Arthur Rothstein Steam shovels on flatcars, Cherokee County, Kansas 1936

“Markets keep treating weak data as “good news” (because it delays Fed tightening), but there comes a point when the macro-economic malaise does so much damage to earnings that reality catches up.”

• Wall Street Soars On Hopes Of Fed Reprieve, Yet Sting In The Tail (AEP)

Pay packets have fallen across the gamut of US industry, manufacturing, and trade over the last two months, greatly reducing the likelihood of any rise in interest rates by the US Federal Reserve until later this year. The Dow Jones index of stocks soared by 260 points to 18,186 in early trading after the US non-farm payrolls report for April revealed that wage pressures remain all but dead in the American labour market. Contracts on the futures markets immediately pushed out the first rate rise for several months, pricing in a 51pc chance of ‘lift-off’ in December. The long-feared inflexion point for the global monetary cycle may have been delayed once again. Emerging market equities rallied strongly on hopes of another six-month reprieve for dollar debtors across the world.

Companies and state entities outside the US have borrowed a record $9 trillion in dollars, leaving them acutely vulnerable to a currency “margin call” triggered by Fed tightening. This dollar leverage has jumped from $2 trillion fourteen years ago. It is heavily concentrated in Brazil, Russia, South Africa, Turkey, China and the rest of emerging Asia. The US generated 223,000 jobs in April and the unemployment rate fell to a 7-year low of 5.4pc, yet the underlying trend remains disappointingly weak. Both overtime and the number of hours worked edged down. The jobs figure for March was revised down sharply to 85,000. The labour participation rate for men is still stuck at 69.4pc, six percentage points lower than it was fifteen years ago and the lowest level since modern data began after WWII.

Had it not been for a surge in pay for financial services – the spill-over from an increasingly frothy asset boom – overall weekly earnings would have dropped for a second month in a row. It is unclear how the Fed will respond this soggy data. Dennis Lockhart, head of the Atlanta Fed, remained hawkish this week, insisting that the economy would soon return to growth rates of 2.5pc to 3pc after grinding to halt in the first quarter. He warned that a rate rise in June was still “in play”, contrary to market assumptions. “I’m still of the view that the conditions will be appropriate in the middle of the year, which we are getting closer to,” he said. Yet the US economy has not yet recovered from a winter shock.

Mr Lockhart’s own advance indicator – the Atlanta Fed’s GDPNow series – suggests that growth has been running at a pace of just 0.8pc in the five weeks to early May. It is below the Fed’s stall speed gauge. China’s exports fell 6.9pc in April from a year earlier and remain shockingly weak. The eurozone’s retail sales unexpectedly slid 0.8pc in March, and Germany’s index of core industrial orders has turned negative. Markets keep treating weak data as “good news” (because it delays Fed tightening), but there comes a point when the macro-economic malaise does so much damage to earnings that reality catches up.

Read more …

“..the number of full-time jobs dropped by 252,000 in April – hardly an endorsement of the awesomeness theme.”

• Wall Street Is One Sick Puppy (David Stockman)

The robo-traders – both the silicon and carbon based varieties – were raging again today in celebration of a “goldilocks” jobs report. That is, the headline number for April was purportedly strong enough to sustain the “all is awesome” meme, while the sharp downward revision for March to only 85,000 new jobs will allegedly enable the Fed to kick-the-can yet again – this time until its September meeting. As one Cool-Aid drinker put it, ‘“Probably best scenario in which the market was hoping for growth but not (so strong) that the Fed needs to hike in June,” said Ryan Larson at RBC Global Asset Management.’ Today’s knee jerk rip, of course, is the fifth one of roughly this magnitude since February 20th, but its all been for naught.

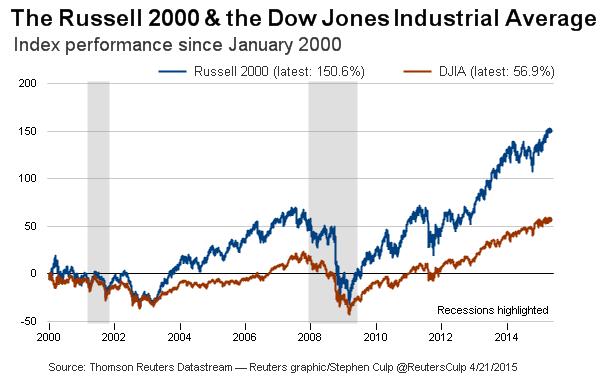

The headline based rips have not been able to levitate the S&P 500 for nearly three months now.In fact, however, the incoming data since February 20 has been uniformly bad. The chop depicted in the graph, therefore, only underscores that the market is desperately churning as it attempts to sustain an irrationally exuberant high. Indeed, today’s jobs data was not bullish in the slightest once you get below the headline. Specifically, the number of full-time jobs dropped by 252,000 in April – hardly an endorsement of the awesomeness theme. True enough, the monthly number for this important metric bounces around considerably. Yet that’s exactly why the algo fevers stirred by the incoming data headlines are just one more piece of evidence that the stock market is completely broken.

