DPC North approach, Pedro Miguel Lock, Panama Canal 1915

“..derivatives contracts may become more liability than protection..”

• Interest Rate Swaps Indicate Big Banks Safer Than US Government (Bloomberg)

Could big banks be safer than the U.S. government? In an unusual twist, the multitrillion-dollar interest-rate swaps market, which investors often turn to for protection against swings in Treasury yields, is sending just such a signal. That obviously can’t be right, so the more likely explanation is that an important market is malfunctioning. And it’s more than just a curiosity. Investors are facing greater exposure to new risks and less insulation from fluctuations in Treasuries, just as the Federal Reserve prepares to inject more volatility into the market. The problem is that the derivatives aren’t tracking the U.S. government rates as reliably as they once did. When the market is functioning normally, investors essentially pay banks a fee to compensate them in the case of rising benchmark rates.

The implied yield on the derivative would normally be higher than on comparable cash bonds because investors are taking on an additional risk of a big bank counterparty going belly up. But that has reversed and the swaps have effectively been yielding less than the actual bonds for contracts of five years and longer, and this month the swap rate plunged to the lowest ever compared with Treasury yields. Again, that’s only logical if investors think that big Wall Street banks are more creditworthy than the U.S. government. There are a host of likely reasons for this phenomenon. The main one is it has become cheaper from a regulatory standpoint for big banks to bet on Treasuries by selling protection against rising yields than just owning the cash bonds. Analysts don’t expect this relationship to revert to its historical state anytime soon because the rules aren’t going away, and the effect of this is significant.

Corporate-bond investors who want to eliminate their risk tied to changing Treasury rates may not be able to hedge as well as they think through interest-rate swaps. In fact, at times, their derivatives contracts may become more liability than protection, as they were at times in the past few months. “Fixed-income investors should care because their most popular hedging tool isn’t working as well,” said Priya Misra at TD Securities. And it’s kind of bad timing: the Fed is preparing to depart from its zero-rate policy for the first time in almost a decade by raising benchmark borrowing costs as soon as next month.

“..even if Beijing intends to perpetuate things by continuing to engineer bailouts, that will only add to the deflationary supply glut that’s the root cause of the problem in the first place..“

• World’s Biggest Bond Bubble Continues To Burst As China Defaults Rise (ZH)

Once China began to mark an exceptionally difficult transition from a smokestack economy to a consumption and services-led model, those who were aware of how the country had gone about funding years of torrid growth knew what was likely coming next. Years of borrowing to fund rapid growth had left the country with a sprawling shadow banking complex and a massive debt problem and once commodity prices collapsed – which, in a bit of cruel irony, was partially attributable to China’s slowdown – some began to suspect that regardless of how hard Beijing tried to keep up the charade, a raft of defaults was inevitable. Sure enough, the cracks started to show earlier this year with Kaisa and Baoding Tianwei and as we documented last month, if you’re a commodities firm, there’s a 50-50 chance you’re not generating enough cash to service your debt:

There’s only so long this can go on without something “snapping” as it were because even if Beijing intends to perpetuate things by continuing to engineer bailouts (e.g. Sinosteel), that will only add to the deflationary supply glut that’s the root cause of the problem in the first place and ultimately, Xi’s plans to liberalize China’s capital markets aren’t compatible with ongoing bailouts so at some point, the Politburo is going to have to choose between managing its international image and allowing the market to purge insolvent companies. On Wednesday we get the latest chapter in the Chinese defaults saga as cement maker China Shanshui Cement said it won’t be paying some CNY2 billion ($314 million) of bonds due tomorrow. Oh, and it’s also going to default on its USD debt and file for liquidation. Here’s Bloomberg with more:

“On Wednesday, the creditors got their answer. Shanshui, reeling from China’s economic slowdown and a shareholder campaign to oust Zhang, said it will fail to pay 2 billion yuan ($314 million) of bonds due on Nov. 12, making it at least the sixth Chinese company to default in the local note market this year. Analysts predict it won’t be the last as President Xi Jinping’s government shows an increased willingness to allow corporate failures amid a drive to reduce overcapacity in industries including raw-materials and real estate.

Shanshui’s troubles – it will also default on dollar bonds and file for liquidation – reflect the fallout from years of debt-fueled investment in China that authorities are now trying to curtail as they shift the economy toward consumption and services. In the latest sign of that transition, data Wednesday showed the nation’s October industrial output matched the weakest gain since the global credit crisis, while retail sales accelerated. “Debt wasn’t a problem during the boom years because profits kept growing,” Zhang said last month. “But it’s not sustainable when the economy slows.” Shanshui’s total debt load as of June 30 was four times bigger than in 2008.”

