Harris&Ewing Happy News Cafe, “restaurant for the unemployed”, Washington, DC 1937

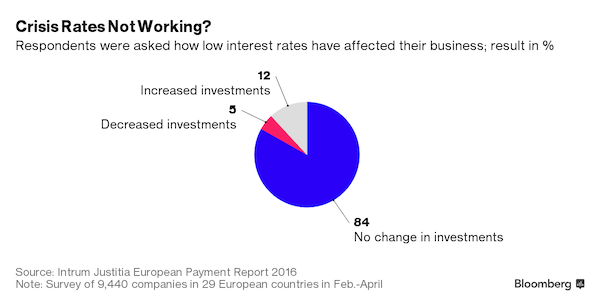

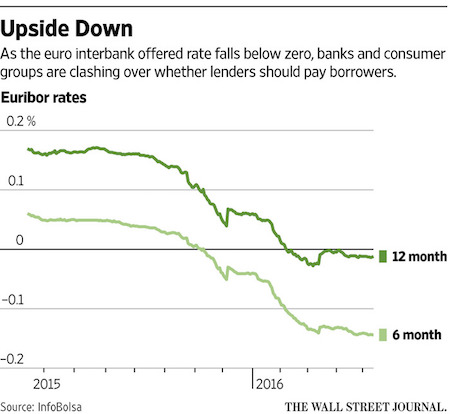

Central bankers seem to think it does, though.

• Bill Gross: Capitalism Doesn’t Work At 0% (CNBC)

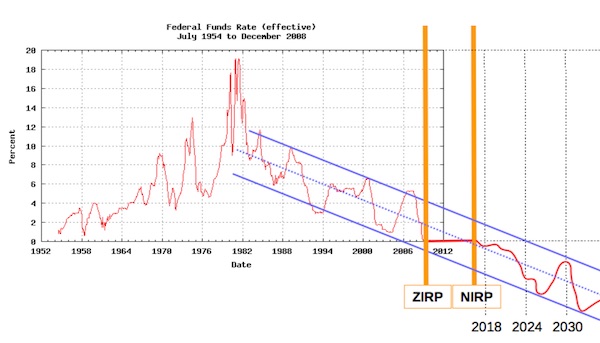

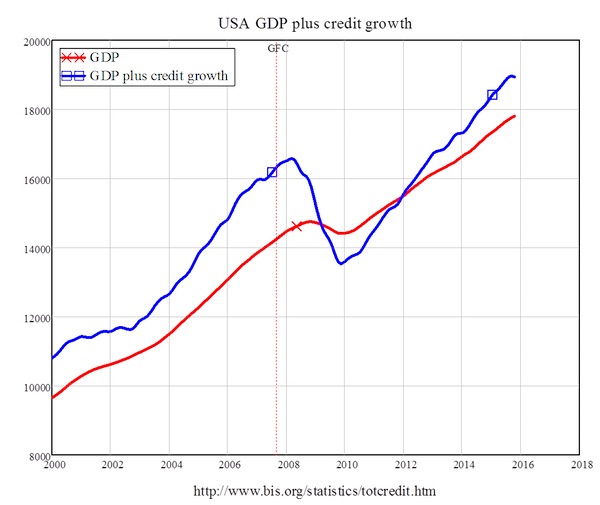

Bill Gross has some bad news for investors. In his June investment outlook released Thursday, the widely followed bond fund manager contended that bond and stock returns realized in the last 40 years are “a grey if not black swan event that cannot be repeated.” Investors should not expect 7% returns on bonds or returns in the high single digits or double digits on stocks, Gross told CNBC on Thursday. “The markets are entirely different and it would pay to travel to Mars as opposed to stay on Earth, because the returns here are very, very low,” the manager of the Janus Capital Unconstrained Bond Fund, said on CNBC’s “Power Lunch”. Gross said easy central bank policy could hold down bond returns. Central banks in Europe and Japan have adopted negative interest rates, while the Federal Reserve’s target rate is at 0.25 to 0.50%.

German and Japanese 10-year bonds currently have negative yields, while their 30-year bonds yield less than 1%. The U.S. 10-year Treasury note yield sat around 1.8% Thursday. Gross contended those rate trends can hurt not only savers but also the broader economy. He said Fed policymakers, who have signaled they could hike rates at least once this year, realize they need to normalize policy. “Ultimately, they have to move back up and I think a certain number of Fed governors realize that the normalization process is necessary in order to save business models and to save capitalism basically because capitalism doesn’t work at 0% and it doesn’t work at negative interest rates,” he said.

Negative bonanza.

• Negative-Yielding Sovereign Debt Tops $10 Trillion (WSJ)

The amount of global sovereign debt with negative yields surpassed $10 trillion for the first time in May, according to Fitch Ratings. The measure stood at $10.4 trillion on May 31, up 5% from $9.9 trillion on April 25, when the rating agency last measured the amount, according to a Thursday report. It is spread across 14 countries, with Japan by far the largest source of negative-yielding bonds. Of the total, $7.3 trillion was long-term debt and $3.1 trillion was short-term debt.

