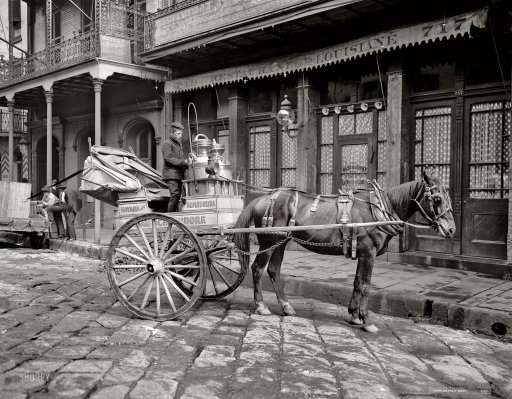

DPC New Orleans milk cart 1903

Should be a good speech. 1 PM EDT.

• Tsipras Scrambles to Find a Way Forward for Greece (Bloomberg)

Prime Minister Alexis Tsipras will outline his plans to keep Greece financially afloat while breaking free from its bailout program when he addresses the nation’s parliament on Sunday. “It is very unlikely that the euro zone will give new money to Greece for months, as the Greek positions are uncertain and significant negotiation is necessary,” Nicholas Economides, professor of economics at New York University’s Stern School of Business, said by e-mail. “This puts cash-strapped Greece in a very dire position.” Jeroen Dijsselbloem, head of the group of 19 euro-area finance ministers, on Friday rejected a short-term financing agreement while Greece negotiates a successor program to its current bailout provided by the EU and IMF. The prime minister will need to address doubts about Greece’s ability to pay its bills, possibly as early as the end of the month.

Tsipras will set out measures for the government to take from now until the end of June, corresponding to the bridge program it has requested from country’s creditors, a government official said after a cabinet meeting Saturday. The prime minister will also set out policies for the next 3 1/2 years, said the official, who commented by e-mail and asked not to be identified in line with policy. The speech is scheduled to start at 7 p.m. local time. Tsipras, 40, will be addressing lawmakers exactly two weeks after his Syriza party swept into power with a promise to reject EU demands for more budget austerity. “Faced with financial reality, the new Greek government will have to reverse or severely pare down its pre-election program,” Economides said. “Already, in a major U-turn, the government has abandoned the position that Greece will not fully pay its debt.”

The next showdown with Greece’s EU partners is scheduled for Feb. 11 in Brussels, when Finance Minister Yanis Varoufakis faces his 18 euro-area counterparts in an emergency meeting. Standard & Poor’s lowered Greece’s long-term credit rating one level to B- and kept the ratings on CreditWatch negative. The rating downgrade to B- pushes Greece’s debt six levels into non-investment grade, or junk status. S&P said it plans to “update or resolve” the CreditWatch status by next month. “We could lower our ratings on Greece if we perceive that the likelihood of a distressed exchange of Greece’s commercial debt has increased further because official funding has been curtailed, government borrowing requirements have deteriorated beyond our expectations, or Greece’s external financing has come under greater stress,” S&P said in a statement on Friday.

“In France and Germany, the mainstream center-left parties have dropped any pretense of fighting the neoliberal orthodoxy that dominates EU economic policy and have been punished by voters accordingly.”

• Europe’s Revolt Isn’t Just In Greece Or Spain (MarketWatch)

Greek voters crowded into Athens’ Syntagma Square to celebrate the landslide election of the leftist Syriza party last month, just as they had the victory of the center-left Pasok party in 1981, which ushered in Greece’s first leftist government after it threw off military dictatorship in 1974. The tens of thousands of Spanish voters who filled Madrid’s Puerta del Sol last Saturday also wanted to celebrate the leftist victory in Greece and rally support for a similar result for Spain’s new left-wing party, Podemos, in parliamentary elections at the end of this year. But the electoral victory of Syriza and the rise of Podemos are not signs of a resurgence of the left in Europe. The huge square in Madrid was also filled with demonstrators in May 2011 when a wave of protests opposed the Socialist government’s willingness to go along with European Union austerity policies.

One of the major ironies of the eurozone crisis, in fact, is that the historic left-wing parties in Europe have been so compromised by the austerity policies dictated by Brussels and Berlin that they have lost significant voter support or collapsed altogether. The once-celebrated Pasok, for instance, which led the government when the euro crisis erupted in 2009, has seen its electoral support plunge from its zenith of 48% in 1981 to a paltry 4.7% in last month’s election. The Spanish Socialist Party, which governed Spain for 14 years under Felipe Gonzalez, has seen its support fall from 48% in 1982 to just 22% in the most recent polls, putting it in third place behind Podemos, which is just one-year-old.

In France and Germany, the mainstream center-left parties have dropped any pretense of fighting the neoliberal orthodoxy that dominates EU economic policy and have been punished by voters accordingly. French Socialist President François Hollande, who swept into office with a parliamentary majority in 2012 on pledges that he would fight German-imposed austerity, saw his approval ratings plummet below 20% when he failed to deliver on that promise. Germany’s Social Democrats, too timid to resist the popularity of conservative Chancellor Angela Merkel, have not only been co-opted into her stringent view of European economic policy but into most every aspect of domestic policy as part of a coalition government.

“Greece “will be the first country to go bankrupt over €5 billion.”

• Greece Could Run Out of Cash in Weeks (WSJ)

Greece warned it was on course to run out of money within weeks if it doesn’t gain access to additional funds, effectively daring Germany and its other European creditors to let it fail and stumble out of the euro. Greek Economy Minister George Stathakis said in an interview with The Wall Street Journal that a recent drop in tax revenue and other government income had pushed the country’s finances to the brink of collapse. “We will have liquidity problems in March if taxes don’t improve,” Mr. Stathakis said. “Then we’ll see how harsh Europe is.” Government revenue has declined sharply in recent weeks, as Greeks with unpaid tax bills hold back from settling arrears, hoping the new leftist government will cut them a better deal. Many also aren’t paying an unpopular property tax that their new leaders campaigned against. Tax revenue dropped 7%, or about €1.5 billion ($1.7 billion), in December from November and likely fell by a similar percentage in January, the minister said.