What counts is not the headline, but the trend; and when it comes to full time jobs there are still 1.1 million fewer now than at the pre-crisis peak in Q4 2007. Needless to say, a net shrinkage of full-time jobs after seven and one-half years is not exactly something that merits a 20.5X multiple on the S&P 500 or 75X on the Russell 2000. That’s the case especially when that same flat lining jobs trend has been underway for nearly a decade and one-half. To wit, since April 2000 the BLS’ full time job count has grown at only 0.35% annually. Now how in the world do you capitalize earnings at a rate which implies gangbusters growth of output and profits as far as the eye can see, when the US economy is self-evidently trapped in a deep rut that represents a drastic downshift from all prior history?

Read more …

Rollercoaster ahead.

• Currencies’ Wild Ride to Get Wilder as US Rate Rise Beckons (Bloomberg)

If you thought the past week in the foreign-exchange market was wild, you haven’t seen anything yet. That’s the outlook from investors and strategists ranging from State Street Global Advisors to Cambridge Global Payments after price swings in the euro versus the dollar approached the highest level in more than three years. Volatility surged as traders unwound bets for gains in European bonds and stocks that had been funded in euros, prompting demand for the shared currency to close out what are known as carry trades. Price swings accelerated Friday after a lackluster U.S. employment report, raising more questions than answers about the timing of Federal Reserve interest-rate increases. “This unusual backdrop is going to create some turmoil,” Dan Farley at State Street.

“The next several weeks are likely to be choppy as things continue to be absorbed, bouncing off the good and the bad news.” The euro’s one-month implied volatility jumped as high as 13.2%, inching toward the 14% level where it last closed in December 2011. The common currency was unchanged on the week at $1.1199 as of 5 p.m. on Friday in New York. The Bloomberg Dollar Spot Index slid 0.7%, falling a fourth week in its longest run of declines since October 2013. The greenback weakened 0.3% to 119.76 yen. Europe’s bond rout wiped more than $400 billion from the value of the region’s debt in the past two weeks as investors questioned whether the ECB will continue its program of asset purchases through September 2016 amid signs the region’s economy is picking up.

The selloff eroded the premium Treasuries pay over bunds to the narrowest since February, lessening the attractiveness of dollar-denominated assets. “You’re going to see continued volatility driven by the bond markets,” said Karl Schamotta at Cambridge Global Payments in Toronto. “Investors are increasingly concerned that they could be caught in the exits when everyone rushes out of the theater.”

Read more …

Apparently these people find it hard to see what’s wrong.

• Low Productivity Alarms US Policy Makers (FT)

US innovators claim they have never been busier, but their ideas are persistently failing to transform the country’s economic data. Labour productivity fell an annual 1.9% in the first three months of the year, while unit labour costs rose sharply, official figures showed on Wednesday. The output per hour figures came as the country’s gross domestic product barely grew during the quarter even as it added an average of nearly 200,000 jobs a month. The numbers confirm a longer-run trend of slowing productivity that is alarming policy makers and complicating Federal Reserve decision-making. “It has slowed in quite a worrying way,” said Torsten Slok, chief international economist at Deutsche Bank.

Productivity, which measures how efficiently inputs such as labour and capital are used, evolves over years and decades. This means a single quarter’s data should not be over-interpreted — especially one that was hit by one-time factors including freezing temperatures. The first quarter dive mirrors a weather-affected first quarter in 2014. But the numbers, which follow a 2.1% annual productivity drop in the fourth quarter, confirm a broader tendency that has been mirrored in a number of advanced economies and has perplexed economists. Analysis from the San Francisco Federal Reserve shows there was a surge in US productivity between 1995 and 2003, driven by the IT boom, with growth doubling from the annualised average of 1.5% set in the 1970s, 1980s and early 1990s.

The picture then reversed, however, and the US has been stuck in a lower-productivity growth trend since. Internationally comparable figures from the Conference Board show a broader slowdown among advanced economies including the UK and Japan over recent decades. Some economists say these weak numbers are jarring given the inventiveness being displayed in sectors such as software, medicine, and advanced manufacturing, and the rapid advance of robotics. “People are saying the pace of innovation has never been higher,” says Martin Neil Baily, an economist at Brookings, the think-tank.

Read more …

“2016 sounds more and more like McCain/Palin’s 2008 loss when the GOP was also deep in denial about the coming market crash..”

• Countdown To The Stock-Market Crash Of 2016 Is Ticking Louder (Paul B. Farrell)

Warning bells just keep getting louder and louder as the countdown to the Crash of 2016 keeps ticking. Wall Street’s in denial, but the Washington Post warns: “U.S. economic growth slows to 0.2%, grinding nearly to a halt.” USA Today hears “Bubble Talk” at the Vegas “Davos for Geeks.” Earlier the Wall Street Journal warned, “declining population could reduce global economic growth by 40%.” Then recently the “slow-growth Fed” was blamed. Wrong, former Fed chief Ben Bernanke counterattacked: “I’m waiting for the Journal to argue for a well-structured program of public infrastructure development, which would support growth in the near term by creating jobs and in the longer term by making our economy more productive.”

But for years the Fed “has been pretty much the only game in town as far as economic policy goes.” Today “we should be looking for a better balance between monetary and other growth-promoting policies, including fiscal policy.” Fiscal policy? No, Ben, not a chance. The GOP controls economic policy. And they will never give “growth-promoting fiscal policy” victories to President Obama and Hillary Clinton before the presidential election of 2016. Never. In spite of Bernanke’s obviously rational solution to the core problems of the American economy, one that would help the American people, the GOP will never, ever agree to fiscal stimulus programs that give the Democrats bragging rights and make Obama and Clinton look good before the elections.

