said that UnionPay is ready for a full-scale collaboration and will provide all infrastructural capacities for that.

Read more …

This may well be a complete lie. Gazprom says no way. But Ukraine may be syphoning off.

• Gazprom Limits Polish Gas Supplies as Reverse Supply Flows Halt (Bloomberg)

Russia’s OAO Gazprom limited natural gas flows to Poland, preventing the European Union member state from supplying Ukraine via so-called reverse flows. Polskie Gornictwo Naftowe i Gazownictwo, or PGNiG, got 20 to 24% less fuel than it ordered from Gazprom Export over the past two days and is compensating flows with alternative supply, the company said today in an e-mailed statement. Poland halted gas supply to Ukraine at 3 p.m. Warsaw time today, according to Ukraine’s UkrTransGaz. Ukraine is seeking to replace some of its Russian gas with fuel from Europe after Gazprom halted its supplies on June 16 in a dispute over debt and prices, echoing spats in 2006 and 2009 that left European customers short of fuel.

Gazprom Chief Executive Officer Alexey Miller said in June the company might limit supplies to gas-metering stations where it observed reverse flows. “It would appear from the outside that stopping reverse flow is something that’s in Gazprom’s interest,” Trevor Sikorski, an analyst at Energy Aspects Ltd. in London, said today by telephone. “Gazprom had said that they were studying any kind of reverse flow and that they would take steps to rectify.” Gazprom is doing pre-winter maintenance on pipelines and filling Russian storage sites, which is limiting supply to Poland at the level of the end of last week, according to a company official who declined to be named, citing policy.

Read more …

• Gazprom First-Quarter Profit Falls 41% on Ukrainian Gas Debt (Bloomberg)

Gazprom, Russia’s biggest company, said its first-quarter profit slumped 41% on a foreign currency loss and Ukraine’s debt for natural gas supplies. Net income dropped to 223 billion rubles ($6 billion) from 381 billion rubles a year earlier, the Moscow-based exporter said in a statement on its website. Gazprom, which provides 30% of the European Union’s gas, halted supplies to Ukraine in June over unpaid bills, including $1.45 billion from 2013. The Russian producer now estimates it’s owed $5.3 billion after raising the price for Ukraine in April to a level higher than it charges Germany, which the government in Kiev has rejected as unfair. The quarter marks the “start of not an easy year,” Gazprombank energy analysts wrote in an e-mailed note before the report.

While a weaker ruble is compensating for a decrease in Gazprom’s export prices, the biggest negative factor is the dispute with Ukraine, the bank said. Gazprom had a 172 billion-ruble loss on depreciation of the Russian currency as well as a 71.3 billion-ruble provision for “doubtful trade accounts” mainly related to Ukrainian gas debt, according to the statement. In August, Gazprom said its first-half net under Russian accounting standards, which is used to calculate dividends, fell 38% to 155 billion rubles, mainly because of a provision for Ukraine’s unpaid dept. Gazprom’s deliveries to Europe, its biggest market by earnings, have been falling compared with last year’s levels since June. The region has a record volume of gas in underground storage after a mild winter and accelerated pumping earlier this year.

Read more …

Propaganda.

• British Business Leaders Join Last-Ditch Effort to Save UK (Bloomberg)

Some of Britain’s best-known companies, including Royal Bank of Scotland, BP and Kingfisher, made their strongest intervention yet in the battle against Scottish independence, as RBS joined Lloyds in saying it would move parts of its business to England in the event of a breakaway. Ian Cheshire, chief executive officer of retailer Kingfisher, which employs 3,000 people in Scotland, urged voters not to make a mistake in a “once-in-a-lifetime decision,” arguing that independence would mean higher prices and lower investment. He predicted that other chief executives will make similar statements ahead of the vote on Sept. 18.

“The referendum is the most pressing political risk that businesses face,” said John Cridland, director general of the Confederation of British Industry, the country’s leading business group. “Scottish independence would be a one-way ticket to uncertainty, with no return.” The comments reflect an increasing willingness by British business leaders to abandon neutrality in the referendum debate. BP Chief Executive Officer Bob Dudley said his company considers “the future prospects for the North Sea are best served by maintaining the existing capacity and integrity of the United Kingdom.” Dudley had only said previously that he thought Great Britain should stay together, but had not made the claim that North Sea oil production would be affected by a vote for independence.

