Dorothea Lange Tobacco sharecropper, with baby on front porch. Person County, NC July 1939

The cluster, – or pride, or cabal – of global central banks, led by the Bank of Japan have come very close to strangling their respective bond markets to the point suffocation with ultra low interest rates, and therefore together moved $29 trillion they had ‘invested’ there into equity markets. Restoring the world’s $100 trillion bond markets to health, even ever, will be a task so daunting that it’s hard to see one single way it can be done. The Bank of Japan has become the de facto only buyer of its own government’s bonds, with the result that trading has ground to a halt, literally so for a number of days last week. Yields on global bonds have been manipulated down so much that not only pension funds and other traditional large-scale fixed-income buyers feel forced to move into stocks, it’s even come to the point where central banks themselves, too, make that move.

Bank of Japan’s Bond Paralysis Seen Spreading Across Markets

The Bank of Japan’s unprecedented asset purchase program has released a creeping paralysis that is freezing government bond trading, constricting the yen to the tightest range on record and braking stock-market activity. Historical price volatility on Japanese bonds slid to a 1 1/2-year low of 0.913% on June 13 and a lack of activity delayed trading at least four days last week. The yen has traded in a range of 4.68 per dollar since Jan. 1, the tightest since Japan ended currency controls four decades ago. Average trading on the Topix index is near its lowest level in more than a year. Asset purchases have not only made BOJ Governor Haruhiko Kuroda the biggest player in Japan’s $9.6 trillion bond market, they have also given him the most leverage over currency and equity markets in the world’s third-largest economy.

China’s State Administration of Foreign Exchange (or Safe), which is part of China’s central bank PBoC, has become “the world’s largest public sector holder of equities”, writes the Financial Times, which has seen an upcoming report by central bank research and advisory group Official Monetary and Financial Institutions Forum (Omfif) : “In a new development, it appears that PBoC itself has been directly buying minority equity stakes in important European companies,” Omfif adds.”The trend “could potentially contribute to overheated asset prices”:

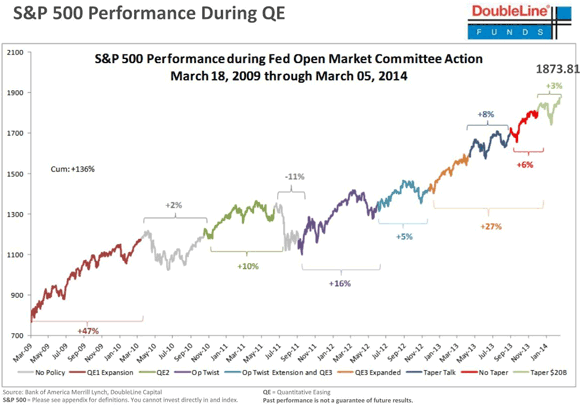

Central Banks Shift $29 Trillion Into Equity As Low Rates Hit Revenues

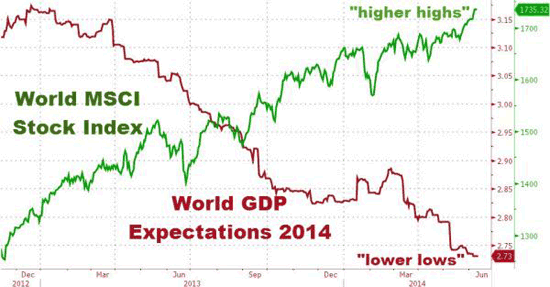

Central banks around the world, including China’s, have shifted decisively into investing in equities as low interest rates have hit their revenues, according to a global study of 400 public sector institutions. “A cluster of central banking investors has become major players on world equity markets [..] Although scant details are available of their holdings Omfif’s first “Global Public Investor” survey points out they have lost revenues in recent years as a result of low interest rates – which they slashed in response to the global financial crisis. The report identifies $29.1 trillion in market investments, including gold, held by 400 public sector institutions in 162 countries. Central banks’ actions aimed at stimulating economies, including quantitative easing, have deliberately sought to push investors into riskier assets, and share prices have risen sharply since 2009 – leading to fears of stock market corrections if economic growth disappoints.

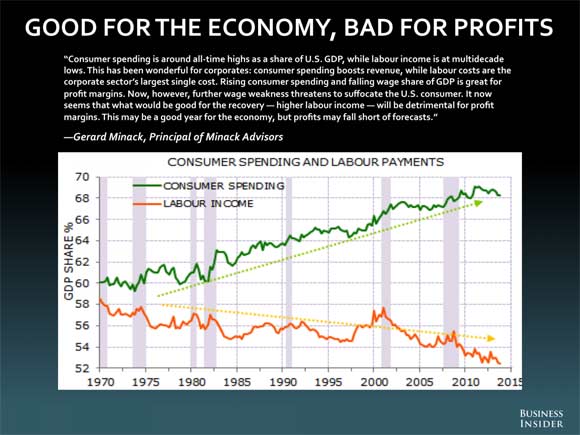

That “could potentially contribute to overheated asset prices” bit is a leading contender for understatement of the new millennium, of course; there’s nothing potential about it, the overheating is a done deal, and the people at Omfif know it. Between corporations utilizing their access to cheap QE related debt to buy back their own shares, and central banks using their own QE funds to first kill markets for their own government bonds and then prop up stock markets, it’s a miracle the latter have ‘only’ risen as high as they have. Because $29 trillion buys a lot of assets. But a behemoth-scale shift from bonds to stocks creates a lot of problems as well. Bloomberg hints at one:

Bond’s Liquidity Threat Is Revealed in Derivatives Explosion

The boom in fixed-income derivatives trading is exposing a hidden risk in debt markets around the world: the inability of investors to buy and sell bonds. While futures trading of 10-year Treasuries is close to an all-time high, bond-market volume for some maturities has fallen a third in the past year. In Japan’s $9.6 trillion debt market, the benchmark note didn’t trade until midday on two days last week. As a lack of liquidity in Italy caused transaction costs in the world’s third-largest sovereign bond market to jump last month, Lombard Odier Asset Management helped propel an eightfold surge in Italian futures by relying more on derivatives. The shift reflects an unintended consequence wrought by central banks, which have dropped interest rates close to zero and implemented policies such as buying debt to restore demand in economies crippled by the financial crisis.