The GOP is hungry for power, very hungry. They lost the presidency twice to Obama. They want it back. And now their collective ego is convinced that with the $889 million backing from the Koch Empire they can beat Hillary and take absolute control of the American democracy: win the presidency, hold Congress, gain the power to issue executive orders and veto legislation, appoint more than 6,000 insiders including cabinet officers, regulatory heads, federal judges, ambassadors, staff bureaucrats, and more. Yes, the GOP knows all that power is on the line in 2016. Listen: 2016 sounds more and more like McCain/Palin’s 2008 loss when the GOP was also deep in denial about the coming market crash. Money manager Jeremy Grantham’s predictions see beyond the Big Oil-funded GOP’s gross denial, he sees that “around the presidential election or soon after, the market bubble will burst, as bubbles always do, and will revert to its trend value, around half of its peak or worse.”

Read more …

Only 15 million out of 93 million not in labor force? So 78 million bluntly refuse to work? Hard to believe.

• ‘Good’ Jobs Report? 15 Million Unemployed People Want To Work (MarketWatch)

There is good news in the jobs market, just not enough of it. The Bureau of Labor Statistics reported Friday that the U.S. economy continued to create jobs at a healthy pace of nearly 200,000 per month in the first four months of the year, and the unemployment rate dipped to 5.4% in April, the lowest since May 2008. But we are still far from achieving an economy that offers a job for everyone who wants one. And wages are barely growing for the 148 million who do have a job. Nearly 15 million jobless people say they want to work, but the Federal Reserve seems nearly ready to declare victory, figuring that the unemployment rate can’t go much lower without setting off a harmful inflationary spiral.

There is scant evidence that tight labor markets are putting any pressure on companies to raise their prices: Unit labor costs are up just 1.1% in the past year. Inflation — no matter how you measure it — is not a risk in the near term, or even in the medium term. There’s little evidence that workers have gotten those hefty raises that economists insisted were coming any day now. Growth in average hourly earnings is stuck in the same tight range of about 2% per year that it’s been at for the past five years. In April, average hourly earnings rose only 0.1%, bringing the change over the past year to 2.2%. And the “average” wage overstates the reality for most workers.

The average is boosted by rapid pay increases for just a few, including executives, whose “salaries” include bonuses and the receipt of shares of the company’s stock or options to buy shares. The encouraging acceleration in compensation that was reported in the employment cost index last week was largely due to sales commissions and bonuses collected by only a few. Most workers aren’t seeing that 2.2% pay increase. For the median full-time worker, usual weekly earnings are up just 1.5% in the past year, far below the 4% pay raise they got the last time that the unemployment rate was as low as 5.4%. (The “median” means that half of the workers got less than a 1.5% pay raise, and half got more.)

Read more …

“While the U.K. Independence Party, which campaigns for an EU exit, has only won one seat, the party won 13% of the popular vote..”

• UK Braces for Battle Over Europe After Cameron’s Victory (Bloomberg)

David Cameron persuaded U.K. voters to give him a second term as prime minister. Now he needs to persuade them to stay in the European Union. The Conservatives’ surprise win came after a campaign that saw Cameron’s pledge of a referendum on EU membership by 2017 share almost equal billing with his record of delivering economic stability. Cameron, who has said he wants the country to stay in the EU, will first seek to renegotiate Britain’s membership terms. The Conservatives “may even try and bring things forward to stop this wrecking the next two years for them,” said Tim Bale, professor of politics at Queen Mary University in London.

“It’s a very tight majority which means he will have to make promises to people and do things to keep them on board on Europe, in particular as Cameron has a record of backing down under pressure to euro skeptics.” While the pound surged on Cameron’s victory amid optimism that an economic recovery will solidify under his administration, some investors warned that the euphoria could be short lived as a EU referendum draws closer into view. The vote is intended to settle a question that’s divided the nation since the U.K. joined Europe’s common market in 1973, and split the Conservatives for a generation. “Initial short-term cheer could be followed by a medium-term chill,” said Fabrice Montagne at Barclays.

“The referendum is likely to generate a substantial amount of uncertainty, particularly if polls fail to show more substantial support for EU membership in the coming weeks and months.” With most seats declared, the BBC forecast the Tories to take 331 of Parliament’s 650 seats to Labour’s 232 seats, a result that would allow Cameron to govern alone. While the U.K. Independence Party, which campaigns for an EU exit, has only won one seat, the party won 13% of the popular vote, according to the BBC. Last year, UKIP won the most votes in elections for the European Parliament, taking almost a third of Britain’s seats.

Read more …

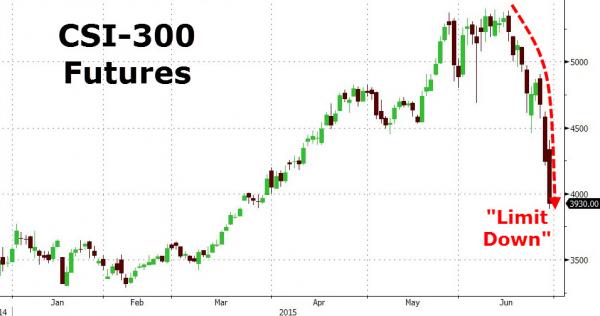

That’s just China’s biggest four banks. “Property prices in 70 Chinese cities have fallen for more than a year..” “Loans backed by properties now comprise 40% of all facilities held by Fitch-rated banks..”