Read more …

• Scotch Whisky Makers Say Single Malt Is Best in a Single Country (Bloomberg)

At the Kilchoman Distillery Co Ltd. on Islay, a windswept island two hours by ferry from the west coast of Scotland, a banner nailed to a weathered barn proclaims “Better Together,” the group opposing Scottish independence. Unraveling the 307-year-old union with England “is not something we should even be considering,” Anthony Wills, Kilchoman’s founder and managing director, said in the distillery’s wood-floored tasting room. Islay, with eight distilleries making some of the world’s priciest whiskies, highlights a paradox of the debate leading up to the referendum a week from today: It’s tough to find support for a Yes vote among makers of a product that rivals tartan plaid and haggis as a national symbol. Last year, Scotland’s 109 distilleries sold 4.3 billion pounds ($7 billion) of whisky abroad, the country’s second-largest export, after oil, according to the Scotch Whisky Association. Many in the industry, which the association says accounts for 85% of Scotland’s food and drink exports, say they would be better off remaining part of the U.K.

Read more …

Propaganda.

• RBS, Lloyds London Move ‘Irreversible’ After Scot Turmoil (Bloomberg)

Bank of Montreal is now based 300 miles away in Toronto after bolting amid the rise of Quebec separatism. Royal Bank of Scotland and Lloyds may make the same decision to leave Edinburgh, no matter how Scotland votes next week. Rather than risk perpetual uncertainty over Scotland’s future, “the banks would want to kick off the relocation process irrespective of the decision,” said Chirantan Barua, an analyst at Sanford C. Bernstein in London. The risk has become “irreversible,” with a move costing the banks as much as 1 billion pounds ($1.6 billion) each, he estimated. RBS and Lloyds, which both received a government bailout in 2008, are the two biggest lenders in Scotland. Lloyds said in a statement late yesterday that it already has a contingency plan for establishing new legal entities in England in the event of a Yes vote, while RBS said today that such an outcome would make it necessary to re-domicile the headquarters.

“The issue could come back again in future years, so it’s entirely conceivable that in due course you’ll see the banks switching their registration to England,” even if there’s a No vote, said Ian Gordon, an analyst at Investec Ltd. in London. RBS, which has roots in Scotland dating back to 1727, said in the statement there are “a number of material uncertainties arising” from the referendum, which could impact its credit ratings as well as the “fiscal, monetary, legal and regulatory landscape to which it’s subject.” “For this reason, RBS has undertaken contingency planning for the possible business implications for a Yes vote,” it said. “In the event of a Yes vote, the decision to re-domicile should have no impact on everyday banking services.”

Read more …

• Amazon Deforestation Jumps 29% (Guardian)

The destruction of the world’s largest rainforest accelerated last year with a 29% spike in deforestation, according to final figures released by the Brazilian government on Wednesday that confirmed a reversal in gains seen since 2009. Satellite data for the 12 months through the end of July 2013 showed that 5,891 sq km of forest were cleared in the Brazilian Amazon, an area half the size of Puerto Rico. Fighting the destruction of the Amazon is considered crucial for reducing global warming because deforestation worldwide accounts for 15% of annual emissions of heat-trapping gases, more than the entire transportation sector. Besides being a giant carbon sink, the Amazon is a biodiversity sanctuary, holding billions of species yet to be studied.

Preliminary data released late last year by Brazil’s space research center INPE had indicated deforestation was on the rise again, as conservationist groups had warned. The largest increases in deforestation were seen in the states of Para and Mato Grosso, where the bulk of Brazil’s agricultural expansion is taking place. More than 1,000 sq km has been cleared in each state. Other reasons for the rebound in deforestation include illegal logging and the invasion of public lands adjacent to big infrastructure projects in the Amazon, such as roads and hydroelectric dams. Despite the increase in 2013, the cleared area is still the second-lowest annual figure since the Brazilian government began tracking deforestation in 2004, when almost 30,000 sq km of forest were lost. The Brazilian government frequently launches police operations to fight illegal loggers in the forest, but environmentalists say more is needed.

