Dorothea Lange Migrant Father June 1938

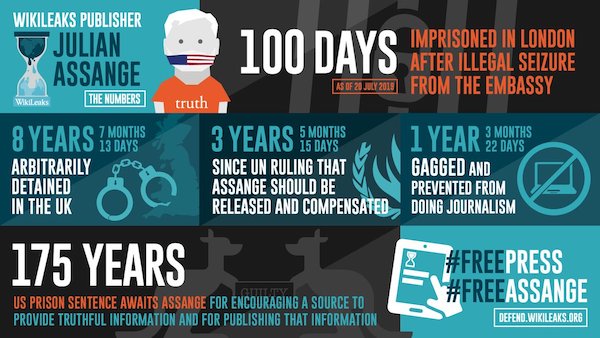

Russiagate intensifies.

Honorable mentions: Trump, hamburgers, Washington Post.

• Russian Assets In America: A Field Guide (RT)

If the mainstream media is to be believed, the Kremlin’s network of hackers and bots could give the Illuminati a run for its money. When its operatives aren’t electing British prime ministers, embarrassing American politicians on debate night and flogging dildos to undermine democracy, they’re overseeing a team of assets earning their borscht openly in the United States. Thankfully, the intrepid detectives in the American press have named and shamed these double agents. We’ve compiled a list here.

Mitch McConnell, alias: Moscow Mitch McTreason

Cleverly posing as a Republican Senator from Kentucky since 1985, Mitch McConnell was outed as a Russian asset by the Washington Post last week when he shot down a trio of bills that would have supposedly beefed up American election security from foreign interference. Never mind that McConnell opposed the bills based almost entirely on partisan disagreements with the Democrats, the Post exclaimed “Mitch McConnell is a Russian asset,” and MSNBC’s Joe Scarborough dubbed the southern Republican “Moscow Mitch.” With his nefarious plan exposed, #MoscowMitchMcTreason had no choice but to shrug, and continue about his day.

Lindsey Graham, alias: Leningrad Lindsey

#LeningradLindsey began trending after the South Carolina lawmaker helped push a controversial asylum bill through the Senate Judiciary Committee on Thursday. Though the bill had nothing to do with Russia, the nickname stuck. Cleverly, Leningrad Lindsey has spent his career on Capitol Hill posing as a Russia-baiter. Graham has repeatedly called for Russia to “pay a price” for allegedly meddling in the 2016 presidential election, and co-sponsored an anti-Russia “sanctions bill from hell.” With a record like that, nobody would suspect that he was secretly a Russian asset all along. Note too that Leningrad does not exist any more. Perhaps Graham’s treachery dates back to the communist era? Either that or Letnerechenskiy Lindsey didn’t have the same ring to it.

I can’t seem to figure out on what specific grounds though.

• Majority of House Democrats Favor Starting Impeachment Proceedings (R.)

A majority of Democrats in the U.S. House of Representatives now favor launching impeachment proceedings against Republican President Donald Trump, after a California lawmaker on Friday became the 118th Democrat to call for the process to begin. “In the past few years, our nation has seen and heard things from this president that have no place in our democracy,” Representative Salud Carbajal said in a statement that accused Trump of “criminal” behavior. “I believe it is time to open an impeachment inquiry into President Donald Trump,” Carbajal said. The Democrats have a majority of 235 members in the House of Representatives. Support for an impeachment inquiry has jumped by more than two dozen Democrats since former Special Counsel Robert Mueller testified on July 24 about his probe of Trump and Russian interference in the 2016 election.

But the total of 118 is still far short of the 218 House votes needed to approve an impeachment resolution, and opinion polls continue to show voters sharply divided over the issue. The House is currently on a summer recess and will not return until Sept. 9. Having a majority of her own caucus favor impeachment could put new pressure on House Speaker Nancy Pelosi, who opposes impeachment as a politically risky move unless investigators find powerful evidence of misconduct by Trump that can unify public opinion. In a statement issued Friday, Pelosi gave no sign she was about to change her cautious approach. Instead, she outlined in considerable detail her strategy of Democrats continuing to investigate the president, while also moving in court to get access to more evidence.