• The $364 Billion Real Estate Threat Inside China’s Biggest Banks (Bloomberg)

Fitch Ratings has called real estate the “biggest threat” to Chinese banks as surging loans tied to properties coincide with defaults and falling sales. Corporate loans backed by buildings have grown almost fivefold since 2008 and residential mortgages have more than tripled in the period among lenders rated by Fitch, the company said Friday. That’s seen property loans held by China’s four biggest lenders soar to a total 2.26 trillion yuan ($364 billion), according to their annual reports. “Collateral is supposed to reduce bank risk – but the rise of property collateral in corporate loans may actually increase the chance of bank failure,” Fitch analysts Jack Yuan and Grace Wu said in the report.

“This is because the widespread use of such collateral has lowered the perceived risks of lending, fueling China’s credit build-up and spreading real-estate risk to other sectors of the economy.” Alarm bells sounded last month when Kaisa Group Holdings Ltd. became the first Chinese developer to default on offshore bonds, putting more scrutiny on a sector that made up a third of the nation’s economy in 2013, according to Gavekal Dragonomics. Property prices in 70 Chinese cities have fallen for more than a year, the worst losing streak in at least a decade, while sales have dropped for 11 of the past 24 months, Bloomberg-compiled data show. Loans backed by properties now comprise 40% of all facilities held by Fitch-rated banks, according to the report. Total credit to real estate could be as high as 60% if other types of financing besides direct loans are included, Fitch said.

“The property market is usually one of the main revenue contributors to the state,” said Raymond Chia, the head of credit research for Asia ex-Japan at Schroder Investment Management Ltd. “With the weakness in the sector, especially with excess inventory overhang as well as weak earnings by developers, economic growth will be affected.” Industrial & Commercial Bank of China, the world’s biggest bank by assets, held 443.5 billion yuan of real estate loans, or 6.6% of all facilities, at the end of last year, according to its annual report. The portion for Bank of China, the nation’s second-largest, was 714.6 billion yuan of advances, or 8.4% of its credit book.

Read more …

“Today, a long depression in the US would be unbearable. The public couldn’t stand it. Six out of ten households live paycheck to paycheck. Can you imagine what would happen if those paychecks ceased?”

• Deflation Works! (Bill Bonner)

As we have seen, Japan has already had a 25-year slump. The US is now in Year 8 of its slump, with fragile growth at only half the rate of the last century. They could get better… or worse. Negative rates could keep the cronies in business. The slump itself – combined with peak debt and 500 million Chinese laborers – could keep inflation in check. But the point comes when investors see that the risk of loss (because something can always go wrong) is greater than the hope of gain. That moment must be approaching in the US stock market. Prices are near record highs, even as the economy flirts with recession. One day, perhaps soon, we will see stocks falling – as much as 1,000 points in 24 hours. Jacking up the stock market has been the Fed’s singular success. Activism has been its creed.

Interventionism is its modus operandi. It will not sit tight as the market falls apart and the economy goes into recession. Instead, it will announce QE 4. It will try to enforce negative interest rates. And it will move – as will the Japanese – to “direct monetary funding” of government deficits. That is, it will dispense with the fiction of “borrowing” from its own central bank. It will simply print the money it needs. The US Fed of 1930 was not nearly as ambitious and assertive as the Fed of 2015. In the ‘30s, it watched as the economy chilled into a Great Depression. As Ben Bernanke told Milton Friedman, “We won’t do that again.” It couldn’t if it wanted to. Back in the ‘30s, consumer debt had barely been invented. Most people still lived on or near farms, where they could take care of themselves even if the economy was in a depression.

Few people had credit. Instead, they had savings. There were no food stamps. No disability. No rent assistance. No zombie industries. No student debt. No auto debt. No cash-back mortgages. And cash was real money, backed by gold. Today, a long depression in the US would be unbearable. The public couldn’t stand it. Six out of ten households live paycheck to paycheck. Can you imagine what would happen if those paychecks ceased? Supposedly, the US economy is still growing… with the stock market near record highs. Yet, one out of every five households in America has not a single wage-earner. Among inner-city black men, ages 20-24, only 4 out of 10 have jobs. Half the households in the US count on government money to make ends meet. And 50 million get food stamps. What would happen to the cities – and the suburbs – in a real depression?

Read more …

They try to act as if Yanis were stupid, but they themselves lack understanding of the matter at hand.

• Documents Distributed by Greece’s Varoufakis ‘Baffle’ Eurozone Officials (WSJ)

Economic plans and growth estimates distributed by Greek Finance Minister Yanis Varoufakis to some of his eurozone counterparts have baffled officials involved in the talks over its international bailout. Officials say that the files differ greatly from what has been discussed at the technical level in Brussels in recent days and underline how Mr. Varoufakis continues to complicate progress toward a financing deal. The 36-page document, entitled “Greece’s recovery: A blueprint” and seen by The Wall Street Journal, was presented by Mr. Varoufakis to his counterparts in Paris and Rome, as well as senior officials in Brussels, while he was touring European capitals over the past week, according to four European officials.

