Wynand Stanley Cadillac touring car at Yosemite in snow 1919

Causation and correlation of energy and economics are not nearly as clear as implied here, but the trends are interesting.

• Peak & Decline of International Reserves: Massive Asset Deflation Ahead (SRSR)

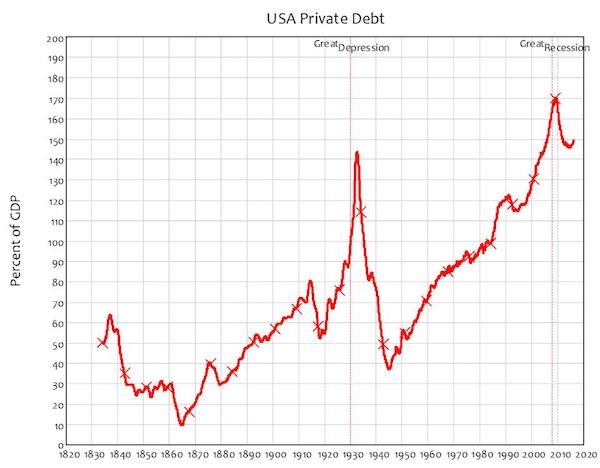

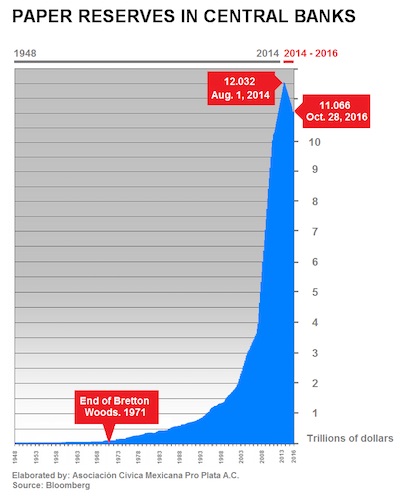

The world is sitting at the edge of a massive deflationary cliff. Even though Central Banks are desperately trying to keep the world’s financial assets from plunging down into the great depression below, signs suggest they are losing the battle. One critical sign is the peak and decline of International Reserves. Hugo Salinas Price has been keeping an eye on International Reserves for quite some time. In his recent article, A Reversal In The Trend Of International Reserves, he stated the following:

International Reserves peaked on August 1, 2014, at $12.032 Trillion dollars, and as of October 28, 2016 they stood at $11.066 Trillion dollars. International Reserves stood at about $10 Trillion in 2011, but the rate of growth slacked off; the weekly increases in Reserves (which Bloomberg used to publish every Friday) stalled and became smaller, week by week. As mid-2014 came around, the increases were quite small. It was clear that the trend was for ever-smaller increases, and that could only mean that finally there would be no increase, which would be immediately followed by decreases in the total of International Reserves held by Central Banks. That is exactly what took place.

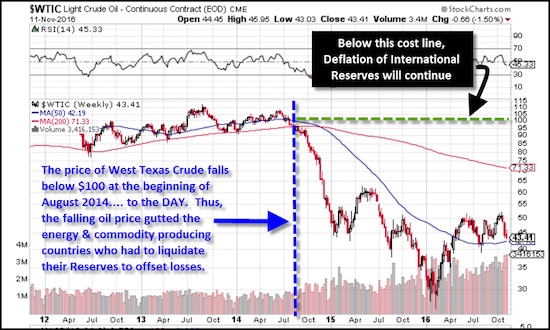

Hugo Salinas Price explains in the article, “that the increases of International Reserves take place when the Reserve Currency issuing countries effect payments to the rest of the world.” Basically, countries such as the United States that run trade deficits, exchange fiat money or Treasuries for goods from other countries. This shows up as an increase in International Reserves. Now, what is important to understand about the chart above is the timing of the PEAK & DECLINE of International Reserves. I had an email exchange with Mr. Salinas on what I believe was the leading factor in why the International Reserves peaked and declined. When I went back and looked at a five-year price chart of a barrel of oil (West Texas), I found a very interesting coincidence:

The price of a barrel of West Texas Crude fell below $100 starting at the beginning of August, 2014…. TO THE DATE. Even though the oil price had traded between $85-$100 over the past three years, it averaged over $95. However, by the end of 2014, it had fallen by more than half. This had a profound impact on International Reserves as the low oil price gutted the energy-commodity-goods producing countries. These are the countries that hold the majority of International Reserves. So, as the price of oil continued to stay below $50 a barrel, these countries had to sell Bonds and acquire cash to fund their own domestic account deficits. Thus, the peak and decline of International Reserves occurred right at the same time, the peak and decline of high oil prices. THIS IS NO COINCIDENCE.