Inefficiencies in the $100 trillion market for bonds may make investors more vulnerable to losses when yields rise from historical lows. “Liquidity is becoming a serious issue,” Grant Peterkin, a money manager at Lombard Odier, which oversees $48 billion, said in a June 11 telephone interview from Geneva. The worry is that when investors try to exit their positions, “there may be some kind of squeeze.” That concern has caused investors to pour into derivatives, which are contracts based on underlying assets that can provide the same exposure without tying up as much capital. As bond trading has slumped, the notional value of over-the-counter contracts soared fivefold in the past decade to a record $710 trillion, based on the latest data from the Bank for International Settlements compiled by Deutsche Bank.

There will be tons of pundits’ comments about how all this is a matter of ‘unintended consequences’, but we should not take that at face value. While QE was advertized as being aimed at reviving the real economy, the actual target from the start was always debt- and derivatives-laden Wall Street banks, and a switch from bonds to stocks fits in perfectly with that reality. The picture seen in the media all day long, every day of rising stock markets keeps a lot of – PR – trouble at bay, illusionary as it may be, and allows for many a trillion here, trillion there scheme to continue happening out of the public’s sight.

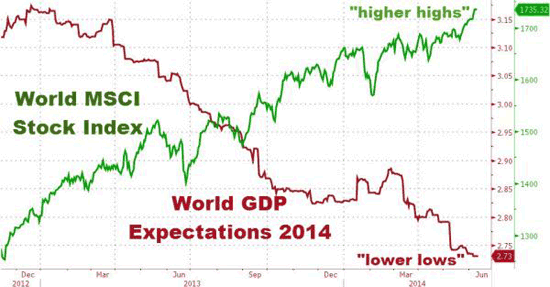

Central banks lose revenue because of the low interest rates they themselves engineered to allegedly “help the real economy”. In that same vein, as Tyler Durden notes:

“To summarize, the global equity market is now one massive Ponzi scheme in which the dumb money are central banks themselves, the same banks who inject the liquidity to begin with.”

If the Bank of Japan can become the only game in town for its ‘own’ bonds and kill the market for these bonds that way, what can we expect from central banks moving head first into stocks? What about a permanent high, or, to be precise, a permanent higher, as long as they keep buying, and after that a whole lot of nothing because all trade has been stifled? Why do we even still talk about bond ‘markets’ and stock ‘markets’? Doesn’t that imply there should be actual trading going on?

Central banks can’t cure the real economy with stimulus or illusions, but they can sure do it a lot of harm with both. Bernanke, Yellen, Kuroda and Draghi have dug themselves into a very deep hole, but they don’t care, because you will be counted on to dig them out. While bankers and large shareholders count their loot and their blessings.

• Central Banks Shift $29 Trillion Into Shares As Low Rates Hit Revenues (FT)

Central banks around the world, including China’s, have shifted decisively into investing in equities as low interest rates have hit their revenues, according to a global study of 400 public sector institutions. “A cluster of central banking investors has become major players on world equity markets,” says a report to be published this week by the Official Monetary and Financial Institutions Forum (Omfif), a central bank research and advisory group. The trend “could potentially contribute to overheated asset prices”, it warns. Central banks are traditionally conservative and secretive managers of official reserves. Although scant details are available of their holdings Omfif’s first “Global Public Investor” survey points out they have lost revenues in recent years as a result of low interest rates – which they slashed in response to the global financial crisis.

The report, seen by the Financial Times, identifies $29.1 trillion in market investments, including gold, held by 400 public sector institutions in 162 countries. Central banks’ actions aimed at stimulating economies, including quantitative easing, have deliberately sought to push investors into riskier assets, and share prices have risen sharply since 2009 – leading to fears of stock market corrections if economic growth disappoints. China’s State Administration of Foreign Exchange has become “the world’s largest public sector holder of equities”, according to officials quoted by Omfif. Safe, which manages $3.9tn, is part of the People’s Bank of China. “In a new development, it appears that PBoC itself has been directly buying minority equity stakes in important European companies,” Omfif adds.

A chapter in the report on Chinese foreign investment trends argues Safe’s interest in Europe is “partly strategic” because it “counters the monopoly power of the dollar” and reflects Beijing’s global financial ambitions. In Europe, the Swiss and Danish central banks are among those investing in equities. The Swiss National Bank has an equity quota of about 15%. Omfif quotes Thomas Jordan, SNB’s chairman, as saying: “We are now invested in large, mid- and small-cap stocks in developed markets worldwide.” The Danish central bank’s equity portfolio was worth about $500m at the end of last year. Overall, the Omfif report says “global public investors” have increased investments in publicly quoted equities “by at least $1 trillion in recent years” – without saying from what level, or how the figure is split between central banks and other public sector investors such as sovereign wealth funds and pension funds.

Growth in countries’ official reserves has increased fears about potential risks to global financial stability. In a contribution to the Omfif report, Ted Truman, a senior fellow at the Peterson Institute for International Economics, writes: “Reforms are urgently needed to enhance the domestic and international transparency and accountability for this activity – in the interests of a better-functioning world economy.” He adds: “Changes, real or rumoured, in the asset or currency composition of foreign exchange reserves have the potential to destabilise exchange rate and financial markets.” Central banks around the world have foregone between $200bn and $250bn in interest income as a result of the fall in bond yields in recent years, Omfif calculates, without giving details. “This has been partly offset by reduced payments of interest on the liabilities side of the balance sheets,” it adds.

Read more …

• “Cluster Of Central Banks” Secretly Invested $29 Trillion In Equity (Zero Hedge)

Another conspiracy “theory” becomes conspiracy “fact” as The FT reports “a cluster of central banking investors has become major players on world equity markets.” The report, to be published this week by the Official Monetary and Financial Institutions Forum (OMFIF), confirms $29.1tn in market investments, held by 400 public sector institutions in 162 countries, which “could potentially contribute to overheated asset prices.” China’s State Administration of Foreign Exchange has become “the world’s largest public sector holder of equities”, according to officials, and we suspect the Fed is close behind (courtesy of more levered positions at Citadel), as the world’s banks try to diversify themselves and “counters the monopoly power of the dollar.” Which leaves us wondering where are the central bank 13Fs?