The Greek Finance Ministry said the document was a first draft of a new plan “for the recovery and growth of the country in the [post-bailout] era,” which it said Mr. Varoufakis had discussed informally with some of his counterparts. “This is a long-term project that goes well beyond the limits of the negotiation that is currently underway in the Brussels Group,” as the group of experts representing Greece and its creditors is known, the ministry said. Greece’s leftist-led government is locked in negotiations with the European Union and the International Monetary Fund over its next slice of financial aid as part of a €245 billion rescue package. Disagreements over cuts to Greece’s pension system and changes to its labor rules that would make it easier to dismiss workers have held up a deal on further loans.

While the talks have become more constructive, differences remain wide, European officials say. The paper focuses on the Greek economy and how it can return to growth. “Perhaps it is time to visualize a recovering Greece before we unlock the present impasse,” the document says, before going into areas where the country plans overhauls. While some of the outlined measures are the same as those agreed to in the negotiations—such as the creation of an independent tax commissioner—the paper differs in other areas. One significant difference is the creation of a so-called bad bank that would house and wind down Greek lenders’ bad loans. “Conveniently, the financing of the bad bank is not treated,” an EU official said.

Read more …

Prelude to multiple bankruptcies.

• Illinois Supreme Court Strikes Down Law to Rein in Public Sector Pensions (WSJ)

The Illinois Supreme Court struck down the state’s 2013 pension overhaul, unraveling an effort by lawmakers to rein in benefits for the consistently underfunded public-sector system. The current pension shortfall is estimated at $111 billion, one of the largest nationally. The high court affirmed a decision in November by a state circuit court that the legislative changes violated pension protections written into the state constitution. The decision is a victory for a consortium of public-sector unions while creating a huge challenge for new Republican Gov. Bruce Rauner, who already faces a yawning budget deficit for the coming fiscal year.

“The financial challenges facing state and local governments in Illinois are well known and significant,” said Justice Lloyd Karmeier, writing for the entire court. “It is our obligation, however, just as it is theirs, to ensure that the law is followed.” Illinois joins Oregon and Arizona as recent examples of high courts peeling back pension overhauls. Other states, including Colorado and Florida, have upheld laws cutting benefits. Mr. Rauner’s office urged a constitutional amendment to help fix the problem. Otherwise, the state will be forced to turn to tax increases, budget cuts or, as Mr. Rauner discussed earlier this year, municipal bankruptcy. Recent federal bankruptcy cases in Detroit and Stockton, Calif., have raised the question of whether pension benefits are fully protected.

After the ruling, Standard & Poor’s Ratings Services put the state’s credit ratings on watch for potential downgrade, saying Illinois faces “profound credit challenges.” The Illinois law would have reduced retirement costs by shrinking cost-of-living increases for retirees, raising retirement ages for younger workers, and capping the size of pensions. “The court’s ruling confirms that the Illinois Constitution ensures against the government’s unilateral diminishment or impairment of public pensions,” said Michael Carrigan, president of the Illinois ALF-CIO, speaking on behalf of the We Are One Illinois coalition of unions.

Read more …

It’s not democracy, it’s what is not democracy but is still called by that name.

• Democracy Is A Religion That Has Failed The Poor (Guardian)

Right now I feel ashamed to be English. Ashamed to belong to a country that has clearly identified itself as insular, self-absorbed and apparently caring so little for the most vulnerable people among us. Why did a million people visiting food banks make such a minimal difference? Did we just vote for our own narrow concerns and sod the rest? Maybe that’s why the pollsters got it so badly wrong: we are not so much a nation of shy voters as of ashamed voters, people who want to present to the nice polling man as socially inclusive, but who, in the privacy of the booth, tick the box of our own self-interest. Rewind 24 hours and it felt so different. Thursday morning was lovely in London, full of the promise of spring. Even the spat I had with the man outside my polling station shouting at “fucking immigrants” didn’t disrupt an overall feeling of optimism.

Were people walking just a little bit more purposefully? Was I mistaken in detecting some calm excitement, almost an unspoken communal bonhomie? Perhaps also a feeling of empowerment, a sense that it was “the people” that could now make a difference. But by bedtime the spell had been broken. Things were going to stay the same. No real difference had been made. The utterly miserable thought strikes me that Russell Brand just might have been right. What difference did my vote make? Why indeed do people vote, and care so passionately about voting, particularly in constituencies in which voting one way or the other won’t make a blind bit of difference? And why do the poor vote when, by voting, they merely give legitimacy to a system that connives with their oppression and alienation?

The anthropologist Mukulika Banerjee suggests a fascinating answer: elections are like religious rituals, often devoid of rational purpose or efficacy for the individual participant, but full of symbolic meaning. They are the nearest thing the secular has to the sacred, presenting a moment of empowerment. But is this empowerment illusory? Is, as Banerjee asks, “the ability to vote … a necessary safety valve which allows for the airing of popular disaffection, but which nevertheless ultimately restores the status quo. In such a reading, elections require the complicity of all participants in a deliberate mis-recognition of the emptiness of its procedures and the lack of any significant changes which this ritual brings about, but are a necessary charade to mollify a restless electorate.”

Read more …

The numbers are insane and growing. This may well make the country ungovernable.

