Dorothea Lange Farm boy at main drugstore, Medford, Oregon 1939

I know, what does any of it mean with 100 people dying in Nice? Still, as many died in Syria.

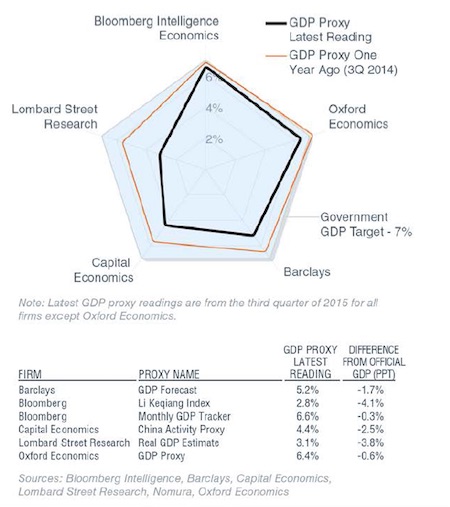

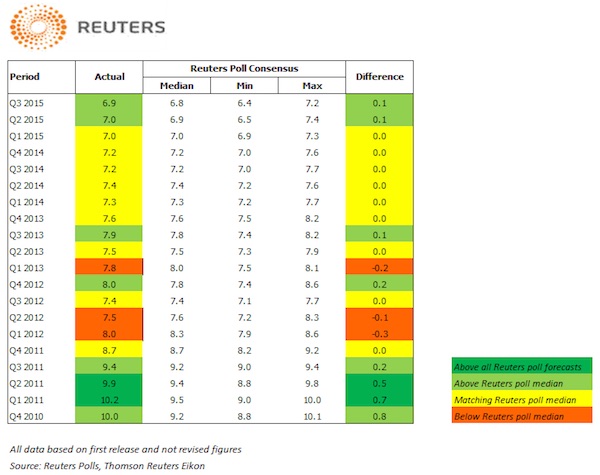

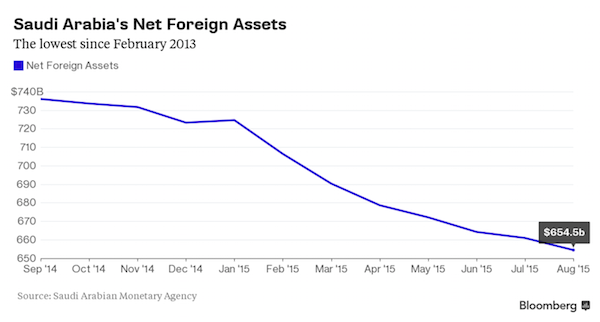

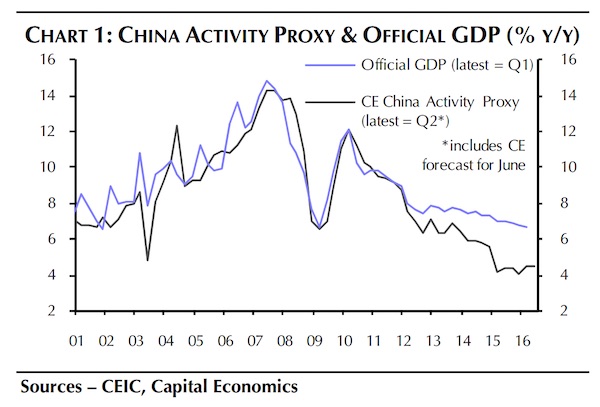

“The speed of growth that it points to is increasingly hard to believe given the clear structural drags that the economy is facing..”

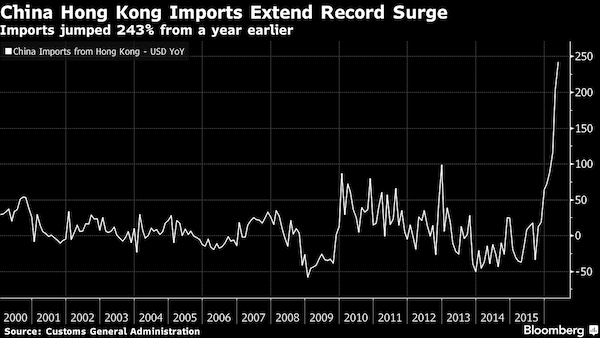

• (Nobody Believes) China’s Q2 GDP Growth Stable at 6.7% (ET)