While most have assumed that this is likely, the recent exuberance in stocks has largely been laid at the foot of another irrational un-economic actor – the corporate buyback machine. However, as The FT reports, what we have speculated as fact for many years now (given the death cross of irrationality, plunging volumes, lack of engagement, and of course dwindling credibility of central planners)… is now fact…

Central banks around the world, including China’s, have shifted decisively into investing in equities as low interest rates have hit their revenues, according to a global study of 400 public sector institutions. [..] “A cluster of central banking investors has become major players on world equity markets,” says a report to be published this week by the Official Monetary and Financial Institutions Forum (Omfif), a central bank research and advisory group. The trend “could potentially contribute to overheated asset prices”, it warns. [..]

The report, seen by the Financial Times, identifies $29.1tn in market investments, including gold, held by 400 public sector institutions in 162 countries. [..] China’s State Administration of Foreign Exchange has become “the world’s largest public sector holder of equities”, as the report argues is “partly strategic” because it “counters the monopoly power of the dollar” and reflects Beijing’s global financial ambitions.

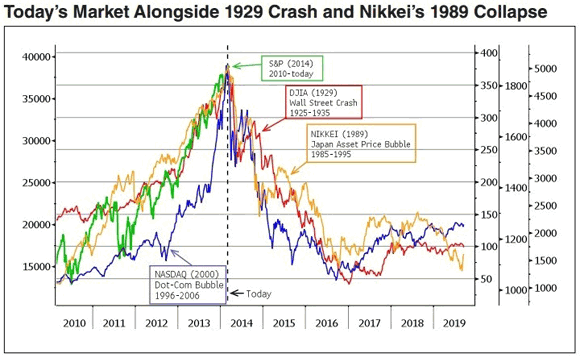

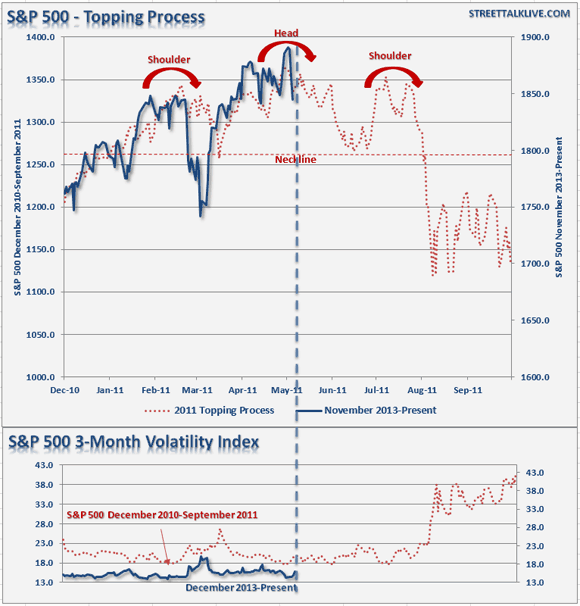

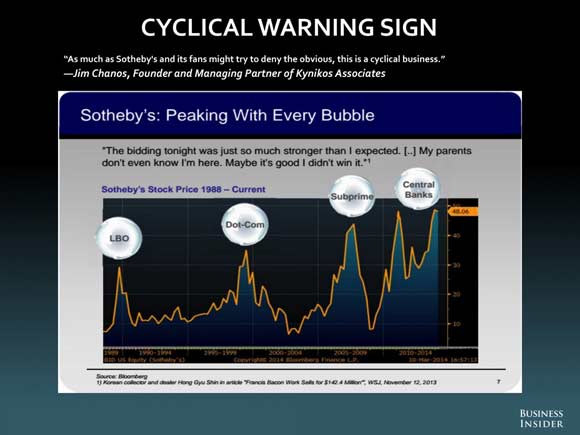

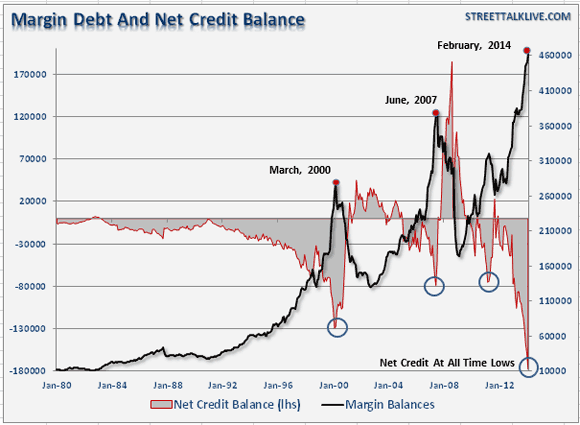

So there it is… conspiracy fact – Central Banks around the world are buying stocks in increasing size. To summarize, the global equity market is now one massive Ponzi scheme in which the dumb money are central banks themselves, the same banks who inject the liquidity to begin with. That would explain this:

That said, good luck with “exiting” the unconventional monetary policy. You’ll need it.

Read more …

• Bond’s Liquidity Threat Is Revealed in Derivatives Explosion (Bloomberg)

The boom in fixed-income derivatives trading is exposing a hidden risk in debt markets around the world: the inability of investors to buy and sell bonds. While futures trading of 10-year Treasuries is close to an all-time high, bond-market volume for some maturities has fallen a third in the past year. In Japan’s $9.6 trillion debt market, the benchmark note didn’t trade until midday on two days last week. As a lack of liquidity in Italy caused transaction costs in the world’s third-largest sovereign bond market to jump last month, Lombard Odier Asset Management helped propel an eightfold surge in Italian futures by relying more on derivatives. The shift reflects an unintended consequence wrought by central banks, which have dropped interest rates close to zero and implemented policies such as buying debt to restore demand in economies crippled by the financial crisis.