Other senior Greek officials said the country would have trouble paying pensions and other charges beyond February. Greece has made no secret of its precarious financial position, but the minister’s comments suggest the country has even less time than many policy makers thought to resolve its standoff with Europe. Eurozone officials have asked Greece to come up with a specific funding plan by Wednesday, when finance ministers have called a special meeting to discuss the country’s financial situation. The country needs €4 billion to €5 billion to tide it over until June, by which time it hopes to negotiate a broader deal with creditors, Mr. Stathakis said, adding that he believes “logic will prevail.” If it doesn’t, he warned, Greece “will be the first country to go bankrupt over €5 billion.” If the Greek government runs out of cash, the country would be forced to default on its debts and reintroduce its own currency, thus abandoning the euro.

Most of the €240 billion in aid that Europe and the International Monetary Fund have pumped into the country would be lost. Greece’s new, leftist government has been in a tug of war with its European creditors for days over relaxing strictures of its bailout program. Athens is pressing for less-onerous terms so it can reverse some of the austerity measures weighing on the country, but its partners in the euro currency area, led by Germany, have refused. Before the two sides can address Greece’s broader bailout framework, however, they need to quickly find a way to keep the country solvent. Mr. Stathakis said Athens has asked for €1.9 billion in profits from Greek bonds held by other eurozone governments. In addition, the government wants the eurozone to allow Greece to raise an additional €2 billion by issuing treasury bills, he said. Both proposals clash with the rules governing Greece’s bailout and eurozone officials have dismissed them.

Very long in-depth analysis of the eurozone by Pettis.

• Syriza and the French indemnity of 1871-73 (Michael Pettis)

1. The euro crisis is a crisis of Europe, not of European countries. It is not a conflict between Germany and Spain (and I use these two countries to represent every European country on one side or the other of the boom) about who should be deemed irresponsible, and so should absorb the enormous costs of nearly a decade of mismanagement. There was plenty of irresponsible behavior in every country, and it is absurd to think that if German and Spanish banks were pouring nearly unlimited amounts of money into countries at extremely low or even negative real interest rates, especially once these initial inflows had set off stock market and real estate booms, that there was any chance that these countries would not respond in the way every country in history, including Germany in the 1870s and in the 1920s, had responded under similar conditions.

2. The “losers” in this system have been German and Spanish workers, until now, and German and Spanish middle class savers and taxpayers in the future as European banks are directly or indirectly bailed out. The winners have been banks, owners of assets, and business owners, mainly in Germany, whose profits were much higher during the last decade than they could possibly have been otherwise

3. In fact, the current European crisis is boringly similar to nearly every currency and sovereign debt crisis in modern history, in that it pits the interests of workers and small producers against the interests of bankers. The former want higher wages and rapid economic growth. The latter want to protect the value of the currency and the sanctity of debt.

4. I am not smart enough to say with any confidence that one side or the other is right. There have been cases in history in which the bankers were probably right, and cases in which the workers were probably right. I can say, however, that the historical precedents suggest two very obvious things. First, as long as Spain suffers from its current debt burden, it does not matter how intelligently and forcefully it implements economic reforms. It will not be able to grow out of its debt burden and must choose between two paths. One path involves many, many more years of economic hell, as ordinary households are slowly forced to absorb the costs of debt — sometimes explicitly but usually implicitly in the form of financial repression, unemployment, and debt monetization. The other path is a swift resolution of the debt as it is restructured and partially forgiven in a disruptive but short process, after which growth will return and almost certainly with vigor

5. Second, it is the responsibility of the leading centrist parties to recognize the options explicitly. If they do not, extremist parties either of the right or the left will take control of the debate, and convert what is a conflict between different economic sectors into a nationalist conflict or a class conflict. If the former win, it will spell the end of the grand European experiment.

“Distrust of the masses is in the EU’s genome.”

• Democracy Could Have Saved Europe From The Disastrous Single Currency (Hannan)

“Elections change nothing,” said Wolfgang Schäuble, Germany’s tough-minded finance minister. He was talking about Greece, but he could have been talking about the entire EU racket. The Europhile elites have a guarded and contingent attitude towards democracy. It has its place, to be sure, but it must never be allowed to slow the process of political integration. As the President of the European Commission, Jean-Claude Juncker, put it in response to Syriza’s election victory, “There can be no democratic choice against the European treaties”. He means it. In 2011, in order to keep the euro intact, the EU connived at the toppling of two elected prime ministers: Silvio Berlusconi in Rome and George Papandreou in Athens. Both men were replaced by Eurocrats who presided over, in effect, Brussels-approved civilian juntas.

Although their regimes were called “national governments”, their purpose was to drive through policies that would be rejected at the ballot box. Distrust of the masses is in the EU’s genome. Its founders had lived through the horrors of the Second World War, and associated democracy – especially in its plebiscitary form – with the demagoguery and fascism of the 1930s. They made no bones about vesting supreme power with a group of Commissioners who were immune to public opinion. Sure enough, those Commissioners and their successors saw it as their role to step in when the voters got it wrong – as when, for example, they voted against closer integration in referendums. I could easily fill the rest of this column with either anger or mockery; but I’d rather do Eurocrats the courtesy of taking their argument seriously.