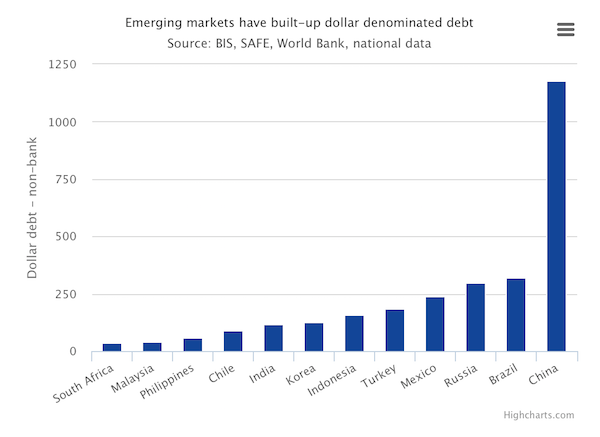

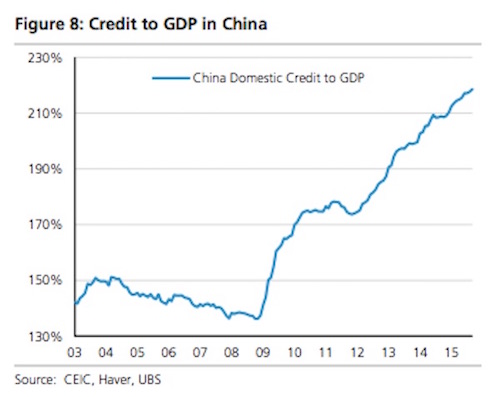

China’s GDP grew at 6.7% year on year in the second quarter of 2016, at least officially. However, most analysts don’t believe the official figures. “The official figure is still around 7%, but those data are made in the statistical kitchen,” says Willem Buiter, the chief economist of Citigroup. He thinks China is not growing at more than 4%. After reporting 6.7% growth over the year in the first quarter of 2016, analysts were looking for 6.6% growth in the second quarter compared to the second quarter of 2015, so China managed to engineer a small beat and create the illusion of stability. Quarterly growth even picked up from 1.1% in the first quarter to 1.8% in the second quarter.

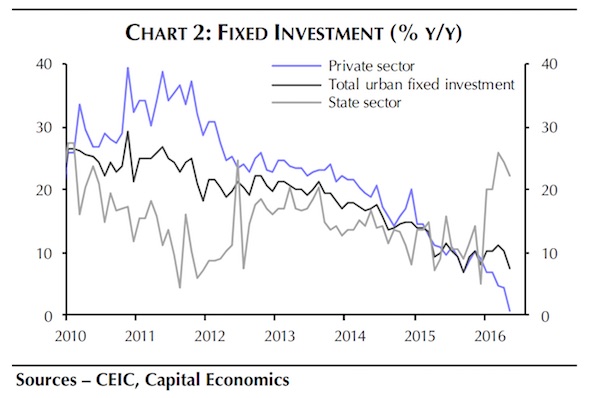

“The speed of growth that it points to is increasingly hard to believe given the clear structural drags that the economy is facing,” research firm Capital Economics writes in a note. The analysts think China grew 4.5% based on a proprietary activity index, roughly the same as in the first quarter. Private investment was the biggest drag on growth, it just expanded 1% in May, down from 15% in early 2015. State companies have picked up the slack. A survey of thousands of companies by the China Beige Book (CBB) released earlier in July paints a similar picture. CBB says most indicators improved in the second quarter, although activity is roughly flat over the year. In most cases, less than 50% of survey respondents report an improvement in sales, hiring, capital expenditure, or bank lending.

The harder they come…

• Asian Shares Rise To Eight-Month Highs (R.)

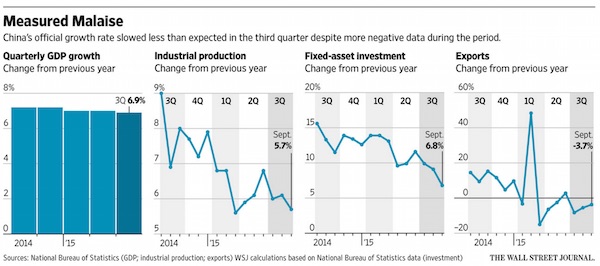

Asian shares extended gains to eight-month highs on Friday, on track for a solid weekly rise, as better-than-expected economic data from China lifted risk sentiment that was already buoyant after record highs on Wall Street. China’s economy grew 6.7% in the second quarter from a year earlier, steady from the first quarter and slightly better than expected as the government stepped up efforts to stabilize growth in the world’s second-largest economy.

Industrial output and retail sales also beat forecasts, which helped alleviate fears of slowing momentum, though fixed-asset investment growth slipped and missed market expectations. “The data showed the signs of stabilisation, which is very encouraging,” said Julian Wang, economist for Greater China at HSBC. “However, public sector investment and housing market are slowing down. So the challenges still loom quite large in the second half of the year.”

Well, that’s a surprise….