Inefficiencies in the $100 trillion market for bonds may make investors more vulnerable to losses when yields rise from historical lows. “Liquidity is becoming a serious issue,” Grant Peterkin, a money manager at Lombard Odier, which oversees $48 billion, said in a June 11 telephone interview from Geneva. The worry is that when investors try to exit their positions, “there may be some kind of squeeze.” That concern has caused investors to pour into derivatives, which are contracts based on underlying assets that can provide the same exposure without tying up as much capital. As bond trading has slumped, the notional value of over-the-counter contracts soared fivefold in the past decade to a record $710 trillion, based on the latest data from the Bank for International Settlements compiled by Deutsche Bank.

The disparity has become more pronounced as at least two dozen nations dropped benchmark rates to 1% or less since the financial crisis, while the Federal Reserve, Bank of Japan and Bank of England sapped supply by purchasing trillions of dollars of debt in unprecedented stimulus programs. It has also depressed yields and deprived traders of the volatility they need to profit from buying and selling bonds. Yields globally have dropped by more than half in the past five years to an average 1.78%, while a gauge of implied yield fluctuations using options on Treasuries is now within 0.1 percentage point of an all-time low, according to index data compiled by Bank of America. At the same time, regulations designed to curb financial risk-taking such as the Volcker Rule and Basel III are limiting the flexibility banks have to facilitate trades for clients.

Read more …

Danger!

• Bank of Japan’s Bond Paralysis Seen Spreading Across Markets (Bloomberg)

The Bank of Japan’s unprecedented asset purchase program has released a creeping paralysis that is freezing government bond trading, constricting the yen to the tightest range on record and braking stock-market activity. Historical price volatility on Japanese bonds slid to a 1 1/2-year low of 0.913% on June 13 and a lack of activity delayed trading at least four days last week. The yen has traded in a range of 4.68 per dollar since Jan. 1, the tightest since Japan ended currency controls four decades ago. Average trading on the Topix index is near its lowest level in more than a year. Asset purchases have not only made BOJ Governor Haruhiko Kuroda the biggest player in Japan’s $9.6 trillion bond market, they have also given him the most leverage over currency and equity markets in the world’s third-largest economy.

Kuroda last week refrained from either expanding or reducing monetary easing that drove the yen to its biggest annual loss in more than three decades, pushed yields to a record low and boosted the Topix index to its highest since 2008. “All the markets have been quiet,” said Daisuke Uno, the Tokyo-based chief strategist at Sumitomo Mitsui Banking Corp. “We’ve already seen the BOJ dominance of JGBs since last year, but recently participants in currency and stock markets are also decreasing as those assets have traded in narrow ranges.” One-month implied volatility in dollar-yen fell to 5.25% on June 9, the lowest in data going back to 1995. The 30-day moving average for trading volume on the Topix dropped to 1.87 billion shares on May 28, the least since December 2012.

Benchmark 10-year bonds failed to trade on April 14 for the first time since December 2000 and didn’t change hands during two morning sessions last week. The 12-month moving average of JGB trading volume dropped to a record 39.6 trillion yen ($388 billion) in April, according to Japan Securities Dealers Association figures going back to September 2004. “The flows on both the buying side and selling side continue to fall,” said Takehito Yoshino, the chief fund manager at Mizuho Trust & Banking, a unit of Japan’s third-biggest financial group by market value. “Falling volatility is a very serious problem for traders and dealers who are unable to get capital gains.”

Read more …

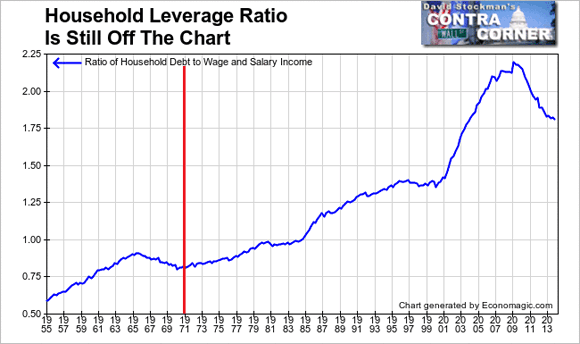

Increased borrowing, also known as more debt, is presented here as a sign of a strengthening economy. In a time when that economy is already drowning in debt.

• Corporate Debt In Asia To Top US, Europe Combined (CNBC)

Corporate debt in Asia-Pacific will exceed that of North America and Europe combined by 2016 as the center of gravity shifts to the region, credit rating agency Standard & Poor’s (S&P) said in a new report. China, the region’s largest economy, already has more outstanding corporate debt than any other country, having surpassed the U.S. last year, according to S&P. Corporate debt in the country amounted to $14.2 trillion at the end of 2013, compared with $13.1 trillion in the U.S., and this gap is expected to widen further in the next five years. The firm estimates that China’s debt needs will reach $20 trillion through the end of 2018 as mainland corporations look to further fuel their expansion. This is equivalent to one-third of the almost $60 trillion in new debt and refinancing needed globally over this period.

Growth in corporate debt in Asia-Pacific will lead to an overall increase in risk, since the credit quality of corporate borrowers is generally lower than in North America and Europe, S&P said. “Consequently, without improved risk assessment among investors and a heightened awareness by regulators of contagion risk, some future financial stress could stem from Asia,” it added. Earlier this year, China’s domestic bond market experienced its first-ever default when solar-cell maker Shanghai Chaori Solar Energy Science and Technology Co. missed an interest payment. The default was seen as a milestone for Chinese markets, as it turned on its head a long-held assumption that the government would bail out any domestic corporation in danger of defaulting.

Read more …

The Fed should step back and out, or things can only get worse.

• Fed Faces Economy With Conflicting Vital Signs (MarketWatch)

This was supposed to be the easy part. After a bleak first quarter, the economy was expected to rebound sharply in this quarter. But as the Federal Reserve prepares to meet Tuesday and Wednesday to set monetary policy, that expected bounce is looking less resilient. “The risks to the outlook have tilted to the downside,” said Sal Guatieri, senior economist at BMO Capital Markets. “It is not as sunny as it was,” he said. “Not everything is pointing in one direction upward.” To be sure, Guatieri still thinks growth will be north of 3%. But new “question marks” have emerged The first question mark, raised this week by the retail sales report as well as the quarterly services survey, is the health of the consumer. The data “raised a few eyebrows about he underlying health of the American household,” he said. Despite upward revisions to the prior month, the report showed a “pretty tired” consumer in May, BMO said.