Their contention is, in effect, that voters often misjudge things – that they are likely simultaneously to demand higher spending and lower taxes, and then complain when the money runs out. As José Manuel Barroso, Mr Juncker’s predecessor, put it four years ago, at the height of the economic crisis: “Governments are not always right. If governments were always right we would not have the situation that we have today. Decisions taken by the most democratic institutions in the world are very often wrong.” At first glance, the recent Greek election seems to sustain that view. Here, after all, is a country brought to ruin by excessive spending and borrowing. Yet its voters have just opted for a party that offers more of the medicine that sickened them: a 50% hike in the minimum wage, higher pensions, free electricity for 300,000 households and other fantasies.

[..] When the EU assumed responsibility for the Greek economy, it licensed Greeks to behave irresponsibly. If voters are treated like recalcitrant teenagers, they will behave like recalcitrant teenagers, storming petulantly at the parents whom they none the less expect to pay their phone bills. Greece is an example, not of too much democracy, but of too little. Had the Hellenic Republic been a sovereign country, wholly accountable to its own electorate, things would have worked out very differently. But for the euro, the debt crisis would never have got so badly out of hand: the markets would have imposed their own discipline years ago.

Dead on: “we must find the means to create a peacekeeping force to protect Russian speakers in Ukraine.” and “It is not destined to join the EU; Ukraine must preserve its role as a bridge between Europe and Russia.”

• Sarkozy: Crimea Cannot Be Blamed For Joining Russia (RT)

Crimea cannot be blamed for seceding from Ukraine – a country in turmoil – and choosing to join Russia, said former president of France, Nicolas Sarkozy. He also added that Ukraine “is not destined to join the EU.” “We are part of a common civilization with Russia,” said Sarkozy, speaking on Saturday at the congress of the Union for a Popular Movement Party (UMP), which the former president heads. “The interests of the Americans with the Russians are not the interests of Europe and Russia,” he said adding that “we do not want the revival of a Cold War between Europe and Russia.” Regarding Crimea’s choice to secede from Ukraine when the country was in the midst of political turmoil, Sarkozy noted that the residents of the peninsula cannot be accused for doing so.

“Crimea has chosen Russia, and we cannot blame it [for doing so],” he said pointing out that “we must find the means to create a peacekeeping force to protect Russian speakers in Ukraine.” In March 2014 over 96% of Crimea’s residents – the majority of whom are ethnic Russians – voted to secede from Ukraine to reunify with Russia. The decision was prompted by a massive uprising in Ukraine, that led to the ouster of its democratically elected government, and the fact that the first bills approved by the new Kiev authorities were infringing the rights of ethnic Russians. Concerning Kiev’s hopes of joining the EU in the near future Sarkozy voiced the same position as had been previously expressed by some EU leaders.

“It is not destined to join the EU,” he said. “Ukraine must preserve its role as a bridge between Europe and Russia.” While the West has been criticizing Russia’s stance on Crimea, the Russian Foreign Minister said on Saturday that the peninsula’s residents had the right to “self-determination” citing the March referendum. He gave the example of Kosovo, which despite not holding a referendum, was allowed to leave Serbia and create its own state. “In Crimea what happened complies with the UN Charter on self-determination,” Lavrov said during his speech at the Munich security conference. “The UN Charter has several principles, and the right of a nation for self-determination has a key position.”

I still don’t get this bit after reading it multiple times: “Obama won’t authorize weapons deployment if Merkel signals that she will not publicly condemn individual nations from arming Ukraine..” Does that mean he will if she will?

• Merkel Objection to Arms for Ukraine May Spur Backlash for Obama (Bloomberg)

Germany’s rejection of supplying weapons to Ukrainian forces fighting pro-Russian rebels may heighten the domestic pressure on a reluctant U.S. President Barack Obama to deliver the arms. Increasing numbers of senior military and State Department officials are joining Republican lawmakers in a push to arm Ukraine – an option the commander-in-chief personally opposes, according to three people familiar with the dynamics in the Obama administration. They asked not to be named due to sensitivity of the matter.

German Chancellor Angela Merkel, who made an impassioned case against shipping lethal military support to Ukraine in a speech Saturday at the Munich Security Conference, will discuss the issue with Obama in Washington on Monday. U.S. Secretary of State John Kerry said he’s confident Obama will make his decision soon after the meeting.Obama’s delay in making his move until after Merkel’s visit reflects not only the gravity of the situation and the dueling arguments, but his emphasis on international alliances, his own deliberative nature and the degree to which he’s concentrated power on foreign policy in the White House. Obama won’t authorize weapons deployment if Merkel signals that she will not publicly condemn individual nations from arming Ukraine, the three people said. If she opposes any unilateral supplying of weapons, Obama will explain his decision to follow her lead by citing the importance of keeping a united front against Russian President Vladimir Putin and the risk of triggering a proxy war with him, the people said. [..]

Merkel in her Saturday speech said, “The progress that Ukraine needs cannot be achieved by more weapons.” Instead, she evoked the perseverance of the U.S. and European diplomatic efforts in confronting the Soviet Union during four decades of Cold War that ended with collapse of communism. Like then, that approach needs staying power and unity, said Merkel, who grew up in communist East Germany. “The problem is that I cannot envisage any situation in which an improved equipment of the Ukrainian army leads to a situation where President Putin is so impressed that he will lose militarily,” she said, reiterating the importance of a negotiated peace without military intervention. “I have to put it in such a blunt manner.” Facing Ukraine President Petro Poroshenko in the audience, she said: “There’s no way to win this militarily — that’s the bitter truth. The international community has to think of a different approach.”

“Our partners in the West have closed their eyes to everything that the Kiev government has said and done, which includes xenophobia.”

