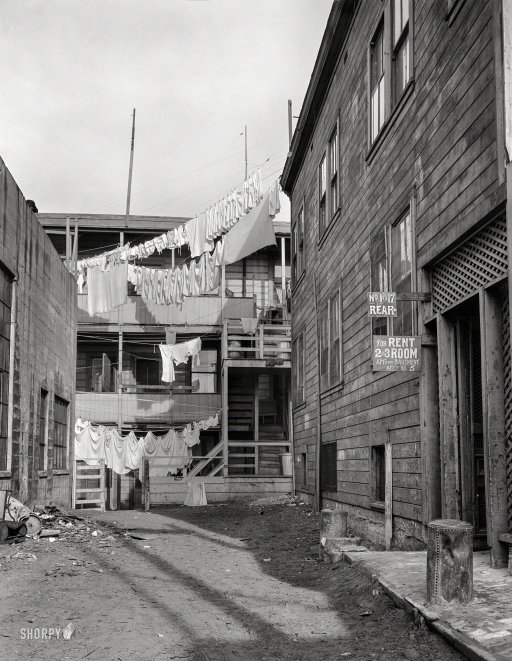

Dorothea Lange Rooms for Rent, Mission District. Slums of San Francisco, California 1936

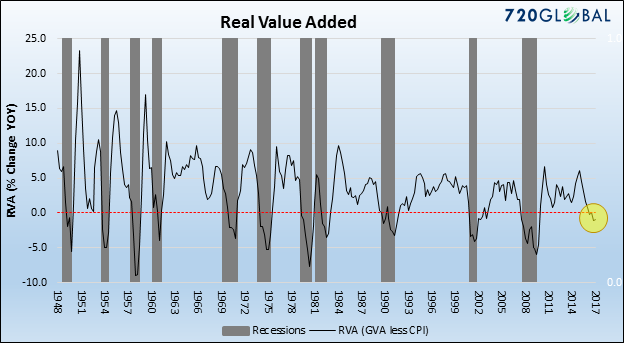

“The data point, Real Value Added, is currently in negative territory and may, therefore, be a harbinger of an economic downturn. If it is a false signal, it would be the first in a 70-year history of observations.”

• An Indicator of Peril (Lebowitz)

Gross Value Added (GVA) and Real Value Added (RVA). GVA is a measure of economic activity, like GDP, but formulated from the production side of the economy. It measures the dollar value of all goods and services produced less all the costs required to produce those goods or services. For example, if 720Global buys $100 worth of wood, $20 worth of other materials and employs $30 worth of labor to build a chair, we have produced a good for $150. If that good is sold for $200, 720Global has created $50 of economic value. Gross Domestic Product (GDP), the more popular measure of economic activity, calculates the level of commerce based on the dollar value of the final goods and services produced. It may help to think of GDP as economic activity measured from the demand side and GVA as measured from the supply side.

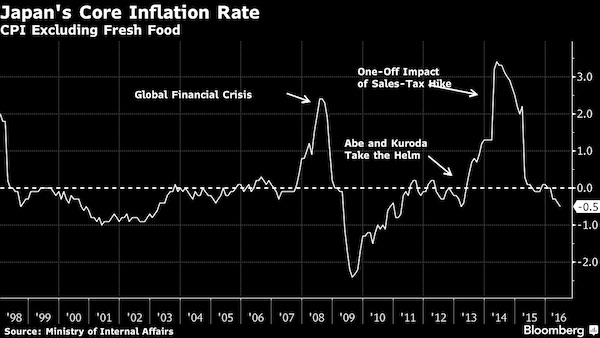

Despite the differences, the levels of economic activity reported are remarkably consistent. Since 1948, nominal GDP has averaged annual growth of 6.55% while GVA has averaged 6.50%. It is important to note that, while they track each other very well over the longer term, they are less correlated quarter to quarter. Economists prefer to measure economic activity without the effect of inflation. If inflation were rampant when making the chair in the example above, some of the incremental value was due to the general trend of rising prices and not value added by 720Global. To strip out the effect of inflation and compute a pure measure of value added, it is commonplace to subtract inflation from GVA. The result is Real Value Added (RVA = GVA less CPI). The graph below plots RVA since 1948. Periods deemed recessionary by the National Bureau of Economic Research (NBER) are denoted in gray.