China has between $25 and $30 trillion notional in financial and non-financial corporate credit (in China, where everything is government backstopper, there isn’t really much of a difference), about 5 times greater than the market cap of Chinese stocks (and orders of magnitude greater than their actual float), and 3 times greater than China’s official GDP, which also makes it the biggest bond bubble in the world, even bigger than the US Treasury market.

But … credit is what built China.

• China Credit Growth Slows As Tepid Economy Erodes Loan Demand (Bloomberg)

China’s broadest measure of new credit fell in October, adding to evidence six central bank interest-rate cuts in a year haven’t spurred a sustained pick up in borrowing. Aggregate financing was 476.7 billion yuan ($75 billion), according to a report from the People’s Bank of China on Thursday. That compared to a projection by economists for 1.05 trillion yuan and September’s reading of 1.3 trillion yuan. The data underscore the government’s challenge to spur an economic recovery even after boosting fiscal stimulus and continued monetary easing. Authorities have said they won’t tolerate a sharp slowdown in the next five years. “Policy makers are serious about 7%, but will not over-stimulate,” Larry Hu, head of China Economics at Macquarie Securities in Hong Kong, wrote in a recent note, referring to the 2015 growth target.

Inertia. “China has essentially spent four years building 300 large coal power plants it doesn’t use.”

• China Coal Bubble: 155 Coal-Fired Power Plants To Be Added To Overcapacity (GP)

China has given the green light to more than 150 coal power plants so far this year despite falling coal consumption, flatlining production and existing overcapacity. According to a new Greenpeace analysis, in the first nine months of 2015 China’s central and provincial governments issued environmental approvals to 155 coal-fired power plants — that’s four per week. The numbers associated with this prospective new fleet of plants are suitably astronomical. Should they all go ahead they would have a capacity of 123GW, more than twice Germany’s entire coal fleet; their carbon emissions would be around 560 million tonnes a year, roughly equal to the annual energy emissions of Brazil; they would produce more particle pollution than all the cars in Beijing, Shanghai, Tianjin and Chongqing put together; and consequently would cause around 6,100 premature deaths a year.

But they’re unlikely to be used to their maximum since China has practically no need for the energy they would produce. Coal-fired electricity hasn’t increased for four years, and this year coal plant utilisation fell below 50%. It looks like this trend will continue, with China committing to renewables, gas and nuclear targets for 2020 — together they will cover any increase in electricity demand. What looks to have triggered this phenomenon is Beijing’s decision to decentralise the authority to approve environmental impact assessments on coal projects starting in March of this year. But it’s been a problem years-in-the-making, driven by the Chinese economy’s addiction to debt-fuelled capital spending. Almost 50% of China’s GDP is taken up by capital spending on power plants, factories, real estate and infrastructure.

It’s what fuelled the country’s enormous economic growth in recent decades, but diminishing returns have fast become massive losses. Recent research estimated that the equivalent of $11 trillion (more than one year’s GDP) has been spent on projects that generated no or almost no economic value. Since the country’s power tariffs are state controlled, energy producers still receive a good price despite the oversupply. And boy is it a huge oversupply: China’s thermal power capacity has increased by 60GW in the last 12 months whilst coal generation has fallen by more than 2% and capacity utilisation has fallen by 8%.

With thermal power generation this year is equal to what it was in 2011, China has essentially spent four years building 300 large coal power plants it doesn’t use. Total spend on the upcoming projects would be an estimated $70 billion, with the 60% controlled by the Big 52 state-owned groups potentially adding 40% to company debt without any likely increase in revenue.

Steel and aluminum industries are dead around the globe.

• China Warns WTO Its Cheap Exports Will Soon Be Harder To Resist (Reuters)

China has served notice to World Trade Organization members including the EU and US that complaints about its cheap exports will need to meet a higher standard from December 2016, a Beijing envoy said at a WTO meeting. Ever since it joined the WTO in 2001, China has frequently attracted complaints that its exports are being “dumped”, or sold at unfairly cheap prices on foreign markets. Under world trade rules, importing countries can slap punitive tariffs on goods that are suspected of being dumped. Normally such claims are based on a comparison with domestic prices in the exporting country.

But the terms of China’s membership stated that – because it was not a “market economy” – other countries did not need to use China’s domestic prices to justify their accusations of Chinese dumping, but could use other arguments. China’s representative at a WTO meeting on Tuesday said the practice was “outdated, unfair and discriminatory” and under its membership terms, it would automatically be treated as a “market economy” after 15 years, which meant Dec. 11, 2016. All WTO members would have to stop using their own calculations from that date, said the Chinese envoy. Dumping complaints are a frequent cause of trade disputes at the WTO, and dumping duties are even more frequently levied on Chinese products.