• Lavrov: US Escalated Ukraine Crisis At Every Stage, Blamed Russia (RT)

Sergey Lavrov has lashed out at the US for their double standards over Ukraine and taking steps that “only promoted further aggravation” of the conflict. He added Russia is ready to guarantee agreements between Kiev and the self-proclaimed republics. One of the major sticking points of the crisis so far has been the failure of Kiev to engage in talks with militia leaders in the East of the country. Lavrov is staggered the US, who talked with the Taliban during their invasion of Afghanistan, through channels in Doha, Qatar, is unable to put pressure on Kiev to engage in discussions. “In the case of Libya, Afghanistan, Iraq, Yemen and Sudan our partners actively asked governments to enter into dialogue with the opposition, even if they were extremists. However, during the Ukrainian crisis, they act differently, making up excuses and try to justify the use of cluster bombs,” the Russian Foreign Minister said, who was speaking at a security conference in Munich on Saturday.

The issue of the far right’s rise in Ukrainian politics has been swept under the carpet by the US and EU. Some members of the Ukrainian parliament have promoted ideas such as exterminating Russians and Jews. However, these haven’t been reported or caused any alarm in the West, Russia’s foreign minister added. “Our partners in the West have closed their eyes to everything that the Kiev government has said and done, which includes xenophobia. Some have advocated an ethnically clean Ukraine.” Throughout the Ukrainian crisis, the West has viewed Russia as the aggressor. The Kremlin has been accused of arming eastern Ukrainian militia and even sending Russian troops to reinforce them – claims Moscow has repeatedly denied. It has stated on many occasions that despite the damning rhetoric no sufficient evidence has been ever presented.

On the contrary, Lavrov says the US has been the destabilizing factor in Ukraine. “Through every step, as the crisis has developed, our American colleagues and the EU under their influence have tried to escalate the situation,” Lavrov maintained. He pointed to the failure of the EU to engage Russia about Ukraine signing an economic association agreement with the bloc, Western involvement during the Maidan protests, the failure of the West to condemn Ukraine for calling its own citizens terrorists and for supporting a coup, which led to the toppling of a democratically elected president. “The US made it public it brokered the transit of power in Ukraine. But we know perfectly well what exactly happened, who discussed candidates for the future Ukrainian government on the phone, who was at Maidan, and what is going on (in Ukraine) right now,” Lavrov said.

The west and its press are no longer even capable anymore of discussing Russia without accusing it of a whole range of alleged misdeeds.

• Europeans Laugh as Lavrov Talks Ukraine (Bloomberg)

In the span of 45 minutes today, Russian Foreign Minister Sergei Lavrov rewrote the history of the Cold War, accused the West of fomenting a coup in Ukraine and declared himself a champion of the United Nations Charter. The crowd here in Germany laughed at and then booed him, but he didn’t seem to care. When Lavrov took the stage Saturday morning at the Munich Security Conference, he knew it was going to be a tough crowd. He was speaking just after German Chancellor Angela Merkel and ahead of U.S. Vice President Joseph Biden. For two days, almost all of the panelists at the conference had railed against Russia’s actions in Ukraine. The debates were not over whether Russia was a bad actor spoiling international security, but rather how to deal with that consensus view.

He looked nervous, perhaps because Sergei Ivanov, chief of staff to Russian President Vladimir Putin and Lavrov’s superior, was sitting in the front row, staring at him as if to warn him not to mess up. But none of that kept him from turning in an audacious performance. “In any situation, the United States is trying to blame Russia for everything,” he said. “Russia will be committed to peace. We are against combat. We would like to see a withdrawal of heavy weapons.” Lavrov then accused the U.S. of supporting military attacks against innocent Ukrainians. (He chose not to mention the Russian heavy weaponry in Eastern Ukraine or the hundreds of Russian military advisers on the ground.) Lavrov accused the Ukrainian military and government of being anti-Jewish and said that the Hungarian minority in Ukraine was being mistreated.

He called out the U.S. for negotiating with the Afghan Taliban but – in his view – not supporting negotiations between the Ukraine government and the Eastern separatists. Talking about the possibility of the U.S. giving lethal aid to the Ukrainian military, Lavrov leveled a thinly veiled threat that the Russians might invade Ukraine outright, as they did Georgia seven years ago after what they saw as provocation from President Mikheil Saakashvili. “I don’t think our Ukrainian colleagues should hope the support they are receiving will solve their problems,” he said. “That support … is going to their heads in the way it did for Saakashvili in 2008, and we know how that ended.” The crowd took that in stride, but then burst out laughing when Lavrov said that the annexation of Crimea, which was invaded by unmarked Russian troops, was an example of international legal norms working well.

“Conditions are likely to come together that will allow the Federal Reserve to hike short-term interest rates anytime “from June on,” said Dennis Lockhart, the president of the Atlanta Fed.”

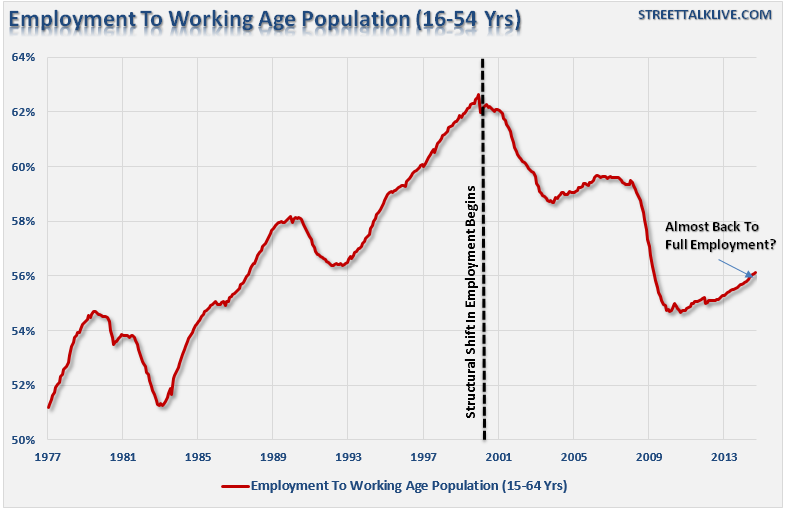

• 4 Reasons Stocks Aren’t Soaring After That Stellar Jobs Report (MarketWatch)

Why isn’t the stock market ripping higher Friday after that stellar jobs report? The S&P 500 and Dow industrials were up only moderately by around midday, then they turned negative to roughly flat in a hurry. Here are four factors:

1) A rally into the jobs report: Stocks already were showing big gains for the week before the jobs report came out. The S&P 500 is still up 3.4% for the week at last check. The Dow is coming off a four-day winning streak that had it up 720 points for the week as of Thursday’s close. So Friday’s lackluster action probably won’t change a positive weekly trend.