Free markets still exist in name though…

• “Developed Countries’ Currencies Solely Driven By Politics” (CNBC)

The G10 currency market is driven solely by political events, one strategist told CNBC Friday. Dominic Bunning, FX Strategist at HSBC said that whereas a range of events had impacted the performance of G10 currency pairs, now it is only politics. “In G10, everything is driven by politics. We used to think about economics and cyclical stories and structural stories and balance of payments etc but now all we care about is politics,” Bunning said. He explained that if you have a strong political view then you make trading decisions on the basis of that. “If you think the euro zone is going to break up then by all means sell the euro,” Bunning said, while warning that he doesn’t have a strong view on euro.

On sterling however, Bunning said the weakness is likely to continue. “We still think there is a strong weakness in sterling even though it is relatively lower because the political outlook in the UK is very challenging.” The G10 currencies are the U.S. dollar, the euro, the pound, the yen, the Swedish krona, the Norwegian krone, the Australian dollar, the New Zealand dollar, the Swiss franc and the Canadian dollar. A number of these currencies have seen a lot of volatility since the start of the year owing to political uncertainties in their respective countries or on a global level. The biggest events this year have been the U.K.’s vote to leave the European Union and the U.S. presidential elections.

While sterling is down more than 16% since the Brexit vote on June 23, the euro has been on its worst losing streak since the currency arrived in 1999. The dollar, meanwhile, has been seeing some strength, rising to a 14-year high against a basket of currencies on the growing perception that the economic policies of U.S. President-elect Donald Trump will push up consumer prices. While traders are growing more bullish on the dollar, HSBC’s Bunning warned that it is not great for emerging market currencies. “You need to be selective in terms of your currency choices. I don’t think it’s a dollar bull run against everything but I do think if you look at the outlook for emerging market currencies, particularly the high-yield currencies at the moment, it is very hard to have a positive currency view.”

Plenty of lofty ideals and ideas out there, but UBI, if it does at all, will happen only out of necessity.

• How A Universal Basic Income Would Transform Society (Agnos)

No child’s dream is to make lots of money. We certainly aren’t born with any innate need for money itself. But at some point in our lives, we are introduced to money and the need to earn it. For many, it comes at a time when we are just beginning to learn about the world and what excites us. We start to open the doors to all of life’s possibilities, when the adult in the room says, “It’s really nice that you want to feed people in need, but what are you going to do to earn a living?” “You mean I can’t actually do what I really want to do?” we wonder. With a universal basic income (UBI) – where the government replaces all other forms of monetary assistance with a yearly stipend given to every adult of say, $20,000 per year – this would all change.

For the first time in human history, people would be able to make their childhood wishes a reality, instead of being forced to work in jobs they are aren’t passionate about just to survive. Today, humanity has the ability to create a world of sustainable abundance where everyone has access to everything they need and much of what they desire. But this requires a shift in long held societal views. Changing the view that money is a reward for hard work and private property is an extension of the self will be difficult. A shift in mindset is needed to see everyone as inherently worthy, rather than in terms of their ability to produce. For this reason, it is important to understand the philosophical justification for a UBI, as it reveals some of the deep underlying flaws of our capitalistic economy and the way it views human nature. Given these flaws, how we fund a UBI will go a long way toward the effectiveness of the shift in mindset from an age of ownership to an age of access.

Let us stop and imagine what we might do if we no longer had to work in order to meet our basic needs. Presently, we are all burdened with the stress that comes with knowing that failure to earn a living could result in social isolation. Imagine the psychological shift in knowing that no matter what happened, you would always have a roof over your head and food to eat without having to give away your precious time and energy. How would not having to work to survive change your day to day life? What would you do instead? A UBI has the potential to unleash unimaginable amounts of human time, energy, creativity, and passion that has the potential to radically transform society. Instead of everyone working to survive, people would have the means to pursue their own dreams, and to spend more quality time with their family, friends, and community.

The Heart of Darkness.

• End London’s Role as a Clearing-House for Dirty Money (G.)