• Petrobras: The Betrayal of Brazil (Bloomberg)

Since March 2014, prosecutors have accused more than 110 people of corruption, money laundering, and other financial crimes. Six construction and engineering firms have been accused of illegal enrichment in what is known as a noncriminal misconduct action. On April 22, Moro delivered the first convictions. He found Costa and Youssef guilty of money laundering, including the Land Rover purchase. Moro gave both men reduced sentences two years house arrest for Costa and three years in prison for Youssef for cooperating with prosecutors. All of that is something of a preview of the big show: Prosecutors say they may accuse some of Brazil s largest builders with running an illegal cartel.

It’s been clearly proven in this case that there was a criminal scheme inside Petrobras that involved a cartel, bid rigging, bribes to government officials and politicians, and money laundering, Moro wrote in sentencing Costa and Youssef. There will be a cartel indictment, says Carlos Lima, a lead prosecutor in the case. I do’ t like to get ahead of myself and say this will happen, but it will. It’s just a matter of time. In filings in Judge Moro’s court, prosecutors have named 16 companies that allegedly formed a cartel to fix Petrobras contracts between 2006 and 2014. The list includes some of Brazil s largest construction and engineering firms, including Camargo Correa, OAS, UTC Engenharia, and the biggest of them all, Construtora Norberto Odebrecht. All of these companies deny being part of a cartel, except Camargo Correa, which declined to comment.

Petrobras says it knew nothing about the bid rigging and is collaborating with authorities in the investigation. As to whether it was the victim of a cartel, the company is certain, Mario Jorge Silva, Petrobras’s executive manager for performance, said at an April 22 news conference. In financial filings, Petrobras says 199.6 billion reais worth of contracts were rigged by the alleged cartel. For years, a co-owner of the engineering firm UTC called members to meetings at his offices in Sao Paulo via text messages, according to testimony and documents submitted in Moro’s court. The participants were greeted by an assistant, who handed out name tags. At the meetings, executives took copious notes detailing how the alleged cartel would divvy up Petrobras contracts, at inflated prices. One builder put together a 2 1/2-page encoded guide for group members that describes contract bidding as a soccer tournament, with leagues and teams.

Another document drawn up by a group member lists the chosen winners of upcoming bidding for 14 contracts for a refinery, with the title Fluminense Final Bingo Proposal, using a nickname for the state of Rio de Janeiro. Prosecutors say the builders got away with it by paying kickbacks, usually 3%, on every contract. Petrobras estimates that the graft added up to at least 6.2 billion reais, much of which, prosecutors say, was funneled into the war chests of the parties that backed Luiz In·cio Lula da Silva, president of the country from 2003 to 2010, and his handpicked successor, Dilma Rousseff. Lula and Rousseff haven t been charged with wrongdoing, but special prosecutors have opened criminal investigations into more than 50 members of congress and other politicians implicated in the corruption scheme.

Read more …

“..in all these years, Hillary Clinton has not publicly condemned Wall Street or any individual Wall Street leader.”

• The Clintons and Their Banker Friends- The Wall Street Connection (Nomi Prins)

The past, especially the political past, doesn’t just provide clues to the present. In the realm of the presidency and Wall Street, it provides an ongoing pathway for political-financial relationships and policies that remain a threat to the American economy going forward. When Hillary Clinton video-announced her bid for the Oval Office, she claimed she wanted to be a “champion” for the American people. Since then, she has attempted to recast herself as a populist and distance herself from some of the policies of her husband. But Bill Clinton did not become president without sharing the friendships, associations, and ideologies of the elite banking sect, nor will Hillary Clinton. Such relationships run too deep and are too longstanding.

To grasp the dangers that the Big Six banks (JPMorgan Chase, Citigroup, Bank of America, Wells Fargo, Goldman Sachs, and Morgan Stanley) presently pose to the financial stability of our nation and the world, you need to understand their history in Washington, starting with the Clinton years of the 1990s. Alliances established then (not exclusively with Democrats, since bankers are bipartisan by nature) enabled these firms to become as politically powerful as they are today and to exert that power over an unprecedented amount of capital. Rest assured of one thing: their past and present CEOs will prove as critical in backing a Hillary Clinton presidency as they were in enabling her husband’s years in office.

In return, today’s titans of finance and their hordes of lobbyists, more than half of whom held prior positions in the government, exact certain requirements from Washington. They need to know that a safety net or bailout will always be available in times of emergency and that the regulatory road will be open to whatever practices they deem most profitable. Whatever her populist pitch may be in the 2016 campaign – and she will have one – note that, in all these years, Hillary Clinton has not publicly condemned Wall Street or any individual Wall Street leader. Though she may, in the heat of that campaign, raise the bad-apples or bad-situation explanation for Wall Street’s role in the financial crisis of 2007-2008, rest assured that she will not point fingers at her friends.

She will not chastise the people that pay her hundreds of thousands of dollars a pop to speak or the ones that have long shared the social circles in which she and her husband move. She is an undeniable component of the Clinton political-financial legacy that came to national fruition more than 23 years ago, which is why looking back at the history of the first Clinton presidency is likely to tell you so much about the shape and character of the possible second one.

Read more …

Deepening.