“Democrats in the Congress continue to legislate, investigate and litigate,” Pelosi declared. “The president will be held accountable.” Democrats opposing impeachment say the best way to remove Trump is by defeating him in 2020, when he is up for re-election. Some Democrats worry that too strong a focus on impeachment could eclipse other issues like healthcare and threaten the re-election of Democrats who pried seats away from Republicans last year in regions where many voters oppose impeachment. Trump has denied any wrongdoing and says he was vindicated by the Mueller report, but the special counsel made clear in his testimony to Congress that that was not the case.

In his report, Mueller described in detail the extensive contact Trump’s team had with Russia during the 2016 election campaign, and how Trump tried to impede Mueller’s investigation. While he stopped short of concluding Trump had committed a crime or that his aides had conspired with Moscow, Mueller did not clear him and indicated it was up to Congress to decide the next steps. Democrats on the House Judiciary Committee effectively rebranded their six-month-old oversight investigation of Trump as an impeachment probe last week, when they asked a federal judge for access to Mueller’s grand jury evidence to determine whether to recommend articles of impeachment against Trump.

More impeachment nonsense.

• The Rise and Fall of Superhero Robert Mueller (Matt Taibbi)

The conspiracy tale has validated every Trump criticism about both crooked media and the deep state. The whole narrative is the brainchild of Clinton hacks, a handful of overzealous intelligence nuts, and a subset of the Democratic Party’s weakest elected minds, in particular murine ex-prosecutor Schiff, a man who should be selling Buicks back in his hometown Burbank. Take a good look at Schiff, at our paranoid outpatient of an ex-CIA chief John Brennan, and at excuse-making Clinton campaign chief Robby Mook (a.k.a. the captain of the Democratic Titanic), and ask if you really want to be re-writing history for those people. They’re making the press accomplices in the most imbecilic effort at political opposition in recent American history.

Hence the desperate public comments and the string of wacked-out stunts, like putting Mueller under oath. Impeachment will be the next adventure in doubling down blind. A significant portion of the original conspiracy theory vanished via a series of under-circulated news reports just in the months since the end of the Mueller probe. Remember the Southern District of New York campaign finance probe that arose in connection with Trump lawyer Michael Cohen, the one described as a “major danger” to Trump? Remember all that talk about how “Trump can’t run the Mueller playbook on the New York feds?” Experts told us that the Cohen probe posed a “significant threat” of new indictments for Trump and his family.

When that investigation closed with no new charges the same week Mueller testified, the commentariat barely noticed. Same with the Democrats v. Earth lawsuit/publicity stunt, in which the Democratic National Committee sued Trump, the Russian government, and Wikileaks under a RICO claim. Plaintiffs charged the Trump campaign conspired to steal and release DNC emails. But a federal judge tossed the suit on the grounds that the Trump campaign “did not participate in the theft.” Moreover, the Clinton-appointed judge said published documents were “of public concern” and therefore protected like any other journalistic work product. The judge also ruled that allegations about all the non-Russian defendants (including Wikileaks) were “insufficient to hold them liable” for any illegality involved in obtaining DNC emails.

More superheroes.

• Obama Looms over the Primary in Invisible Ways (TPM)

When Bernie Sanders got into the race in 2016 in many ways his campaign was premised on the idea that Obama had gotten most things wrong. Perhaps his presidency wasn’t a disaster, as my friend argues. But the premises of Sanders’ campaign was that Democrats needed to move in a dramatically different direction and that Obama’s policies and presidency were – while better than the GOP alternative – fundamentally misguided. Sanders was pretty straightforward about this before getting into the race. And he didn’t really hide it once he got in. But in the nature of things, since Obama was a popular incumbent, it wasn’t a point he emphasized during his campaign.

We also know that the entire country has moved left on a number of issues over the last decade (LGBTQ issues and marijuana legalization are just two examples). Democrats, meanwhile, have moved significantly to the left on a much broader range of issues. Some of this is an on-going trend. Some of it is in reaction to Trump, having his extremity lead to a reevaluation of practices that most Democrats didn’t focus much on. Maybe the best example of this is on immigration. As immigration advocates were saying very clearly at the time, the Obama administration deported lots and lots of people. It’s hard to see that in quite the same light after what we’ve all been exposed to about the mechanics of ICE, detention, deportation and everything that goes with it.