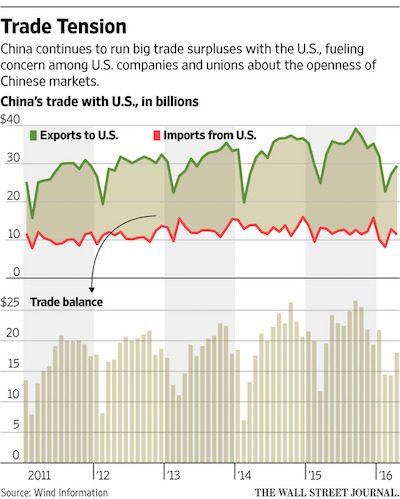

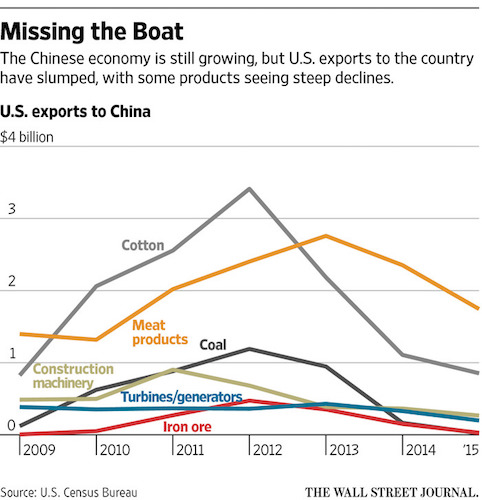

• US Exporters’ Gains From Chinese Economic Growth Shrink Further (WSJ)

China’s economic roller coaster is taking a bite out of American exporters, hurting U.S. industries ranging from mining equipment to cotton producers and adding to criticism that China is getting more than it gives in trade with the U.S. The U.S. shipped just $42.4 billion to China in the first five months of the year, or 8.2% less than the year-earlier period and 13.8% below the peak export year of 2014, according to the Census Bureau. The export drop comes as China’s economy, while slowing, is still officially expanding at more than 6% a year. That growth is driven in part by the mountain of goods—worth $174 billion so far this year—the U.S. imports from China. That is quadruple the size of its exports to China during those months, and only slightly less than 2014 levels.

The slowdown in U.S. exports could exacerbate accusations in the 2016 presidential campaign that China is engaged in unfair trade practices. Donald Trump, the presumptive Republican nominee, has cited the trade gap with China in threatening to slap new tariffs on the country if he becomes president. U.S. companies have grown increasingly vocal in criticizing Beijing for allegedly dumping subsidized steel and other products on world markets and for refusing to open major parts of its economy to foreign investment—a roadblock that almost certainly hinders two-way trade.

No doubt it could. But Brussels will first try and turn it into Greece….

• Could Italy Bring Down The Euro? (Kern)

[..] M5S’s Luigi Di Maio, who, polls show, has a very good chance of succeeding Renzi as prime minister, has reiterated his party’s long-standing call for a referendum on the euro: “We want a consultative referendum on the euro. The euro as it is today does not work. We either have alternative currencies or a ‘euro 2.’ We entered the European Parliament to change many treaties. The mere fact that a country like Great Britain even held a referendum on whether to leave the EU signals the failure of the European Union.” A referendum on the euro would be “consultative” because Italian law does not allow such plebiscites to change international treaties, including those that involve Italy’s relations with the European Union.

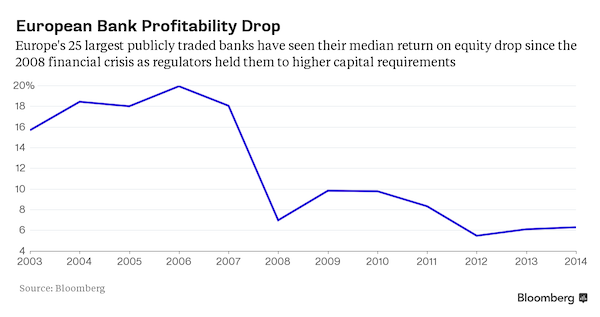

But Grillo is seeking a legislative change to allow an “ad hoc” exception, similar to the one in June 1989, when Italy held a consultative referendum on whether to transfer certain powers to the European Parliament. The exception would presumably be approved if M5S wins the prime minister’s office. Meanwhile, analysts are warning that the turmoil in Italy could spread to the rest of the eurozone. The risk of contagion is due to the so-called “doom loop” that exists between European governments and European banks, which have more than doubled the holdings of their own governments’ debt from a low of €355 billion in September 2008 to €791 billion today. International banks have lent Italy more than €500 billion, according to Die Welt, which reports that French banks alone hold €250 billion of Italian debt.