Currently, three of the last four quarters have produced negative RVA levels. Real GDP is not producing similar results, having averaged 2% growth over the same quarters. As mentioned earlier, RVA and Real GDP may not be well correlated over short time frames. RVA is just one source of data arguing that economic trouble lies ahead, therefore, we would be wise not to read too much into this one indicator. Of concern, however, is that negative RVA readings have an impeccable pattern of signaling recession as a coincident indicator.

Debt ceiling solution far from done.

• Former CBO Director: Fall 2017 Will Be “Very Scary”, Expect A Market Crash (ZH)

Rudy Penner, the former director of the Congressional Budget Office and the person described by MarketNews international as “one of Washington’s most respected fiscal policy experts”, told MNI Wednesday in an exclusive interview that he expects a “very scary” fall 2017 due to fiscal issues, with market-disrupting battles ahead on both the debt ceiling and fiscal year 2018 spending. Penner directed the CBO under president Reagan, worked at high level posts in the White House budget office, and the Council of Economic Advisers. He is currently a fellow at the Urban Institute and sits on the board of the Committee for a Responsible Federal Budget. “There are so many politically hard issues and so little consensus on budget and tax policy. I assume we’ll somehow get through this, but not without getting frightened on a regular basis,” Penner said.

“Probably the best we can hope for is muddling through the (FY 2018) budget and the debt limit and getting very limited health, tax, and infrastructure legislation. There is not going to be significant stimulus coming out of Washington in the foreseeable future,” he said, echoing what many other pundits have said before. Penner said a “bipartisan negotiation is badly needed” to forge even a limited FY 2018 spending agreement. But he’s not certain this will occur. “Even a very limited spending agreement might be an impossible dream. We may just stumble into a series of short-term CRs,” he said, referring to temporary spending bills to keep the government funded. While the “record polarization” rhetoric is familiar, the clock is starting to tick ever louder: the 2018 fiscal year begins on October 1, 2017 and extends until September 30, 2018. None of the 12 annual spending bills for FY 2018 have yet been approved by Congress.

On to the debt ceiling, the one item on the calendar which Morgan Stanley (and others) have said will be the biggest hurdle for the market in the next two months, Penner said he believes it will be “very challenging” for Congress to pass legislation this fall to increase the statutory debt ceiling. Treasury Secretary Steve Mnuchin has asked Congress to lift the debt ceiling by the end of September. Penner countered that a “plausible path” for dealing with the debt ceiling is to pass legislation in September to suspend the debt ceiling until after the November 2018 mid-term elections. However, such legislation, he said, may have to be negotiated by an unusual coalition assembled by House Speaker Paul Ryan, a Republican, and House Minority Leader Nancy Pelosi, a Democrat. Such an agreement, Penner said, “could put Speaker Ryan’s job in peril” by conservative Republicans who oppose it. He said he believes the debt ceiling is “an incredibly stupid law that makes no logical sense.”

What happens when you save banks only.

• US Still Stuck Firmly In The Great Recession (BI)