In September alone, the WTO said it had been notified of EU anti-dumping actions on 22 categories of Chinese exports, from solar power components to various types of steel products and metals, as well as food ingredients such as aspartame, citric acid and monosodium glutamate. The EU was also slapping duties on Chinese bicycles, ring binder mechanisms and rainbow trout. From the end of next year, such lists would need to be based on China’s domestic prices “to avoid any unnecessary WTO disputes”, the Chinese representative said. More than 20% of the 500 disputes brought to the WTO in its 20 year history have involved dumping, including several between China and the EU or the United States in the last few years.

But Draghi doesn’t seem to listen.

• Germany’s ‘Wise Men’ Call ECB Policies Risk To Financial Stability (Reuters)

The German government’s panel of economic advisers said on Wednesday the ECB’s low interest rates were creating substantial risks, and Finance Minister Wolfgang Schaeuble warned of a “moral hazard” from loose monetary policy. The double-barrelled message came after Reuters reported on Monday that a consensus is forming at the ECB to take the interest rate it charges banks to park money overnight deeper into negative territory at its Dec. 3 meeting. The ECB raised the prospect last month of more monetary easing to combat inflation which is stuck near zero and at risk of undershooting the ECB’s target of nearly 2% as far ahead as 2017 due to low commodity prices and weak growth.

But Schaeuble, who solidified his cult status within the conservative wing of Chancellor Angela Merkel’s party with his tough stance on the Greek crisis, said loose monetary policies risked creating false incentives and eroding countries’ willingness to reform their economies. “I have great respect for the independence of the central bank,” he said at an event in Berlin on European integration. “But I tell the central bankers again and again that their monetary policy decisions also have a moral-hazard dimension.” Earlier, the German government’s panel of economic advisers said the ECB’s low interest rates were creating substantial risks for financial stability and could ultimately threaten the solvency of banks and insurers. The euro zone central bank embarked on a trillion-euro-plus asset-buying plan in March to combat low inflation and spur growth, and is widely expected to expand or extend the scheme next month. But the advisers urged it not to ease policy again.

“There are no grounds to force the loose monetary policy further,” Christoph Schmidt, who heads the group, told a news conference. With regard to the ECB’s bond-buying programme, he added: “We have come to the conclusion that a slowdown in the pace is called for. At least, the ECB should not do more than planned.” The council of economic experts, presenting its annual report, criticised the policies of the ECB in unusually stark language, saying it was creating “significant risks to financial stability”. “If low interest rates remain in place in the coming years and the yield curve remains flat, then this would threaten the solvency of banks and life insurers in the medium term,” the council noted in the report.

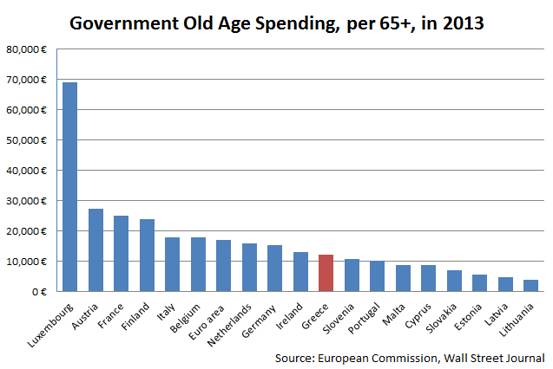

6 months after chastizing Greece.

• ‘Sick Man Of Europe’ Finland Agonises Over Austerity (Reuters)

Finland was one of the toughest European critics of Greece during its debt crisis, chastising it for failing to push through reforms to revive its economy. Now the Nordic nation is struggling to overhaul its own finances as it seeks to claw its way out of a three-year-old recession that has prompted its finance minister to label the country the “sick man of Europe”. Efforts by new Prime Minister Juha Sipila to cut holidays and wages have been met with huge strikes and protests, while a big healthcare reform exposed ideological divisions in his coalition government that pushed it to the brink of collapse last week. There have even been calls from one of Sipila’s veteran lawmakers for a parliamentary debate over whether Finland should leave the euro zone to allow it to devalue its own currency to boost exports – a sign of the frustration gripping the country.

In the latest manifestation of the difficulties of cutting spending in euro zone states, Sipila is walking a political tightrope. He must push through major reforms to boost competitiveness and encourage growth, while placating labour unions to avoid further strikes and costly wage deals next year – and carrying his three-party coalition with him. Unemployment and public debt are both climbing in a country hit by high labour costs, the decline of flagship company Nokia’s phone business and a recession in Russia, one of its biggest export markets. And with a rapidly-ageing population, economists say the outlook is bleak for Finland, which has lost its triple-A credit rating and is experiencing its longest economic slump since World War II. Sipila – who has warned Finland could be the next Greece – is pushing for €10 billion of annual savings by 2030, including €4 billion by 2019.