The National Crime Agency says up to £90bn is laundered through the UK each year, while an estimated £120bn worth of UK property is owned by offshore shell companies. Some 75% of properties whose owners are under investigation for corruption made use of offshore corporate secrecy to hide their identities. And according to the director of the National Crime Agency, “the London property market has been skewed by laundered money. Prices are being artificially driven up by overseas criminals who want to sequester their assets here in the UK.” Those assets are far too often being extracted from developing nations desperately in need of tax revenues. A century on from Heart of Darkness, the Democratic Republic of the Congo still ranks near the bottom of the UN Human Development Index, with one in seven children dead before the age of five.

And, as in Conrad’s time, London’s imperial connections are helping to facilitate the exploitation of this asset-rich nation. Diamond and mineral wealth is being extracted by political elites, funnelled via London to old remnants of empire in the overseas territories, then repatriated via Kensington townhouses back to the UK. Our financial, accountancy and property agents are the beneficiaries, the people of the DRC and househunters of London the losers. [..] We are told that much of London’s success is because of its unimpeachable legal system and absence of corruption. But that is no good if, under the banner of the rule of law, we are also aiding and abetting exploitation. In Surrey mansions and Mayfair sit the lost wealth, the never-built hospitals and unopened schools of too many developing nations.

“.. the only way to deal with Brexit is hard Brexit. Otherwise we would be seen to be giving in to a country that is leaving. That would be fatal.”

• Europe’s Leaders To Force Britain Into Hard Brexit (O.)

European leaders have come to a 27-nation consensus that a “hard Brexit” is likely to be the only way to see off future populist insurgencies, which could lead to the break-up of the European Union. The hardening line in EU capitals comes as Nigel Farage warns European leaders that Marine Le Pen, leader of the Front National, could deliver a political sensation bigger than Brexit and win France’s presidential election next spring – a result that would mean it was “game over” for 60 years of EU integration. According to senior officials at the highest levels of European governments, allowing Britain favourable terms of exit could represent an existential danger to the EU, since it would encourage similar demands from other countries with significant Eurosceptic movements.

One top EU diplomat told the Observer: “If you British are not prepared to compromise on free movement, the only way to deal with Brexit is hard Brexit. Otherwise we would be seen to be giving in to a country that is leaving. That would be fatal.” The latest intervention by Farage will only serve to fuel fears in Europe that anti-EU movements have acquired a dangerous momentum in countries such as France and the Netherlands, following the precedent set by the Brexit vote. Ukip’s interim leader, who predicted both the vote for Brexit and Donald Trump’s US victory, said that while Le Pen was still more likely to be runner-up to an establishment candidate next May, she now had to be taken seriously as a potential head of state. “She will clearly win through to the second round. And after what has happened elsewhere, only a fool would say she would have no chance of winning overall. France is a deeply, deeply unhappy country. If she were to win, it would be game over for the EU.”

“It’s a banking crisis, an economic crisis, a debt crisis, and a political crisis all rolled into one..”

• Italy’s Crisis Turns into a Multi-Headed Hydra (DQ)

Bank stocks have surged just about everywhere since Trump’s election, with one exception: Italy. In the last month only one large Italian bank has seen its shares rise, and that’s the 500-year old bank at the center of Italy’s banking crisis, Monte dei Paschi di Siena, whose nearly worthless shares jumped to €0.24. Shares of Italy’s other large banks have suffered heavy losses. Over the past week alone, shares of Italy’s largest bank, Unicredit, plunged 15%, as did the shares of Banca Popular and UBI Banca. Shares of Italy’s second largest bank, Intesa Sanpaolo, fell just under 10%. The recent losses compound what’s been a miserable year for Italy’s banking stocks. The best performing stock is the investment bank Mediobanca, which is down a mere 24% for 2016. During the same period, Unicredit has shed over 60%, UBI Banca 65%, Banco Popolare 80%, and Monte dei Paschi 85%.

It’s not just banks’ shares that are flashing all the wrong signals. UniCredit’s five-year credit default swap surged to 221.2 basis points on Friday, meaning it now costs €221,200 to insure €10 million of UniCredit’s debt against default over five years. As with all major crises, Italy’s current predicament is a multi-headed hydra. It’s a banking crisis, an economic crisis, a debt crisis, and a political crisis all rolled into one, and all coming to a head at the same time. Italy’s economy has been in reverse ever since it joined the euro 17 years ago. Since 2007, its GDP has shrunk by a staggering 10%. In the meantime its public debt has continued to grow, reaching 135% of GDP today, the highest level of any Eurozone country with the exception of Greece. And now the yield on Italy’s 10-year bond is on the rise, hitting 2.09% on Friday in a NIRP world, its highest point in over 13 months.