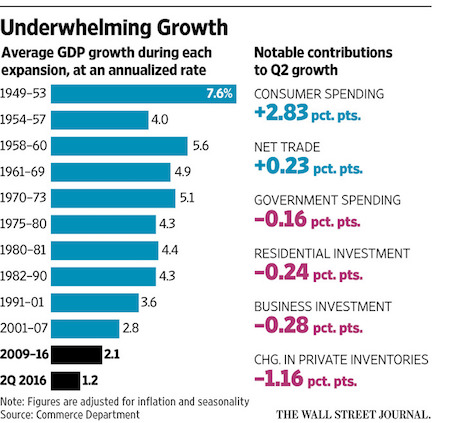

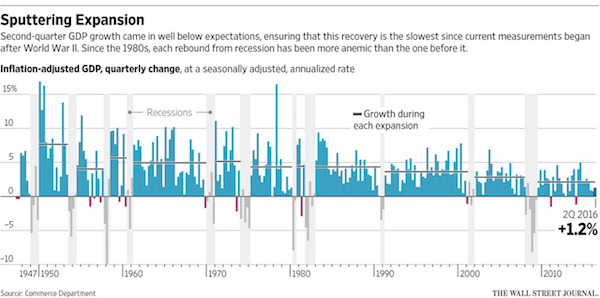

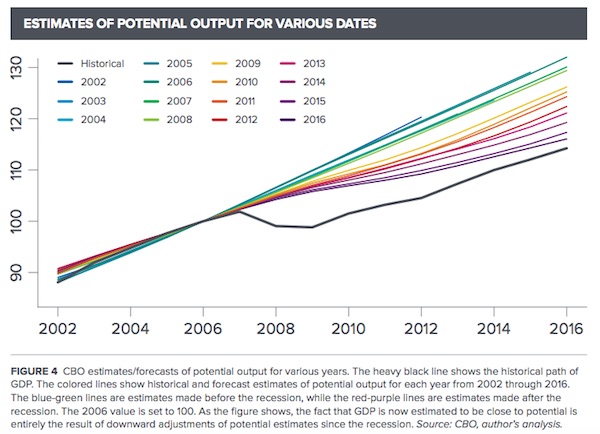

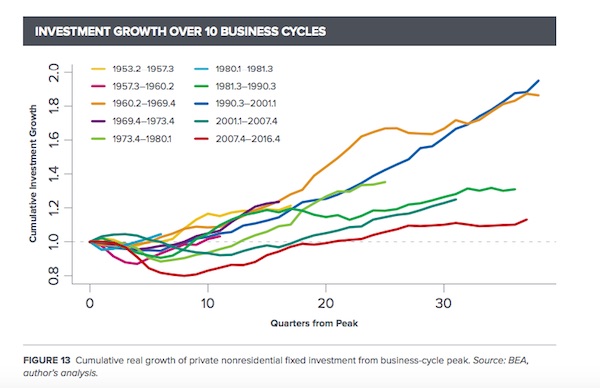

Expectations are everything, especially in economics. That’s why a distinct lack of progress in a few basic measures of economic progress, particularly relative to pre-crisis expectations, has left many Americans questioning how much they have personally benefitted from the economic recovery. A new report from the Roosevelt Institute, a liberal think tank in Washington, highlights a number of ways in which “the recovery since 2009 is, in a sense, a statistical illusion.” The study finds the nation’s total economic output, its gross domestic product, “remains about 15% below the pre-recession trend, a larger gap than at the bottom of the recession.” The first chart below shows that lag, while the second offers insights into just how badly the crisis dented expectations about the future.

Strong employment gains in recent months have brought the jobless rate down to a historically-low 4.3%. However, this decline has not been accompanied by rising incomes or consumer prices, generally associated with a sustainable economic boom. Some Federal Reserve policymakers have found this trend puzzling, while many labor economists point to underlying weaknesses in the job market, including high levels of underemployment and long-term joblessness, as drags on income. Stagnant wages amid rising profits have meant that the wage share in US national income has fallen from 63% to 57% in the last 15 years, according to the report. “It is impossible for the wage share to ever rise if the central bank will not allow a period of ‘excessive’ wage growth,” writes J.W. Mason, who authored the report. “A rise in the wage share necessarily requires a period in which wages rise faster than would be consistent with longterm macroeconomic stability.”

Zombie-to-be economies.

• 10 Years After Crisis, Another Crash Is ‘Almost Inevitable’ – Steve Keen (RT)

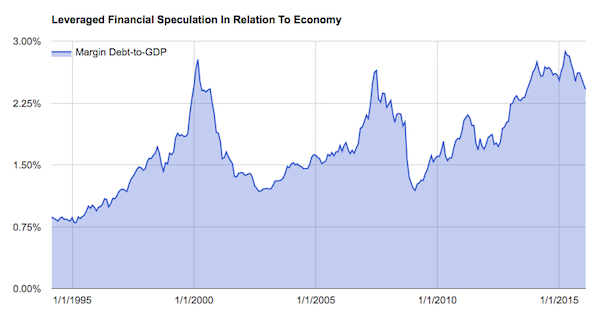

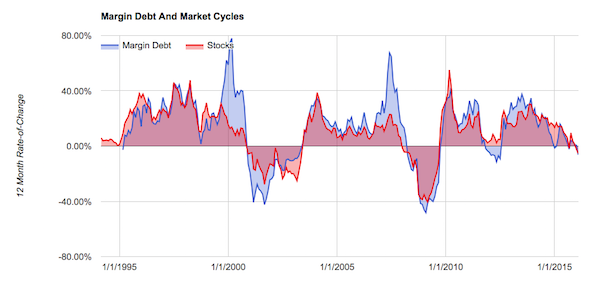

Speaking to RT, Keen said another financial crisis could be just around the corner unless a fundamentally different approach to debt is adopted. He says we are too focused on government debt, when what actually caused the crisis was “run-away private debt.” “The economy in the UK is not stable. It’s in the aftermath of the biggest financial crisis since the great depression, and there’s still a lack of awareness in the political classes about what actually caused the crisis in the first place,” Keen said. “The Tories were incredibly successful in convincing the electorate that the crisis was caused by government spending, which is absurd. That is technically saying government spending in the UK caused the financial crisis in the United States. Which is just nonsense. “And that gave us austerity for the last 10 years. That austerity has actually further weakened the economy.”