German banks hold €84 billion of Italian bonds. The only question, according to analysts, is whether taxpayers or bondholders will be left holding the tab. Wolfgang Münchau warned of the consequences of a disorderly Italian exit from the euro: “An Italian exit from the single currency would trigger the total collapse of the eurozone within a very short period. It would probably lead to the most violent economic shock in history, dwarfing the Lehman Brothers bankruptcy in 2008 and the 1929 Wall Street crash.” As Ambrose Evans-Pritchard of the Telegraph has pointed out, however, Italy must choose between the euro and its own economic survival. Leaving the euro “may be the only way to avert a catastrophic deindustrialization of the country before it is too late.”

…like here.

• EU Finance Ministers Get Tough With Italian Bank Trying For Third Bailout (G.)

The idea of modern banking was born in Siena in 1624, when the Medici Grand Duke decided to guarantee accounts held at Monte dei Paschi, the world’s oldest bank, with the proceeds of pasture he held in the Maremma in south-western Tuscany. Nearly 400 years later, the principle established by the Tuscan ruler – that account holders and investors are protected by the state – lies at the heart of a crisis at Monte dei Paschi di Siena (MPS) that is worrying financial markets around the world. The country’s third-largest lender has already been bailed out twice in modern Italian history but is likely to need a third multibillion-euro intervention by the Italian government – a move that would need Brussels to break new rules designed to prevent such taxpayer bailouts after the 2008 global financial crisis.

So the question of who will pay for the inevitable rescue of MPS, whose share value has fallen 80% over the past year, has yet to be answered. Three weeks after the news that Britain has voted to leave the European Union shocked the markets, a debate over the fate of MPS and the economic and political repercussions of inaction is raging from Rome to Brussels and Paris to Berlin. The welfare of thousands of Italian households is at stake, as well as the political fortune of Italy’s prime minister, Matteo Renzi, who is facing the toughest political challenge of his career. It is also testing Italy’s credibility among foreign investors. “There is no way they will let the bank go and create a systemic effect,” said Wolfango Piccoli, co-president of Teneo Intelligence. “The mechanics are still unclear but there will be a third bailout of Monte dei Paschi.”

[..] Unlike the US, Spanish and Irish financial crises, the Italian banking crisis is not the result of a speculative property bubble. While other issues have exacerbated the turmoil at Monte dei Paschi’s – including a poorly judged €9bn acquisition – the primary reason the bank is in trouble is because it doled out billions of euros in loans to small businesses at a time when the scale of the recession facing Italy was gravely underestimated. From 2007 to 2013, Italy lost about a quarter of its industrial production and tens of thousands of companies collapsed. In 2013 more than 150 shops closed every day. Construction and home sales slumped and none of the sectors has recovered fast enough.

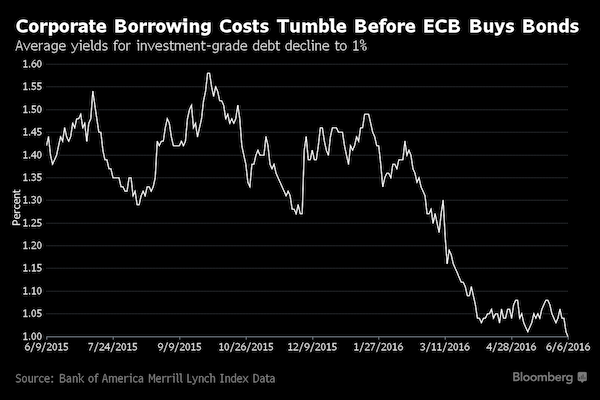

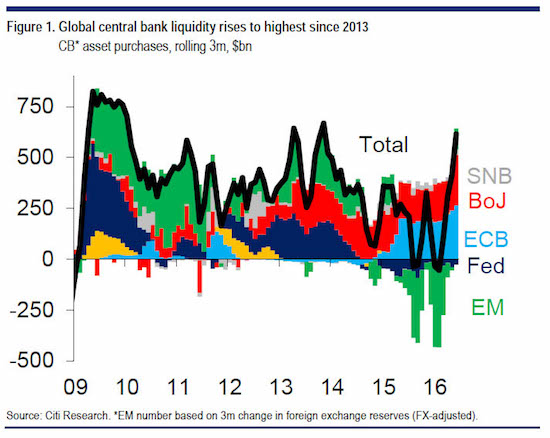

Central banks are the only buyers left.