The amount of debt with yields below zero has increased sharply this year as global central banks have instituted unconventional policy measures, such as negative interest rates. The Bank of Japan in January surprised markets by driving its rates below zero, pushing Japanese government-bond yields sharply lower. Banks in the euro currency bloc have also increased demand for government debt to meet regulatory requirements, another factor weighing on yields, Fitch said. “Higher amounts of Japanese and Italian sovereign securities with sub-zero yields were the biggest contributors to the monthly changes,” said Fitch analysts, led by Robert Grossman.

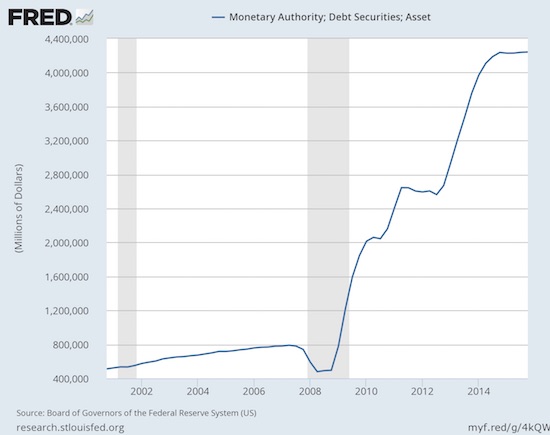

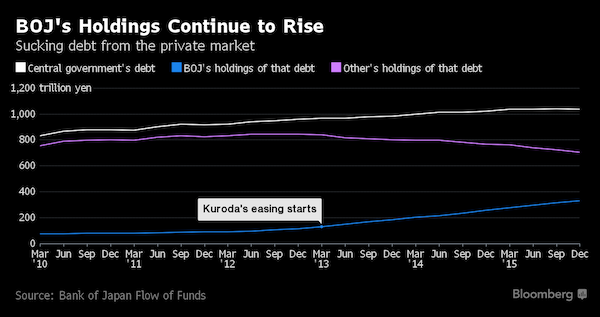

Because it’s shifting into private hands. The BOJ buys it all. Which allows the government to keep on borrowing with abandon.

• Japan’s Sovereign Debt Burden Is Quietly Falling the Most in the World (BBG)

Japan for years has been renowned for having the world’s largest government debt load. No longer. That’s if you consider how the effective public borrowing burden is plunging – by one estimate as much as the equivalent of 15 percentage points of GDP a year, putting it on track toward a more manageable level. Accounting for the Bank of Japan’s unprecedented government bond buying from private investors, which some economists call “monetization” of the debt, alters the picture. Though the bond liabilities remain on the government’s balance sheet, because they aren’t held by the private sector any more they’re effectively irrelevant, according to a number of analysts looking at the shift. “Japan is the country where public debt in private hands is falling the fastest anywhere,” said Martin Schulz at Fujitsu Research Institute in Tokyo.

While Japan’s estimated gross government debt is now over twice the size of the economy, according to Schulz’s calculations using BOJ data, the shuffle of holdings from private actors like banks and households to the central bank is having a big impact. It means debt in private hands will fall to about 100% of GDP in two to three years, from 177% just before Prime Minister Shinzo Abe took power in late 2012, he estimates. It’s not like Japan is slowing down on borrowing. Abe’s administration is now laying the groundwork for another burst of fiscal stimulus, which could be funded by selling bonds. He also announced Wednesday a delay to a sales tax hike planned for April 2017, rebuffing fiscal hawks who argued it was vital to raise revenue.

Finance Minister Taro Aso explained Tuesday that “the biggest problem is that private consumption hasn’t risen,” making now not a good time to raise the levy. Helping improve household sentiment could be one reason for making it explicit that at least some of the government bonds in the BOJ’s holdings will be written off. If Japanese consumers understand they’re not on the hook for all the gross debt outstanding, their mood could potentially perk up.

What can we say but: Anything Goes!

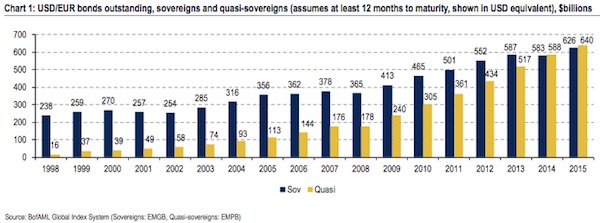

• Explosion in Quasi-Sovereign Bond Issuance Is Making Analysts Queasy (BBG)