As part of this the government, in power for five months, plans to overhaul healthcare, local government and labour markets to boost employment and export competitiveness. But the premier’s call for a “common spirit of reform” was met with uproar when he proposed cutting holidays in the public sector and reducing the amount of extra pay given to employees working on Sunday to lower unit labour costs by 5%. About 30,000 protesters rallied in Helsinki in September in the county’s biggest demonstration since 1991, and strikes halted railroads, harbours and paper mills. The government soon backtracked, saying it would find savings from other benefits. The average Finn works fewer hours a week than any other EU citizens, according to the Finnish Business and Policy Forum think-tank.

Government supports strike against itself.

• Syriza Faces Mass Strike In Greece (Guardian)

Greece’s leftist-led government will get a taste of people power on Thursday when workers participate in a general strike that will be the first display of mass resistance to the neoliberal policies it has elected to pursue. The country is expected to be brought to a halt when employees in both the public and private sector down tools to protest against yet more spending cuts and tax rises. “The winter is going to be explosive and this will mark the beginning,” said Grigoris Kalomoiris, a leading member of the civil servants’ union Adedy. “When the average wage has already been cut by 30%, when salaries are already unacceptably low, when the social security system is at risk of collapse, we cannot sit still,” he said. Schools, hospitals, banks, museums, archaeological sites, pharmacies and public services will all be hit by the 24-hour walkout.

Flights will also be disrupted, ferries stuck in ports and news broadcasts stopped as staff walk off the job. “We are expecting a huge turnout,” Petros Constantinou, a prominent member of the anti-capitalist left group Antarsya told the Guardian. “This is a government under duel pressure from creditors above and the people below and our rage will be relentless. It will know no bounds.” The general strike – the 41st claim unionists since the debt-stricken nation was plunged into crisis and near economic collapse in 2010 – will increase pressure on prime minister Alexis Tsipras, the firebrand who first navigated his Syriza party into power vowing to eradicate austerity. On Monday eurozone creditors propping up Greece’s moribund economy refused to dispense a €2bn rescue loan citing failure to enforce reforms.

Snap elections in September saw Tsipras win a second term, this time pledging to implement policies he had once so fiercely opposed in return for a three-year, €86bn bailout clinched after months of acrimony between Athens and its partners. But Tsipras himself said he did not believe in many of the conditions attached to the lifeline, the third to be thrown to Greece in recent history. In a first for any sitting government, Syriza also threw its weight behind the strike exhorting Greeks to take part in the protest. The appeal – issued by the party’s labour policy division and urging mass participation “against the neoliberal policies and the blackmail from financial and political centres within and outside Greece” – provoked derision and howls of protest before the walkout had even begun.

Nide read.

• Why Owning A House Is Financial Suicide (Altucher)

Owning your own house is as much the Australian dream as the American dream, and it’s one that feels increasingly out of reach for many. But when one user on Quora pondered whether it was ultimately better to rent or own your own home, blogger and investor James Altucher penned this highly controversial response: I am sick of me writing about this. Do you ever get sick of yourself? I am sick of me. But every day I see more propaganda about the American Dream of owning the home. I see codewords a $15 trillion dollar industry uses to hypnotise its religious adherents to BELIEVE. Lay down your money, your hard work, your lives and loves and debt, and BELIEVE! But I will qualify: if someone wants to own a home, own one. There should never be a judgment. I’m the last to judge.

I’ve owned two homes. And lost two homes. If I were to write an autobiography called: “My life – 10 miserable moments” owning a home would be two of them. I will never write that book, though, because I have too many moments of pleasure. I focus on those. But I will tell you the reasons I will never own a home again. Maybe some of you have read this before from me. I will try to add. Or, even better, be more concise. Everyone has a story. And we love our stories. We see life around us through the prism of story. So here’s a story. Mum and Dad bought a house, say in 1965, for $30,000. They sold it in 2005 for $1.5 million and retired. That’s a nice story. I like it. It didn’t happen to my mum and dad. The exact opposite happened. But … for some mums I hope it went like that. Maybe Mum and Dad had their troubles, their health issues, their marriage issues. Maybe they both loved someone else but they loved their home.

Here’s a fact: The average house has gone up 0.2% per year for the past century. Only in small periods have housing prices really jumped and usually right after, they would fall again. The best investor in the world, Warren Buffett, is not good enough to invest in real estate. He even laughs and says he’s lost money on every real estate decision he’s made. There’s about $15 trillion in mortgage debt in the United States. This is the ENTIRE way banks make money. They want you to take on debt. Else they go out of business and many people lose their jobs. So they say, and the real estate agents say, and the furniture warehouses say, and your neighbours say, “it’s the American dream”. But does a country dream? Do all 320 million of us have the same dream? What could we do as a society if we had our $15 trillion back? If maybe banks loaned money to help people build businesses and make new discoveries and hire people?

What happens when you stop investing.