2) Fresh Greek worries: A downgrade of Greece by Standard & Poor’s on Friday afternoon may have sparked a move away from riskier assets like stocks. S&P cut the troubled nation’s long-term rating to B-minus from B, meaning further into junk territory. The folks at ZeroHedge, known for spotlighting the negative, say what’s “scariest” is that S&P itself is mentioning capital controls and bank runs. But other market watchers have been playing down the significance of the latest Greek drama, and they note Friday’s downgrade is similar to an earlier one by Moody’s Investors Service. That said, there are mounting concerns that Greece must get tidy its economic house or risk roiling the market.

3) Rate hikes ahead: The strong jobs report has boosted expectations around the Fed’s rate hikes, and higher rates ought to peel some investors away from stocks. Investors now think the Federal Reserve will raise rates one more time by December 2016 than they expected before Friday’s January job report, as MarketWatch’s Gregg Robb notes. Robb also reports on a notable Fed speech on Friday afternoon. Conditions are likely to come together that will allow the Federal Reserve to hike short-term interest rates anytime “from June on,” said Dennis Lockhart, the president of the Atlanta Fed.

4) A lagging indicator: The January jobs report reveals a lot, but it is important to realize the labor market is often a lagging indicator. Don’t let the stellar report make you forget about real challenges facing the U.S. economy, says MarketWatch’s Steve Goldstein. In a similar vein, Barry Ritholtz at Bloomberg View argues investors might want to ignore every monthly jobs report, since trading off it requires guessing not just the results, but also how much it is already reflected in stock prices.

And then we go and call that a recovery.

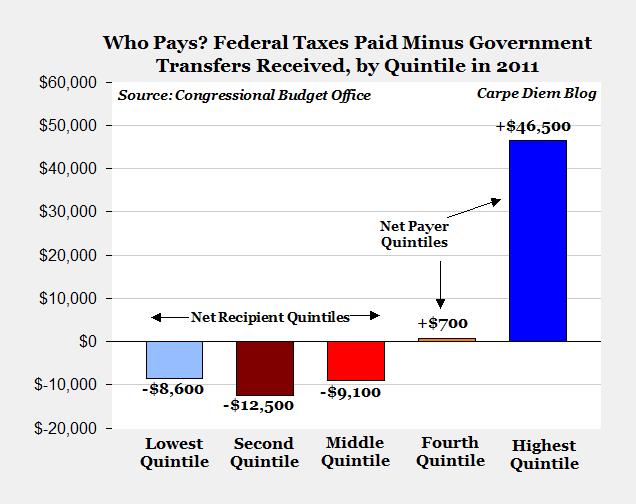

• America’s Shrinking Middle Class Is Holding On For Dear Life (MarketWatch)

Middle America is holding on for dear life. The share of Americans who are part of middle-income households has plunged to 51% in 2013 from 61% in 1970, according to new research by the Pew Research Center, a nonpartisan, nonprofit think tank in Washington, D.C. And from 1990 to 2013, the share of adult Caucasians and Asians living in middle-income households decreased the most of any ethnic group, from 58% to 53% (for Caucasians) and from 56% to 50% (for Asians). The decline was less pronounced among Hispanics (from 48% to 47%) and African-Americans (from 47% to 45%). Over the same period, the share of the country that qualifies as ‘lower-income’ has also grown: they make up 29% of all households in 2013, after comprising 25% of all households in 1970.

The share of upper income households, on the other hand, rose from 14% in 1970 to 20% in 2013. (To fall in those categories in 2013, household incomes had to be: $166,623 a year for upper income, $71,014 a year for middle income, and $23,659 a year for lower income.) About one-in-four white and Asian adults are upper income versus just one-in-10 Hispanic and black adults, and there was “no meaningful change in these gaps in the past two decades,” Pew found. What’s more, the median incomes of all households fell by 7% during the “lost decade” of 2000 to 2013. In the last three years (between 2010 and 2013), however, the share of middle-income families has remained steady.

“While the muddled recovery has yet to bolster the middle, this flat trend might actually be good news because, for now, it stems a decades-long slide,” it concluded. Not everyone sees this as a reason for celebration. “Marching in place after the recession is a bit like saying, ‘We survived.’ But who has thrived?” says Mark Hamrick, Washington, D.C. bureau chief at personal finance website Bankrate.com. “The problem is that the middle class hasn’t made much headway over the past decade or so.” High-earning Americans have fared better than Middle America, he says. “Ultimately this is an economic problem that presents itself thoroughly across our society. It helps explain why the interests of the middle class have not been well attended to.”

“The low oil price is bringing to a halt the world’s great engine of supply growth over the last five years..”

• Fears For US Economy As Shale Industry Goes Into Hibernation (Observer)

America’s fracking revolution is becoming a victim of its own success. The controversial boom in shale gas and oil has driven the US economic recovery and helped lower world crude prices. But a price plunge from $115 (£75) a barrel last June to just above $50 last week means many shale operations no longer pay. Rigs across the US are being deactivated at a rate of nearly 100 a week. In the final week of January, 94 were pulled offline – the most since 1987, according to oil services company Baker Hughes. The number of active rigs fell by from 1,609 in October to 1,223 in January and some experts predict fewer than 1,000 will remain by the end of the year. “The low oil price is bringing to a halt the world’s great engine of supply growth over the last five years,” said James Burkhard at IHS Energy. “The US upstream is very responsive to changes in price and drilling is likely to slow down further until prices recover.