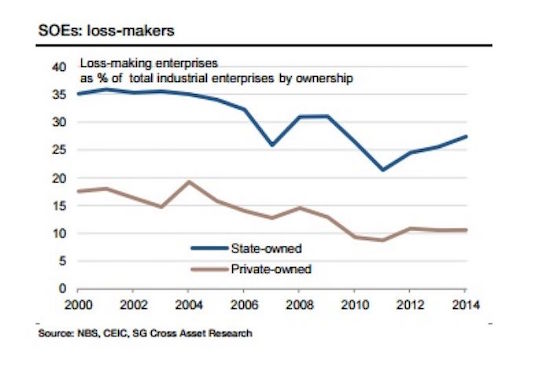

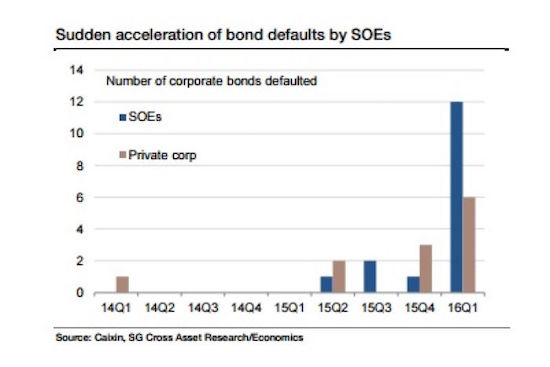

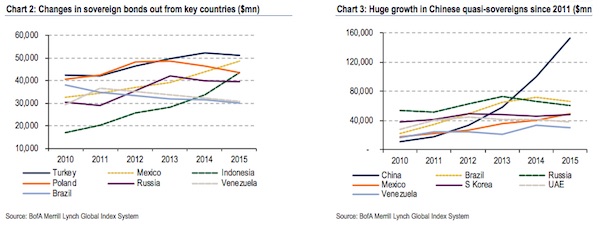

Which fixed-income asset class is growing fast, outperforms similar debt issues, and rarely defaults? Emerging market ‘quasi-sovereign’ bonds, of course! At some $600 billion, debt sold by state-supported companies in emerging markets ranging from China to Oman has surpassed the amount of emerging market government debt outstanding, according to a new note from Bank of America Merrill Lynch. Such quasi-sovereign debt issuance has helped propel the stunning growth of the overall bond market, with EM issuance accounting for 47% of the growth in global debt between 2007-14, compared to 22% in the previous seven years, according to S&P Global Ratings.

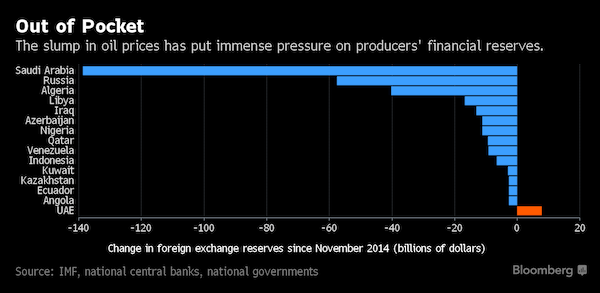

But the surge in ‘quasi’ bonds is making some feel, well, queasy. “Quasi-sovereigns are effectively a ‘contingent liability’ for a country,” write the BofAML analysts, led by Kay Hope. They note that quasi-sovereign issuance now makes up half of the $1.6 – 1.8 trillion euro- and dollar-denominated corporate bond market for emerging markets, which could put added pressure on strained emerging market coffers.

China, with its lumbering state-owned enterprises, accounts for a full quarter of this kind of debt — despite the Chinese sovereign itself lacking virtually any foreign-denominated bonds. Meanwhile, the amount of debt from Brazilian quasi-sovereigns has nearly quadrupled, according to BofAML, while that sold by Mexico’s state-owned companies has just about doubled. Much of the growth has been driven by companies in the energy and commodities sectors, with giants of industry including Pemex, Petrobras, China National Offshore Oil and Gazprom all tapping the market in recent years.

There’s going to be trouble.

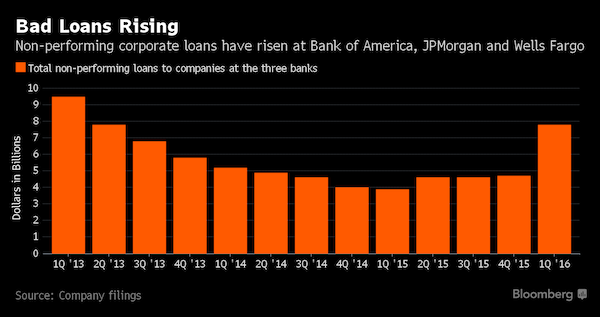

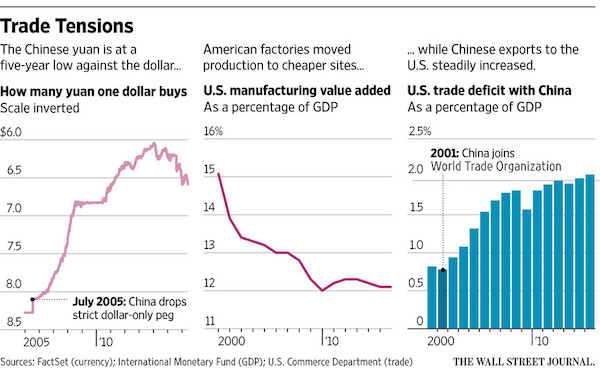

• US-China Trade Troubles Grow (WSJ)