If Renzi loses the referendum next month, how much longer can this can be kicked?

• Italian Banks ‘Not Necessarily Bankrupt’ But Awfully Close (NYT)

Victor Massiah has grown weary of talk that the Italian banking system is so threadbare and stuffed with terrible loans that it threatens Europe with another financial crisis. The mansion that serves as local headquarters for the bank he runs, UBI Banca, one of Italy’s largest lenders, does not feel like a place on the verge of running out of money. An inlaid marble fireplace sits in a conference room beneath wooden beams worthy of a castle. A statue of the Greek goddess Athena stands triumphantly over a staircase. “As you can see,” he says, sweeping a hand across the scene, “we’re not necessarily bankrupt.” Among policy makers alert for signs of the next financial disaster, Italy’s mountain of uncollectable bank debt is a subject discussed in tones ordinarily reserved for piles of plutonium.

Its banks seem at once too big to fail and eminently capable of doing so, menacing the global economy. For years, Italian lenders have muddled through, hoping time would cure their afflictions. But Italy’s economy has been terminally weak, not growing at all over a recent 13-year stretch. Bad loans have festered. Good loans have deteriorated. Italy’s problems are Europe’s problems. Nearly one-fifth of all loans in the Italian banking system are classified as troubled, a toll worth €360 billion, at the end of last year, according to the International Monetary Fund. That represents roughly 40% of all the bad loans within the countries sharing the euro. In recent weeks, the world’s focus has shifted to Germany’s largest lender, Deutsche Bank, on fears that it could be forced to seek a rescue.

But if Deutsche has become the crisis of the moment, Italy is the perpetual threat that could, at any moment, present the world with an unpleasant surprise potent enough to send legions of officials descending on Rome to try to contain the damage. The Italian government has sought to spend more money to spur the economy. But European leaders, led by Germany, have enforced rules limiting budget deficits. And Italian banks have held tight to cash and are reluctant to lend, starving an already anemic economy of capital. All of which leaves Italy and Europe, and to some extent the global economy, with a formidable conundrum. Europe may never regain economic vigor so long as Italy’s banks are a slow-motion emergency. But Italy’s banks cannot get healthy without growth. And Italy’s economy can’t grow without healthy banks.

One of the few thinking men left in Europe.

• > ‘Political Amateurs Are Conquering The World’ – Beppe Grillo (EN)

euronews “Beppe Grillo, our meeting takes place at a time that, without undue exaggeration, can be labelled ‘historic’. That’s to say, the election of Donald Trump to the presidency of the United States. What’s your take on that?” Beppe Grillo, Leader of the Five Star Movement “It’s an extraordinary turning point. This corn cob – we can also call Trump that in a nice way – doesn’t have particularly outstanding qualities. He was such a target for the media, with such terrifying accusations of sexism and racism, as well as being harassed by the establishment – such as the New York Times – but, in the end, he won. “That is a symbol of the tragedy and the apocalypse of traditional information. The television and newspapers are always late and they relay old information.

They no longer anticipate anything and they’re only just understanding that idiots, the disadvantaged, those who are marginalised – and there are millions of them – use alternative media, such as the Internet, which passes under the radar of television, a medium people no longer use. “With Trump, exactly the same thing has happened as with my Five Star Movement, which was born of the Internet: the media were taken aback and asked us where we were before. We gathered millions of people in public squares and they marvelled. We became the biggest movement in Italy and journalists and philosophers continued to say that we were benefitting from people’s dissatisfaction. We’ll get into government and they’ll ask themselves how we did it.”

euronews “There is a gap between giving populist speeches and governing a nation.” Beppe Grillo “We want to govern, but we don’t want to simply change the power by replacing it with our own. We want a change within civilisation, a change of world vision. “We’re talking about dematerialised industry, an end to working for money, the start of working for other payment, a universal citizens revenue. If our society is founded on work, what will happen if work disappears? What will we do with millions of people in flux? We have to organise and manage all that.”

euronews “Do you think appealing to people’s emotions is enough to get elected? Is that a political project?” Beppe Grillo “This information never ceases to make the rounds: you don’t have a political project, you’re not capable, you’re imbeciles, amateurs… “And yet, the amateurs are the ones conquering the world and I’m rejoicing in it because the professionals are the ones who have reduced the world to this state. Hillary Clinton, Obama and all the rest have destroyed democracy and their international policies. “If that’s the case, it signifies that the experts, economists and intellectuals have completely misunderstood everything, especially if the situation is the way it is. If the EU is what we have today, it means the European dream has evaporated. Brexit and Trump are signs of a huge change. If we manage to understand that, we’ll also get to face it.”