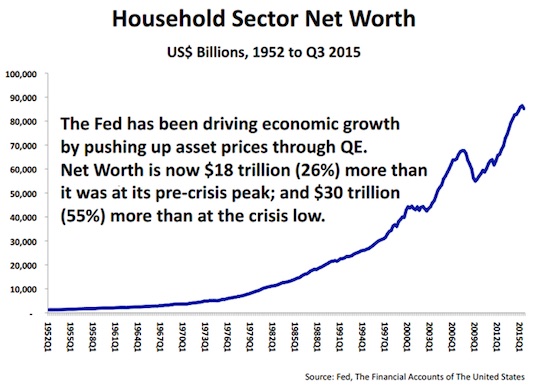

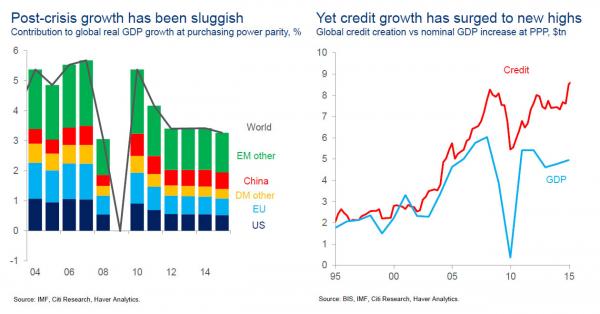

With the market breaking out to all-time highs, the media has started to once again reach for their party hats as headlines suggest clear sailing for investors ahead. While I certainly do not disagree the breakout is indeed bullish, and signals a continuation of the long-term bullish trend, there are more than sufficient reasons to remain somewhat cautious. Earnings are still weak, there is little evidence of economic resurgence and inflationary pressures globally remain nascent. But, for now, a rash of global Central Banks continue to support asset prices by increasing accommodative policies either through additional reductions in interest rates or direct injections of liquidity. As Matt King from Citi recently noted: “It has been a surge in net global central bank asset purchases to their highest level since 2013.”

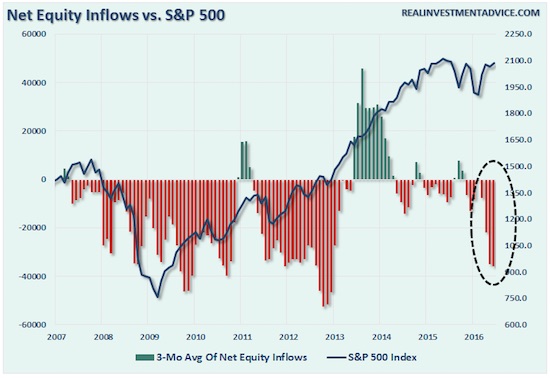

With the ECB in full QE mode, the BOC now using $300 billion in Pension Funds to prop up prices, and the BOJ now moving towards an additional $130 billion in QE as well, the liquidity push continues. Interestingly, despite the push by Central Banks to loft asset prices higher, individual market participants as measured by the Investment Company Institute (ICI) have a different idea. As shown in the chart below, despite asset prices ringing all-time highs, net equity inflows have turned decisively negative. This was much the same case following the 2012 market rout and it wasn’t until the launch of QE3 in 2013 that investors began to once again chase the markets.

Trudeau needs to act, and very fast, or he’ll be staring a monster in the face.

• Canada New Home Prices Grow At Fastest Pace In Nearly 9 Years (R.)

Canadian new home prices in May grew at their fastest pace in almost nine years, soaring 0.7% from April on strength in the booming markets of Toronto and Vancouver, Statistics Canada said on Thursday. Analysts polled by Reuters had predicted a 0.2% advance. May’s increase was the largest since the 1.0% jump recorded in July 2007. The Liberal government is concerned about rapidly rising prices in Toronto and Vancouver and is mulling more restrictions on mortgages. The combined region of Toronto and Oshawa – which accounts for 27.92% of the entire Canadian market – posted a 1.9% gain, the highest in 27 years.

Builders cited market conditions and the price of land. Market conditions also helped drive up new home prices in Vancouver by 1.1%. Overall, housing prices increased by 2.7% from May 2015, the largest year-on-year rise since the 2.7% advance seen in September 2010. The new housing price index excludes apartments and condominiums, which the government says are a particular cause for concern and which account for one-third of new housing.

A feature, not a bug.

• UK MPs Decry ‘Failed’ Effort To Stop London Property Money Laundering (G.)

Government attempts to stop the UK property market being exploited by international money launderers are “totally inadequate” and the country has instead “laid out a welcome mat” to criminals, the House of Commons home affairs committee has said. The influential panel of MPs, chaired by the Labour backbencher Keith Vaz, said it was disgraceful that at least £100bn was being laundered through the UK every year and astonishing that just 335 out of 1.2m property transactions last year were deemed to be suspicious by law enforcement officials. That means only 0.01% of the 2.4 million buyers and sellers in the UK generated suspicious activity reports at the National Crime Agency (NCA), whose system, Vaz said, was not fit for purpose.

“The proceeds of crime legislation has failed,” Vaz said. “London is a centre for money laundering, and its standing as a global financial centre is dependent on proactively and effectively tackling money laundering. Investment in London properties is a major route which tarnishes the image of the capital. Supervision of the property market is totally inadequate.” The NCA’s system gathers suspicious activity reports from lawyers, accountants, bankers and other professionals but is overwhelmed with more than 380,000 reports per year, when it is designed to handle 20,000. [..] The MPs said it remained “far too easy for someone intent on laundering money to buy a property with their ill-gotten gains, and rent it out in a very buoyant and robust letting market and take in clean money in perpetuity”.