The second question will be under the microscope in the coming week: the health of the housing market. “It is clear to us that the housing market was soft in the past six months and not just because of bad weather,” he said. Questions linger over whether the sector can rebound, he said. Fed Chairwoman Janet Yellen told lawmakers last month that the weakness in the housing data “bear watching.” On Tuesday, the Commerce Department will release construction starts on U.S. homes in May. Economists polled by MarketWatch expect starts to retreat after surging by 13.2% to a seasonally adjusted annual rate of 1.07 million in April, the fastest pace in five months. With vitals signs pointing up, down and flat, Guatieri expects the Fed to remain on “cruise control” trimming its asset purchase program by an additional $10 billion per month to $35 billion. “Growth remains fast enough so the Fed can wind down QE but not strong enough that it has to consider tightening policy in the near term,” he said.

Read more …

Not at all.

• We Are So Not Prepared For Another Oil Shock (John Rubino)

In one sense, energy doesn’t matter all that much to what’s coming. Once debt reaches a certain level, oil can be $10 a barrel or $200, and either way we’re in trouble. But the cost of energy can still play a role in the timing and shape of the next financial crisis. The housing/derivatives bubble of 2006 -2008, for instance, might have gone on a while longer if oil hadn’t spiked to $140/bbl in 2007. And the subsequent recovery was probably expedited by oil plunging to $40 in 2008. With the Middle East now lurching towards yet another major war, it’s easy to envision a supply disruption that sends oil back to its previous high or beyond. So the question becomes, what would that do to today’s hyper-leveraged global economy? Bad things, obviously. But before looking at them, let’s all get onto the same page with a quick explanation of why everyone seems so mad at everyone else over there:

The story begins in 570 A.D. in what is now Saudi Arabia, with the birth of a boy named Muhammad into a family of successful merchants. After having some adventures and marrying a rich widow, around the age of 40 he begins having visions and hearing voices which lead him to write a holy book called the Qur’an. More adventures follow, eventually producing a religious/political system called Islam that comes to dominate a large part of the local world. In 632 Muhammad dies without naming a successor, creating a permanent fissure between the Shi’ites, who believe that only descendants of the Prophet Muhammad should run Islam, and the Sunnis, who want future leaders to be chosen by consensus.

Read more …

Wonder how crazy this can get.

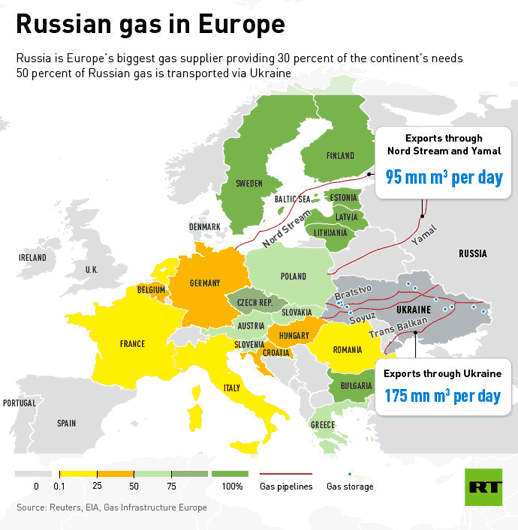

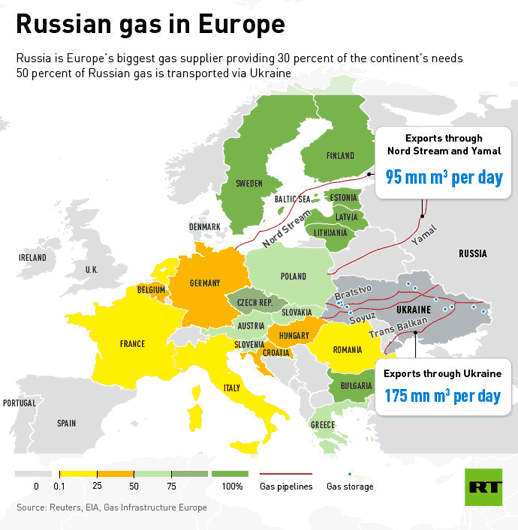

• Gazprom: Ukraine On Gas Prepayment Plan After ‘Chronic’ Failure To Pay (RT)

There will be no more delays for Ukraine to start paying for gas it gets from Russia, gas giant Gazprom announced. After failing for months to cover its gas bill, Kiev now has to pay for any gas it wants in advance. “This decision was taken due to systematic failure of Naftogaz Ukraine to pay. The debt of the company for Russian gas stands at $4.458 billion, including $1.451 billion for November and December 2013, and $3.007 billion for April-May 2014,” Gazprom said in a statement posted on their website. “They’ve paid zero. Correspondingly we deliver zero,” Sergey Kupriyanov, a Gazprom spokesperson said in a press conference following the announcement.

Gazprom announced that it is filing a lawsuit against Naftogaz with the Stockholm Chamber of Commerce Arbitration to seek payment for the $4.5 billion debt as well as Ukraine’s failure to import the agreed upon amount of natural gas under their “take or pay” contract with Gazprom over the past two years. The penalty in accordance with the contract could be around $18 billion. This week, Ukrainian energy minister Yury Prodan reiterated Kiev’s intentions to file an appeal with the arbitration court in Stockholm. Prodan stressed that taking the case to Stockholm is the only way to settle the matter. Kiev was also late in payments in the winters of 2006 and 2009. Both periods lasted about three weeks, during which Kiev attempted to siphon off supplies for themselves, which left millions of European homes without heat. “Volumes of gas for European customers will be fully met in compliance with their contracts. Naftogaz must ensure transportation to the delivery points,” Kupriyanov said.

Read more …

Great analysis by my penpal Jesse.

• Fed Vice-Chairman Fischer A Truly Dangerous Bubble-Blower (Jesse Colombo)

The U.S. Senate finally confirmed former Bank of Israel governor Stanley Fischer as vice chairman of the Federal Reserve on Thursday. As the second-most influential Fed board member, Fischer will play a key role in advising and assisting Fed chairwoman Janet Yellen. While many in the international economics community cheer Stanley Fischer’s appointment to the Fed, I view it as a disaster waiting to happen because of his role as the main architect of Israel’s little-known and still-unpopped bubble economy. As the governor of the Bank of Israel from 2005 to 2013, Stanley Fischer earned praises for his management of Israel’s economy during and after the Global Financial Crisis. In 2009, 2010, 2011 and 2012, Global Finance magazine’s Central Banker Report Card gave Fischer an “A” rating. Bank of Israel was ranked the world’s most efficiently functioning central bank under Fischer’s leadership in 2010.