“The great revival of US production has been from intensive onshore drilling. These aren’t massive $7bn projects that can’t be stopped: these are mostly onshore fracking that be started and stopped much more easily.” Burkhard said the US fracking boom accounted for more than half of global oil supply growth over the last five years, and it is the easiest tap to turn off while the world waits for the oil price to recover. The US has built up its largest stockpile of crude in 84 years. The profitability of onshore US wells varies considerably, with some only turning a profit when oil price is as high as $90 while others can make money at $30. IHS says nearly 30% of new wells started in 2014 can break even at $81 a barrel. By comparison, Morgan Stanley says some Middle Eastern onshore production is profitable at $10 per barrel.

Oil companies big and small have been knocked by falling prices. Chevron last month reported a 30% fall in quarterly profits (its worst since 2009), while oil exploration company ConocoPhillips swung to a loss as its average realised price fell 19% to $52.88 per barrel. Continental Resources, one of the largest drillers in North Dakota’s Bakken shale, said late last year it would cut its active rigs by 40% this year, with three-quarters of cuts coming by April. North Dakota’s Department of Mineral Resources says the state’s producers need a wellhead price of around $55-$65 to sustain current output of 1.2m barrels per day. If similar cuts were made across the industry, the rig count would fall below 1,100 by the end of March and 950 by the end of the year. A collapse in US oil production – now at 12m barrels a day after rising from 5m in 2008 – is likely to have a big impact on the nation’s economy. The fracking boom has made millionaires out of landowners, strengthened the country’s energy security and created hundreds of thousands of well-paid jobs.

“Bob Dudley, CEO of BP, warned last week that the industry had to prepare for a “new phase” of lower prices that could last months, even years.”

• Bitter Economic Winds Hasten Oil Industry Retreat From North Sea (Observer)

For one oil industry veteran, the dismantling of the Brent oil field in the North Sea prompts mixed feelings. There is gratitude for the livelihood earned from Britain’s post-war energy boom. And relief that it means farewell to “hell on Earth”. “Brent kept me and my family in gainful employment, so I have something to be grateful for, but these platforms are from an era long gone,” says Jake Molloy, who was a production assistant on the Brent Delta platform. Describing the structure, which Shell plans to remove from the North Sea, Molloy adds: “Putting people down platform legs [which store pumps and vessels] is really bad. You could climb down thousands of steps to the bottom with 40 pounds of breathing apparatus on your back only for the alarms to go off and you had to go all the way back again. It was the worst working environment – horrendous, hell on earth.”

Shell’s announcement that it plans to remove the platform was just one of many symbolic retreats staged by the oil industry last week. A day after the Brent proposals, Shell’s rival BP said it was taking a $4.5bn (£3bn) hit in its quarterly accounts to pay for the cost of bringing forward the closure of some unprofitable UK fields, partly due to lower oil prices. Situated 115 miles east of the Shetland Islands, Brent is estimated to have produced 10% of all North Sea oil and gas while generating £20bn of tax revenues since it opened in 1976. Brent is not the first North Sea field to face decommissioning and BP has been planning closures for some time. But the timing makes the closures all the more pointed. Shell’s field gave its name to a benchmark that has plummeted over the past year.

The price of a barrel of Brent crude has dived from $115 in June last year to less than $50 last month. The price has bounced back in the past two weeks to $58 but Bob Dudley, CEO of BP, warned last week that the industry had to prepare for a “new phase” of lower prices that could last months, even years. There will be more cost-cutting moves by the global oil industry over the next 12 months. BP is halving its exploration activity, slashing its capital expenditure by 20% and spending $1bn on making staff redundant after recording a $1bn loss in the last quarter. The $4.5bn writedown for its North Sea operations includes “increases in expected decommissioning costs” – an accounting footnote viewed by Iain Reid at BMO Capital Markets, as an inevitable outcome of low oil prices. “It’s bound to lead to North Sea field shutdowns being brought forward,” he says.

“..the levels of crude oil in storage have soared to a record. Which will pressure prices further.”

• US Oil Rig Count Plunges 29% from Peak. Halfway to Bottom? (WolfStreet)

In the US, oil companies have been laying off workers and cutting capital expenditures at a feverish pace. With revenues dropping as a function of the price of oil that has fallen by over half since June, preserving cash is suddenly a priority. Wall Street, after years of handing out money no questions asked, shut off the spigot for junk-rated drillers that need new money the most. So it’s crunch time. The number of rigs actively drilling for oil in the US, reported by Baker Hughes every Friday, is a preliminary gauge of these changes. And during the last reporting week, that rig count plunged by 83 to 1,140 rigs, after having plunged by an all-time record of 93 in the prior week. The rig count is now down 469 rigs, or 29%, from the high of 1,609 in October.

And it’s down 359 rigs over the six reporting weeks so far this year. Never before has the rig count plunged this fast this far. During the financial crisis, the oil rig count fell 60% from peak to trough. If this oil bust plays out the same way on a percentage basis, the count would drop to 642 rigs! The bloodletting in the exploration and production sector would be enormous. Having cut the rig count by 29% already since the October peak, the sector might already be about halfway there. But production of oil from existing and recently completed wells continues to set records, and wells to be completed in the near future will add to it. Demand in the US has been slack. And the levels of crude oil in storage have soared to a record. Which will pressure prices further.

“Floating exchange rates and resulting depreciation can cause the debt burden of firms and fiscal budgets to bloat overnight.”