Read more …

She’s back! I thouht they would have buried her in a hole in the ground. How many blunders does one get to make in the States these days?

• Victoria Nuland: All Foreign Forces Must Be Withdrawn From Ukraine (DW)

The US has cautiously welcomed what Ukraine’s President Poroshenko described as a withdrawal of Russian troops from eastern Ukraine. The State Department said it was “a good, tiny first step,” but insufficient. Ukrainian President Petro Poroshenko said on Wednesday that Russia had removed most of its soldiers from the rebel-held eastern parts of his country, raising hopes for an end to a five-month-long violent conflict that has killed more than 2,600 people. “According to the latest information I have received from our intelligence, 70% of Russian troops have been moved back across the border,” Poroshenko said in a televised cabinet meeting. “This further strengthens our hope that the peace initiatives have good prospects.” The president said that Friday’s ceasefire – backed by both Kyiv and Moscow – had dramatically improved the security situation in Ukraine’s eastern regions. Poroshenko, however, added that the ceasefire with pro-Moscow rebels was proving to be difficult because “terrorists” were constantly trying to provoke Kyiv’s forces.

US State Department spokeswoman Marie Harf said on Wednesday evening that the United States could not confirm the Ukrainian leader’s claims. “Of course, even if we eventually can verify his claims about the Russian troops pulling back, there would still be Russian troops that remain there,” Harf said. “Obviously, any de-escalatory steps would be good ones, but there is much more work to be done here.” Victoria Nuland, the US assistant secretary of state for European and Eurasian affairs, was more cautious in her reaction. Speaking at the German Marshall Fund in Washington, Nuland said “all foreign forces have to be withdrawn” from the eastern European country. “All foreign material has to be withdrawn, the border has to be secured, there has to be the decentralization and amnesty that have been promised,” she said, adding that “there is a long way to go.”

Poroshenko said he would propose a bill to Ukrainian parliament next week offering “special status” to parts of conflict-ridden Donetsk and Luhansk regions of eastern Ukraine which are now under control of separatists. The Ukrainian president, however, rejected the calls for complete independence or the “radical federalization” of these areas as demanded by Moscow. “Ukraine will not make any concessions on issues of its territorial integrity,” he said. A pro-Russia separatist leader in Donetsk dismissed Poroshenko’s comments and said the rebels intended to become independent.

Read more …

• Law On War Crimes Amnesty For Ukraine Troops Discussed In Parliament (RT)

The Ukrainian parliament is to debate a law on amnesty for Ukrainian troops who have committed war crimes in the course of military actions in Eastern Ukraine. Earlier, an Amnesty International report confirmed the facts of large-scale crimes. A bill on amnesty for military personnel who committed war crimes during the military crackdown in Eastern Ukraine was introduced in the Rada (the Ukrainian parliament) on Wednesday, its website says. The bill assumes the discharge of legal responsibility and punishment of military staff and “other people” for the actions which “bear the marks of war crime.” Earlier, on 8 September, Amnesty International presented a report in which confirmed that such actions were committed by the Aidar volunteer battalion.

Aidar is one of over 30 volunteer battalions which appeared after Kiev started the military operation in the Donetsk and Lugansk regions. It is loosely connected with the Ukrainian security structures. “Members of the Aidar territorial defense battalion, operating in the north Luhansk [Lugansk] region, have been involved in widespread abuses, including abductions, unlawful detention, ill-treatment, theft, extortion, and possible executions,” the AI report says. The AI researchers interviewed dozens of victims and witnesses of the abuses and crimes, as well as local officials, police and army commanders in Lugansk area. The watchdog pointed out that while formally operating under the command of the Ukrainian security forces combined headquarters in the region, members of the Aidar battalion act “with virtually no oversight or control, and local police are either unwilling or unable to address the abuses.”