• Major Oil Companies Have Half-Trillion Dollars to Fund Takeovers (Bloomberg)

The world’s six largest publicly traded oil producers have more than a half-trillion dollars in stock and cash to snap up rival explorers. Exxon Mobil tops the list with a total of $320 billion for potential acquisitions. Chevron is next with $65 billion in cash and its own shares tucked away, followed by BP with $53 billion. Merger speculation was running high after Anadarko said Wednesday it withdrew an offer to buy Apache for an undisclosed amount. Apache rebuffed the unsolicited offer and wouldn’t provide access to internal financial data, Anadarko said. Both companies are now takeover targets, John Kilduff, a partner at Again Capital said. Royal Dutch Shell has $32.4 billion available, almost all of it in cash.

That said, The Hague-based company is unlikely to go hunting for large prey given plans announced in April to take over BG Group for $69 billion in cash and stock. At the bottom of the pack are ConocoPhillips with $31.5 billion and Total SA with $30.5 billion. More than 90% of ConocoPhillips’ stockpile is in the form of shares held in its treasury. Total’s arsenal is 85% cash. Even with its lowest cash balance in at least a decade, Exxon still wields a mighty financial stick. The Irving, Texas-based company has $316 billion of its own shares stockpiled in the company treasury that it could use for an all-stock takeover. The world’s biggest oil company by market value made its two largest acquisitions of the last 20 years with stock – the $88 billion Mobil deal in 1999 and the $35 billion XTO transaction in 2010.

If prices remain at current levels, this will start cascading in early 2016.

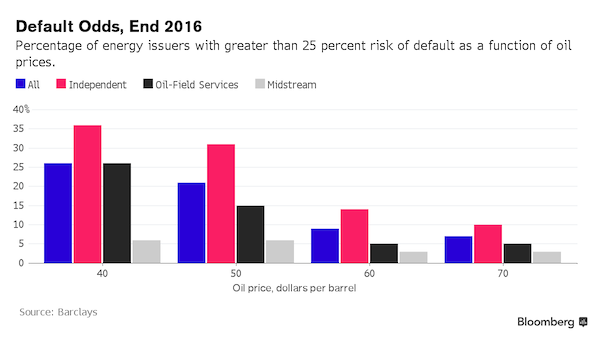

• US Energy Default Alarms Get Louder as Pain Seen Lasting Into 2016 (Bloomberg)

Eleven months of depressed oil prices are threatening to topple more companies in the energy industry. Four firms owing a combined $4.8 billion warned this week that they may be at the brink, with Penn Virginia, Paragon Offshore, Magnum Hunter Resources and Emerald Oil. saying their auditors have expressed doubts that they can continue as going concerns. Falling oil prices are squeezing access to credit, they said. And everyone from Morgan Stanley to Goldman Sachs is predicting that energy prices won’t rebound anytime soon. The industry is bracing for a wave of failures as investors that were stung by bets on an improving market earlier this year try to stay away from the sector. Barclays analysts say that will cause the default rate among speculative-grade companies to double in the next year.

Marathon Asset Management is predicting default rates among high-yield energy companies will balloon to as high as 25% cumulatively in the next two to three years if oil remains below $60 a barrel. “No one is putting up new capital here,” said Bruce Richards, co-founder of Marathon, which manages $12.5 billion of assets. “It’s been eerily silent in the whole high-yield energy sector, including oil, gas, services and coal.” That’s partly because investors who plowed about $14 billion into high-yield energy bonds sold in the past six months are sitting on about $2 billion of losses, according to data compiled by Bloomberg. And the energy sector accounts for more than a quarter of high-yield bonds that are trading at distressed levels, according to data compiled by Bloomberg.

Ambrose thinks climate will be a big financial deal.

• Saudi Arabia Risks Destroying OPEC And Feeding The ISIL Monster (AEP)

The rumblings of revolt against Saudi Arabia and the Opec Gulf states are growing louder as half a trillion dollars goes up in smoke, and each month that goes by fails to bring about the long-awaited killer blow against the US shale industry. Algeria’s former energy minister, Nordine Aït-Laoussine, says the time has come to consider suspending his country’s Opec membership if the cartel is unwilling to defend oil prices and merely serves as the tool of a Saudi regime pursuing its own self-interest. “Why remain in an organisation that no longer serves any purpose?” he asked. Saudi Arabia can, of course, do whatever it wants at the Opec summit in Vienna on December 4. As the cartel hegemon, it can continue to flood the global the market with crude oil and hold prices below $50.