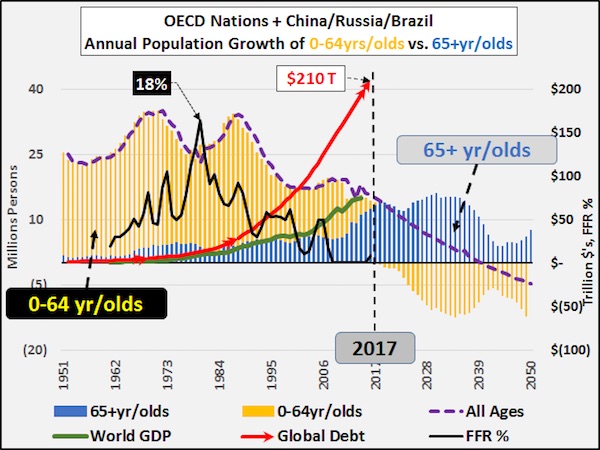

Keen says the level of private debt in the UK peaked at about 195% of GDP post-crisis. While it is now down to about 170% of GDP, it is roughly three times the level of debt England carried before the Margaret Thatcher era, he says. “That’s the stuff that’s being ignored. Nothing is really being done about that. With the amount of debt just sitting there we are still likely to have another crisis – but more likely, we are going to have stagnation.” What is cause for concern, Keen says, is what he calls the “zombie-to-be” economies, such as Australia, Belgium, China, Canada, and South Korea, which avoided the 2008 crisis by borrowing their way through it. Now they have a bigger debt burden to deal with when the next crisis hits, which could be between 2017 and 2020, he says.

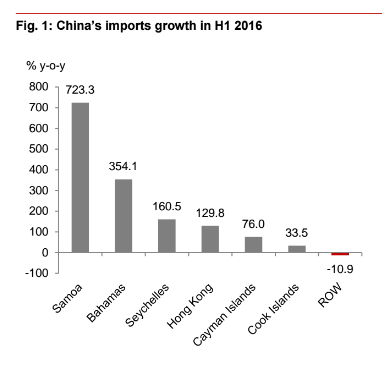

“[The ‘zombie-to-be’ economies] are roughly equivalent in size to the American economy. So when they fall, then there will be a crisis that affects the rest of the world, including the UK.” Keen sees China as a terminal case. It has expanded credit at an annualized rate of around 25% for years on end. With private sector debt exceeding 200% of GDP, China resembles the over-indebted economies of Ireland and Spain prior to 2008. He also has little hope for his native Australia, whose credit and housing bubbles failed to burst in 2008. Last year, Australian private sector credit nudged above 200% of GDP, up more than 20 percentage points since the global financial crisis. Australia shows “that you can avoid a debt crisis today only by putting it off until tomorrow,” Keen says.

Pensions.

• This $5 Trillion Time Bomb Will Devastate Americans (IM)

Over 3,000 millionaires have fled Chicago in recent months. This is the largest outflow of wealthy people from any US city right now. It’s also one of the largest outflows of wealthy people in the world. But it’s not just millionaires… Every five minutes someone leaves Illinois. In a recent poll, 47% of people in Illinois said they want to leave the state. Over the last decade, more than half a million people have done just that. This is the largest outflow of people from any state in the country. The people who leave are generally better educated, more skilled, and earn more money than those who stay. Entire towns of affluent Illinois refugees have sprouted up in Florida, Arizona, and other states. Illinois is bleeding productive people. This is a major warning sign. Wealthy people are often the first to leave a bad situation. They have the means to simply get up and go.

And when they do, they take their money and their businesses with them. This hurts the local property market and the rest of the local economy. Many of Illinois’ millionaires own businesses that employ large numbers of people. As they leave, there are fewer people and businesses left to shoulder the state’s enormous and growing financial burdens. Many of these people are leaving for one simple reason: rising taxes. Illinois’ leftist tax-and-spend politicians are continuing to increase all sorts of taxes, which were already high in the first place. The state just passed a 32% income tax hike. Rising taxes are pushing more and more productive people to make the chicken run… and at the worst possible moment for the state’s coffers. Illinois is the most financially distressed state in the US. Every month, it spends $600 million more than it takes in.