Read more …

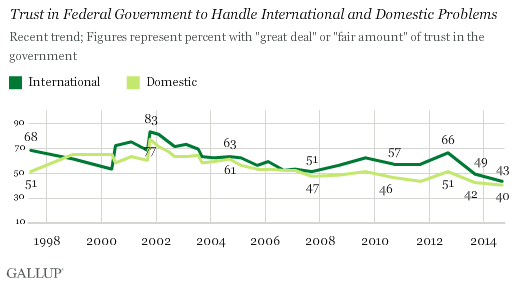

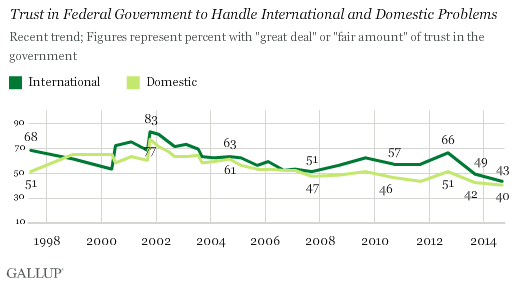

Loss of trust at home …

• Trust in US Government on International, Domestic Issues at New Low (Gallup)

Americans’ trust in the federal government to handle international problems has fallen to a record-low 43% as President Barack Obama prepares to address the nation on Wednesday to outline his plan to deal with ISIS. Separately, 40% of Americans say they have a “great deal” or “fair amount” of trust in the federal government to handle domestic problems, also the lowest Gallup has measured to date. The results are based on Gallup’s annual Governance poll, conducted Sept. 4-7. This year’s poll was conducted at a time when the government is faced with instability in many parts of the world, including Iraq and Syria, the Middle East, and Ukraine.

Americans’ confidence in the government to handle international problems slid 17 %age points last year, when the Obama administration was planning military action against Syria. Russia later brokered an agreement to avert that action. Last year’s poll marked the first time that fewer than half of Americans trusted the federal government’s ability to deal with international threats. With the world stage seemingly more unstable now, the public’s trust has dipped an additional 6 %age points this year. Likewise, trust in the government’s ability to handle domestic problems dropped slightly this year after a larger decline in 2013. Although the economy has improved, it may be overshadowed by partisan gridlock in Washington, which has led to little formal government action to deal with important domestic challenges facing the United States. Indeed, Americans have consistently mentioned dissatisfaction with government as one of the most important problems facing the country in 2014.

Gallup has never measured lower levels of trust in the federal government to handle pressing issues than now. That includes the Watergate era in 1974, when 51% of Americans trusted the government’s ability to handle domestic problems and 73% trusted its ability to deal with international problems, and also at the tail end of the Bush administration when his job approval ratings were consistently below 40% and frequently below 30%. The key question going forward is whether Americans’ trust in the federal government can be restored. Although there have been short-lived increases in recent years, including in Obama’s first year in office and in his re-election year, these were not maintained. The general trend since the post-9/11 surge has been toward declining trust. [..] given the public’s frustration with the way the government is working, it may be necessary to elect federal officials who are more willing to work together with the other party to find solutions to the nation’s top problems.

Read more …

… and abroad.

• US, Obama Lose Favor with Germans Over Spying Scandal (WSJ)

The U.S. has lost favor with its traditional ally Germany over the past year, a new study shows, with German approval for President Barack Obama’s policies plummeting in the wake of the National Security Agencyspying scandal. Over the past year, the number of Germans with a positive view of the U.S. president’s policies has nose dived 20%age points to 56%, according to a study by U.S. think tank the German Marshall Fund. The study noted “the German-U.S. relationship appears to have cooled off markedly.” Trans-Atlantic ties have frayed since 2013 news reports over the NSA’s vast intelligence collection program and U.S. surveillance in Germany—including of Chancellor Angela Merkel’s cellphone. Revelations based on documents provided by former NSA contractor Edward Snowden shocked the German public and continue to burden the usually-close relationship between Washington and Berlin. The survey, which polled about 1,000 people in Germany, found “favorability of the U.S. in Germany” dropped from 68% in 2013 to 58% this year.