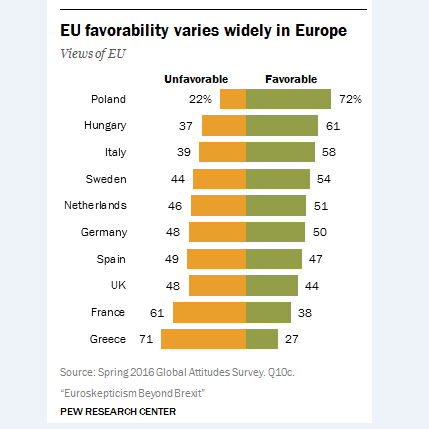

As I said many times before: when growth goes, so does centralization. It seems hard to make that connection.

• McKinsey Slams Globalization: “The Resentment Will Explode” (ZH)

The IMF is getting nervous, and what it appears to be most concerned about, is a collapse of the status quo. Moments ago, in a speech in Washington, IMF head Christine Lagarde said that “The greatest challenge we face today is the risk of the world turning its back on global cooperation—the cooperation which has served us all well. We know that globalization – and increased integration – over the past generation has yielded many economic benefits for many people.” The IMF is not alone: for years, consultancy giant McKinsey towed the party line as well saying in 2010 that “the core drivers of globalization are alive and well” and adding as recently as 2014 that “to be unconnected is to fall behind.”

That appears have changing, and cracks are starting to form behind the cohesive push for globalization, at least among those who benefit the most from globalization. In a stunning study released today, one which effectively refutes all its prior conclusions on the matter, McKinsey slams the establishment’s status quo thinking and admits that the economic gains of changes in the global economy have not been widely shared lately, especially in the developed world. In the report titled “Poorer Than Their Parents? Flat or Falling Incomes in Advanced Economies” it finds that prospects for income growth have deteriorated significantly since the financial crisis, and that the benefits from globalization are now over:

This overwhelmingly positive income trend has ended. A new McKinsey Global Institute report finds that between 2005 and 2014, real incomes in those same advanced economies were flat or fell for 65 to 70% of households, or more than 540 million people. And while government transfers and lower tax rates mitigated some of the impact, up to a quarter of all households still saw disposable income stall or fall in that decade.

As Bloomberg reports, Britain’s vote to exit the European Union exemplifies what happens when people feel like the system is letting them down, Richard Dobbs, the co-leader of the research, said in an interview Wednesday, ahead of the report’s release. He likened the buildup of resentment over globalization to a dangerous natural gas leak in a row of houses. “One of them will explode. I did not think that it would be the U.K. first,” said Dobbs, a senior partner of McKinsey and a member of the McKinsey Global Institute Council in London. “When we launch a new policy, let’s think about the impact on those groups” who have been left behind, Dobbs said. Sometimes the goals of fairness and efficiency can conflict, he said. “Are we prepared to damage competitiveness a bit to reduce the risk of an explosion?”

Brandon Smith on one of my ‘hobby horses’. More good stuff in the article.

• Globalism vs. “Populism” (Smith)

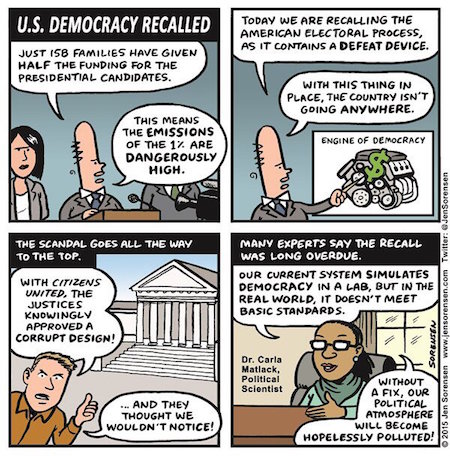

The globalists have used the method of false dichotomies for centuries to divide nations and peoples against each other in order to derive opportunity from chaos. That said, the above dichotomy is about as close to real as they have ever promoted. As I explained [earlier], the recent passage of the Brexit referendum in the U.K. has triggered a surge of new propaganda from establishment media outlets. The thrust of this propaganda is the notion that “populists” are behind the fight against globalization and these populists are going to foster the ruin of nations and the global economy. That is to say – globalism good, populism bad. There is a real fight between globalists and those who desire a free, decentralized and voluntary society.