Europe’s MO. Keep squeezing.

• Bruegel Institute Chief: 4th Bailout Seems Inevitable for Greece (GR)

Bruegel Institute Chief Zsolt Darvas said that there are two possible solutions for Greece’s debt problems following 2018. One is huge debt restructuring or a fourth bailout program for the country. Speaking with Greek daily Ta Nea, the Hungarian economist said that even if Greece has the expected development for 2017-2018, debt will still be at a high rate. He does not believe that Greece will be able to borrow from the markets at a reasonable rate under the current circumstances. Darvas expects to see some form of debt restructuring within a time framework to bond maturation, along with a lowering or freezing of interest rates. He said that this per se may still not be enough for Greece to avoid a fourth bailout program.

Regarding investments, Darvas said that the height of Greece’s debt is not helping draw investors. Another problem is the excessive bureaucracy. The OECD indexes also show Greece’s weaknesses. When asked about U.S. President Barack Obama’s support for debt relief for Greece, Darvas said that he fears that Obama cannot influence European decisions regarding Greece. In the past, there were no results when he or other members of the government called for debt relief. He considers this unlikely to change. He does not believe that there will be any decision regarding debt relief until after the German elections.

Every country, every society, should make protection of basic needs their number one priority. They are indeed ‘not a market commodity’.

• Slovenia Adds Water To Constitution As Fundamental Right For All (AFP)

Slovenia has amended its constitution to make access to drinkable water a fundamental right for all citizens and stop it being commercialised. With 64 votes in favour and none against, the 90-seat parliament added an article to the EU country’s constitution saying “everyone has the right to drinkable water”. The centre-right opposition Slovenian Democratic party (SDS) abstained from the vote saying the amendment was not necessary and only aimed at increasing public support. Slovenia is a mountainous, water-rich country with more than half its territory covered by forest.

“Water resources represent a public good that is managed by the state. Water resources are primary and durably used to supply citizens with potable water and households with water and, in this sense, are not a market commodity,” the article reads. The centre-left prime minister, Miro Cerar, had urged lawmakers to pass the bill saying the country of two million people should “protect water – the 21st century’s liquid gold – at the highest legal level”. “Slovenian water has very good quality and, because of its value, in the future it will certainly be the target of foreign countries and international corporations’ appetites. “As it will gradually become a more valuable commodity in the future, pressure over it will increase and we must not give in,” Cerar said.

Only Greece and Italy need worry about this now. The rest can sit pretty. It’ll cost them the EU though.

• EU Ministers At Odds Over Immigration, No Compromise In Sight (R.)

European Union interior ministers were at odds on Friday over how to handle immigration, with heated discussions between states who want more burden sharing and those who oppose any kind of obligatory relocation. “We are looking for compromises but at the moment they are not there,” said Thomas De Maiziere of Germany, which last year took in about 900,000 migrants and refugees. The ministers disagreed over a proposal by the EU’s current chair Slovakia on reforming the bloc’s asylum system, which collapsed last year as 1.3 million refugees and migrants from the Middle East and Africa reached Europe and member states quarrelled over how to handle the influx.

Overall, the arrivals have decreased from last year but they continue unabated in Italy and tens of thousands of people are still stuck in Greece and Italy, sometimes in dire conditions. Despite agreeing last year to relocate 160,000 people from Italy and Greece, eastern European countries, including Slovakia, Poland and Hungary, have refused to take any in. “We cannot pretend that the quotas as we know them now are working,” said Robert Kalinak of Slovakia. “The 160,000 is only a very small part of the million that came to Europe last year and we only relocated less than 10,000 people. Even those who were for this system were not successful. We want to come up with a system that would be effective.”

The mess below the surface.

• Pentagon and Intelligence Chiefs Urge Obama To Remove NSA Chief (WaPo)

The heads of the Pentagon and the nation’s intelligence community have recommended to President Obama that the director of the National Security Agency, Adm. Michael S. Rogers, be removed. The recommendation, delivered to the White House last month, was made by Defense Secretary Ashton B. Carter and Director of National Intelligence James R. Clapper Jr., according to several U.S. officials familiar with the matter. Action has been delayed, some administration officials said, because relieving Rogers of his duties is tied to another controversial recommendation: to create separate chains of command at the NSA and the military’s cyberwarfare unit, a recommendation by Clapper and Carter that has been stalled because of other issues.