Contrary to popular belief, Israel’s so-called economic strength is the byproduct of a temporary economic bubble that Fischer helped to inflate rather than the result of sound and sustainable monetary policies. Stanley Fischer is a member of the New Keynesian school of economics – a group that is notorious for using incredibly stimulative monetary policies (also known as “money printing”) to create artificial economic growth, while virtually ignoring the existence of obvious economic bubbles and the risks of monetary policy-induced inflation. During his tenure as governor of the Bank of Israel from 2005 to 2013, Stanley Fischer’s New Keynesian policies caused the country’s M1 money supply to surge by an astounding 250% Israel’s money supply growth during this period caused consumer prices to increase by approximately 25% according to the official CPI, but this figure is dubious like many government-published inflation measures are.

Government statistics agencies are known for developing inflation indexes that understate the true rate of inflation for the purpose of justifying inflationary monetary policies and preventing public outrage. The Israeli public wasn’t fooled by these questionable inflation figures, however, when hundreds of thousands of people flooded the streets in 2011 and 2012 to protest the soaring cost of living. Led by a 25-year-old video editor-turned activist named Daphni Leef, hundreds of inflation protestors also set up tents in the middle of streets in Tel Aviv and other major cities to protest the country’s rapidly-rising housing costs, which are the result of a housing bubble that began to inflate under Stanley Fischer’s watch. In fast-rising money supply environments like Israel’s, growing asset bubbles (including property bubbles) often act as a “relief valve” for inflationary pressures. While these asset bubbles help to disguise the effects of inflation on the economy for a time, they set the stage for economic crises when they inevitably pop. Following this pattern, Israel’s property prices have soared by 80% since 2007 and 67% since 2009.

Read more …

It’s all fake.

• Credit Cards Are Still Tapped-Out: The Borrowing Blip That Wasn’t (Lee Adler)

Consumer revolving credit has been in the news recently as the Fed’s data on consumer credit for April reportedly showed a record surge. However, we have more current data and it clearly shows that these reports are another case of hysterical media over reaction. The Fed’s weekly H8 statement reports the aggregate balance sheet of the nation’s commercial banking system every Friday as of Wednesday the previous week. Current data is for the June 4 week. It shows credit card debt up by 1.77% year over year. Whoop dee doo.

That’s in nominal terms. Adjusted for inflation, that’s a big fat zero, zilch, nada. So much for “increased consumer confidence,” increased consumer borrowing, yadda yadda, propelling retail sales. As usual, it’s juvenile nonsense from breathless teenage Valley Girl reporters. The vast majority of American consumers remain moribund. The evidence strongly indicates that they are going backward, not forward, as their real income continues to shrink. Whatever gains there are in retail sales, are being driven by the handful of people at the top of the wealth spectrum, and by shopping tourism, as foreigners pour into the US to vacation and shop in steadily growing numbers.

Read more …

Is that really the goal?

• PBOC Expands Reserve-Ratio Cuts to Support Small Businesses (Bloomberg)

China’s central bank extended a reserve-requirement cut to Industrial Bank Co. and China Minsheng Banking Corp. as officials try to support economic growth without unleashing broader stimulus. The People’s Bank of China approved a half percentage-point cut for Industrial Bank and Minsheng Bank also got a reduction, spokesmen said in separate telephone interviews. China Merchants Bank was also included, according to analysts at China International Capital. Chinese officials are trying to shore up an economy set for the weakest growth since 1990 without worsening credit risks fueled by an explosion in lending during and after the global financial crisis.

The PBOC is widening the group of lenders covered by a reserve-ratio move that was announced on June 9 and is intended to help boost funding for small and micro businesses and agriculture. “It further confirms that China’s neutral monetary policy is leaning towards relaxation,” said Ding Shuang, senior China economist with Citigroup in Hong Kong. “At the same time, it also shows that the central bank is still not willing to send a strong signal of policy easing,” by taking more aggressive measures, he said. The three national lenders had about 7 trillion yuan ($1.1 trillion) of combined deposits by the end of last year, according to their annual reports. That suggests that a half-point cut for all three would free up about 35 billion yuan.

Read more …

Loosening reserve requirements in the face of extreme leverage, what a great idea.

• China Swap Rate Declines Most in Two Weeks on More Reserves Cuts (Bloomberg)

China’s interest-rate swaps extended their decline, falling the most in almost two weeks, after the central bank expanded cuts in reserve requirements to some larger lenders. China Minsheng Banking Corp. and Industrial Bank Co. have received permission from the People’s Bank of China to lower their reserve ratios, spokesmen at the two banks said today, while China Merchants Bank Co. also got approval, according to a research note by China International Capital Corp. Ratios for most city commercial banks, non-county level rural commercial lenders and rural cooperatives are being cut by 50 basis points today, the monetary authority said last week.

“The message is that the PBOC is ready for further selective easing,” said Dariusz Kowalczyk, a senior economist at Credit Agricole SA in Hong Kong. “On one hand, this is positive for growth, but on the other, inclusion of larger private banks in targeted RRR cuts lowers the odds for a nationwide move, and this is the key message from the news.” The cost of one-year interest-rate swaps, the fixed payment needed to receive the floating seven-day repurchase rate, dropped six basis points, the most since June 3, to 3.44% as of 1:41 p.m. in Shanghai, data compiled by Bloomberg show.

Read more …

NO!

• At Some Point There Will Be A Reckoning On UK House Prices (Telegraph)

This week my attention turns to a subject that I always approach with trepidation – house prices. I argued in 2003 that the housing market was becoming dangerously over-valued and that at some point average prices would fall by about 20pc. I made my prediction too early. Prices continued to rise. But by 2007 they had indeed started to fall. From peak to trough, national average prices fell by 20pc and they even fell sharply in prime central London. I am returning to this subject now because both people actively in the market and economic policy-makers are concerned about the extent to which a new bubble could be developing. If it is, then, when it bursts, a new period of financial and economic instability could lie before us. The initial danger is that, as interest rates go up, borrowers find that they cannot afford their mortgage payments.