It’s now $15 billion behind on its bills and counting. Illinois is about to become America’s first failed state. Even its governor has described it as a “banana republic.” Today, Illinois can’t pay contractors to fix the roads. It doesn’t have enough cash to pay lottery winners. (What happened to the money it collected selling lottery tickets?) The state can’t even afford food for its prisoners. Here are the sad facts. Illinois has: Nearly $15 billion in overdue bills (including $800 million in interest). A $7 billion budget deficit. And an eye-watering $250 billion bottomless pit of unfunded pension obligations. This $250 billion tab is one of the worst public pension crises in the US.

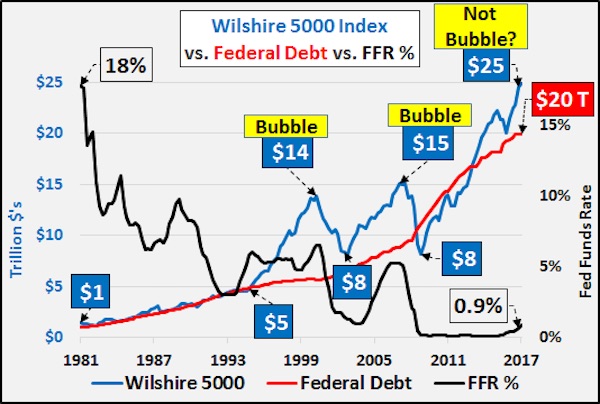

[..] While Illinois has the worst pension situation, it’s not the only state or city in crisis. California’s public pension system is also broken beyond repair. It’s $750 billion underfunded. State pension plans in Connecticut, Pennsylvania, New Jersey, and many other states are taking on water, too. Unfunded public pension liabilities in the US have surpassed $5 trillion. And that’s during an epic stock and bond market bubble.

A long overview of all the evidence.

• New Report Raises Big Questions About Last Year’s DNC Hack (N.)

It is now a year since the Democratic National Committee’s mail system was compromised—a year since events in the spring and early summer of 2016 were identified as remote hacks and, in short order, attributed to Russians acting in behalf of Donald Trump. A great edifice has been erected during this time. President Trump, members of his family, and numerous people around him stand accused of various corruptions and extensive collusion with Russians. Half a dozen simultaneous investigations proceed into these matters. Last week news broke that Special Counsel Robert Mueller had convened a grand jury, which issued its first subpoenas on August 3. Allegations of treason are common; prominent political figures and many media cultivate a case for impeachment.

The president’s ability to conduct foreign policy, notably but not only with regard to Russia, is now crippled. Forced into a corner and having no choice, Trump just signed legislation imposing severe new sanctions on Russia and European companies working with it on pipeline projects vital to Russia’s energy sector. Striking this close to the core of another nation’s economy is customarily considered an act of war, we must not forget. In retaliation, Moscow has announced that the United States must cut its embassy staff by roughly two-thirds. All sides agree that relations between the United States and Russia are now as fragile as they were during some of the Cold War’s worst moments. To suggest that military conflict between two nuclear powers inches ever closer can no longer be dismissed as hyperbole.

All this was set in motion when the DNC’s mail server was first violated in the spring of 2016 and by subsequent assertions that Russians were behind that “hack” and another such operation, also described as a Russian hack, on July 5. These are the foundation stones of the edifice just outlined. The evolution of public discourse in the year since is worthy of scholarly study: Possibilities became allegations, and these became probabilities. Then the probabilities turned into certainties, and these evolved into what are now taken to be established truths. By my reckoning, it required a few days to a few weeks to advance from each of these stages to the next. This was accomplished via the indefensibly corrupt manipulations of language repeated incessantly in our leading media.

America still ignores its no. 1 Russia expert.

• Unverified ‘Russiagate’ Allegations a Grave Threat to America (Stephen Cohen)

Considering all these unprecedented factors, it needs to be emphasized again: President Trump is right about this “all-time low & very dangerous” moment in US-Russian relations. Having recently returned from Russia, Cohen reports that the political situation there is also worsening, primarily because of the Cold War fervor in Washington, including the politics of Russiagate and and new sanctions. Contrary to opinion in the American political-media establishment, Putin has long been a moderate, restraining factor in the new Cold War, but his political space for moderation is rapidly diminishing. His reaction to the congressional sanctions—reducing the number of personnel in US official outposts in Russia to the far lesser number of Russians in American ones—was the least he could have done.