• Bracing for Another Storm in Emerging Markets (Kevin Gallagher)

In 2012, Brazilian President Dilma Roussef scolded U.S. Federal Reserve Chairman Ben Bernanke’s monetary easing policies for creating a “monetary tsunami”: Financial flows to emerging markets that were appreciating currencies, causing asset bubbles, and generally exporting financial instability to the developing world. Now, as growth increases in the United States and interest rates follow, the tide is turning in emerging markets. Many countries may be facing capital flight and exchange-rate depreciation that could lead to financial instability and weak growth for years to come. The Brazilian president had a point. Until recently U.S. banks wouldn’t lend in the United States despite the unconventionally low interest rates. There was too little demand in the U.S. economy and emerging market prospects seemed more lucrative.

From 2009 to 2013, countries like Brazil, South Korea, Chile, Colombia, Indonesia, and Taiwan all had wide interest rate differentials with the United States and experienced massive surges of capital flows. The differential between Brazil and the U.S. was more than 10 percentage points for a while—a much better bet than the slow growth in the United States. According to the latest estimates from the Bank for International Settlements (BIS), emerging markets now hold a staggering $2.6 trillion in international debt securities and $3.1 trillion in cross border loans—the majority in dollars. Official figures put corporate issuance at close to $700 billion since the crisis, but the BIS reckons that the figure is closer to $1.2 trillion when counting offshore transactions designed to evade regulations. Now the tide is turning.

China’s economy is undergoing a structural transformation that necessitates slower growth and less reliance on primary commodities. Oil prices and the prices of other major commodities are stabilizing or on the decline. It should be no surprise then that many emerging-market growth forecasts are continually being revised downward. Meanwhile, growth and interest rates are picking up in the United States. The dollar gains strength; the value of emerging market currencies fall. [..] Floating exchange rates and resulting depreciation can cause the debt burden of firms and fiscal budgets to bloat overnight. Given that most of the capital inflows were in dollars, depreciating currencies mean that nations and firms will need to come up with ever-more local currency to pay debt—but in a lower growth environment.

“..imports slumped by 19.9%..”

• China’s Exports Slump, Imports Crash In January, Record Trade Surplus (Reuters)

China’s exports fell 3.3% in January from a year earlier, while imports slumped by 19.9%, both missing expectations by a wide margin, and resulting in a record monthly trade surplus of $60 billion. Thinking that easing measures in Europe would boost demand for Chinese goods, analysts polled by Reuters had expected to exports to rise by 6.3%, and imports to fall by only 3%, to give a trade deficit of $48.9 billion. Instead, exports slid 12% on a monthly basis, while imports dove 21.1%, according to the data released by the Customs Administration said on Sunday. The decline was led by a sharp slide in commodities imports, in particular imports of coal which dropped nearly 40% to 16.78 million tonnes, down from December’s 27.22 million tonnes, as well as a scale back in crude oil imports, which slid 7.9%.

While the trade data augured badly for an economy that suffered its slowest economic growth in 24 years in 2014, analysts say strong seasonal distortions due to the Lunar New Year holiday make it difficult to interpret the data. Last year the holiday fell in January, and this year it falls in February. China’s export numbers tend to be erratic, sharp moves in opposite directions are common and the combined January and February figures are often a more accurate gauge of the overall trend, analysts say. [..] During 2014, China’s total trade value increased by 3.4% from a year earlier, short of the official target of 7.5%, and some analysts have raised questions about whether export data was inflated by fake invoicing as firms speculated in the currency and commodities markets.

“Value of crude oil imports fell 41.8% from a year earlier, iron ore imports dropped 50.3% and coal plummeted 61.8%.” [..] “We are going to see more of these alarming data in the next few months.”

• China’s Record Trade Surplus Highlights Weak Domestic Demand (Bloomberg)

China registered a record trade surplus last month as imports plunged on falling commodity prices and weak domestic demand. Imports fell by the most in more than five years, declining 19.9% from a year earlier. That compared with estimates for a 3.2% drop in a Bloomberg survey of analysts. Exports slid 3.3%, leaving a trade surplus of $60 billion, the customs administration in Beijing said. A property downturn and a stall in manufacturing are signals the government may need to step up measures to stimulate the economy, as domestic demand for commodities including crude oil and iron ore declines. The record trade surplus, combined with declines in exports and imports, complicates the government’s management of exchange rates after January’s depreciation.

“It seems that sharp decline in commodity prices, weak domestic demand and weak external demand, reflected in processing imports, all played a role in the decline in imports,” said Wang Tao at UBS in Hong Kong. “Trade data again creates a dilemma for the exchange rate. A record trade surplus is supposed to add appreciation pressure, but declining exports would say otherwise.” It’s not in China’s interest to let the yuan depreciate sharply, Liu Ligang and Zhou Hao at ANZ wrote in a note. “China’s central bank will continue to use a slew of instruments, including fixing rates, open market operations, and direct interventions, to prevent the RMB from weakening sharply,” they wrote.

Value of crude oil imports fell 41.8% from a year earlier, iron ore imports dropped 50.3% and coal plummeted 61.8%. Quantities of the commodities declined as well. Imports declined from all major trade partners, including the EU and US. Falling prices have cut the dollar value of imports and contributed to a prolonged decline in factory gate prices, which may extend to a record 35 months, according to economist estimates. “The slump in imports means a slump in the overall situation of the economy,” said Hu Yifan at Haitong in Hong Kong. “We are going to see more of these alarming data in the next few months.”