The poll was conducted by research company TNS Opinion from June 2 to June 26. As Berlin takes a more assertive stance on geopolitical affairs like the crises in Ukraine and Iraq, a majority of Germans polled said, for the first time, that they would prefer their country take a more independent approach from the U.S. on security and diplomatic policy. “Germany is at a crossroads in defining the role it wants to take in foreign policy and the world at large,” said Lora Anne Viola, a political scientist at Berlin’s Free University, noting that Berlin is in a unique position to react to current events like the conflict in Ukraine and the euro crisis. A departure from Germany’s historical reluctance to engage in geopolitical affairs could ultimately be a boon to Washington. The countries could shake off their traditional big brother and little brother relationship as, despite Germans’ current wariness toward the U.S., there are “too many problems the U.S. and Germany have to confront together,” Ms. Viola said.

Read more …

• China Inflation Data Show Economy Losing Momentum: Nomura (CNBC)

China’s consumer inflation eased in August while wholesale deflation intensified, clouding the outlook for an economy struggling to stage a convincing recovery. China’s consumer prices eased to 2% last month, data on Thursday showed, slower than July’s 2.3% rise and below a Reuters poll expecting a 2.2% increase. This remains below Beijing’s official target of 3.5%. Producer prices, meanwhile, continued their deflationary spiral, dipping 1.2% after falling 0.9% in July, a tad worse than the 1.1% fall expected. Producer prices in China have been declining since February 2012, weighed by falling commodity prices, overcapacity and weakening demand.

“I think the figures are consistent with a whole lot of data showing that the Chinese economy losing momentum again,” said Rob Subbaraman, chief economist at Nomura. “The PPI deflation is worsening, I think that’s a sign of overcapacity problems. The oversupply problem in the property sector is starting to have effects on the upstream industries that supply the property sector. They’re feeling the pinch now so that’s showing in the PPI,” he added. China’s economy growth slowed to 7.4% in the first quarter from a year earlier, the slowest pace in six quarters. Growth inched higher to 7.5% the second quarter, but a flurry of recent data has painted a bleak picture in credit inflows, manufacturing and the real estate market.

Read more …

Squeeze out the last bits

• China Speculators Go Online Chasing Profits as Home Prices Drop (Bloomberg)

With just 11,000 yuan ($1,796), 50-year-old Deng Bangfu made his first property investment in China, flipping it in just two months for a profit even as the nation’s home prices fall. Deng and about 300 other investors bought a 14.9 million yuan townhouse in June in the southern Chinese city of Dongguan and sold it in August for 16 million yuan. The vehicle: a peer-to-peer lending and financing website called Tuandai, which is testing a crowdfunding product that meets developers’ desire to quicken sales by tapping demand for better returns. “Now I can tell people I once owned a townhouse, which I could never afford myself all my life,” Deng, an accountant at a technology company in Dongguan, said by phone. “We know that local governments have started loosening home-purchase restrictions. As soon as banks ease mortgage curbs, home prices will quickly rebound.”

Online investors, who since 2011 helped drive a 50-fold increase in financing through peer-to-peer websites such as Tuandai, are turning to property as falling home prices prompt the government to ease curbs aimed at stamping out speculation. Officials are seeking to revive local-government revenues at the risk of bringing home-flippers back to the market. Speculators could return, Fitch Ratings said in an Aug. 7 report. “If liquidity recovers, home prices start to go up and sentiment improves,” Andy Chang, Fitch’s Hong Kong-based property analyst, said by phone. “Peer-to-peer lending will surely play a stronger role pushing the waves because it’s pure speculation or investment demand.”

Speculative buying – selling assets in a short period of time – accounts for more than 20% of demand in first-tier cities, which include Beijing and Shanghai, JPMorgan analyst Ryan Li wrote in a report last month. Investors accounted for 40% of homebuyers in 2007, when Shenzhen World Union Properties Consultancy Inc. started asking clients their reason for buying. That was three years before former Premier Wen Jiabao imposed home-purchase curbs and raised down payments to prevent a housing bubble. Home sales plunged 10.5% in the first seven months from a year earlier amid tight credit, according to government data, reversing a 27% jump last year. New-home prices fell in 64 of the 70 cities tracked by the government in July from June, the most since January 2011.

Read more …