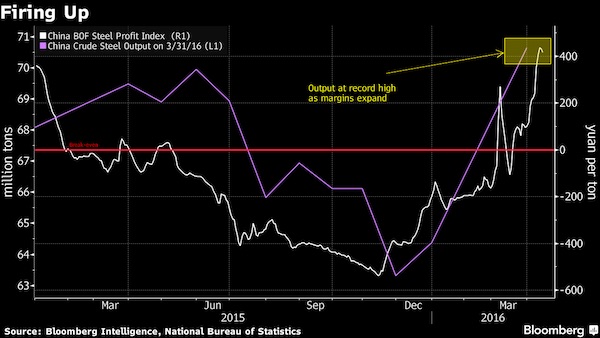

The U.S. and China, facing mounting political pressures at home, are seeing economic tensions flare to their worst point in years over currency and trade practices. China has pushed the yuan to a five-year low against the dollar, reviving charges from American firms of currency manipulation to gain a competitive advantage for Chinese goods. The Obama administration has fired off a series of trade complaints and levied duties on several Chinese industries, from chicken feet to cold-rolled steel used in appliances and auto parts. The friction between the world’s two largest economies could worsen as domestic politics collide with already weak growth.

The U.S., seeing heightened anti-China rhetoric in the presidential election, wants China to press ahead with promised policies to open up its markets and allow greater international investment. Chinese leaders, worried about a deeper economic slowdown, are trying to keep factories humming and prevent the kind of market unrest that gripped global investors over the past year. [..] Some analysts think President Xi Jinping, wanting to consolidate power in the Communist Party ahead of a leadership transition next year, has paused reform efforts and instead is revving up the old playbook of credit-fueled growth and infrastructure spending. His aim: Ensure economic stability and mollify rivals, they say.

An attempt last year by Beijing to allow markets to play a role in setting its exchange rate was mismanaged, adding to a summertime of woe for China’s financial markets and sparking global jitters. The reaction surprised Chinese officials and created a headache for reformers. The Chinese government is keeping steel mills, coal plants and a host of manufacturing industries afloat despite dwindling demand and a tumble in commodity prices that should have closed many. [..] By supporting excess production capacity, the Chinese government is “engaged in economic warfare against the U.S.,” said John Ferriola, chief executive of North Carolina steel giant Nucor Corp. “Thousands of hardworking Americans have lost their jobs because of these illegal, unfair trade practices.”

“..nearly half of all respondents said they could not cover an unexpected expense of $400..”

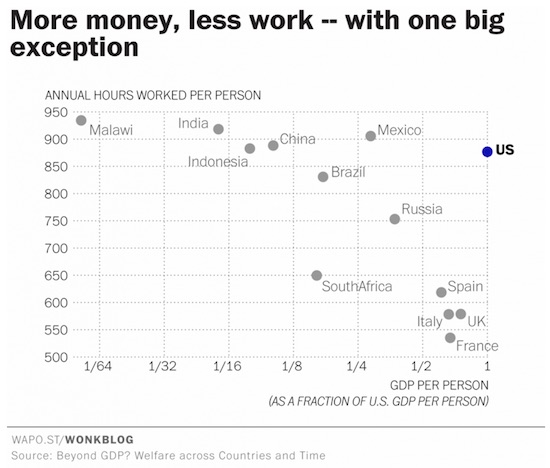

• One Third Of Americans Are ‘Just Getting By’ (NY Times)

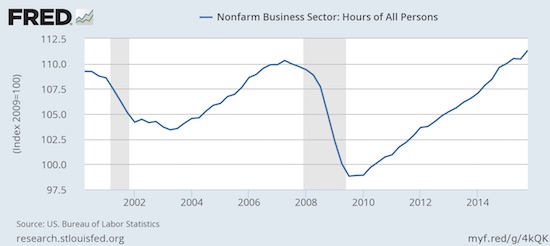

In the United States, nearly one-third of adults, about 76 million people, are either “struggling to get by” or “just getting by,” according to the third annual survey of households by the Federal Reserve Board. That finding, dismal though it is, represents a mild improvement in general well-being last year, compared with the two years before. The improvement, however, was clearly too little to raise Americans’ spirits: The new survey, which was conducted in late 2015 and released last week, also shows that optimism about the future has tempered. The Fed policy committee should take the survey to heart when it meets this month to decide whether to raise interest rates.

Higher rates are a way to slow an economy that is at risk of overheating – a far-fetched proposition when tens of millions of Americans are barely hanging in there. Congress and other economic policy makers, as well as the presidential candidates, could also use the survey to get some insight into Americans’ real economic problems. Among them is deep insecurity. Nearly 70% of adults said they were “living comfortably” or “doing O.K.” — up a bit from previous years — but nearly half of all respondents said they could not cover an unexpected expense of $400, or could do so only by selling something or borrowing money. Americans seeking a path upward through education are staggering under a load of debt. The median debt load for someone with a bachelor’s degree was $19,162.