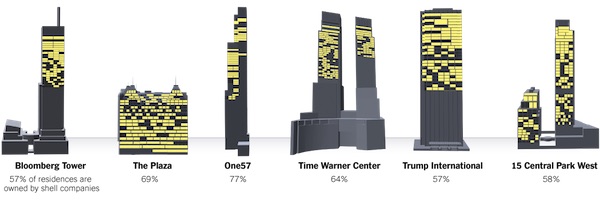

Extensive NYT reasearch project. This reflects very poorly on New York, the US, the UK and London.

• Stream of ‘Dark’ Foreign Wealth Flows to Elite New York Real Estate (NY Times)

On the 74th floor of the Time Warner Center, Condominium 74B was purchased in 2010 for $15.65 million by a secretive entity called 25CC ST74B L.L.C. It traces to the family of Vitaly Malkin, a former Russian senator and banker who was barred from entering Canada because of suspected connections to organized crime. Last fall, another shell company bought a condo down the hall for $21.4 million from a Greek businessman named Dimitrios Contominas, who was arrested a year ago as part of a corruption sweep in Greece. A few floors down are three condos owned by another shell company, Columbus Skyline, which belongs to the family of a Chinese businessman and contractor named Wang Wenliang. His construction company was found housing workers in New Jersey in hazardous, unsanitary conditions.

Behind the dark glass towers of the Time Warner Center looming over Central Park, a majority of owners have taken steps to keep their identities hidden, registering condos in trusts, limited liability companies or other entities that shield their names. By piercing the secrecy of more than 200 shell companies, The New York Times documented a decade of ownership in this iconic Manhattan way station for global money transforming the city s real estate market. Many of the owners represent a cross-section of American wealth: chief executives and celebrities, doctors and lawyers, technology entrepreneurs and Wall Street traders. But The Times also found a growing proportion of wealthy foreigners, at least 16 of whom have been the subject of government inquiries around the world, either personally or as heads of companies. The cases range from housing and environmental violations to financial fraud.

Four owners have been arrested, and another four have been the subject of fines or penalties for illegal activities. The foreign owners have included government officials and close associates of officials from Russia, Colombia, Malaysia, China, Kazakhstan and Mexico. They have been able to make these multimillion-dollar purchases with few questions asked because of United States laws that foster the movement of largely untraceable money through shell companies. Vast sums are flowing unchecked around the world as never before whether motivated by corruption, tax avoidance or investment strategy, and enabled by an ever-more-borderless economy and a proliferation of ways to move and hide assets. Alighting in places like London, Singapore and other financial centers, this flood of capital has created colonies of the foreign super-rich, with the attendant resentments and controversies about class inequality made tangible in the glass and steel towers reordering urban landscapes.

Lovely.

• Twitter Execs Enrich Themselves At Shareholders’ Expense (MarketWatch)

In October, we pointed out that the $170 million in stock-based compensation dished out to Twitter employees during the third quarter represented 47% of the company’s third-quarter revenue. That was an outsized amount — much higher than the most recently reported payouts for any company included in the S&P 1500 Composite Index. Twitter suffered a third-quarter net loss of $175 million, owing almost entirely from the stock awards. (Twitter is not yet included in the S&P 1500, presumably because it has been publicly traded for only a little over a year.)

Following a memo to employees in which Twitter CEO Dick Costolo said the company was doing a poor job preventing abuse over its messaging platform, the company said on Thursday that for the fourth quarter, its stock-based compensation totaled $177 million, or 37% of revenue. The company reported a net loss of $125.4 million, or 20 cents a share, but would have shown a profit of $79.3 million, or 12 cents a share, if the non-cash stock awards were excluded. The good news for Twitter was that its fourth-quarter revenue totaled $479.1 million, rising from $361.3 million the previous quarter and $242.7 million a year earlier. The company beat consensus estimates for earnings and revenue, though it reported a slowdown in subscriber growth. Twitter said it expects growth to pick up, and investors believed it, sending the shares up 13% on Friday.

“We’re slowly poisoning America’s food supply, poisoning the whole world’s food supply.”

• Peak Food Is The World’s No. 1 Ticking Time Bomb (Paul B. Farrell)

Global food poisoning? Yes, We’re maxing out. Forget Peak Oil. We’re maxing-out on Peak Food. Billions go hungry. We’re poisoning our future, That’s why Cargill, America’s largest private food company, is warning us: about water, seeds, fertilizers, diseases, pesticides, droughts. You name it. Everything impacts the food supply. Wake up America, it’s worse than you think. We’re slowly poisoning America’s food supply, poisoning the whole world’s food supply. Fortunately Cargill’s thinking ahead. But politicians are dragging their feet. They’re trapped in denial, protecting Big Oil donors, afraid of losing their job security; their inaction is killing, starving, poisoning people, while hiding behind junk-science.

The truth is, America, Big Ag worldwide farm production can’t feed the 10 billion humans forecast on Planet Earth by 2050. Can we wait till 2050 for the fallout? No. The clock’s ticking on the Peak Food disaster dead ahead. We’re at the critical tipping point, the planet is boiling over. Conservative Greg Page, executive chairman of the Cargill food empire, has that great can-do spirit of capitalism: At $43 billion, Cargill is America’s largest privately held company, launched during the Civil War with one grain warehouse. An unabashed optimist, Page was sounding a loud battle cry in Burt Helm’s New York Times op ed, “The Climate Bottom Line:”

Page is a powerful leader, optimistic, realistic, experienced … admits he “doesn’t know … or particularly care … whether human activity causes climate change … doesn’t give much serious thought to apocalyptic predictions of unbearably hot summers and endless storms.” Page wants action, results. Yes, he’s no left-wing environmentalist. Far from it. This is business, jobs, profits, because it’s a fact, climate’s already damaging huge sectors of America’s agricultural business … dust bowls in the heartland, in California’s bone dry central valley, all over … Georgia, North Carolina, Texas, all farm economics are affected. Meanwhile, our politicians dilly-dally, drifting, dragging their feet, in denial, playing petty ideological games.