• Germany Spies, US Denies (Bloomberg)

Reports of German spying on European corporate targets at the behest of the U.S. have led to calls that Chancellor Angela Merkel was hypocritical for complaining about U.S. spying on Germany. Well, yes — but the hypocrisy of politicians hardly comes as a shock. What’s more striking about the recent revelations is their targets – and what they say about U.S. government claims that it doesn’t spy on behalf of private U.S. corporations. Start with a rather obvious question: Why would the U.S. government rely on Germany to spy on European corporations? Why not just do the spying directly? It’s not as if the U.S. lacks the intelligence capacity to do it. After all, the U.S. spied directly on Merkel in the episode that made her object so strongly and publicly and hypocritically.

It’s hard to know for sure, and the answer may conceivably lie in complex interstate agreements that aren’t public. But there’s a highly plausible alternative answer, one connected to the recent history of U.S. efforts to vilify Chinese government’s industrial espionage. The U.S. may be using Germany to do industrial spying because it wants to claim that, unlike other countries, the U.S. doesn’t do spying on behalf of its corporations. In August 2013, a National Security Agency spokesman told the Washington Post in an e-mail that the Department of Defense “does ***not*** engage in economic espionage in any domain, including cyber.” In case you’re wondering, the six asterisks appeared in the original e-mail. Notice that the NSA statement didn’t say that other agencies avoid economic espionage, just those that are part of the Department of Defense.

Notice, too, that the statement didn’t say that no one shares stolen information with the U.S. The next month, after a fresh round of Edward Snowden revelations, the director of national intelligence, James Clapper, issued a further statement. He acknowledged that “the Intelligence Community” (his capitalization) “collects information about economic and financial matters.” But he insisted that: “What we do not do … is use our foreign intelligence capabilities to steal the trade secrets of foreign companies on behalf of – or give intelligence we collect to – U.S. companies to enhance their international competitiveness or increase their bottom line.” A close, retrospective reading of this statement reveals it to be completely consistent with the U.S. relying on foreign intelligence organizations, such as the Germans, to spy on private targets – and then share the proceeds with American companies for whatever reason.

Read more …

All globalization does.

• Trans-Pacific Partnership Will Lead To A Global Race To The Bottom (Guardian)

At a time when economic inequality around the globe continues to widen, the Trans-Pacific Partnership (TPP) will only make things worse. Unlike what President Obama claims, the agreement will only encourage a race to the bottom, in which a small percentage of people get ridiculously rich while most workers around the globe stay miserably poor. We can’t let that happen. Today, President Obama is visiting Nike’s headquarters in Beaverton, Oregon to garner support for the trade deal, which would be signed by the US and 11 Pacific Rim countries. That’s an apt place for Obama to beat the free-trade drum – Nike, like the TPP, is associated with offshoring American jobs, widening the income inequality gap, and increasing the number of people making slave wages overseas.

Since the passage of NAFTA in 1993, we’ve seen the loss of nearly five million US manufacturing jobs, the closure of more than 57,000 factories, and stagnant wages. This deal won’t be any different. In November, Zachary Senn, a college student reporter at the Modesto Bee, spent three weeks in Indonesia living with and interviewing workers who make goods for Nike, Adidas, Puma and Converse. When you hear Obama talking about those “high-quality jobs,” think of RM, a 32-year-old mother who told Senn that she works 55 hours, six days a week and makes just $184 a month after 12 years at the PT Nikomas factory, a Nike subcontractor that employs 25,000 people. That’s 83 cents an hour or $2,208 a year. RM works in the sewing department and is expected to process 100 shoes an hour.

“If we don’t meet our quotas, we get yelled at”, she told Senn. “And then the quotas are piled into the next day”. Eating lunch is difficult because the food “smells bad,” and worse yet, RM said there is only one restroom, with 15 stalls, for 850 women. RM told Senn that she doesn’t want Nike to leave Indonesia; she wants an end to verbal abuse and a 50% raise, which would allow her to better provide for her family. Is $368 a month too much to ask from a multinational corporation that posted $27.8 billion in revenue and spent $3 billion on advertising and promotions in fiscal 2014? Nike CEO Mark Parker was paid $14.7 million in compensation last year. That’s $7,656 an hour. Wages in Vietnam, a key TPP partner, are even lower than Indonesia. Nike’s largest production center is in Vietnam where 330,000 mostly young women workers with no legal rights earn just 48 to 69 cents an hour.

Read more …

6 weeks old, but too good to leave behind.

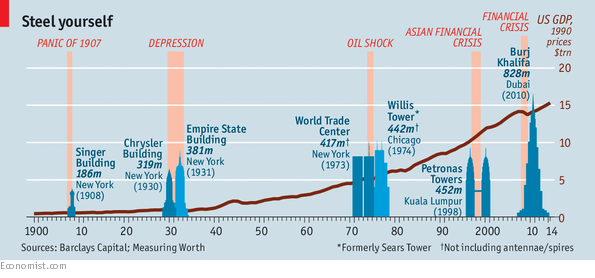

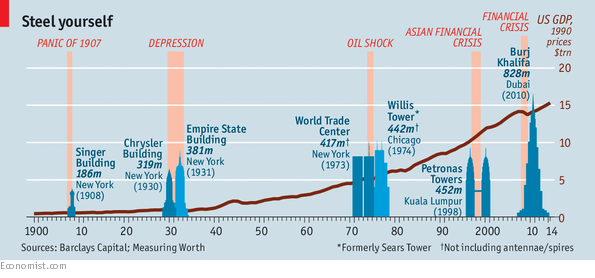

• Is There Such A Thing As A Skyscraper Curse? (Economist, March 28)

The world is in the middle of a skyscraper boom. Last year nearly 100 buildings over 200 metres tall were built—more than ever before. This year China’s business capital will welcome the Shanghai Tower, which will be the world’s second-tallest building. Saudi Arabia is building Kingdom Tower, which will be the world’s tallest (and twice the height of One World Trade Centre in New York, the tallest building in the Americas). Does this frenzy of building augur badly for the world economy? Various academics and pundits, many of them cited by The Economist, have long argued as much, but new research casts doubt on it.