But with all of this, there’s a shift that has taken place that manages to be both all but invisible and yet very obvious. Part of it is Sanders deep imprint on the 2020 policy conversation – especially on health care and student debt but on other issues as well. Part of it is the wave of left activism that predates Trump but has intensified under his presidency. But taken together they’ve created a 2020 campaign policy conversation which at least implicitly gives a pretty negative verdict on Obama and his presidency. Perhaps not a disaster as my friend puts it but in many regards a mistake rather than something to build on. That, I think, is the root of Biden’s continuing strength, even with all the bobbles, flubs, the archaic policy histories and all the rest. It’s not just because he was Obama’s Vice President and people like Obama. It’s because the terms of the policy debate are in conflict – when forced together – with where the great majority of Democrats are, which is holding Obama and his presidency in very high regard.

“Maybe the Democratic Party should move out of the ghetto it’s built for itself.”

The shriekings of “racism” aren’t helping much anymore. Few observers have missed the fact that the city of Baltimore has been run by an African American city hall (Mayor, Police Chief, District Attorney) for many years, with over a billion dollars in additional federal assistance. So, if political power is the answer, how’s that working out? Add some extra shrieking about “white privilege” to explain the situation? How does “white privilege” explain the fact that 86 percent of kids in Baltimore primary schools can’t read and 89 percent can’t do arithmetic to grade level? This, despite the fact that at $15,564 per pupil, Baltimore is fourth highest per student of the 100 largest school districts in the nation, according to the U.S. Census Bureau.

Maybe becoming the party of a national race hustle isn’t such a good idea. The race hustle is wearing out its welcome in American politics, and the more the Democratic Party resorts to race hustling as its chief strategy, the sooner the party will go extinct. That is, if it doesn’t incite some kind of civil war first. Cue the cry, “That’s racist!”

Maybe there is a whole range of human values and human behaviors that have nothing to do with race — like reading to small children and helping them learn the English language so they don’t grow into adults who have to say “know what I mean?” every other sentence because they’ve barely acquired enough language skill themselves to know what they mean. Maybe there’s something called an American common culture that contains values and behaviors worth emulating rather than opposing. Maybe “multiculturalism” wasn’t such a good idea after all. Maybe ghetto culture is not such a precious foundation for a successful life. Maybe the Democratic Party should move out of the ghetto it’s built for itself.

‘Even if my career is over, I can’t put my name to this.’

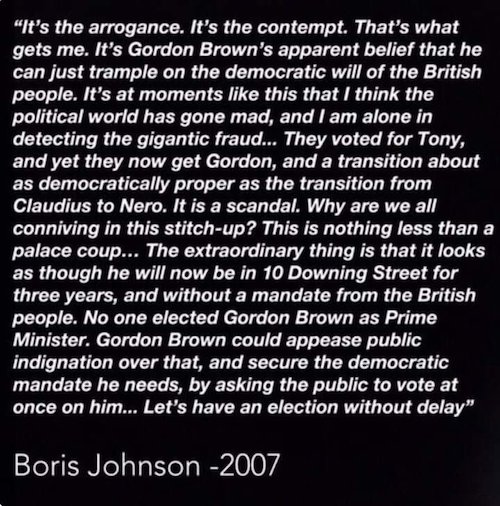

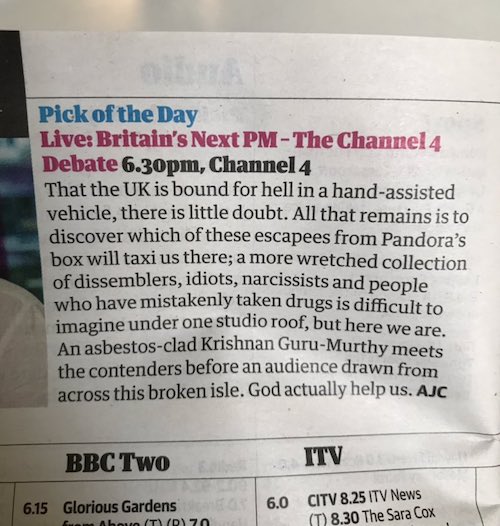

• Tory Rebels Threaten Boris Johnson After Majority Cut To One (G.)

Boris Johnson faced a grave threat to his control of parliament on Friday as he was warned that Conservative rebels could cross the House of Commons to foil Brexit in the aftermath of a byelection that reduced his working majority to just one MP. Overnight, the Liberal Democrats’ Jane Dodds won a crucial byelection in Brecon and Radnorshire by a margin of 1,425, overturning the Tories’ previous majority of more than 8,000. The result prompted immediate recriminations across the party. Conservative no-deal sceptics warned about the rapidly growing threat the government could face from the reinvigorated Lib Dems, while insiders blamed Theresa May’s administration for choosing a candidate who had already been ousted for expenses fraud.