They have just changed some of the labels and the language. We have yet to see how effective this strategy will be for the elites, but it is very useful for them in certain respects. The wielding of the term “populist” is about as sterilized and distant from “freedom and liberty” as you can get. It denotes not just “nationalism,” but selfish nationalism. And the association people are supposed to make in their minds is that selfish nationalism leads to destructive fascism (i.e. Nazis). Therefore, when you hear the term “populist,” the globalists hope you will think “Nazi.” Also, keep in mind that the narrative of the rise of populism coincides with grave warnings from the elites that such movements will cause global economic collapse if they continue to grow.

Of course, the elites have been fermenting an economic collapse for years. We have been experiencing many of the effects of it for some time. In a brilliant maneuver, the elites have attempted to re-label the liberty movement as “populist” (Nazis), and use liberty activists as a scapegoat for the fiscal time bomb THEY created. Will the masses buy it? I don’t know. I think that depends on how effectively we expose the strategy before the breakdown becomes too entrenched. The economic collapse itself has been handled masterfully by the elites, though. There is simply no solution that can prevent it from continuing. Even if every criminal globalist was hanging from a lamp post tomorrow and honest leadership was restored to government, the math cannot be changed and decades of struggle will be required before national economies can be made prosperous again.

By Manuela Cadelli, President of the Magistrates’ Union of Belgium. Bit older, but interesting reasoning.

• President of Belgian Magistrates: Neoliberalism Is A Form Of Fascism (DDP)

Every totalitarianism starts as distortion of language, as in the novel by George Orwell. Neoliberalism has its Newspeak and strategies of communication that enable it to deform reality. In this spirit, every budgetary cut is represented as an instance of modernization of the sectors concerned. If some of the most deprived are no longer reimbursed for medical expenses and so stop visiting the dentist, this is modernization of social security in action! Abstraction predominates in public discussion so as to occlude the implications for human beings. Thus, in relation to migrants, it is imperative that the need for hosting them does not lead to public appeals that our finances could not accommodate. Is it In the same way that other individuals qualify for assistance out of considerations of national solidarity?

Social Darwinism predominates, assigning the most stringent performance requirements to everyone and everything: to be weak is to fail. The foundations of our culture are overturned: every humanist premise is disqualified or demonetized because neoliberalism has the monopoly of rationality and realism. Margaret Thatcher said it in 1985: “There is no alternative.” Everything else is utopianism, unreason and regression. The virtue of debate and conflicting perspectives are discredited because history is ruled by necessity. This subculture harbours an existential threat of its own: shortcomings of performance condemn one to disappearance while at the same time everyone is charged with inefficiency and obliged to justify everything. Trust is broken. Evaluation reigns, and with it the bureaucracy which imposes definition and research of a plethora of targets, and indicators with which one must comply. Creativity and the critical spirit are stifled by management.

In general, everywhere native people get an actual say, things improve.

• In New Zealand, Lands and Rivers Can Be People -Legally Speaking- (NYT)

Can a stretch of land be a person in the eyes of the law? Can a body of water? In New Zealand, they can. A former national park has been granted personhood, and a river system is expected to receive the same soon. The unusual designations, something like the legal status that corporations possess, came out of agreements between New Zealand’s government and Maori groups. The two sides have argued for years over guardianship of the country’s natural features. Chris Finlayson, New Zealand’s attorney general, said the issue was resolved by taking the Maori mind-set into account. “In their worldview, ‘I am the river and the river is me,’” he said. “Their geographic region is part and parcel of who they are.”

From 1954 to 2014, Te Urewera was an 821-square-mile national park on the North Island, but when the Te Urewera Act took effect, the government gave up formal ownership, and the land became a legal entity with “all the rights, powers, duties and liabilities of a legal person,” as the statute puts it. “The settlement is a profound alternative to the human presumption of sovereignty over the natural world,” said Pita Sharples, who was the minister of Maori affairs when the law was passed. It was also “undoubtedly legally revolutionary” in New Zealand “and on a world scale,” Jacinta Ruru of the University of Otago wrote in the Maori Law Review.

Personhood means, among other things, that lawsuits to protect the land can be brought on behalf of the land itself, with no need to show harm to a particular human. Next will be the Whanganui River, New Zealand’s third longest. The local Maori tribe views it as “an indivisible and living whole, comprising the river and all tributaries from the mountains to the sea — and that’s what we are giving effect to through this settlement,” Mr. Finlayson said. It is expected to clear Parliament and become law this year.

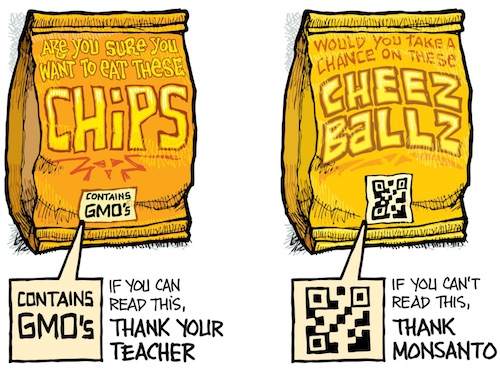

How crazy is this? ‘Misinformation is also information’.