In 1999 Andrew Lawrence, then of Dresdner Kleinwort Benson, an investment bank, identified what came to be known as the “skyscraper curse”.* Mr Lawrence noticed a curious correlation between the construction of the world’s tallest buildings and economic crises. The unveiling of the Singer Building and the Metropolitan Life Tower in New York, in 1908 and 1909 respectively, roughly coincided with the financial panic of 1907 and subsequent recession. The Empire State Building opened its doors in 1931, as the Great Depression was getting going (it was soon dubbed the “Empty State Building”). Malaysia’s Petronas Towers became the world’s tallest building in 1996, just before the Asian financial crisis. Dubai’s Burj Khalifa, currently the world’s tallest building, opened in 2010 in the middle of a local and global crash.

Skyscrapers can be hugely profitable, since by building upwards developers can rent out more floor space on a given plot of land. But at some point extra storeys are no longer a good deal, since marginal costs—for more lifts and extra steel to stop the building from swaying in the wind, for example—increase faster than marginal revenues (rents or sales). William Clark and John Kingston, an economist and an architect writing in 1930, found that the profit-maximising height for a skyscraper in midtown New York in the 1920s was no more than 63 storeys. (The ideal height is probably not much different today.) Record-breaking skyscrapers could therefore be seen as an indication that gung-ho investors are overestimating the probable future returns from new construction.

Indeed, developers may be building record-breaking towers even though they know they are economically inefficient. There is, after all, a certain cachet to having a very tall building with your name on it. In 1998 Donald Trump, a magnate, presented a plan to build the world’s tallest residential building in New York as the righting of a historical wrong, not a shrewd business move. “I’ve always thought that New York should have the tallest building in the world,” he proclaimed. If such vanity projects can secure funding, the theory goes, financial markets must be out of control and will soon suffer a sharp correction. Mr Trump’s tower opened just as the dotcom bubble was bursting.

Read more …

And London, New York etc. Real estate is a great way to launder cash.

• Global Crime Syndicates Are Buying Expensive Australia Real Estate (Domain)

Some of Australia’s most expensive real estate is being bought by global crime syndicates, one of the country’s top crime-fighting bodies says. So worried are they about the influx of dirty money that the Australian Crime Commission has launched an investigation looking at money laundering and terrorism financing through property. Concerns that criminals may be targeting real estate were raised within the commission about six months ago, according to an ACC spokeswoman. The Targeting Criminal Wealth Special Investigation is expected to run until June next year. “Taskforce investigations have uncovered information about organised crime entities investing in high-value commodities, such as real estate, to help launder illicit funds into the legitimate economy,” said ACC chief executive Chris Dawson, APM.

“The Australian real estate sector is perceived as stable and at low risk of significant depreciation in the short term, and potential for growth in the long term. It is likely that organised crime are exploiting these conditions to invest in the Australian real estate market to launder the proceeds of illicit activity including drug profits.” The ACC declined to specify countries of concern because the investigation is ongoing. Parliamentary secretary to the Treasurer Kelly O’Dwyer said the federal government was being forced to play catch-up on the issue because there had been no co-ordinated data matching scheme on property records to date. The recently announced data-matching scheme set to start from December 1 as part of the federal government’s crackdown on foreign investment would be a big help to agencies like the ACC in these investigations, Ms O’Dwyer said.

Read more …

Brilliant.

• Australian PM Adviser Exposes Cimate Change As Hoax, Shames All of Science (SBS)

Business Adviser Maurice Newman has been praised today for his stellar work uncovering that climate change was a hoax perpetrated by the United Nations and the vast majority of the entire scientific community from all around the world. Newman, who also managed to expose the New World Order as something that actually exists and isn’t just made up by conspiracy theorising weirdos, has been widely praised for his efforts in bringing down what is thought to be the most elaborate conspiracy of all time. “Of course he will be in consideration for the Nobel Prize,” said one science observer. “To completely humiliate the vast majority of the scientific community like this on such a huge issue is almost unprecedented.

“In years to come we’ll say Maurice Newman in the same breath as we say Albert Einstein and Isaac Newton. To think, thousands of scientists and millions upon millions of dollars of resources couldn’t uncover this conspiracy but one guy with no expertise managed to bring it all down on a lark.” The world’s scientists have reacted with abject shame at being found out after all this time. “I always knew we’d be found out,” said one scientist. “It’s only so long you can keep something like this up when you have to independently incorporate every person studying climate, sea levels, soil, and thousands of other aspects. The paper trail alone was incredibly obvious. Not to mention our connection with the United Nations meaning we had to have every nation on board with tricking Australia for some reason.

Read more …