Far harsher political and economic countermeasures are being widely discussed in Moscow, and urged on Putin. For now, he resists, explaining, “I do not want to make things worse,” but he too has a surrounding political elite and it is playing a growing role against any accommodation or restraint in regard to US policy. Meanwhile, the pro-American faction in Russian governmental circles is being decimated by Washington’s actions; and, as always happens in times of escalating Cold War, the space for Russian opposition and other dissident politics is rapidly shrinking.

Well, if you build yourselves €1 billion offices, who cares?

• European Commission Spending Thousands On ‘Air Taxis’ For Top Officials (G.)

Jean-Claude Juncker and his top officials are spending tens of thousands of euros on chartering private planes, according to documents detailing the European commission’s travel expenses. After three years of battling with transparency campaigners fighting for full disclosure, the EU’s executive has released two months of travel costs for 2016, revealing regular use of chartered planes to transport Brussels’ 28 commissioners. The most expensive mission for which details have been released was in the name of Federica Mogherini, the EU’s high representative for foreign affairs. It cost €77,118 for her and aides to travel by “air taxi” to summits in Azerbaijan and Armenia between 29 February and 2 March 2016.

A two-day visit by Juncker, the European commission president, with a delegation of eight people to see Italy’s political leaders in Rome in February 2016 cost €27,000, again due to the chartering of a private plane. Mina Andreeva, a commission spokeswoman, said the use of air taxis was only allowed where commercial flights were either not available or their flight plans did not fit in with a commissioner’s agenda. Security concerns would also allow the chartering of a private plane under commission rules. She said of Juncker’s trip that there had been “no available commercial plane to fit the president’s agenda” in Italy, where he met the Italian president and prime minister, among other dignitaries. The spokeswoman added that the EU’s total spending on such administrative costs was publicly available and that the organisation led the way in being transparent in their work.

The commission was not able to provide details of how many planes are chartered by Brussels every year, although she insisted the number was limited. The travel costs accumulated by the commissioners come out of the general budget, agreed by the member states. [..] According to documents relating to the two months in 2016, total travel and accommodation costs for visits by commissioners to European parliament sessions in Strasbourg, the World Economic Forum in Davos and official missions to countries came to €492.249, an average of €8,790 a month per commissioner.

That’ll teach them to stay home.

• Refugee Crisis Triggers Heightened Risk Of Slavery In EU Supply Chains (G.)

The migrant crisis has increased the risk of slavery and forced labour tainting supply chains in three-quarters of EU countries over the past year, researchers have found. Romania, Italy, Cyprus and Bulgaria – all key entry points into Europe for migrants vulnerable to exploitation – were identified by risk analysts as particularly vulnerable to slavery and forced labour. The annual modern slavery index, produced by Verisk Maplecroft, assessed the conditions that make labour exploitation more likely. Areas covered by the index include national legal frameworks and the severity, and frequency, of violations. Countries outside Europe, such as North Korea and South Sudan, were judged to be at the greatest risk of modern slavery, but the researchers said the EU showed the largest increase in risk of any region over the past year.

“In the past, the slavery story has been in supply chains in countries far away, like Thailand and Bangladesh,” said Dr Alexandra Channer, a human rights analyst at Verisk Maplecroft. “But it is now far closer to home and it something that consumers, governments and businesses in the EU have to look out for. With the arrival of migrants, who are often trapped in modern slavery before they enter the workplace, the vulnerable population is expanding.” The International Labour Organisation estimates that 21 million people worldwide are subject to some form of slavery. The biggest global increase in the risk of slavery was in Romania, which rose 56 places in the indexand is the only EU country classified as “high risk”. Turkey came a close second, moving up 52 places, from medium risk to high risk.

The influx of hundreds of thousands of Syrians fleeing war, combined with Turkey’s restrictive work permit system, has led to thousands of refugees becoming part of an informal workforce, said the study. The government, which is focused on political crackdown, does not prioritise labour violations, further adding to the risk. Over the past year, several large brands from Turkish textile factories have been associated with child labour and slavery. The picture in Romania is more complex, researchers said. The country’s high risk category reflects more severe and frequent instances of modern slavery, but also reflects a greater number of criminal investigations in Romania, usually in collaboration with EU enforcement authorities. Both Romania and Italy, which rose 17 places, have the worst reported violations in the EU, including severe forms of forced labour such as servitude and trafficking, the study said.