One of the most prominent Conservative supporters of a second referendum told the Guardian on Friday he was actively considering defecting to the Lib Dems or sitting as an independent, a move that would leave Johnson at the helm of a minority government. Dr Phillip Lee, the former justice minister, who first suggested he could quit the party in his own podcast, On the House, told the Guardian he was not alone among colleagues considering defecting or resigning if the government pursued no deal. “I have things to think about over the summer, but it is not just me,” he said.

“There are a number of colleagues who are spending the summer reflecting on what is the right way for them to confront this no-deal scenario. Of course, it is difficult for all of us because we joined the Conservative party, but it has morphed into something a lot different to what I joined in 1992.” Although Johnson might be able to rely on Labour Brexiters and independents to vote for a deal, Lee suggested that the government could still be threatened by the many Conservatives in the party’s centre who had been alienated by the number of rightwingers in Johnson’s cabinet. “At the moment Boris Johnson has a very difficult pitch to play and that has been made even harder by the formation of this cabinet,” he said. “There are increasingly people who think, ‘Even if my career is over, I can’t put my name to this.’

“[..] the pound has plummeted since his appointment. It is currently the second worst performing currency in the world – after the Madagascan Ariary.”

• Watch Out Boris Johnson the Chickens are Coming Home to Roost (English)

[..] a week is a long time in politics and Prime Minister Johnson quickly ran out of hot air. Just saying stuff will happen does not make stuff happen. You can’t strike a better deal if you refuse point blank to meet your opposite numbers. You see, incredibly, instead of setting up meetings with his fellow heads of state and selling his Brexit vision, Johnson has declared that he won’t meet Angela Merkel, Emmanuel Macron or any of the EU heads unless they scrap the backstop. This is the same ludicrous negotiating tactic he deployed when as Mayor of London he refused to engage with London Underground union reps. It didn’t work then and led to long strikes. It’s even less likely to work now – and the end result will be far more damaging.

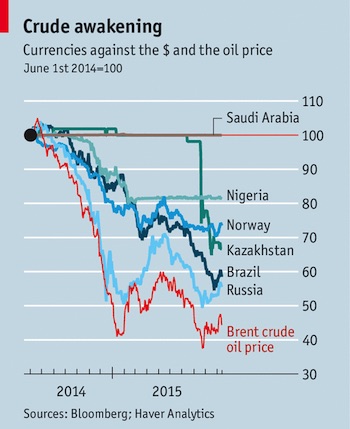

Johnson is all about image and image management. His team has already set to work on a £100 million taxpayer-funded propaganda campaign – the biggest of its kind since World War Two – to convince the British people that a ‘no deal’ Brexit will be fine and, failing that, it will be everyone else’s fault. Every single reputable economist disagrees. And so do the markets, which is why the pound has plummeted since his appointment. It is currently the second worst performing currency in the world – after the Madagascan Ariary.

Some Brexit cultists argue that a weak currency is good for the economy. They’re wrong. Unless you’re a hedge fund manager or a holiday lettings firm in Cornwall, a weak pound is a disaster. It’s bad for consumers and calamitous for manufacturers relying on tight margins and supply chains. It’s awful for pensioners, holiday-makers or anyone who has an interest in the British economy functioning. A falling currency is like a failing heart. If it were otherwise, then Madagascar would be the economic powerhouse of the global economy and Italy would have been the envy of the world in the Berlusconi years.

Freedom’s just another word for nothing.

• Pentagon Testing Mass Surveillance Balloons Across The US (G.)

The US military is conducting wide-area surveillance tests across six midwest states using experimental high-altitude balloons, documents filed with the Federal Communications Commission (FCC) reveal. Up to 25 unmanned solar-powered balloons are being launched from rural South Dakota and drifting 250 miles through an area spanning portions of Minnesota, Iowa, Wisconsin and Missouri, before concluding in central Illinois. Travelling in the stratosphere at altitudes of up to 65,000ft, the balloons are intended to “provide a persistent surveillance system to locate and deter narcotic trafficking and homeland security threats”, according to a filing made on behalf of the Sierra Nevada Corporation, an aerospace and defence company.