For a master’s, it was $36,000, and for a professional degree, $100,000. Many students with debt use deferments or other plans to delay or extend repayments, but in most cases that increases the balance they owe. For those making payments, the average monthly bill was $533. By all indications, however, they are the relatively lucky ones. Americans who had attended college accounted for most of the improvement reported in the survey. Financial stress was more prevalent among less-educated people who responded to the survey, as well as racial and ethnic minorities and adults making less than $40,000 a year.

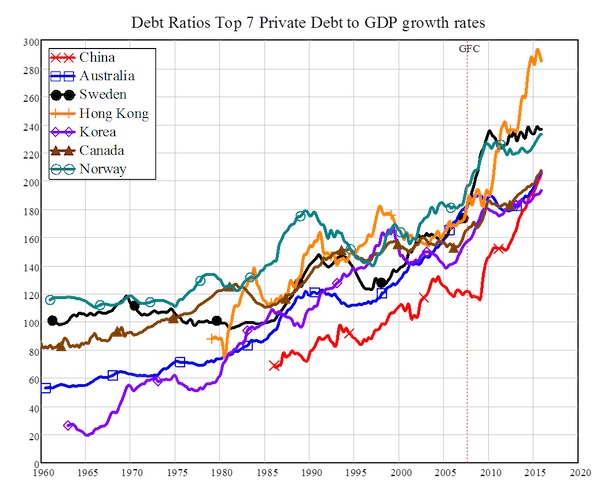

Please remember and compare to yesterday’s (also OECD): “We’re a little concerned about housing prices in the greater Vancouver area and Toronto..”

• OECD Sees ‘Dramatic And Destabilising’ End To Australia Property Boom (AFR)

Australia may be on the cusp of a “dramatic and destabilising” end to the housing boom rather than a hoped-for soft landing because of the apartments building boom, the Organisation for Economic Co-operation and Development said. In its latest assessment of the threats to the economy, the Paris-based think tank said jitters over the federal election are adding to risks, and called for an increase in the goods and services tax. Somewhat paradoxically, the OECD appears particularly worried about how to interpret changes in the housing market – even as it notes simultaneously that risks of a boom appear to be receding which, it argues, provides leeway for even more official interest rate cuts.

“Domestically, the unwinding of housing market tensions to date may presage dramatic and destabilising developments, rather than herald a soft landing,” it said. Parts of the real estate industry have already warned about failed settlements as record numbers of new apartments come due for completion in Sydney, Melbourne and Brisbane this year and next. The warning, which is accompanied by graphs showing dwelling approvals retreating from a peak and house prices levelling out, appears to have been prepared ahead of more recent evidence of a rebound in both measures.

First things first.

• Fed Likely To Avoid Rate Hike Before Britain Votes On Leaving EU (R.)

The U.S. Federal Reserve may be forced to delay a rate hike at its June meeting because of mounting concern over the economic fallout from Britain’s vote on whether to leave the European Union. The geopolitical risk likely will push any rate increase until at least July, despite apparent consensus among Fed officials that a hike is warranted by stronger U.S. growth and tight labor markets. The Fed’s June 14-15 rate-setting meeting comes just a week before the British vote on June 23. A “leave” vote is expected to roil financial markets, cause credit spreads to widen, trigger a rush into safe assets and bolster the dollar. The dollar’s recent stability is one reason the Fed has become more comfortable with raising rates, and officials may want to let the threat of Brexit pass before moving to tighten financial conditions.

Fed Board Governor Daniel Tarullo on Thursday joined the chorus of those warning of his concerns over the British vote, telling Bloomberg that Brexit would be a “factor” he would consider at the Fed’s June policy meeting and said that the British vote’s impact on markets would be key. [..] If the Fed does indeed take a pass at its June meeting, officials have signaled they’ll be ready to move in July. Minutes of the Fed’s March policy meeting showed officials preparing the ground for higher rates sometime in the summer months. After July, the next option would be September, in the middle of a U.S. election campaign, in which the Fed and Yellen could well become targets of debate.

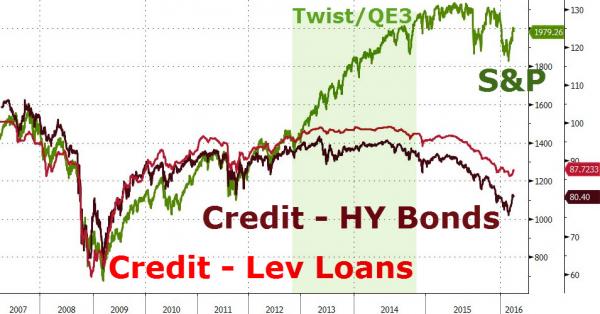

The illusion gets expensive, as returns diminish.