• Obama Expected to Sign Industry-Backed GMO Label Bill Into Law (EW)

Looks like we’re finally getting GMO labels on food products—just not the kind you can actually read. President Obama is expected to throw his weight behind a controversial bill that allows businesses to use a smartphone scannable QR code instead of clear, concise wording that informs consumers if a product contains genetically modified ingredients. The bill would also nullify state-by-state GMO labeling mandates such as Vermont’s landmark law that took effect on July 1. “While there is broad consensus that foods from genetically engineered crops are safe, we appreciate the bipartisan effort to address consumers’ interest in knowing more about their food, including whether it includes ingredients from genetically engineered crops,” White House spokeswoman Katie Hill told Bloomberg in an e-mail.

“We look forward to tracking its progress in the House and anticipate the president would sign it in its current form.” The House of Representatives is voting today on legislation from the Senate, which voted 63 to 30 in favor of the bill on July 7, less than a week after Vermont enacted its GMO label law. The bipartisan “compromise” bill was conceived after years of negotiations by Democrat Sen. Debbie Stabenow and Republican Sen. Pat Roberts and is supported by the very industry that produces and profits from such products, including the powerful Grocery Manufactures Association and world’s largest seed producer and pesticide giant Monsanto. UPDATE: The U.S. House of Representatives passed the bill by a 306-117 vote Thursday. The bill now heads to President Obama’s desk.

Can’t stop the brilliance of the human brain.

• Biodiversity Is Below Safe Levels Across More Than Half Of World’s Land (G.)

The variety of animals and plants has fallen to dangerous levels across more than half of the world’s landmass due to humanity destroying habitats to use as farmland, scientists have estimated. The unchecked loss of biodiversity is akin to playing ecological roulette and will set back efforts to bring people out of poverty in the long term, they warned. Analysing 1.8m records from 39,123 sites across Earth, the international study found that a measure of the intactness of biodiversity at sites has fallen below a safety limit across 58.1% of the world’s land. Under a proposal put forward by experts last year, a site losing more than 10% of its biodiversity is considered to have passed a precautionary threshold, beyond which the ecosystem’s ability to function could be compromised.

“It’s worrying that land use has already pushed biodiversity below the level proposed as a safe limit,” said Prof Andy Purvis, of the Natural History Museum, and one of the authors. “Until and unless we can bring biodiversity back up, we’re playing ecological roulette.” Researchers said the study, published in the journal Science on Thursday, was the most comprehensive examination yet of biodiversity loss. The decline is not just bad news for the species but in the long term could spell problems for human health and economies. “If ecosystem functions don’t continue, then yes it affects the ability of agriculture to sustain human populations and we simply don’t know at which point that will be reached,” said Dr Tim Newbold, lead author of the work and a research associate at University College London. “We are entering the zone of uncertainty.”

There’s a man and then there’s ‘a mensch’.

• Gleaning: Harvesting Spain’s Unwanted Crops To Feed The Hungry (G.)

Under a blazing Catalan sun, Abdelouahid wipes the sweat from his brow in a cabbage patch full with clouds of white butterflies. “It’s really not warm today,” he says. “It’s only hot if you stop working.” Around him, unemployed workers and environmentalists squat in green bibs, black gloves and hats, plucking cabbages that would otherwise be threshed, to distribute at food banks around Barcelona. A 39-year-old Moroccan emigré with two small children, Abdelouahid began “gleaning” – harvesting farmers’ unwanted crops – with the Espigoladors (gleaners) after losing his job in the construction industry four years ago. It is Ramadan and he is fasting but still smiling as he cuts at the green jewels.

“I don’t like to spend my days at home, sending CVs to employers, waiting for their rejection letters, or going around the restaurants trying to find food,” he says. “I prefer to do something positive. A lot of people need this food. It is better to collect it than to leave it.” Europe wastes some 88m tonnes of food each year – around 173 kg per person – with costs estimated at €143bn (£113bn). Advocates of the new gleaning movements say that its collection could reduce pressure on land use, improve diets, feed the hungry and provide work for the socially excluded.

For now, most of its recovered foods go to food banks, but the Espigoladors social enterprise has launched an “Es Imperfect” (is imperfect) brand of jams, soups and sauces made from recovered produce. The line is growing so fast that the day after the cabbage picking, the project’s founder, Mireia Barba, was called to a meeting of Cotec, King Felip VI’s national development foundation. Another fruit of the gleaning project has been an “I’m imperfect too” advertising campaign which challenges conventional ideas of food and beauty, by using photos of ordinary people holding painted fruit. The idea was to change misconceptions about browned, soft or unusually shaped fruit and veg being any less tasty.