It can ignore desperate pleas from Venezuela, Ecuador and Algeria, among others, for concerted cuts in output in order to soak the world glut of 2m barrels a day, and lift prices to around $75. But to do so is to violate the Opec charter safeguarding the welfare of all member states. “Saudi Arabia is acting directly against the interests of half the cartel and is running Opec over a cliff. There could be a total blow-out in Vienna,” said Helima Croft, a former oil analyst at the US Central Intelligence Agency and now at RBC Capital Markets. The Saudis need Opec. It is the instrument through which they leverage their global power and influence, much as Germany attains world rank through the amplification effect of the EU.

The 29-year-old deputy crown prince now running Saudi Arabia, Mohammad bin Salman, has to tread with care. He may have inherited the steel will and vaulting ambitions of his grandfather, the terrifying Ibn Saud, but he has ruffled many feathers and cannot lightly detonate a crisis within Opec just months after entangling his country in a calamitous war in Yemen. “It would fuel discontent in the Kingdom and play to the sense that they don’t know what they are doing,” she said. The International Energy Agency (IEA) estimates that the oil price crash has cut Opec revenues from $1 trillion a year to $550bn, setting off a fiscal crisis that has already been going on long enough to mutate into a bigger geostrategic crisis. Mohammed Bin Hamad Al Rumhy, Oman’s (non-Opec) oil minister, said the Saudi bloc has blundered into a trap of their own making – a view shared by many within Saudi Arabia itself.

“If you have 1m barrels a day extra in the market, you just destroy the market. We are feeling the pain and we’re taking it like a God-driven crisis. Sorry, I don’t buy this, I think we’ve created it ourselves,” he said. The Saudis tell us with a straight face that they are letting the market set prices, a claim that brings a wry smile to energy veterans. One might legitimately suspect that they will revert to cartel practices when they have smashed their rivals, if they succeed in doing so. One might also suspect that part of their game is to check the advance of solar and wind power in a last-ditch effort to stop the renewable juggernaut and win another reprieve for the status quo. If so, they are too late. That error was made five or six years ago when they allowed oil prices to stay above $100 for too long.

More cars, more brands, but also more fines and lawsuits?

• Germany Cites Signs of More Elevated Diesel Pollution in Probe (Bloomberg)

Germany’s diesel pollution probe in the wake of the Volkswagen cheating scandal has found signs of elevated emissions in some cars, authorities said in initial results of tests planned for more than 50 car models. Regulators and carmakers are in talks about “partly elevated levels of nitrogen oxides” found in raw data from some of the cars in the probe, the Federal Motor Transport Authority, or KBA, said in a statement Wednesday. Vehicles were chosen for testing based on new-car registration data as well as “verified indications” from third parties and were evaluated on test beds as well as on the streets.

German authorities are about two-thirds finished with the review they started in late September, when the Volkswagen scandal prompted a deeper look at real-world diesel emissions. Volkswagen admitted to rigging the engines of about 11 million cars with software that could cheat regulations by turning on full pollution controls only in testing labs, not on the road. The scandal has since spread to include carbon dioxide emissions labels in another 800,000 vehicles, including one type of gasoline engine. Other major automakers, including BMW and Daimler, have said they didn’t manipulate emissions tests.

Sealing the fate of mankind: profit from destruction.

• The Melting Arctic Is Like ‘Discovering A New Africa’ (CNBC)

Governments and the private sector are positioning to develop the Artic, where the wealth of resources is akin to a “new Africa,” according to Iceland’s president. The melting of the Arctic is an ongoing phenomenon: In October, about 7.7 million square kilometers (about 3 million square miles) of Arctic sea ice remained, around 1.2 million square kilometers less than the average from 1981-2010, according to calculations by Arctic Sea Ice News & Analysis that was published by researchers at the National Snow and Ice Data Center. One effect of the melting ice has been newly opened sea passages and fresh access to resources. “Until 20 or so years ago, (the Arctic) was completely unknown and unmarked territory,” Iceland’s President Olafur Grimsson told an Arctic Circle Forum in Singapore on Thursday.

“It is as if Africa suddenly appeared on our radar screen.” Grimsson cited resources that included rare metals and minerals, oil and gas, as well as “extraordinarily rich” renewable energy sources such as geothermal and wind power. Developing the Arctic to access these resources “doesn’t only have grave consequences,” he said, noting that shipping companies had found new, faster sea routes through the area. Grimsson cited Cosco’s trial Northern sea journey a couple years ago with a container ship, which was able to travel from Singapore to Rotterdam in 10 fewer days than the normal route, saving on fuel and other costs. China’s state-owned Cosco announced last month that it would begin a regular route through the Arctic Ocean to Europe.

Singapore, which due to its key location in global shipping lanes has punched above its weight in the maritime industry for nearly 200 years, is watching the development of the Arctic closely. “The Northern Sea Route, traversing the waters north of Russia, Norway and other countries of the Arctic, could reduce travel time between Northeast Asia and Europe by a third,” Singapore’s Deputy Prime Minister Teo Chee Hean said at the forum. He noted that divisions of government-linked Keppel Corp, a conglomerate with interests in rig building, had already built and delivered 10 ice-class vessels and was working with oil companies and drillers to develop a “green” rig for the Arctic. Teo quoted a 2012 Lloyd’s of London report that estimated companies would invest as much as $100 billion in the Arctic over the next decade.