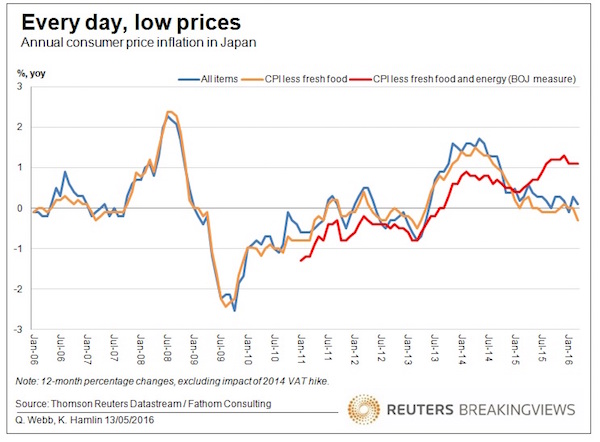

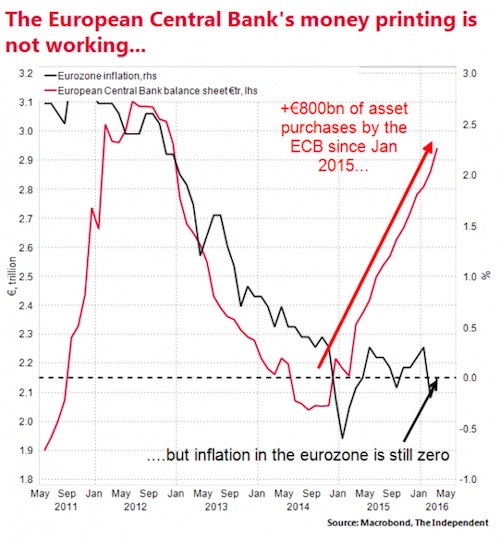

• Draghi Insists ECB Stimulus Only Half Done (BBG)

Mario Draghi’s insistence that his stimulus program is only half done brings with it a worrying thought. What if its best effects are already spent anyway? At least four times at Thursday’s press conference in Vienna, the European Central Bank president emphasized how policy makers need to see the “full impact” and must “focus on implementation” of their measures. That augurs a busy month ahead as officials keep hoovering up government debt, start buying corporate bonds and enact the first of four long-term loan offerings to banks. While Draghi’s remarks suggest the next major calendar point for the ECB’s assessment of its stimulus will be September – after the release of economic-growth data and coinciding with its fresh forecasts – the omens so far are weak.

Yet another report of negative consumer prices this week underscored the challenge of revitalizing an economy fatigued by years of debt crises and delayed reforms, and battered by global forces beyond the ECB’s control. “We’re getting to the point of radically diminishing effectiveness of these interventions,” Andrew Balls, Pimco’s global fixed income chief investment officer, said on Bloomberg Television. “If we get a recession, which is perfectly plausible over the next three to five years, there’s a real question in terms of how policy makers can respond.”

France blames emerging economies.

• Bank of France Cuts Inflation Outlook, 2017 GDP Forecast (WSJ)

The Bank of France cut its inflation forecasts and trimmed its 2017 economic growth forecast in a semi-annual economic outlook Friday. The Bank of France pared back its GDP forecast for 2017 to 1.5% from 1.6% in December as it expects weaker trade to drag on the French economy. Despite a stronger-than-expected first quarter, it kept its GDP forecast for the whole of 2016 at 1.4%. The softer forecasts indicate how weak oil prices and uncertainty over the outlook for the global economy are cooling eurozone economies just as they emerge from a long period of weak growth. “While global demand is dynamic, it will accelerate only slightly in 2016, due to a less favorable growth outlook than previously forecast in emerging economies,” the Bank of France said.

Germany blames exports in general. Stingy Greeks?!

• Bundesbank Cuts German GDP Forecasts On Weaker Export Demand (R.)

The Bundesbank cut its German inflation and growth forecasts on Friday citing weaker demand for exports, even as it predicted that robust consumer demand and a tightening labor market would keep the domestic economy buoyant. The euro zone’s biggest economy has been an outperformer in recent years, posting healthy growth and driving the currency bloc’s best run since the start of the global financial crisis almost a decade ago. Exporters have been forced to “surrender” some of their market share gained in recent years, however, and this trend may continue this year and offset strong domestic factors, the central bank said in a biannual economic outlook.

“This should probably be interpreted mainly as a correction of previous market share gains not explained by price competitiveness,” the Bundesbank said. “This process could continue further into 2016 according to Ifo and DIHK surveys, in which industrial firms reported subdued export expectations and only a comparatively moderate increase in exports this year,” it said. The bank now sees GDP growing at 1.7% this year, below a December projection for 1.8%, and 1.4% in 2017, down from 1.7% seen earlier. The growth rate would then rebound to 1.6% in 2018.

Not going to happen.

• President Obama, Pardon Edward Snowden and Chelsea Manning (G.)

As he wraps up his presidency, it’s time for Barack Obama to seriously consider pardoning whistleblowers Chelsea Manning and Edward Snowden. Last week, Manning marked her six-year anniversary of being behind bars. She’s now served more time than anyone who has leaked information to a reporter in history – and still has almost three decades to go on her sentence. It should be beyond question at this point that the archive that Manning gave to WikiLeaks – and that was later published in part by the Guardian and New York Times – is one of the richest and most comprehensive databases on world affairs that has ever existed; its contribution to the public record at this point is almost incalculable. To give you an idea: in just the past month, the New York Times has cited Manning’s state department cables in at least five different stories.