The news comes as Rogers is being considered by President-elect Donald Trump to be his nominee for director of national intelligence to replace Clapper as the official who oversees all 17 U.S. intelligence agencies. In a move apparently unprecedented for a military officer, Rogers, without notifying superiors, traveled to New York to meet with Trump on Thursday at Trump Tower. That caused consternation at senior levels of the administration, according to the officials, who spoke on the condition of anonymity to discuss internal personnel matters. [..] Carter has concerns with Rogers’s performance, officials said. The driving force for Clapper, meanwhile, was the separation of leadership roles at the NSA and U.S. Cyber Command, and his stance that the NSA should be headed by a civilian.

[..] Rogers, 57, took the helm of the NSA and Cyber Command in April 2014 in the wake of revelations by a former intelligence contractor of broad surveillance activities that shook public confidence in the agency. The contractor, Edward Snowden, had secretly downloaded vast amounts of digital documents that he shared with a handful of journalists. His disclosures prompted debate over the proper scale of surveillance and led to some reforms. But they also were a black eye for an agency that prides itself on having the most skilled hackers and cybersecurity professionals in government. Rogers was charged with making sure another insider breach never happened again. Instead, in the past year and a half, officials have discovered two major compromises of sensitive hacking tools by personnel working at the NSA’s premier hacking unit: the Tailored Access Operations. One involved a Booz Allen Hamilton contractor, Harold T. Martin III, who is accused of carrying out the largest theft of classified government material.

Even if he would pardon Snowden, Manning, Assange, what would their lives look like?

• Obama Claims He Cannot Pardon Snowden but He Knows That’s Not True (TD)

In a big interview with the German media outlet Der Spiegel, President Obama was asked about his interest in pardoning Ed Snowden in response to the big campaign to get him pardoned. Obama’s response was that he could not, since Snowden has not been convicted yet: ARD/SPIEGEL : Are you going to pardon Edward Snowden? Obama:” I can’t pardon somebody who hasn’t gone before a court and presented themselves, so that’s not something that I would comment on at this point. I think that Mr. Snowden raised some legitimate concerns. How he did it was something that did not follow the procedures and practices of our intelligence community. If everybody took the approach that I make my own decisions about these issues, then it would be very hard to have an organized government or any kind of national security system.

At the point at which Mr. Snowden wants to present himself before the legal authorities and make his arguments or have his lawyers make his arguments, then I think those issues come into play. Until that time, what I’ve tried to suggest – both to the American people, but also to the world – is that we do have to balance this issue of privacy and security. Those who pretend that there’s no balance that has to be struck and think we can take a 100-percent absolutist approach to protecting privacy don’t recognize that governments are going to be under an enormous burden to prevent the kinds of terrorist acts that not only harm individuals, but also can distort our society and our politics in very dangerous ways. And those who think that security is the only thing and don’t care about privacy also have it wrong.”

This is simply incorrect – as is known to anyone who remembers the fact that Gerald Ford pardoned Richard Nixon before he had been indicted. And it appears that the President knows this. Because, as the Pardon Snowden campaign points out, Obama pardoned three Iranian Americans who had not yet stood trial. That happened this year. So for him to say it’s impossible to pardon someone who hasn’t gone before the court is simply, factually, historically wrong. And there’s a Supreme Court ruling that makes this abundantly clear. 150 years ago, in the ruling on Ex Parte Garland, the Supreme Court stated: “The power of pardon conferred by the Constitution upon the President is unlimited except in cases of impeachment. It extends to every offence known to the law, and may be exercised at any time after its commission, either before legal proceedings are taken or during their pendency, or after conviction and judgment. The power is not subject to legislative control.”

‘Old’ media write their own death warrant.

• The Real Fake News List (Liberty Report)

We’ve seen the make-shift “fake news” list created by a leftist feminist professor. Well, another fake news list has been revealed and this one holds a lot more water. This list contains the culprits who told us that Iraq had weapons of mass destruction and lied us into multiple bogus wars. These are the news sources that told us “if you like your doctor, you can keep your doctor.” They told us that Hillary Clinton had a 98% chance of winning the election. They tell us in a never-ending loop that “The economy is in great shape!” This is the real Fake News List (and it’s sourced):