As long as the wrong people stay in charge, things can only get worse.

• Europe’s Leaders Struggle To Save Floundering Migrant Policy (FT)

The image of beaming Syrian and Iraqi children waving from the gangway of an Aegean Airlines plane in Athens was supposed to show the EU at last getting to grips with its migrant crisis. They were six families of refugees who had been selected to be flown from Greece to Luxembourg to illustrate the EU’s flagship relocation policy, in which member states have agreed to divide up some 160,000 asylum-seekers. Greek prime minister Alexis Tsipras called it a “trip to hope”. Martin Schulz, the president of the European Parliament, made the hop from Brussels to see them off last week. But the image of grinning politicians loading refugees on to a jet to one of Europe’s richest nations rankled some senior EU officials, who have been hoping the bloc might discourage migrants by communicating the message that a trip to Europe is no free lunch.

“It did not look great,” one EU official groaned while others described it as a disaster. The controversial photo opp is but one issue on the agenda when EU leaders meet today for the sixth time in seven months — this time in Malta’s capital Valletta — to try to right what has been a foundering response to the crisis. While the setting has changed, the problems and disagreements remain the same. With up to 6,000 people pouring into Greece each day, EU leaders will rake over what has gone wrong with the bloc’s response and how to cut a deal with Turkey, which has become the main stopping-off point for people trying to enter Europe. The much-vaunted plan to contain asylum-seekers in Italy and Greece before distributing 160,000 across the bloc has been sluggish. Despite months of planning, only 147 have been relocated since it was approved in September.

The scheme was the subject of bitter political argument between Germany, which backed it, and its eastern neighbours, who opposed it. Now it is being hindered by everything from the reluctance of national capitals to provide the places, IT failures on the ground and even asylum-seekers’ point-blank refusal to take part. (Last week’s flight to Luxembourg was the second attempt after a previous group turned down transit to the Grand Duchy). The policy looks set to become even more contentious. In a bid to kick-start it, leaders will now discuss methods of forcing migrants to be fingerprinted so that their asylum claims can be processed in the country where they land. Ministers from across the EU agreed on Monday to allow countries to detain asylum-seekers who refuse to have prints taken. “The migrants themselves have their own agenda,” said one official. “They know when they arrive where they want to go.” (Not Luxembourg, apparently).

They’re planning to throw €3 billion at Erdogan now. Will that help the refugees in any sense at all?

• EU Leaders Court Turkey in Bid to Stem Flow of Refugees (Bloomberg)

European Union governments will solicit Turkey’s help in stemming the flow of refugees by offering financial aid, visa waivers for Turkish travelers and the relaunch of Turkey’s membership bid. EU leaders will debate the incentives package for Turkey at a summit in Valletta, Malta, on Thursday, before the bloc’s top officials meet Turkish President Recep Tayyip Erdogan at the Group of 20 summit starting Sunday. Chancellor Werner Faymann of Austria, one of the refugees’ main destinations, said the EU has to move faster to seal an agreement to step up aid for Turkey as the price for Erdogan’s cooperation in halting the refugee tide. “When are we going to pick up the pace?” Faymann told reporters Wednesday in Valletta.

EU courtship of Turkey came as the bloc’s internal dissension over refugees intensified with Sweden, another magnet for asylum seekers, announcing temporary border controls as of midday Thursday. EU-Turkey ties have frayed since Turkey started entry talks in 2005, as Erdogan’s governments strayed from EU civil rights standards and the bloc’s economic woes dimmed its interest in further expansion. Those strains flared up on Tuesday, when the European Commission criticized the Turkish government for intimidating the media and cracking down on domestic dissent. Turkey responded that the EU’s reproaches were unjust. The EU at first weighed €1 billion to help Turkey lodge Syrian war refugees and prevent them from going on to Europe, but Turkey has driven up the price.

Now a figure as high as €3 billion is under discussion. Britain, a fan of Turkey’s entry bid until U.K. Prime Minister David Cameron’s government turned against EU enlargement, plans to make a separate contribution of 275 million pounds ($418 million) over two years, a British official told reporters in Valletta. Turkey is also pushing for the restart of its stalled entry negotiations and for European governments to waive visa requirements on Turkish visitors, a step that would be popular with young people especially. “Turkey isn’t just looking for just a financial commitment from Europe, but also for a political commitment,” Maltese Prime Minister Joseph Muscat said in an interview.

Schengen with razor wire.