And that’s almost six years after they first started making headlines. We know now that, despite being embarrassing for the United States, the leaks caused none of the great harm that US government officials said would come to pass. Even the government admitted during Manning’s trial that no one died because of her revelations, despite the hyperbolic government comments at the time, including that WikiLeaks had “blood on its hands”. (By the way, the US officials knew they were exaggerating in the media at the time.) Even if you think that she deserves some punishment for breaking the law, six years behind bars (and being tortured during her pretrial confinement) should be more than enough.

Creepy.

• Facial Recognition Will Soon End Your Anonymity (MW)

Nearly 250 million video surveillance cameras have been installed throughout the world, and chances are you’ve been seen by several of them today. Most people barely notice their presence anymore – on the streets, inside stores, and even within our homes. We accept the fact that we are constantly being recorded because we expect this to have virtually no impact on our lives. But this balance may soon be upended by advancements in facial recognition technology. Soon anybody with a high-resolution camera and the right software will be able to determine your identity. That’s because several technologies are converging to make this accessible. Recognition algorithms have become far more accurate, the devices we carry can process huge amounts of data, and there’s massive databases of faces now available on social media that are tied to our real names.

As facial recognition enters the mainstream, it will have serious implications for your privacy. A new app called FindFace, recently released in Russia, gives us a glimpse into what this future might look like. Made by two 20-something entrepreneurs, FindFace allows anybody to snap a photo of a passerby and discover their real name — already with 70% reliability. The app allows people to upload photos and compare faces to user profiles from the popular social network Vkontakte, returning a result in a matter of seconds. According to an interview in the Guardian, the founders claim to already have 500,000 users and have processed over 3 million searches in the two months since they’ve launched.

What’s particularly unsettling are the use cases they advocate: identifying strangers to send them dating requests, helping government security agencies to determine the identities of dissenters, and allowing retailers to bombard you with advertisements based on what you look at in stores. While there are reasons to be skeptical of their claims, FindFace is already being deployed in questionable ways. Some users have tried to identify fellow riders on the subway, while others are using the app to reveal the real names of porn actresses against their will. Powerful facial recognition technology is now in the hands of consumers to use how they please.

American history 101.

• The Fat Lady Always Sings Twice (Jim Kunstler)

That was the week Hillary began to look like the candidate who fell off a truck wearing a Nixon mask. Email-gate is taking on the odor of Watergate — the main ingredient of which was not the dopey crime itself but the stonewalling around it. The State Department Inspector General’s report saying definitively, no, she was not “allowed” to use a private, unsecured email server validated Donald Trump’s juvenile name-calling of “Crooked Hillary.” We may never hear the end of that now (if Trump is actually nominated). And, of course, there lurks the Godzilla-sized skeleton in her closet of the still-unreleased Goldman Sachs speech transcripts, the clamor over which is sure to grow. Meanwhile the specter of the California primary looms, a not inconceivable loss to Bernie Sanders.

And onto the convention in Philly which I contend will be even more fractious and violent than the 1968 fiasco in Chicago. I’ll say it again: Hillary is a horse that ain’t gonna finish. The Democrats better be prepared to haul Uncle Joe out of the closet, fluff up his transplanted hair, wax his dentures, give him a few Vitamin B-12 shots, and stick a harpoon in his fist for the autumn run against the White Whale (if Trump is actually nominated). The Republican convention in Cleveland is apt to be as bloody and violent a spectacle too (if Trump is actually nominated), with Black Lives Matters cadres having already promised to put on a show for global television and their Latino counterparts marching with Mexican Flags and cute signs saying: Trump: Chingate tu madre, perhaps garnished with the sobriquet pendejo.

In such a situation, Trump has enormous potential to make things worse with his childish snap-backs. Hubert Humphrey in 1968 at least had the good sense to keep his mouth shut about the moiling multitudes out on Michigan Avenue inveighing against him. The Vietnam War was a grave debacle, and it especially pissed off the young men subject to being drafted to fight in it, but the woof and warp of American life was otherwise intact. Blue collar workers still pulled in high wages in the Big Three auto plants, and women had not yet declared war on men, and the airwaves weren’t pornified, and there were still people in government with moral authority who loudly opposed official policy. The sobering martyrdoms of Martin Luther King and Robert Kennedy sanctified the opposition to the status quo.

Even Hubert Humphrey himself, a thoughtful man underneath his Rotarian clown mask, began to turn away from Lyndon Johnson’s war hawks. Nixon won. He surely benefited most not so much from the war issue and the riots in the streets as from the mass defection of Southern states from the long-entrenched domination of the Democratic Party — directly due to Johnson’s dismantling of the old Jim Crow laws. As a personality, Nixon was as much a pendejo as Donald Trump, but no one doubted his ability to run the machinery of government, if not the way they wanted to run it.

” The figures of migrant unemployment follow a trend in Sweden of high unemployment for foreigners.”