They would then cut their spending, leading to an economic downturn. Further effects would follow from the resulting damage to banks as many of their loans turned sour. And falling house prices would clobber wealth and confidence. The indications as to whether or not this is a realistic danger now are mixed. On the consoling side, mortgage lending is low and average house prices are still below their previous peaks. Moreover, the proportion of first-time buyers’ incomes that they have to spend on mortgage payments is just below the long-term historical average, implying that mortgages are readily affordable. True, prices in London are well above their previous peaks but London is a separate country – a combination of the world’s playground, work hub and bolthole. It dances to a different beat. Yet this consoling picture starts to seem less convincing when you look more closely.

Read more …

• British Public Wrongly Believe Rich Face Highest Tax Burden (Guardian)

The British public dramatically underestimate what the poorest pay in tax and wrongly believe the richest face the biggest tax burden, according to new research that calls for a more progressive system. The poorest 10% of households pay eight percentage points more of their income in all taxes than the richest – 43% compared to 35%, according to a report from the Equality Trust. The thinktank highlights what it sees as a gulf between perceptions of the tax system and reality. Its poll, conducted with Ipsos Mori found that nearly seven in ten people believe that households in the highest 10% income group pay more of their income in tax than those in the lowest 10%. The survey of more than 1,000 people also found a strong majority – 96% – believe that the tax system should be more progressive than is currently the case.

Duncan Exley, director of the Equality Trust, said the findings underlined the need for the next government to overhaul the system. “The public are misled about this country’s tax system. They think households with the highest incomes pay more than those with the lowest, whereas the opposite is the case. Even more concerning is how little our current system matches people’s preferences on tax. There is clearly strong support for a system that places far less burden on low-income households,” he said ahead of the “Unfair and Unclear” report. “We’re calling on all parties seeking to form the government from 2015 to commit to the principle that any changes in tax policy are progressive.” Not a single respondent in the poll knew how much the richest and poorest paid in tax. On average the public underestimates what the poorest 10% pays in tax by 19 percentage points, believing they pay just 24% of their income in taxes, the Equality Trust said.

Read more …

Start with the French?

• Could The UK Start Jailing Bankers? (CNBC)

U.K. Treasury chief George Osborne is taking a tough line on the City, threatening jail terms for bankers if they manipulate the markets. However, some City-watchers warn that loopholes will prevent the measure from having any real bite. Osborne launched a two-pronged attack on market manipulation Thursday at his speech at Mansion House in London. He confirmed a year-long joint review by the Treasury, the Bank of England and the Financial Conduct Authority (FCA) into the way wholesale financial markets operate. He also pledged to make the manipulation of the foreign currency, commodity and fixed income markets a criminal offence.

These new measures add to a financial services law last year that meant senior bankers in Britain could now face up to seven years in prison if they were found guilty of reckless misconduct in regards to interest rate rigging. This bill was part of a wide range of reforms to overhaul the country’s banking industry in the wake of the 2008 financial crisis. It also separates the U.K. from a rules being drawn up by the European Union for increased regulation on market abuse. “The (finance minister) sent a very clear message that maintaining fair and efficient markets is priority and he put forward the two levers that he has,” Bill Nosal, the global head of product management at Smarts group which provides surveillance and compliance technology, told CNBC Friday. “It’s really critical to the City that the markets are fair and official here.”

Read more …

The wonderful world of privatization!

• Thames Water: The Drip, Drip, Drip Of Discontent (Guardian)

Has anyone seen Sid? In the winter of 1986, his name haunted almost every ad break. “Tell Sid,” actors would urge each other, with varying degrees of stiltedness, as they plotted how to cash in on the sale of publicly owned British Gas. It became the catchphrase for the first wave of privatisations, that era bursting with promises of a prosperous share-owning democracy and record investment in essential public services. And unlike last year’s sale of Royal Mail, it was just about possible back then to believe they really meant it. I wonder what Sid would have made of last week’s results from Thames Water. Here, surely, was proof that Thatcher was right: Britain’s largest water firm is still enjoying bumper profits after 25 years in private hands. Yet had Sid taken a punt on Thames in 1989, he would long ago have been bought out – the company is now in the hands of a private consortium, led by Australian bank Macquarie (once dubbed “the Millionaires’ Factory”).

If Sid had been a Thames employee, chances are he would long ago have been laid off: its headcount has fallen by two-thirds. And were he a customer, he would have been lumbered with a monopoly service with a dismal track record – and which year after year has lobbied to get captive households to stump up for major improvements, while shovelling hundreds of millions into the pockets of a small group of largely foreign investors. Margaret Thatcher and her lieutenants pledged a future of dynamic, efficient private managers rebuilding a dilapidated private realm. “The [water] industry is going to benefit from the biggest and most sustained period of investment in its history,” proclaimed the then environment secretary Chris Patten on the eve of its sale. But Thames shows the opposite.

Few businesses are more basic than the supply of water. But Thames now doesn’t look anything like a water company; it more closely resembles a Russian doll. Holding company sits within holding company sits within holding company: in all, there are five intermediate firms between the business that supplies the water and sorts the sewage and the eventual shareholders. That’s before you reach the two subsidiary firms that go out to the markets to raise cash, one of which is naturally based in the tax haven of the Cayman Islands. Who gains from such a corporate Byzantium? Not regulators and politicians, nor journalists and analysts, because such a layout is the opposite of transparent. But the beneficiaries are identified by John Allen and Michael Pryke at the Open University, who pored over Thames’s accounts from 2007 (the first full year after the Macquarie consortium took over) up to 2012. In three of those five years, investors took more dividends out of the business than it raised in profits after tax. Bung in interim payments, and there was only one year in which the consortium of shareholders took less out of the company than it had in post-tax profits. What replaced the profits? In a word: debt, which more than doubled to £7.8bn in that period.

Read more …

Fun with Michael Lewis.