The balloons are carrying hi-tech radars designed to simultaneously track many individual vehicles day or night, through any kind of weather. The tests, which have not previously been reported, received an FCC license to operate from mid-July until September, following similar flights licensed last year. Arthur Holland Michel, the co-director of the Center for the Study of the Drone at Bard College in New York, said, “What this new technology proposes is to watch everything at once. Sometimes it’s referred to as ‘combat TiVo’ because when an event happens somewhere in the surveilled area, you can potentially rewind the tape to see exactly what occurred, and rewind even further to see who was involved and where they came from.”

“even smaller-scale intervention could spark a knee-jerk exodus from the city’s financial markets..”

• What Would Chinese Military Intervention In Hong Kong Look Like? (ZH)

According to a new lengthy Bloomberg exploration outlining the possibilities that China’s military could intervene against the now eight weeks-long increasingly violent protests that have gripped Hong Kong streets, a central question now on everyone’s mind is, What will the Chinese military do? Reports began appearing late last week of a Chinese security forces build-up just outside the semi-autonomous city, setting nerves on edge, and this week the chief of the Chinese military garrison in Hong Kong warned that the army stands ready to “protect” Chinese sovereignty. And then there was also the extremely provocative just released “riot control” video, showing People’s Liberation Army (PLA) solders conducing a drill to invade a city in an imagined armed crackdown on protesters and unrest.

The Bloomberg report begins by noting that though Chinese army occupation of Hong Kong remains unlikely, it remains that “even smaller-scale intervention could spark a knee-jerk exodus from the city’s financial markets, drag down property prices and prompt international companies to reconsider their presence in the territory, analysts say.” The major financial hub could suffer “irreparable damage” by such an exodus, along with severely weakening the “one country, two systems” concept in effect since 1997. Chinese military officials, and especially state media have begun floating the argument for “military options” and intervention. Officials also recently described the US as a “black hand” behind the anti-Beijing protests – which began over a proposed extradition bill – something which the US state department dismissed as “ridiculous”.

And all the sinners saints.

• First Human-Monkey Chimera Raises Concern Among Scientists (G.)

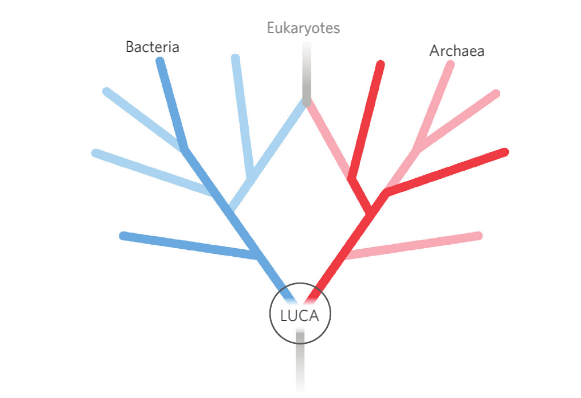

Efforts to create human-animal chimeras have rebooted an ethical debate after reports emerged that scientists have produced monkey embryos containing human cells. A chimera is an organism whose cells come from two or more “individuals”, with recent work looking at combinations from different species. The word comes from a beast from Greek mythology which was said to be part lion, part goat and part snake. The latest report, published in the Spanish newspaper El País, claims a team of researchers led by Prof Juan Carlos Izpisúa Belmonte from the Salk Institute in the US have produced monkey-human chimeras. The research was conducted in China “to avoid legal issues”, according to the report.

Chimeras are seen as a potential way to address the lack of organs for transplantation, as well as problems of organ rejection. Scientists believe organs genetically matched to a particular human recipient could one day be grown inside animals. The approach is based on taking cells from an adult human and reprogramming them to become stem cells, which can give rise to any type of cell in the body. They are then introduced into the embryo of another species. Izpisúa Belmonte and other scientists have previously managed to produce both pig embryos and sheep embryos which contain human cells, although the proportions are tiny: in the latter case, researchers estimate that only one cell in 10,000 was human.

Pig-human and sheep-human chimeras are attractive in part because pigs and sheep have organs about the right size for transplantation into humans. However Alejandro De Los Angeles, from the department of psychiatry at Yale University, said it was likely monkey-human chimeras were being developed to explore how to improve the proportion of human cells in such organisms. “Making human-monkey chimeras could teach us how to make human-pig chimeras with the hope of making organs for transplantation,” he said. “It could teach us which types of stem cells we should be using, or other ways of enhancing what’s called ‘human chimerism levels’ inside pigs.”