• Fewer Than 500 of 163,000 Migrants Find Jobs In Sweden (BB)

Sweden’s state-funded broadcaster has revealed that of 163,000 migrants who came to Sweden, less than 500 have found jobs. Sweden saw a record 163,000 applications for asylum last year as a result of the migrant crisis and many Swedes were assured that the new arrivals would contribute to the economy; but new research from Sweden’s state-owned SVT reveals that fewer than 500 migrants have found work. Using data from the Swedish employment agency and the Swedish migration authority, Migrationsverket, the network claims that only 494 asylum seekers are contributing to the economy, The Local reports. While in many countries asylum seekers are banned from formally working while their application is being processed, in Sweden there are exceptions.

The “at-und” is an exemption granted by Migrationsverket which allows asylums seekers access to the labour market. In an effort to explain the incredibly low number of migrants working, Lisa Bergstrand of Migrationsverket told SVT: “There was an incredible number of people applying for asylum in Sweden and so that we should be able to register them, we had to de-prioritise certain tasks, and that was the matter of jobs”. Of the migrants who claimed asylum in 2015 approximately one third of the men and women aged 20-64 were given the exemption to allow them to work, which is around 53,790 migrants. The figures of migrant unemployment follow a trend in Sweden of high unemployment for foreigners. The unemployment for those born in Sweden is at the lowest point since the 2008 financial crisis at around 4.8%, while foreign born unemployment is at 14.9%.

Question to Italian readers: what effect has the death of Casaleggio had on Beppe?

• Corruption Gripes Help Five Star Movement Top Italy Local Election Polls (G.)

Alessandro Aquilini had her by the hand. And he wasn’t letting go. Virginia Raggi, the woman tipped to be the next mayor of Rome, was hunting for votes in the street market in Boccea, a lower middle-class district of the Italian capital. Raggi’s trademark is exquisite courtesy – she proffers a slender hand even to reporters who approach her with hostile questions. At the butcher’s stall, though, she got more of a handshake than she bargained for. “We need help,” the 50-year-old Aquilini began. “Left. Right. Centre. We can’t take any more [of party politicians]. This country needs a bit more honesty.” Still gripping Raggi’s hand as he stretched across the slabs of veal, the burly butcher added: “We’re up to here with taxes and corruption.”

His monologue captured many of the reasons why Raggi, the candidate of the Five Star Movement (M5S), is leading the polls ahead of local elections in Rome and other Italian cities on Sunday. Unlike other non-traditional movements that have prospered in Europe, such as Syriza in Greece, the M5S’s protest is not so much against austerity as the corruption and cronyism of Italy’s mainstream parties. Nowhere has this been highlighted more vividly than Rome, where establishment politicians and officials are on trial alongside alleged mobsters, charged with conspiring to pocket millions of euros from rigged public contracts. All three of the final polls released before a ban took effect on 21 May put Raggi ahead by 3-6%age points in the mayoral race.

Run-offs between the two leading candidates in each town are slated for 19 June. Only then will it be known if the 37-year-old lawyer – almost unknown to the public until a few months ago – has won. A victory for Raggi would be a stinging reverse for Italy’s prime minister, Matteo Renzi, who leads the centre-left Democratic party, and a dramatic breakthrough for the internet-based M5S. Founded less than seven years ago by the comedian Beppe Grillo and his digital guru, the late Gianroberto Casaleggio, the M5S is today Italy’s leading opposition party. Grillo has said he will set fire to himself in public if Raggi fails to win. But he may yet regret that pledge.

Is there hope?

• US Announces Near-Total Ban On Trade Of African Elephant Ivory (AFP)

US authorities announced a near-total ban on the trade of African elephant ivory Thursday, finalizing a years-long push to protect the endangered animals. “Today’s bold action underscores the United States’ leadership and commitment to ending the scourge of elephant poaching and the tragic impact it’s having on wild populations,” Secretary of the Interior Sally Jewell said. The new rule “substantially limits” imports, exports and sales of such ivory across state lines, the US Fish and Wildlife Service (FWS) said. However, it does make exceptions for some “pre-existing manufactured” items, such as musical instruments, furniture and firearms that contain less than 200 grams of ivory and meet other specific criteria, according to the FWS.

Antiques, as defined under the Endangered Species Act, are also exempt. The new measures fulfill restrictions in an executive order on combating wildlife trafficking issued by President Barack Obama in 2013, the FWS said in its statement announcing the ban. It said that once illegal ivory enters the market it becomes virtually impossible to tell apart from legal ivory, adding that demand for elephant ivory, particularly in Asia, “is so great that it grossly outstrips the legal supply and creates a void in the marketplace that ivory traffickers are eager to fill.”

“We hope other nations will act quickly and decisively to stop the flow of blood ivory by implementing similar regulations, which are crucial to ensuring our grandchildren and their children know these iconic species,” Jewell said. The Wildlife Conservation Society welcomed the ban, calling it historic and groundbreaking. “The USA is shutting down the bloody ivory market that is wiping out Africa’s elephants,” WCS president and chief executive Cristian Samper said in a statement. “The USA is boldly saying to ivory poachers: You are officially out of business.” Some 450,000 elephants can be found on the African continent and it is estimated that more than 35,000 of these animals are killed each year.