• A Bazillionaire’s Guide to Stress Relief (Michael Lewis)

I’d like to start by making a confession: It’s never been easy being me. Managing billions of dollars of other people’s money, and countless millions of my own, has been highly stressful. There was a time when I thought my anxiety, not to mention the investigations of my affairs by various U.S. government authorities, might break me — and so, on the advice of my attorneys, I took some time off. But that period of my life, thankfully, is now over. Just last week, for the first time in months, I fired up my Bloomberg terminal! There I discovered that I’m not the only extremely distinguished Wall Street trader whose life is more difficult than ordinary people understand. Looking over the stories that people who can afford Bloomberg terminals have been e-mailing to one another over the past few months, I see the anxiety of financiers hitting new highs.

Old bankers have been killing themselves; young bankers, burned out by their 90-hour-a-week jobs, have been quitting in droves to work for startups; hedge-fund managers are now telling the public that the stock market feels so dangerous that they are selling their holdings and going into cash. The most widely circulated horror story was about people giving up golf. Apparently, Wall Street guys have been fleeing their game because their anxiety has them feeling they need to text all the time, and they can’t free up their hands long enough to swing the club. It’s like we’ve all become teenage girls. So maybe I shouldn’t have been so surprised that the story that got all of Wall Street’s attention was about a hot new stress reduction strategy: transcendental meditation. Several of my esteemed hedge-fund colleagues apparently actually do this.

David Ford told Bloomberg Pursuits that his mantra helped him make a killing in the emerging markets crash – and he isn’t alone. “Ford is part of a growing number of Wall Street traders, including A-list hedge-fund managers Ray Dalio, Paul Tudor Jones and Michael Novogratz, who are fine-tuning their brains – and upping their games – with meditation,” said the story, which went on to say that the TM classes at Goldman have a waiting list of hundreds. Personally, I would find it stressful, if I worked at Goldman Sachs (which, thank God, I don’t!) to be on a wait list for anything. Why can’t they just buy as many gurus as they need? But I digress. The point of this crazy meditation article was how much money a guy can make these days just from staying calm. “Meditation used to have this reputation as a hippie thing for people who speak in a particularly soft tone of voice,” a meditation expert explains, to correct the popular misperception. “Samurai practiced meditation to become more effective killers. … It’s value neutral.”

Read more …

Thoughtful dialogue.

• Inequality, Free Markets, and Crashes (Nassim Taleb, Mark Spitznagel)

Nassim Taleb: Mark, your book is the only place that understands crashes as natural equalizers. In the context of today’s raging debates on inequality, do you believe that the natural mechanism of bringing equality — or, at the least, the weakening of the privileged — is via crashes?

Mark Spitznagel: Well straight away let’s ask ourselves: Are we really seeking realized financial equality? How can we ever know what is the natural or acceptable level of inequality, and why is it even the rule of the majority to determine that? That aside, one can absolutely say logically and empirically that asset-market crashes diminish inequality. They are a natural mechanism for this, and a cathartic response to central banks’ manipulation of interest rates and resulting asset-market inflation, as well as other government bailouts, that so amplify inequality in the first place. So crashes are capitalism’s homeostatic mechanism at work to right a distorted system. We are in this ridiculous situation where utopian government policies meant to lessen inequality are a reaction to the consequences of other government policies — a round trip of market distortion. After we’ve been run over by a car, the assumed best treatment is to back the car over us again.

Taleb: I see you are distinguishing between equality of outcome and equality of process. Actually one can argue that the system should ensure downward mobility, something much more important than upward one. The statist French system has no downward mobility for the elite. In natural settings, the rich are more fragile than the middle class and we need the system to maintain it. The reason I am discussing that here is linked to your book, The Dao of Capital, which mixes (rather, unifies) personal risk-taking with explanations of global phenomena. But as an author I hate people’s summaries of my work. Can you provide your own summary in a paragraph?

Read more …

• Fed Watchers See Restaurants Test Disinflation (Bloomberg)

Restaurants could see an opportunity for additional price increases as Americans encounter more expensive food at grocery stores. The cost of eating at home rose 1.7% in April from a year ago, the largest increase in almost two years, while consumers paid 2.2% more at U.S. eateries, according to the Bureau of Labor Statistics’ monthly consumer-price index. Food-at-home inflation has been accelerating, reaching its narrowest gap relative to dining out since June 2012. May data on retail prices will be released tomorrow.

“People who have to predict things like inflation or pricing power should be watching this differential very closely,” said John Manley, chief equity strategist at Wells Fargo Funds Management in New York. That’s because, amid concerns about disinflation, investors and Federal Reserve watchers are looking for signs that companies are able to pass along higher costs to their customers, he said. While central-bank policy makers have said price pressures are ‘‘contained,’’ some districts reported rising food costs, particularly for meat and dairy products, according to the June 4 Beige Book business survey. With commodities such as beef and pork now more expensive at grocery stores, restaurant operators may see room to boost prices of certain menu items, Manley said.

Read more …

Yeah, why not set limits to lunacy …

• EU To Set Limit On Food-Based Biofuels (RT)

EU ministers have agreed to 7% cap on the use of food-based biofuels in transport fuel. The agreement comes after a long-standing controversy, with biofuels being criticized for adding to environmental problems. The so-called “first generation” biofuels are made from crops such as maize, beetroot, or rapeseed. They were initially backed by the EU as a way to tackle climate change and reduce EU dependence on imported oil and gas. However, research has since shown that biofuels do more environmental harm than good. Making fuel out of crops has been criticized for displacing other crops and forcing the clearing of valuable habitats and virgin vegetation, particularly mangrove swamps in Southeast Asia.

Biofuels have also been blamed for inflating food prices by competing with food production, which leads to shortages and higher prices in some of the world’s poorest countries. In response to the criticism, EU energy ministers agreed on a reduction of biofuels use at a meeting on Friday. The new deal is aimed at capping the use of fuel made from food products to seven% of transport sector energy use by 2020. An original target set in 2009 was 10%, but the European Commission originally backed a five% limit. Acknowledging that the current seven% agreement is weaker than hoped, EU Energy Commissioner Guenther Oettinger said the result is “better than no decision at all.”

Read more …

![]()