• EU’s Deep Dilemmas Over Refugees Laid Bare At Malta Summit (Guardian)

The two-day Valletta summit is a lavish event, bringing together more than 60 European and African leaders, with the EU carrying a mixed bag of sticks and carrots, including a €1.8bn “trust fund” in an attempt to cajole African governments into taking migrants back and stopping them from coming to Europe in the first place. Many of them are disenchanted with an EU containment strategy that they feel resembles a form of blackmail. “They say it’s all about Europe externalising and outsourcing its own problems,” said the diplomat, who has been liaising with the African governments. “The Europeans are not exactly visionaries,” another international official taking part in Malta said. “And they don’t realise that they are no longer the centre of the world.”

The African meetings are to be followed on Thursday by another emergency EU summit called by Donald Tusk, the president of the European council, who increasingly takes a pro-Orbán line on the crisis. His entourage is predicting that Tusk will push for “drastic and radical action” by the EU, which translates as partial border closures in Europe’s Schengen area, both externally and internally. Given its size and geography, and the number of people involved, Germany is Europe’s shock absorber in the refugee crisis. It is expected to take in a million newcomers this year. At a meeting with Balkan leaders two weeks ago, Merkel was repeatedly asked to clarify her policy. “Many of them did not like that they were summoned by Germany to be told what to do. But the problem is that the Germans don’t know what to do,” said the senior diplomat.

The signals from Berlin have been very mixed over the past week. Merkel’s interior and finance ministers, both in the same party, regularly contradict her. On Friday the interior ministry announced an abrupt U-turn, saying Syrians would no longer qualify for full asylum in Germany. That was then retracted amid coalition cacophony. On Tuesday, the same ministry said Berlin was ending the open-door policy on Syrians and would now return them to the country where they entered the EU, albeit not Greece. This amounts to a tightening of the German border, with alarming knock-on effects for EU countries such as Croatia and Slovenia, which will only let tens of thousands of migrants in if they are in transit. The same applies to non-EU countries on the Balkan route, such as Serbia and Macedonia. “Merkel was asked if she would close the border, and told the other leaders very clearly ‘I will never do that’,” said another senior EU policymaker. “If you close the German border, you end European integration. You cannot do that.”

“..we have nowhere to return. Our country and our homes are destroyed and we are in Europe to stay.”

• Tiny Slovenia Tries To Stem Massive Migrant Surge Across Balkans (AP)

German Chancellor Angela Merkel has been under increased domestic pressure to reconsider her welcoming policy for migrants and reduce the arrivals. Germany, which is expected to take up to 1.5 million people by the new year, has already tightened its refugee policy by saying that Afghans should not seek asylum and that only Syrians have a chance. With both Germany and Austria reconsidering their free-flow policies, the worst-case scenario of tens of thousands of migrants, many with young children, stranded in the Balkans in a brutal winter looks more and more likely. “If Austria or Germany shut their borders, more than 100,000 migrants would be stuck in Slovenia in few weeks,” Cerar said. “We can’t allow the humanitarian catastrophe to happen on our territory.”

But analysts warn that shutting down borders would only trigger more havoc in the Balkans, the main European escape route from war and poverty in the Middle East, Asia and Africa. “The closure of the borders in not a solution, it only passes the problem to another country,” said Charlie Wood, an American humanitarian worker looking to help migrants in their journey across Slovenia. “If Slovenia closes its border, Croatia will close its border and then Serbia will do the same … and so on. That does not stop babies from dying in cold.” Slovenian refugee camps once planned to handle a few hundred people a day. Now they struggle to provide shelter and food for an average of 6,000 a day.

The Slovenian government has warned that the figure could soon reach 30,000 a day as the onset of cold weather has not stopped the surge. Last week, thousands of people crammed into a refugee camp at Sentilj on the border with Austria, many angry about the speed of their transit and hurling insults at machine-gun-toting Slovenian policemen patrolling outside a wire fence with sanitary masks over their faces. “We haven’t eaten or had water for over 12 hours,” said Fahim Nusri from Syria, who had to spend a night in the camp in cold and foggy weather together with his wife and two small children before they were allowed into Austria. “Me and my wife are not a problem, but what about our children?”

When Hungary closed its border with Croatia in mid-October, thousands turned to Slovenia instead, many of them marching through cold rivers, desperate to continue their journey westward before the weather gets even colder. Croatia and Slovenia later negotiated a deal to transport migrants and refugees across their border in trains, which led to a more orderly transit. But, with Slovenia now placing barriers, the chaotic surge could resume. “If someone thinks that border fences will stop our march, they are really wrong,” said Mohammed Sharif, a student from Damascus, as he tried to keep warm by a bonfire in the Sentilj camp. “It will just make our trip more dangerous and deadly, but we have nowhere to return. Our country and our homes are destroyed and we are in Europe to stay.”